Market

How Ripple’s $1.25 Billion Deal Could Surge XRP Demand

Ripple’s acquisition of Hidden Road could lead to a surge in demand for (XRP) XRP and Ripple USD (RLUSD) stablecoin, according to industry experts.

On April 8, Ripple acquired the global prime brokerage platform Hidden Road for $1.25 billion. This has positioned it for significant growth in the financial services sector.

How Will Ripple’s Hidden Road Acquisition Impact XRP Demand?

In a detailed thread on X (formerly Twitter), Jake Claver, Managing Director of Digital Ascension Group, highlighted the scale of Hidden Road’s operations. He noted that the firm processes over $10 billion in daily transactions, more than many blockchains handle in a month.

With this acquisition, he emphasized that transactions will now be processed on the XRP Ledger (XRPL). This development raises intriguing possibilities, particularly as prominent financial institutions are set to harness XRPL for its original design — a decentralized, efficient system built for seamless financial transactions.

“What happens when just a fraction of that $10 billion daily volume starts settling through XRP? Demand skyrockets. These aren’t retail traders—these are hedge funds and market makers who need XRP to power their operations. And they’ll be buying lots of it,” he wrote.

Claver also explained that Hidden Road’s integration of RLUSD makes it the first stablecoin to enable cross-margining between digital and traditional markets. According to him, this acquisition addresses issues of risk and inefficiency by using XRP for fast settlement and RLUSD for stable collateral.

“Ripple’s acquisition of Hidden Road is a fundamental shift in XRP and RLUSD’s position in global finance. Increased utility, institutional demand, and improved liquidity create the perfect storm for long-term value growth,” he noted.

Dom Kwok, co-founder of EasyA, corroborated this sentiment. He stressed that the move boosts the adoption of XRP Ledger and the RLUSD stablecoin.

“I’ve tracked tons of deals in the crypto space but Ripple’s acquisition of hidden road is without a doubt one of the most important deals for crypto,” Kwok claimed.

In a statement shared with BeInCrypto, Nic Puckrin, the founder of The Coin Bureau, emphasized that this acquisition might fuel more demand for the XRP tokens.

“It’s also notable that this acquisition is in part financed by XRP, along with cash and stock, while Hidden Road will migrate its post-trade activity to the XRP Ledger (XRPL) – Ripple’s native blockchain. This has the potential to drive demand for XRPL and is potentially good news for XRP’s price trajectory, which has struggled with performance despite the recent SEC win as tariff news decimated the altcoin market,” Puckrin told BeInCrypto.

Despite the optimism, XRP continues to struggle amid a broader market crash. Over the past day, the altcoin has dropped 2.9%. At the time of writing, it was trading at $1.8.

Nonetheless, an analyst urged the community to remain optimistic. He elaborated that Ripple is quietly building the “Internet of Value” with its strategic acquisitions and partnerships.

“XRP’s price isn’t reflecting the bullish news right now, and that’s not a glitch. It’s a reminder. A reminder that price isn’t the mission. Understanding the tech is,” the post read.

He emphasized that Ripple’s every move is part of a larger, interconnected strategy. This even includes the launch of RLUSD. This initiative is positioned as more than just a trend.

It’s part of a broader effort to rebuild the global financial infrastructure from the ground up, offering a stable, secure, and innovative alternative to traditional monetary systems.

“Yet the price remains quiet. Because until they flip the switch. Until the new system is fully in place. We’re just being handed breadcrumbs, enough for those with eyes to see,” he added.

The analyst stresses viewing any potential XRP price drops as an opportunity rather than a reason to panic sell. He encouraged investors to focus on long-term goals, such as building the future of finance, rather than chasing short-term gains.

He asserts that those who stack, learn, and hold the line position themselves ahead of the curve and become part of a historic shift in the financial landscape.

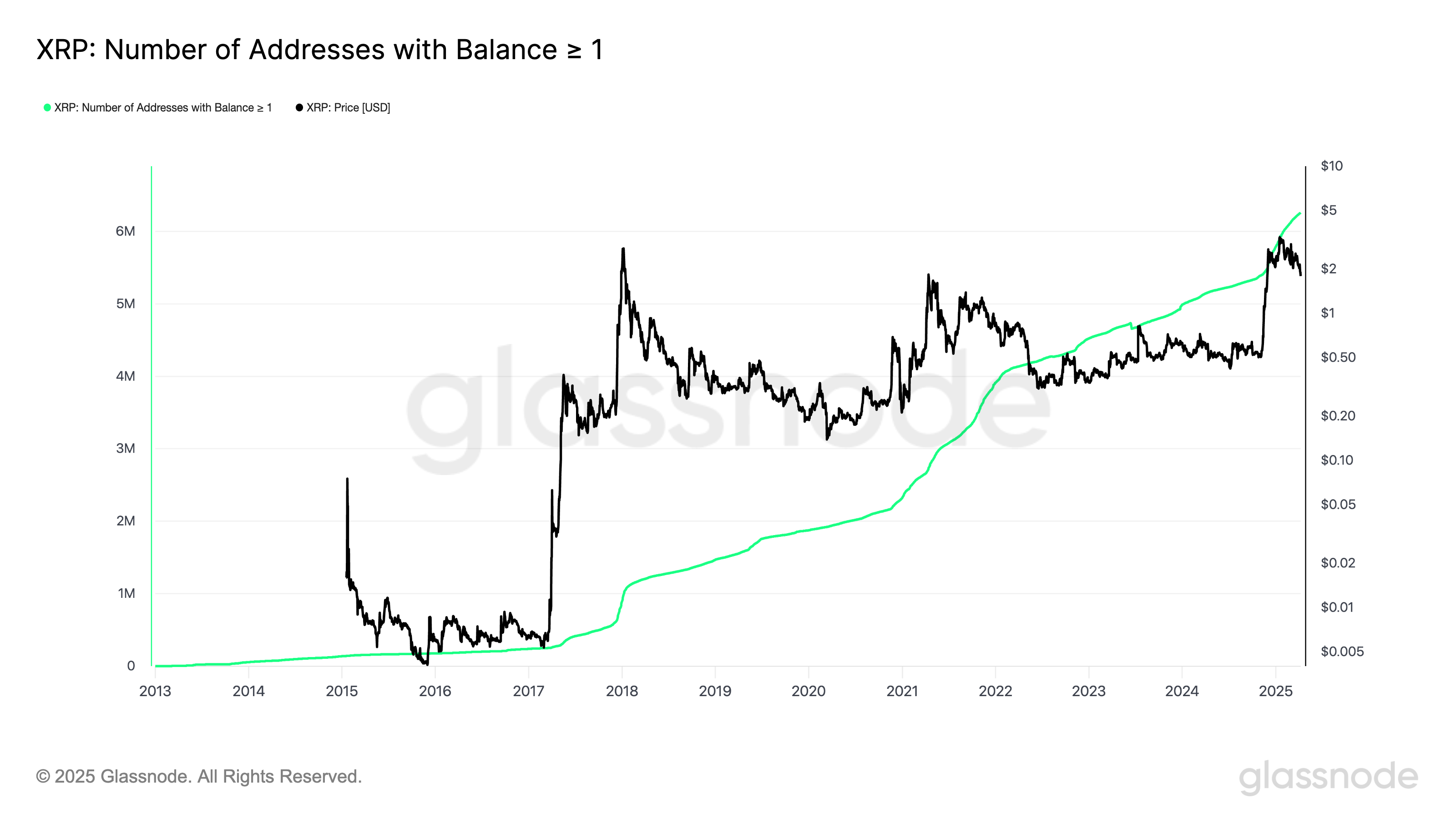

Interestingly, it seems that many share the same belief. Despite the recent volatility, small investor interest in XRP is on the rise. According to recent data from Glassnode, addresses holding 1 XRP or more have reached an all-time high of 6.2 million.

This surge in participation from retail investors suggests growing confidence in XRP’s long-term potential, even as broader market struggles persist.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

Market

$7 Million Hack Hits Binance-Backed Project

KiloEx, a newly launched perpetual trading platform backed by YZi Labs (formerly Binance Labs), has suffered a cross-chain exploit resulting in the theft of approximately $7 million.

The attack, which began on April 14, is ongoing and has impacted operations across BNB Smart Chain, Base, and Taiko networks.

Hackers Drain $7 Million from KiloEx Using Tornado Cash

Cyvers analysts report that the attacker used a Tornado Cash-funded address to execute a series of coordinated transactions. It exploited potential access control flaws in KiloEx’s price oracle system.

On-chain evidence shows rapid fund movements between multiple chains. This raises concerns over systemic vulnerabilities in multi-chain DeFi architecture.

KiloEx launched its Token Generation Event (TGE) on March 27 in partnership with Binance Wallet and PancakeSwap. It’s currently listed on Binance Alpha.

“Root cause was a potential price oracle access control vulnerability. The attacker is still actively exploiting the system, and USDC may be subject to blacklisting,” wrote Cyvers.

The project was incubated by YZi Labs, an investment and innovation division previously branded as Binance Labs.

The launch attracted significant attention due to its backing and integration with BNB Smart Chain.

Following the attack, KiloEx has suspended its platform and is collaborating with security partners to investigate the breach and track stolen funds.

The team has announced plans to launch a bounty program to encourage white hat assistance and recover user assets.

The incident has triggered sharp market reactions. The KILO token plummeted by 30%, with its market capitalization dropping from $11 million to $7.5 million within hours of the attack.

Security teams are actively monitoring the attacker’s wallet addresses. The situation remains fluid as remediation efforts continue and the vulnerability is further assessed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MANTRA (OM) Charts Look Worse than LUNA – No Buying Activity

Yesterday, MANTRA (OM) suffered a staggering 90% crash, and it’s still spiraling down today. Most notably, OM charts and indicators seem as bad as the 2022 Terra LUNA collapse, if not worse.

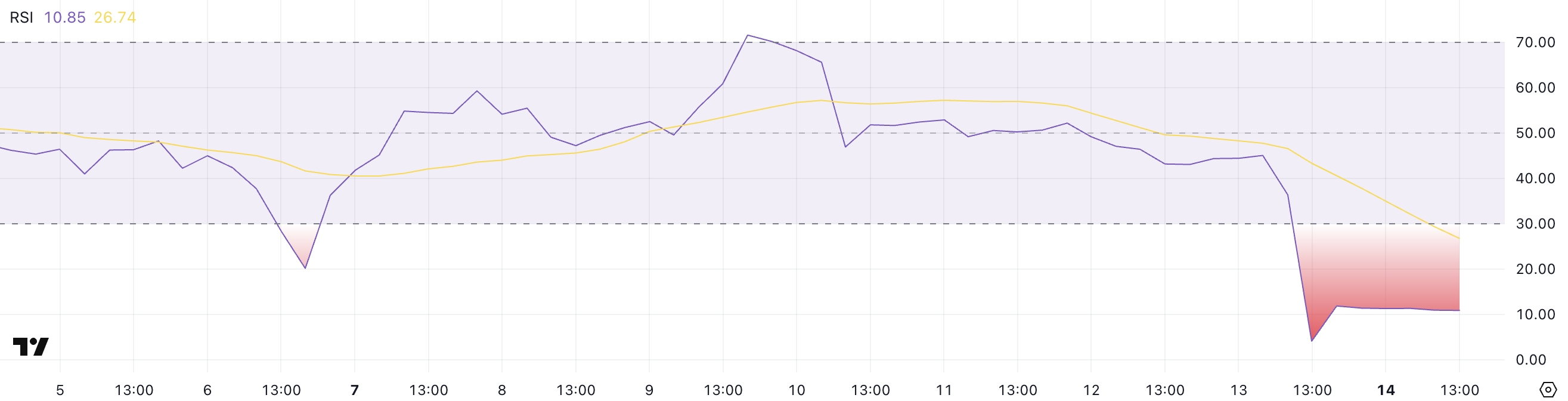

OM’s RSI is hovering near extreme oversold levels, and indicators reflect there’s barely any buying activity. When LUNA collapsed, a large number of traders bought the crash for a short-term pump. But, even this seems unlikely for MANTRA, based on current charts.

OM RSI Reached Levels Below 10

After crashing more than 90% in a matter of hours, some traders may be eyeing MANTRA’s OM token as a potential “buy the crash” opportunity.

However, the Relative Strength Index (RSI) tells a different story—OM’s RSI plummeted from 45 to 4 during the collapse and has only slightly recovered to 10.85.

The RSI is a momentum indicator that measures the speed and magnitude of price changes on a scale from 0 to 100. Typically, values below 30 indicate oversold conditions, while levels above 70 suggest the asset is overbought.

Despite bouncing from extreme lows, OM’s RSI has hovered around 10.85 for several hours, signaling that very few buyers are stepping in to support the price.

This lack of follow-through buying pressure shows that sentiment remains heavily bearish, and traders are not yet confident enough to accumulate the token—even at these steeply discounted levels.

Recently, talking to BeInCrypto, analysts warned about Mantra’s potential lack of true on-chain value.

OM is potentially setting up for further downside or a prolonged period of stagnation as the market waits for a catalyst or clearer recovery signals.

Mantra DMI Shows Buying Activity Is Almost Non-existent

Mantra’s DMI (Directional Movement Index) chart clearly shows intense bearish momentum. The ADX, which measures the strength of a trend regardless of direction, is currently at 47.23—well above the 25 threshold and showing no signs of weakening.

The -DI, which tracks selling pressure, has decreased from its peak of 85.29 to 69.69, indicating that while the panic sell-off may be slowing, it remains dominant.

Meanwhile, the +DI, which measures buying pressure, has dropped from 3.12 to just 2.42, highlighting a complete lack of bullish response to the collapse.

This imbalance reveals that although the worst of the immediate selling may be over, virtually no meaningful buying activity is stepping in to support OM’s price.

The fact that +DI remains extremely low suggests traders are still avoiding the token, hesitant to buy even after a massive discount.

As long as this dynamic continues—strong trend strength, high selling pressure, and near-zero buying pressure—OM is likely to stay under severe bearish pressure, with any recovery attempt extremely unlikely unless sentiment shifts dramatically.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market18 hours ago

Market18 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Market17 hours ago

Market17 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Altcoin16 hours ago

Altcoin16 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market21 hours ago

Market21 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Bitcoin16 hours ago

Bitcoin16 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market16 hours ago

Market16 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds