Ethereum

Breakout To $1,800 With These Two Supply Zones

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Even with the Ethereum price struggling amid the market downturn, there are still some who remain bullish on the second-largest cryptocurrency by market cap. One of those is pseudonymous crypto analyst NotWojak, who took to the TradingView website to share a rather bullish prediction for the Ethereum price that goes contrary to the current market sentiment.

Bearish Ethereum Price Downtrend Coming To An End

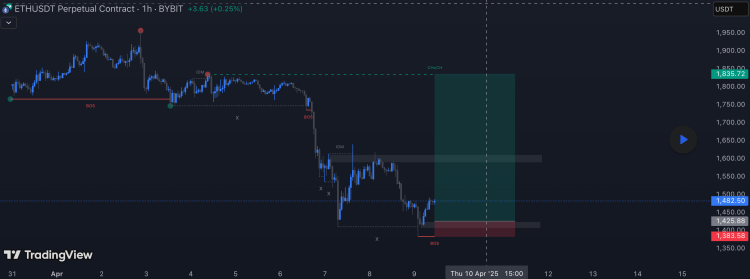

The Ethereum price is still stuck in an apparent downtrend. However, according to the crypto analyst, this could be ending anytime soon with two supply zones coming up. So far, there have been multiple liquidity sweeps across major levels, sending the Ethereum price towards lower lows. Nevertheless, this could turn bullish soon as they could suggest a reversal is coming for the cryptocurrency.

Related Reading

Currently, the two supply zones called out by the analyst are the $1,425 and $1,600 level. As they explain, the $1,425 level has already been mitigated during the latest retracement. So, this leaves only the $1,600 level unmitigated. As such, this could easily turn this level into resistance in the event of an uptrend.

Despite sellers still dominating currently with high volumes pouring into the market, the crypto analyst puts the bottom before $1,350. In this case, this level could be potential support and the breakout could begin from here.

The target for this major breakout has been placed 20% above the current level, with the analyst setting a high $1,835 target. This could lead to further upside, especially if resistances are easily cleared from here.

ETH On-Chain

Ethereum’s profitability has plummeted with the price decline as only 32% of all investors are seeing any profit on their positions. On the other side, 65% of all holders are in losses and only 2% are sitting at breakeven price, according to data from the on-chain data aggregation website, IntoTheBlock.

Related Reading

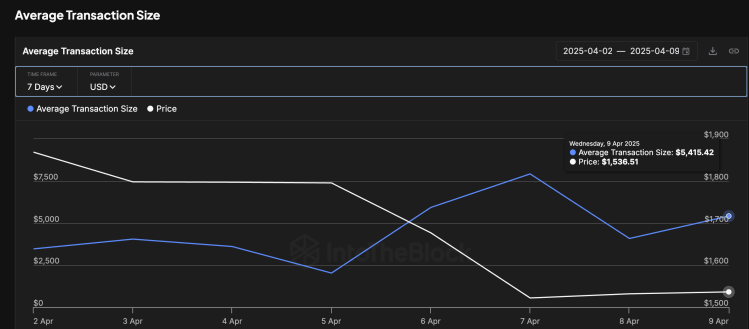

Ethereum whales have also been very active during this time and this could mean that large investors have been behind the selling that has crashed the ETH price. Large transactions rose from $4.8 billion to $6.48 billion by April 9 as the Ethernet price dropped back below $1,500.

Average transaction size also grew during the this time from $4,048 to $5,415. This suggests that investors are moving more coins at the time, which could explain the increased selling that has plagued the cryptocurrency. If this continues, then the ETH price could see further crashes from here.

At the time of writing, the Ethereum price was trending at $1,544, down 4.56% in the last day.

Featured image from Dall.E, chart from TradingView.com

Ethereum

77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

Ethereum

Over 1.9M Ethereum Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading above the $1,500 mark after a week of heightened volatility and continued global trade uncertainty. Macroeconomic tensions — driven by tariffs, shifting policies, and weakened investor sentiment — continue to weigh heavily on crypto markets. Despite the recent bounce, Ethereum’s price action still hints at a broader downtrend, with bulls struggling to reclaim key resistance levels that could trigger a meaningful recovery.

Related Reading

However, there are signs of potential strength ahead. If bulls manage to push ETH above immediate resistance zones, a bullish momentum shift could emerge. Market watchers are closely monitoring cost basis levels to identify where strong demand may resurface.

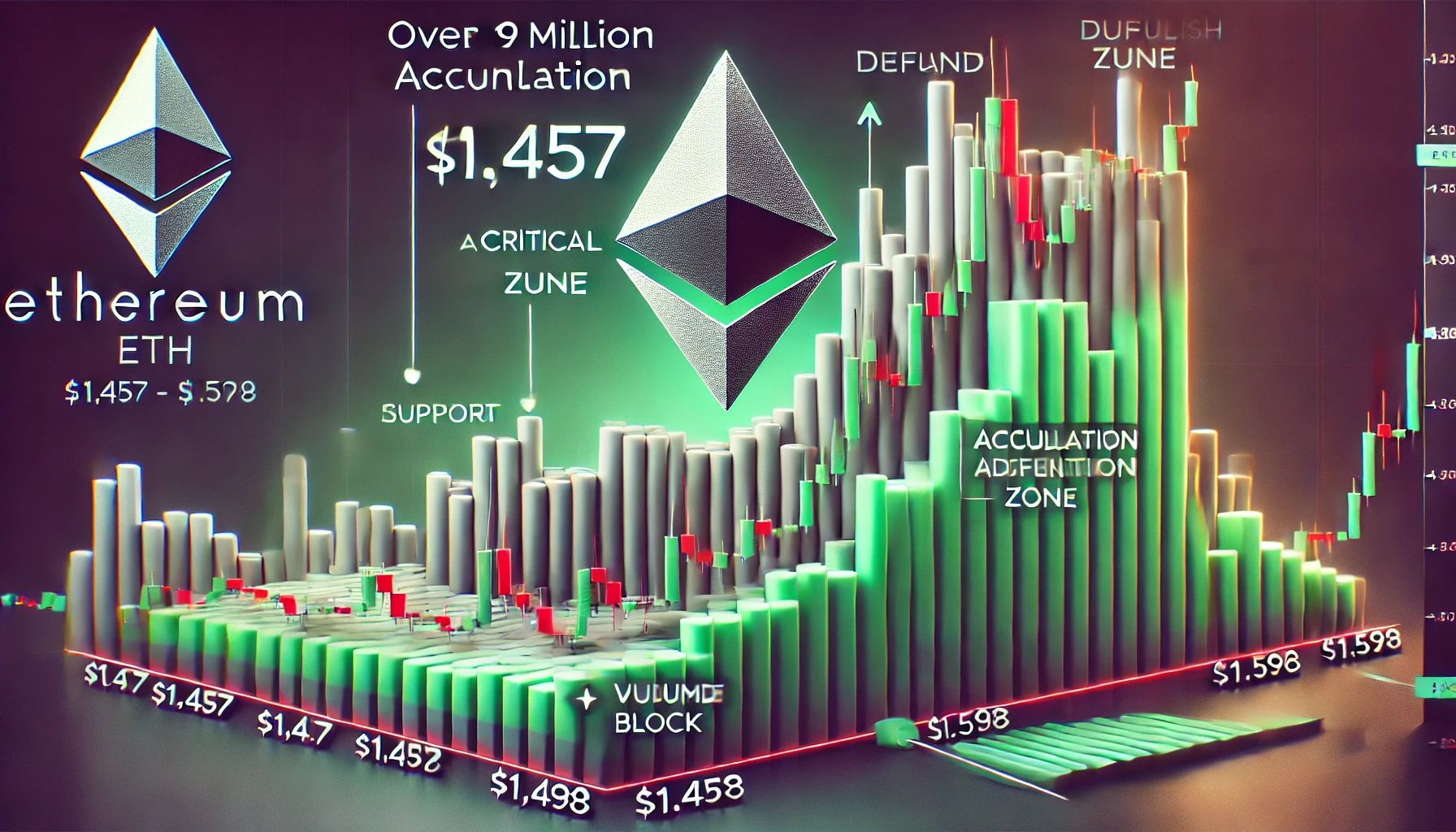

According to data from Glassnode, Ethereum’s Cost Basis Distribution reveals three key price clusters likely to shape short-term action. Among them, the $1,546 level stands out as the most significant, with 822,440 ETH previously accumulated in this range. A successful hold or breakout above this zone could provide a solid foundation for a larger recovery.

For now, Ethereum’s outlook remains cautiously neutral, with bulls needing to reclaim higher levels to shift sentiment and challenge the broader downtrend.

Ethereum Key Cost Basis Levels Could Define Price Action

Ethereum has lost over 50% of its value since early February, setting the stage for a challenging but potentially pivotal recovery phase. After months of heavy selling pressure, ETH is now trading just above the $1,500 mark, a zone that could serve as a springboard if bullish momentum builds. While the broader market has shown signs of recovery, Ethereum’s underwhelming price action continues to test investor patience. Still, analysts believe a recovery rally is possible, especially if macroeconomic sentiment improves.

Persistent global trade tensions, ongoing tariff battles, and US foreign policy shifts continue to inject volatility into financial markets. These factors have suppressed demand for risk assets like Ethereum, but some believe that the worst may be behind.

Glassnode’s on-chain data offers a more detailed look at Ethereum’s short-term outlook. According to their Cost Basis Distribution analysis, three price clusters are likely to shape ETH’s near-term price action. Around $1,457, roughly 408,000 ETH were previously accumulated. At $1,546, over 822,000 ETH sit, making it one of the most critical levels. Finally, approximately 725,000 ETH were acquired around $1,598.

These clusters reflect areas of high on-chain activity and are expected to act as support or resistance zones during the current phase of price consolidation. A breakout above the $1,600 level could trigger a more significant move toward $1,800 and beyond. For now, Ethereum’s price remains range-bound, but market participants are watching these levels closely for signs of a decisive shift.

Related Reading

ETH Faces Crucial Resistance As Bulls Fight to Regain Momentum

Ethereum is currently trading at $1,580 after failing to break above the $1,700 resistance level, signaling that bullish momentum remains weak. Despite a brief recovery from recent lows, ETH has struggled to reclaim higher ground, and key resistance levels continue to weigh on price action.

For bulls to confirm the start of a true recovery phase, Ethereum must push above the 4-hour 200 MA and EMA, both hovering around $1,820. A decisive move above these indicators would indicate renewed market confidence and open the door for a push toward critical demand levels around $2,000.

However, the risk of further downside remains. If Ethereum loses the $1,500 support level, selling pressure could accelerate, potentially driving the price below the $1,400 mark. This zone served as a key level in early 2023 and could be retested if bearish momentum builds.

Related Reading

With macroeconomic uncertainty and trade tensions still dominating the narrative, investors remain cautious. The next few trading sessions will be critical for ETH, as it hovers between potential recovery and the threat of renewed decline. Traders should watch for volume spikes and reaction around the $1,700 and $1,500 zones to assess the next move.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

Ethereum (ETH) is down nearly 50% over the past year, eroding investor confidence in the second-largest cryptocurrency by market cap. However, crypto analysts suggest that ETH’s fortunes might be about to turn.

Ethereum Set For A Bullish Breakout?

Unlike Bitcoin (BTC), ETH has not significantly benefited from the bullish developments of 2024. While the approval of spot BTC exchange-traded funds (ETFs) opened the floodgates for institutional capital to flow into the top digital asset, ETH ETFs have failed to generate the same level of interest.

Moreover, ETH’s underperformance relative to BTC has only deepened. Crypto analyst Daan Crypto Trades shared the following two-week ETH/BTC chart showing how ETH has consistently broken through key high time-frame support levels against BTC over the past few years.

Currently, ETH is trading at levels not seen since 2020 relative to BTC. According to the analyst, the final major ETH/BTC support lies around 0.016 – nearly 20% below the current level of 0.019.

On a more optimistic note, fellow analyst Ted pointed out that ETH may be breaking out of a downward-sloping trendline on the two-hour chart. He commented:

Global markets are gaining some strength, so expect Ethereum to hold the $1,550-$1,600 level. For now, I’m hoping for a breakout above and close above $1,670 for a rally towards $2K.

Similarly, seasoned analyst Titan of Crypto highlighted that ETH appears poised to break out from an ascending triangle pattern on the weekly time frame. According to him, ETH is currently trading at the bottom of the structure and could be setting up to test the top of the formation around $3,600.

For the uninitiated, the ascending triangle is a continuation pattern that forms when price makes higher lows while facing resistance at a horizontal level, eventually creating a triangle shape. It signals building buying pressure, and a breakout above the resistance line often leads to a strong upward move.

Rising ETH Exchange Reserves Could Suppress Price

While the analysts above point to a potential bullish reversal for ETH, crypto analyst Ali Martinez noted that over 368,000 ETH has been sent to exchanges since the beginning of the month. A rise in exchange reserves for a digital asset is typically bearish news, as it indicates that holders may be looking to sell their assets in the near-term.

Additionally, even if ETH has already bottomed for this market cycle, it still faces strong resistance around the $2,300 mark. At press time, ETH trades at $1,612, down 2.7% over the past 24 hours.

Featured Image from Unsplash.com, charts from X and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin23 hours ago

Altcoin23 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Market20 hours ago

Market20 hours agoHow It’s Impacting the Network

-

Altcoin18 hours ago

Altcoin18 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market16 hours ago

Market16 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Market23 hours ago

Market23 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

-

Market13 hours ago

Market13 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market19 hours ago

Market19 hours agoRaydium’s New Token Launchpad Competes with Pump.fun