Market

SEC Delays Ethereum ETFs as Hightower Buys Bitcoin ETFs

The United States Securities and Exchange Commission (SEC) has once again delayed its decision on highly-anticipated Ethereum exchange-traded funds (ETFs). This postponement marks another chapter in the complex interplay between regulatory actions and market dynamics in the crypto sector.

Meanwhile, amidst this uncertainty, Hightower, a New York-based firm with over $130 billion of assets under management (AUM), has opted to intensify its investments. The firm is focusing on various spot Bitcoin ETFs.

Dampened Ethereum ETFs Prospects as Bitcoin ETFs Show Resilience

The SEC’s recent filing extended the review period for Galaxy Invesco’s Ethereum ETF application by an additional 60 days. This pushes the next decision deadline to July 5.

“The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” the SEC outlined.

Read more: Ethereum ETF Explained: What It Is and How It Works

This delay follows a pattern, as the SEC deferred decisions on similar applications from financial giants like BlackRock and Fidelity in March. The continued delay raises doubts across the sector. Prominent figures like Jan van Eck, CEO of VanEck, are expressing skepticism about the likelihood of approval shortly.

Analysts James Seyffart and Eric Balchunas of Bloomberg Intelligence have even significantly lowered the approval probability to less than 35%. Moreover, Todd Rosenbluth, head of ETF analysis at VettaFi, believes the approval is more likely to be delayed “until 2024 or longer.” He attributes the delay to an unclear regulatory environment.

Echoing Rosenbulth’s predictions, Michael Saylor of MicroStrategy projects that the SEC might classify Ethereum as a security. Consequently, the commission may deny the spot Ethereum ETF applications from several asset managers, including BlackRock. Nonetheless, the market eagerly awaits the SEC’s responses to spot Ethereum ETF filings from VanEck and ARK on May 23 and 24.

Despite Ethereum ETFs’ challenges, Bitcoin ETFs are experiencing a contrasting narrative. Hightower recently disclosed substantial acquisitions in various Bitcoin ETFs totaling $68.35 million. This portfolio includes significant stakes in offerings from Grayscale ($44,84 million), Fidelity ($12.41 million), BlackRock ($7.62 million), ARK ($1.7 million), Bitwise ($998,000), and Franklin Templeton ($778,000).

This investment spree comes at a crucial time for Bitcoin ETFs in the US. They have seen a resurgence of investor interest.

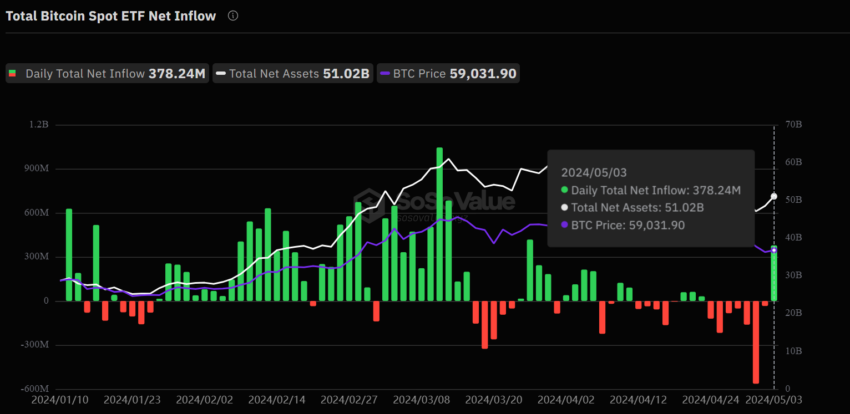

After seven days of consecutive outflows, the market witnessed an impressive inflow. A total of $378.24 million flowed into US-traded Bitcoin ETFs on May 3.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Notably, the Grayscale Bitcoin Trust (GBTC), which had suffered from persistent outflows since its first trading day, also recorded a fresh inflow. It received $63.01 million on the same day.

As the crypto market evolves, regulatory decisions by bodies like the SEC will be crucial in shaping its future. For now, the community remains watchful and hopeful for a regulatory framework that fosters innovation while ensuring market stability and investor protection. Meanwhile, the strategic moves by firms like Hightower may signal how major players navigate the complexities of crypto investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Reclaims Top DeFi Spot As Solana DEX Volume Drops

Ethereum (ETH) has regained its position as the leading blockchain for decentralized exchange (DEX) trading volume.

On this metric, Ethereum has effectively surpassed Solana (SOL) for the first time since September 2024.

Ethereum Surpasses Solana in DEX Trading Volume

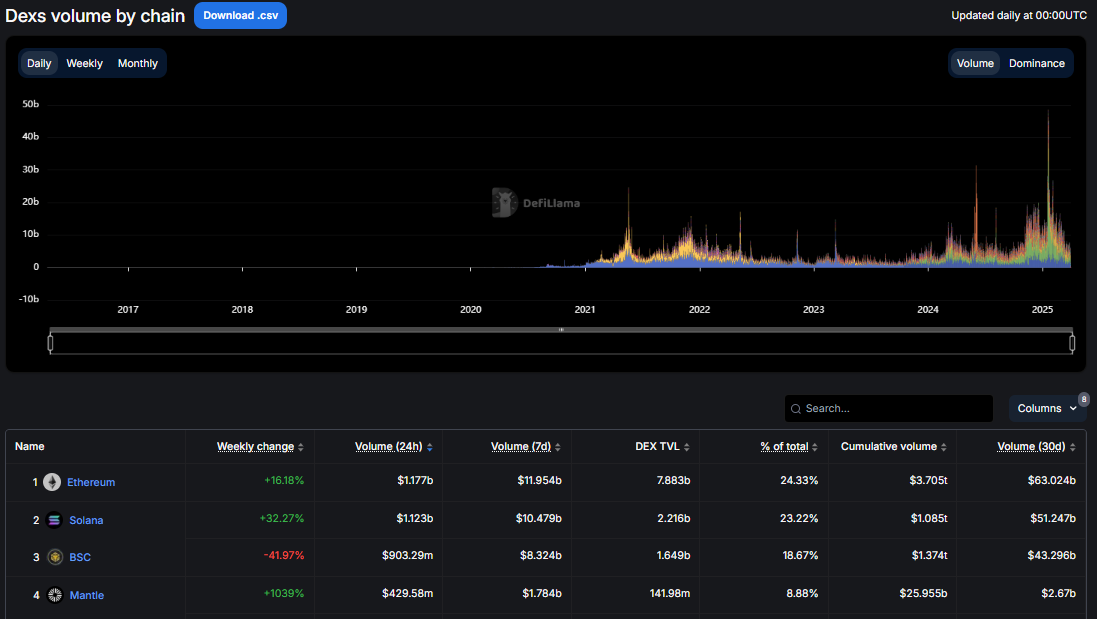

According to data from DefiLlama, Ethereum-based DEXs recorded approximately $63 billion in trading volume throughout March 2025. This traction saw Ethereum overtake Solana’s $51 billion during the same period.

The shift marks a significant moment in the ongoing competition between Ethereum and Solana in the decentralized finance (DeFi) ecosystem.

Solana had dominated the DEX space for months, bolstered by its low fees and high transaction throughput. Franklin Templeton noticed the trend and predicted Solana’s DeFi surge could rival Ethereum’s valuation.

“Solana DeFi valuation multiples trade on average lower than their Ethereum counterparts despite significantly higher growth profiles. This highlights an apparent valuation asymmetry between the two ecosystems,” read an excerpt in Franklin Templeton’s report.

However, recent declines in trading volume on key Solana-based platforms suggest a changing market dynamic. The drop in Solana’s DEX trading volume is closely tied to decreased activity on major platforms like Raydium (RAY) and Pump.fun.

Pump.fun, in particular, has seen a sharp decline in trading volume since the beginning of the year. Monthly volumes fell from a January peak of $7.75 billion to just $2.53 billion in March, representing a 67% drop.

Data on Dune shows that this downturn aligns with a slowdown in the platform’s token graduation rate, which has fallen from 0.8% to 0.65% per week.

The graduation rate reflects the percentage of new tokens reaching the $100,000 market capitalization threshold required to migrate from Pump.fun to the Raydium platform.

A lower graduation rate suggests fewer tokens are reaching this threshold, which is reducing overall trading activity on Solana’s DEX ecosystem.

Ethereum’s Strength in the DEX Market

While Solana’s DEX activity has faltered, Ethereum’s trading volume has remained resilient. This is likely bolstered by the strong performance of platforms like Uniswap (UNI) and Curve Finance (CRV).

In March, Uniswap alone facilitated over $30 billion in trading volume, significantly contributing to Ethereum’s overall market dominance.

Ethereum’s ability to reclaim the top spot is also attributed to its established infrastructure and network effects. Despite higher gas fees than Solana, Ethereum continues attracting high-value trades, institutional interest, and liquidity. These reinforce its position as the primary blockchain for DeFi activity.

Against this backdrop, industry analysts believe that while Solana is very competitive, it still has a long way to go before it can dethrone Ethereum.

Meanwhile, others say Ethereum’s resurgence may extend into the second quarter (Q2), driven by upcoming network upgrades and broader market trends.

“On-chain developments offer some hope for ETH…With Pectra now successfully deployed on the Holesky testnet and a mainnet upgrade expected in Q2, could we see a reversal of the downward ETH/BTC trend in the coming quarter?” analysts at QCP Capital noted.

The Pectra upgrade, once implemented on the Ethereum mainnet, is expected to improve scalability and efficiency, potentially boosting user adoption and trading activity.

Adding to the positive momentum, spot Ethereum ETFs (exchange-traded funds) saw net inflows on Monday, contrasting with net outflows from Bitcoin ETFs. This trend suggests growing investor confidence in Ethereum’s market position.

This shift in ETF flows could indicate a broader reallocation of capital within the crypto market, particularly as Ethereum strengthens its DeFi ecosystem and prepares for key upgrades.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

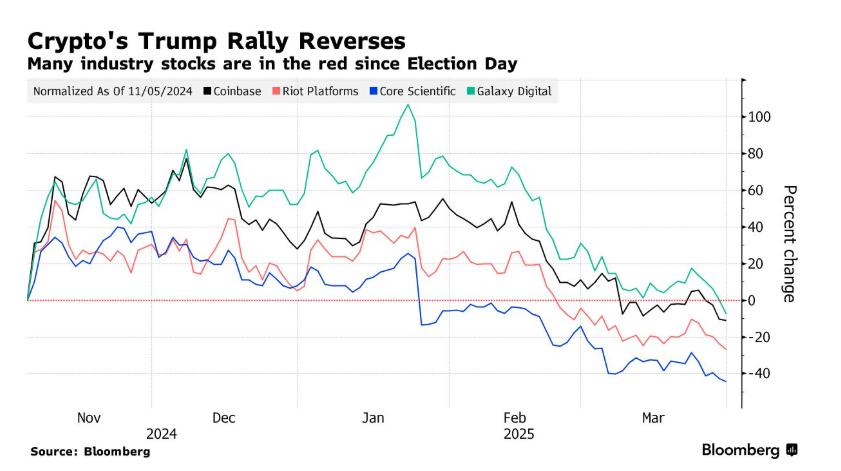

Coinbase, the largest US crypto exchange, has recorded its worst quarter since the dramatic collapse of FTX in late 2022.

Coinbase’s stock (COIN) plummeted by 30% in Q1 2025, mirroring the steep losses seen across the broader crypto market.

Crypto Stocks and Assets Bleed Red in Q1

According to Bloomberg, the sharp decline has hit several other major crypto-related stocks as well. This includes Galaxy Digital, Riot Blockchain, and Core Scientific, all of which have experienced significant downturns.

Furthermore, the broader crypto market is facing tough times. Bitcoin, which has long been considered the bellwether of digital assets, has dropped by 10% this quarter. More dramatically, Ethereum (ETH) has seen a staggering 45% decline. These losses reflect a broader downturn in the crypto market, fueled by several macroeconomic factors.

Analysts point to the global uncertainty surrounding the US economy, including concerns over Trump’s tariffs and recession fears. This has resulted in a general “risk-off” mood among investors.

“In a risk-off mood, no asset is safe stocks, crypto, all get hit. It’s more about sentiment than fundamentals in those moments,” an investor commented on X.

While some point to these macroeconomic pressures as the primary cause, others argue that the market’s underperformance is more due to lingering fears of trade wars and broader geopolitical instability.

“Trump’s trade wars are driving markets into a panic. As much as he is doing for crypto, the macro market conditions are speaking louder – as bullish as the news is from the white house – His trash trade war is squelching any price surge,” another X user remarked.

Coinbase has been hit especially hard in this downturn. Coinbase’s revenue model is heavily reliant on altcoins and transaction volumes beyond Bitcoin. Hence, the overall market drop could have made a mark on the exchange’s stock prices. Moreover, the news comes as Coinbase users have collectively lost more than $46 million to scams in March.

While crypto has been in a freefall, other assets have fared much better. Gold, for example, has surged, posting its best quarter since 1986 as investors flock to safer assets amid the market turmoil. The shift toward traditional assets is particularly noticeable as the post-election crypto hype, which briefly boosted Bitcoin’s value to $109,000, begins to fade.

Despite the overall market challenges, some crypto-related firms have shown resilience. MicroStrategy, led by CEO Michael Saylor, remains in the green year-to-date, bolstered by its substantial Bitcoin holdings.

For now, the crypto market is left to weather the storm, with analysts continuing to scrutinize the interplay of macroeconomic factors and its impact on digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

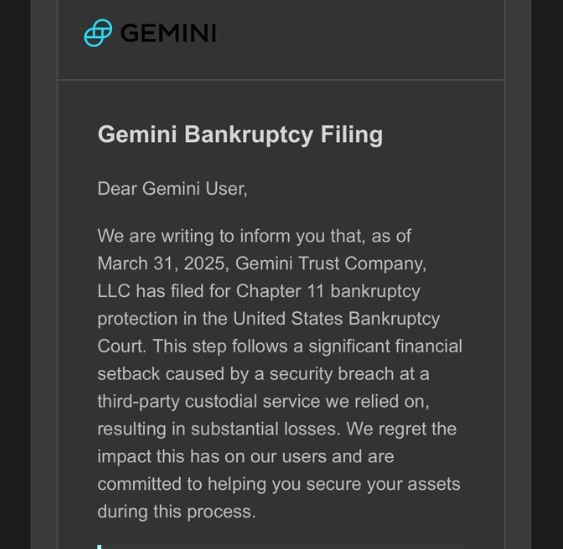

Fake Gemini Bankruptcy Emails Target Users

Crypto scams are surging as more people flock to digital currencies, with fraudsters exploiting the industry’s rapid growth to deceive investors.

Recently, numerous crypto users reported receiving fraudulent emails claiming that the Gemini exchange had filed for bankruptcy. Meanwhile, Coinbase Exchange has admitted that an employee illegally accessed user account information.

Gemini Exchange Addresses Bankruptcy Allegations

Multiple accounts highlighted the scam on social media, indicating that an email circulating falsely claims that Gemini has filed for bankruptcy. The email instructed users to withdraw to an Exodus wallet and provided a seed phrase.

These phishing emails, shared on April 1, urged recipients to withdraw their funds into a specified crypto wallet to protect their assets. This was an attempt to deceive users into transferring their cryptocurrencies to wallets controlled by scammers.

“Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email,” wrote Jason Williams, a contributor to Fox Business.

The deceptive emails alleged a substantial loss of $1.2 billion by Gemini Exchange. Understandably, some novice investors would heed this email and even move their assets to the address. After all, some victims of FTX Exchange contagion continue to pursue their funds even years after the incident.

“I got one also. It is better than your typical ‘Coin Base’ one, but still not quite there. Might fool a boomer though,” one X user remarked.

However, security experts advise users to always verify information through official channels, avoid clicking on unsolicited links, and refrain from sharing personal data. Gemini issued an official warning in response to the scam, acknowledging the threat against its users.

“We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets,” the exchange articulated.

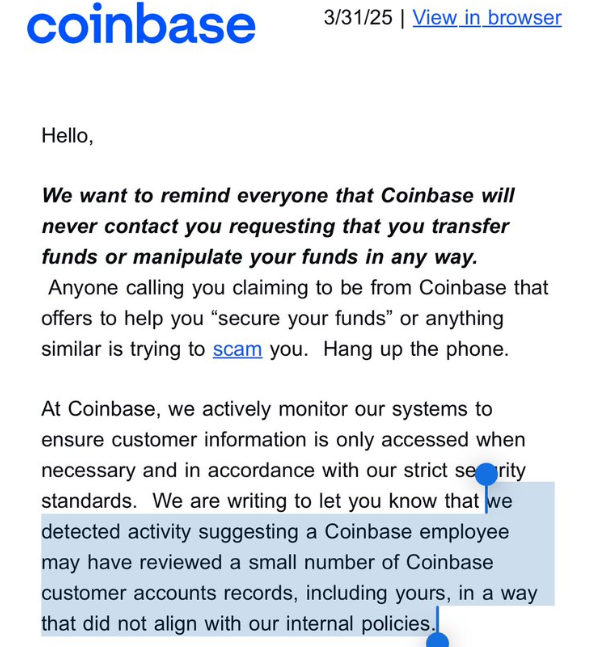

Coinbase Admits Employee Illegally Accessed User Account Data

Coinbase exchange acknowledged a privacy violation by one of its staff in a somewhat related development. Specifically, a customer service employee accessed user account information without authorization.

This breach has raised concerns about potential scams targeting Coinbase users. Mike Dudas, a crypto investor and co-founder at The Block, shared an email from Coinbase acknowledging the incident.

“That explains the fake Coinbase phishing emails and phone calls today,” he stated.

This breach coincides with reports of phishing attempts, as users have received fake emails and calls purporting to be from Coinbase. These incidents reflect a broader wave of crypto-related fraud.

Blockchain investigator ZachXBT reported that Coinbase users lost over $65 million to social engineering scams between December 2024 and January 2025.

“Coinbase did not detect it; I sent them the intel,” the blockchain investigated noted.

Additionally, crypto analyst Cobie suggested Kraken might be experiencing a similar issue. Per his post, a new attack may be budding, where attackers infiltrate customer service roles to exfiltrate data.

“Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data),” the analyst remarked.

Amidst these events, ZachXBT recently explained how to avoid crypto scams. He emphasizes the importance of conducting thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains.

Additionally, he advises caution when dealing with projects with few credible followers, as these may indicate potential scams.

Therefore, it is imperative that users remain vigilant against sophisticated phishing scams and unauthorized data breaches.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Bitcoin22 hours ago

Bitcoin22 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market21 hours ago

Market21 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market23 hours ago

Market23 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Regulation23 hours ago

Regulation23 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Market22 hours ago

Market22 hours agoPi Network Struggles, On Track for New All-Time Low

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Price Confirms Breakout From Ascending Triangle, Target Set At $7,800