Market

Is $0.415 the Key to Further Gains?

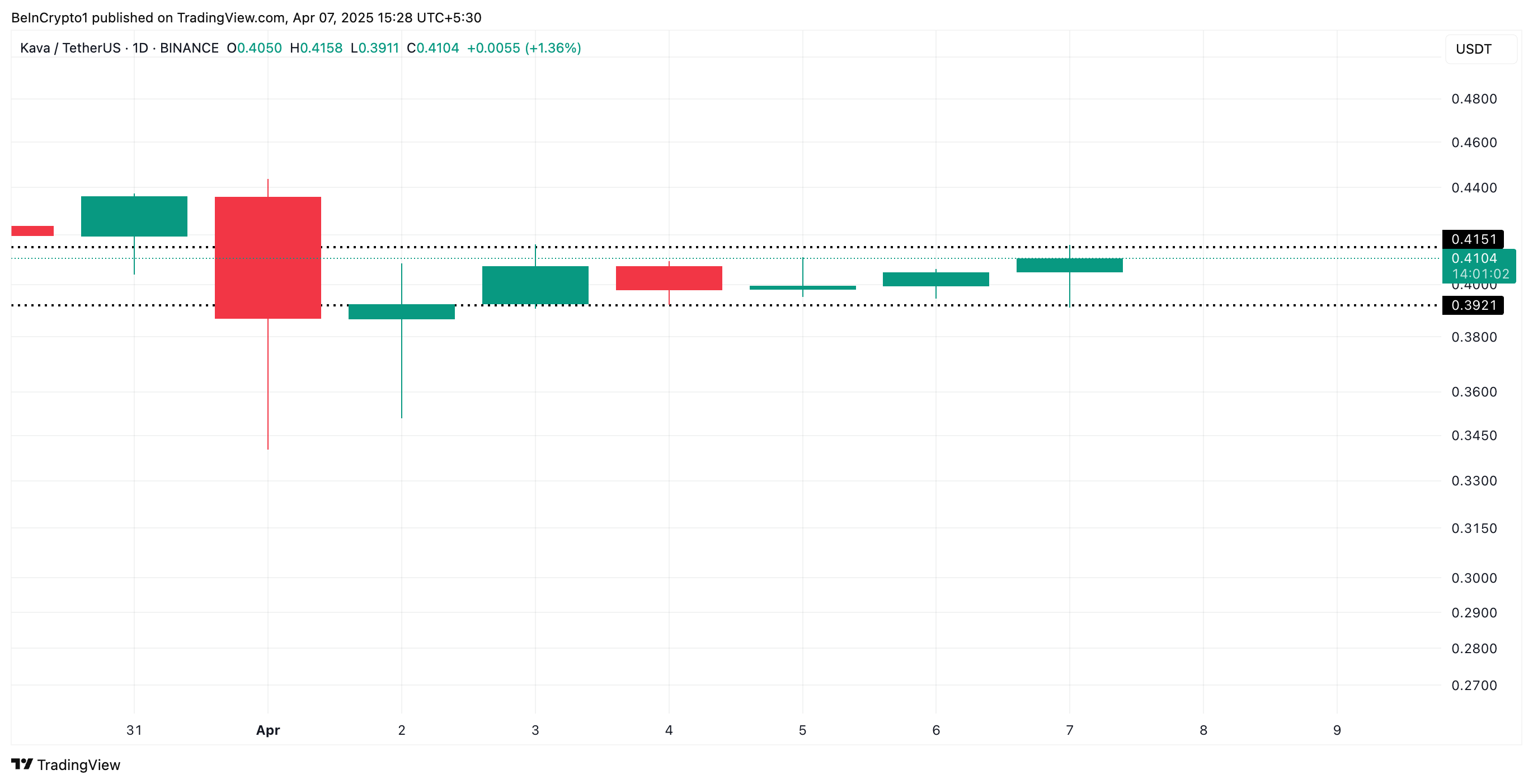

Layer-1 (L1) coin KAVA has emerged as the day’s top performer with a modest 0.10% gain over the past 24 hours. The coin remains range-bound despite this lead, signaling a relative balance between buying and selling pressure.

Still, the sentiment around KAVA is quietly bullish. With technical and on-chain indicators pointing to a surging positive bias, the altcoin might be poised for a breakout above its narrow range.

Buyers Dominate as KAVA Teases Break Above Resistance

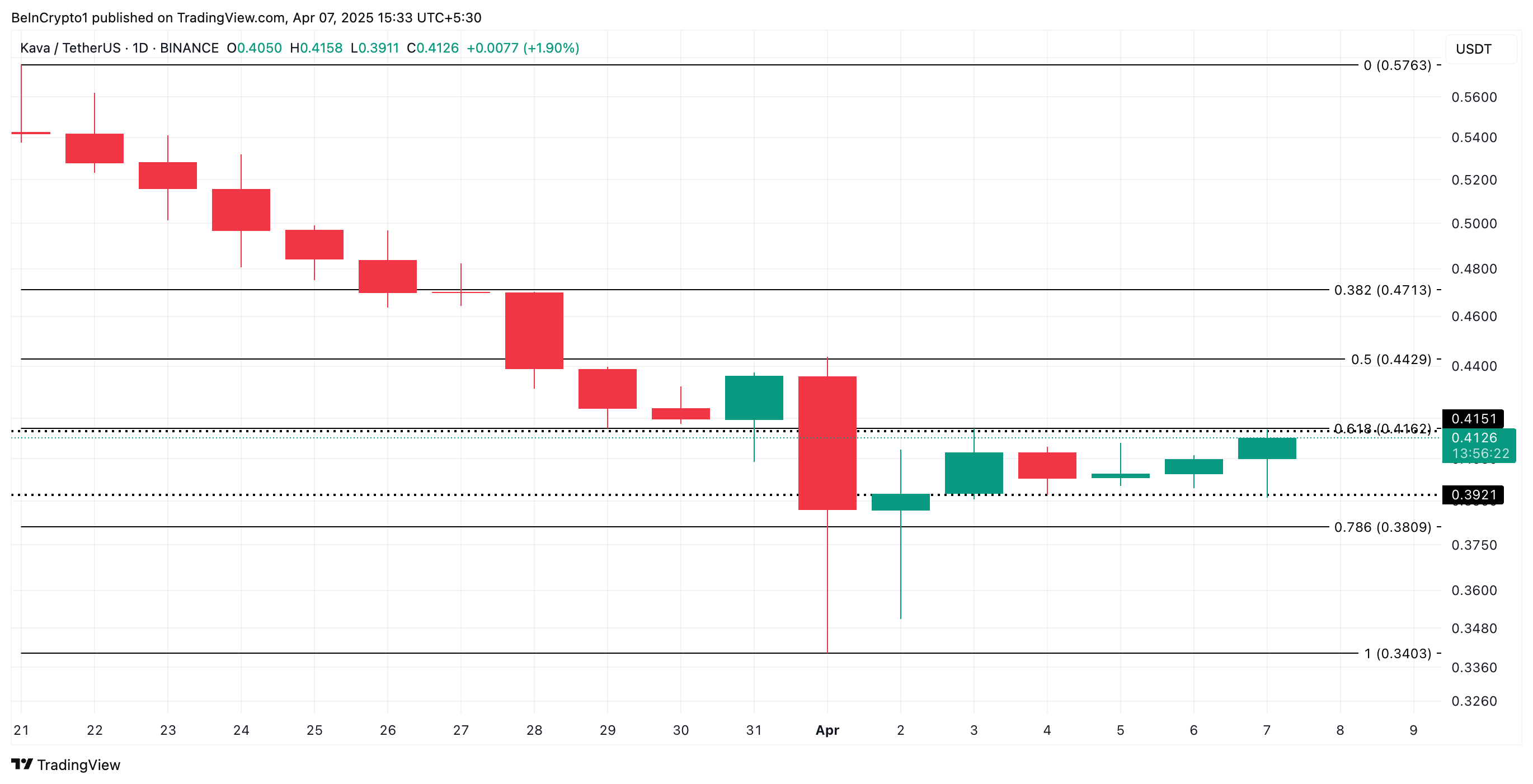

Since the beginning of April, KAVA’s price has oscillated within a range. The 98th largest crypto by market capitalization has faced resistance at $0.415 and has found support at $0.392.

With the gradual resurgence in bullish bias toward the altcoin, KAVA could see a break above the $0.415 resistance level in the near term.

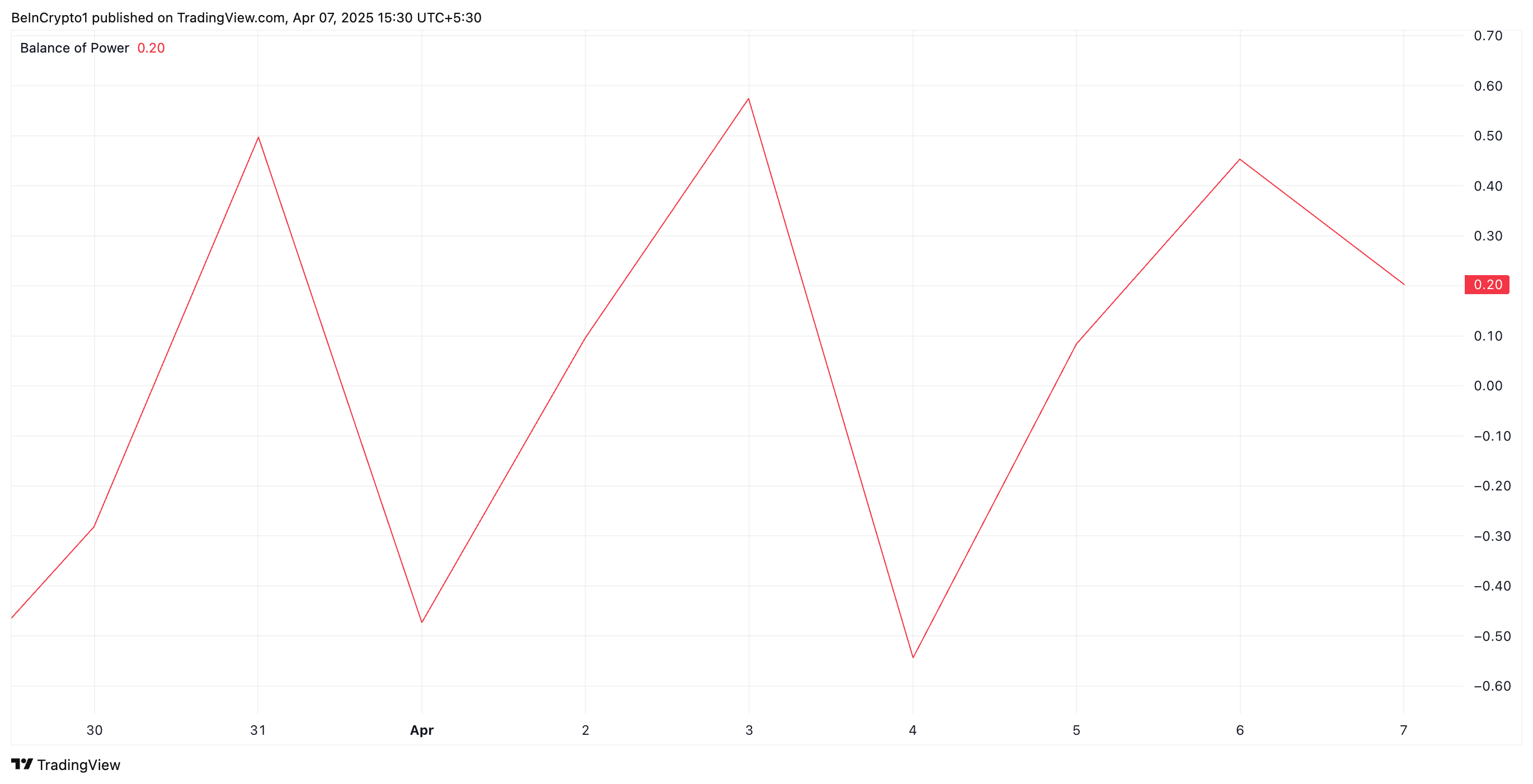

Its positive Balance of Power (BoP) on the daily chart confirms this outlook. At press time, this momentum indicator is at 0.20.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is negative, sellers are dominating the market over buyers.

