Altcoin

NFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

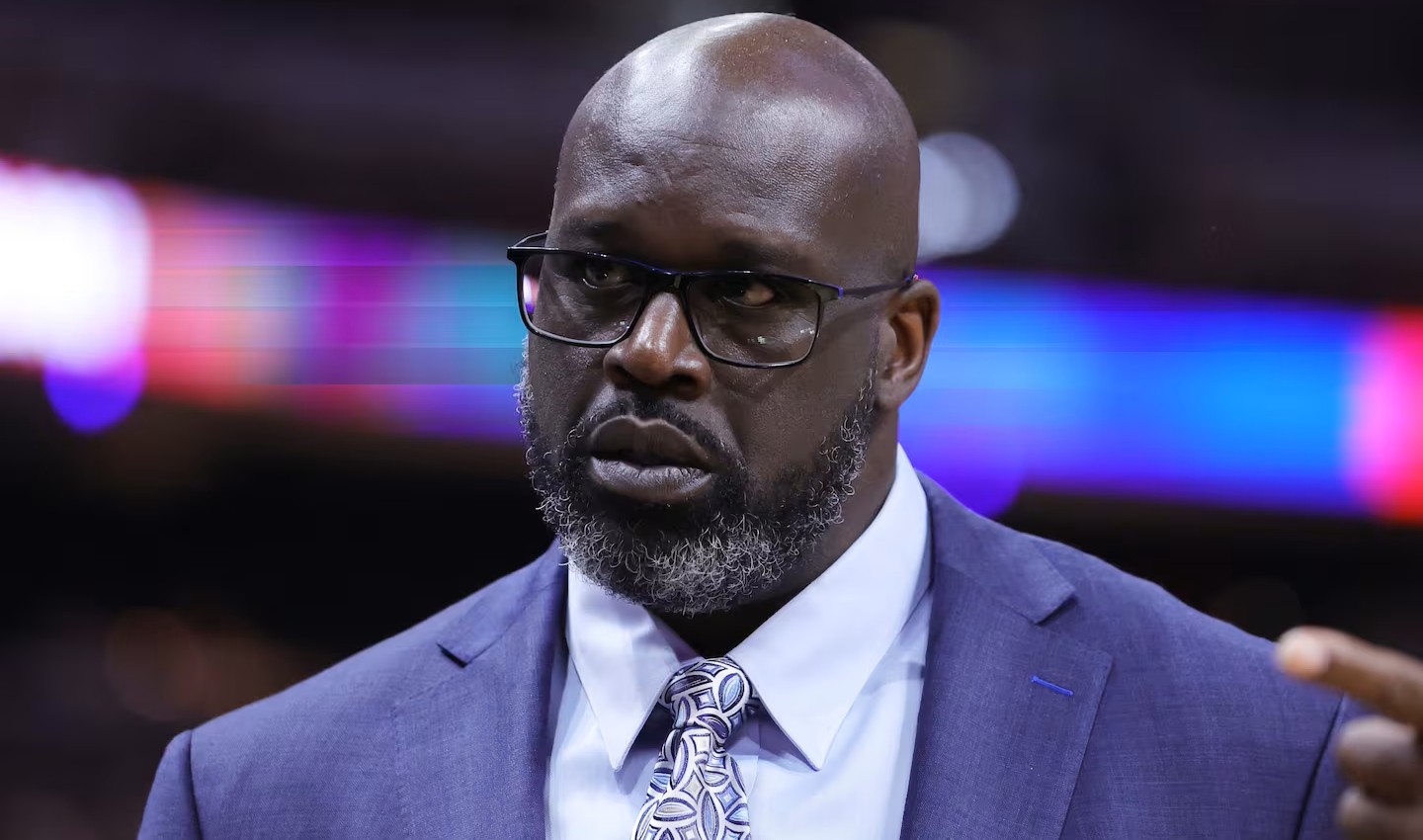

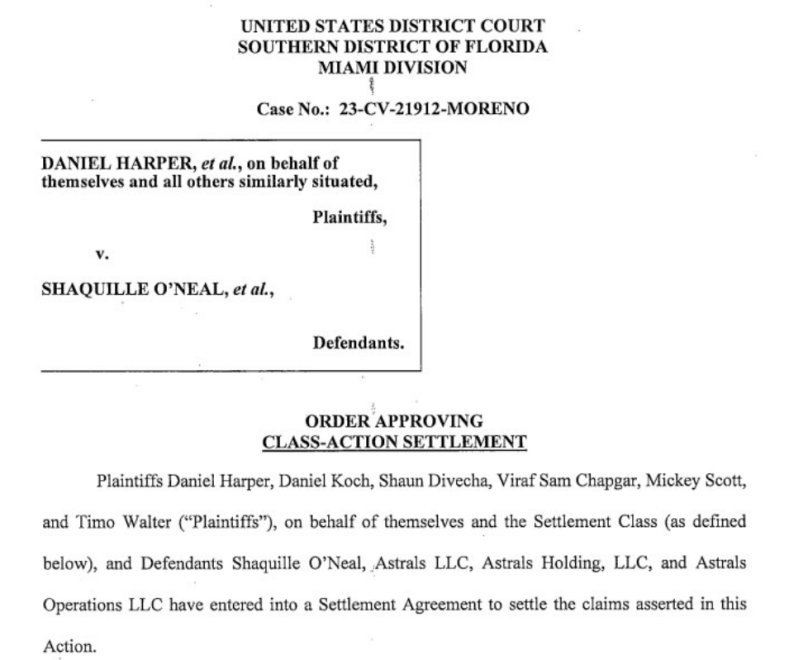

NBA legend Shaquille O’Neal has agreed to pay $11 million to settle a class-action lawsuit over his promotion of the failed Astrals NFT project. A Florida federal judge approved the settlement on April 1, with the order becoming public just this week on April 8, according to court documents.

Basketball Icon Caught In Crypto Controversy

The lawsuit, first filed in May 2023, claimed O’Neal promoted the sale of unregistered securities through the Solana-based Astrals NFT collection. Investors who bought Astrals NFTs or the project’s GLXY tokens between May 2022 and January 15, 2024, will now be eligible for compensation from the settlement fund.

Judge Federico Moreno previously acknowledged that plaintiffs had made a plausible case that the former NBA star acted as a seller under securities law. The settlement comes after months of legal back-and-forth, with O’Neal reaching an agreement with plaintiffs last November.

The next shot – Shaquille O’Neal and #Astrals NFTs + $GLXY tokens.

Shaq actively promoted the tokens, calling himself “Astrals Chief Astronaut.” But after the FTX collapse in November 2022, the project’s reputation took a hit, and token sales slowed significantly.$GLXY is down… pic.twitter.com/quHziiGCdA

— 11th.com (@11thestate) March 28, 2025

Lawyers Take Home $2.9 Million Slice

The court approved $2.9 million in attorney fees and related costs as part of the settlement package. Judge Moreno ruled these fees were “fair and reasonable,” and noted that none of the plaintiffs objected to the amount lawyers would receive.

The lawyers were able to convince the court that investors lost their money because of O’Neal’s marketing campaigns for the project.

Court papers indicate that O’Neal urged potential investors to “hop on the wave before it’s too late,” something that came to haunt him in court.

Screenshot of court document on Shaq's legal settlement. Source: Courtlistener

Failed Project Promised Virtual Meetings With Shaq

Astrals were released in April 2022, providing 10,000 one-of-a-kind 3D avatars designed by artist Damien Guimoneau. The venture presented itself as a fully immersive metaverse experience through which users would be able to interact with other users as well as with O’Neal himself.

Despite the star power behind it, the collection has shown zero signs of activity over the past two years based on data from NFT marketplace OpenSea.

O’Neal reportedly continued to support the project publicly even after the major cryptocurrency exchange FTX collapsed in November 2022.

The court did throw O’Neal one small victory, dismissing claims that he was a “control person” within the project—a designation that would have suggested he held actual power over its operations rather than just serving as its famous face.

Shaquille O’Neal to Face Legal Action Over Astrals NFT Project and FTX Involvement

TLDRShaquille O’Neal faces a class action lawsuit over his involvement in the Astrals NFT project

The court dismissed allegations that O’Neal was a “control person” but found he could be cons… pic.twitter.com/tslw52EwOw

— 🛑 BREAKING NEWS 🛑📢🔔⚠💥❗💬 (@NotAnotherTip) August 19, 2024

NFT Market Continues Downward Spiral

The settlement comes as the broader NFT market struggles to regain its former glory. Total NFT sales volume stood at just $27 million for the week ending April 7, 2025, a dramatic drop from the $2 billion-plus weekly volumes recorded during the market’s peak in 2021.

This downward trend has been ongoing, with trading volumes falling by more than 60% in February alone. The drop continues a slide that began in early 2024, suggesting the once-hot digital collectibles market remains in a prolonged slump.

Featured image from Megan Briggs/Getty, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

The Mantra team has addressed the crypto community following the Mantra (OM) token price crash of over 80% in the last 24 hours. Despite the statement, the community is still concerned that this might have been a rug pull by the team, which controls a huge amount of the token’s total supply.

Mantra Team Responds Following Token Crash

In an X post, the Mantra team assured the community that the token is “fundamentally strong” despite the crash that occurred in the last 24 hours. The team blamed the crash on “reckless liquidations” and denied it had anything to do with the project.

They further assured that this had nothing to do with the team and revealed that they were looking into the Mantra price crash and would share more details about what happened as soon as possible.

In an X post, the project’s co-founder, John Patrick Mullin, further revealed that there was a massive forced liquidation from a large OM investor on a Centralized Exchange (CEX). However, he didn’t reveal whether it was one of the top crypto exchanges.

In another X post, Mullin tried to set the record straight. He stated that they didn’t delete the Telegram channel. He further remarked that the team’s tokens all remain in custody and provided a wallet address (mantra…..quam) for community members to verify this claim.

The Mantra co-founder added that they are actively figuring out why these massive forced liquidations occurred and will provide more information as soon as possible. He assured that they are still here and not going anywhere.

Mantra Price Crashes By Over 80% In 24 Hours

CoinMarketCap data shows that the Mantra price has crashed by over 80% in the last 24 hours. The token sharply dropped from an intra-day high of $6.3 to as low as $0.4. However, it has reclaimed the $1 price level following the team’s statement.

However, amid this statement, some community members still seem convinced that this was a rug pull, as the team controls a huge amount of the token’s supply. Crypto commentator Sjuul described the OM token as the LUNA of this cycle.

He further explained why the community believes the crash was a rug pull, stating that the crash began when a wallet believed to be connected to the team suddenly deposited 3.9 million OM tokens to the OKX crypto exchange. This deposit led to significant selling pressure, which caused the Mantra price to crash.

Besides the token’s crash, the broader crypto market is witnessing a downtrend following US President Donald Trump’s statement in which he debunked reports of an exemption. This comes just a day after the crypto market rebounded following reports that the US president had exempted computers, phones, and chips from his tariffs on China and other countries.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ethereum Price Eyes Rally To $4,800 After Breaking Key Resistance

Ethereum’s shoddy run of form is reaching its lowest ebb with investors lapping at the charts in bullish fashion. Ethereum price is tipped for a rally to $4,000 after technical indicators flash glimpses of promise for the largest altcoin.

Ethereum Price To $4,800 Is In Play

Cryptocurrency analyst Javon Marks is predicting an extended rally for Ethereum price in the coming weeks on the backs of solid technicals. According to an analysis on X, Ethereum price continues to trade outside of the previous descending trendline after a strong breakout despite recent poor price performances.

Marks notes that the previous breakout triggered an extended bullish run for Ethereum but previous declines leave ETH outside the descending trendline. According to the cryptocurrency analyst, if ETH continues to trade above the trendline, a price target of $4,800 is within grasp. While Marks did not give a timeline, the $4,000 prediction aligns with Standard Chartered’s revised prediction for ETH for the end of 2025.

“With Ethereum still being well broken out of an older resisting trend the target at the $4811.71 level goes unchanged,” said Marks.

While Marks’ prediction offers a ray of hope for the bruised and battered altcoin, trading above the trendline is an uphill climb. For starters, ETH price charts are indicating lower lows and lower highs, confirming a strong downtrend.

Ethereum price has fallen to a new 5-year low against Bitcoin after posting its worst Q1 performance in nearly five years. ETH tanked to lows of $1,400 as investor optimism for the altcoin sunk to previously unseen levels.

Marks Says ETH Can Still Clinch $8,000

The analyst notes if the Ethereum price powers through the maze of challenges on its path to $4,800, it can trigger a sustained rally to $8,000. While the prediction is a steep ascent for ETH, prices have formed a 2020 historical pattern pointing to a rally.

“With this target still in play, an over 200% uphill run to reach it can take place and with the extensive post-breakout action, a break above is possible, bring $8,557.68 into play,” said Marks.

Bankless cofounder David Hoffman has revealed a strategy to improve ETH price performance. The plan involves attracting new users to the Ethereum network while ditching attempts to police users’ behavior.

Despite the possibilities for an upswing, Ethereum price is staring down the barrel of a gun. There are comparisons that the ETH price is mirroring Nokia’s decline with Solana’s rise delivering the final blow for Ethereum.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Bitcoin Analyst Says Shiba Inu Price Is Not Hitting $1, Here’s Why

A recent analysis by a Bitcoin analyst has thrown cold water on the possibility of the Shiba Inu price hitting the $1 mark. The analyst firmly dismissed the idea, suggesting that it is highly unlikely, if not downright impossible.

Why Shiba Inu Price Will Never Hit $1

Davinci Jeremie, a prominent Bitcoin analyst with over 825,700 followers on X (formerly Twitter) has declared the Shiba Inu price will never reach $1. To understand why the analyst has made such a grim prediction, he points to Shiba Inu’s market capitalization and supply dynamics.

With Shiba Inu’s vast circulating supply, Jeremie argues that reaching $1 would require an astronomical market cap far beyond what the crypto market could sustain. As of April 2025, the total circulating supply of SHIB is around 589.5 trillion. However, this number fluctuates with daily token burns.

For Shiba Inu to hit $1, Jeremie has stated that its market capitalization would need to surge to a staggering $600 trillion. To put the sheer scale of this figure into perspective, a comparison between Bitcoin, gold, and the global crypto market cap helps illustrate just how unrealistic this milestone is.

Currently, Bitcoin, the world’s largest cryptocurrency by market cap, is worth around $1.66 trillion. For Shiba Inu to achieve a $1 price point, it would need to surpass almost 600 times the total market cap of Bitcoin.

Gold, which is widely regarded as a reliable store of value and has a market cap of approximately $21.857 trillion, would still be significantly dwarfed by the required market cap for SHIB at $1. To put it simply, Shiba Inu reaching this figure would need a valuation nearly 300 times greater than the entire global crypto market cap, which currently sits around $2.65 trillion.

As mentioned earlier, Shiba Inu’s massive supply also significantly contributes to why a $1 price is unrealistic. While cryptocurrencies like Bitcoin have a capped supply, SHIB’s is exponentially larger, created to appeal to its community.

The sheer number of tokens in circulation is part of what keeps SHIB’s current price so low at $0.000012. It also makes it virtually impossible to reach $1 unless drastic changes are made to supply or token burns skyrocket astronomically.

Community Acknowledges SHIB’s $1 Pipe Dream

Following Jeremie’s declaration that Shiba Inu is unlikely ever to hit $1, many in the crypto community echoed his sentiment, emphasizing just how unrealistic and ambitious this target is. While many concluded that Shiba Inu cannot reach $1, others offered potential solutions they believe could one day turn this far-fetched goal into a reality.

One member highlighted the need to reduce Shiba Inu’s supply. Primarily, this would involve token burns, which permanently remove tokens from circulation. Since its inception, over 410.7 trillion SHIB tokens have been burnt. However, despite this progress, the circulating supply remains overwhelmingly large.

Featured image from Pixabay, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin5 hours ago

Altcoin5 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Bitcoin11 hours ago

Bitcoin11 hours agoNew Bill Pushes Bitcoin Miners to Invest in Clean Energy

-

Market18 hours ago

Market18 hours agoNew York Proposes Bill to Accept Bitcoin Payments for Tax

-

Market10 hours ago

Market10 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market17 hours ago

Market17 hours agoXRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?

-

Market9 hours ago

Market9 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin16 hours ago

Bitcoin16 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Market15 hours ago

Market15 hours agoDOGE Spot Outflows Exceed $120 Million in April

✓ Share: