Ethereum

Is Ethereum Price Nearing A Bottom? This Bullish Divergence Suggests So

The cryptocurrency market was fairly stable despite the global macroeconomic headwind that rocked the traditional markets during the past week. The Ethereum price didn’t enjoy the same relief as other large-cap assets, beginning the month of April almost as it ended the first quarter of 2025.

The second-largest cryptocurrency is on the verge of losing the $1,800 level, having declined in value by almost 5% in the past week. However, the latest on-chain data suggests that the Ethereum price might be close to a bottom and might be readying for a rebound in the coming weeks.

Rising Metric Says Ethereum Price Might Be Ready For A Comeback

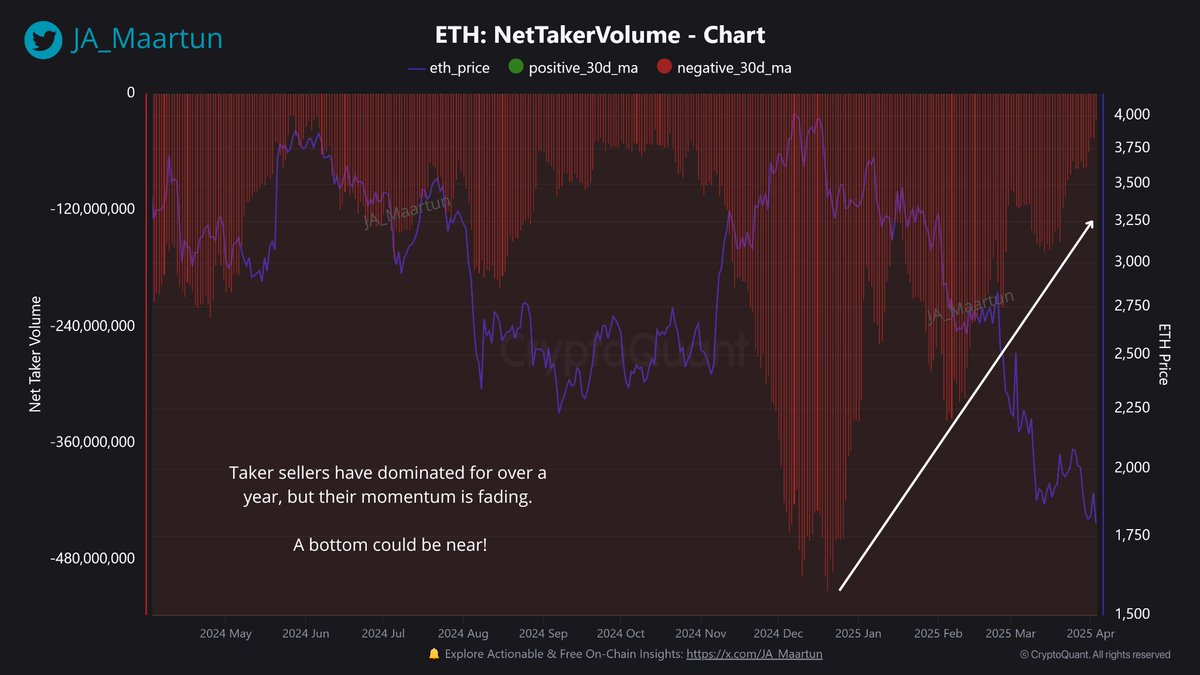

In a recent post on the X platform, on-chain analyst Maartunn shared a fresh insight into the activity of Ethereum investors on centralized exchanges. According to the crypto pundit, this latest on-chain shift suggests that a new bottom could be brewing for the Ethereum price.

The relevant indicator here is the Net Taker Volume metric, which tracks the difference between taker buy volume and taker sell volume in a particular asset market (Ethereum, in this case). This on-chain indicator can be used to gauge the strength of the selling or buying pressure in the market.

When the Net Taker Volume is positive, it indicates that aggressive buying activity (taker buys) is overwhelming selling activity (taker sells), suggesting a growing bullish sentiment. A negative metric implies that the taker sell volume is higher than the taker buy volume, which is typically a bearish signal.

Maartunn noted in his post that aggressive selling activity has been outweighing the buying activity in the Ethereum market for over a year. However, the on-chain analyst highlighted that the taker sell volume appears to be waning and losing some steam in the past few weeks.

Source: @JA_Maartun on X

As shown in the chart above, the Net Taker Volume is forming higher lows, even as the Ethereum price is making new lower lows. This classic bullish divergence suggests that the altcoin could be preparing to bottom out and experience a bullish reversal.

As of this writing, the ETH token is valued at around $1,806, reflecting a roughly 1% price jump in the past 24 hours.

ETH Whales Trimming Their Holdings

Interestingly, a conflicting piece of on-chain data has also emerged, showing that an important class of investors known as whales has been offloading their assets. This investor cohort is influential on the market dynamics due to their significant holdings and, as such, is typically monitored by other investors.

Source: @ali_charts on X

In a April 4 post on X, crypto analyst Ali Martinez revealed that whales (holding between 10,000 and 100,000 coins) have sold over 500,000 ETH tokens in the past 48 hours. Considering the size of this sell-off and the influence of the investors, this activity could be a bearish roadblock for a possible Ethereum price recovery.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

After a slight rebound on Tuesday to the $1,600 threshold, Ethereum‘s price was faced with notable resistance, which led to a sudden breakdown to $1,450. ETH’s persistent weak performance this year has impacted investor conviction in the market, triggering significant selling pressure in the past few weeks.

Bearish Sentiment Toward Ethereum Grows On Binance

The bearish sentiment toward Ethereum has increased in crypto exchanges, especially on Binance, the world’s largest cryptocurrency exchange. Verified author and on-chain expert for CryptoQuant, Darkfost, revealed that ETH’s Open Interest (OI) on Binance continues to see a steady decline.

The persistent drop in open interest on the crypto exchange indicates that ETH‘s derivatives market is cooling down. It also reflects rising caution among investors and traders as the altcoin battles to sustain its bullish momentum.

Darkfost highlighted that the open interest on Binance continues to drop without stopping and is now changing under its 365 Simple Moving Average (SMA). This movement implies that speculative activity is pulling back as investors might be waiting for more certain signals before making a forceful comeback to the market.

After hitting an all-time high of $7.78 billion in December, the open interest on Binance has decreased by almost 50% between December and April, wiping out nearly $4 billion within the period. The chart shows that ETH’s open interest on Binance is now valued at $3.1 billion, suggesting a massive shift in investor sentiment on the platform.

According to the on-chain expert, Ethereum’s price has been significantly impacted by this sharp drop, and there are no indications that the ongoing downward trend will be stopping anytime soon. Furthermore, it reflects the magnitude of recent liquidations as well as a heightened aversion to risk among investors.

In the event that the trend continues, Darkfost noted that “Ethereum’s price is still far from entering a period of stability.” Thus, Darkfost has urged traders to monitor investors’ behavior on Binance, which remains a valuable indicator since the largest trade volumes across the market are regularly captured by the crypto platform.

ETH Is Poised For A Massive Upswing To New All-Time Highs

With ETH’s open interest decreasing on the largest crypto exchange and the market extremely volatile, this raises concerns about its price stability. Nonetheless, many crypto analysts are confident that a rebound could be on the horizon, which is likely to push the altcoin toward new highs.

Market expert and trader Milkybull Crypto shared a post on the X platform, outlining Ethereum’s potential to surge significantly in the upcoming weeks. At the time of the post, ETH was trading at $1,585, and the expert stated that the altcoin typically marks a macro bottom at this level. Should this level hold, Milkybull anticipates a huge rally, putting his next target at the $10,000 milestone.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Major Ethereum Whale Dumps 10,000 ETH After 2 Years, Is It Time To Get Out?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even through a bull market. This capitulation from the ETH whale suggests it might be a good time to offload the leading altcoin, with a further crash in the coming weeks a possibility.

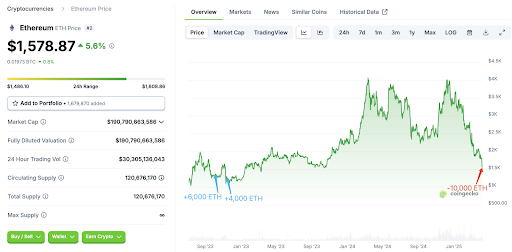

Ethereum Whale Dumps 10,000 ETH After 900 Days

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale finally capitulated after holding for over 900 days, selling all their 10,000 ETH for $15.71 million. This whale had originally bought 10,000 ETH for $12.95 million at an average price of $1,295 on October 4 and November 14, 2022.

Related Reading

The Ethereum whale didn’t sell any of their ETH holdings, even when the leading altcoin broke through $4,000 twice in 2024. However, the whale has now capitulated with the Ethereum price below $1,500, nearing their average entry price of $1,295. The investor sold the coins for a $2.75 million profit, while their unrealized profit was $27.6 million at its peak.

This Ethereum whale isn’t the only one who is capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 coins in the space of 48 hours. This development is thanks to Ethereum’s massive crash, with the leading altcoin at risk of dropping lower. This decline is part of a broader crypto market crash, which has occurred due to Donald Trump’s tariffs.

Trump’s tariffs have led to a major trade war with China, which has promised not to back down, further sparking concerns among investors. As such, the Ethereum price looks more likely to suffer a further crash in the meantime, which explains why these Ethereum whales are capitulating to cut their losses.

Donald Trump’s World Liberty Financial Also Capitulating?

Donald Trump’s World Liberty Financial (WLFI), an Ethereum whale, looks to be feeling the heat and might have already started capitulating. Citing Arkham Intelligence’s data, Lookonchain revealed that a wallet possibly linked to WLFI sold 5,471 ETH for $8.01 million at the price of $1,465, representing a loss for the whale in question.

Related Reading

World Liberty Financial had previously bought 67,498 ETH for $210 million at an average price of $3,259. The crypto firm is now sitting on an unrealized loss of $125 million, seeing as the Ethereum price has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum price will crash further in the short term, indicating that Ethereum whales like WLFI could witness more unrealized loss on their ETH holdings. Martinez stated that $1,200 could be where the leading altcoin finds its footing.

At the time of writing, the Ethereum price is trading at around $1,400, down over 8% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Uncertainty Rocks Market As ETH/BTC Drops To 6-Year Low, Where Is Bitcoin Headed Next?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin price continues to lead the market and with each crash, it has taken down the altcoin market with it. Amid this, Ethereum has performed especially poorly, returning to prices not seen since seven years ago. As Donald Trump’s tariff situation rocks the market, the question on everyone’s lips is, where is the Bitcoin price headed from here?

Market Experts Chime In On Bitcoin Price

Crypto market sentiment has tanked to levels not seen in years with the Bitcoin crash into the $ 70,000 territory, and according to many, the battle is far from over. One of the experts who have said that the Bitcoin price could stay low during this time is Alex Guts, CEO of Banxe.

Related Reading

According to Guts, the BTC price could continue to trade in a tight $72,000-$84,000 range during this time. Looking over for the long-term, the CEO sees “prospects staying bullish as adoption and policy support grow.”

On the same note, while Trump’s policies and tariff wars have caused the markets to tank, expectations remain that this could be good for the markets in the long term. In an analysis shared with NewsBTC, a Bitunix expert analyst pointed out that what the Trump administration is doing is “igniting a regulatory renaissance for crypto.”

He points out that all of the President’s actions since he took office have shown this, especially with his empowerment of crypto leaders. So, despite the market being down now, Trump’s moves could end up igniting further growth for the market.

The Bitunix analyst warns that investors should not allow the news of the tariff wars to cloud their judgment. He outlines that sometimes it is imperative to implement new things in order to fix what is broken, likening it to ‘taking medicine’.

As for where the Bitcoin price could be headed next from here, the expert analyst told NewsBTC:

“Well, the recent price drop in major cryptocurrencies has worried retail investors, but we believe that Bitcoin could potentially reach $117k after the dust settles.”

The Sad State Of Affairs Of ETH/BTC

Despite being the second-largest cryptocurrency in the world, the Ethereum price has performed poorly, especially in comparison to Bitcoin. Looking at the ETH/BTC chart, there seems to be no support in sight as the crash continues.

Related Reading

So far, Ethereum has fallen to 0.01889 BTC, a level that has not been recorded since 2019. This suggests that Ethereum has completely retraced its gains from the past six years, plunging believers and supporters into deep losses.

For a turnaround for Ethereum, it seems major news would have to come out to propel a recovery. Otherwise, the lack of support suggests that Ethereum holders have more turbulence ahead of them to deal with.

Featured image from Dall.E, Chart from TradingView.com

-

Market24 hours ago

Market24 hours ago5 RWA Altcoins to Watch In April 2025

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Crashes Below $75,000 As Asian Stock Markets Bleed

-

Bitcoin19 hours ago

Bitcoin19 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Altcoin18 hours ago

Altcoin18 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Market17 hours ago

Market17 hours agoDogecoin (DOGE) at Risk of More Losses as Market Volatility Spikes

-

Market15 hours ago

Market15 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Market23 hours ago

Market23 hours agoBerachain Drops 47% in a Month as Bearish Signals Grow

-

Altcoin15 hours ago

Altcoin15 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?