Ethereum

Ethereum Network Activity Hints At Imminent Takeoff

Ethereum, the world’s second-largest cryptocurrency by market cap, finds itself in a curious position. While the price struggles for direction, its underlying network is experiencing a surge in activity.

Ethereum Network Sees Increase In New Users

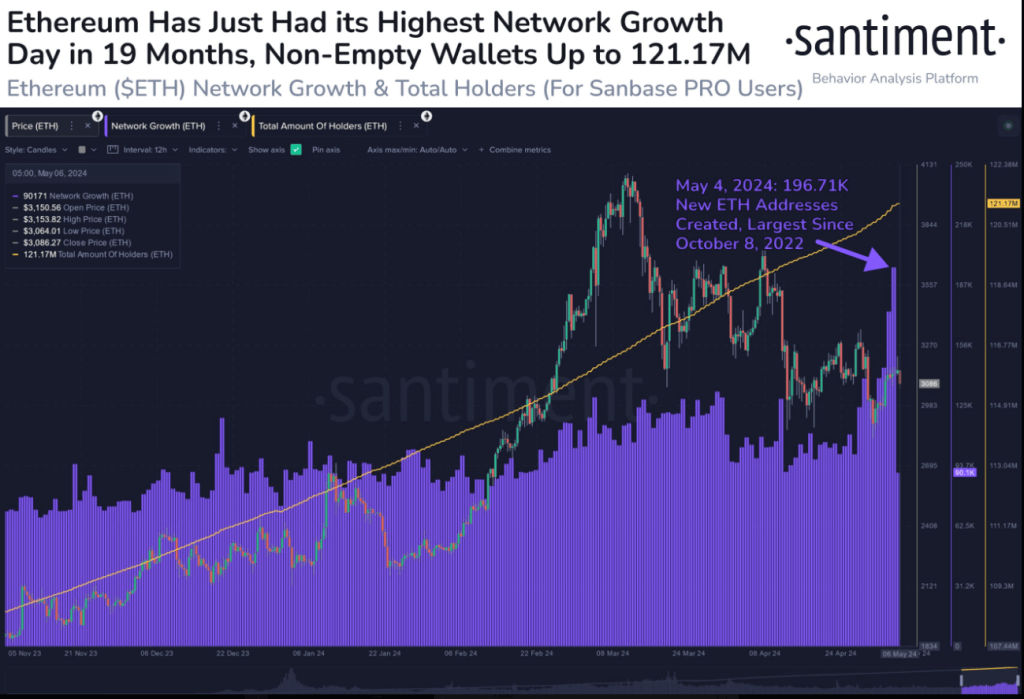

According to crypto data firm Santiment, May 4th saw a whopping 200,000 new Ethereum addresses created, marking the highest single-day growth in nearly two years.

This surge suggests a renewed interest in the Ethereum ecosystem, potentially driven by factors like the burgeoning Decentralized Finance (DeFi) space and the ever-evolving world of Non-Fungible Tokens (NFTs).

📈 #Ethereum rebounded back above $3,200 this weekend, and saw massive network growth. 196.71K new addresses were created on the $ETH network on May 4, 2024, the largest single day of growth since October 8, 2022. This should be viewed as a #bullish sign. https://t.co/l9iFVWCJpE pic.twitter.com/MlHQTvKKN0

— Santiment (@santimentfeed) May 6, 2024

This network growth is a bullish signal, and indicates strong and increasing interest in Ethereum, which could translate to significant capital inflows when macroeconomic conditions become more favorable.

Is The Price Dip A Buying Opportunity?

While the network thrives, Ethereum’s price currently sits at $2,995, a 1.8% decline in the past 24 hours. This puts it precariously close to falling below its 200-day Exponential Moving Average (EMA), a technical indicator often interpreted as a sign of bearish momentum.

However, a closer look reveals a potentially bullish twist. The price decline is accompanied by a drop in trading volume, which could indicate that selling pressure is waning. Historically, such a scenario has sometimes preceded a price reversal, where buyers re-enter the market, pushing prices upwards.

Total crypto market cap currently at $2.2 trillion. chart: TradingView

Investor Optimism Buoyed By Potential Fed Pivot

The recent weakness in the US economy, highlighted by a disappointing jobs report, has sparked speculation that the Federal Reserve might consider easing interest rates. This could inject fresh liquidity into the market, potentially benefiting riskier assets like cryptocurrencies.

According to analysts, a dovish pivot from the Federal Reserve could be a game-changer for Ethereum. Lower interest rates generally make holding cryptocurrencies more attractive compared to traditional fixed-income investments.

Ether seven-day price action. Source: CoinMarketCap

The future path of Ethereum remains uncertain. While the network’s fundamentals appear robust, the price faces immediate challenges. Navigating this complex scenario will require investors to carefully consider both the on-chain activity and the broader economic landscape.

Regulation and Innovation: Key Factors to Watch

Regulatory clarity around cryptocurrencies will undoubtedly play a crucial role in attracting institutional investors, a potential catalyst for significant price growth.

Related Reading: Cardano (ADA) Trading Activity Goes Quiet: Will This Drag Down The Price?

Featured image from Book My Flight, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum

Analyst Reveals When The Ethereum Price Will Reach A New ATH, It’s Closer Than You Think

The Ethereum price has been consolidating for about a week since it hit a four-month high at $3,420. As the second largest cryptocurrency, Ethereum has the biggest price correlation with Bitcoin. However, you could argue the Ethereum price has been largely left behind in terms of performance throughout the ongoing bull cycle. Interestingly, a crypto analyst, Ben Lilly, has shared a bold prediction about the trajectory of the Ethereum price.

Taking to a post on the social media platform X, Ben Lilly forecasted that the Ethereum price will reach a new all-time high (ATH) between December 21, 2024, and January 7, 2025. The prediction stems from his analysis of the previous performance of the ETH price movements during Bitcoin’s ATH discovery phase in 2021.

A Historical Parallel: Ethereum’s 2021 Rally

In his analysis, Ben Lilly referenced Ethereum’s price behavior during the historic rally of the Bitcoin price in the 2021 bull run. At the time, the Ethereum price was trading nearly 60% below its 2018 peak. After Bitcoin broke out to fresh ATH levels, it took Ethereum five weeks to follow suit, rallying by about 640% to reach its current ATH of $4,878.

Related Reading

Lilly believes the present market conditions mirror those of 2021, with the Bitcoin price recently entering price discovery mode. Ethereum, which was approximately 50% below its 2021 peak of $4,418 as of November 2024, has started to rebound, showing over 20% gains within just two weeks from a low of $2,366 on November 4.

Interestingly, the analyst’s comments suggest that as the Bitcoin price continues to set new price records this bull run, Ethereum is likely to follow with a substantial price leap very soon. The timeframe for this substantial price leap, he projects, aligns closely with late December 2024 and early January 2025.

Based on his projections, the analyst asserts that Ethereum could repeat its historical pattern and rally significantly within a short timeframe. He highlights that a 300% surge from Ethereum’s November 4 low price level could push it toward the $10,000 mark.

ETH will form a new ATH between Dec 21-Jan7.

I don’t make the rules. pic.twitter.com/NVgVdQ8Bsj

— Ben Lilly (@MrBenLilly) November 20, 2024

Current State Of The Ethereum Price

Ben Lilly’s Ethereum price prediction highlights the importance of the Bitcoin price momentum to that of the second-largest asset. Particularly, the 2021 pattern he pointed to is a result of an altcoin season where the altcoin market (led by Ethereum) started to outperform the Bitcoin price.

Related Reading

As it stands, an altcoin season has yet to materialize this cycle, and all the interest is going into Bitcoin. The Bitcoin price is currently on an all-time high roll, meaning the market will have to continue to wait for the interest to roll into Ethereum.

At the time of writing, the ETH price is trading at $3,107 and is down by 3.84% in the past seven days.

Featured image created with Dall.E, chart from Tradingview.com

Ethereum

Ethereum A Ticking Bomb? Derivatives Metrics Break Records

Data shows the Ethereum derivatives-related metrics have shot up recently, a sign that the price is at risk of going through a volatile storm.

Ethereum Open Interest & Leverage Ratio Have Both Spiked Recently

In a CryptoQuant Quicktake post, an analyst has discussed about the trend in the derivatives indicators of Ethereum. The metrics in question are the Open Interest and the Estimated Leverage Ratio.

First, the Open Interest keeps track of the total amount of ETH-related contracts that are currently open on all derivatives platforms. The metric naturally takes into account for both long and short positions.

When the value of this metric rises, it means the investors are opening up fresh positions on the market. Such a trend suggests derivatives trading interest in the coin is going up.

On the other hand, the indicator registering a drawdown implies positions in the market are going down. This could be because of investors willfully closing them up, or due to exchanges forcibly liquidating them.

Now, here is a chart that shows the trend in the Ethereum Open Interest over the last few years:

The value of the metric appears to have been shooting up in recent days | Source: CryptoQuant

The above graph shows that the Ethereum Open Interest has witnessed rapid growth recently. It has surpassed the previous all-time high (ATH) to set a new record above $13 billion.

When considering the timeframe of the past four months, the indicator has increased by over 40%, which suggests an explosion in speculative interest around the cryptocurrency has occurred.

This development, however, may not be the healthiest, as the trend in the second indicator of relevance, the Estimated Leverage Ratio, would suggest. This metric measures the ratio between the Open Interest and the Derivatives Exchange Reserve.

The Derivatives Exchange Reserve is naturally just the total amount of the cryptocurrency sitting in wallets associated with all centralized derivatives exchanges.

The Estimated Leverage Ratio tells us the amount of leverage or loan that the average derivatives user in the Ethereum market is currently opting for.

Below is a chart for this indicator.

Looks like the value of the metric has been heading up over the last few weeks | Source: CryptoQuant

From the graph, it’s apparent that the Ethereum Estimated Leverage Ratio has shot up recently. This would mean that the increase in the Open Interest has been more rapid than the rise in the Derivatives Exchange Reserve.

The investors are now sitting on all-time high (ATH) leverage, which can be a bad sign for ETH as it implies any volatility in the future could take down the overleveraged positions and induce a mass liquidation event called a squeeze.

The quant has pointed out that the Ethereum Funding Rate, a ratio between long and short positions, is positive right now, which suggests that if a squeeze is to happen shortly, it’s more likely to involve the bullish side of the market.

ETH Price

At the time of writing, Ethereum is floating around $3,000, down almost 7% over the past week.

The price of the coin seems to have been consolidating sideways recently | Source: ETHUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Ethereum

Fundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

- JustGiving now accepts over 60 cryptocurrencies for people to donate with

- 94% of crypto users are Millennials and Generation Z

- More than $2 billion has been donated to charitable causes over the past five years

UK-based fundraising platform JustGiving is teaming up with The Giving Block, a digital asset company, to start accepting crypto donations.

JustGiving now allows users to donate in more than 60 cryptocurrencies, including Bitcoin, Ethereum, Tether, and Doge, according to a report from UK Fundraising. The move comes as the crypto market is experiencing a surge in value, with Bitcoin recording a new all-time high of over $94,000 yesterday on CoinMarketCap.

According to JustGiving’s website, over the past 24 years, the fundraising platform has raised $7.2 billion (£6 billion) and is trusted by thousands of charities worldwide, including the Alzheimer’s Society, the British Heart Foundation, Macmillan Cancer Support, and Mind.

Pascale Harvie, President and General Manager of JustGiving, said:

“In recent years there has been a surge in the use of cryptocurrencies and our decision to enable cryptocurrency donations is the latest demonstration of our commitment to forward-thinking innovation.”

Tapping into a tech-savvy demographic is also key. According to JustGiving, 94% of crypto users are Millennials and Gen Z.

Alex Wilson, co-founder of The Giving Block, said that “charities need to tap into this new donor demographic,” adding:

“580 million people now use cryptocurrency around the world and the market is worth nearly $3 trillion. Our goal is to make accepting cryptocurrency donations just as easy as taking any other online donations.”

In a 2024 Annual Report from The Giving Block, it noted that more than $2 billion has been donated to charitable causes over the past five years.

-

Market17 hours ago

Market17 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum14 hours ago

Ethereum14 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market21 hours ago

Market21 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Regulation20 hours ago

Regulation20 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Market20 hours ago

Market20 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates

-

Market19 hours ago

Market19 hours agoDogecoin (DOGE) Price Momentum Weakens Despite Rally

-

Altcoin19 hours ago

Altcoin19 hours agoCrypto Analyst Says Dogecoin Price Has Entered Parabolic Surge To $23.36. Here Are The Reasons Why