Converesly, a positive BoP like this suggests that buying activity outweighs selling pressure. This reflects KAVA’s growing demand and potential for its price to appreciate further.

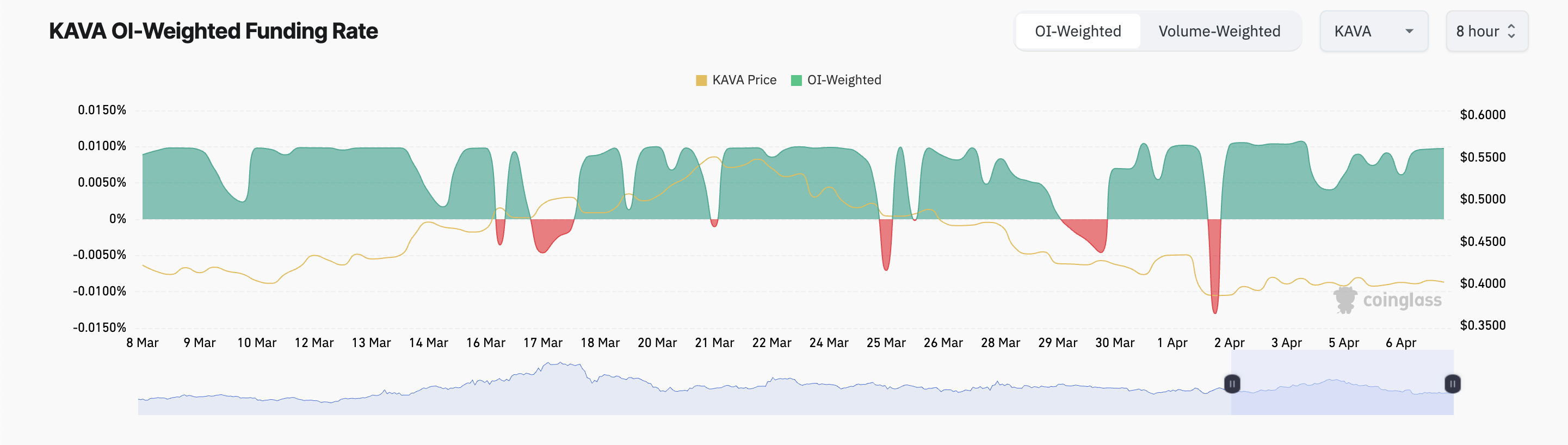

Moreover, the coin’s positive funding rate highlights the bullish sentiment among KAVA’s futures traders. As of this writing, the metric stands at 0.0097%.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep prices aligned with the spot market. KAVA’s positive funding rate means long positions are paying short. This trend indicates that more KAVA traders are betting on its price to increase.

KAVA Approaches Breakout—Can It Flip $0.41 Into Support?

KAVA’s strengthening buying pressure could trigger a break above the resistance at $0.415. If this price level is successfully flipped into a support floor, KAVA’s uptrend will gain momentum and could reach $0.44.

Conversely, if profit-taking spikes, the coin could slip below support at $0.392. In this scenario, KAVA’s price could fall further to $0.38.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

RWA Tokenization Takes Center Stage in Hong Kong

At this week’s series of Web3 events in Hong Kong, industry leaders are highlighting real world asset (RWA) tokenization as a pivotal evolution in blockchain’s journey toward mainstream adoption.

“This is the perfect time for our whole industry,” said Shukyee Ma, Chief Strategy Officer of Plume, during an exclusive interview. “After last year’s disappointment with DeFi yields, users are looking for something new, and we have the tokenized assets ready.”

Read more: The Impact of Real World Asset (RWA) Tokenization

Purpose-Built Blockchains Leading the Way

A key trend emerging from the discussions is the development of purpose-built blockchains specifically designed for RWAs, rather than using existing general-purpose chains.

“All those public chains are not built for RWA protocols,” explained Ma. “That’s why we build this RWA chain and put DeFi composability on top of it to make it easier for crypto users to adopt.”

“Over the next 10 years we’re going to see a lot of existing fungible assets coming on chain—US treasuries, sovereign bonds, equities,” predicted Jayant Ramanand, Co-founder of MANTRA. “As these assets come on chain, you’ll have fungible, movable value that can be transferred across the world instantly.”

Regulatory Challenges and Opportunities

Industry professionals identified regulatory certainty as vital for widespread adoption.

“In order to further unlock the potential of this technology and encourage traditional finance to adopt it, we issued circulars to provide guidance,” said Elizabeth Wong, Director of Fintech at Hong Kong’s Securities and Futures Commission. “We maintained it to be agnostic to the technology used, as each blockchain has their benefits and limitations.”

Vivian Mei, a lawyer specializing in RWA compliance, observed that global regulatory frameworks are becoming increasingly aligned: “The overall regulatory landscape is moving toward high convergence in terms of virtual asset definitions, KYC requirements, and compliance standards.”

George Chou, Chief Fintech Officer at Hong Kong Monetary Authority, highlighted their Project Ensemble initiative: “We want to explore an innovative market infrastructure with the industry to facilitate settlement using tokenized money, and identify impactful domestic and cross-border use cases with leading experts and industry pioneers.”

Bridging Traditional Finance with Crypto

“It’s not just simply bringing offline assets on-chain. It’s providing a structural change in how the real world and virtual world connect,” said JJ from The PAC, whose platform recently tokenized a quantitative fund with approximately $100 million in assets.

While financial assets will lead early adoption, Rachel Keum, CEO of VaultX, offers a different approach with her platform tokenizing art assets using NFC technology: “Our mission is to revolutionize RWA ownership by empowering digital-illiterate creators and collectors to unlock new value in the digital economy.” She explained that VaultX had already launched partnerships with galleries across Asia and Europe, creating a decentralized marketplace for artists to receive ongoing royalties from secondary sales.

Consumer-focused applications are also emerging. “The real distribution is never for institutional investors—it’s for the people,” said EudemoniaCC from Morph, whose Black Card quickly gained popularity. “We’re trying to put payment and consumption at the center, letting people spend their crypto assets in the real world while bringing new audiences into the ecosystem.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

RWA Tokens Outperform Bitcoin During Tariffs

Binance Research published its report on Trump’s tariffs and how they might impact the crypto market. It noted that the riskiest investments suffered the most, while RWAs and exchanges suffered the least.

Additionally, the perceived risk associated with Bitcoin increased, thanks to its new correlation with stock markets. Only 3% of its polled investors considered it their preferred asset class in the event of a trade war.

Binance Research Analyzes Tariffs

Binance Research, a subsidiary of the world’s largest crypto exchange, has been heavily exploring industry trends in 2025. Most recently, it reported significant gaps in latest crypto airdrops and distribution models.

Today, Binance Research produced its newest report, which concerns US tariffs.

President Trump’s proposed tariffs are particularly relevant to Binance, as they’ve had an outsized impact on the crypto market. The report notes that these will be the US’ most stringent tariffs since the 1930s, driving fears of stagflation and a global trade war.

Binance Research analyzed different crypto-related assets to determine their risks:

The claims are backed up by today’s market moves. For example, Ethereum fell to March 2023 levels, while MANTRA’s OM token rose after it announced a major RWA fund.

Apparently, RWAs are the crypto market sector that faces the lowest risks from tariffs. The report notes that the most vulnerable sectors are those perceived as the riskiest, such as meme coins and AI.

Both the AI tokens and meme coins sectors have dropped more than 50% since the tariff announcements, while RWA tokens have lost only 16%. Exchange-based tokens only dipped by 18%.

Binance Research further claims that only 3% of FMS investors view Bitcoin as their preferred asset class in the event of a trade war. Although one of the most popular narratives about Bitcoin is that it can hedge against inflation, this new correlation may impact that characteristic.

“Macroeconomic factors — particularly trade policy and rate expectations — are increasingly driving crypto market behavior, temporarily eclipsing underlying demand dynamics. Whether this correlation structure persists will be key to understanding Bitcoin’s longer-term positioning and diversification value,” Binance Research claimed.

Ultimately, the report identified a lot of factors that could seriously influence the crypto market. A few of the other factors include trade war escalation, rising inflation, Federal Reserve policy, and crypto-specific developments.

“The risk-off response to the reciprocal tariff announcement has seen the S&P 500 lose over $5 trillion in two trading days. Over the past 44 trading sessions, the US stock market has lost over $11 trillion, a figure that accounts for about 38% of the entire country’s GDP. Trump’s tariff policies have intensified recession fears, with JP Morgan raising the odds to 60%,” Fakhul Miah, the Managing Director GoMining Institutional told BeInCrypto.

Overall, the key takeaway is that many variables are in play right now, but it’s still very possible to pick a safe option despite this chaos. Blockchain projects driven by utility and long-term development seem to be the safest option in the current volatile ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Pundit Reveals What Will Happen If XRP Price Does Not Break $2.3

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amidst ongoing market instability and volatility, the XRP price maintained support levels, even as many altcoins crashed this past week. A well-known crypto pundit has spotlighted a critical resistance level at $2.3, saying that XRP’s next move will largely depend on whether it can successfully break through this barrier.

XRP Price At $2.3: A Make Or Break Point

According to AMCrypto, an analyst on X (formerly Twitter), XRP had been maintaining strong support at $2. Compared to other altcoins that experienced severe price crashes earlier this year, XRP was one of the few that didn’t fall below the February capitulation price.

Related Reading

The $2 price level was a key support zone that acted as a barrier for XRP, as buyers stepped in to prevent further price decline. Notably, XRP had been consolidating just above this point for the past few months, showing immense resilience amid broader market volatility driven by news of the United States (US) tariff plans. However, recently XRP has dropped below $2 and is now trading at $1.68.

AMCrypto has shared a price chart, highlighting that XRP recently broke out of a Descending Triangle pattern — a formation usually associated with strong price moves. However, for this breakout to have real momentum, the altcoin must push past the critical resistance level at $2.3.

If XRP manages to clear this resistance level, the analyst predicts that its price could experience a rapid push toward the $3.00 – $3.20 region, marking new highs. Looking at the analyst’s price chart, historically, the token has experienced two strong breakouts from similar Descending Triangles. The most recent triangle saw XRP break above the $2.3 resistance zone with strong bullish candles.

AMCrypto has warned that without a decisive breakout above the $2.3 resistance, XRP’s price action will likely remain confined in a wider consolidation range. This does not bode well for a short-term momentum, as it would limit further upward movement for the cryptocurrency until stronger bullish confirmation emerges.

Analyst Predicts Price Crash To $0.6

The XRP price appears to be mirroring the broader market’s bearish trend, plunging by approximately 20% in the last 24 hours, according to CoinMarketCap. The cryptocurrency has also declined by 30% over the past month, highlighting sustained downward pressure and waning investor confidence.

Related Reading

In a recent post on X, crypto analyst Jesse Colombo pointed out XRP’s recent breakdown below key support zones, warning that the cryptocurrency is likely headed for an even deeper price crash to $0.6. The analyst highlighted the formation of a Head and Shoulder pattern on the price chart, a classic bearish reversal signal that often precedes a significant downward move.

With XRP’s price currently trading at $1.68, a decline to $0.6 would represent a significant 64% decrease. Notably, AMCrypto has identified new support levels between $2 and $2.2, indicating that a rebound to this range could act as a critical barrier against further downside for the altcoin.

Featured image from Adobe Stock, chart from Tradingview.com

-

Market18 hours ago

Market18 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market22 hours ago

Market22 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Bitcoin19 hours ago

Bitcoin19 hours ago$1 Billion in Liquidations Over the Weekend

-

Market19 hours ago

Market19 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low

-

Bitcoin17 hours ago

Bitcoin17 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Market16 hours ago

Market16 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market13 hours ago

Market13 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Altcoin13 hours ago

Altcoin13 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?