Market

Crypto gambling — how does the future of secure gambling look?

Online gambling is a huge part of the casino world, but there is a small percentage of players who worry about its security — welcome, cryptocurrency casinos. It’s 2024, and although crypto casinos are nothing new, there is a wide range of some of the huge household names now utilizing this form of payment to stay ahead. It used to be that security processes were a major block for many players online, as when you gamble online you are putting your data, funds, and personal information in the hands of the online casino. Luckily, we’re in a new era of technology and the security methods that these brands now use are second to none.

If we were to look at the history of online casinos, we would see that traditional platforms struggled to build robust security methods, which left players susceptible to fraud and hackers. However, that fear is one of the past, as all online casinos that are worth playing on have to be regulated and in turn, adopt a fortress-like level of security. It not only puts you as the player in safe hands but offers up a new way of using decentralized funds, that are transparent and completely controlled by you. We’re going to be taking a look at how one of the safest forms of online gambling is evolving, and what measures shape where it’s got to today. Ever worried about online casinos before? Well, you won’t now!

Blockchain — what is it?

If you were looking for one advancement to thank in this evolving secure digital landscape, then it would most definitely be blockchain. Although to many it sounds unmeasurably confusing, it’s a piece of technology that works wonders in online gambling. Blockchain is a decentralized digital piece of technology that acts as a record sheet for transactions. It is a secure, transparent piece of tech that, in summary, is a digital ledger/database. It stores the transactions in things called blocks, which are then linked by a chain… sounds obvious, right?

Each and every block that is formed on this digital ledger then contains an individual yet unique cryptographic node that cannot be modified as the chain goes on. Therefore, in summary, as the chain progresses, it becomes inevitably stronger and unable to be hacked or tampered with. It’s also getting more valuable all the time.

It is the undisputed heavyweight in all security processes and stands as the backbone of anything cryptocurrency-related.

But how does it keep your information safe in gambling?

- Immutability — This means that it is unable to be changed, ever. When a piece of data has been recorded on the ledger (blockchain), it is then unable to be altered. This creates a transparent record in a casino, showing that all bets have been safely placed and will never be tampered with.

- Decentralization — Like everything with crypto, when using crypto in a casino, it becomes completely decentralized. This cuts out any third parties such as banks, and therefore reduces potential threats. Although you may think your funds are safe with the central banks, they are far more susceptible to hackers than if they were placed in a virtual crypto wallet — hence why they’re the future of online gambling.

- Fairer — Above all else, when you’re gambling online, one of the most important requests is fairness. Blockchain makes sure that all the algorithms in a casino’s interface are fully leveled out, meaning that crypto pokies are guaranteed to be treated equally with all their pay-ins, pay-outs, and hand/slot automation.

The future of privacy and transparency

Online gambling is only growing exponentially because both crypto and blockchain are putting support in place for its players. Crypto gives the player a whole new level of anonymity, while blockchain dishes up transparent records for safeguarding their data. This opposes the older methods of online casinos, as pre-crypto users would use traditional payment methods that resulted in your data being shared, and potentially hacked. Before crypto was utilized by online casinos, players would have to input a lot more personal data — which would put them at risk of identity fraud. Now, the online player uses a virtual wallet that is decentralized and secure from all threats.

The role of cryptocurrency is growing and the future of it is only getting more resilient against security worries. As of early 2024, there are 13,217 cryptocurrencies in existence, with new ones appearing all the time — and this is expected to grow by the end of the year. We’re in an era where technological changes are inevitable, and to stay ahead as a business, you need to adopt change. This makes customers in online gambling feel safe, and encourages them to utilize the platforms that prioritize their safety above all else.

With every bet you place being recorded on the blockchain and every payout you receive being fully untraceable — secure gambling is not just the future, it’s the now.

