Regulation

Coinbase Talks About SEC Lawsuits and Political Donations In Investor Letter

On Thursday, May 2, cryptocurrency exchange Coinbase (NASDAQ: COIN) announced its Q1 results with higher-than-expected revenue amid the strong run-up in the cryptocurrency market and the launch of the spot Bitcoin ETFs.

Coinbase Opens Up About SEC Lawsuit

Coinbase Global Inc. delved into its ongoing legal matters with the US Securities and Exchange Commission (SEC) and its political contributions while unveiling better-than-expected results for the first quarter.

The leading US cryptocurrency exchange highlighted a Manhattan federal court’s ruling in March, which dismissed the SEC’s allegation that Coinbase operated as an unregistered broker via its Wallet service in its shareholder letter. However, it also noted that the court rejected the company’s motion to dismiss the case entirely. In a note to investors, Coinbase noted:

“Clarity is the ultimate goal and the court’s decision continues us on that path. We remain confident in the strength of our legal arguments and are fully prepared for an intensive discovery phase throughout the remainder of the year.”

Crypto Exchange Talsk About Political Donations

The cryptocurrency exchange also emphasized its political engagements, disclosing its support for Fairshake PAC, a prominent super PAC in the United States. Coinbase stated that the political action committee backs candidates from both parties who are supportive of cryptocurrency, highlighting the influence of the pro-crypto movement.

Notably, during the March primary elections, crypto supporters made significant strides in states like California, Texas, and Alabama, aiding pro-crypto candidates in advancing beyond the primaries.

In a notable Senate primary race in March, cryptocurrency lobbying efforts were attributed to the defeat of Democratic Representative Katie Porter, known for her critical stance on the digital asset industry.

The strong results for Coinbase in Q1 came on the heels of a strong crypto market rally in that period. As enthusiasm for the leading cryptocurrency begins to fade in April, analysts are growing apprehensive about the potential impact on demand from one of Coinbase’s key clientele i.e. individual investors.

John Todaro, an analyst at Needham & Co., expressed concerns that the second quarter may not match the strength of the first quarter and warned that the recent downturn in crypto prices could erode the gains made in retail user participation.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

FDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

The Federal Deposit Insurance Corporation (FDIC) has updated its guidelines, enabling banks to engage in cryptocurrency-related activities without seeking prior approval. This new policy shift signals a change in the FDIC’s approach to the growing role of digital assets in the banking sector.

New FDIC Guidelines on Crypto-Related Activities

The FDIC has issued a new Financial Institution Letter (FIL-7-2025), which provides updated guidance for banks looking to engage in cryptocurrency activities. The new guidance rescinds the previous policy set out in FIL-16-2022, which required banks to notify the FDIC before engaging in such activities.

Under the new rules, banks can now participate in permissible crypto-related activities without waiting for FDIC approval, as long as they manage the risks appropriately.

This change is seen as a shift in the FDIC’s stance, following the agency’s earlier stance that required prior approval for crypto engagements. FDIC Acting Chairman Travis Hill expressed that this new approach aims to establish a more consistent framework for banks to explore and adopt emerging technologies like crypto-assets and blockchain.

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years,” said Hill in a statement.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

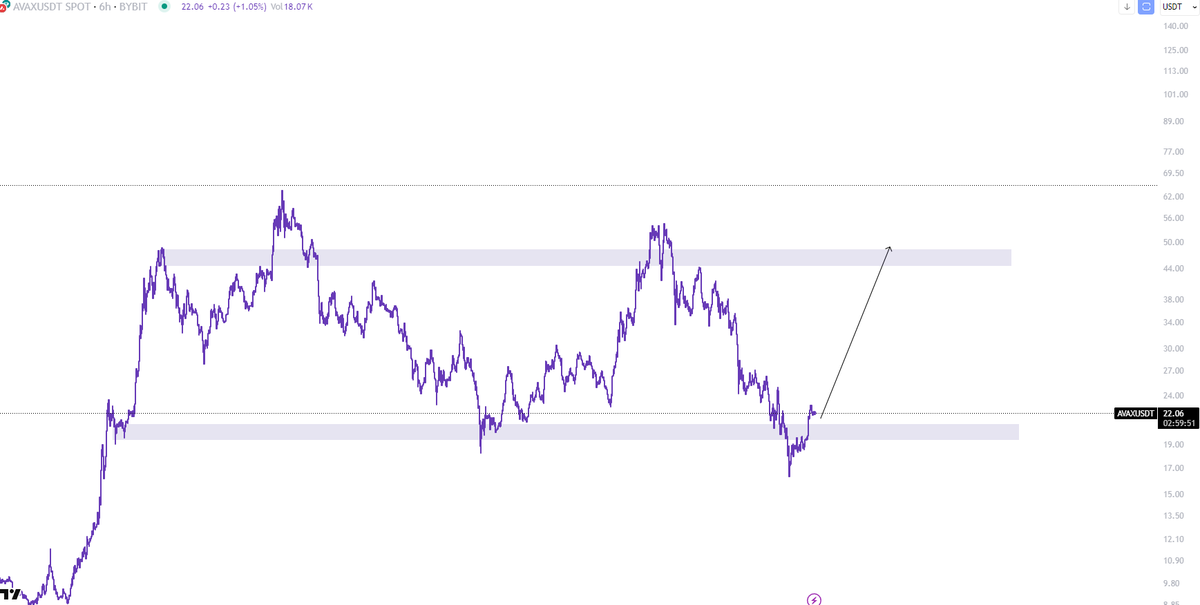

AVAX Price Eyes Rally To $44 As Grayscale Files For Avalanche ETF

According to a recent analysis, the AVAX price is eyeing a rebound to as high as $44. This comes just as asset manager Grayscale files to offer an Avalanche ETF, which will list and trade on the Nasdaq exchange.

Grayscale Files With US SEC To Offer Avalanche ETF

Grayscale has officially filed with the US SEC to offer an Avalanche. This came following Nasdaq’s 19b-4 filing with the Commission to list and trade this proposed ETF on the exchange. The SEC will have to determine whether or not to approve the fund.

Grayscale becomes the second asset manager to file to offer an AVAX ETF. VanECK was the first as the asset manager filed the S-1 for its ETF with the SEC two weeks ago. It is worth mentioning that Grayscale already has an Avalanche Trust, which it is simply looking to convert to an ETF.

Asset managers continue to file for several altcoin ETFs under the new SEC administration, with acting Chair Mark Uyeda looking to create a regulatory-friendly environment for the crypto industry. US SEC Chair nominee Paul Atkins has also affirmed that he plans to prioritize regulatory clarity for the industry.

Market expert Nate Geraci also highlighted the wave of altcoin ETFs that have stormed the SEC’s desk including filings for XRP, Solana, Dogecoin, Cardano, SUI, Hedera, Polkadot, Litecoin, Aptos, and Axelar.

AVAX Price Eyes Rebound To $44

The AVAX price is eyeing a rebound to $44 as predicted by crypto analyst Jarfan. Grayscale’s filing for an Avalanche ETF undoubtedly provides a bullish outlook for the altcoin and could spark this rally.

Jarfan stated that AVAX’s chart is one of the cleanest on the market at the moment. He remarked that the altcoin has taken out previous lows and looks to be putting a double bottom on the higher timeframe.

In line with this, he affirmed that overall, a very bullish structure is forming at the moment and that AVAX is showing a lot of relative strength in comparison to other altcoins. The analyst noted that there have been major moves from other coins recently, although they have been mainly meme coins, and that the fact that Avalanche is keeping up with them is truly impressive.

Jarfan also stated that the AVAX price is holding above a very strong support right now with barely any drawbacks. As such, he belives that the altcoin will rally to $30 in no time once Bitcoin breaks out from $88,000.

His accompanying chart also showed that the altcoin could rebound to $44, although it would face a major resistance at that level as it attempts to further rally to the upside. The crypto analyst predicts that Avalanche will break in the top 10 cryptocurrencies by market cap very soon.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC Chair Nominee Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry

US SEC Chair nominee Paul Atkins has revealed his intention to prioritize providing regulatory clarity for the crypto industry. This came following Atkins’ nomination hearing before the US Senate Banking Committee.

Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry

During his Senate Banking Committee nomination hearing, Paul Atkins stated that a top priority of his chairmanship will be to work with his fellow commissioners and Congress to provide a “firm regulatory foundation for digital assets through a rational, coherent, and principled approach.

This comes just as CoinGape reported that the US SEC plans to shift its focus from crypto enforcement actions to traditional cases. Under past Chair Gary Gensler, the Commission adopted the regulation by enforcement approach instead of providing clarity for the industry.

However, Atkins is looking to change that, with his mission already aligning with the moves the agency, under Acting Chair Mark Uyeda, has made so far to create a regulatory-friendly environment for the industry.

During the hearing, Committee Chairman Tim Scott alluded to the backlash that the SEC faced under Gensler. Paul Atkins admitted that all prior issues were disturbing and committed to working on boosting the agency’s image. He added that he wants to go back to the basics and ensure that the Commission works in line with its mission.

Atkins Crypto Holdings Revealed

Coingape recently reported that Paul Atkins holds almost $6 million in crypto investments, according to a disclosure released on Tuesday. Between $250,000 and $500,000 is equity in crypto custodian Anchorage Digital.

Meanwhile, the US SEC Chair nominee previously held a board position at the BlackRock-backed tokenization firm and had nearly $250,000 to $500,000 in call options. $1 million to $5 million of these investments came from stakes in Off the Chain Capital, where he is a limited partner.

It is unclear if Paul Atkins will offload these crypto investments if the US Senate confirms him as the next US SEC Chair. However, Senator Elizabeth Warren described his financial conflicts of interest as “breathtaking.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market22 hours ago

Market22 hours agoCan Cardano (ADA) Reach Back to $1 in April?

-

Market21 hours ago

Market21 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Market20 hours ago

Market20 hours agoBinance To List MUBARAK, BROCCOLI, BANANAS31, and Tutorial

-

Market17 hours ago

Market17 hours agoBinance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

-

Market23 hours ago

Market23 hours ago3 Altcoins Poised for a Move on Trump’s Liberation Day

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Cup And Handle Pattern Signals Recovery To $0.4, Here’s How

-

Market16 hours ago

Market16 hours agoWhy BTC Price Stayed Unchanged

✓ Share: