Market

Key Levels to Watch in Analysis

Polygon’s (MATIC) price has risen 10% following Bitcoin’s surge yesterday, leading to the discovery of a key resistance level.

Can MATIC recover from its 40% drawdown since its March 2024 local peak?

MATIC Price and Ichimoku Cloud Insights

Polygon price is nearing entry into the daily Ichimoku cloud, a typically bullish signal. The Ichimoku cloud analysis suggests potential upside movement, as price action within the cloud often indicates a trend reversal or continuation.

An upside penetration of the daily Ichimoku cloud signifies strong bullish momentum. If the price breaks the 0.618 Fibonacci level, it could imply further upside levels that intensify the bullish momentum, with a price target set at $0.99.

Key Fibonacci Levels include the $0.67 level, which serves as strong support; the 0.618 level at $0.80, marking potential resistance; the 0.5 level at $0.89 as key resistance; the 0.382 level at $0.99, indicating further resistance if upward movement continues; a significant resistance level in a bullish scenario.

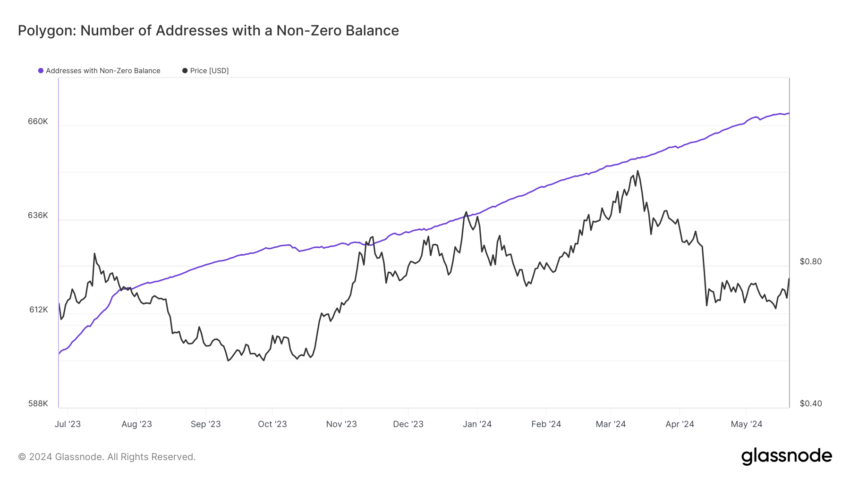

Increasing Addresses with Non-Zero Balance:

The number of MATIC addresses with a non-zero balance steadily increases, indicating robust network growth and adoption.

This trend signifies a healthy and expanding user base for MATIC.

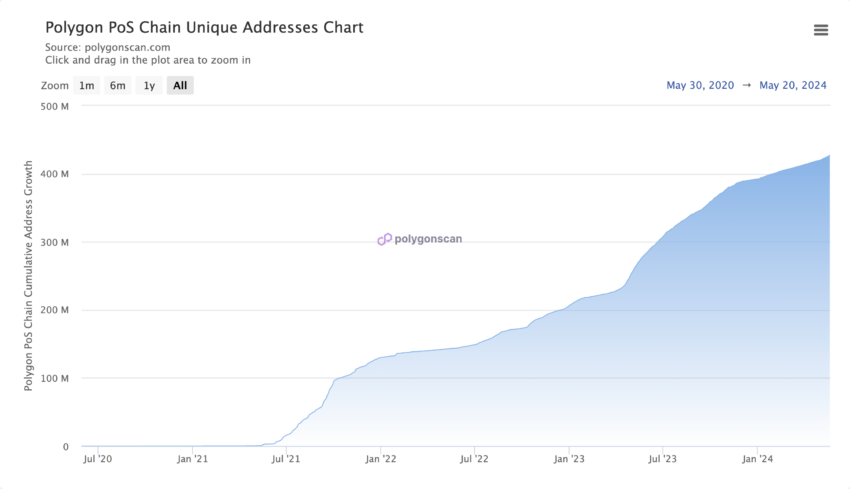

Growth in Unique Addresses:

The Polygon network continues to see a rise in unique addresses, reflecting sustained interest and user participation.

This growth is a positive indicator of MATIC’s long-term potential.

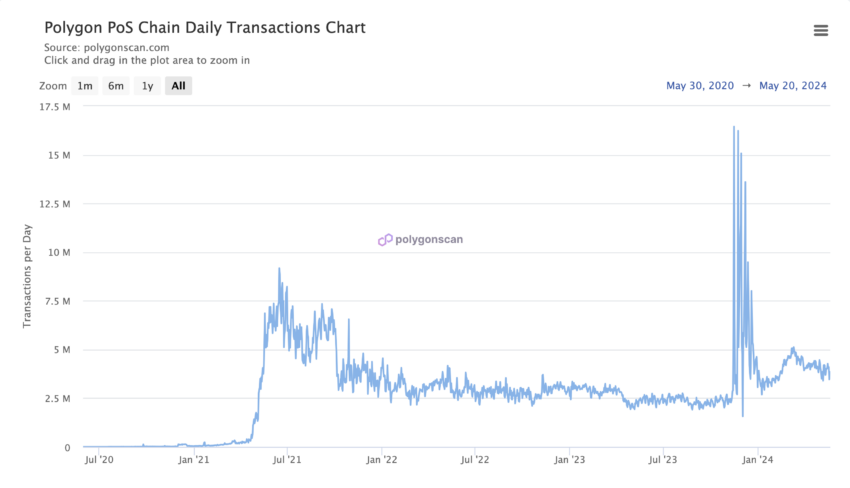

Consistent Daily Transactions:

The daily transaction chart shows significant activity on the Polygon network, with notable spikes indicating periods of high usage.

Sustained transaction volume supports the case for MATIC’s price appreciation, as it reflects an active and engaged network.

Strategic Recommendations and Price Projections

Bullish to Neutral Outlook for MATIC:

Target Level at $0.8052: If MATIC enters the daily Ichimoku cloud, the initial target is $0.8052, a significant resistance level.

Potential for Major Price Appreciation: Breaking above $0.8052 could trigger further price increases, targeting $0.8984, $0.9915, and beyond.

Downside Risk: If MATIC tests and fails to hold the lower boundary of the Ichimoku cloud, it could lead to a bearish exit, negating the bullish outlook and leading to further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stablecoin Regulation Bill Passes US House as Market Heats Up

The US House Financial Services Committee voted 32-17 to pass the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act of 2025, aimed at stablecoin regulation.

This legislative milestone comes amid growing activity in the stablecoin market. Competition is heating up as major traditional financial institutions prepare to enter the space.

STABLE Act Passes Committee Vote

Chairman French Hill and Representative Bryan Steil spearheaded the legislation (H.R. 2392). It seeks to establish a robust framework for stablecoin issuance, mandating 1:1 reserve backing, monthly audits, and AML requirements.

“This legislation is a foundational step toward securing the future of financial payments in the United States and solidifying the dollar’s continued dominance as a world reserve currency,” Representative Steil remarked.

The bill’s passage saw bipartisan support, with six Democrats voting in favor. Notably, this comes shortly after the US Senate Committee on Banking, Housing, and Urban Affairs greenlit the GENIUS Act. The bill passed in a bipartisan 18-6 vote.

“The bills await debate time on the floor and a vote in their respective chambers,” Journalist and Host of Crypto In America, Eleanor Terrett, noted.

According to Terrett, efforts are underway to align the two bills closely over the next few weeks. The aim is to address differences between the bills. Aligning them will make it easier to proceed without creating additional complications.

“If they can get them to be in relatively the same place on their own, it will avoid having to set up a so-called conference committee which is formed so members from both chambers can negotiate to create a final version of the bill everyone agrees on,” she added.

Stablecoin Competition Heats Up, but Are There Signs of a Purge?

The drive for legislation occurs alongside rising activity in the stablecoin market. Global players are joining the fray.

For instance, in Japan, Sumitomo Mitsui Banking Corporation (SMBC) and major entities have signed a Memorandum of Understanding (MoU). The MoU initiates joint discussions on the potential use of stablecoins for future commercialization.

“This Agreement will see SMBC, Fireblocks, Ava Labs, and TIS collaborate to develop a framework for stablecoin issuance and circulation, including exploring key technical, regulatory, and market infrastructure requirements both in Japan and further afield. This Joint Discussion will not only focus on pilot projects but will aim to concretely define use cases for ongoing business applications,” the notice read.

In addition, Bank of America’s CEO previously revealed plans to launch a stablecoin once proper regulation is in place. Notably, BeInCrypto reported last month that the Office of the Comptroller of the Currency (OCC) had granted national banks and federal savings associations permission to provide crypto custody and certain stablecoin services.

That’s not all. The state of Wyoming is set to launch its own stablecoin, WYST, in July. Fidelity has also announced similar plans. Moreover, President Trump-backed World Liberty Financial officially launched its USD1 stablecoin in late March. This highlights continued interest in stablecoin adoption across both private and public sectors.

Meanwhile, Ripple announced the integration of its Ripple USD (RLUSD) into Ripple Payments. Changpeng Zhao (CZ), former CEO of Binance, reacted to the development on X.

“Stablecoin war, I mean healthy competition, just getting started,” CZ said.

As competition intensifies, the stablecoin market is also facing growing pains. Despite new entrants gaining traction, some players face heightened scrutiny.

Justin Sun, founder of Tron (TRX), recently accused First Digital Trust of insolvency. Following Sun’s allegations, First Digital USD (FDUSD) temporarily depegged.

The market’s future may hinge on the survival of only the most compliant and resilient stablecoins. This leads to a potential “purge” where weaker players fail to meet the increasing regulatory and market demands.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Recovery Stalls—Bears Keep Price Below $2K

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price attempted a recovery wave above the $1,880 level but failed. ETH is now trimming all gains and remains below the $1,880 resistance zone.

- Ethereum failed to stay above the $1,850 and $1,880 levels.

- The price is trading below $1,850 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,865 and $1,890 resistance levels to start a decent increase.

Ethereum Price Fails Again

Ethereum price managed to stay above the $1,800 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,850 and $1,880 resistance levels.

The bulls even pushed the price above the $1,920 resistance zone. However, the bears are active near the $1,950 zone. A high was formed at $1,955 and the price trimmed most gains. There was a break below a key bullish trend line with support at $1,865 on the hourly chart of ETH/USD.

A low was formed at $1,781 and the price is now consolidating near the 23.6% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

Ethereum price is now trading below $1,850 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,865 level and the 50% Fib retracement level of the downward move from the $1,955 swing high to the $1,781 low.

The first major resistance is near the $1,920 level. A clear move above the $1,920 resistance might send the price toward the $1,950 resistance. An upside break above the $1,950 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,865 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,780

Major Resistance Level – $1,865

Market

Cardano (ADA) Downtrend Deepens—Is a Rebound Possible?

Cardano price started a recovery wave above the $0.680 zone but failed. ADA is consolidating near $0.650 and remains at risk of more losses.

- ADA price failed to recover above the $0.70 resistance zone.

- The price is trading below $0.680 and the 100-hourly simple moving average.

- There was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.70 resistance zone.

Cardano Price Dips Again

In the past few days, Cardano saw a recovery wave from the $0.6350 zone, like Bitcoin and Ethereum. ADA was able to climb above the $0.680 and $0.6880 resistance levels.

However, the bears were active above the $0.70 zone. A high was formed at $0.7090 and the price corrected most gains. There was a move below the $0.650 level. Besides, there was a break below a connecting bullish trend line with support at $0.6720 on the hourly chart of the ADA/USD pair.

A low was formed at $0.6356 and the price is now consolidating losses near the 23.6% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. Cardano price is now trading below $0.680 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.6720 zone or the 50% Fib retracement level of the recent decline from the $0.7090 swing high to the $0.6356 low. The first resistance is near $0.6950. The next key resistance might be $0.700.

If there is a close above the $0.70 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.7420 region. Any more gains might call for a move toward $0.7650 in the near term.

Another Drop in ADA?

If Cardano’s price fails to climb above the $0.6720 resistance level, it could start another decline. Immediate support on the downside is near the $0.6420 level.

The next major support is near the $0.6350 level. A downside break below the $0.6350 level could open the doors for a test of $0.620. The next major support is near the $0.60 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.6420 and $0.6350.

Major Resistance Levels – $0.6720 and $0.7000.

-

Market24 hours ago

Market24 hours agoBNB Price Faces More Downside—Can Bulls Step In?

-

Regulation18 hours ago

Regulation18 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Fueling The Shibarium Boost?

-

Bitcoin20 hours ago

Bitcoin20 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin14 hours ago

Altcoin14 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Altcoin13 hours ago

Altcoin13 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Altcoin10 hours ago

Altcoin10 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin21 hours ago

Altcoin21 hours agoFranklin Templeton Eyes Crypto ETP Launch In Europe After BlackRock & 21Shares