Market

BeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Standard Chartered sees early signs of institutional investors turning to Bitcoin as a hedge against equity market volatility, just as traders gear up for a potentially volatile week driven by tariff news. At the same time, Coinbase wraps up its worst quarter since the FTX collapse, and U.S. regulators inch closer to unified stablecoin legislation.

Standard Chartered Sees Signs of Bitcoin Starting to Be Used as Hedge Against Market Volatility

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, sees signs that institutional traders are starting to use Bitcoin as a hedge against equity market volatility.

In a recent exclusive interview with BeInCrypto, Kendrick highlighted that this trend is already underway, with investors seeking alternatives to traditional instruments. “This is happening already,” Kendrick stated. “Investors used to use FX, specifically AUD, for this purpose due to its highly liquid and positive correlation to stocks, but now I think Bitcoin is being used because it is also highly liquid and trades 24/7.”

Additionally, in an investor note from late March, Kendrick expanded on Bitcoin’s evolving role in investment portfolios, suggesting that over time, Bitcoin may serve multiple purposes—both as a hedge against traditional financial market fluctuations and as a proxy for tech stocks.

He pointed out signs that markets could anticipating a less severe tariff announcement from the U.S. on April 2. “Given this has been the worst quarter for the Nasdaq since Q2 2022, there should be a degree of portfolio rebalancing (buying) that needs to take place,” Kendrick added.

As of April 1, 2025, Bitcoin has shown resilience amid broader market uncertainties. The cryptocurrency is up approximately 3.32%, trading at $84,282. This uptick comes alongside an overall increase in the global cryptocurrency market capitalization. In contrast, U.S. stock futures, including Dow Futures, S&P 500 Futures, and Nasdaq Futures, are all trending lower in pre-market trading, reflecting investor caution ahead of the anticipated tariff announcements.

Bitcoin Options Heat Up Before Trump’s “Liberation Day”

FalconXCrypto Global Co-Head of Markets, Joshua Lim, noted that in anticipation of Wednesday’s Trump-tariff “Liberation Day,” crypto funds are actively purchasing Bitcoin options at two key strike prices: $75,000 on the downside to hedge against potential losses and $90,000 on the upside to capitalize on a price surge.

Lim highlighted that the options market is pricing in a potential 4% move in Bitcoin’s price during the event. “The implied event move embedded in Bitcoin options is around 4% for the 2 April event,” he told BeInCrypto.

He also pointed out that traders are likely to keep buying put options in the short term as a protective measure, maintaining a high options cost premium. “We believe the front of the options curve will hold its premium as traders continue to hedge their portfolios or replace spot positions with limited-loss option positions,” Lim added.

Additionally, he noted a 4-point increase in the VIX, signaling that investors expect heightened volatility in the coming days and are turning to options to manage risk or capitalize on price swings. “US equities are also showing a bid in options, with the front-month VIX up 4 points to 22v from last week,” he said.

Crypto Stocks Slide: Coinbase Suffers Worst Quarter Since FTX Collapse

Coinbase is closing out its roughest quarter since the FTX collapse, with its stock tumbling over 30% since January. While it dipped nearly 1% in early U.S. pre-market trading on Monday, the stock managed to claw back losses and is now up around 1%.

Other crypto-linked companies are also feeling the pressure. Galaxy Digital Holdings has dropped over 8% in pre-market trading, while mining firms Riot Platforms and Core Scientific are only barely staying afloat, each gaining less than 0.5%.

Meanwhile, CoreWeave, which pivoted from Bitcoin mining to AI infrastructure, is struggling after a disappointing IPO. Initially aiming for a $2.7 billion raise, the company had to settle for $1.5 billion, slashing its offer price from the $47–55 range to $40 per share. Since going public last Friday, its shares are down 6.8%, with a 7.3% drop recorded in the last 24 hours.

Byte-Sized Alpha

– Today’s JOLTS report, a key gauge of U.S. job openings, could sway Bitcoin—strong data may boost the dollar and hurt crypto, while a sharp decline could fuel rate-cut hopes and lift risk assets.

