Market

Decentralized Masters and Their DeFi Journey

Decentralized finance (DeFi) scene is growing quickly. Tan Gera and Salim Elhila and have entered this dynamic field, starting Decentralized Masters, a platform to guide and teach people about the crypto world.

The entrepreneur duo’s journey shows their ability to adapt, overcome, and evolve, as they create a space for themselves in DeFi’s changing environment.

Decentralized Masters is a platform designed to educate and guide individuals in the DeFi space. It offers comprehensive resources and strategies for navigating the crypto industry, covering everything from portfolio management to market analysis. The platform fosters a mastermind community, bringing together high-value individuals to share insights and strategies. Decentralized Masters aims to bridge the gap between traditional finance and the emerging DeFi world, equipping members with the knowledge and tools to succeed.

From Wall Street to Web3

Salim, an AI and big data engineer by trade, found his calling beyond the corporate world. With a background in engineering, mathematics, and statistical modeling, he expanded his expertise to include marketing and sales strategies for online ventures, becoming the marketing mastermind behind a combined $100M in sales in these industries.Yet, his real breakthrough came in 2022 when a tweet by Elon Musk sparked his interest in Bitcoin (BTC), propelling him down the cryptocurrency rabbit hole.

“I participated in many Web3 projects, the most famous being MetaLegends, where I was managing the marketing side of things. This project sold out for $20 million. That’s when I realized things are happening way faster in the Web3 world”, Salim says. “And by that time, I met Tan. At the peak of the last bull market we chose to launch something together. And that’s how Decentralized Masters came to be.”

Tan, on the other hand, began his journey in the world of finance, climbing the investment banking ladder. From the suburbs of Paris, he navigated a traditional path, securing a role on Wall Street, where he witnessed the inner workings of the banking industry. But Tan’s experience with crypto conferences and witnessing the potential of blockchain technology led him to shift gears. He recognized the power of DeFi, particularly in comparison to traditional banking systems, and made the transition to the crypto space.

“At 21 I passed my CFP1 and got access to Wall Street. I did an internship there as an investment banker, and it really opened my eyes,” Tan adds. “I saw behind the curtains of the big investment banks how the game was rigged. And I saw true use cases of crypto, how it could make everything better.”

Turning Adversity into Opportunity

The inception of Decentralized Masters came at a crucial moment. The company launched just before a brutal market crash: one of the biggest centralized exchanges in the US, FTX, collapsed, triggering a domino effect throughout the industry. The downfall of Sam Bankman-Fried’s empire led to widespread fear, eroded trust in CEXes and intensified the challenges for a freshly launched company.

Despite early success, their journey took a steep turn when their payment processor unexpectedly blocked transactions and banking partners temporarily froze funds. Plus, social platforms restricted their content and it was as if everyone was against them. However, Salim and Tan saw an opportunity in the adversity.

“We were starting to sell really well. It was a massive success. But after one or two weeks of sales, the FTX crash happened,” – Salim reflects. “And from there, everything went downhill. We almost gave up, it felt like the whole Universe was conspiring to make sure we wouldn’t win. But by the end of the year we were like – you know what, if we manage to do this during a bear market, imagine how amazing it will be during a bull market? And from there, it has been a crazy ascension.”

The duo’s resilience paid off, as they secured new banking partners and payment processors, and Decentralized Masters grew from zero employees by the end of 2022 to over 80 team members in just a year.

Both entrepreneurs now look back to late November 2022 as a turning point for the whole DeFi space. People recognized that centralized exchanges were not safe and reaffirmed the value proposition of DeFi platforms.

Tan notes centralized exchanges function like traditional banks, using clients’ assets to make money and offering crypto products without leveraging blockchain technology. According to him, this leads to issues such as limited transparency and lack of security, as seen in the FTX case.

“What centralized exchanges do? They pay clients 3-4% and use their crypto to make 20-30-40% in DeFi protocols. That’s exactly what the bank does when you leave your money in savings,” he recalls. “What we want to teach people is to self-custody their funds to hedge against the monetary system, so they can control it and make the profit instead of giving it to the third party.”

The Decentralized Approach

Decentralized Masters provides comprehensive education on DeFi and crypto markets. The platform’s value lies in its multifaceted approach, from portfolio management and asset selection to technical analysis and strategy development.

As for now, the company boasts a team of 10 full-time analysts who conduct in-depth research into various projects, comparing them across a range of variables. They provide a full overview of each asset, incorporating fundamental, technical, on-chain, and team analyses. The projects are then graded based on these variables, resulting in a ranking system to assess their success potential.

“We’re lucky to be surrounded by a team of people who are all experts in their different narratives. They conduct due diligence on a daily basis,” Tan explains. “That allows us to basically rate different protocols, different projects, and make sure that we only invest in projects that have a high potential of staying alive.”

But the team’s vision extends beyond analysis, encompassing community building and mentoring. Decentralized Masters offers a mastermind community and a platform for members to connect and share knowledge. This extensive ecosystem has fostered a thriving community, where members proudly display their credentials.

“We gather high-value individuals with the same sophistication and values,” Salim notes. “Сommunity in crypto is everything: it can make or break one’s success. At the end of the day, when you’re surrounded by the right people, things tend to work pretty well.”

Bridging TradFi and DeFi

Decentralized Masters’ narrative was designed to act as a bridge between traditional finance (TradFi) and DeFi. Their strategies leverage portfolio management principles from Tan’s CFA background, while also incorporating decentralized finance tools. This convergence of two worlds is pivotal to their mission.

“We teach people to stay away from risk while optimizing potential rewards. It’s all about the portfolio allocation principles that we have and the rules that we follow to make sure we avoid the downside,” Salim comments. “Once you have decided which 10 to 12 assets you want to hold, you can use DeFi tools to juice up the returns with a long term mindset. When the market is going red, you can add some delta-neutral strategies and more elaborate strategies on top.”

The founders draw a parallel from the TradFi world to the current DeFi space, where concepts such as restaking and liquid restaking echo the derivatives ideology from traditional finance. They highlight that this transition represents a broader shift, with all the innovation from TradFi moving to DeFi, where everything can be tokenized.

“While TradFi currently holds more capabilities due to decades of development, DeFi is quickly catching up, particularly with finance experts joining the pace. This space needs real finance people to jump ship and help the devs,» Tan asserts, highlighting the need for collaboration between financial and technical expertise.

This union is embodied in the Decentralized Masters team, with Salim’s engineering prowess and Tan’s finance acumen driving the platform’s growth. The project is poised to expand further, led by its dedication to education, innovation, and community building. Decentralized Masters’ vision reflects the evolving crypto space, as they merge the old and new financial worlds, offering nuanced insights and strategies.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

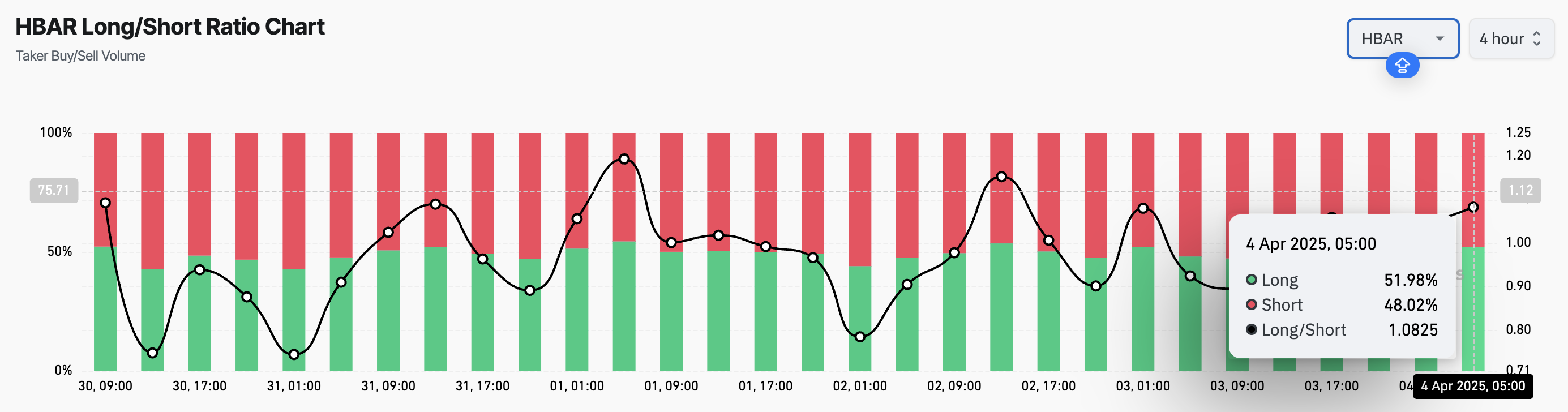

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

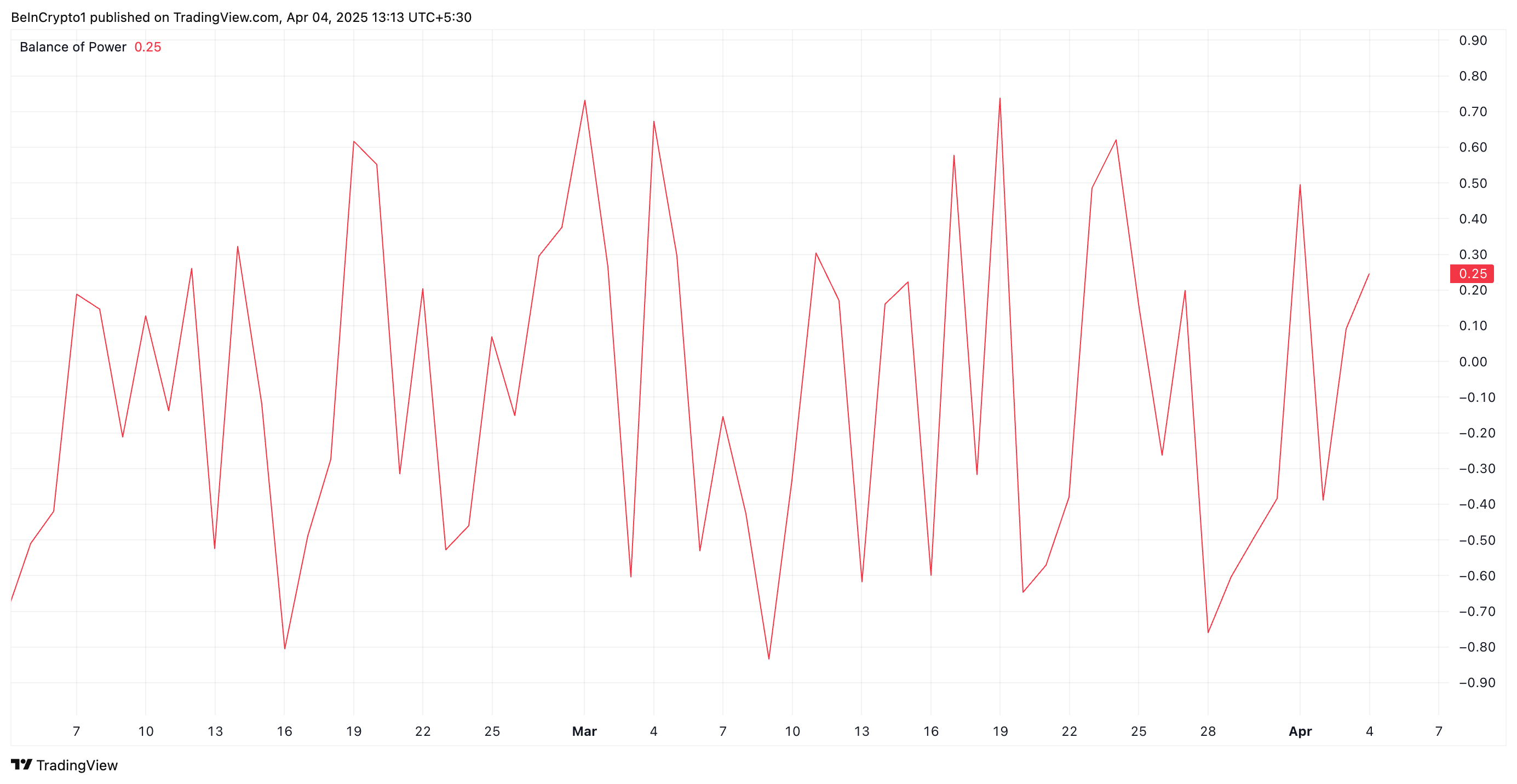

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding firm above $79,000 despite a sharp equities sell-off. Markets are bracing for the March NFP report and rising recession risks. With Fed rate cuts on the table and ETF inflows staying strong, all eyes are on what’s next for macro and crypto markets.

Is Bitcoin in a Bear Market?

The highly anticipated March U.S. non-farm payrolls (NFP) report is due later today, and it’s expected to play a key role in shaping market sentiment heading into the weekend.

“With the key macro risk event now behind us, attention turns to tonight’s non-farm payroll report. Investors are bracing for signs of softness in the U.S. labour market. A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy. At the time of writing, markets are pricing in four rate cuts in 2025—0.25 bps each in June, July, September and December,” QCP Capital analysts said.

Traditional markets are increasingly pricing in a recession, with equities retreating sharply—a 7% decline overall, including a 5% drop just yesterday. This broad de-risking environment helps explain the current pause in crypto inflows.

On the derivatives front, QCP adds:

“On the options front, the desk continues to observe elevated volatility in the short term, with more buyers of downside protection. This skew underscores the prevailing mood – uncertain and cautious.”

However, they also note that “with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce.”

Bitcoin remains resilient despite market volatility, holding above $79,000 with strong ETF inflows and signs of decoupling from stocks and altcoins. According to Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau: “Bitcoin is nowhere near a bear market at this stage. The future of many altcoins, however, is more questionable.”

Chart of the Day

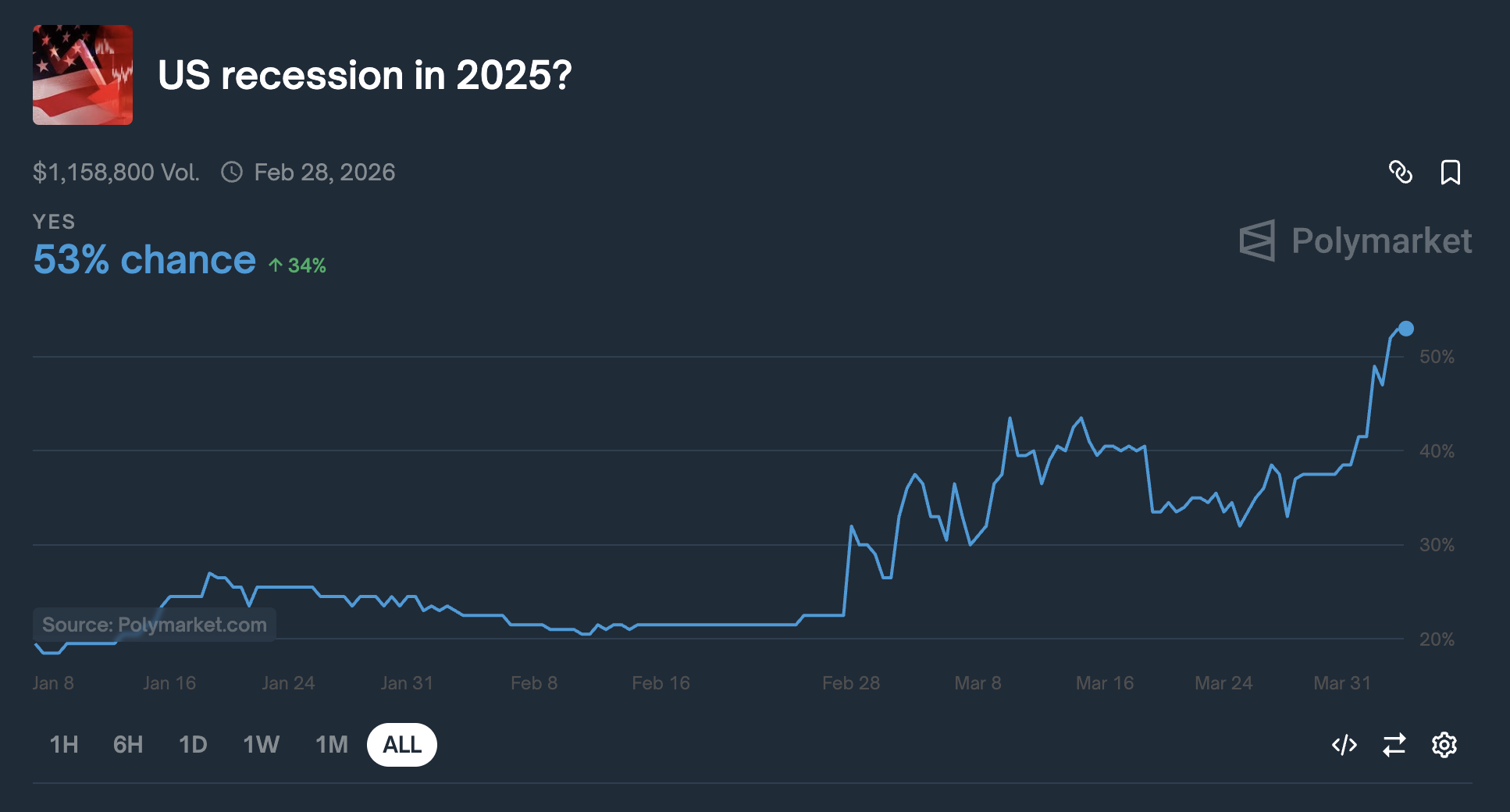

Chances of a US Recession in 2025 jumped above 50% for the first time, currently at 53%.

Byte-Sized Alpha

– Major ETF issuers are buying Bitcoin, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish BTC sentiment, but options traders remain cautious, signaling mixed market outlook.

– Coinbase is launching XRP futures after Illinois lawsuit relief, signaling growing regulatory support for crypto.

– Despite Trump’s tariff-driven crash, analysts see potential for a Bitcoin rebound—though inflation may cap gains.

– The Anti-CBDC bill passed a key House vote, aiming to block Fed-issued digital currencies and protect privacy.

– Today at 11:25 AM, Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Price Recovery Next As Whales Buy 230 Million ADA

Cardano has experienced a tough period, with the failed price recovery and declining market conditions. However, the recent buying behavior of whales and the potential for a price surge suggest a change in momentum.

If Cardano (ADA) can break through the $0.70 level, it could signal the end of the bearish sentiment.

Cardano Whales Are Hopeful

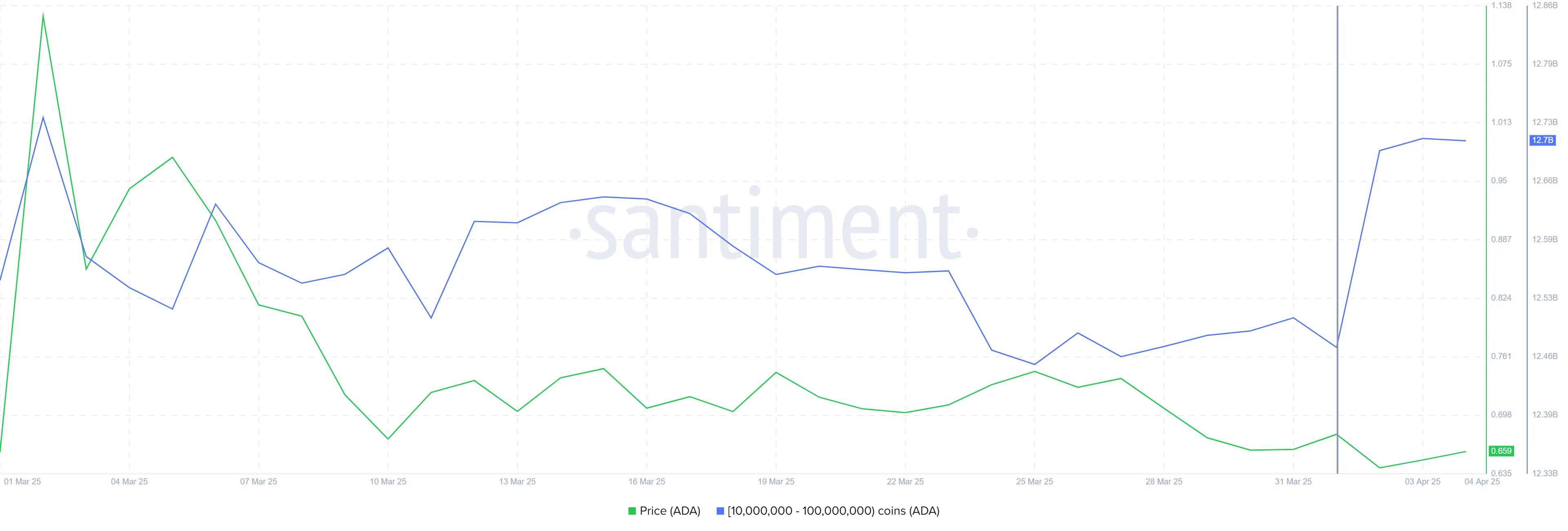

Over the past 72 hours, whales holding between 10 million and 100 million ADA have accumulated over 230 million ADA, valued at over $150 million at current prices. This shift from selling and staying neutral to accumulation indicates a shift in sentiment, with whales optimistic about ADA’s potential for Q2 2025. Their recent activity signals confidence in the altcoin’s recovery despite the recent market struggles.

Whale accumulation is often a bullish indicator as these investors have significant influence over the market. The accumulation is crucial, as it provides the support needed for ADA to break through resistance levels.

The liquidation map for Cardano shows that approximately $15 million in short contracts will expire as soon as ADA rises above the $0.70 level. This presents a key opportunity for the altcoin. Short-sellers may be forced to close their positions, which could lead to a short squeeze and drive the price higher.

Potential liquidation of short positions may create upward pressure, preventing further declines and allowing ADA to recover. The combination of whale accumulation and the looming liquidation of short contracts could provide Cardano with the momentum it needs to break free from its recent downtrend.

Can ADA Price Breach $0.70?

At the time of writing, Cardano’s price is at $0.65, holding above the crucial $0.62 support level. The altcoin has struggled in recent weeks, but the whale-buying activity offers hope for recovery. A breach of the $0.70 barrier could lead to further upward movement.

Should ADA successfully break through $0.70, it could gain the necessary momentum to continue its recovery. Flipping $0.77 into support would provide an additional boost, positioning Cardano to regain recent losses and possibly challenge higher resistance levels.

However, if Cardano fails to breach $0.70, the price may return to the $0.62 support level. Losing this support would invalidate the bullish outlook and send ADA to a lower level of $0.58, extending the ongoing decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Market21 hours ago

Market21 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market23 hours ago

Market23 hours agoTRUMP Token Hits Record Low Due To Liberation Day Tariffs

-

Market22 hours ago

Market22 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market20 hours ago

Market20 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market19 hours ago

Market19 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market18 hours ago

Market18 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?