Market

xyOS Beta Launch Enhances Digital Autonomy & Data Sovereignty

XYO, a company pioneering technology to improve data validity and user control, has taken a significant step towards a more empowered digital future. On 1st May 2024, they launched the beta version of xyOS, a groundbreaking operating system designed to simplify blockchain interaction and put you back in charge of your digital life.

With this innovative development, XYO aims to revolutionize the landscape of decentralized technology, empowering users with unprecedented control over their online interactions and data ownership.

In this article, we are going to dive into xyOS, exploring its user-friendly features, its built-in XYO Name Service (xyoNS), and how it empowers users within the XYO ecosystem.

xyOS, short for XYO Operating System, represents a pioneering advancement in the realm of decentralized technology. Designed to simplify the complexities of blockchain-based applications, xyOS introduces a user-friendly graphical interface that resonates with both seasoned enthusiasts and newcomers to the digital landscape.

At its core, xyOS is more than just an operating system—it’s a catalyst for change, bridging the chasm between intricate decentralized networks and everyday users.

This innovative platform democratizes access to the XYO ecosystem, offering seamless navigation through a familiar interface akin to popular platforms like the iPhone Home Screen or Windows desktop. Through xyOS, users can effortlessly engage with decentralized applications (dApps) with a mere tap or click, ushering in a new era of accessibility and empowerment.

Central to the ethos of xyOS is the concept of data sovereignty and user autonomy. By storing all data locally, xyOS ensures that users retain complete control over their information, enabling them to modify or delete it at their discretion.

This heightened level of control not only safeguards privacy but also instills confidence in users, fostering a sense of ownership over their online interactions.

Furthermore, xyOS streamlines interaction with the blockchain, offering simplified setup processes for nodes and providing real-time data insights into XYO technologies. From customizable profiles to intuitive settings and system health monitoring, xyOS caters to diverse user needs while laying the foundation for peer-to-peer engagements within the XYO ecosystem.

xyOS goes beyond just a user-friendly interface. It packs a punch with features designed to empower users and revolutionize data ownership:

Data Sovereignty at Your Fingertips

Unlike traditional platforms that store your data on their servers, xyOS keeps your information local. This means you have complete control over it. Need to modify or delete something? xyOS puts the power in your hands.

Effortless Access to the XYO Ecosystem

xyOS acts as your gateway to the entire XYO world. With a few clicks, you can access the XYO platform, protocol, and network, unlocking the vast potential of this innovative ecosystem.

Built-in dApps for Everyday Needs

xyOS comes pre-loaded with essential dApps (decentralized applications) to manage your profile, settings, and system health. This built-in functionality streamlines your experience within the XYO ecosystem.

A Platform for Future Innovation

xyOS isn’t just about pre-built apps. It allows third-party developers to create their own dApps, expanding the functionalities and possibilities within the XYO ecosystem. This opens the door for exciting new features and services in the future.

Additional Features

Moreover, xyOS offers additional features that enhance user experience and control:

- Customization Options: Don’t like the default look? xyOS lets you personalize your experience with OS theming options, allowing you to tailor the interface to your preferences.

- Quick Search Functionality: Need to find something specific within the XYO ecosystem? xyOS’ built-in quick search function helps you locate what you’re looking for in a flash.

- Real-time Insights: Stay informed with xyOS’ dashboard clock that provides real-time updates on the XYO network and your system health. This transparency empowers you to make informed decisions about your data and interactions within the ecosystem.

- Multiple Identity Management: xyOS allows you to create and manage multiple identities within the system. Each identity can have its own set of preferences and data, offering enhanced control and flexibility for different use cases.

Imagine trying to remember a long string of numbers and letters just to identify yourself online. Sounds cumbersome, right? This is where XYO Name Service (xyoNS), a clever feature integrated within xyOS, comes in. xyoNS tackles the challenge of complex wallet addresses often associated with blockchain technology. It allows users to create memorable usernames that replace those cryptic strings. Think of it like choosing a nickname for your online identity within the XYO ecosystem.

The launch of xyOS signifies a turning point for the XYO ecosystem. Here’s how it paves the way for a more vibrant and user-centric future:

Lowering the Barrier to Entry

With its intuitive interface and familiar design, xyOS removes the technical hurdles that might have previously discouraged newcomers. This opens the door for a wider user base to explore the XYO ecosystem and its potential applications.

Empowered Users, Stronger Ecosystem

By placing data control back in users’ hands, xyOS fosters trust and encourages active participation within the XYO network. This empowered user base can contribute valuable data and ideas, ultimately strengthening the XYO ecosystem as a whole.

A Platform for Innovation

xyOS acts as a springboard for developer creativity. With its open platform for third-party dApps, xyOS unlocks a vast potential for new functionalities and services. This fosters innovation within the XYO ecosystem, leading to exciting possibilities for the future.

The beta launch of xyOS marks a significant milestone for XYO and the future of data ownership. This user-friendly operating system dismantles the complexity often associated with blockchain technology, putting users back in control of their data.

Features like local data storage and built-in dApps empower users to navigate the XYO ecosystem with confidence. Furthermore, XYO Name Service (xyoNS) simplifies identity management, making interaction within the network more seamless. The impact of xyOS extends beyond individual users.

By attracting a wider user base and fostering developer creativity, xyOS has the potential to fuel innovation and propel the XYO ecosystem forward. If you’re looking for a user-centric approach to blockchain technology and a place to reclaim control of your data, xyOS is definitely worth exploring.

The beta version is now available, so head over to XYO’s website or discord server to learn more and embark on this new era of data sovereignty.

Links:

Twitter | Instagram | Discord | Reddit | LinkedIn | Telegram

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FDIC and CFTC Rescind Old Crypto Guidelines

The FDIC and CFTC have both been working to change previous crypto guidelines. As federal regulators reconcile with the industry, they are removing old rules that specifically target crypto.

The former institution is removing the requirement that banks report crypto business, while the latter holds crypto to the same standards as other industries.

FDIC and CFTC Change Crypto Policies

The FDIC is one of the top financial regulators in the US, and it’s turning over a new leaf. After being one of the principal architects of Operation Choke Point 2.0, it recently began declassifying documents and changing rules that allowed crypto debanking.

Today, the agency is revoking a 2022 directive that impacted banks’ interactions with crypto:

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years. I expect this to be one of several steps the FDIC will take to lay out a new approach for how banks can engage in crypto- and blockchain-related activities in accordance with safety and soundness standards,” said FDIC Acting Chairman Travis Hill.

Specifically, it rescinded a rule that mandated that all banks and institutions under its supervision notify the FDIC of any crypto involvement. The new guideline claims that banks “may engage in permissible crypto-related activities without receiving prior FDIC approval” without enacting any other policies.

Since Gary Gensler left the SEC, all the top US financial regulators have been trying to rework their relationship with crypto. In an apparent coincidence, the CFTC made a very similar move to the FDIC by rescinding two crypto guidelines.

Both of these actions did not establish a new policy; they merely removed the old ones.

Essentially, both of the CFTC’s rule changes are set to ensure that crypto-related derivatives are subject to the same requirements as non-crypto ones. This is somewhat surprising, considering that the industry has typically tried to insist that it necessitates specific regulations.

However, this is largely beside the point. The FDIC and CFTC are both working to remove previous guidelines that opposed the crypto industry.

These institutions will undoubtedly be amenable to creating new ones in the spirit of cooperation. In the meantime, this olive branch can help build a lot of goodwill.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network (PI) Drops Further Despite Telegram Wallet Deal

Pi Network (PI) has been under heavy selling pressure, with its price down more than 61% over the last 30 days. Despite a recent partnership with the Telegram Crypto Wallet, PI has struggled to regain momentum, as technical indicators remain mostly bearish.

Its BBTrend has been negative for 12 consecutive days, and although the RSI has recovered slightly from oversold levels, it still sits below the neutral 50 mark. With the downtrend firmly intact and critical support levels approaching, PI’s next move will likely depend on whether buyers can step in and reverse the current trajectory.

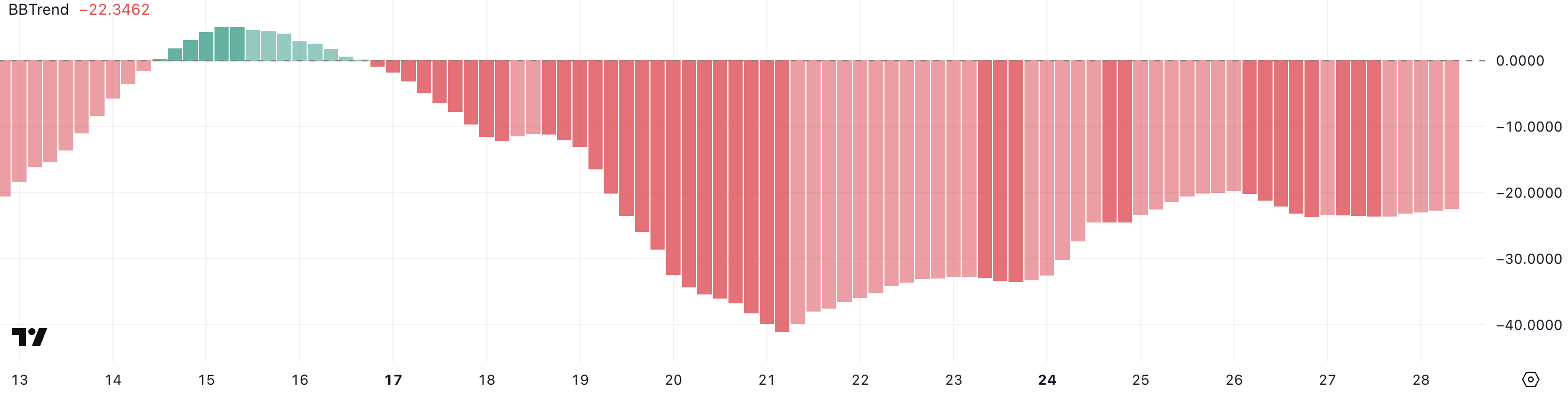

PI BBTrend Has Been Negative For 12 Days

Pi Network (PI) continues to face bearish pressure, as reflected in its BBTrend indicator, which remains deep in negative territory at -22.34.

This is despite recent headlines about the Telegram Crypto Wallet integrating Pi Network, news that has yet to translate into sustained upward momentum.

The BBTrend hit a recent low of -41 on March 21 and has stayed negative since March 16, marking twelve consecutive days of bearish trend signals. This prolonged weakness highlights the ongoing struggle for buyers to regain control of the market.

BBTrend, or Bollinger Band Trend, is a momentum-based indicator that helps gauge the strength and direction of a trend. Positive BBTrend values indicate bullish momentum, while negative values point to bearish sentiment—the further from zero, the stronger the trend.

With PI’s BBTrend sitting at -22.34, the market remains firmly under bearish influence, even if the worst of the recent downtrend may be easing slightly from its extreme lows.

Unless this trend flips back into positive territory soon, PI’s price could remain under pressure, with buyers staying cautious despite the recent integration news.

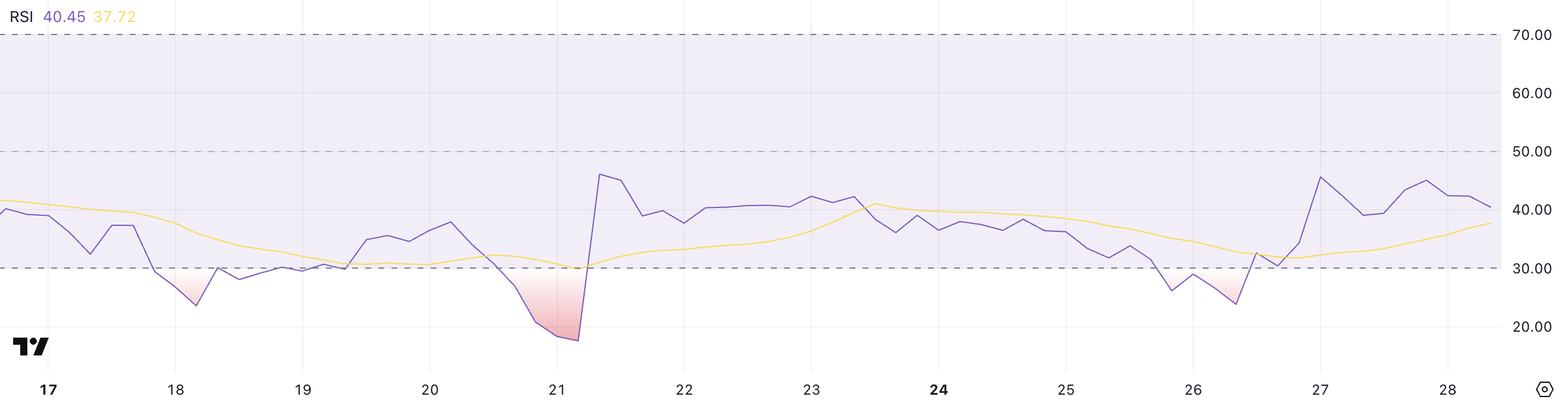

Pi Network RSI Has Recovered From Oversold But Still Lacks Bullish Momentum

Pi Network is showing early signs of recovery in momentum, with its Relative Strength Index (RSI) rising to 40.45 after hitting 23.8 just two days ago.

While this rebound suggests a reduction in overselling pressure, PI’s RSI hasn’t crossed above the neutral 50 mark in the past two weeks—highlighting ongoing weakness in bullish conviction.

Despite the slight uptick, the market has yet to see enough strength to shift sentiment meaningfully in favor of buyers. This cautious climb could either lead to a breakout or stall into continued consolidation.

The RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and those below 30 suggesting the asset is oversold.

With PI’s RSI currently at 40.45, it’s in a neutral-to-bearish zone—no longer extremely oversold but still lacking strong buying pressure.

For a clearer trend reversal, the RSI would likely need to break above 50, which hasn’t happened in two weeks. Thus, the current move is more of a potential bottoming attempt rather than a confirmed shift.

Will PI Continue Its Correction?

PI price is currently trading within a well-established downtrend, as indicated by the alignment of its EMA (Exponential Moving Average) lines—where shorter-term EMAs remain firmly below longer-term ones.

This setup reflects persistent selling pressure, and if the correction continues, PI could revisit key support levels at $0.718, with a potential drop to $0.62 if that floor fails to hold.

However, recent signs of life in the RSI hint that a short-term rebound might be brewing, offering some hope for a recovery.

If bullish momentum builds, PI could challenge resistance at $1.05 in the near term. A breakout above that level would shift sentiment and open the door for further gains, with $1.23 and even $1.79 as potential targets if the uptrend strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes 20% Move With Golden Pocket Appearance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price is gearing up for another bullish move upward, as a crypto analyst has predicted a 20% surge in the near future. This optimistic forecast is backed by the formation of a key technical pattern called the Golden Pocket and indicators including strong support levels and a critical resistance zone.

Golden Pocket Signals XRP Price Surge

According to TradingView analyst TehThomas, the XRP price is currently trading within a well-defined Ascending Channel, setting the stage for a potential 20% move upwards. In the 4-hour time frame, XRP has continued to respect this Ascending Channel, forming higher highs and higher lows — a key indicator of a sustained uptrend.

Related Reading

Interestingly, the most notable development in XRP’s price action is the appearance of a Golden Pocket on its chart. A Golden Pocket is a key Fibonacci retracement area that is often used to identify potential support and resistance levels. It represents a complete trend reversal for a cryptocurrency and a possibility of an aggressive uptrend.

The TradingView analyst has revealed that XRP’s current Golden Pocket aligns with an imbalance zone, an area of unfilled liquidity where prices typically revisit before resuming movement.

In the chart, XRP’s Golden Pocket sits between the 0.618 – 0.65 Fibonacci retracement level — a well-known area where the price usually finds strong support before continuing the trend. Historically, XRP has reacted twice from this key level, indicating that buyers have been actively defending this area.

TehThomas has predicted that as long as the XRP price can hold above the key Fibonacci retracement level, which also acts as a critical resistance, the cryptocurrency’s bullish structure will remain unchanged. Additionally, XRP could be primed for a massive rally toward the 0.618 Fibonacci extension level, which corresponds with the upper boundary of the Ascending Channel.

If this bullish momentum continues, it means that the analyst expects the XRP price to see a rally to a target between the $2.8 to – $2.9 range. This represents a 29% price increase from XRP’s current price of $2.2.

Short-Term Resistance Could Trigger Decline

TehThomas’s bullish outlook for the XRP price, the TradingView analyst noted that the 1-hour time frame presents short-term resistance, which could lead to a significant pullback before the next leg up. XRP recently faced a rejection at the imbalance zone, indicating that sellers are increasing activity at this level.

Related Reading

Previously, when the price struggled to break the imbalance zone, it highlighted a lack of liquidity to sustain a continued uptrend. A repeat of this could result in a retracement toward the Golden Pocket in the 4-hour timeframe.

Notably, a confirmed breakout from the 1-hour imbalance timeframe could reinforce XRP’s bullish momentum, supporting its projected move toward upper levels of the Ascending Channel. However, a failure could shift this bullish structure, leading to a deeper correction toward lower support levels.

Featured image from iStock, chart from Tradingview.com

-

Market24 hours ago

Market24 hours agoPi Network Integrates With Telegram’s Crypto Wallet

-

Market22 hours ago

Market22 hours agoEthereum Price Struggles—Is Another Breakdown on The Horizon?

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Adds Support For MUBARAK, CZ’s Dog, & These Crypto, Here’s All

-

Market21 hours ago

Market21 hours ago$14 Billion in Bitcoin and Ethereum Options Set to Expire Today

-

Market20 hours ago

Market20 hours agoDogecoin (DOGE) Faces Market Correction—Will Buyers Step Back In?

-

Bitcoin20 hours ago

Bitcoin20 hours agoStrategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

-

Market16 hours ago

Market16 hours agoCoinbase to Rival Binance With BNB Perpetual Futures

-

Market15 hours ago

Market15 hours agoSatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future