Altcoin

Whale Moves $46M ETH Amid Price Rally, What’s Next?

Ethereum (ETH) has once again captured the attention of investors and enthusiasts alike within the broader crypto market. Following a notable price rally observed over the past week, the token has emerged as a focal point of activity, with on-chain data signaling heightened engagement among large-scale investors. This resurgence in Ethereum’s price has catalyzed a flurry of whale activity, marking a significant development within the crypto landscape.

Ethereum Whale Activity Sparks Market Speculation

Ethereum (ETH), the second-largest cryptocurrency by global market cap, has once again attracted attention with a significant price recovery observed in the past 24 hours. Amid this resurgence, on-chain data has revealed notable activity by large holders, commonly referred to as whales, suggesting potential shifts in the market landscape. One such instance involves a whale identified as 0x7f1, who recently deposited 15,000 ETH, valued at over $45.98 million, into the Kraken exchange at a price of $3,065.

https://x.com/spotonchain/status/1792375721928839544

This sizable transaction has prompted speculation among crypto enthusiasts regarding the future trajectory of ETH’s price. The influx of such transactions has stirred mixed sentiments within the market, reflecting the ongoing debate between investors who view Ethereum as a lucrative investment opportunity and those who may be capitalizing on recent price movements to realize profits. Notably, the same whale had earlier moved 120,874 $ETH from Kraken at an average price of $1,645 in early Sep 2022. Currently the whale holds 105,874 $ETH worth $326M with a total profit of $173M depicting a whopping +87%.

Also Read: U.S. SEC Can Approve 19b-4 for Spot Ethereum ETF, What It Means?

Analyzing Ethereum’s Price Movement and Market Dynamics

Ethereum’s price has experienced a modest increase of 0.51% within the past 24 hours and a more substantial uptick of 7.23% over the past week. At present, ETH is trading at $3,126, with its price range oscillating between $3,135.70 and $3,056.20. Market data from Coinglass indicates a marginal 1.55% decline in ETH’s open interest, accompanied by a notable 51.55% decrease in options volume.

These fluctuations in trading activity could potentially contribute to the volatility observed in Ethereum’s price action. However, despite market uncertainties surrounding regulatory issues and the delayed anticipation of an ETH exchange-traded fund (ETF), Ethereum continues to navigate through challenges with cautious optimism.

The Relative Strength Index (RSI) currently stands at 57.35, suggesting an increasing bullish sentiment, which could exert upward pressure on ETH’s price in the near term. Additionally, as the broader cryptocurrency market awaits the potential resurgence of altcoins following the Bitcoin halving event, Ethereum remains positioned to capitalize on future market trends.

Also Read: Shiba Inu Coin: SHIB Burn Rate Spikes 500%, Price Rally Imminent?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

XRP price has surged nearly 10% today, indicating a renewed market interest in Ripple’s native asset. Notably, the robust surge comes amid a broader crypto market recovery and several other positive developments like the successful ETF launch in the US. Amid this, a top expert has highlighted the XRP/BTC performance and said that Ripple’s native asset is likely to hit $22 if Bitcoin hits a new ATH ahead.

XRP/BTC Bullish Cross Signals Massive Surge Ahead

Crypto analyst EGRAG CRYPTO recently highlighted a major bullish signal on the XRP/BTC chart. He pointed out a rare crossover of two key indicators, i.e. the 55-week Exponential Moving Average (EMA) and the 155-week Moving Average (MA). According to him, this “Bullish Cross” could be a game-changer for XRP holders.

EGRAG explained that the last time this crossover occurred was back in May 2017. XRP price rallied 958% shortly after that event. A similar cross took place again on February 17, 2025, and could repeat the explosive pattern if market conditions align.

Meanwhile, he added that if XRP/BTC retests the 55 EMA level of 0.00001850, Ripple’s coin could reach around $1.48, assuming Bitcoin trades at $80,000. However, if the historical pattern plays out and XRP/BTC gains another 958%, XRP price could skyrocket much higher. Besides, it also comes amid a surge of nearly 6% in BTC price today.

XRP Price Likely To Follow Bitcoin Move

EGRAG CRYPTO’s prediction hinges heavily on Bitcoin’s next major move. If Bitcoin price revisits its 2025 ATH near $109,000 and retraces to $97,000, XRP could hit $16.5. But if BTC breaks into higher territory, the numbers look even more bullish.

For context, he calculated that if Bitcoin touches $130K, XRP could trade at $22. Furthermore, if BTC rallies to $150K, XRP might surge to $25. A push toward $170K could propel XRP to $29, he added.

Why Does This Technical Signal Matters?

The analyst believes most traders overlook the significance of the 55 EMA and 155 MA combination. He noted that many still doubt XRP’s ability to reach double digits, especially after the recent crypto market crash.

However, the analyst remains firm in his belief that the chart tells a different story. He believes that as long as the XRP/BTC pair holds above the 55 EMA, the bullish projection for the XRP price stays valid.

XRP Price Soars 10%

XRP price today was up nearly 10% and exchanged hands at $2, while its one-day volume rose 3% to $8 billion. Simultaneously, the XRP Futures Open Interest also soared past the $3 billion mark with over 4% surge, CoinGlass data showed.

Notably, this recent surge comes as the Ripple network has seen a massive surge in active addresses recently. Besides, the recent XRP ETF launch in the US has also bolstered market confidence. The first-day volume of the Teucrium 2X Long Daily XRP ETF has outshined Solana’s 2X ETF (SOLT) first-day volume.

Considering all these fundamental developments, it appears that the crypto is gearing up for a major rally ahead. Besides, the analyst’s forecast, if holds true, could send the crypto to over $20 in the coming days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will Q2 2025 Mark the Return of Altcoin Season?

The cryptocurrency market is showing potential signs of an impending altcoin season. Market watchers cite a confluence of technical, sentiment, and macroeconomic factors that could lead to a significant rally in altcoins.

The outlook follows a notable downturn in the altcoin market, which has dropped about 37.6% since its high in early December 2024. As of the latest data, the market cap stands at $1.1 trillion.

Is Altcoin Season Coming?

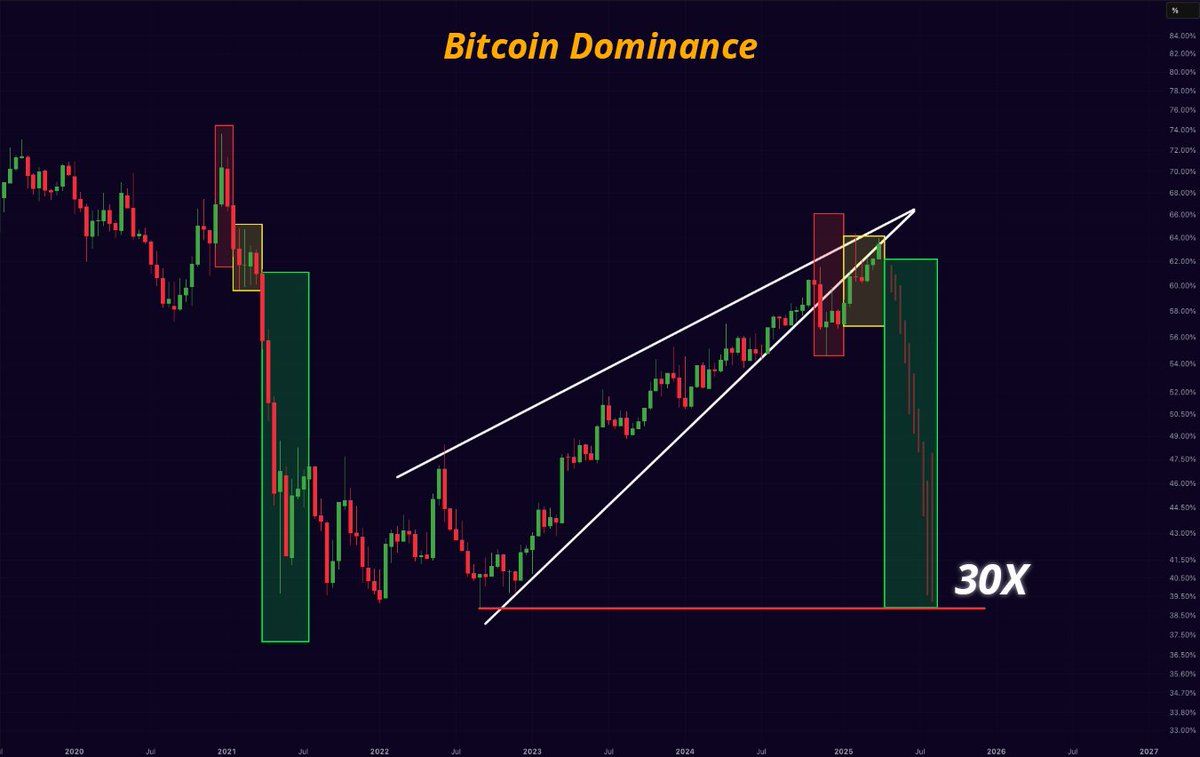

From a technical perspective, Bitcoin (BTC) Dominance, which measures Bitcoin’s market share relative to the total cryptocurrency market, seems to be at a key turning point.

