Market

Yellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

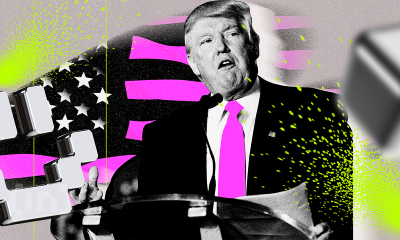

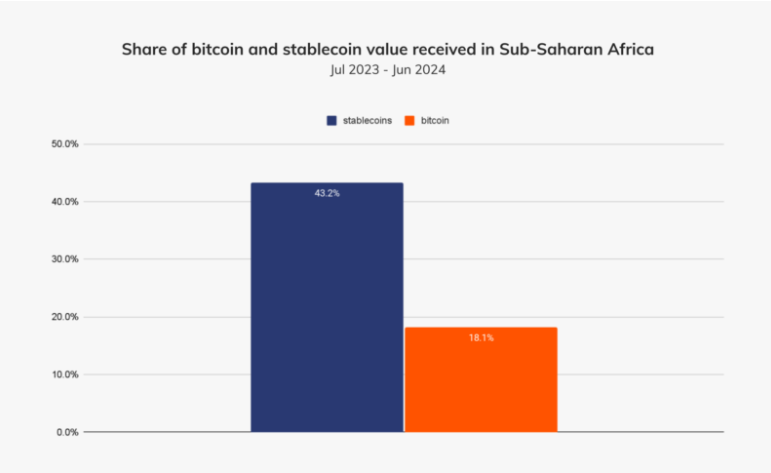

For years, crypto in Africa was synonymous with Bitcoin (BTC). Today, that narrative has flipped, with companies like Yellow Card, a crypto exchange operating in Africa, clearly reflecting this shift.

In an exclusive with BeInCrypto, Yellow Card co-founder and CEO Chris Maurice reveals how it is building a pan-African stablecoin network to leapfrog traditional finance (TradFi). This is amid growing regulatory clarity, collapsing fiat systems, and a remittance revolution.

Stablecoins Are Transforming Africa’s Financial Scene

The pan-African exchange operates in over 20 markets, and Maurice says stablecoins now account for over 99% of its transactions. This makes Yellow Card a bellwether for what might be the most transformative trend in emerging markets finance.

“When we first launched Yellow Card in 2019, people were exclusively buying Bitcoin. Now, the most popular asset is Tether (USDT),” Maurice told BeInCrypto.

As it happened, necessity, not speculation, has driven this evolution. Africa leads the world in peer-to-peer (P2P) crypto trading volume. However, unlike global crypto hubs chasing volatile returns, Africans are choosing stablecoins out of financial survival.

Local currencies are eroding under inflationary pressure in countries like Nigeria, which ranks second globally in crypto adoption (per Chainalysis). Stablecoins offer a reliable store of value and seamless means of cross-border payments.

This is especially critical in a continent with $48 billion annual remittances and persistent banking limitations.

“Stablecoins are solving practical financial services challenges in Africa. People aren’t in love with the tech. They need faster, cheaper ways to move money to survive and thrive,” Maurice added.

Infrastructure Built for the Unbanked

Yellow Card has gone beyond trading services. Its infrastructure integrates mobile money systems (like M-Pesa in Kenya) and local fiat currencies such as the Nigerian naira and Ghanaian cedi. According to the firm’s CEO, this helps onboard users without bank accounts.

By managing compliance, currency exchange, and payments internally, the firm enables businesses to operate without battling unreliable local rails.

“Our mission is to let companies invest, hire, and grow in emerging markets without needing to stress over infrastructure. We’ve built the back office [meaning] cybersecurity, AML, [and] data protection, so they can focus on growth,” he articulated.

The Regulatory Dam Has Broken

Maurice also observed that African regulators kept crypto in limbo for years. In Yellow Card’s view, 2024 marked a tipping point.

“There is regulatory momentum in Africa that is only accelerating. The dam has broken,” he said.

South Africa now classifies crypto as a financial product. It has licensed major exchanges like Luno and VALR. Countries in the Central African Economic and Monetary Community (CEMAC), Mauritius, Botswana, and Namibia have followed suit with licensing regimes.

Meanwhile, regulatory incubators are emerging in Kenya, Nigeria, Rwanda, and Tanzania. Against this backdrop, Maurice says Yellow Card has actively helped draft legislation in Kenya and supports crypto frameworks in Morocco.

Fighting the Informal Market

Still, challenges remain. In countries like Ethiopia, Cameroon, and Morocco, outright bans have driven users underground into high-risk P2P networks. Yellow Card pushes for frameworks that level the playing field for compliant players.

“We face a lot of competition from companies that don’t maintain high AML standards…A level playing field is all we seek,” he said.

With $85 million in venture funding, Yellow Card is deploying capital into compliance and partnerships. With this, the company positions itself as the go-to infrastructure provider for global firms looking to tap African markets.

From Africa to Emerging Markets Everywhere

Cross-border payments are perhaps Yellow Card’s most powerful use case. The company’s co-founder says its stablecoin-powered rails are helping businesses reduce working capital needs, expand to new regions, and hire faster.

“We’ve had clients tell us we’ve enabled them to scale into new countries and reduce their costs dramatically. That’s real economic impact,” said Maurice.

The company is not stopping at Africa. Its infrastructure extends into other frontier markets, with a wave of strategic partnerships expected in 2025.

“Yellow Card has built a series of easy buttons for developed world companies to expand into complicated, high-growth markets,” he noted.

The End of SWIFT?

Perhaps the boldest claim from Yellow Card is what it sees on the five-year horizon: the decline of SWIFT and traditional international transfers altogether.

“As we look out five years, SWIFT is in trouble. In ten, no one will be making international wires again,” Maurice chimed.

Backed by enterprise-grade security and regulatory rigor, Yellow Card attracts interest from blue-chip firms like PayPal and Coinbase exchange, which are looking for stablecoin partners in emerging markets.

“Stablecoins are already a standard part of the financial infrastructure in Africa. CFOs and treasurers in traditional industries are now routinely using them to store and transfer value,” he added.

Africa’s crypto market is still small compared to global giants. Nevertheless, as the world shifts from speculation to utility, the continent’s fragmented financial systems may offer a glimpse into crypto’s most impactful use case: economic empowerment. For Yellow Card, the mission is clear and increasingly urgent.

“We’ve built a company for longevity and scale. Crypto adoption in Africa is stablecoin adoption,” Maurice concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

DWF Invests $25 Million in Trump’s World Liberty Financial

DWF Labs announced today that it invested $25 million into Trump Family-backed World Liberty Financial and is planning to open an office in New York City. It hopes to use this office to drive new relationships with regulators, financial institutions, and more.

Although this partnership would potentially create more liquidity opportunities for the US crypto market, previous allegations against DWF have raised some concerns about political misconduct.

Understanding DWF Labs’ Investment in WLFI

World Liberty Financial (WLFI), one of the Trump family’s major crypto ventures, has been making some big moves since the President’s inauguration in January.

The DeFi project allegedly entered talks with Binance to launch a new stablecoin, and it officially announced USD1 shortly after. Today, WLFI has entered a new partnership with Dubai-based Web3 investment firm DWF Labs.

“The US is the world’s largest single market for digital asset innovation. Our physical presence reflects our confidence in America’s role as the next growth region for institutional crypto adoption. Moreover, the USD1 stablecoin and forthcoming global DeFi solutions align with our broader mission to improve financial services,” claimed Managing Partner Andrei Grachev.

DWF’s statement includes a few key details about its new relationship with WLFI. It essentially boils down to two key points: the firm has already purchased $25 million in WLFI tokens, and it plans to open a physical office in New York City.

On a positive note, this partnership could be significant for the overall US crypto market. DWF Labs has a portfolio of over 700 crypto projects.

So, physically setting up a hub in New York will give me regulatory freedom and the opportunity to invest directly in the local crypto market. This would potentially open up more liquidity for upcoming Web3 projects and startups in the US

Concerns of Financial Misconduct

Although DWF Labs is a popular market maker, it has been at the center of major controversies. Last year, it was accused of wash trading and market manipulation, and Binance allegedly shut down its internal investigation due to financial incentives.

Also, one of its partners was dismissed back in October over allegations of drugging a job applicant. So, the firm’s credibility and reputation have been shaky in recent times.

This is to say that the crypto community has reasons to worry about a deal between DWF and World Liberty Financial. A report from late March determined that most WLFI revenues go directly to Trump’s family.

WLFI owners are unable to actually trade their tokens, and the stated governance use of the assets seems unclear. In other words, there isn’t a clear reason why anyone would invest.

The growing concern is that firms like DWF would invest in WLFI as an easy tool for political corruption. Shortly after the election, Tron founder Justin Sun invested $30 million into World Liberty. Trump’s family apparently got most of this money, and the SEC settled a fraud case against Tron in February.

If DWF Labs invested a similar amount in WLFI, could this give it some legal protection? The Department of Justice already gutted its Crypto Enforcement Team, and New York’s US Attorney also signaled its intent to stop crypto prosecutions.

As this deal goes forward, it will be important to look for signs of any possible financial misconduct.

BeInCrypto has contacted DWF Labs about the 2024 market manipulation claims but has yet to receive a reply.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Are TRUMP Meme Coin Investors Selling Before Friday’s Unlock?

The TRUMP meme coin has lost 29% of its value over the past month and is now down more than 90% from its all-time high. The sharp decline has been accompanied by weakening momentum across multiple indicators.

Both suggest that bullish strength has faded and downside risks are growing. Adding to the pressure, a large wallet just withdrew millions in USDC ahead of a $317 million token unlock next week, raising concerns about possible selling activity.

Indicators Suggest Weak Momentum for TRUMP Meme Coin

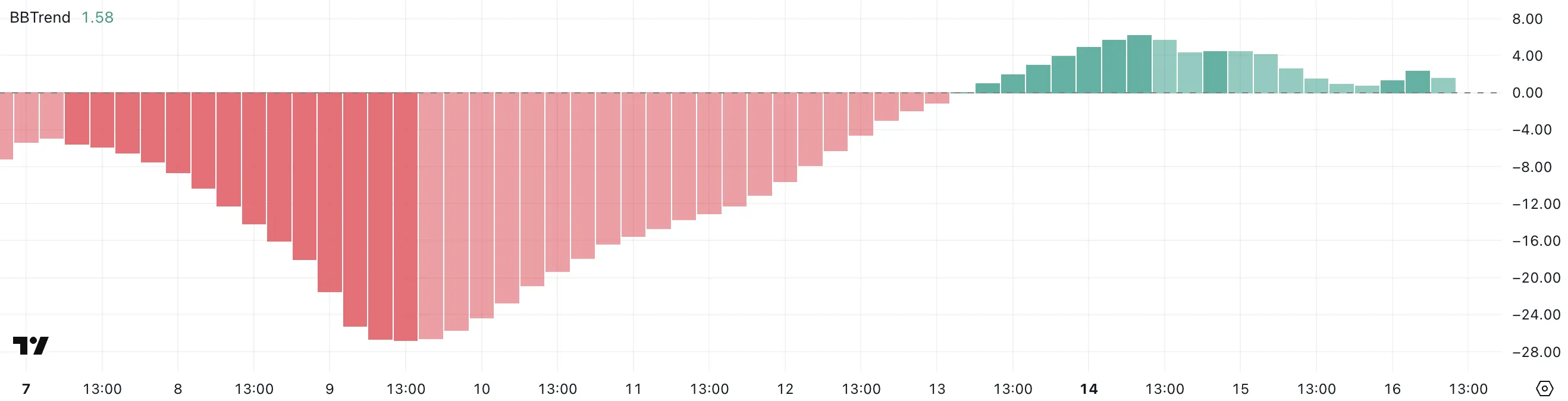

TRUMP’s BBTrend indicator has sharply dropped to 1.58, down from 6.23 just two days ago. This sudden decline suggests that the strength of the previous trend has significantly weakened.

After showing strong momentum earlier in the week, the current BBTrend reading points to a possible shift toward consolidation or even a reversal if buying interest continues to fade.

BBTrend, short for Bollinger Band Trend, is a technical indicator that measures the strength of a price trend based on the width of Bollinger Bands.

Higher values typically indicate a strong directional move, while lower values suggest that the market is entering a less volatile phase.

With TRUMP’s BBTrend now at 1.58—close to the neutral zone—it could signal that the strong bullish phase is cooling off. If the indicator continues to fall and the price loses support, it may point to a period of sideways movement or the beginning of a downtrend.

TRUMP’s Ichimoku Cloud chart shows a clear bearish setup. The price is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline).

This positioning suggests that short-term momentum remains weak, and buyers have yet to regain control.

The fact that price candles are still beneath the cloud reinforces the ongoing bearish sentiment, as the cloud often acts as resistance when prices are below it.

Looking ahead, the cloud (Kumo) is transitioning from red to green but remains flat and narrow, signaling limited upside strength. The green Senkou Span A is only slightly above the red Senkou Span B, meaning the future trend outlook is still uncertain and lacks conviction.

For any bullish reversal to gain traction, TRUMP meme coin would need to break above the cloud with strong volume. Until that happens, the chart points to continued caution, with the potential for more sideways or downward price action.

Whale Withdrawal Raises Concerns Ahead of $317 Million TRUMP Unlock

A wallet linked to Donald Trump’s memecoin withdrew $4.6 million in USDC from the Solana DEX Meteora on Tuesday.

These funds were previously used to provide liquidity for the TRUMP-USDC trading pair. They helped ensure smoother trading and price stability. This wallet has made a withdrawal for the first time, and the size and timing of the move make it noteworthy.

Even after the withdrawal, the pool still holds around $205 million in USDC and $122 million in TRUMP tokens.

This activity comes just days before a major unlock event set for next Friday. Around $317 million worth of TRUMP meme coin tokens will become available.

Unlocks often worry investors as they increase token supply. If a large portion is sold, it can push prices down. The $4.6 million withdrawal has raised speculation about insider moves. Some believe funds are being repositioned ahead of the unlock.

While it’s not clear if a selloff is coming, the timing suggests caution. In the days ahead, on-chain activity should be closely watched.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Crypto Security Flaw Could Expose Seed Phrases

Crypto users often focus on user interfaces and pay less attention to the complex internal protocols. Security experts recently raised concerns about a critical vulnerability in Crypto-MCP (Model-Context-Protocol), a protocol for connecting and interacting with blockchains.

This flaw could allow hackers to steal digital assets. They could redirect transactions or expose the seed phrase — the key to accessing a crypto wallet.

How Dangerous is the Crypto-MCP Vulnerability?

Crypto-MCP is a protocol designed to support blockchain tasks. These tasks include querying balances, sending tokens, deploying smart contracts, and interacting with decentralized finance (DeFi) protocols.

Protocols like Base MCP from Base, Solana MCP from Solana, and Thirdweb MCP offer powerful features. These include real-time blockchain data access, automated transaction execution, and multi-chain support. However, the protocol’s complexity and openness also introduce security risks if not properly managed.

Developer Luca Beurer-Kellner first raised the issue in early April. He warned that an MCP-based attack could leak WhatsApp messages via the protocol and bypass WhatsApp’s security.

Following that, Superoo7—head of Data and AI at Chromia—investigated and reported a potential vulnerability in Base-MCP. This issue affects Cursor and Claude, two popular AI platforms. The flaw allows hackers to use “prompt injection” techniques to change the recipient address in crypto transactions.

For example, if a user tries to send 0.001 ETH to a specific address, a hacker can insert malicious code to redirect the funds to their wallet. What’s worse, the user may not notice anything wrong. The interface will still show the original intended transaction details.

“This risk comes from using a ‘poisoned’ MCP. Hackers could trick Base-MCP into sending your crypto to them instead of where you intended. If this happens, you might not notice,” Superoo7 said.

Developer Aaronjmars pointed out an even more serious issue. Wallet seed phrases are often stored unencrypted in the MCP configuration files. If hackers gain access to these files, they can easily steal the seed phrase and fully control the user’s wallet and digital assets.

“MCP is an awesome architecture for interoperability & local-first interactions. But holy shit, current security is not tailored for Web3 needs. We need better proxy architecture for wallets,” Aaronjmars emphasized.

So far, no confirmed cases of this vulnerability being exploited to steal crypto assets exist. However, the potential threat is serious.

According to Superoo7, users should protect themselves by using MCP only from trusted sources, keeping wallet balances minimal, limiting MCP access permissions, and using the MCP-Scan tool to check for security risks.

Hackers can steal seed phrases in many ways. A report from Security Intelligence at the end of last year revealed that an Android malware called SpyAgent targets seed phrases by stealing screenshots.

Kaspersky also discovered SparkCat malware that extracts seed phrases from images using OCR. Meanwhile, Microsoft warned about StilachiRAT, malware that targets 20 crypto wallet browser extensions on Google Chrome, including MetaMask and Trust Wallet.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market17 hours ago

Market17 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market16 hours ago

Market16 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market23 hours ago

Market23 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin23 hours ago

Altcoin23 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market15 hours ago

Market15 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1