Market

Ripple And The SEC File Joint Motion for Final Settlement

The SEC and Ripple filed a joint motion today, asking a US Appeals Court to halt any appeals and cross-appeals between the two parties. This is a prelude to a formal settlement, which both parties are inclined towards.

The filing notes that any further procedural developments may take up to 60 days despite expectations that the outcome is largely predetermined. In the meantime, the XRP market appears to have priced in the likelihood of a resolution.

Ripple and The SEC Move To Settle

The SEC vs Ripple case has been one of crypto’s most important legal battles over the last few years. After months of hints and credible rumors, the Commission finally dropped its lawsuit last month.

Today, both parties are getting close to a final agreement, filing a joint motion regarding one of the case’s remaining loose ends:

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” claimed James Filan, a lawyer and Ripple supporter who is in no way directly affiliated with the firm’s legal efforts.

Specifically, the loose end between Ripple and the SEC regards Ripple’s cross-appeal, which was filed last October. With this new joint motion, the two parties have “reached an agreement-in-principle” to resolve all outstanding business.

This includes the SEC’s initial appeal, the aforementioned cross-appeal, and any other claims involving individual actors.

Technically, both parties publicly announced that they were ready to settle over two weeks ago. It’s unclear why Ripple and the SEC took so long to file this joint motion.

The price of XRP has persistently been less impacted by lawsuit updates since the comission first dropped its case, and this development seems fully priced in.

The joint motion also mentions that further progress may take another 60 days. When they completely finalize a settlement, it could likely have landmark implications for US crypto policy.

However, based on the way that the SEC is improving relations with Ripple, Coinbase, Kraken, etc., a favorable outcome seems extremely likely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

User Data from Major Crypto Exchanges Leaked to Dark Web

April continues to witness a surge in user data from major crypto companies, including Ledger, Gemini, and Robinhood, being sold on the dark web.

The leaked information includes full names, addresses, cities, states, ZIP codes, phone numbers, email addresses, countries, and more. The breach has sparked serious concerns about cybersecurity in the crypto sector, which is already grappling with rising online threats.

How Are User Details Ending Up on the Dark Web?

The Dark Web Informer account on X (formerly Twitter) recently shared a troubling update. An account claimed to be selling data from well-known crypto platforms, including Ledger, Gemini, and Robinhood.

Dark Web Informer posted screenshots showing that the seller has access to detailed user information—from phone numbers to home addresses. Most of the affected users are based in the United States, which matches the primary user base of Gemini and Robinhood.

So far, none of the mentioned platforms have issued official statements about the reported leaks.

This isn’t the first time such an incident has occurred. In 2021, Robinhood suffered a breach in which hackers stole more than 5 million email addresses and 2 million customer names. The attack exploited a customer support employee through social engineering.

A more recent report by BeInCrypto revealed that a similar data breach also affected over 100,000 users. The compromised data contains similar personal information, mostly belonging to US-based users. A smaller portion includes users from Singapore and the UK.

Experts at Dark Web Informer believe these leaks likely did not stem from system breaches within the exchanges. Instead, they point to phishing attacks as the probable cause. Phishing scams trick individuals into sharing sensitive data by impersonating trusted entities, suggesting the exchanges themselves may not have been directly compromised.

However, the scale of the leaks—impacting hundreds of thousands—highlights that many users still fall prey to such tactics. The growing use of AI may worsen the problem. AI-driven fraud, deepfake scams, synthetic identities, and automated phishing attacks are becoming more sophisticated and harder to detect.

“Stay vigilant—your data might already be exposed,” Dark Web Informer warned.

Meanwhile, BeInCrypto’s investigation noted a rise in user complaints on X regarding phishing messages. Many users reported that scam messages, disguised as coming from Binance’s official sender ID used for authentication alerts, deceived them. Somehow, attackers managed to obtain users’ phone numbers.

In response, Binance’s Chief Security Officer told BeInCrypto that the company has expanded its anti-phishing code feature. The update now includes SMS verification in an effort to combat the issue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Rises Steadily—But Can the Rally Hold This Time??

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $82,500 zone. BTC is now consolidating gains and might attempt to clear the $85,850 resistance.

- Bitcoin started a fresh increase above the $83,200 zone.

- The price is trading above $82,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Rises Again

Bitcoin price started a fresh increase above the $81,500 zone. BTC formed a base and gained pace for a move above the $82,500 and $83,200 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the price remained stable above $82,200. Bitcoin price is now trading above $82,500 and the 100 hourly Simple moving average. There was a break above a connecting bearish trend line with resistance at $84,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,500 level. The first key resistance is near the $85,850 level. The next key resistance could be $86,500. A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $88,000 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $84,200 level. The first major support is near the $82,200 level and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

The next support is now near the $81,200 zone. Any more losses might send the price toward the $80,500 support in the near term. The main support sits at $80,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $82,200.

