Bitcoin

Bitcoin (BTC) To Take Off In June, Analyst Pins Market Target At $175,000

Since hitting a new all-time high in January, Bitcoin (BTC) has struggled to establish a bullish form resulting in a downtrend that has lasted over the last two months. According to prominent market analyst Egrag Crypto, the premier cryptocurrency could likely remain in correction for the next few months before launching a price rally.

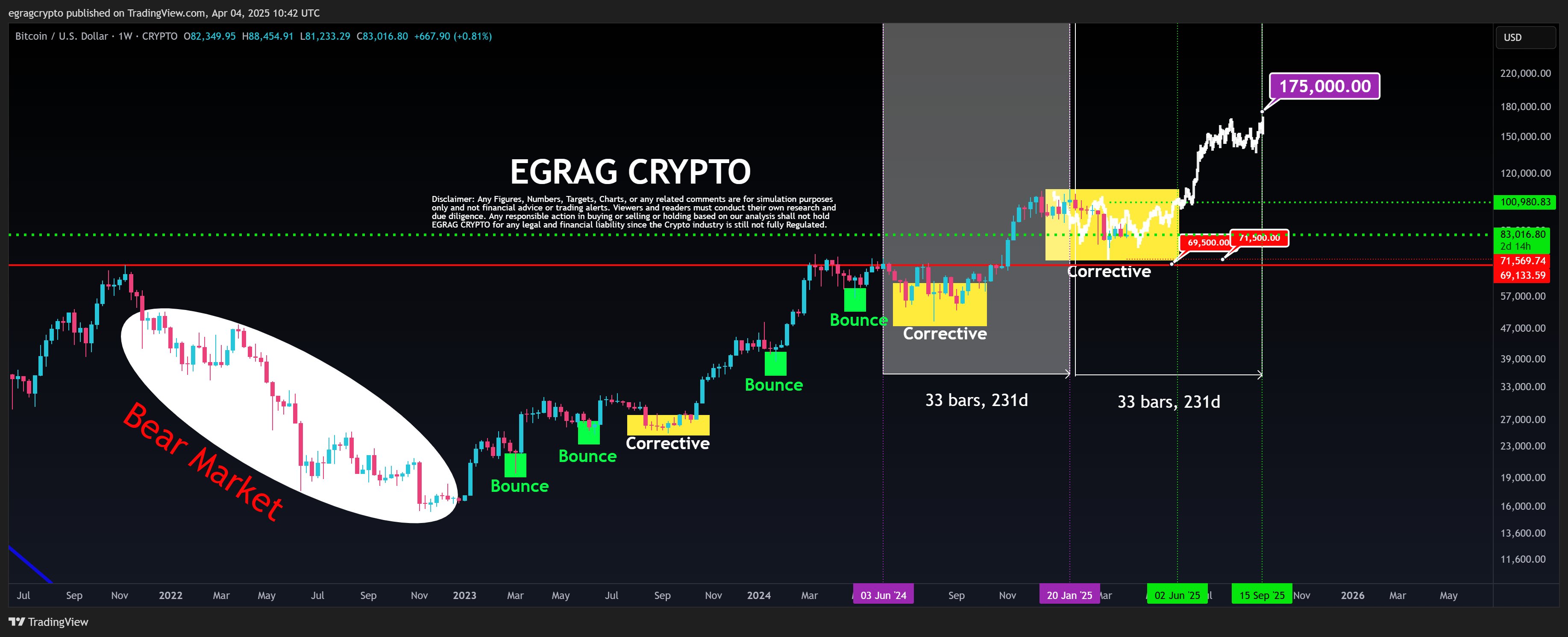

Bitcoin’s 231-Day Cycle Hints At $175,000 Target By September

Following an initial price decline in February, Egrag Crypto had postulated Bitcoin could experience a price correction due to a CME gap before experiencing a price bounce. However, the lack of strong bullish convictions over the past weeks has forced a conclusion that the premier cryptocurrency is stuck in a potentially long corrective phase.

According to Egrag in a recent post, Bitcoin’s ongoing correction aligns with a fractal pattern i.e. a repeating price structure that has appeared across multiple timeframes. This pattern is based on a 33-bar (231-day) cycle during which BTC transits from a corrective phase to an explosive price rally.

In comparing previous cycles to the current developing one, Egrag has predicted Bitcoin could potentially break out of its recalibration by June. In this case, the analyst expects the crypto market leader to hit a market top of $175,000 by September, hinting at a potential 107.83% gain on current market prices.

However, in igniting this price rally, market bulls must ensure a breakout above the stiff price barrier at $100,000. On the other hand, any potential fall below the $69,500-$71,500 support price level could invalidate this current bullish setup and possibly signal the end of the current bull run.

BTC Investors Wait As Exchange Activity Slows Down

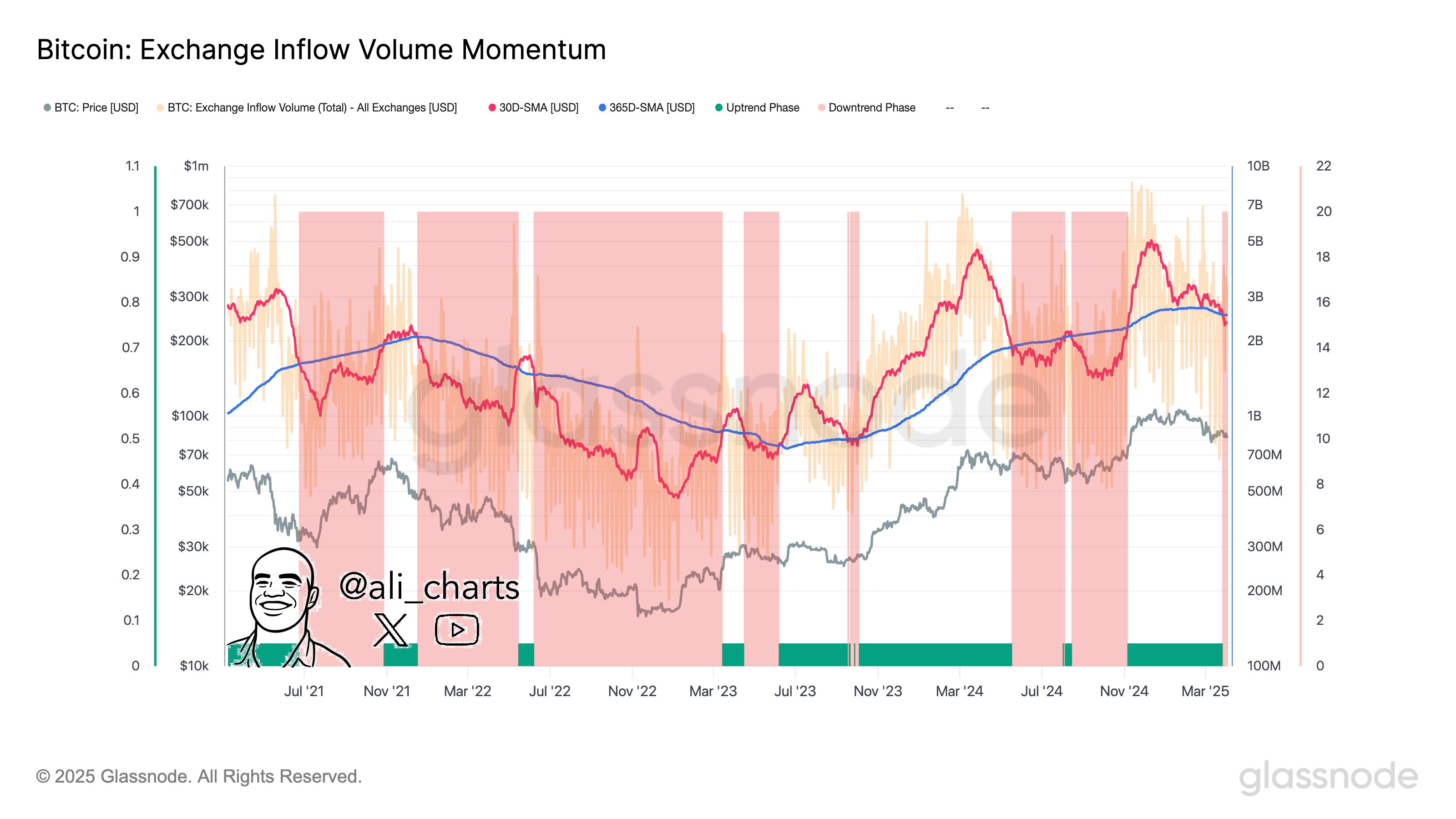

In other news, popular crypto expert Ali Martinez has reported a decline in Bitcoin exchange-related activity indicating reduced investors’ interest and network utilization. Notably, this development suggests that investors are hesitating to deposit or withdraw Bitcoin on exchanges perhaps due to market uncertainty on the asset’s immediate future trajectory.

According to Martinez, Bitcoin is now likely to undergo a trend shift as investors wait for the next market catalyst. Notably, Bitcoin has shown commendable resilience despite the new tariffs imposed by the US government on April 2. According to data from Santiment, BTC’s price dipped only 4% in the hours following the announcement—a milder reaction compared to previous tariff-related market moves.

Since then, BTC has made some price gains and currently trades at $83,805 as investors flock to the crypto market which has recorded a $5.16 billion inflow over the past day. Meanwhile, BTC’s trading volume is up by 26.52% and is valued at $43.48 billion.

Featured image from UF News, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin Whale Activity Peaks Amid Market Uncertainty

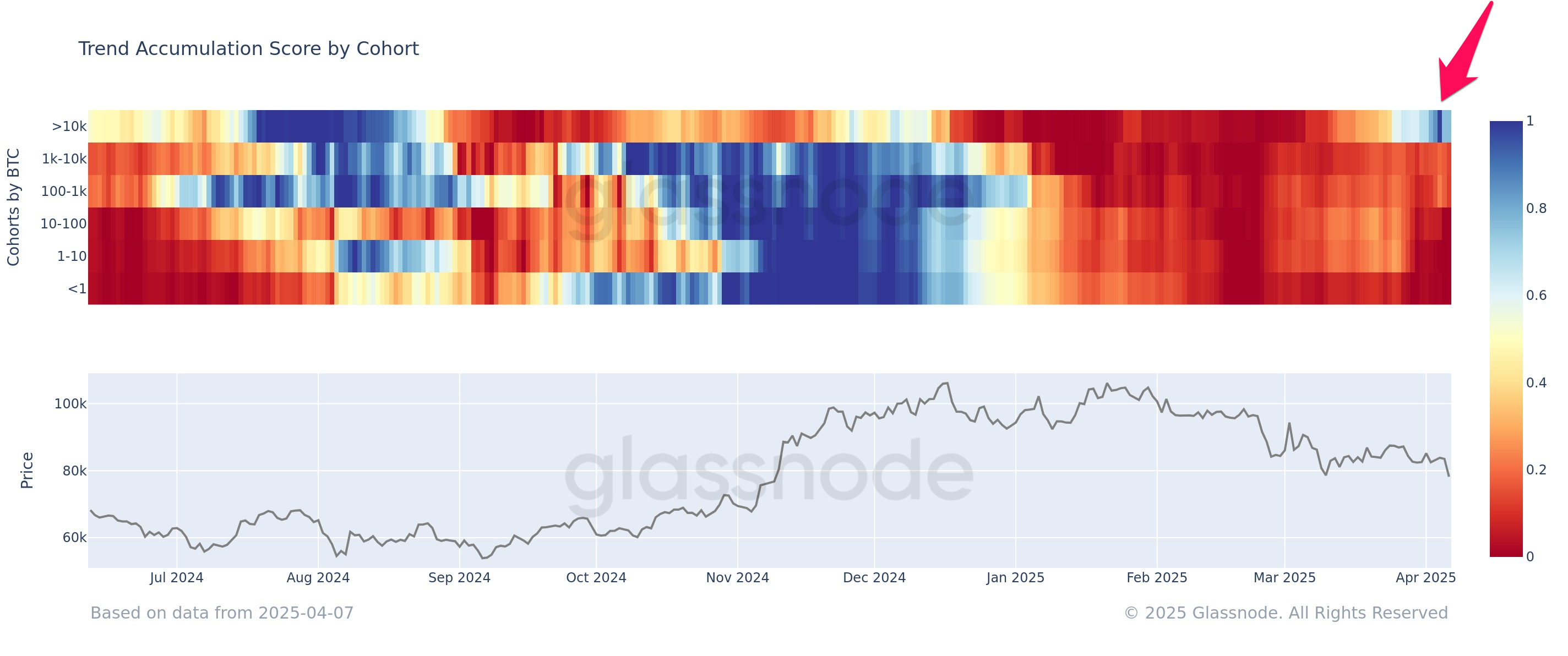

According to Glassnode, Bitcoin whales—entities holding over 10,000 BTC—achieved an accumulation score of approximately 1.0 earlier this month, reflecting intense buying activity.

This score marks a significant deviation from the behavior of smaller holders, who are leaning toward distribution.

Why Bitcoin Whales Are Buying While Smaller Holders Sell

Glassnode highlighted the shift in the latest X (formerly Twitter) post.

“Whales holding >10,000 BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month,” Glassnote posted.

This score reflected a 15-day period of intense purchasing activity. However, after this spike, the score slightly eased to around 0.65. While this suggested a more moderate pace of buying, it still pointed to steady accumulation by large holders.

Meanwhile, smaller Bitcoin holders, categorized as those with holdings between <1 BTC and 100 BTC, shifted their focus to distribution. On-chain data revealed that these cohorts have significantly increased their selling activity, with accumulation scores trending down to between 0.1 and 0.2.

“This divergence shows the bigger players are still accumulating, while smaller holders are selling. Market sentiment remains split,” a user noted on X.

The growing gap between the actions of large and small holders is indicative of differing market sentiments. Whales appear to be betting on Bitcoin’s long-term growth. At the same time, smaller holders may be more cautious or reactive, choosing to liquidate their positions as a hedge against potential market downturns.

The contrasting strategies come amid heightened geopolitical tensions and trade war concerns, which some analysts believe will drive Bitcoin’s appeal as a hedge. Industry expert Will Clemente recently weighed in on the broader implications.

“Zooming out, seeds are being sown for global accumulation of BTC for not only hedging against money supply but de-globalization and geopolitical tensions. These allocations won’t come overnight, but this is what Bitcoin was made for,” Clemente remarked.

Despite the long-term optimism, the macroeconomic conditions have weighed heavily on BTC, causing it to drop below $80,000. Nonetheless, BeInCrypto data showed that Bitcoin saw modest gains of 5.0% over the past day. At the time of writing, it traded at $79,454.

Notably, the price dip has led to significant unrealized losses for public companies holding Bitcoin reserves, with many now seeing their holdings valued below their acquisition costs. In fact, Strategy even paused its Bitcoin purchases, reflecting caution in the face of market uncertainty.

