Market

White House Opposes FIT21: Aiming for Crypto Regulation

With the House of Representatives poised to vote on the Financial Innovation and Technology for the 21st Century Act (FIT21) today, the White House’s position on the bill has become prominent. The administration has opposed the bill, raising concerns but stopping short of issuing a veto threat.

The Biden administration is willing to collaborate with Congress to develop a comprehensive and balanced regulatory framework for crypto assets.

Biden Admin Rejects FIT21, Open to Crypto Regulation

In its statement on Wednesday, the administration outlined several critical issues with FIT21. The primary concern was the bill’s perceived need for more sufficient protections for consumers and investors.

“The Administration opposes passage of H.R. 4763, which would affect the regulatory structure for digital assets in the United States,” the statement read.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

The White House’s opposition to FIT21 is significant as the House readies for the vote. If it becomes law, FIT21 would significantly bolster the regulatory oversight of crypto spot markets and digital commodities, such as bitcoin. It also introduces a mechanism for secondary market trading of digital commodities initially offered as part of investment contracts.

Bipartisan Support Amid Debate

Despite opposition to FIT21, the White House strongly desires to work with Congress. The statement further underlined the administration’s intent to leverage existing authorities to foster an environment conducive to innovation while safeguarding consumers and investors. Senator Cynthia Lummis commented on the bill’s bipartisan support.

“There’s a bipartisan majority in both chambers of Congress in favor of crypto. The future is very bright,” she stated.

FIT21 has sparked controversy. Representative Maxine Waters criticized the bill during a House Rules Committee meeting. Waters argued that FIT21 would stretch the Commodity Futures Trading Commission (CFTC) resources, weakening its enforcement capabilities. She also highlighted that with its more extensive staff, the Securities and Exchange Commission (SEC) would be better suited to oversee the industry.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

SEC Chair Gary Gensler has also voiced his opposition to FIT21. Gensler warned that the bill would create new regulatory gaps by disregarding the Howey Test, an essential legal standard for determining whether an asset qualifies as a security.

FIT21 faces an uncertain future in the Senate. Many top lawmakers in the Democrat-controlled Senate have shown little interest in the bill. Investment bank TD Cowen recently suggested that FIT21 cannot become law in this Congress.

Political dynamics may also impact the bill’s fate. There have been rumblings that the Biden administration is paying more attention to crypto, given its potential influence on voters in the upcoming presidential election. Presumptive Republican presidential candidate Donald Trump has made pro-crypto moves, including accepting campaign donations in crypto.

The debate over FIT21 highlights the complexities of regulating the crypto market. As the House prepares to vote, the administration’s stance reflects the importance of developing a regulatory framework that ensures market stability while encouraging technological advancements in the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Avalanche Price Holds Under $20, Low Selling Can’t Lift Price

Avalanche (AVAX) price has been unable to reclaim the $20.00 support level after falling through it in the recent correction. The altcoin is now trading well below that key mark despite a noticeable decline in selling pressure.

However, bullish momentum has not been strong enough to counter prevailing bearish cues.

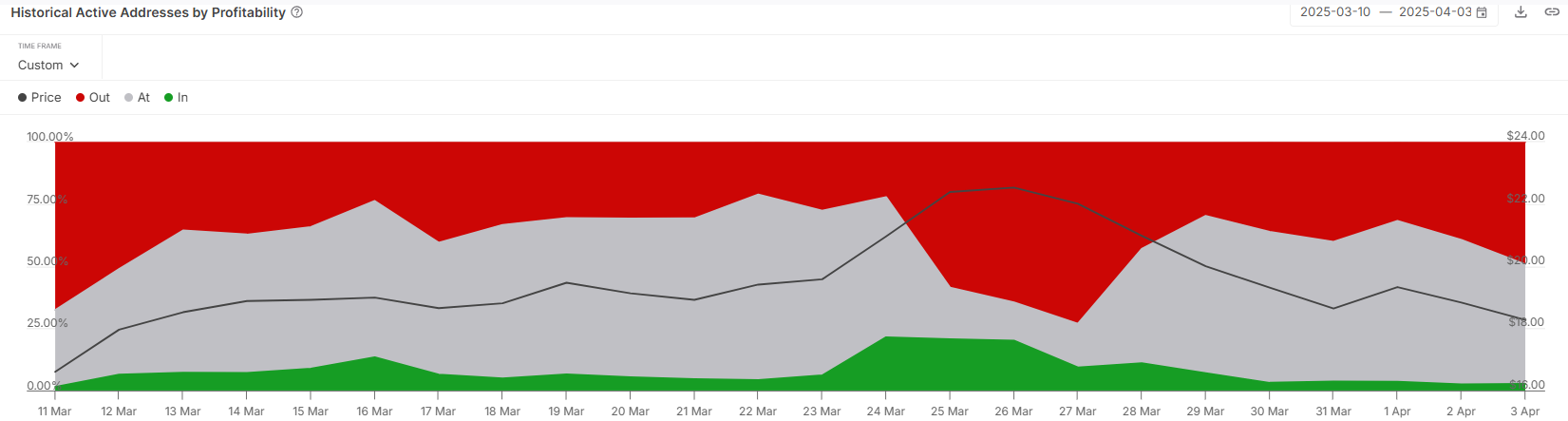

Avalanche Investors Are Not Selling

Analyzing the active address profitability reveals that less than 3% of current participants are in profit. This data highlights a crucial detail: most AVAX holders are unwilling to sell at a loss. Instead, they appear to be HODLing in anticipation of a recovery. This lack of selling is a bullish indicator.

The patience shown by investors during this downturn could help Avalanche establish a stronger base once broader market conditions stabilize. As fewer holders are actively selling, downward pressure on AVAX’s price is reduced. Given the right market catalysts, this opens a window for the altcoin to bounce back.

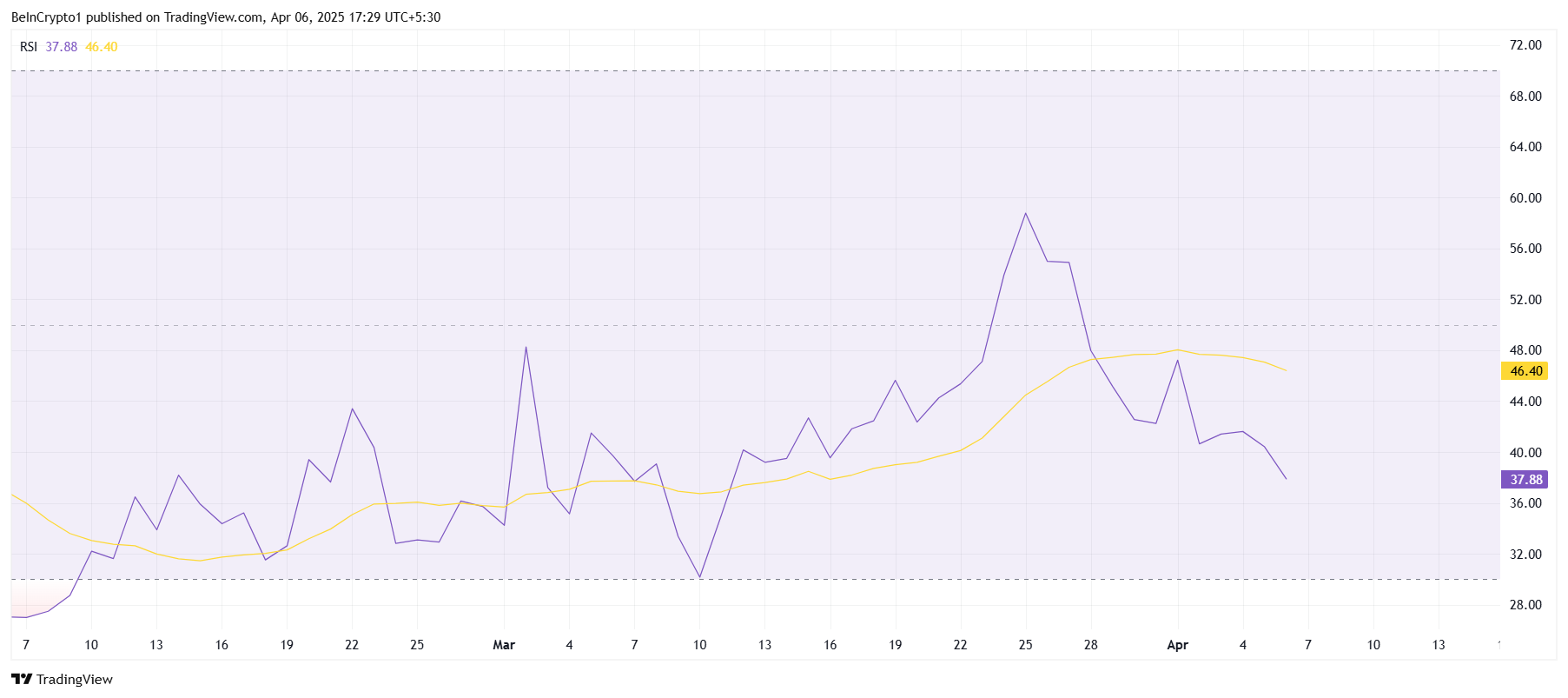

Despite low selling activity, the technical indicators continue to signal weakness. The Relative Strength Index (RSI) has dropped back into the bearish zone after a brief recovery attempt. This suggests a lack of buying pressure and continued uncertainty among investors.

Market support has been lacking for AVAX in recent sessions, preventing a meaningful rebound. The altcoin is facing consistent resistance and has failed to generate strong upward momentum.

The RSI trend reinforces that the macro environment is still leaning bearish, keeping Avalanche subdued.

AVAX Price Is Vulnerable

Avalanche is currently priced at $17.19, marking a 25% decline over the past two weeks. The sharp drop came after AVAX failed to break through the $22.87 resistance level. This rejection led to the current consolidation below $20.00, with bulls unable to reverse the trend.

Given the existing market cues, Avalanche may struggle to reclaim $18.27 as a support level. If the altcoin fails to secure this level, it risks dropping further to $16.25. This would deepen investor losses and delay any chances of recovery.

On the upside, a key shift would occur if AVAX can flip $19.86 into support. This would suggest strengthening bullish sentiment and open the door for a rally toward $22.87. Reclaiming this level could allow Avalanche to recover some recent losses and restore investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Justin Sun Claims First Digital Trust Fraud Exceeds Impact of FTX

TRON founder Justin Sun is intensifying his accusations against First Digital Trust (FDT), the issuer of the FDUSD stablecoin, who he claims embezzled $500 million of its clients’ funds.

In an April 5 post on X, Sun compared FDT to the now-defunct FTX exchange, claiming the FDT case is “ten times worse.” FTX filed for bankruptcy in November 2022 after a bank run revealed an $8 billion shortfall in its assets.

Justin Sun Compares First Digital Trust to FTX

Sun argued that while FTX misused user funds, the exchange at least maintained an internal system that portrayed the activity as pledged loans.

He explained that FTX used assets like FTT, SRM, and MAPS tokens as collateral in transactions that, on the surface, had some structure. In contrast, Sun claims First Digital Trust outright stole funds without user consent or any internal pledge mechanism.

“FDT simply siphoned off $456m from TUSD’s custodial funds without client authorization or knowledge, and booked as loans to a dubious third party Dubai company without any collaterals,” Sun claimed.

The Tron founder further asserted that the now-convicted FTX founder Sam Bankman-Fried (SBF) indeed misused funds. However, Sun noted much of that capital went into investments in reputable firms such as Robinhood and AI company Anthropic.

On the other hand, Sun alleged that FDT diverted user assets into private entities for personal gain without any meaningful investment.

Sun also took aim at FDT CEO Vincent Chok Zhuo, criticizing his apparent indifference following the exposure of the alleged misconduct.

According to him, Chok has shown no intention of taking responsibility. This contrasts with SBF, who took steps to recover user assets and cooperated with authorities.

“Vincent Chok has acted deceptively and maliciously, pretending nothing happened when exposed,” Sun stated.

Considering this development, the TRON founder urged Hong Kong authorities to take swift action. He called for a response similar to that of US regulators during the FTX collapse.

Sun emphasized that Hong Kong’s reputation as a global financial hub is at risk and called for immediate enforcement to prevent further damage.

“Hong Kong must act like its US counterparts—swiftly, decisively, and effectively. We cannot allow the fraudsters continue its pyramid scheme against the public,” the crypto entrepreneur concluded.

To support investigations, Sun has launched a $50 million bounty program aimed at exposing the alleged misconduct. He also met with Hong Kong lawmaker Johnny Wu to discuss potential regulatory action.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for This Week: AXS, JTO, XAV

Token unlocks play a pivotal role in the crypto market, impacting liquidity, price volatility, and investor sentiment. They are events in crypto where locked coins or tokens are released and become available for trading in the open market.

This week, three major projects—Axie Infinity (AXS), Jito Labs (JTO), and Xave (XAV)—will release previously locked tokens into circulation. Here’s what you need to know and watch for.

