Market

How Vitalik Buterin Plans to Enhance Ethereum’s Privacy

Ethereum (ETH) co-founder Vitalik Buterin has proposed a comprehensive roadmap to enhance user privacy on the blockchain.

The plan envisions creating a world where private transactions are the default, and users can interact across applications without publicly linking their activities.

Vitalik Buterin Unveils Privacy-Focused Ethereum Roadmap

Buterin shared the roadmap on April 11 on the Ethereum Magicians forum. It outlined practical, incremental improvements to make private transactions and anonymous on-chain interactions more accessible for everyday users without requiring major changes to Ethereum’s core consensus protocol.

“This roadmap can be combined with a longer-term roadmap that makes deeper changes to L1, or privacy-preserving application-specific rollups, or other more complex features,” Buterin stated.

The roadmap addresses four key privacy forms by implementing various short-term and long-term solutions. These are focused on improving on-chain payment privacy, partial anonymization of in-app activity, privacy of on-chain reads, and network-level anonymity.

Firstly, he advocated for integrating privacy tools into wallets. This would enable features like default “shielded balances,” allowing users to keep transactions private. The idea is to enhance privacy without requiring users to switch to a separate privacy-focused wallet.

Next, Buterin suggested a “one address per application” standard to limit traceability.

“This is a major step, and it entails significant convenience sacrifices, but IMO, this is a bullet that we should bite because this is the most practical way to remove public links between all of your activity across different applications,” he said.

Additionally, Buterin proposed making “send-to-self” transactions privacy-preserving by default. According to him, this is necessary for the address-per-application design to function effectively.

He also focused on using Trusted Execution Environments (TEEs) in the short term for RPC privacy. Buterin added that Private Information Retrieval (PIR) could be used in the future.

“If we also add security armoring to RPC nodes (ie. light client support), it becomes practical for a user to trust a much larger set of RPC servers. This reduces metadata leakage,” Buterin remarked.

The roadmap outlined deeper changes for the long term, such as EIP-7701 (account abstraction) and FOCIL (Fork-Choice enforced Inclusion Lists) implementation. This would allow privacy protocols to operate without centralized relays, making them more resilient to censorship. That’s not all. It would also contribute to increased privacy.

Buterin’s roadmap has generated substantial traction from the community, with many expressing optimism. The Ethereum ecosystem has long been calling for improvements in user privacy, and this new plan seems to resonate with those concerns.

“Vitalik’s finally giving privacy the attention it deserves, this roadmap looks like a solid step toward making Ethereum more user-friendly without messing with consensus,” an analyst posted.

Nonetheless, not all feedback was unequivocally positive. Some in the community remain cautious about the potential challenges involved in implementing such ambitious changes.

“Vitalik’s roadmap is solid but execution risk is high. Adopting zk tech is key if they want real privacy without bloating L1,” another analyst cautioned.

The proposal comes as the Ethereum ecosystem prepares for the Pectra upgrade. While Pectra focuses on performance and usability, Buterin’s privacy roadmap complements these efforts by addressing a critical user need. If executed, these changes could position Ethereum as a more privacy-conscious blockchain, potentially driving greater adoption as the network evolves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

User Data from Major Crypto Exchanges Leaked to Dark Web

April continues to witness a surge in user data from major crypto companies, including Ledger, Gemini, and Robinhood, being sold on the dark web.

The leaked information includes full names, addresses, cities, states, ZIP codes, phone numbers, email addresses, countries, and more. The breach has sparked serious concerns about cybersecurity in the crypto sector, which is already grappling with rising online threats.

How Are User Details Ending Up on the Dark Web?

The Dark Web Informer account on X (formerly Twitter) recently shared a troubling update. An account claimed to be selling data from well-known crypto platforms, including Ledger, Gemini, and Robinhood.

Dark Web Informer posted screenshots showing that the seller has access to detailed user information—from phone numbers to home addresses. Most of the affected users are based in the United States, which matches the primary user base of Gemini and Robinhood.

So far, none of the mentioned platforms have issued official statements about the reported leaks.

This isn’t the first time such an incident has occurred. In 2021, Robinhood suffered a breach in which hackers stole more than 5 million email addresses and 2 million customer names. The attack exploited a customer support employee through social engineering.

A more recent report by BeInCrypto revealed that a similar data breach also affected over 100,000 users. The compromised data contains similar personal information, mostly belonging to US-based users. A smaller portion includes users from Singapore and the UK.

Experts at Dark Web Informer believe these leaks likely did not stem from system breaches within the exchanges. Instead, they point to phishing attacks as the probable cause. Phishing scams trick individuals into sharing sensitive data by impersonating trusted entities, suggesting the exchanges themselves may not have been directly compromised.

However, the scale of the leaks—impacting hundreds of thousands—highlights that many users still fall prey to such tactics. The growing use of AI may worsen the problem. AI-driven fraud, deepfake scams, synthetic identities, and automated phishing attacks are becoming more sophisticated and harder to detect.

“Stay vigilant—your data might already be exposed,” Dark Web Informer warned.

Meanwhile, BeInCrypto’s investigation noted a rise in user complaints on X regarding phishing messages. Many users reported that scam messages, disguised as coming from Binance’s official sender ID used for authentication alerts, deceived them. Somehow, attackers managed to obtain users’ phone numbers.

In response, Binance’s Chief Security Officer told BeInCrypto that the company has expanded its anti-phishing code feature. The update now includes SMS verification in an effort to combat the issue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Rises Steadily—But Can the Rally Hold This Time??

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $82,500 zone. BTC is now consolidating gains and might attempt to clear the $85,850 resistance.

- Bitcoin started a fresh increase above the $83,200 zone.

- The price is trading above $82,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Rises Again

Bitcoin price started a fresh increase above the $81,500 zone. BTC formed a base and gained pace for a move above the $82,500 and $83,200 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the price remained stable above $82,200. Bitcoin price is now trading above $82,500 and the 100 hourly Simple moving average. There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,500 level. The first key resistance is near the $85,850 level. The next key resistance could be $86,500. A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $88,000 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $84,200 level. The first major support is near the $82,200 level and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

The next support is now near the $81,200 zone. Any more losses might send the price toward the $80,500 support in the near term. The main support sits at $80,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $82,200.

Major Resistance Levels – $85,500 and $85,800.

Market

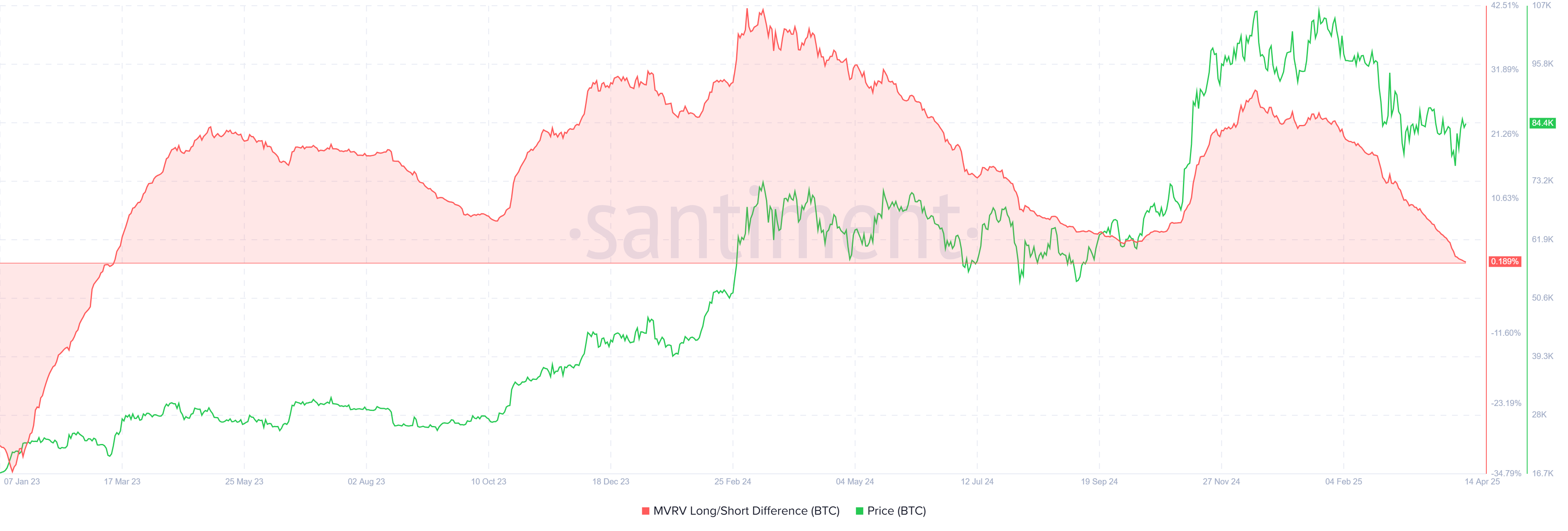

Bitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

Bitcoin’s price continues to struggle below the psychological $85,000 mark, failing to break past this critical level over the past two months.

Despite some attempts to secure a rise, the leading cryptocurrency has remained stagnant, increasing pressure on long-term holders (LTHs). These investors, once enjoying solid profits, are now seeing a decline in their unrealized gains.

Bitcoin Investors Are Pulling Back

The MVRV Long/Short Difference, a key metric used to gauge market sentiment, reveals a concerning trend for LTHs. The indicator recently hit a two-year low, suggesting that long-term holders’ profits are at their lowest since March 2023. This shift indicates that the market conditions are increasingly unfavorable for LTHs.

As Bitcoin’s price fails to recover, short-term holders (STHs) are beginning to dominate, capitalizing on the price fluctuations. Meanwhile, long-term holders (LTHs), facing diminishing profits, hold off on buying or holding more.

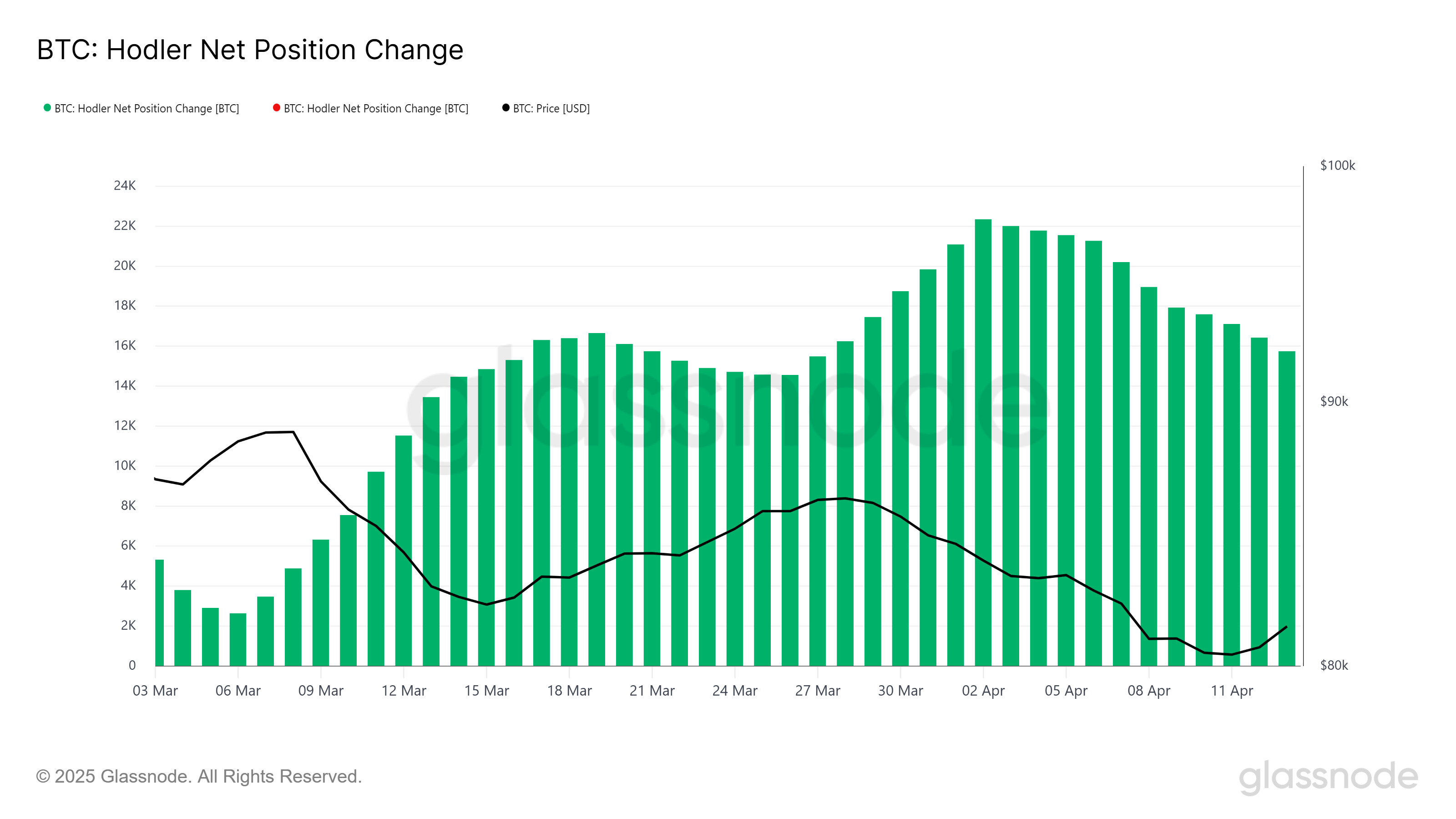

The overall momentum of Bitcoin, measured by technical indicators, also reflects bearish signals. The HODLer net position change further backs this narrative, as it shows that LTHs have sold a significant portion of their holdings over the last two weeks. In total, these sales amounted to more than 6,596 BTC, which is worth over $550 million.

Although this figure may not be enormous, the psychological shift from confidence to caution among LTHs is a larger concern. This lack of conviction could delay Bitcoin’s recovery and contribute to further price stagnation. In turn, this could further limit market activity and exacerbate the ongoing downturn.

BTC Price Is Facing A Decline

Bitcoin’s price is trading at $84,421, hovering just above the crucial support level of $82,619. The price remains trapped under the key $85,000 resistance level, which could cause further pressure if it fails to break above. If Bitcoin loses support at $82,619, a decline to the next major psychological support of $80,000 is possible.

If the bearish trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support would mark a more significant downturn, confirming the continued market weakness and deepening the bearish outlook for Bitcoin.

However, if Bitcoin manages to breach and hold $85,000 as support, it could ignite a recovery, pushing the price back up toward $86,848. A sustained rise above $85,000 would invalidate the current bearish trend and pave the way for a potential surge toward $89,800, reestablishing confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin10 hours ago

Altcoin10 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market15 hours ago

Market15 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin24 hours ago

Bitcoin24 hours agoScottish School Lomond Pioneers Bitcoin Tuition Payment In The UK

-

Market24 hours ago

Market24 hours agoNew York Proposes Bill to Accept Bitcoin Payments for Tax

-

Market16 hours ago

Market16 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Bitcoin22 hours ago

Bitcoin22 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market21 hours ago

Market21 hours agoDOGE Spot Outflows Exceed $120 Million in April