Market

Is It the Safest Crypto Sector?

Onchain data shows that RWA tokenization is bucking macroeconomic trends by growing remarkably while other crypto sectors face uncertainty and contractions. There is an increasing belief that these are some of the safest Web3 assets.

Several experts shared key insights into this remarkable growth with BeInCrypto.

How Can RWAs Change Crypto?

Real-world Assets (RWAs) are an important part of the crypto market for several reasons. For example, a report from Binance Research claims that they are the Web3 economy’s most tariff-resilient asset sector.

According to new data, RWAs are growing substantially, surpassing $20 billion on-chain with 12% growth in the last 30 days.

This data gives a few key insights that may be especially relevant in the near future. Importantly, while most of the crypto market is retreating under macroeconomic concerns, the RWA sector is on the rise.

Over the past month, Trump’s on-and-off tariff chaos and inflation fears have injected extreme volatility into the crypto market. Altcoins like Ethereum and XRP have lost over 10% on the monthly chart, but daily volatility has been much worse.

However, major RWA tokens, like Chainlink, Mantra, and ONDO, either remained comparatively stable or had positive positive gains during this period.

Kevin Rusher, founder of RWA lending platform RAAC, remarked on these dynamics in an exclusive commentary shared with BeInCrypto.

“The tokenized RWA market crossing $20 billion in this market is a strong signal. First, it is the only sector in crypto still reaching new ATHs while most are far from their highest levels and suffering heavy losses. Secondly, it shows that it’s not only hype anymore. Institutions are not just talking about it; they are actively tokenizing Real World Assets now,” Rusher said.

Rusher’s comments about institutional RWA investment are clearly visible in the crypto market. On April 7, MANTRA’s OM token held onto value despite broad-sector losses, as it announced a $108 million RWA fund.

Major institutional investors like BlackRock and Fidelity have also increased their RWA commitments.

Rusher went on to state that RWAs are especially attractive because of their stability. Although most of the crypto market is highly susceptible to volatility, RWAs are “building actual infrastructure with long-term value” and generating liquidity.

Tracy Jin, COO of crypto exchange MEXC, also echoed these sentiments:

“Historically, during seasons of liquidity crunch, investors seek refuge in more traditional stable assets like treasuries or cash. However, this time, the geopolitical turbulence has also triggered a sell-off in treasuries. With tokenized gold approaching a $2 billion market cap and tokenized treasuries seeing an 8.7% increase over the past 7 days, these assets continue to build market momentum at the heart of the general market slump,” Jin stated.

Overall, the capital flowing into the RWA ecosystem amid the financial market storm is a positive indicator for the broader crypto space. These funds could even encourage investors to increase their crypto exposure after the market settles. For these reasons, the RWA space has a lot of immediate potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price saw a rise in value over the weekend as bulls seemed to return to the table. Since the market has been low over the past few months, investors unsurprisingly took this as an opportunity to get out at a somewhat higher price. This has led to more negative networks over the last few days, adding even more red to the month of April that has been dominated by outflows.

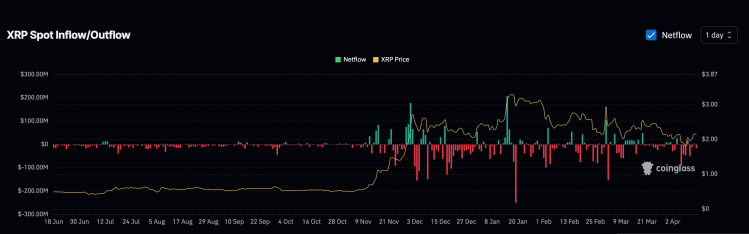

XRP’s April Outflows Cross $300 Million

According to data from Coinglass, XRP has been struggling with negative net flows for the better part of April, recording more red days than green. Even the green days have been quite muted and have fallen short of the volumes recorded on the red days. With only 13 days gone out the month so far, there has already been more than $300 million in outflows recorded for the month already.

Related Reading

So far, only four out of the 13 days have ended with positive net flows, coming out to $56.08 million in inflows for the month. In contrast, the other nine days have been dominated by outflows, coming out to $311 million by Sunday.

This consistent outflow suggests that sellers are still dominating the market, which explains why the XRP price has continued to remain low throughout this time. Additionally, if this negative net flow trend continues, then the XRP price could suffer further crashes from here.

However, in comparison to the last three months, the month of April seems to be recording a slow down when it comes to outflows. For example, months of January and March recorded $150 million outflow days, whereas the highest so far in April has been $90 million, which occurred on April 6.

One More Dip Coming?

While there has been a return of positive sentiment among XRP investors, bearish expectations still abound, although mainly for the short-term. Crypto analyst Egrag Crypto, a known XRP bull, has pointed out that the altcoin is likely to see another dip in price before a recovery. Nevertheless, the expectations for the long-term are still extremely bullish.

Related Reading

The crypto analyst highlights the possibility for the XRP price to dip to $1.4, but explains that he continues to hold his position. As for how high the price could go, the analyst maintain three major price targets: $7.50, $13, and $27.

“For me, I follow the charts with a clear understanding that certain events will unfold, but I stay updated on the news to see what narratives are created to influence market movements,” Egrag Crypto explained.

Featured image from Dall.E, chart from TradingView.com

Market

User Data from Major Crypto Exchanges Leaked to Dark Web

April continues to witness a surge in user data from major crypto companies, including Ledger, Gemini, and Robinhood, being sold on the dark web.

The leaked information includes full names, addresses, cities, states, ZIP codes, phone numbers, email addresses, countries, and more. The breach has sparked serious concerns about cybersecurity in the crypto sector, which is already grappling with rising online threats.

How Are User Details Ending Up on the Dark Web?

The Dark Web Informer account on X (formerly Twitter) recently shared a troubling update. An account claimed to be selling data from well-known crypto platforms, including Ledger, Gemini, and Robinhood.

Dark Web Informer posted screenshots showing that the seller has access to detailed user information—from phone numbers to home addresses. Most of the affected users are based in the United States, which matches the primary user base of Gemini and Robinhood.

So far, none of the mentioned platforms have issued official statements about the reported leaks.

This isn’t the first time such an incident has occurred. In 2021, Robinhood suffered a breach in which hackers stole more than 5 million email addresses and 2 million customer names. The attack exploited a customer support employee through social engineering.

A more recent report by BeInCrypto revealed that a similar data breach also affected over 100,000 users. The compromised data contains similar personal information, mostly belonging to US-based users. A smaller portion includes users from Singapore and the UK.

Experts at Dark Web Informer believe these leaks likely did not stem from system breaches within the exchanges. Instead, they point to phishing attacks as the probable cause. Phishing scams trick individuals into sharing sensitive data by impersonating trusted entities, suggesting the exchanges themselves may not have been directly compromised.

However, the scale of the leaks—impacting hundreds of thousands—highlights that many users still fall prey to such tactics. The growing use of AI may worsen the problem. AI-driven fraud, deepfake scams, synthetic identities, and automated phishing attacks are becoming more sophisticated and harder to detect.

“Stay vigilant—your data might already be exposed,” Dark Web Informer warned.

Meanwhile, BeInCrypto’s investigation noted a rise in user complaints on X regarding phishing messages. Many users reported that scam messages, disguised as coming from Binance’s official sender ID used for authentication alerts, deceived them. Somehow, attackers managed to obtain users’ phone numbers.

In response, Binance’s Chief Security Officer told BeInCrypto that the company has expanded its anti-phishing code feature. The update now includes SMS verification in an effort to combat the issue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Rises Steadily—But Can the Rally Hold This Time??

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $82,500 zone. BTC is now consolidating gains and might attempt to clear the $85,850 resistance.

- Bitcoin started a fresh increase above the $83,200 zone.

- The price is trading above $82,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Rises Again

Bitcoin price started a fresh increase above the $81,500 zone. BTC formed a base and gained pace for a move above the $82,500 and $83,200 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the price remained stable above $82,200. Bitcoin price is now trading above $82,500 and the 100 hourly Simple moving average. There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,500 level. The first key resistance is near the $85,850 level. The next key resistance could be $86,500. A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $88,000 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $84,200 level. The first major support is near the $82,200 level and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

The next support is now near the $81,200 zone. Any more losses might send the price toward the $80,500 support in the near term. The main support sits at $80,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $82,200.

Major Resistance Levels – $85,500 and $85,800.

-

Altcoin11 hours ago

Altcoin11 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market15 hours ago

Market15 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin23 hours ago

Bitcoin23 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market21 hours ago

Market21 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market19 hours ago

Market19 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Bitcoin18 hours ago

Bitcoin18 hours agoNew Bill Pushes Bitcoin Miners to Invest in Clean Energy

-

Market16 hours ago

Market16 hours agoHackers are Targeting Atomic and Exodus Wallets