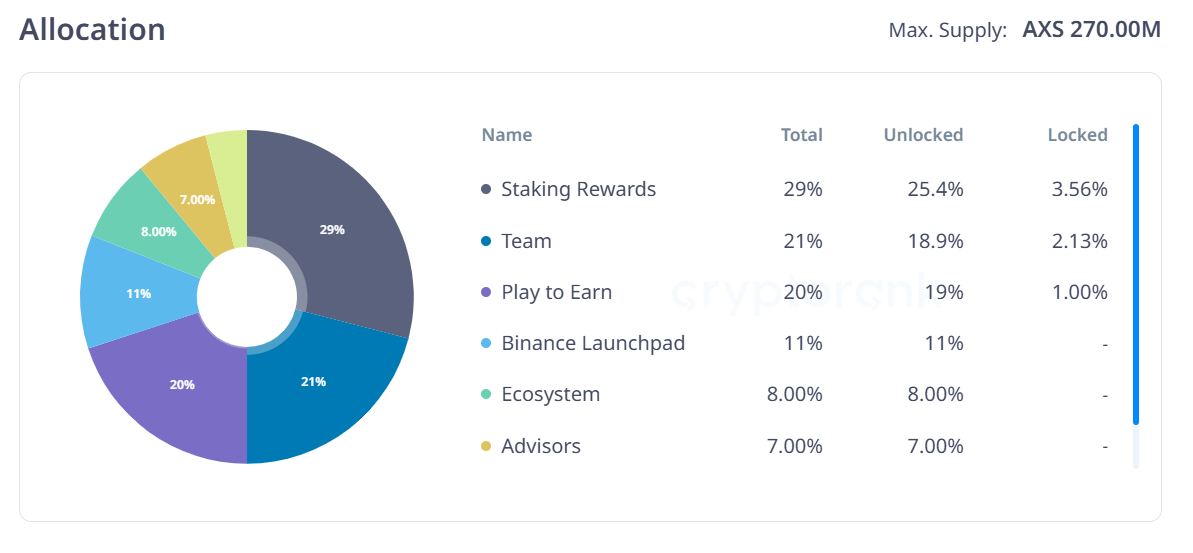

1. Axie Infinity (AXS)

- Unlock Date: April 12

- Number of Tokens to be Unlocked: 10.72 Million AXS (3.97% of Total Supply)

- Current Circulating Supply: 160.159 Million AXS

- Total supply: 270 Million AXS

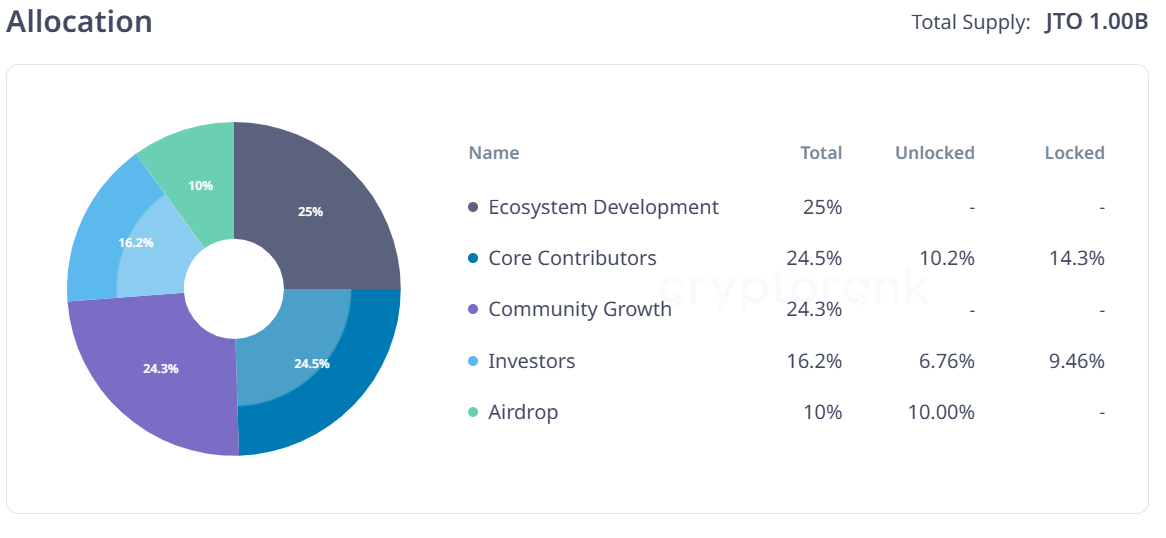

- Unlock Date: April 7

- Number of Tokens to be Unlocked: 11.31 Million JTO (1.13% of Total Supply)

- Current Circulating Supply: 313.37 Million JTO

- Total supply: 1 Billion JTO

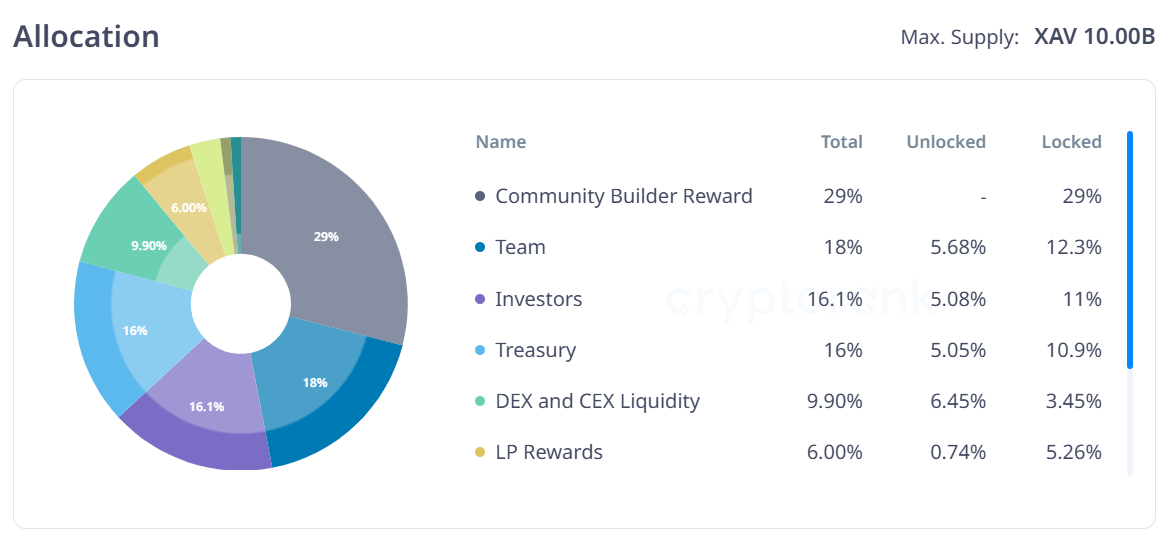

- Unlock Date: April 11

- Number of Tokens to be Unlocked: 313.29 Million XAV (3.13% of Total Supply)

- Total supply: 10 Billion XAV

Axie Infinity is a blockchain-based game featuring digital creatures called Axies, often compared to Pokémon. This pet-centric game combines elements of blockchain, NFTs, and ERC-20 tokens, offering players the chance to collect, battle, and trade unique creatures in a virtual world.

The April 12 unlock will consist of 10.72 million AXS tokens valued at about $29 million. Axie Infinity will award the majority of these tokens for staking rewards and for the team.

2. Jito Labs (JTO)

Jito is a liquid staking service on Solana that distributes MEV rewards to holders. On April 7, Jito will unlock 11.3 million tokens which is currently worth around $20 million.

The project will allocate the majority of the unlocked tokens for ecosystem development, core contributors, and community growth. Additionally, it will allocate 10% of the tokens for airdrops.

3. Xave (XAV)

Xave is a DeFi platform that focus on decentralized foreign exchange (FX) markets. It enhances stablecoin liquidity through an automated market maker (AMM) model.

On April 11, the network will unlock over 313 million XAV tokens, which constitutes just over 3% of the total supply. Xave will largely focus distribution to the team, investors, and treasury.

Other prominent token unlocks that investors can look out for this week include Delysium (AGI), Parcl (PRCL) and Circular Protocol (CIRX).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoSolana Altcoin Saros Rallies 1000% Since March, Hits New High

-

Market24 hours ago

Market24 hours agoKey Levels To Watch For Potential Breakout

-

Altcoin20 hours ago

Altcoin20 hours agoWhat’s Next for ADA Price?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Indicator Signals Momentum Building – Capital Inflows Surge 350% In 2 Weeks

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin (BTC) To Take Off In June, Analyst Pins Market Target At $175,000

-

Altcoin18 hours ago

Altcoin18 hours agoEthereum Price Threatens Decline To $1600 After Breakdown From Symmetrical Triangle

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Whales Dump 500,000 ETH In 48 Hours: On-Chain Data

-

Altcoin14 hours ago

Altcoin14 hours agoBitcoin Holds $83K Despite Macro Heat, What’s Happening?