Market

XRP Exchange Boss Gets 8 Years Behind Bars: Here’s Why

An unnamed XRP exchange operator, identified as Mr. A, received an eight-year prison sentence. He was convicted of embezzling approximately 4.6 billion Korean won (around $3.3 million).

This decision highlights South Korea’s stringent approach to crypto fraud, reflecting the growing legal scrutiny in the sector.

How XRP Exchange Operator Cheated South Korean Citizens

According to a local outlet, Mr. A had been a central figure in the South Korean crypto market since 2015. He has been exploiting his role to defraud investors by promising to purchase Ripple’s XRP tokens at below-market rates.

In 2015, Mr. A convinced an investor, Mr. B, to give him 200 million won (approximately $145,947), promising XRP acquisitions at about 20% below the going rate. Furthermore, in 2017, he misled another investor, Mr. C, by taking 2.35 million XRP and pledging a high return that was never realized.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Additionally, Mr. A engaged in more direct theft. He acquired the crypto wallet information of another victim, Mr. D, under false pretenses. Subsequently, he swapped Mr. D’s 4 million XRP for Bitcoin and transferred these to a Bitcoin account under his son’s name, culminating in losses valued at 3.5 billion won (about $2.5 million).

The appellate court’s decision to reduce Mr. A’s sentence from the initial 12 years reflects his partial repayment to one of the victims. However, the presiding judge stressed the severity of Mr. A’s actions and his apparent disregard for legal consequences.

“The defended has shown no signs of remorse. He has also shown serious disregard for the law, so he needs to be punished severely,” the Judge said.

Moreover, Mr. A attempted to manipulate the judicial process. He requested sentencing postponements and sought additional time to compensate victims, only to use these opportunities to flee from justice. His recapture after two years marked the end of his evasion efforts.

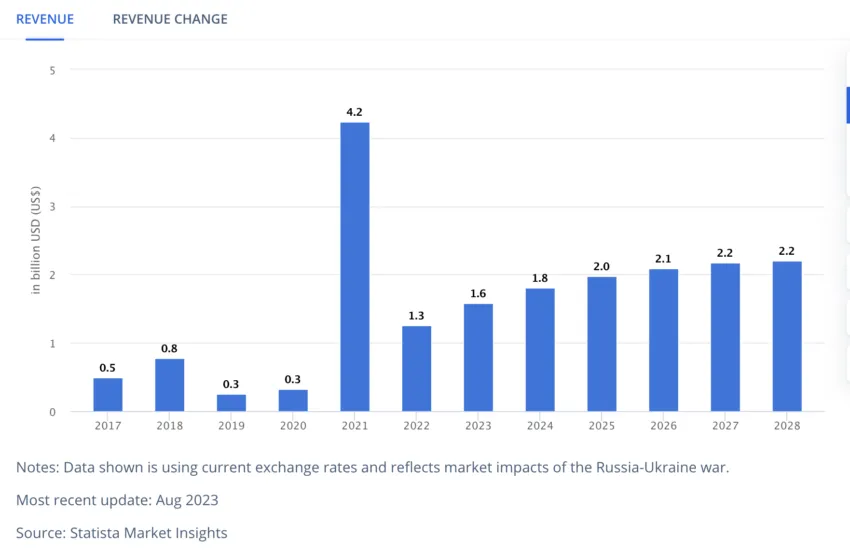

This case occurs within a broader context of rising crypto market activities in South Korea, projected to generate $2.2 billion in revenue by 2028.

As the market expands, so does the incidence of crypto-related crimes, prompting a robust regulatory response. In April 2024, in response to the increasing complexities of virtual asset crimes, South Korea announced the establishment of a new investigative unit.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This specialized team, stationed at the Seoul Southern District Prosecutors’ Office, includes experts from prosecution, finance, and intelligence sectors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle Files for IPO

Leading stablecoin issuer Circle finally launched an IPO. It has been preparing for this launch for almost a year, and joins several other crypto firms that are interested in an IPO filing.

This gives Circle a number of opportunities, both to benefit financially and to better integrate with the financial infrastructure and regulatory apparatus.

Circle’s IPO Comes At Last

Circle, one of the world’s largest stablecoin issuers, just filed for an IPO. The firm has been planning this move for nearly a year, relocating to the United States to make the process easier. Since Trump won the most recent Presidential election, the firm’s chances of an IPO increased, and now it has finally pulled the trigger:

“For Circle, becoming a publicly traded corporation on the New York Stock Exchange is a continuation of our desire to operate with the greatest transparency and accountability possible. We are building what we believe to be critical infrastructure for the financial system, and we seek to work with leading companies and governments around the world in shaping and building this new internet financial system,” founder and CEO Jeremy Allaire claimed in the filing.

By launching this IPO, Circle has opened a few new doors for itself. Of course, it’s a substantial opportunity for revenue, but it’s also an important way to intensify the firm’s connections to the financial infrastructure. In this respect, it joins a number of other crypto firms that have sought their own IPO in the last month.

Circle’s IPO filing doesn’t list many concrete numbers, such as initial public offering price, number of available shares, proceeds to the selling stockholders, etc. However, this development is very recent. Further details will likely come to light as the sale progresses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Faces Resistance While ETH Sees DEX Volume Boost

Solana (SOL) is attempting to recover from an almost 12% correction over the past seven days. The RSI has surged into overbought territory, suggesting strong bullish momentum. However, the BBTrend remains deeply negative—though it’s beginning to ease, hinting at potential stabilization.

Meanwhile, the EMA lines are setting up for a possible golden cross, signaling that a trend reversal could be forming if key resistance levels are broken. Still, with Ethereum overtaking Solana in DEX volume for the first time in six months and critical support levels not far below, SOL remains in a delicate position.

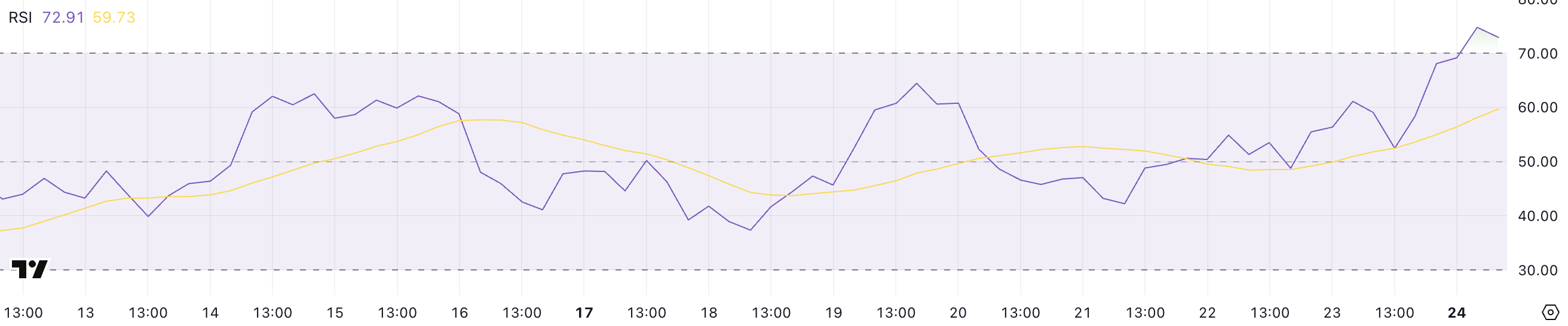

SOL RSI Is Now At Overbought Levels

Solana’s Relative Strength Index (RSI) has surged to 72.91, up sharply from 38.43 just a day ago—indicating a rapid shift in momentum from neutral to strongly bullish territory.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 typically suggest an asset is overbought and may be due for a pullback, while levels below 30 indicate oversold conditions and potential for a rebound.

With Solana’s RSI now above 70, the asset has officially entered overbought territory, reflecting intense buying pressure in the short term.

While this can sometimes precede a correction or consolidation, it can also signal the start of a breakout rally.

Traders should watch closely for signs of continuation or exhaustion. If momentum holds, Solana could push higher, but any stalling may trigger profit-taking and short-term volatility.

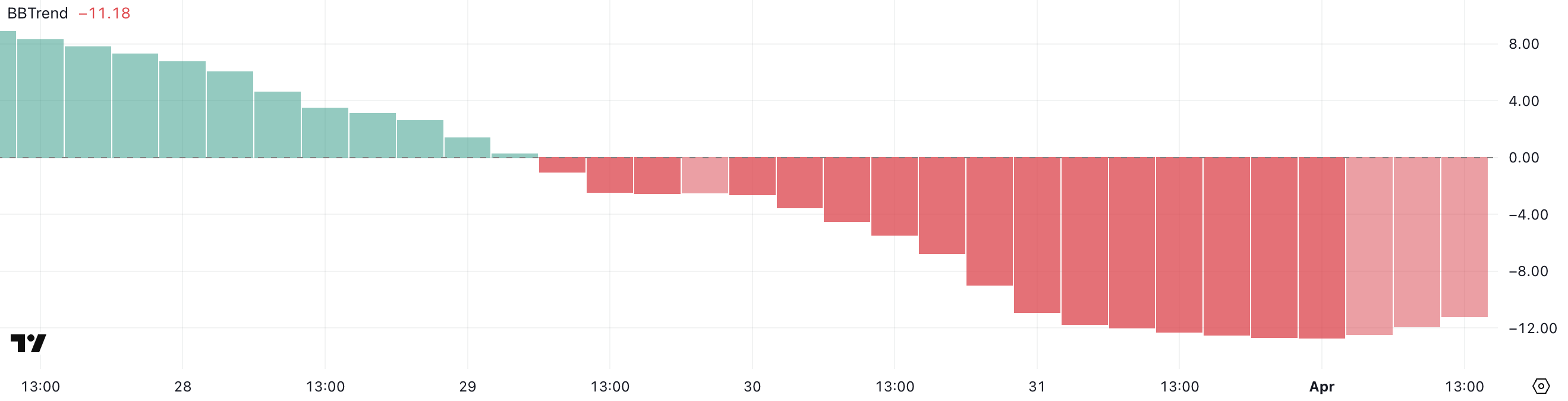

Solana BBTrend Is Decreasing, But Still Very Negative

Solana’s BBTrend indicator has climbed slightly to -11.18 after hitting a low of -12.68 earlier today. That suggests that the bearish momentum is starting to ease.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on how price interacts with the Bollinger Bands.

Values below -10 typically indicate strong bearish pressure, while values above +10 reflect strong bullish momentum. A rising BBTrend from deep negative territory can be an early sign of a potential reversal or at least a slowdown in the downtrend.

With SOL’s BBTrend still in bearish territory but improving, the market may be attempting to stabilize after a period of intense selling.

However, broader ecosystem developments complicate the technical picture. For example, Ethereum recently surpassed Solana in DEX volume for the first time in six months.

While the easing BBTrend hints at recovery potential, Solana still needs a stronger confirmation to shift the trend fully in its favor. Until then, cautious optimism may be warranted, but the bears haven’t fully let go.

Solana Still Has Challenges Ahead

Solana’s EMA lines are showing signs of an impending golden cross. A golden cross occurs when a short-term moving average crosses above a long-term one. That’s often seen as a bullish signal that can mark the start of a sustained uptrend.

If this pattern is confirmed and buying momentum continues, Solana price could push up to test the resistance at $131.

A successful breakout above that level may open the door to further gains toward $136, and potentially even $147.

However, downside risks remain if buyers fail to hold recent gains.

If SOL pulls back and loses the key support at $124, it could trigger further selling pressure, pushing the price down to $120.

Should the downtrend gain strength from there, SOL might revisit deeper support levels around $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hill Rejects Interest-Bearing Stablecoins Despite Armstrong’s Wish

Representative French Hill, who Chairs the House Committee on Financial Services, rejected requests to approve interest-bearing stablecoins. Coinbase CEO Brian Armstrong made a public appeal in support of this yesterday.

Hill has been a vocal supporter of new stablecoin regulations, and the crypto industry counted his Committee appointment as a victory.

French Hill Rejects Interest-Bearing Stablecoins

If there’s one topic that’s a top priority for US crypto policy, it’d be stablecoin regulations. Significant momentum is building behind pro-industry regulations, and President Trump claimed that stablecoins will play a role in dollar dominance. However, Representative French Hill pushed back on one request, saying he opposes interest-bearing stablecoins:

“I hear the point of view, but I don’t think that there’s consensus among the parties or the Houses [of Congress] on having a dollar-backed payment stablecoin pay interest to the holder of that stablecoin,” Hill told reporters earlier today.

Although Hill portrayed this position on stablecoins as a common-sense viewpoint, it represents a limit to the crypto industry’s political influence. When Hill was chosen to head the House Committee on Financial Services, crypto took it as a big win. Further, he’s been a visible presence in the fight for stablecoin regulation. So, what’s the problem?

Essentially, Coinbase CEO Brian Armstrong made an appeal to Hill and other legislators regarding interest-bearing stablecoins. Just yesterday, Armstrong called this policy a “win-win” and a huge opportunity to help consumers and the economy.

“US stablecoin legislation should allow consumers to earn interest on stablecoins. The government shouldn’t put it’s thumb on the scale to benefit one industry over another. Banks and crypto companies alike should both be allowed to, and incentivized to, share interest with consumers. This is consistent with a free market approach,” Armstrong claimed.

Since Armstrong made this public appeal yesterday, it’s remarkable that Hill rejected his vision of stablecoins so quickly. Ostensibly, Armstrong’s political influence has been on the rise, as he played a prominent role in Trump’s Crypto Summit, and the SEC dropped its suit against Coinbase.

It’s an important fact for the US crypto industry to learn: no matter how quickly its influence is growing, it’s still very new to most people. Earlier this year, a string of state-level Bitcoin Reserve proposals failed in Republican-controlled states. President Trump may support crypto, but his supporters have limits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market22 hours ago

Market22 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Market21 hours ago

Market21 hours agoTop 3 Made in USA Coins to Watch In April

-

Market19 hours ago

Market19 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Bitcoin11 hours ago

Bitcoin11 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market18 hours ago

Market18 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Ethereum18 hours ago

Ethereum18 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market17 hours ago

Market17 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz