Ethereum

Is Ethereum Set For A Major Rally? Options Traders Bet Big On $3,600+ Targets For June

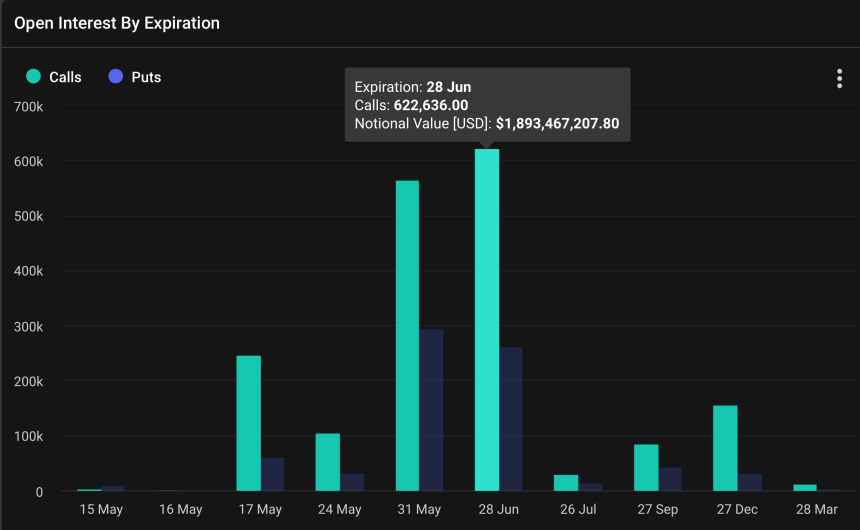

Ethereum (ETH) options for June show a marked interest in higher strike prices, focusing on levels exceeding $3,600.

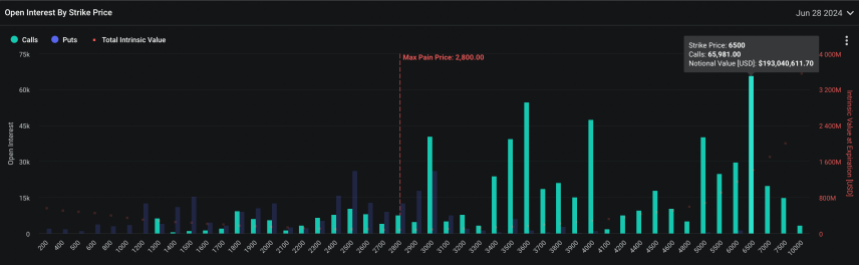

Data from Deribit reveals a concentrated bet among traders on calls surpassing this price, indicating a bullish sentiment toward Ethereum’s near-term trajectory. The most favored strike price among these optimistic bets is an ambitious $6,500.

Related Reading

Options Market Bullish On Ethereum

Notably, options are contracts that give traders the right, but not the obligation, to buy (in the case of calls) or sell (in the case of puts) the underlying asset at a specified strike price by the expiry date.

A call option is typically purchased by traders who believe the asset will increase in price, allowing them to buy at a lower rate and potentially sell at a higher market price. Conversely, put options are favored by those anticipating a decline in the asset’s price, aiming to sell at the current rate and repurchase at a lower value.

Currently, the Ethereum options market is tilting heavily towards calls, with the aggregate open interest—representing the total number of outstanding contract options—showing a preference for higher strike prices.

This concentration of calls, primarily above the $3,600 mark, suggests that a significant market segment is positioning for Ethereum to ascend to higher levels by the end of June.

According to Deribit data, roughly 622,636 Ethereum call contracts are set to expire by June’s end, encapsulating a notional value above $1.8 billion. Such substantial positioning underscores the market’s confidence in Ethereum’s potential uplift.

Data further shows that the most substantial open interest is clustered around the $6,500 strike price, with a notional value of $193 million.

This concentration reflects trader optimism and supports Ethereum’s market price, especially if these options are exercised as the asset price approaches or surpasses these strike levels.

Despite the optimism embedded in these options, Ethereum is currently navigating a slight downturn. It has dropped 5.4% over the past week and 2.2% in the last 24 hours, positioning it below $2,900. This decline places even more focus on upcoming market catalysts that could significantly sway ETH’s price.

Regulatory Decisions And Technical Indicators: A Dual Influence on ETH’s Path

One significant upcoming event is the US Securities and Exchange Commission’s (SEC) decision on several applications for Ethereum-based Exchange-Traded Funds (ETFs), which is due by May 25th.

This decision is pivotal as approval could usher in a wave of institutional investments into Ethereum, potentially catapulting its price. Conversely, rejection could dampen the bullish sentiment and lead to further pullbacks.

From a technical analysis standpoint, signs are pointing to a possible rebound. The “Bullish Cypher Pattern,” identified by the analyst Titan Of Crypto, suggests that Ethereum could be at a turning point. Currently, Ethereum is at the 38.2% Fibonacci retracement level, a key support zone in many bull markets.

Related Reading

This level has historically acted as a launchpad for upward price movements, hinting that Ethereum could be gearing up for a significant rise.

#Altcoins #Ethereum Bounce incoming.

The Bullish Cypher Pattern played out perfectly and all the targets got reached 🎯.#ETH is currently at the 38.2% Fibonacci retrace level also called “1st stop”. In a bull market this level holds.

I expect a bounce from this level. 🚀 pic.twitter.com/o9e6VLEREz

— Titan of Crypto (@Washigorira) May 12, 2024

Featured image from Unsplash, Chart from TradingView

Ethereum

Ethereum May Have To Undo This Death Cross For Bull’s Return

A quant has revealed how Ethereum (ETH) saw a death cross in this indicator shortly before bearish momentum took the asset in full force.

Ethereum Formed A Death Cross In Funding Rates Earlier

In a CryptoQuant Quicktake post, an analyst has shared a chart for the Funding Rates of Ethereum. The “Funding Rates” refers to a metric that keeps track of the amount of periodic fee that traders on the derivatives market are exchanging between each other right now.

When the value of this indicator is positive, it means the long contract holders are paying a premium to the short investors in order to hold onto their positions. Such a trend suggests a bullish sentiment is shared by the majority of the derivatives traders.

On the other hand, the metric being under the zero mark implies a bearish mentality is dominant in the sector, as short holders are overwhelming the long ones.

Now, here is the chart for the Ethereum Funding Rates posted by the quant, which shows the trend in the 50-day and 200-day simple moving averages (SMAs) of the indicator over the last couple of years:

Looks like these two lines saw a crossover earlier in the year | Source: CryptoQuant

As displayed in the above graph, the 50-day SMA of the Ethereum Funding Rates crossed under the 200-day SMA in January of this year. This suggests that the optimism in the market witnessed a shift.

From the graph, it’s visible that since the crossover in the two SMAs of the indicator has emerged, the ETH price has been sharply moving down. The trend isn’t unique to the asset, as the wider cryptocurrency sector has also seen a similar pattern, with investors becoming risk-averse.

In the first half of last year, the Funding Rates observed the same type of crossover, and then, the Ethereum price followed up with a period of bearish action.

It wasn’t until the reverse crossover happened, with the 50-day SMA finding a break above the 200-day SMA, that bullish momentum returned in the cryptocurrency market. The same pattern was also seen back in 2023.

It’s possible that for constructive price action to return for Ethereum and other assets, a bullish crossover in the Funding Rates may once again have to take place. “When the speculators return and start using their greedy leverage, the crypto bull market will begin,” notes the analyst.

When this would happen, however, is anyone’s guess, as the 50-day and 200-day SMAs of the indicator are currently quite far apart. In 2024, the lines took many months before they crossed back, so it’s possible that it will take some time for the crossover to occur now as well.

ETH Price

Ethereum is moving to end the month of March on a red note as its price has fallen to the $1,800 level, after seeing a decline of almost 14% in the past week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

Comparing current price action with past performances, Ethereum, the second-largest crypto asset, seems to have witnessed its worst-ever first quarter as it draws closer to its end. However, many investors are expressing interest in ETH’s prospects again, purchasing the asset in huge chunks.

Investors Buying The Ethereum’s Price Dip

Ethereum has continued to struggle to undergo a major upward move even as other digital assets make history in the ongoing market cycle. Despite the recent pullback in ETH’s price, Ali Martinez, a seasoned crypto analyst and trader, has highlighted a renewed bullish sentiment among investors.

Specifically, investors are seizing the opportunity to stack up on ETH in light of ongoing price correction, signaling interest and confidence in the asset’s long-term potential. This buying activity suggests that seasoned traders are considering the current drop as a strategic entry or buying point.

According to Ali Martinez, the development was spotted as Ethereum encountered a significant resistance wall between the $2,200 and $2,580 price mark. Examining the data from IntoTheBlock, the expert reported that over 12.43 million investors purchased a massive portion of 66.18 million ETH within the $2,200 and $2,580 price zones.

These kinds of accumulation show that both retail and institutional investors are hopeful about the market. Should this substantial buying activity extend, Ali Martinez is confident that bullish momentum might build up for ETH, leading to a break above the zone.

Market analyst and trader CryptoELITES predicts a robust upswing for ETH to new all-time highs in the upcoming weeks. CryptoELITES prediction is based on past price trends in which ETH witnessed a massive rally after a lengthy period of downward movements.

Delving into the recent price action, the expert believes ETH’s correction has reached a bottom similar to the 2017 and 2021 bull market cycles. With the altcoin potentially reaching a bottom, CryptoELITES anticipates an over 700% upsurge in 2025.

A 700% surge will bring the altcoin’s price to the $15,000 milestone before the ongoing bull market cycle completes. Given that Ethereum is mirroring past trends, a possible price reversal could be on the horizon.

ETH Eyeing A Breakout From Key Chart Pattern

While ETH is facing volatility, it is presently at a critical junction that might determine its next move. Jonathan Carter, a crypto and technical analyst, reveals that Ethereum is holding above the lower boundary of a Descending Triangle formation after navigating its price in the 4-hour time frame.

At this zone, the asset might muster enough momentum for a rebound. Carter expects a bounce from the current support zone to push ETH toward key resistance levels at $1,950, $2,080, $2,230, and $2,320. However, if the altcoin falls below the support, the price may drop further to the downside.

Featured image from Pexels, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Price Confirms Breakout From Ascending Triangle, Target Set At $7,800

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Ethereum price has finally broken out of a months-long consolidation pattern, signaling the possible start of a significant bullish move. The recent breakout of an Ascending Triangle formation suggests that ETH is set for more gains, with a crypto analyst suggesting a price target of $7,800 in the coming months.

Ethereum Price Targets $7,700 ATH

The Ethereum price is believed to be targeting a new all-time high of $7,800 after its recent breakout from an Ascending Triangle. For months now, the cryptocurrency has been trading within this classic bullish chart pattern, where prices make higher lows while facing strong resistance at a fixed level.

Related Reading

This consolidation pattern has been active since late 2024, establishing strong resistance at $4,000. TradingView analyst Sohaibfx has predicted that if Ethereum can surpass this resistance level, it would confirm a bullish trend, leading to a strong upward continuation in its price.

Looking at the analyst’s price chart, Ethereum spent several months navigating between $2,000 and $4,000 in Q1 2025. This region represented an accumulation phase where buyers had quietly built their positions in anticipation of a potential rally.

A descending channel marked in orange in the price chart also shows that Ethereum had experienced a significant pullback mid-to-late 2024 before breaking out. This was likely the final shakeout before it regained its bullish momentum.

According to Sohaibfx, a measured move of the Ascending Triangle suggests that Ethereum is poised for an explosive 333% surge to $7,800. This bullish target is calculated by determining the height of the triangle, which is the difference between its base at $2,000 and resistance level at $4,000.

When the price breaks above the resistance, the common method for estimating the possible next move is to add the triangle’s height to the breakout point, which gives a technical target of $6,000. However, based on past price behaviour and strong buying momentum, the Ethereum price could push even higher, with $7,800 being a key psychological level.

Support Levels And Momentum Indicators To Watch

In his price analysis, Sohaibfx has pinpointed the $4,000 and $3,000 price levels as support levels for Ethereum. This support should act as a safety net, where buyers are likely to step in to prevent further decline after Ethereum reaches its projected $7,800 target.

Related Reading

Moving forward, the analyst highlights key momentum indicators that should be monitored. While the analyst’s chart does not specify indicators like Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI), Ethereum’s sharp upward move suggests that strong momentum will be a major contributor to its rise to a new ATH.

Sohaibfx has advised traders to watch out for RSI levels above 70, as overbought conditions could signal a potential pullback while Ethereum approaches higher levels.

Featured image from Adobe Stock, chart from Tradingview.com

-

Altcoin24 hours ago

Altcoin24 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market20 hours ago

Market20 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market19 hours ago

Market19 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund

-

Market9 hours ago

Market9 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Market15 hours ago

Market15 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

-

Regulation8 hours ago

Regulation8 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Bitcoin14 hours ago

Bitcoin14 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More