Ethereum

Ethereum Whales Dump 500,000 ETH In 48 Hours: On-Chain Data

Ethereum is trading below the $1,900 level as selling pressure continues to mount, raising concerns that the recent downtrend could extend further. After losing the critical $2,500 support in late February, bulls have struggled to regain control. What began as a minor pullback has turned into a broader correction, disappointing investors who had anticipated a bullish 2025 for ETH.

The failure to reclaim key levels has eroded market confidence, and price action remains weak across both short and mid-term timeframes. Ethereum’s inability to sustain even brief recoveries has only reinforced the bearish sentiment that has gripped the crypto space in recent weeks.

Adding to the negative outlook, new data from Santiment reveals that whales have sold approximately 500,000 ETH over the past 48 hours. This massive distribution by large holders highlights a clear lack of confidence among some of the most influential players in the market — a trend that could weigh heavily on Ethereum’s near-term performance.

As ETH hovers below $1,900, all eyes are on whether bulls can defend remaining support levels, or if continued selling from whales and broader market uncertainty will drive the price further down in the days ahead.

Ethereum Whale Selling Fuels Bearish Outlook

Ethereum is down 55% from its December high, with price action continuing to reflect the broader market’s weakness. The selloff has been sharp and consistent, fueled by growing macroeconomic uncertainty and global instability. The latest wave of volatility was triggered by US President Donald Trump’s renewed tariff threats and unpredictable policy direction, which have spooked financial markets and driven capital away from high-risk assets.

As a result, Ethereum — a key altcoin with deep ties to speculative sentiment — has become one of the hardest-hit major cryptocurrencies. Bulls are struggling to hold support near the $1,800 level, and every attempt to rally has been met with renewed selling pressure. Without a clear shift in trend, ETH remains vulnerable to further downside in the near term.

Adding to the bearish sentiment, top analyst Ali Martinez shared data showing that whales sold 500,000 ETH over the last 48 hours. This massive distribution from large wallets suggests that even experienced market participants are growing increasingly cautious. Such activity tends to precede deeper corrections, particularly when accompanied by weak technicals and broader risk-off sentiment.

Unless Ethereum can reclaim key resistance levels and show signs of accumulation, the current trend may continue to favor sellers. As markets digest macro developments, ETH holders are watching closely for any indication that the worst is over — but for now, the pressure remains firmly to the downside.

Ethereum Trades At $1,810 As Bulls Defend Crucial Support

Ethereum is trading at $1,810 after repeated failed attempts to reclaim the $1,900 level. The price continues to face strong resistance, and bullish momentum has significantly weakened in recent weeks. Bulls are now in a critical position, with $1,800 emerging as the most important support level in the current cycle. A decisive breakdown below this mark could trigger a deeper correction, potentially sending ETH as low as $1,550 — a zone not seen since mid-2023.

The broader crypto market remains under pressure, and Ethereum’s price action reflects that. Sentiment has been weighed down by macroeconomic headwinds and aggressive selling from whales, adding to the difficulty for bulls to regain control. Still, hope remains if ETH can stabilize and push higher in the coming sessions.

A breakout above the $2,000 level would mark a significant shift in momentum and could spark a strong recovery rally. That level remains the psychological and technical threshold for a potential trend reversal. Until then, Ethereum continues to walk a tightrope between consolidation and further downside, with bulls needing to hold $1,800 at all costs to avoid cascading losses. The next few days will be crucial in determining ETH’s short-term direction.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Major Ethereum Whale Dumps 10,000 ETH After 2 Years, Is It Time To Get Out?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even through a bull market. This capitulation from the ETH whale suggests it might be a good time to offload the leading altcoin, with a further crash in the coming weeks a possibility.

Ethereum Whale Dumps 10,000 ETH After 900 Days

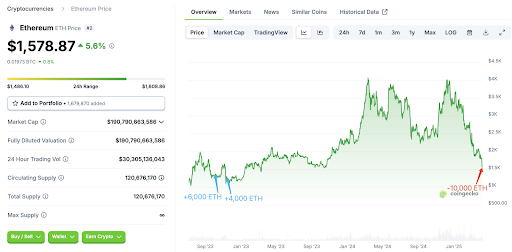

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale finally capitulated after holding for over 900 days, selling all their 10,000 ETH for $15.71 million. This whale had originally bought 10,000 ETH for $12.95 million at an average price of $1,295 on October 4 and November 14, 2022.

Related Reading

The Ethereum whale didn’t sell any of their ETH holdings, even when the leading altcoin broke through $4,000 twice in 2024. However, the whale has now capitulated with the Ethereum price below $1,500, nearing their average entry price of $1,295. The investor sold the coins for a $2.75 million profit, while their unrealized profit was $27.6 million at its peak.

This Ethereum whale isn’t the only one who is capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 coins in the space of 48 hours. This development is thanks to Ethereum’s massive crash, with the leading altcoin at risk of dropping lower. This decline is part of a broader crypto market crash, which has occurred due to Donald Trump’s tariffs.

Trump’s tariffs have led to a major trade war with China, which has promised not to back down, further sparking concerns among investors. As such, the Ethereum price looks more likely to suffer a further crash in the meantime, which explains why these Ethereum whales are capitulating to cut their losses.

Donald Trump’s World Liberty Financial Also Capitulating?

Donald Trump’s World Liberty Financial (WLFI), an Ethereum whale, looks to be feeling the heat and might have already started capitulating. Citing Arkham Intelligence’s data, Lookonchain revealed that a wallet possibly linked to WLFI sold 5,471 ETH for $8.01 million at the price of $1,465, representing a loss for the whale in question.

Related Reading

World Liberty Financial had previously bought 67,498 ETH for $210 million at an average price of $3,259. The crypto firm is now sitting on an unrealized loss of $125 million, seeing as the Ethereum price has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum price will crash further in the short term, indicating that Ethereum whales like WLFI could witness more unrealized loss on their ETH holdings. Martinez stated that $1,200 could be where the leading altcoin finds its footing.

At the time of writing, the Ethereum price is trading at around $1,400, down over 8% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Uncertainty Rocks Market As ETH/BTC Drops To 6-Year Low, Where Is Bitcoin Headed Next?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin price continues to lead the market and with each crash, it has taken down the altcoin market with it. Amid this, Ethereum has performed especially poorly, returning to prices not seen since seven years ago. As Donald Trump’s tariff situation rocks the market, the question on everyone’s lips is, where is the Bitcoin price headed from here?

Market Experts Chime In On Bitcoin Price

Crypto market sentiment has tanked to levels not seen in years with the Bitcoin crash into the $ 70,000 territory, and according to many, the battle is far from over. One of the experts who have said that the Bitcoin price could stay low during this time is Alex Guts, CEO of Banxe.

Related Reading

According to Guts, the BTC price could continue to trade in a tight $72,000-$84,000 range during this time. Looking over for the long-term, the CEO sees “prospects staying bullish as adoption and policy support grow.”

On the same note, while Trump’s policies and tariff wars have caused the markets to tank, expectations remain that this could be good for the markets in the long term. In an analysis shared with NewsBTC, a Bitunix expert analyst pointed out that what the Trump administration is doing is “igniting a regulatory renaissance for crypto.”

He points out that all of the President’s actions since he took office have shown this, especially with his empowerment of crypto leaders. So, despite the market being down now, Trump’s moves could end up igniting further growth for the market.

The Bitunix analyst warns that investors should not allow the news of the tariff wars to cloud their judgment. He outlines that sometimes it is imperative to implement new things in order to fix what is broken, likening it to ‘taking medicine’.

As for where the Bitcoin price could be headed next from here, the expert analyst told NewsBTC:

“Well, the recent price drop in major cryptocurrencies has worried retail investors, but we believe that Bitcoin could potentially reach $117k after the dust settles.”

The Sad State Of Affairs Of ETH/BTC

Despite being the second-largest cryptocurrency in the world, the Ethereum price has performed poorly, especially in comparison to Bitcoin. Looking at the ETH/BTC chart, there seems to be no support in sight as the crash continues.

Related Reading

So far, Ethereum has fallen to 0.01889 BTC, a level that has not been recorded since 2019. This suggests that Ethereum has completely retraced its gains from the past six years, plunging believers and supporters into deep losses.

For a turnaround for Ethereum, it seems major news would have to come out to propel a recovery. Otherwise, the lack of support suggests that Ethereum holders have more turbulence ahead of them to deal with.

Featured image from Dall.E, Chart from TradingView.com

Ethereum

Analyst Reveals What Could Come Next

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

-

Market23 hours ago

Market23 hours agoIs Ethereum Falling to $1,000 This April?

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows

-

Market21 hours ago

Market21 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Market20 hours ago

Market20 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Altcoin20 hours ago

Altcoin20 hours agoWhy Is XRP Price Falling After ETF Hype?

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Makes Important Move in Ripple Case, Here’s All

-

Market19 hours ago

Market19 hours agoCardano (ADA) Surges 8% as Bulls Push for Breakout

-

Market18 hours ago

Market18 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China