Market

Web3 Projects Adjust to Market Chaos

Crypto and global markets are reeling from the escalating trade war sparked by President Trump’s latest tariffs. Bitcoin, Ethereum, and Solana have plummeted this week, sending Web3 projects into a tailspin.

BeInCrypto contacted Shane Molidor, founder of Forgd, which has shepherded over 1,000 token launches. The former Gemini business development associate explains how fledgling ventures that once relied on a 2025 bull market adjust strategies and survival tactics.

Market Turmoil Forces Web3 Projects to Rethink Token Launches

Molidor unpacked how Web3 teams are rethinking everything from airdrops to tokenomics. Citing retail exhaustion that has collided with this week’s crypto market panic, he says demand for new tokens is dimming.

“Launching in these conditions risks a flop, and that’s a death knell for projects needing momentum,” he started.

Most projects try to time their token generation events (TGEs) with a bull market to ride speculative retail demand. When the macro market tanks, like it has this week, they hesitate to list.

Poor price performance scares off future investors. Token launches, which once drew excitement, are now becoming high-risk gambles. The market conditions are forcing many to delay or reconsider their approaches.

“The pressure is building, and with major cryptocurrencies like Bitcoin and Ethereum taking a hit, teams are wary of entering the market with new tokens,” Molidor adds.

Airdrops Under Fire: From Hype Machine to Risky Proposition

Crypto airdrops, once a go-to for user acquisition and buzz, are also under fire. Molidor notes that founders have become more cautious.

“Big airdrops often trigger sell pressure that kills TGE buzz,” he says.

Exceptions like Solana-based Jito (JTO) airdrop aligned well with market timing and community engagement, passing as outlier successes. Amidst prevailing bearish sentiment, however, the trend is shifting toward more targeted reward mechanisms that focus on filtering out speculative traders.

“Founders are moving toward methods like vesting periods, Sybil resistance, and eligibility filters to route tokens to crypto-native users rather than to people just looking to cash out immediately,” Molidor adds.

This suggests utility is crucial now, with the Forgd executive articulating that airdrops without a clear narrative and use case will fall flat.

Tokenomics: The Return of Low Float, High FDV Models

Tokenomics is also undergoing a makeover. Molidor notes that low float, high fully diluted valuation (FDV) strategies are back in fashion as projects attempt to curb sell-offs from airdrop dumpers. These models limit the circulating supply at launch, giving the impression of high value.

“It’s an illusion of strength. Early price pops distort market caps, but thin liquidity and front-loaded unlocks alienate both retail and institutional investors,” Molidor cautions.

This approach can appear predatory, enticing retail investors only to leave them with little liquidity and big insider exits.

However, Molidor notes that the market is wise to these games now. Projects must ensure that tokenomics are well-designed to foster long-term growth and avoid manipulation. Instead of chasing short-term hype, Molidor urges founders to focus on strategies that promote real user adoption.

“The key is balance. You want tokenomics that encourage long-term engagement while still protecting against early sell pressure,” he explained.

The Funding Drought: Crowd Funding and Angel Investors Step In

Molidor also demonstrated cognizance that the venture capital playing field has shifted dramatically. With funding tightening over the last 12 months, many Web3 projects are turning to alternative sources of capital.

Crowdfunding platforms like Legion and Echo are gaining traction among perceptive retail investors. They offer smaller, more flexible funding rounds. However, these rounds often cannot replace the scale of traditional venture capital.

“Crowdfunding is definitely on the rise, especially for earlier-stage projects. However, while crowd-funding platforms are becoming a vital tool, they are not a one-stop shop. Projects will still need larger rounds of VC funding to scale and deliver on their long-term visions,” he noted.

In response, venture capitalists are doubling down on early-stage equity and token stakes to offset dilution from later crowdfunding efforts.

According to Molidor, this strategy is creating an interesting dynamic in the funding arena, with VCs pushing for larger ownership stakes earlier in the process.

Compared to previous bear markets, he says this adjustment is a return to fundamentals but with more sophistication. In past bear markets, projects would typically delay their launches or aggressively cut costs. However, Molidor says that founders are taking a more nuanced approach.

“Delays and cost-cutting are still part of the playbook, but what’s different now is the level of sophistication in how teams manage their tokenomics, airdrops, and launch strategies. The cost of a mispriced launch is brutal reputationally and economically. Retail is fatigued, VCs are more hands-on, and communities are quicker to call out misaligned interests,” he explained.

Based on these, Molidor and his team at Forgd advise projects to take a surgical approach. The most successful projects take the time to understand their community, create value, and resist the urge to chase short-term hype.

“Narrative-driven airdrops, intentional community sales, and valuations built to last,” he advises.

A Market Test of Web3’s Resilience

Molidor says that the next six months will test Web3’s resilience. The sharpest projects will weather the storm as Trump’s tariffs upend the early-2025 bull market dreams.

“Token design is like capital structure now. It’s deliberate, contextual, and enduring—that’s what wins,” Molidor concludes.

For founders, it is adapt or die. For investors and users, it is a front-row seat to crypto’s latest crucible. Only the most thoughtful and strategic projects will succeed in this challenging market environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

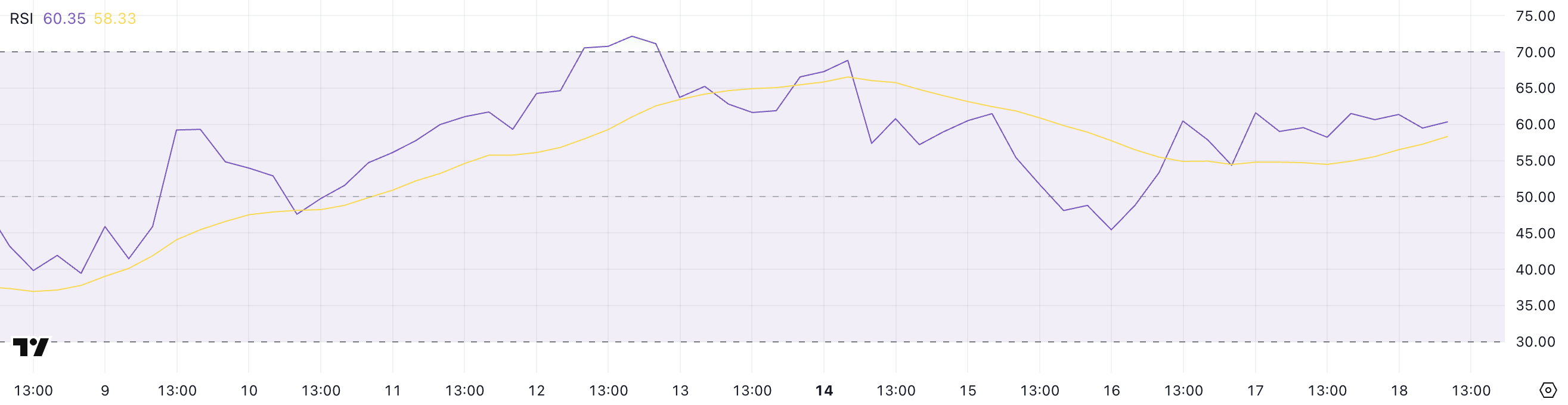

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Roadmap Frustrates Users Over Missing Timeline

Pi Network released its Mainnet Migration Roadmap today. The roadmap lays out a three‑phase plan to move tens of millions of Pioneers who are still waiting to be moved to the open network. It also introduces new rewards, such as referral bonuses.

However, unlike most project roadmaps, Pi network didn’t provide any estimated date or timeline. This lack of clarification has frustrated early adopters who still await key rewards and clarity on rollout pacing.

Pi Network’s Three‑Phase Migration Plan

According to the roadmap, Pi Network will first complete initial migrations for Pioneers already in the queue. This batch covers verified base mining rewards, Security Circle contributions, lockup commitments, utility‑app usage rewards, and confirmed Node rewards for some operators.

After clearing the first wave, the team will tackle second migrations, adding all referral mining bonuses linked to KYC‑verified team members. Pi says these referral rewards will follow once the current queue finishes.

Finally, the network will move into ongoing periodic migrations—potentially monthly or quarterly—to process any remaining bonuses and rewards.

The cadence “is to be determined,” the roadmap notes.

Community Concerns and Critical Gaps

A thorough observation reveals several gaps and potential concerns in the roadmap.

For one, the plan never discloses how many Pioneers remain in the queue or the network’s daily migration capacity. Without those figures, users can’t predict when their own migration will occur.

Node operators report that some “confirmed Node rewards” have landed, but criteria for qualification remain opaque. Early node runners worry they may miss out without clear benchmarks.

Many Pioneers say they have tapped their claim buttons daily since migration opened yet still lack basic mining rewards. They question whether those base rewards and deferred referral bonuses will ever arrive in phase two.

Also, the roadmap admits the UI’s “Transferable Balance” underestimates actual migrated amounts to save resources. Users fear this pessimistic display could erode trust if their true balances remain hidden.

“I thought we were mining all of these PI coins this whole time? I thought the security circles were the Consensus Mechanism. It kinda seems to me like there isn’t a blockchain, and never was one. What kind of “Blockchain protocol” would “Require” all tokens to be minted at genesis?” one community member wrote.

Crucially, Pi offers no audit or error‑resolution process for users who spot mismatches in their historical mining data.

Given six years of complex records, occasional disputes seem inevitable, but the roadmap remains silent on redress.

All migrations hinge on KYC completion, yet the team omits any scaling targets or timelines for identity verification. A bottleneck here could stall every subsequent phase.

The schedule also ignores how major token unlock events—such as the roughly 108.9 million PI tokens due to release this month—will align with migration waves.

Finally, some Pioneers challenge the project’s foundational narrative. They note that Pi’s statement “all tokens were minted at genesis” contradicts six years of “mining.”

This raises doubts about whether Pi ever operated on a true blockchain protocol.

In the past month, PI price has dipped by over 45%. To sustain momentum and community trust, the team must now supply concrete timelines, transparent criteria, and clear audit paths for its Mainnet migration.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Market20 hours ago

Market20 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin23 hours ago

Altcoin23 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market18 hours ago

Market18 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin21 hours ago

Altcoin21 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End