Market

Fuser on How Crypto Regulation in Europe is Finally Catching Up

As crypto continues its transformation from fringe curiosity to legitimate asset class, traditional financial institutions are no longer sitting on the sidelines. In a candid conversation, Alessandro Fuser, Head of Sales at Crypto Finance, a firm enabling banks to navigate the digital asset world, unpacks how regulation, especially across Europe, is finally catching up with innovation.

Fuser breaks down how institutions are shifting from hesitation to action, the role of trust in this transition, and why the “start small but start now” approach is key to success. From the fallout of recent hacks to the promise of deeper liquidity access and the landmark partnership with Clearstream, this conversation maps out the evolving role of crypto infrastructure in mainstream finance.

Fuser on Crypto Finance Bridging TradFi and Crypto

At the end of the day, Crypto Finance provides market infrastructures to enable banks that are interested in crypto services to launch in a compliant and secured manner services across trading, custody, and post-trade settlements. My role as the head of sales is to enable them to go through this kind of journey in the safest way possible. With all the questions that, at the end of the day, different teams will have and ultimately create that level of familiarity that is needed for the traditional financial space to embrace new asset classes like crypto

Trust is important. Generally, there’s a difficulty in finding trust when there aren’t answers. The answers, especially now in 2025, obviously exist. The regulatory market is only now catching up in areas such as the European Union. So, a lot of what we do, especially as someone who’s been in Switzerland, working with Swiss banks that are alive in the space, is to provide visibility to other entrances as to how companies that they compare themselves to have done things. Phased approaches, starting in a conservative manner and only over time, add more complexity and more sophistication to the services so that they don’t have any reputational risks. They can take advantage of the opportunities of crypto as an asset class. And provide a service to their customers that is of the quality that they expect.

Shifting Attitudes and Regulations in 2025

I think the biggest difference is that despite everyone knowing that regulation in Europe is coming, the regulation is now here. On the back of this, a lot of different banks are formalizing projects, which up to that point they were not and only through experience do they effectively know what should and should not be done.

The speed at which a lot of these projects are now being formalized is obviously faster, mainly on the back of the elections and, to an extent, on the back of increased competitiveness that will exist with the United States now being more open to crypto as an asset class. So I think this is an important one. At the time I had talked about a degree of fragmentation in the market, when it came to custody, when it came to liquidity.

I think there are a number of initiatives that are ultimately making the landscape more efficient. Some of these initiatives are happening at a crypto-native level. I think about off-exchange services, which reduce your counterpart and your risk on the custody side and allow you to have exposure to markets. But this is also true on the custodial front, with companies such as Clearstream, for example, which is a traditional ICSD offering the new asset class without reinventing the wheel, simply allowing banks that they connected to leverage the connectivity and unlock the asset class.

Crypto’s Agility vs. TradFi’s Caution: Finding Common Ground

I like the juxtaposition. I don’t think that the two approaches are mutually exclusive. You have a secure compliant setup that isn’t necessarily boring or excessively conservative to make you lose the opportunity. And that’s potentially where, within a protective environment, it makes sense to experiment and “break things,” to use your words. Now, Crypto Finance, specifically being a regulated entity, obviously has more constraints. Having said this, what we do is to continue being innovative by partnering with all sorts of players in the market to reinforce our service offering, to future-proof our service offering without compromising at the end of the day the reputation and especially the status quo.

I would like to mention one thing, though: our experience is mainly revolving around regulated clientele and what we always advise is ‘start small, start simply, but do start’. And I think this is what has been missing in the past. The lack of certainty around certain things of even the complexity around launching a new offering, was oftentimes preventing the regulating intermediaries from getting into the space in the first place, which then resulted in a harder consumer protection because service providers were instead coming from a completely different angle.

So a lot of what we do now is that we try to push to get started with simple, close-look trading and custody, allow the banks, allow the product issuers to start accumulating experience with, for example, on the product issuer’s side a single token in ETP. This is not going to be the most revolutionary thing but it allows you to understand flows, and then add complexity, adding staking and over time potentially borrowing and lending.

Adapting to the Pace of Traditional Finance

To an extent, I believe that the decision making is still very much low in the regulated traditional financial space. At the same time, I have seen projects in the crypto space being formalized and enacted or executed at a pace that is significantly faster compared to potentially other asset classes in the past. And the reason is two folds: the market, I think, has validated the crypto asset class sufficiently. The competitiveness of, say retail brokers, neo-banks, crypto exchanges is obviously to an extent a threat to some of the traditional players, especially retail banks for example.

There have been outflows for the past couple years, which for some have hurt, but more importantly, the growth or the rate at which those outflows are happening is something that is raising the alarm here and there. So, the banks, because of this, are acting ; they’re making sure that they have the right amount of knowledge, the right amount of talent in house, and they’re starting somewhere.

Neo-Banks vs Traditional Banks: A Shift in Custody Models

I think there is a degree of disruption happening for sure. Also, the underlined service is being packaged differently but the substance isn’t really too different. I would also argue that some of the – let me use the word – “sexier” neo-banks, for example, of financial institutions that are offering cash account and investment products, oftentimes are very good at showing specific sides and not showing others. There is the general perception that traditional banking is more expensive.

Of course, broadly speaking, this is probably true, if you think about the infrastructure that they have to support, but today, even crypto exchanges cycle between buying crypto assets, storing those assets, selling them and especially FX ; it’s still generating significant fees. The customers aren’t probably realising it and again, it’s an exotic market. It’s not commoditized just yet, so it is normal for there to be fees that are probably higher than a security that has been around for decades. Nonetheless, it is an attention economy and I think the TradFi is also paying attention.

Managing Security Concerns After Major Exchange Hacks

It always raises eyebrows. It was obviously very unfortunate that this hack occurred. Without commenting too specifically on the matter, I think it was also managed in a way that showed maturity compared to, for example, other scandals in the past, whether it was with Terra Luna depegging, whether it was the FTX scandal. I think the market is now reacting less negatively. Of course, a bank or an asset manager with potentially trillions of assets has to go through the process of unlocking access to an asset class whilst maintaining the same level of risks standards, compliance standards and also technological security standards.

It is in some ways a positive, because it allows, or it triggers the right kind of questions and I don’t believe that there is a “trust issue” in the market because today, in 2025 – and I could argue this is true already of last year – there are institutional grade solutions which are as bullet-proof as they can realistically be.

What we do, specifically speaking to Crypto Finance, is making sure – we’re a regulated entity, so we have standards to maintain – that we always innovate without ultimately sidelining the core, which is security. Crypto introduces a complexity, the finality of transactions is obviously something very different compared to traditional capital markets. Private key management is something that is new to many, and we just make sure that we can keep that as sophisticated without over-engineering things. We stick with battle-tested technology, that’s generally where the market is also.

How Bybit Differentiated Itself from FTX

What is also fascinating is that what happened with Bybit is very different from what happened in the past. There was a lot more support from the community. Obviously, there was an issue with the technology. It was unfortunate that there was an attack in the first place, but I think the market as a whole showed this kind of concept that “we’re all in this together’. Now, something to keep in mind as well : a crypto exchange has a different starting point compared to other service providers, which are natively tailored to financial institutions.

Exchanges started early, they started mainly with the retail type of clientele and over the years, as they became more successful, had to invest and became more sophisticated, more secure, more licensed, so on and so forth, but I think that it will still take time to reach a level of security that is ultimately sufficient for some of the larger traditional financial institutions. It could also be that they will never get there, but that is why companies like Crypto Finance and some of its rivals exist in the first place ; to act as a regulated counterparty between the market and between the client.

Future Partnerships in the Pipeline

Companies like ourselves, other regulated brokers – a couple already have MiCA licences including ourselves – already have and have had for many, many years relationships with the market. This normally comes in the form of – and the reason behind this is generally tied to token availability, we need to make sure we can source liquidity from different sources, also from a purely availability or disaster recovery process, or rather business continuity.

There’s nothing necessarily new and I think what brokers like ourselves will continue doing is grow their relationship with the market in a way that doesn’t expose the clientele to the market directly. Because then the value chain does become, to an extent, weaker, let’s say it this way. What I am seeing, though, is a very rapid growth in the opposite direction, where you have crypto exchanges and other types of retail native venues which are becoming more sophisticated.

As the existing distribution channels in today’s market become more involved in the asset class, they are the ones that already possess a relationship with the end customers. So it is unlikely for the end customers to abandon these rails outside of an early majority and the maximalists which, of course, the market has now been dominated by over the past couple years. So, there is an incentive for the market to be, instead, rooting its flow to these new distribution actors, such as the banks, and use them as aggregators.

All of a sudden there’s a shift from a direct relationship between a customer – end customer, a private customer – and the exchange to the bank. It allows exchanges to continue receiving flows but it also allows the final consumer to be significantly more protected, just because of the nature of the bank that is not something in between.

What’s in Store for Q2?

Yes, there will be exciting announcements in Q2. But I wouldn’t be doing my job if I didn’t also bring attention to something that is very important, which is the partnership between Clearstream and Crypto Finance. As you know, we’re both owned by Deutsche Börse Group, and I believe this is the first time that, at scale, we have seen an international central securities depository and global custodian effectively unlock access to all of its clients with zero project cost, with Crypto Finance simply as the additional self-custodian link.

This is as far as my world is concerned. I do expect the market to be very positively reacting to, say, the new stablecoin regulation coming over in the United States. I think all eyes are going to be on the US this year. If the first few banks come in if more products get approved, all of a sudden, Europe will have to change speed. Europe is already doing a good job but I think they’ll have to step it up even more, and I’m looking forward to more competitiveness in the market.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Turns Green, Sparks Hopes of a Fresh Upside Push

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Steadies After Increase—Now Eyes More Gains Ahead

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

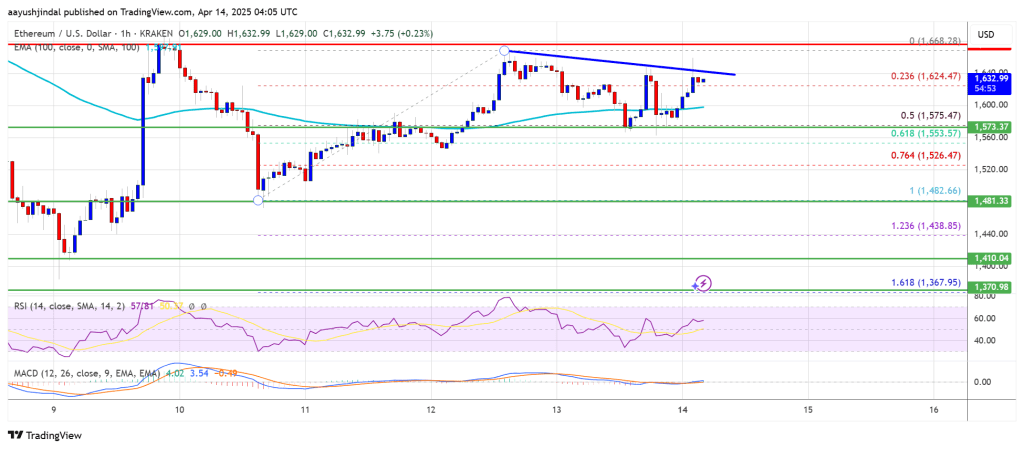

Ethereum price started a fresh increase above the $1,580 zone. ETH is now consolidating gains and might aim for more gains above $1,665.

- Ethereum started a decent increase above the $1,580 and $1,620 levels.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,665 resistance zone.

Ethereum Price Gains Pace

Ethereum price formed a base above $1,500 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,550 and $1,580 resistance levels.

The bulls even pumped the price above the $1,620 zone. A high was formed at $1,668 and the price recently started a downside correction. There was a move below the $1,650 support zone. The price dipped below the 23.6% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

Ethereum price is now trading below $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,640 level. There is also a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD.

The next key resistance is near the $1,665 level. The first major resistance is near the $1,680 level. A clear move above the $1,680 resistance might send the price toward the $1,720 resistance. An upside break above the $1,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,640 resistance, it could start a downside correction. Initial support on the downside is near the $1,600 level. The first major support sits near the $1,575 zone and the 50% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

A clear move below the $1,575 support might push the price toward the $1,550 support. Any more losses might send the price toward the $1,520 support level in the near term. The next key support sits at $1,480.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,575

Major Resistance Level – $1,665

Market

MANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

The MANTRA (OM) token suffered a catastrophic price collapse on April 13, plummeting over 90% in under an hour and wiping out more than $5.5 billion in market capitalization.

The sudden crash, which took OM from a high of $6.33 to below $0.50, has drawn comparisons to the infamous Terra LUNA meltdown, with thousands of holders reportedly losing millions.

Why did MANTRA (OM) Crash?

Multiple reports suggest that the trigger is a large token deposit linked to a wallet allegedly associated with the MANTRA team. Onchain data shows a deposit of 3.9 million OM tokens to OKX, sparking concerns about a possible incoming sell-off.

Given that the MANTRA team reportedly controls close to 90% of the token’s total supply, the move raised immediate red flags about potential insider activity and price manipulation.

The OM community has long expressed concerns around transparency. Allegations have surfaced over the past year suggesting the team manipulated the token’s price through market makers, changed tokenomics, and repeatedly delayed a community airdrop.

When the OKX deposit was spotted, fears that insiders might be preparing to offload were amplified.

Reports also indicate that MANTRA may have engaged in undisclosed over-the-counter (OTC) deals, selling tokens at steep discounts — in some cases at 50% below market value.

As OM’s price rapidly declined, these OTC investors were thrown into losses, which allegedly sparked a mass exodus as panic selling took hold. The chain reaction triggered stop-loss orders and forced liquidations on leveraged positions, compounding the collapse.

The MANTRA team has denied all allegations of a rug pull and maintains that its members did not initiate the sell-off.

In a public statement, co-founder John Patrick Mullin said the team is investigating what went wrong and is committed to finding a resolution.

The project’s official Telegram channel was locked during the fallout, which added to community frustration and speculation.

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” wrote MANTRA founder JP Mullin.

If OM fails to recover, this would mark one of the largest collapses in crypto history since the Terra LUNA crash in 2022.

Thousands of affected holders are now demanding transparency and accountability from the MANTRA team, while the broader crypto community watches closely for answers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin8 hours ago

Altcoin8 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market13 hours ago

Market13 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market12 hours ago

Market12 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin19 hours ago

Bitcoin19 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market18 hours ago

Market18 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market16 hours ago

Market16 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Stays Below Realized Price: Once-In-A-Cycle Opportunity?