A recent chart shared by crypto analyst Mister Crypto on X highlighted that Bitcoin Dominance has reached a resistance following a rising wedge pattern. This pattern is generally seen as a bearish signal, often leading to sharp pullbacks.

“Bitcoin Dominance will collapse. Altseason will come. We will all get rich this year!” he wrote.

In addition, another analyst corroborated these findings, noting that Bitcoin Dominance has reached a peak. Thus, he forecasted a subsequent downturn.

However, the Altcoin Season Index has dropped to a low of 16. The index, which analyzes the performance of the top 50 altcoins against Bitcoin, indicated that altcoins are currently underperforming.

Notably, this level mirrors the bottom for altcoins observed around August 2024. This period preceded a significant altcoin rally, and the index peaked at 88 by December 2024.

Lastly, from a macroeconomic perspective, the 90-day delay in President Donald Trump’s tariff implementation has renewed market confidence. This delay is perceived as a positive signal, potentially encouraging capital inflows into altcoins.

“90 days tariff pause = 90 days of altseason,” an analyst claimed.

Moreover, analyst Crypto Rover pointed to quantitative easing (QE) as a catalyst for an altseason. According to him, when the central bank starts pumping money into the economy (through QE), altcoins could experience a significant price surge, benefiting from the increased liquidity and investor optimism.

“Once QE starts. Altcoin season will make a massive comeback!” he stated.

However, in the latest report, Kaiko Research stressed that a traditional altcoin season may no longer be feasible. Instead, any potential rally could be selective, with only a few altcoins experiencing significant upside. The focus will likely be on assets with real-world use cases, strong liquidity, and revenue-generating potential.

“Altseasons may become a thing of the past, necessitating a more nuanced categorization beyond just ‘altcoins,’ as correlations in returns, growth factors, and liquidity among crypto assets are diverging significantly over time,” the report read.

Kaiko Research noted that the growing concentration of liquidity in a few altcoins and Bitcoin may disrupt the typical capital flow into altcoins during market upswings. Furthermore, as Bitcoin becomes more widely adopted as a reserve asset by institutions and governments, its position in the market strengthens further.

Ultimately, while the signs point to a potential altcoin rally, it’s clear that the future of altcoins could involve more nuanced market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Most Altcoins Now In ‘Opportunity’ Zone, Santiment Reveals

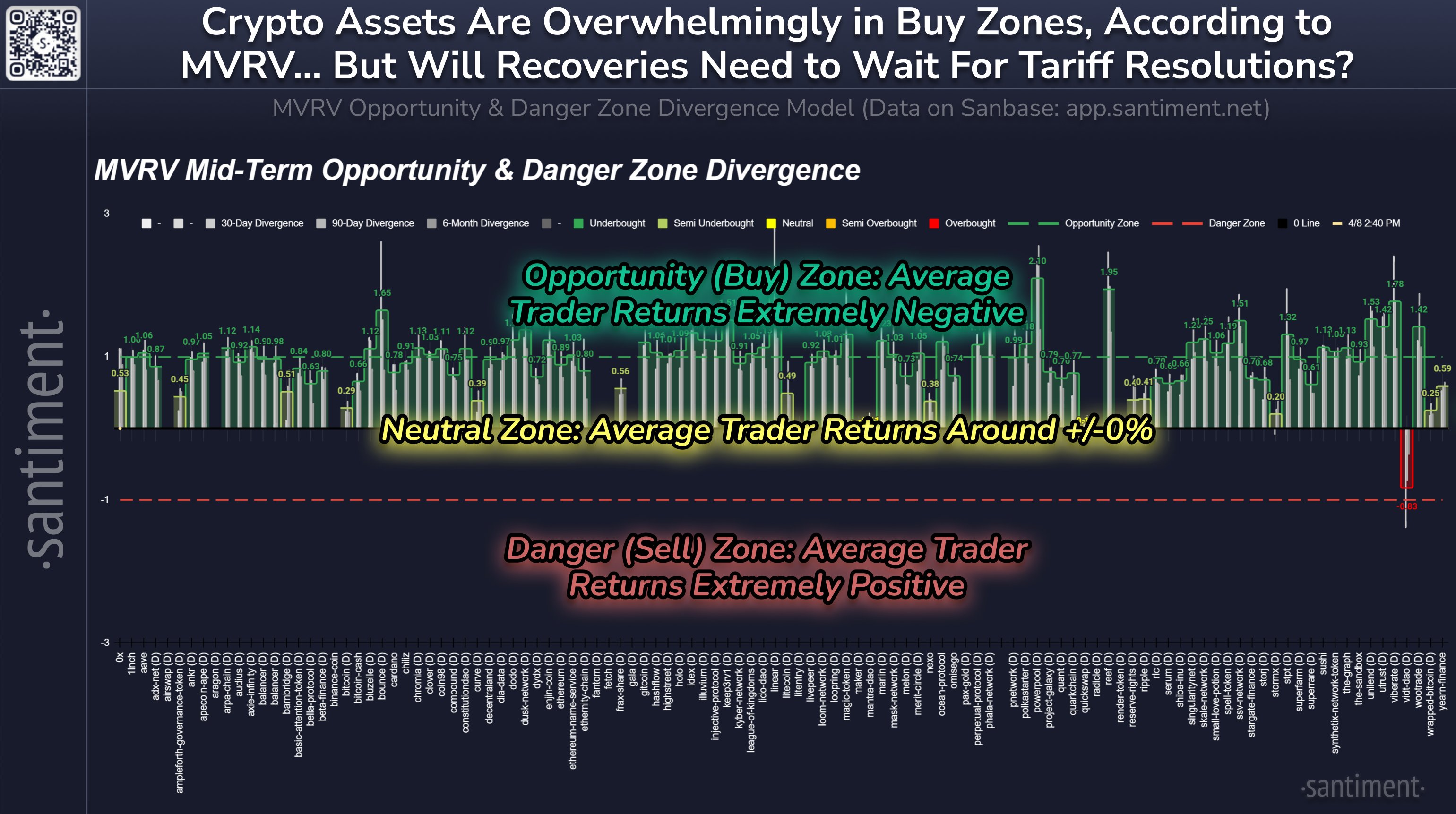

The on-chain analytics firm Santiment has revealed how the majority of the altcoins are currently in what has historically been a buy zone.

Mid-Term Trading Returns Are Extremely Negative For Most Altcoins

In a new post on X, Santiment has shared an update for its MVRV Opportunity & Danger Zone Divergence Model for the various altcoins in the sector. The model is based on the popular “Market Value to Realized Value (MVRV) Ratio.”

The MVRV Ratio is an on-chain indicator that basically tells us whether the investors of a cryptocurrency as a whole are holding their coins at a net profit or loss.

When the value of this metric is greater than 1, it means the average investor is holding a profit. On the other hand, it being under this threshold suggests the dominance of loss.

Historically, holder profitability is something that has tended to have an effect on the prices of digital assets. Whenever the investors are in large profits, they can become tempted to sell their coins in order to realize the piled-up gains. This can impede bullish momentum and result in a top for the price.

Similarly, holders being significantly underwater results in market conditions where profit-takers have run out, thus allowing for the cryptocurrency to reach a bottom.

Santiment’s MVRV Opportunity & Danger Zone Divergence Model exploits these facts in order to define buy and sell zones for the altcoins. The model calculates the divergence of the MVRV Ratio on various timeframes (30 days, 90 days, and 6 months) to find whether an asset is inside one of these zones or not.

Here is the chart shared by the analytics firm that shows how the different altcoins are currently looking based on this model:

Looks like most of the sector is currently in the buy region | Source: Santiment on X

In this model, a value greater than zero suggests average trader returns are negative for that timeframe and that below it is positive. This is the opposite orientation of what it’s like in the MVRV Ratio, with the zero level taking the role of the 1 mark from the indicator.

From the graph, it’s visible that almost all of the altcoins have their MVRV divergence greater than zero on the different timeframes. Out of these, most of them have their mid-term MVRV divergence greater than 1. The opportunity zone mentioned earlier lies beyond this mark, so the model is currently showing a buy signal for the majority of the altcoins.

The average negative returns have come for these coins as the market has been in turmoil following the news related to tariffs. While the model may be showing a buy signal for the altcoins, it’s possible that this uncertainty will continue to haunt the market. As Santiment explains,

If and when a global tariff solution is reached, it would undoubtedly trigger a very rapid cryptocurrency recovery,” notes However, this is currently a very big “if” based on the latest media coverage on what is quickly being referred to as a full-fledged “trade war” between the US and the majority of the world.

BTC Price

At the time of writing, Bitcoin is floating around $76,900, down more than 9% in the last seven days.

The price of the coin has already erased its attempt at recovery | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Bitcoin12 hours ago

Bitcoin12 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market12 hours ago

Market12 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin16 hours ago

Altcoin16 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market21 hours ago

Market21 hours agoPaul Atkins SEC Confirmation Vote

-

Market8 hours ago

Market8 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market13 hours ago

Market13 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Regulation12 hours ago

Regulation12 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Altcoin23 hours ago

Altcoin23 hours agoPepe Coin Whales Offload Over 1 Trillion PEPE

✓ Share: