Altcoin

Altcoins Sink Into “Danger Zone”, Is A Correction Incoming?

Data of an on-chain indicator suggests the majority of the altcoins have now dropped into the historical “danger zone,” a sign that could be bearish.

Altcoins May Be Overbought Currently As Trader Profits Have Shot Up

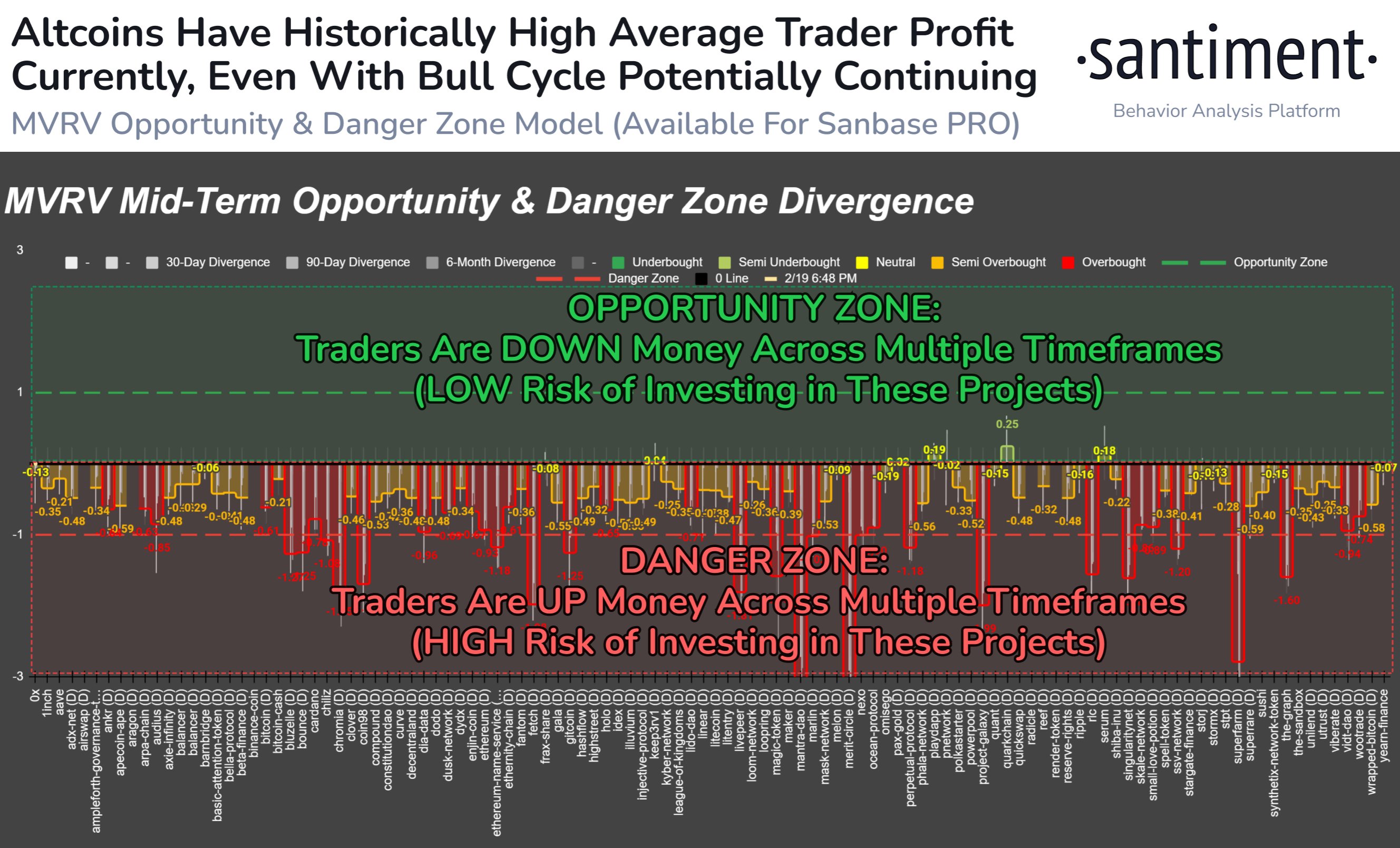

In a new post on X, the on-chain analytics firm Santiment has discussed how the altcoins as a whole have been observing high profits recently based on the MVRV ratio.

The “Market Value to Realized Value (MVRV) ratio” is an indicator that keeps track of the ratio between the market cap and realized cap for any given cryptocurrency.

The “realized cap” here refers to a capitalization model that assumes the real value of any token in circulation is not the current spot price of the asset, but rather the value at which it was last moved on the blockchain.

As the previous transaction for any token was likely the point at which it last changed hands, this previous price would serve as its current cost basis. As such, the realized price essentially accounts for the cost basis of every investor in the market.

Since the MVRV ratio compares the market cap of an asset (that is, the total value the investors are holding right now) with its realized cap (the value that the holders as a whole put into the coin), it can tell us about the profitability ratio for the average investor of the cryptocurrency.

Historically, the investors holding large amounts of profits (that is, a high MVRV ratio) have been a signal that the asset is overheated, while the investors being in losses have suggested an underbought status. Based on this historical pattern, Santiment has defined “opportunity” and “danger” zones for the market.

The chart below shows a measure of the divergence of the MVRV ratio for different timeframes and for various altcoins:

The value of the metric seems to have been negative for all of these altcoins | Source: Santiment on X

According to Santiment’s model, the MVRV ratio diverging to the -1 mark (from its normal 0% value) suggests the asset in question is inside the danger zone where traders carry high profits. From the graph, it’s visible that most of the altcoins are inside this region right now.

“Outside of a few lagging altcoins, the vast majority of crypto projects have generated profits for the average wallet on a mid to long term timescale,” explains Santiment. “This means that our model is indicating a fair bit of ‘overbought’ signals.”

Similar to the danger zone but opposite to it is the opportunity zone, where the indicator’s divergence reaches the 1 level. In this zone, few investors are carrying high profits, so coins inside this zone may present a ripe opportunity for accumulation. Currently, though, no asset is present in this region.

“This certainly doesn’t mean that cryptocurrency is on the verge of a massive correction,” says the analytics firm. “But based on history, the highly reputable MVRV metric is revealing there is a higher risk than average in buying or opening new positions while markets are in the midst of a 4+ month surge.”

ETH Price

Ethereum has seen a decoupling from Bitcoin recently as the coin has registered a fresh surge above the $2,900 mark, while the original cryptocurrency has slumped sideways.

Looks like the price of the asset has surged recently | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net

Altcoin

$33 Million Inflows Signal Market Bounce

Crypto inflows hit $226 million last week, signaling a cautiously optimistic investor sentiment amid ongoing market volatility.

According to CoinShares data, altcoins broke a five-week streak of negative flows, recording their first inflows in over a month.

Crypto Inflows Hit $226 Million Last Week

This turnout marks a significant slowdown from the previous week when crypto inflows hit $644 million, ending a five-week outflow streak. Before that, inflows peaked at $1.3 billion, with Ethereum outpacing Bitcoin in investor demand.

“Digital asset investment products saw $226 million of inflows last week suggesting a positive but cautious investor,” read an excerpt in the report.

The pullback to $226 million last week suggests a more measured approach by investors as they assess macroeconomic conditions and regulatory uncertainties.

Specifically, CoinShares’ researcher James Butterfill ascribes Friday’s minor outflows of $74 million to core personal consumption expenditure (PCE) in the US, which came in above expectations.

“The Fed’s preferred measure of inflation (Core PCE) moved up to 2.8% in February & remains well above their 2% target that has yet to be achieved. The market is expecting the Fed to hold rates steady again at their next meeting on May 7 (at 4.25-4.50%),” investor Charlie Bilello noted.

Nevertheless, this turnaround comes after nine consecutive trading days of inflows into crypto ETPs (exchange-traded products).

Despite the slowdown, Bitcoin continued to attract strong inflows of $195 million. Meanwhile, short-Bitcoin products registered outflows of $2.5 million for the fourth consecutive week. This suggests that investors are leaning bullish on Bitcoin, even as altcoins begin to recover.

The CoinShares report shows that altcoins saw $33 million in inflows last week after suffering $1.7 billion in outflows over the past month.

Altcoins Rebound After $1.7 Billion in Outflows

Ethereum (ETH) led the recovery, attracting $14.5 million, then Solana (SOL) at $7.8 million, while XRP and Sui recorded $4.8 million and $4.0 million, respectively. Market analysts believe altcoins may be bottoming out, creating potential buying opportunities.

“Altcoins are oversold. The bottom is close. We’re ready for a bounce,” renowned analyst Crypto Rover highlighted.

Other analysts echoed the sentiment, suggesting growing attention toward altcoins. Among them was trader Thomas Kralow, who said, “altcoins are setting up for a comeback.”

Adding credence to this bullish outlook for altcoins, project researcher BitcoinHabebe, known for insightful mid-low cap sniper entries, pointed to technical indicators suggesting a market reversal.

“While bears are trying to spread fear & make you sell your altcoins, the TOTAL3 [Altcoins market cap chart excluding Bitcoin and Ethereum] just bounced off an HTF [higher timeframe] retest,” the analyst stated.

This means most coins have bottomed out and are expected to start reversing soon. Cole Garner noted a key buy signal in market liquidity metrics, further supporting this view.

“Tether Ratio Channel already flashed a double buy signal this month. Now my lower timeframe version is popping off. Fresh capital incoming,” he indicated.

The Tether Ratio Channel is an on-chain analytical tool that helps traders identify potential buy signals. It tracks the ratio of Bitcoin’s market capitalization to that of stablecoins, acting as a leading indicator for short- to medium-term trends.

When the ratio hits certain levels, it can signal shifts in market sentiment, often indicating whether fresh capital is entering or exiting the market.

While overall crypto inflows have slowed compared to previous weeks, the return of capital into altcoins suggests renewed investor confidence. Analysts see signs of an impending altcoin rally, with market metrics indicating that most coins have bottomed out.

As investors weigh macroeconomic uncertainties, the coming weeks could be critical in determining whether the altcoin recovery sustains momentum or if caution prevails.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Cardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

Cardano price is repeating a pattern from 2024 that experts say is a signal for a massive pump in the coming weeks. While present figures are largely underwhelming for ADA, investors are brimming with confidence for a strong reversal in the near future.

Cardano Price Can Reach $2.5 In May

According to pseudonymous cryptocurrency analyst Master Kenobi, Cardano price is exhibiting cyclical behavior. In a post on X, Master Kenobi notes that ADA’s consolidation in recent days mirrors its price action from Q3 of 2024.

At the time, Cardano’s price suffered a steep correction in early August and endured a lengthy consolidation period before rallying. Presently, Cardano’s price is consolidating after the deep in early February that sent prices to $0.49.

“ADA is currently in a consolidation phase that resembles its behavior from August-September 2024,” said Master Kenobi. “Since the dip on August 5, it hasn’t recorded a new low – just as it hasn’t now, following the dip on February 3.”

According to Master Kenobi, a lengthy consolidation phase will be the precursor for an impressive rally for Cardano’s price. The analyst theorizes that the incoming rally will send Cardano to impressive levels in May. In the short term, analysts are eyeing ADA to hit $1, citing rising whale activity and positive fundamentals.

“If this pattern holds, May could bring a massive pump, potentially pushing the price toward $2.5,” said Master Kenobi.

ADA Ripples With Bullish Activity

At the moment, Cardano price is trading at $0.6646, a far cry from its all-time high of $3.10. Despite the lull in price action, the ecosystem is brimming with bullish activity for higher valuation.

Investors have their eyes on $10 after ADA outperformed top S&P 500 companies in a strong show of resilience. Futhermore, increased whale activity in the space is signaling an impending rally for ADA as community sentiment reaches an all-time high.

Analysts have opined that an ADA rally to $10 is not a crazy prediction, citing a slew of positive fundamentals for the network. However, pundits are urging investors to brace for multiple corrections in the march to reach a valuation of $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

Crypto analyst Egrag Crypto has again provided a bullish outlook for the XRP price. This time, he alluded to historical trends to explain why the altcoin can hit a new all-time high (ATH) in 90 to 120 days.

Why The XRP Price Can Hit ATH In 90 To 120 Days

In an X post, Egrag Crypto alluded to historical patterns to explain why the XRP price can hit a new ATH in the next 90 to 120 days. He noted that the RSI chart shows important historical patterns and stated that the altcoin usually has two peaks during its bull runs.

The crypto analyst further revealed that in 2021, the second peak occurred after 90 days, while in 2017, it occurred after 120 days. Based on this, Egrag Crypto affirmed that this historical timeframe provides market participants with a potential for a “great opportunity,” hinting at the altcoin hitting a new ATH.

In another post, he raised the possibility of the XRP price reaching a new ATH of $3.9 by May. This came as he identified an Inverse Head and Shoulder pattern, which was forming for the altcoin. The crypto analyst stated that the measured move is $3.7 to $3.9.

For now, an XRP analysis has shown that the altcoin is struggling at $2.15 amid regulatory uncertainty over SEC Chair nominee Paul Atkins. In his update on this Inverse Head and Shoulder pattern, Egrag Crypto remarked that a close above $2.24, the Fib 0.888, is the next minor target. He affirmed that the pattern is still unfolding as anticipated.

Ripple’s Native Token Could Still Drop Below $2

Crypto analyst Dark Defender has predicted that the XRP price could still drop below $2 before the next leg up. In an X post, he stated that Ripple’s native token is in the 4th Wave of the Monthly Elliott Wave structure.

His accompanying chart showed that XRP could drop to as low as $1.88 on this Wave 4 corrective move. Once that is done, the altcoin will witness its next leg up, rallying to as high as $5.8, which would mark a new ATH.

Dark Defender assured that Wave 4 will end soon and that XRP will continue to reach its targets. The crypto analyst recently affirmed that the altcoin is the “one” and explained why it would dominate Bitcoin and Ethereum.

Crypto analyst CasiTrades also suggested that XRP could further decline before its next leg to the upside. She noted that after the drop to $2.27, the altcoin showed no bullish RSI divergence, which signaled that the drop wasn’t quite done yet.

She added that the coin is now likely heading down to test the 0.618 golden retracement at $2.17, or possibly the golden pocket at $2.15 for a final low before “lift-off.” However, CasiTrades also mentioned that RSI is starting to build the bullish divergence and that the selling pressure is exhausting.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: