Ethereum

Ethereum Sell Side Liquidity Thinning On CEXes: Time For $4,000?

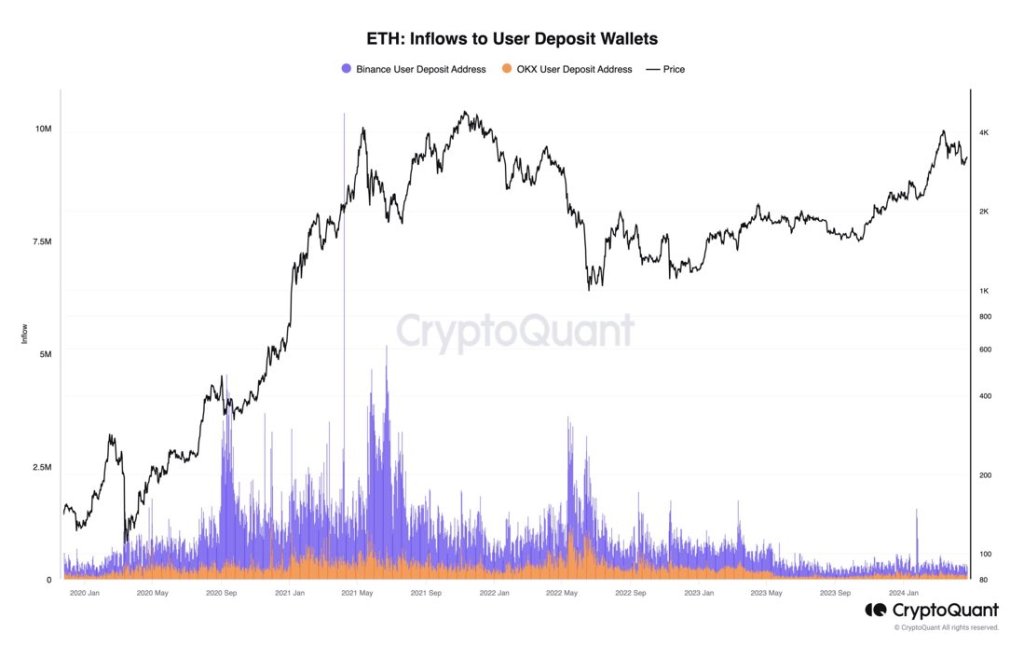

Taking to X on April 26, one analyst notes that there is a high probability of Ethereum spiking in the sessions ahead because of thinning sell-side liquidity across major centralized exchanges like Binance and Coinbase.

Thin Sell-Side, Big Potential Move For ETH

Thinning sell-side liquidity, as seen on order books across CEXes, means that few sellers are willing to liquidate. With few sellers on the market, a small upsurge in demand could theoretically see prices skyrocket.

Even so, market makers could fill this imbalance by considering how the market works. At the same time, prices are not guaranteed to rally even if they remain as they are.

Unlike new meme coins, for instance, Ethereum is extremely liquid; it is the second largest coin by market cap, only trailing Bitcoin. That means billions will be needed to push prices above the immediate resistance levels at $3,300 and $3,700, as clearly shown in the daily chart.

Ethereum has been under pressure for the better part of April following a drop from its all-time high of $4,090. Looking at the development in the daily chart, the coin is down 23% from all-time highs, finding strong rejection from the middle BB–or the 20-day moving average.

Analysts expect buyers to take over and reverse mid-April losses if a comprehensive breakout above $3,300 is marked by expanding volume. If not, ETH risks falling below $2,800, aligning with the April 12 and 13 sell-off.

Spot Ethereum ETF Launch In Hong Kong, Adoption Fuel Optimism

However, traders are generally bullish, anticipating a price rebound in the months ahead. Several factors could propel ETH prices upwards. A major catalyst is the highly anticipated launch of spot Ethereum exchange-traded funds (ETFs) in Hong Kong. Like the impact of spot Bitcoin ETFs on BTC prices, this product for ETH may prop up the coin, allowing traditional investors to gain exposure to the second world’s most valuable coin.

In the United States, the largest obstacle preventing the Securities and Exchange Commission (SEC) from approving a similar product is the uncertainty of ETH’s classification. On April 25, ConsenSys sued the regulator, pressing the regulator to classify the coin as a commodity.

Beyond the launch of this product by the end of the month, Ethereum’s core strengths remain. The ongoing adoption of Ethereum and Layer 2 scaling solutions continues. As more protocols choose to deploy on the smart contracts platform, it fosters optimism for Ethereum’s long-term viability and growth.

Feature image from Canva, chart from TradingView

Ethereum

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has once again fallen below the $2,000 mark, a psychological level it had briefly reclaimed earlier this week. The market-wide correction over the past 24 hours has weighed on Ethereum’s recovery momentum, and the leading altcoin has seen a dip in sentiment that could lead to a deeper decline or a sharp mid-term rebound.

Short-term sentiment is cautious, but a new analysis from a well-followed crypto analyst has brought attention to a significant technical event that opens up a bullish perspective for the Ethereum price.

Ethereum Hits 300-Week Moving Average Again: What Happened The Last Time?

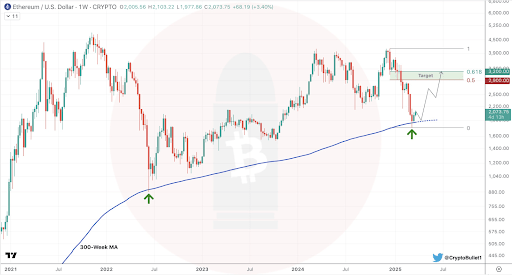

Taking to social media platform X, crypto analyst CryptoBullet pointed out that Ethereum has now touched the 300-week moving average for only the second time in its history. The first instance was in June 2022, during the market-wide crash that saw the Ethereum price plummet to as low as $880 before beginning a long, slow recovery.

Related Reading

The second occurrence has come this month, March 2025, just as Ethereum continues to extend its struggles in gaining a footing above $2,000. With Ethereum touching the 300-week moving average again, we can only look back to see what happened last time to get a perspective of what to expect now.

In June 2022, Ethereum’s touch of the 300-week moving average marked the beginning of a long-term recovery phase. After the bounce from that level, the Ethereum price surged more than 140% over the next eight weeks, eventually pushing above $2,100 in August 2022 before another correction.

Mid-Term Rebound In Focus For ETH, But Resistance Ahead

CryptoBullet noted the significance of this moving average, framing it as a key historical support zone. The analyst argued that regardless of bearish sentiment in the short term, this kind of macro-level support typically sets the stage for a meaningful bounce.

Related Reading

“Even if you’re a bear, you can’t deny that we hit a very important support level,” he wrote, adding that his price target for the coming bounce is between $2,900 and $3,200. Nonetheless, the bounce will depend on how the Ethereum price reacts to the level, as a continued downside move would cancel out any bullish momentum.

For now, Ethereum’s price is trapped under bearish sentiment, and bulls will need to reclaim the $2,000 zone before any sustainable bounce toward the $2,900 and $3,200 range can begin to materialize. Furthermore, the recent price correction in the past 24 hours increases the risks of the Ethereum price closing March below the 3M Bollinger bands, which is currently just around $2,000. A close below the 3M Bollinger bands could spell trouble for the leading altcoin.

However, if CryptoBullet’s analysis proves to be accurate, Ethereum may soon enter a period of stronger price action that plays out over the coming weeks. At the time of writing, Ethereum is trading at $1,907, down by 5.82% in the past 24 hours.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Fails To Break $2,100 Resistance – Growing Downside Risk?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has lost its grip on the key $2,000 level, reigniting fears of a deeper correction as selling pressure returns to the market. Since March 19, ETH has managed to hold above $1,930, but recent weakness has pushed the price dangerously close to breaking below the $1,900 mark. The drop has added fuel to bearish speculation, with traders and analysts now questioning whether a larger pullback is underway.

Related Reading

The inability to hold above psychological support levels has weighed heavily on sentiment, especially as broader market volatility continues to grow. Top analyst Carl Runefelt shared his outlook on Ethereum’s current structure, noting that the asset has repeatedly failed to overcome resistance at $2,100 — a level that now acts as a firm ceiling for bullish momentum. According to Runefelt, this repeated rejection suggests Ethereum could be in serious trouble if buyers don’t step in soon.

With momentum fading and no clear catalyst in sight, Ethereum risks slipping further if $1,900 fails to hold. Traders are watching closely for signs of a reversal, but for now, the path of least resistance appears to be downward. ETH must regain lost levels quickly to avoid confirming a broader bearish trend.

Bulls Face Key Test As Resistance Weighs on Price Action

Ethereum is under pressure as the broader crypto market faces one of its most crucial tests in months. With macroeconomic uncertainty mounting and fears of a potential recession in the United States, risk assets across the board are struggling to gain traction — and Ethereum is no exception. The current market environment remains hostile, with inflation concerns, unstable monetary policy, and global trade tensions shaking investor confidence.

ETH’s price action has been particularly underwhelming. Despite widespread expectations that Ethereum would lead a strong rally in early 2025, the asset has failed to meet bullish projections. Instead of gaining ground, ETH has stalled and is now struggling to hold support levels amid growing selling pressure.

Runefelt’s bearish outlook suggests that Ethereum has repeatedly failed to break through the $2,100 resistance level. According to Runefelt, this resistance zone is critical — and Ethereum’s inability to overcome it could be a sign of deeper weakness ahead. He warns that if Bitcoin experiences a breakdown, Ethereum could follow and potentially retest the wick near $1,750, which marked a local low during a previous correction.

With momentum fading and no clear bullish catalyst in sight, Ethereum’s price structure remains fragile. Unless bulls reclaim key levels soon, ETH could face a deeper retrace, especially if broader market sentiment continues to deteriorate.

Traders are closely watching Bitcoin and macroeconomic developments for cues, knowing that a decisive move in either direction could shape Ethereum’s next major trend. For now, the pressure is on — and Ethereum’s resilience is about to be tested.

Related Reading

ETH Bulls Struggle to Hold Key Support

Ethereum (ETH) is currently trading at $1,910 after failing to hold above the critical $2,000 level, a psychological and technical barrier that has now flipped into resistance. The breakdown has weakened short-term momentum and left bulls in a defensive position as selling pressure continues to mount.

At this stage, the $1,880 level has emerged as a key support zone that bulls must defend to avoid a deeper correction. Holding this level could allow for a consolidation phase and give Ethereum a chance to stabilize before attempting another push higher. However, if ETH loses $1,880, it could spark a wave of aggressive selling, triggering a continuation of the current downtrend and potentially pushing the price toward the $1,750 range.

Related Reading

To regain control of the trend, bulls must reclaim the $2,000 mark as soon as possible. A decisive move back above this level would signal renewed strength and could open the door for a rebound toward higher resistance zones. Until then, Ethereum remains in a fragile position, with the risk of further downside growing as macroeconomic pressure and technical weakness continue to weigh on price action.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Price Eyes Major Resistance At $2,100 As Analyst Reveals Bullish Price Range

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Ben Gray has asserted that the Ethereum price is bullish and revealed the price range that the leading altcoin is targeting. However, ETH is set to face major resistance at $2,100, a level which it needs to break out from as it targets new highs.

Ethereum Price Faces Major Resistance At $2,100

In a TradingView post, Ben Gray revealed that the Ethereum price is facing a key resistance level at $2,160 even as it eyes a rally to new highs. Despite this development, the analyst asserted that ETH’s market is bullish. While noting that the leading altcoin is fluctuating between $2,044 and $2,080, he remarked that there are signs that Ethereum initially formed a bottom.

Related Reading

Based on his analysis of the 4-hour candlestick chart, Gray stated that the Ethereum price is attempting to break through upwards, with the key resistance level at $2,160. He further showed his optimism for ETH in 2025 by stating that the expected range is between $2,904 and $4,887, although that puts the altcoin below its current all-time high (ATH).

Meanwhile, the crypto analyst mentioned that the Ethereum price has shown a strong and positive performance this week. Going forward, he stated that the key focus should be on whether ETH can break through the resistance level of $2,160, which would play a key role in determining the altcoin’s trajectory in the short and mid-term.

Crypto analyst Ali Martinez also recently highlighted the $2,300 level as another resistance level to watch out for the Ethereum price. He noted that with ETH reclaiming $2,040, the next key hurdle is this $2,300 level, where the pricing bands suggest strong resistance.

Why ETH Has Bottomed

In an X post, crypto analyst Titan of Crypto stated that the Ethereum price is showing signs of bottoming. He revealed that the weekly Stochastic RSI bullish crossover is in oversold territory, a development that has often signaled market bottoms for ETH. His accompanying chart showed that the leading altcoin could rally to as high as $6,000 as it records a bullish reversal.

Related Reading

Crypto analyst Crypto Caesar also stated that the Ethereum price is currently bottoming out and that ETH is “heavily undervalued.” He added that in every bull cycle, there is always a moment when most market participants think that the altcoin will never recover after a big bearish event. However, Ethereum always recovers and ends up making new highs. As such, the analyst believes this time won’t be different, and ETH is ready to stage a bullish reversal.

At the time of writing, the Ethereum price is trading at around $2,022, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Altcoin16 hours ago

Altcoin16 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation16 hours ago

Regulation16 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market23 hours ago

Market23 hours agoSatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

-

Altcoin23 hours ago

Altcoin23 hours agoBlessing or Curse for the Crypto Market?

-

Market22 hours ago

Market22 hours agoHedera Falls 4% as Bears Dominate: What’s Next for HBAR?

-

Regulation18 hours ago

Regulation18 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Altcoin22 hours ago

Altcoin22 hours agoWhy the US SEC Is Delaying the Ripple Case?