– Bitcoin is off to its worst quarterly start since 2018, dropping nearly 12% in Q1 2025—but growing whale accumulation, falling exchange supply, and signs of consolidation hint at a potential rebound ahead.

– Crypto scams are on the rise, with fake Gemini bankruptcy emails and a Coinbase employee breach fueling phishing attacks

– OKX has appointed former NYDFS Superintendent Linda Lacewell as Chief Legal Officer, a move aimed at bolstering its regulatory credibility as the exchange accelerates global expansion into regions like Europe and the UAE.

– A unified U.S. stablecoin regulation could soon become reality, as the STABLE and GENIUS Acts differ by only 20% and enjoy strong bipartisan support alongside SEC and CFTC involvement.

– A push for expanded crypto oversight is underway as incoming CFTC Chair Brian Quintenz meets with Senator Chuck Grassley to discuss regulating the crypto spot market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Price Stalls After Major $147 Million Token Unlock

SUI enters a critical phase today as a $147 million token unlock threatens to inject selling pressure into a market already testing key resistance levels. Despite a sharp rebound in momentum—evident in the RSI’s surge from oversold territory—SUI failed to break above the crucial 60 mark, signaling buyer hesitation.

The Ichimoku Cloud shows price action pressing against the cloud’s edge, but lacking the conviction needed for a clear breakout. With a possible golden cross forming on the EMA lines, bulls still have a chance—if they can overcome resistance at $2.50 and avoid being dragged down by post-unlock volatility.

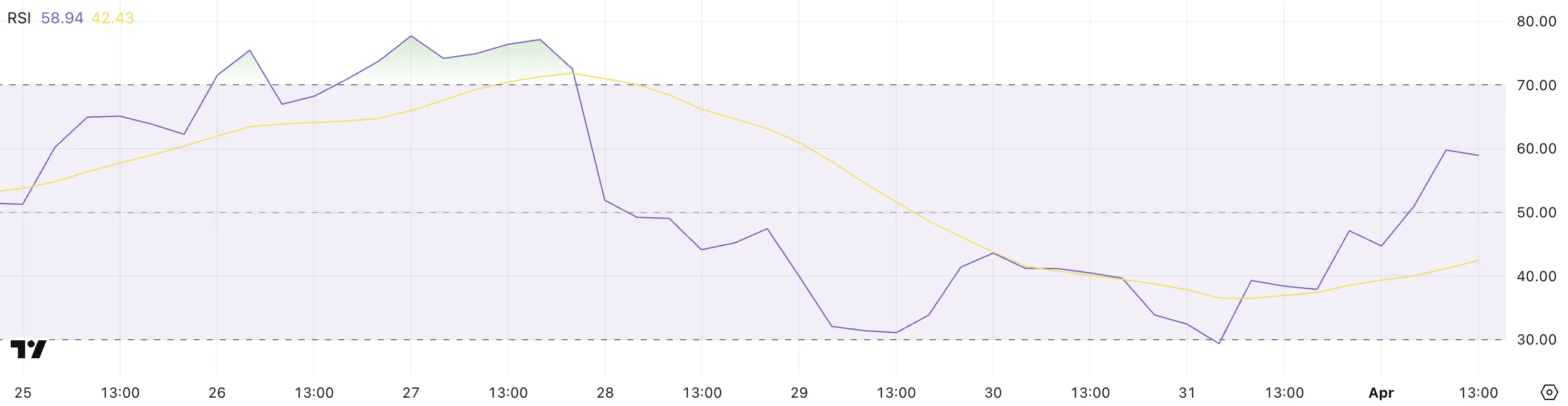

SUI RSI Surged Since Yesterday But Failed To Break Above 60

SUI’s Relative Strength Index (RSI) has jumped sharply to 58.94, up from 29.38 just a day ago, reflecting a strong shift in short-term momentum.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It typically ranges from 0 to 100. Readings below 30 suggest an asset may be oversold, while levels above 70 indicate it may be overbought.

The rapid rise in SUI’s RSI suggests buyers have stepped in aggressively after a period of heavy selling.

However, despite the impressive rebound, SUI’s RSI briefly approached but failed to break above the 60 threshold earlier today.

This level often acts as a short-term resistance during recovery phases, and the rejection may indicate lingering hesitation among buyers or profit-taking after the surge.

While the RSI nearing 60 is encouraging, a decisive move above it would be needed to confirm a breakout. For now, SUI appears to be in a recovery mode. However, the inability to push past 60 highlights that bulls are not fully in control just yet.

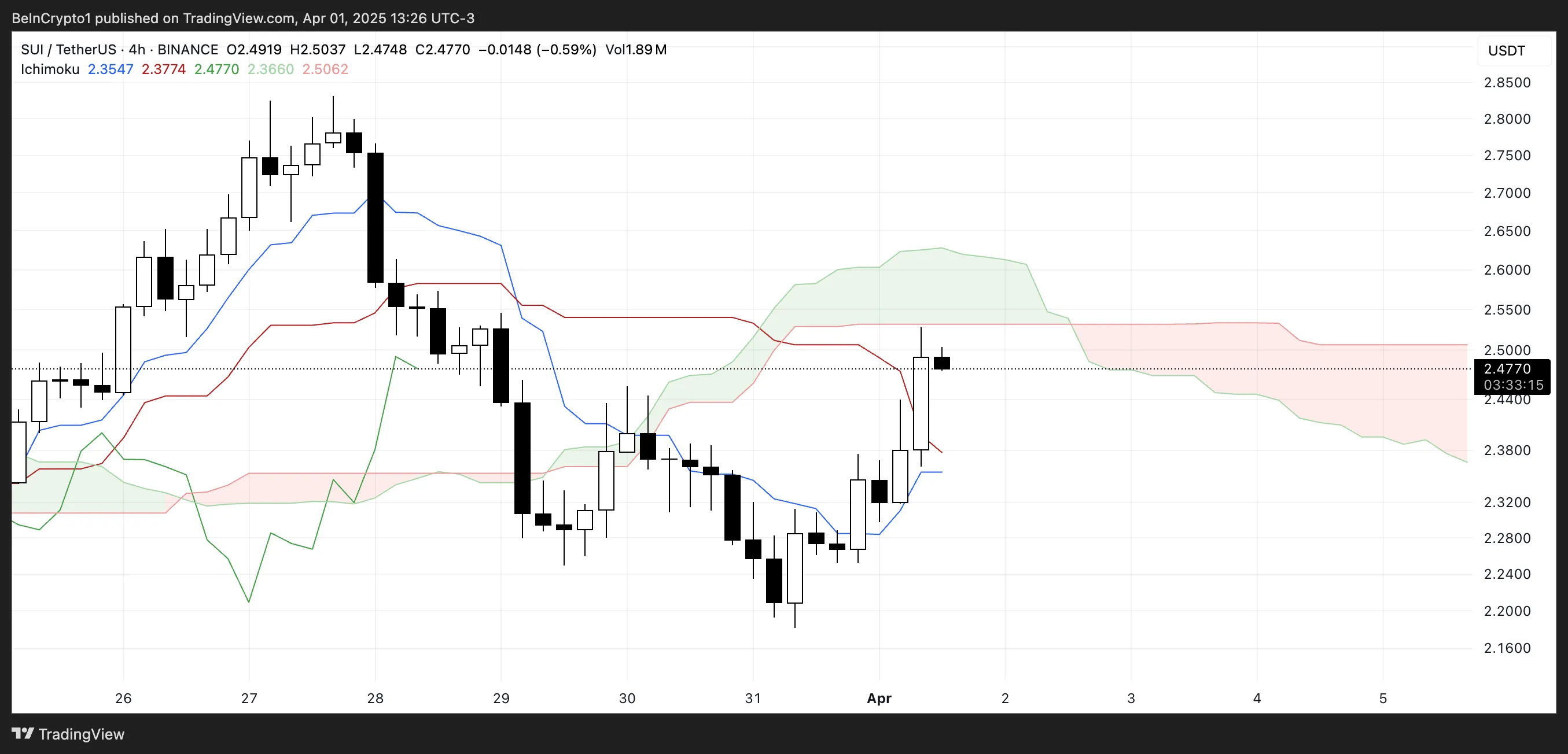

Ichimoku Cloud Shows Lack Of Strong Upward Momentum

SUI blockchain Ichimoku Cloud chart shows a potential breakout attempt, as the price has surged upward and is now hovering right at the edge of the Kumo (cloud).

This movement suggests bullish momentum is trying to build. However, the resistance provided by the thick, red cloud ahead could make it difficult for SUI to sustain the uptrend without stronger confirmation.

The Tenkan-sen (blue line) is starting to rise and has crossed above the Kijun-sen (red line), which is a bullish signal. However, the price still needs to clearly break and hold above the cloud to flip the overall trend from bearish to bullish.

For now, the cloud remains bearish and flat, indicating possible resistance and a lack of strong upward conviction.

The current position suggests that SUI is at a key decision point—either break through the cloud to initiate a trend reversal or get rejected and slip back into the previous downtrend range.

If buyers can sustain the pressure and push the price above the upper cloud boundary, it could trigger a stronger rally. But without increased volume and broader market support, the price risks getting stuck in consolidation or turning back downward.

Will SUI Rise Back To $2.80?

SUI’s EMA lines are tightening and showing signs of a potential golden cross. That happens when a short-term moving average crosses above a longer-term one—a classic bullish signal that often precedes upward momentum.

However, the price is currently grappling with a key resistance near the $2.50 level.

If bulls manage to break through this level, it could open the path for a move toward $2.83.

That said, downside risks remain, particularly with today’s $147 million token unlock, which could introduce significant selling pressure. If that selling materializes, SUI price could fall back to test the support at $2.23.

A breakdown below that level would likely shift momentum back in favor of bears. This would expose deeper supports at $2.11 and $1.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle Files for IPO

Leading stablecoin issuer Circle finally launched an IPO. It has been preparing for this launch for almost a year, and joins several other crypto firms that are interested in an IPO filing.

This gives Circle a number of opportunities, both to benefit financially and to better integrate with the financial infrastructure and regulatory apparatus.

Circle’s IPO Comes At Last

Circle, one of the world’s largest stablecoin issuers, just filed for an IPO. The firm has been planning this move for nearly a year, relocating to the United States to make the process easier. Since Trump won the most recent Presidential election, the firm’s chances of an IPO increased, and now it has finally pulled the trigger:

“For Circle, becoming a publicly traded corporation on the New York Stock Exchange is a continuation of our desire to operate with the greatest transparency and accountability possible. We are building what we believe to be critical infrastructure for the financial system, and we seek to work with leading companies and governments around the world in shaping and building this new internet financial system,” founder and CEO Jeremy Allaire claimed in the filing.

By launching this IPO, Circle has opened a few new doors for itself. Of course, it’s a substantial opportunity for revenue, but it’s also an important way to intensify the firm’s connections to the financial infrastructure. In this respect, it joins a number of other crypto firms that have sought their own IPO in the last month.

Circle’s IPO filing doesn’t list many concrete numbers, such as initial public offering price, number of available shares, proceeds to the selling stockholders, etc. However, this development is very recent. Further details will likely come to light as the sale progresses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Bitcoin14 hours ago

Bitcoin14 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market23 hours ago

Market23 hours agoTop 3 Made in USA Coins to Watch In April

-

Market21 hours ago

Market21 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Bitcoin13 hours ago

Bitcoin13 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market20 hours ago

Market20 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Ethereum19 hours ago

Ethereum19 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market19 hours ago

Market19 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz