Market

Buy Nike Gear and PS5 with SHIB

CoinGate, a fintech company based in Lithuania, has boosted the utility of Shiba Inu (SHIB) by integrating it with Polygon and Binance Smart Chain (BSC).

This strategic move allows SHIB holders to purchase products from major brands like Nike and book services like Airbnb.

Shiba Inu Price Consolidates Despite Growing Adoption

The payment gateway CoinGate acts as a link between crypto and traditional finance, facilitating digital asset transactions for goods and services. The inclusion of SHIB tokens on these platforms enhances accessibility and presents numerous opportunities for SHIB holders to participate in real-world transactions.

“Shibarmy, use your SHIB to book Airbnb, grab the latest games from Steam & PS5, refresh your wardrobe with Nike & Zalando and more,” CoinGate wrote.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

Moreover, Shiba Inu is not just expanding its transactional use. It is trying to evolve beyond its meme coin origins. The launch of Shibarium, an Ethereum layer-2 scaling solution, represents a significant step forward in improving blockchain efficiency.

This update includes a major hard fork completed earlier this month, which is expected to result in faster transactions and more stable gas fees, enhancing the overall user experience.

In April, the Shiba Inu team also made headlines by raising $12 million to develop a new layer-3 blockchain. This fundraising attracted significant contributions from notable investors, including Polygon Ventures, Mechanism Capital, and Animoca Brands, highlighting the growing confidence in SHIB’s potential.

Despite these advancements, the price of SHIB has been consolidating. Since May 7, it has fluctuated between $0.00002379 and $0.00002227. A breakout could propel the price to $0.00002558, marking an increase of over 13% from current market price.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Conversely, a breakdown could see the price drop to approximately $0.00002080, nearly 8% below the current level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cboe Launches Bitcoin ETF Options linked to its ETF Index

Cboe Global Markets Inc. announced plans to introduce the first cash-settled index options tied to Bitcoin’s spot price.

Cboe’s Bitcoin ETF options will debut on December 2 and will be based on its ETF Index, which tracks a group of US-listed spot Bitcoin exchange-traded funds.

Bitcoin ETFs Options Continue to See Interest from Institutional Investors

This development comes shortly after Nasdaq listed Bitcoin ETF options, allowing investors to speculate on Bitcoin’s price movement or manage risk through derivatives.

Crypto derivatives, including options and futures, have traditionally been traded outside the United States due to regulatory hurdles.

However, increasing demand and a favorable stance toward cryptocurrency adoption have encouraged major U.S. exchanges to expand their offerings in the sector.

“We expect the unique benefits of cash-settlement, combined with the availability of various index sizes and FLEX options, will give customers more flexibility in their trading strategies,” Cboe stated in its press release.

Earlier this week, Grayscale joined the trend by starting options trading for its GBTC and BTC Mini ETFs. Meanwhile, BlackRock’s IBIT options trading set a record on its first day, with over $425 million in trades.

Overall, spot Bitcoin ETFs continue to gain significant traction, now accounting for 5.33% of all mined Bitcoin. Bitcoin price peaks in March and November coincided with $4 billion in ETF inflows, highlighting a strong connection between ETF demand and price accumulation.

“Options are expanding the ecosystem, bringing more traders involved, and bringing more liquidity. And liquidity is big fish bait. So, you should see more institutions using not only options but the ETF itself because of the advent of options being available,” ETF analyst Eric Balchunas said in a recent podcast.

Bitcoin ETF trading volumes exceeded $7.22 billion earlier this month, driven by optimism surrounding regulatory clarity. Ethereum ETFs also recorded inflows of $295 million, fueled by institutional interest led by firms like BlackRock and Fidelity.

BlackRock’s Bitcoin ETF has further cemented its dominance by reaching $40 billion in assets under management (AUM). This rapid growth places IBIT among the top 1% of ETFs globally by AUM.

BlackRock’s aggressive acquisition of nearly 9,000 Bitcoin in a single day has further boosted its ETF’s position in the market.

This series of developments signals a growing acceptance of cryptocurrency products within traditional financial markets, with institutional interest driving unprecedented growth in Bitcoin and Ethereum ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Polymarket Bans French Users Amid Gambling Law Probe

Polymarket, a decentralized prediction platform, has restricted access for French traders following an investigation into its compliance with gambling laws by France’s national gaming authority, the ANJ.

Reports emerged Friday that French users attempting to access the platform via a VPN encountered access blocks. This ban has yet to be formally added to Polymarket’s terms of service.

Polymarket Continues to Face Strong Regulatory Scrutiny

The scrutiny comes from a French trader’s large bets on Donald Trump winning the 2024 US Presidential election, raising concerns about the platform’s operations in France.

A French journalist on social media highlighted the restriction, sparking further attention to Polymarket’s legal challenges.

The platform, which allows cryptocurrency-based betting on political events, sports, and other outcomes, became popular during the US presidential race.

“Even if Polymarket uses cryptocurrencies in its operation, it remains a betting activity and this is not legal in France – a source close to the National Gaming Authority (ANJ), the gambling regulator, explained to me,” French journalist Grégory Raymond wrote on X (formerly Twitter).

Reports claim users wagered over $3.2 billion during the election period. The platform saw a record trading volume of $294 million on November 5. Ahead of the results, Trump held a 67% probability on Polymarket for securing a win.

However, later research suggested that 30% of the platform’s trading activity could be linked to wash trading. The platform was allegedly used for repetitive buying and selling to inflate perceived market activity.

Such practices can distort public sentiment and encourage further betting.

Also, the platform reportedly paid out significant sums to top bettors following the election. Three high-value traders collectively earned $47 million. The largest single payout amounted to $20.4 million.

In a post-election development, the FBI confiscated Polymarket CEO Shayne Coplan’s electronic devices. Sources allege the raid is tied to market manipulation accusations. No formal charges or arrests have been made.

Despite these regulatory challenges, the platform recently reported plans for launching its own token. The platform is seemingly trying to keep its popularity alive beyond the election hype. However, more regulatory hurdles are expected.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Optimism (OP) Price Shows Strong Uptrend, Eyes $3 Resistance

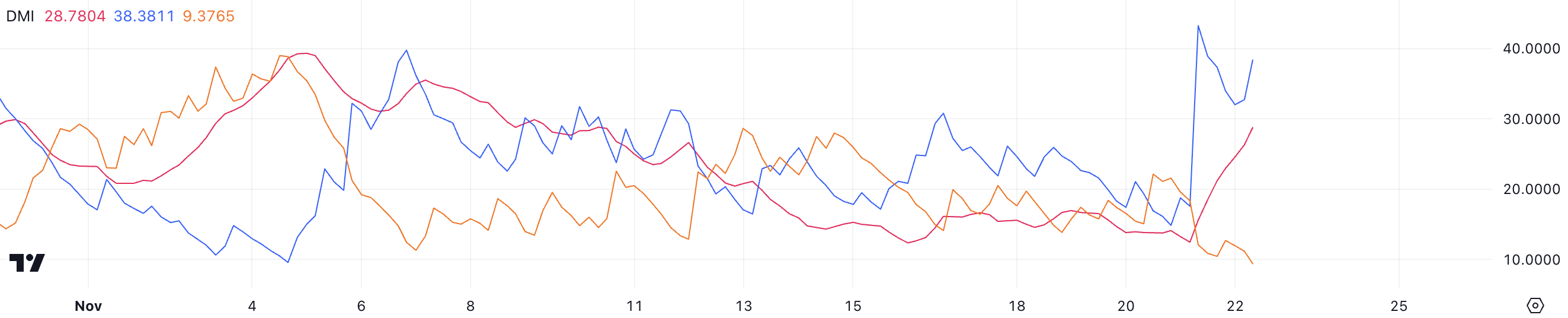

Optimism (OP) price has surged 43.40% in the last seven days, showcasing strong bullish momentum in the market. The uptrend is supported by rising trend strength, with the ADX confirming growing momentum and EMA lines showing a bullish setup.

Despite the rally, a declining trend in daily active addresses suggests caution, as it may indicate reduced network activity and potential pressure on OP’s price. Whether OP can sustain this momentum to test resistance at $3 or face a deeper correction depends on the strength of buyer interest in the coming days.

OP Current Uptrend Is Strong

Optimism currently has an ADX of 28.7, a significant surge from below 15 just a day ago. The sharp rise in ADX indicates that the strength of OP’s current trend is increasing fast, signaling growing momentum behind the price movement.

The ADX measures trend strength, with values above 25 indicating a strong trend and below 20 suggesting a weak or nonexistent trend. At 28.7, OP’s ADX confirms that its uptrend is gaining traction and could sustain further upward momentum if this strength persists.

The positive directional index (D+) is at 38.8, while the negative directional index (D-) is at 9.37, showing that bullish pressure far outweighs bearish activity. This large gap between D+ and D- reflects strong buyer dominance, reinforcing the uptrend.

The combination of a rising ADX and a high D+ suggests that OP’s price could continue climbing as long as market conditions remain favorable and buying pressure persists.

OP Daily Active Addresses Bring An Important Signal

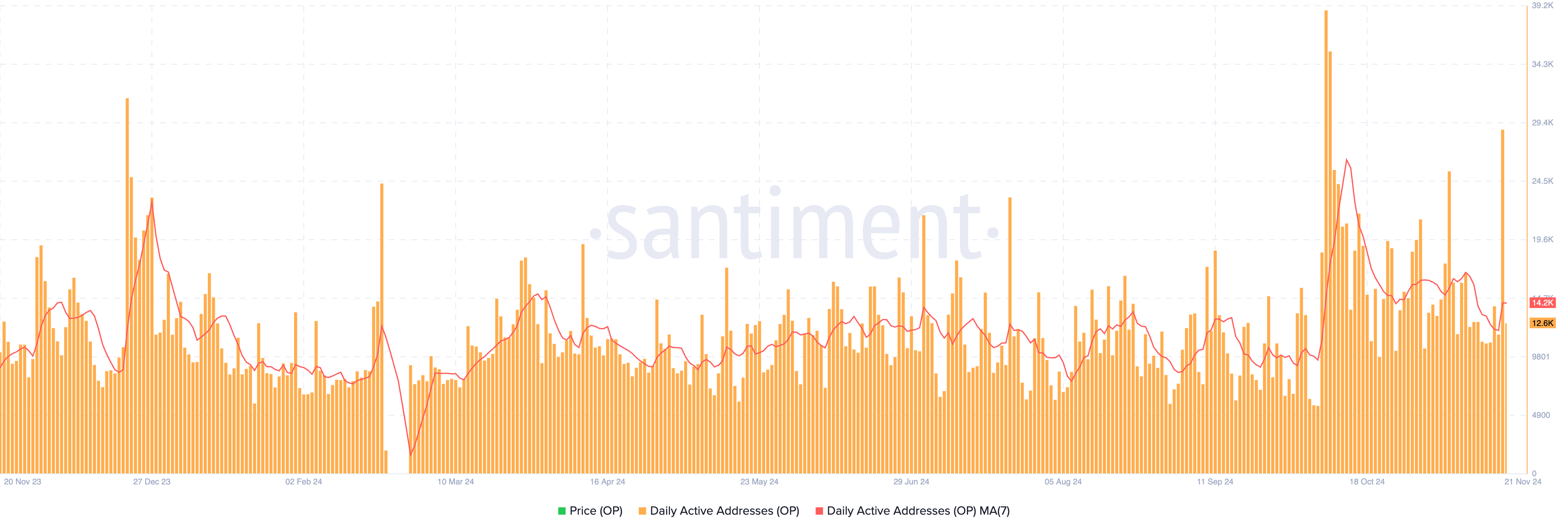

OP 7-day moving average of daily active addresses was 14,200 as of November 21.

This metric reflects the number of unique wallet interactions with the network, which indicates continued strong activity but is down from the yearly peak of 26,300 on October 13.

Daily active addresses are a crucial metric because they provide insights into network usage and overall demand. A decreasing trend in this metric may signal waning interest or reduced activity on the network, which could translate into lower buying pressure for OP.

If the trend continues to decline, it may exert downward pressure on OP price as market enthusiasm fades. However, a reversal in this metric could reignite bullish sentiment and support future price growth.

Optimism Price Prediction: Can OP Reach $3 In November?

If Optimism price maintains its uptrend, it could test the next resistance levels at $2.55 and potentially $3.04. Breaking above $3.04 could pave the way for OP price to challenge $3.41, its highest price since April.

This bullish scenario is supported by the EMA lines, which show a favorable setup with short-term lines positioned above the long-term ones, indicating strong momentum.

However, if the trend reverses, OP price could face significant downward pressure, with the next supports at $1.82 and $1.53.

If these levels fail to hold, the price could drop further to $1.06, representing a steep 51% correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market20 hours ago

Market20 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Altcoin20 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

-

Market22 hours ago

Market22 hours agoTrump Media Files Trademark for Crypto Platform TruthFi

-

Market21 hours ago

Market21 hours agoRipple (XRP) Price Hits 109% Monthly Gain as Indicators Weaken

-

Regulation20 hours ago

Regulation20 hours ago“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

-

Market16 hours ago

Market16 hours agoRallies 10% and Targets More Upside

-

Market16 hours ago

Market16 hours agoRallies 10% and Targets More Upside