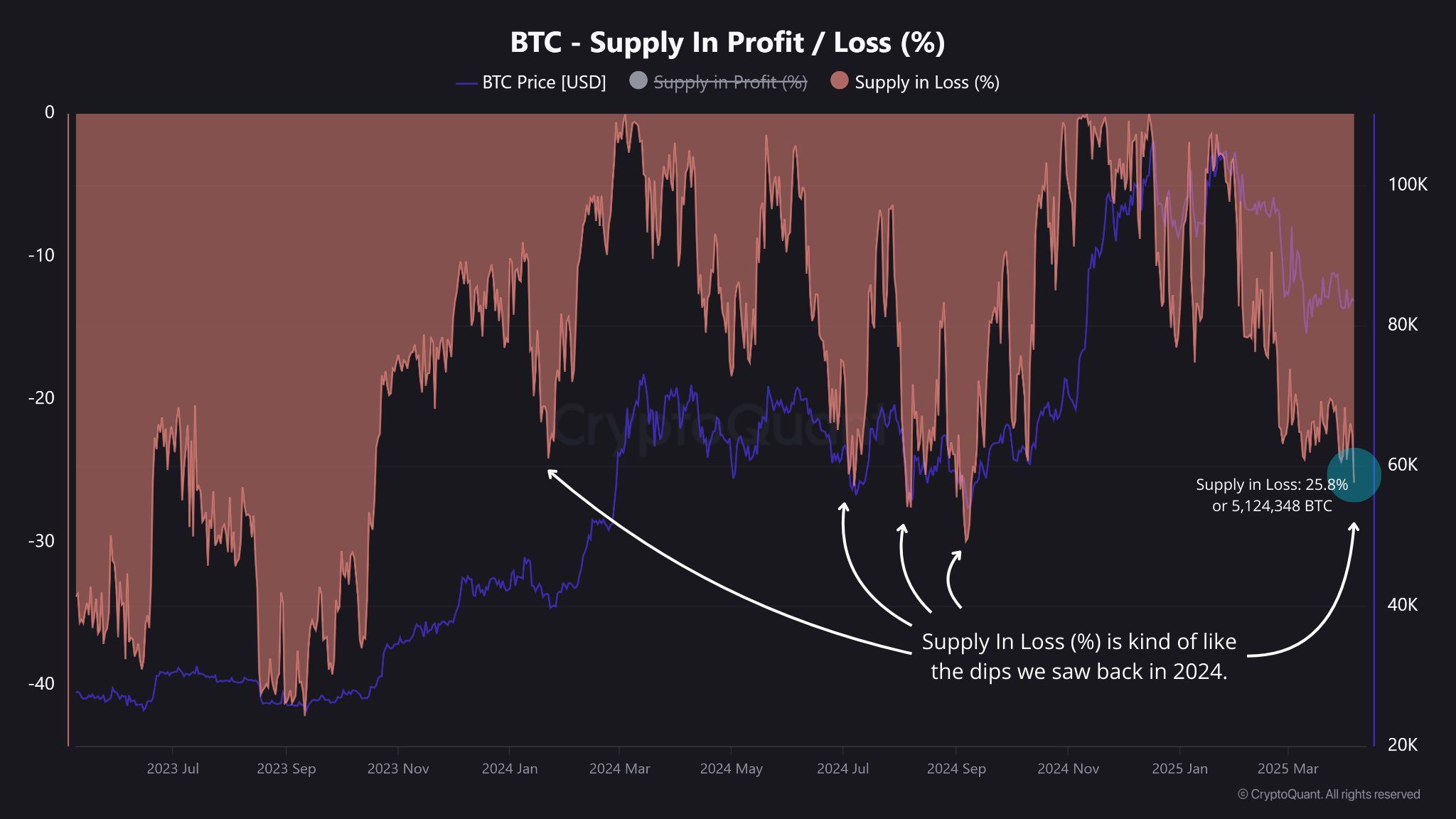

Moreover, data from CryptoQuant disclosed that 25.8% of the total Bitcoin supply is in loss.

“While it might seem alarming, it’s not unprecedented,” the post noted.

CryptoQuant added that similar scenarios have occurred throughout 2024, where a substantial portion of Bitcoin was also held at a loss. For instance, in January 2024, 24.1% of the circulating Bitcoin was underwater. In September, that figure rose to 29.9%.

Thus, these fluctuations show that periods of Bitcoin being held at a loss are not unusual and are part of the market’s cyclical nature, where price corrections affect a significant share of the supply.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Will the Fed Return to Quantitative Easing?

Crypto and financial markets, in general, are reeling from renewed volatility and mounting geopolitical pressure. As a result, speculation is intensifying around whether the Federal Reserve (Fed) will pivot back toward Quantitative Easing (QE).

A potential QE would be reminiscent of the aggressive monetary interventions of 2008 and 2020. For crypto, the implications could be enormous, with many traders bracing for a potential V-shaped recovery and a historic rally if QE is revived.

Analysts Share Signals Why the FED Could Act

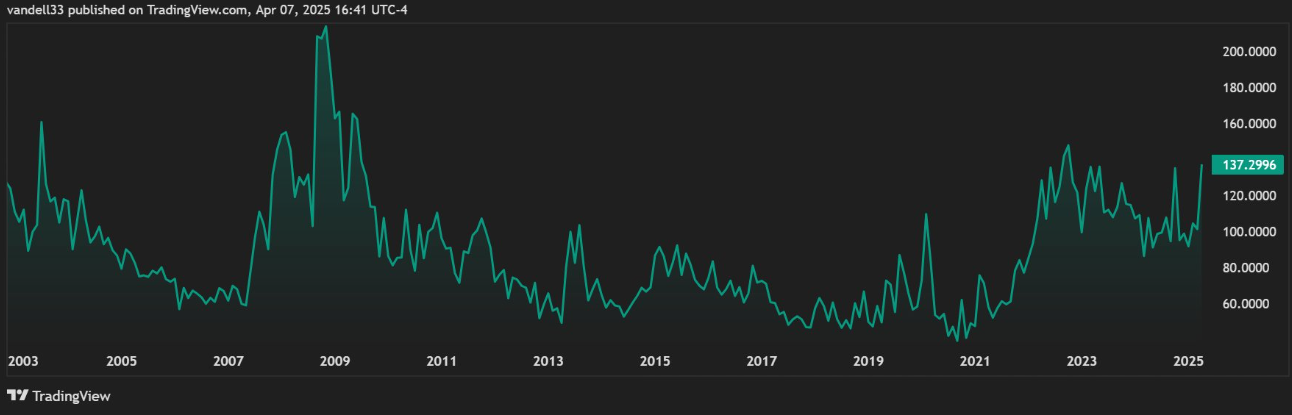

Analysts have shared reasons that could prompt the Fed to intervene, with one citing the MOVE Index. This is Wall Street’s “fear gauge” for the bond market. At 137.30, the index is currently within the 130–160 range where the Fed has historically acted during crises.

“Now it’s at 137.30, in the 130–160 range where the Fed might step in, depending on the economy. If they don’t, they’ll still cut rates soon because they have to refinance the debt to keep the Ponzi going,” wrote Vandell, co-founder of Black Swan Capitalist.

This signal aligns with other warning signs of financial instability, including global market sell-offs that set the tone for the crypto black Monday narrative. This prompted the Fed to schedule a closed-door board meeting on April 3.

According to analysts, this timing was not random, with mounting pressure likely to see the Fed cave and President Trump having his way.

“With the Fed hinting at QE, everything changes Risk: Reward is now in favor of the bulls. Watch for choppy price action, but do not miss the recovery rally. And remember… it’s easier to trade this market than to hold through it,” said Aaron Dishner, a crypto trader and analyst.

This suggests that investors are reading between the lines, particularly with the Fed’s next scheduled policy decision not until May 6–7. JPMorgan recently became the first Wall Street bank to forecast a US recession amid Donald Trump’s proposed tariffs, adding urgency to the conversation.

The bank suggests the Fed may be forced to act sooner, possibly with rate cuts or even QE, before the scheduled FOMC meeting. Against this backdrop, crypto investor Eliz shared a provocative take.

“I honestly think Trump is doing all this to speed up the Fed’s process to lower rates and QE,” they noted.

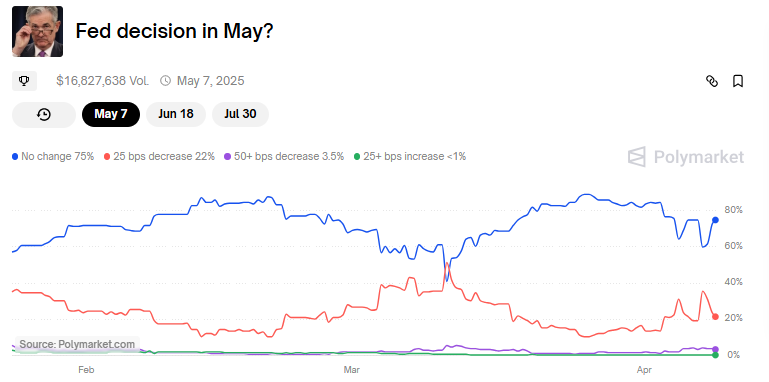

That may not be far-fetched given that the Fed must also manage over $34 trillion in federal debt. Noteworthy, this becomes harder to service at higher interest rates. According to Polymarket, there is now a 92% chance the Fed will cut rates at some point in 2025.

Why Crypto Could Benefit From QE

Should QE materialize, history suggests crypto could be one of the biggest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted that QE could inject up to $3.24 trillion into the system, nearly 80% of the amount added during the pandemic.

“Bitcoin rose 24x from its COVID-19 low thanks to $4 trillion in stimulus. If we see $3.24 trillion now, BTC could hit $1 million,” he said.

This aligns with his recent prediction that Bitcoin could reach $250,000 by year-end if the Fed shifts to QE to support markets.

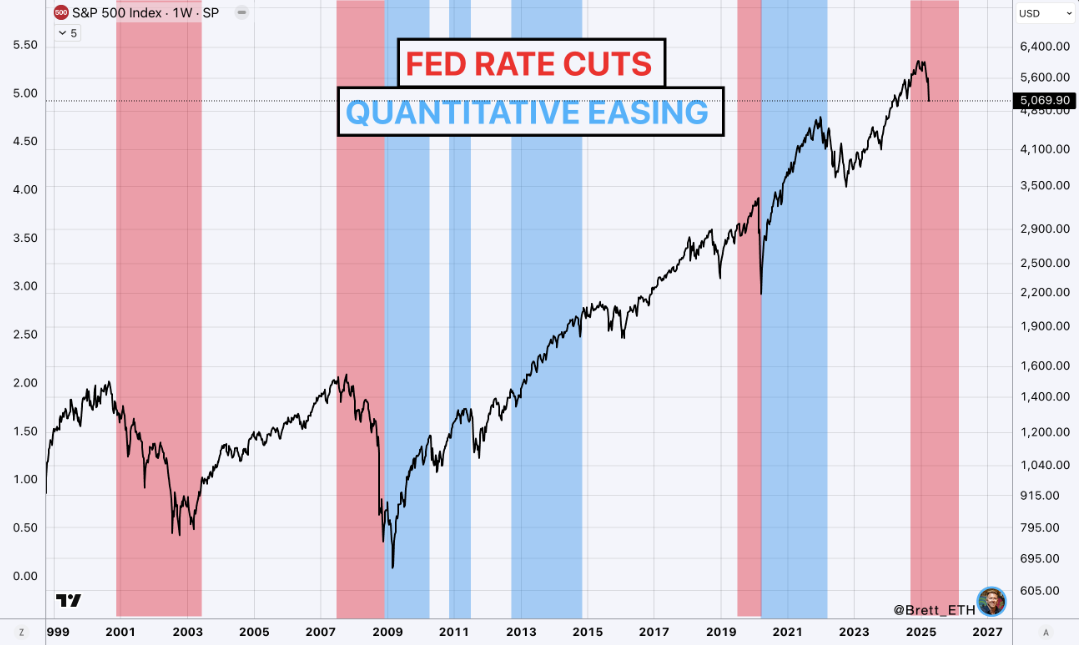

Analyst Brett offered a more measured view, noting that QE typically follows rate cuts rather than precedes them.

“We’re likely going to see rate cuts through mid-2026…like in 2008 and 2020, Powell has said QE doesn’t come until rate cuts are complete,” Brett explained.

Based on this, the analyst committed to buying selectively but did not expect a V-shaped bounce unless something drastic changed.

That “something” could be Trump reversing his tariffs or the Fed front running a recession with emergency easing measures. If either happens, the crypto market could rally hard and fast.

Altseason on the Horizon?

Meanwhile, Our Crypto Talk says a Quantitative Easing in May could lay the groundwork for a possible altcoin season.

Their forecast echoes previous cycles where QE triggered explosive moves in risk assets. When QE kicked off in March 2020, altcoins surged over 100X by the time it ended in 2022.

Traders are now eyeing May as a potential kickoff for the next liquidity wave, with bettors wagering a 75% chance the Fed will hold rates steady. If those odds shift, traders expect the money printer to follow.

While some anticipate more price “chop” in the short term, most agree that the long-term setup is increasingly favorable.

“If QE really kicks off in May, this chop is just the calm before the giga pump,” wrote MrBrondorDeFi on X.

Even if quantitative easing does not occur immediately, confidence remains strong that it will happen this year.

“Maybe not May, then later. It will happen this year, which is good for another rally and new highs,” Our Crypto Talk added.

Therefore, the buck stops with the Fed. Whether it is rate cuts, QE, or both, the implications for crypto are enormous.

If history repeats and the Fed opens the liquidity floodgates again, Bitcoin and altcoins could be poised for a historic breakout. This could eclipse the gains seen during the 2020-2021 bull run.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

Strategy (formerly MicroStrategy) did not buy any Bitcoin or sell any common stock this week, breaking a long-running streak. The firm officially disclosed that it has $5.91 billion in unrealized losses due to downturns in the crypto market.

Two likely scenarios explain this pause: Strategy is either waiting for more favorable market conditions or is forced into caution by these losses. Either way, the uncertainty may signal further apprehension among institutional investors.

MicroStrategy’s Bitcoin Purchase Pause: Cautious Signal or Liquidity Move?

Since Michael Saylor directed Strategy (formerly MicroStrategy) to start acquiring Bitcoin, it has become one of the world’s largest BTC holders. So far, it’s been a major purchaser in 2025, acquiring around $2 billion in Bitcoin on two occasions.

However, according to its most recent Form 8-K, Strategy bought zero BTC last week and didn’t sell any stock, either.

This isn’t the first interruption in Strategy’s Bitcoin purchases this year; it also paused acquisitions in February. Unlike that incident, this time feels substantially different due to fears of a US recession.

The pause in Bitcoin buying may suggest that Strategy’s management is taking a wait-and-see approach amid ongoing market volatility, possibly indicating that they believe Bitcoin could bottom out further before resuming purchases.

Billions have been liquidated from crypto and TradFi alike, and corporate Bitcoin holders have suffered serious losses.

The firm may also be trying to break its historic streak of consecutive purchases to avoid further downside risk until clearer market trends emerge.

However, a few prominent voices are taking a much more critical approach. The same Form 8-K shows that Strategy currently has $5.91 billion in unrealized losses in its Bitcoin holdings. There were already concerns about the firm’s liquidity, tax obligations, and over-leveraged debts.

Some community members are wondering how Saylor can avoid a crisis:

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red. That’s the thin line between ‘visionary CEO’ and ‘leveraged lunatic with a God complex,’” claimed Edward Farina via social media.

What’s Next for Strategy?

Essentially, Strategy serves as a major pillar of confidence in Bitcoin. If the firm sells, the market will notice. The crypto ecosystem carefully documents minor discrepancies in the firm’s BTC purchasing strategy, and a sale would be highly bearish.

Meanwhile, firms are already inventing novel ETF tools to short the company, praying for its collapse. What’s the best path to move forward?

So far, Saylor has been quiet about these market turns. MicroStrategy may be biding its time, planning to pull out another huge Bitcoin purchase whenever the market bottoms out.

It may also be paralyzed, unable to act due to its debt crisis and unrealized losses. For now, the uncertainty may signal broader apprehension among institutional investors.

This cautious stance may signal broader apprehension among institutional investors regarding current crypto market conditions, hinting at a potential pause before a renewed accumulation phase if market fundamentals improve.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Market24 hours ago

Market24 hours agoRWA Tokenization Takes Center Stage in Hong Kong

-

Market17 hours ago

Market17 hours agoBitcoin Price Recovery In Play—But Major Hurdles Loom Large

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Drops 8% as Market Signals Remain Mixed

-

Altcoin17 hours ago

Altcoin17 hours agoBitcoin +6%, Ethereum +10% Amid Tariff Uncertainty; FARTCOIN Skyrockets +38%, Recovery or Bubble?

-

Market21 hours ago

Market21 hours agoXRP Price Recovery Fades—$2 Remains A Tough Nut to Crack

-

Altcoin18 hours ago

Altcoin18 hours agoJohn Deaton Highlights Ripple’s Journey from Legal Struggle To ETF Launches

-

Ethereum16 hours ago

Ethereum16 hours agoHere’s Where Ethereum’s Last Line Of Defense Lies, According To On-Chain Data