Major Resistance Levels – $85,500 and $85,800.

Market

Bitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

Bitcoin’s price continues to struggle below the psychological $85,000 mark, failing to break past this critical level over the past two months.

Despite some attempts to secure a rise, the leading cryptocurrency has remained stagnant, increasing pressure on long-term holders (LTHs). These investors, once enjoying solid profits, are now seeing a decline in their unrealized gains.

Bitcoin Investors Are Pulling Back

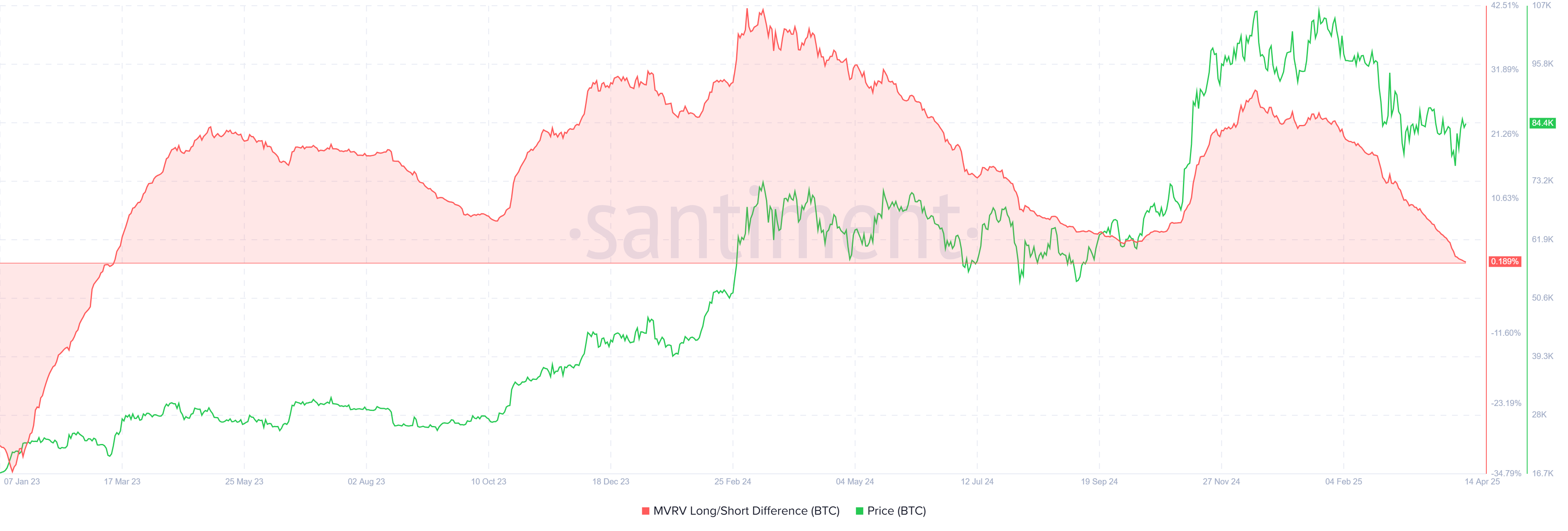

The MVRV Long/Short Difference, a key metric used to gauge market sentiment, reveals a concerning trend for LTHs. The indicator recently hit a two-year low, suggesting that long-term holders’ profits are at their lowest since March 2023. This shift indicates that the market conditions are increasingly unfavorable for LTHs.

As Bitcoin’s price fails to recover, short-term holders (STHs) are beginning to dominate, capitalizing on the price fluctuations. Meanwhile, long-term holders (LTHs), facing diminishing profits, hold off on buying or holding more.

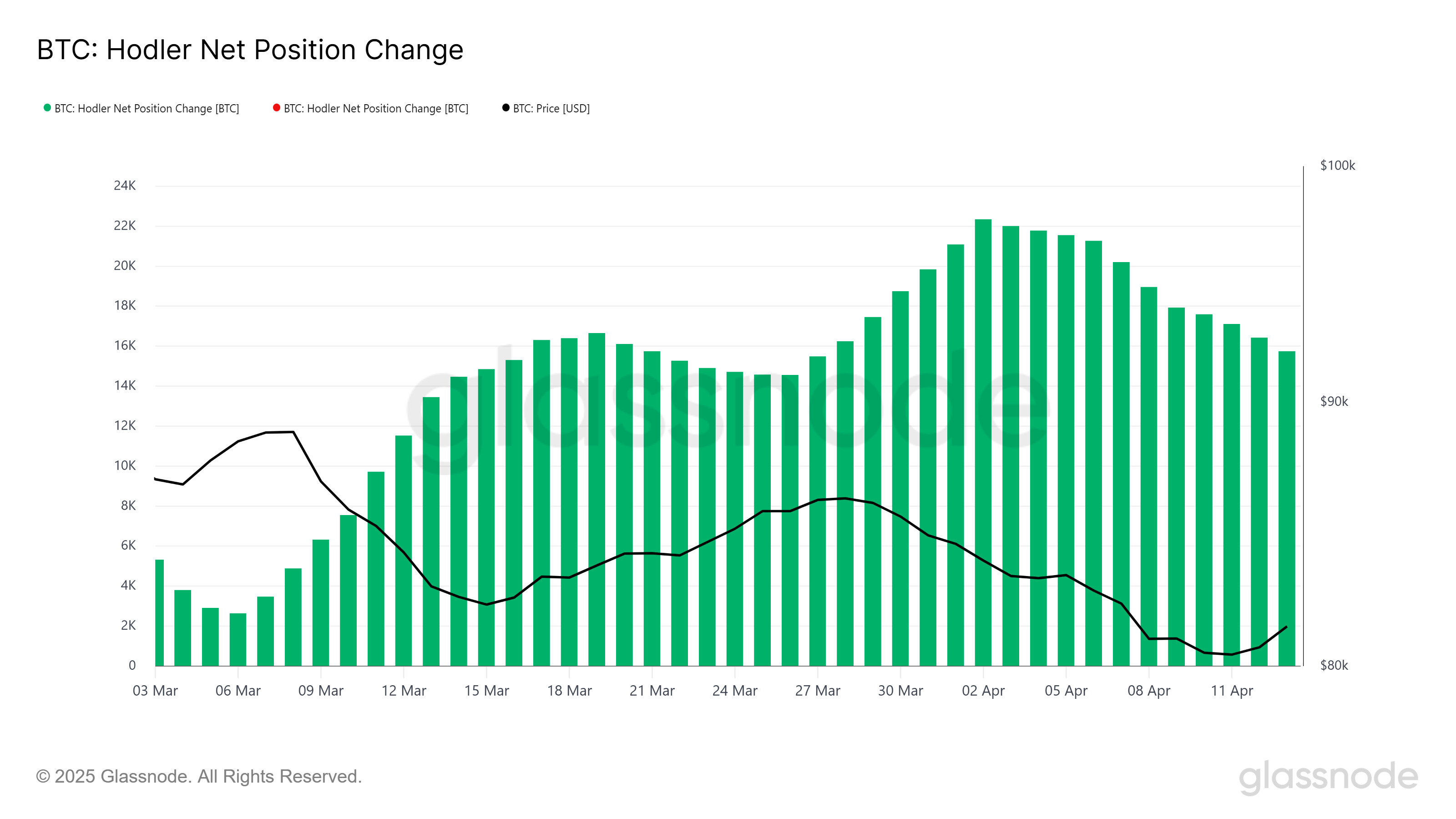

The overall momentum of Bitcoin, measured by technical indicators, also reflects bearish signals. The HODLer net position change further backs this narrative, as it shows that LTHs have sold a significant portion of their holdings over the last two weeks. In total, these sales amounted to more than 6,596 BTC, which is worth over $550 million.

Although this figure may not be enormous, the psychological shift from confidence to caution among LTHs is a larger concern. This lack of conviction could delay Bitcoin’s recovery and contribute to further price stagnation. In turn, this could further limit market activity and exacerbate the ongoing downturn.

BTC Price Is Facing A Decline

Bitcoin’s price is trading at $84,421, hovering just above the crucial support level of $82,619. The price remains trapped under the key $85,000 resistance level, which could cause further pressure if it fails to break above. If Bitcoin loses support at $82,619, a decline to the next major psychological support of $80,000 is possible.

If the bearish trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support would mark a more significant downturn, confirming the continued market weakness and deepening the bearish outlook for Bitcoin.

However, if Bitcoin manages to breach and hold $85,000 as support, it could ignite a recovery, pushing the price back up toward $86,848. A sustained rise above $85,000 would invalidate the current bearish trend and pave the way for a potential surge toward $89,800, reestablishing confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin11 hours ago

Altcoin11 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market15 hours ago

Market15 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin23 hours ago

Bitcoin23 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market21 hours ago

Market21 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market19 hours ago

Market19 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Market16 hours ago

Market16 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market23 hours ago

Market23 hours agoXRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?