Market

Dogecoin Faces $200 Million Liquidation If It Slips To This Price

Dogecoin (DOGE) price has recently struggled with momentum, failing to break key resistance levels. As of press time, DOGE is holding at $0.169, just above the crucial support of $0.164.

This stagnation hints at the potential for further declines, but key investors are still holding strong.

Dogecoin Is Facing Challenges

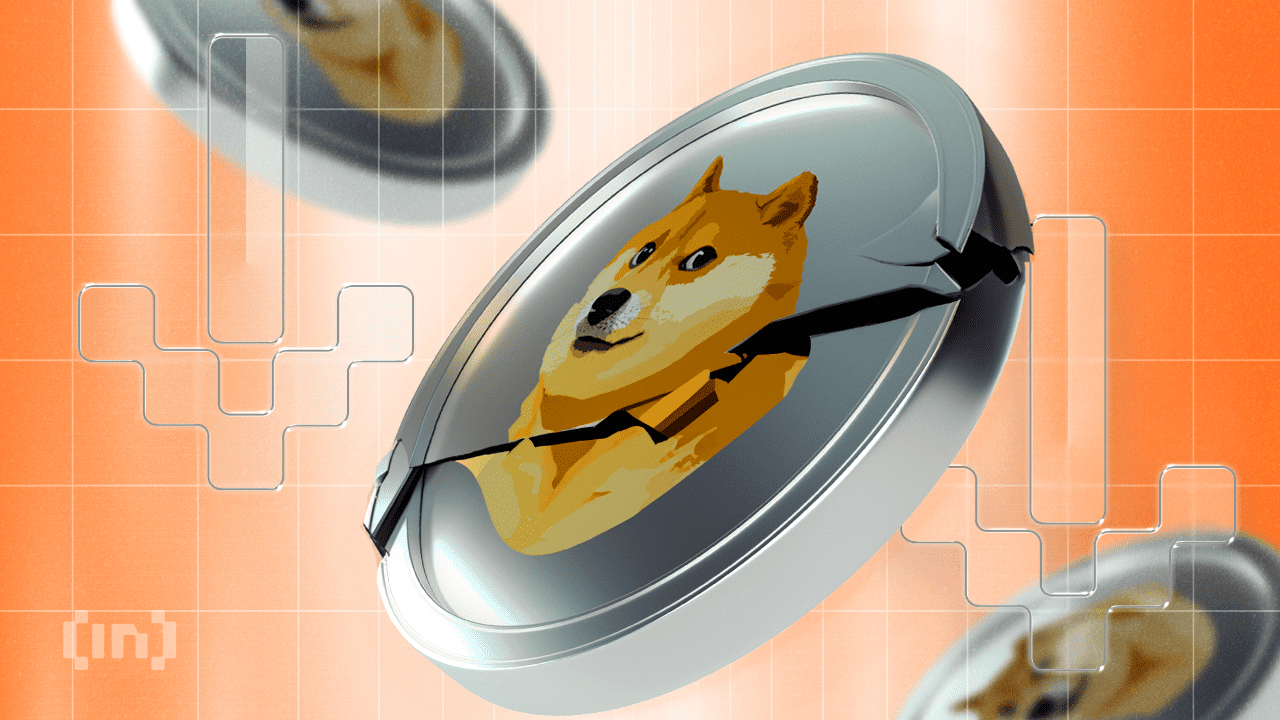

The liquidation map reveals that approximately $216 million worth of long positions could face liquidation if Dogecoin’s price declines to $0.150. This price is not far from its current critical support of $0.164.

If DOGE drops below this level, the liquidation of long contracts could fuel a further sell-off, pushing the price lower. This would likely prompt more bearish sentiment among traders, discouraging new investments in the meme coin.

Moreover, the threat of liquidation looms large as the price hovers near critical support levels. If DOGE continues to weaken, traders may be more inclined to exit positions, exacerbating the downtrend.

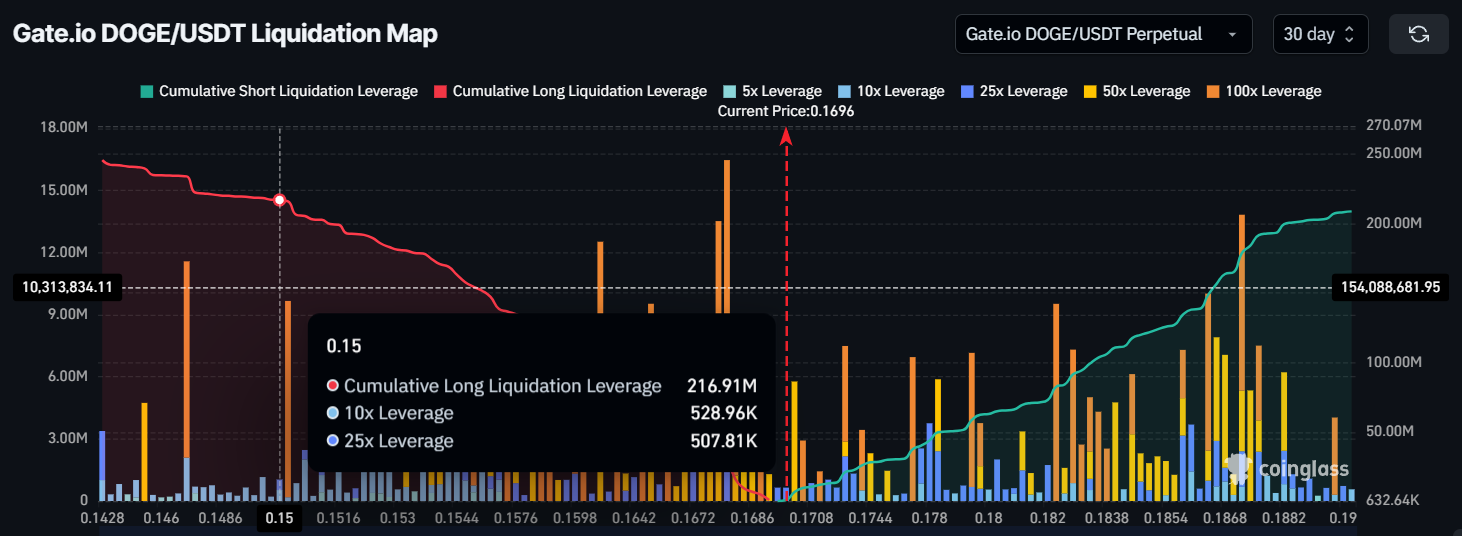

On the other hand, Dogecoin’s long-term holders (LTHs) seem to be focused on accumulating the asset at its current low price.

The HODLer net position change shows an increasing number of LTHs who are confident in eventual price recovery. As DOGE remains relatively inexpensive, these investors view the current conditions as a potential opportunity for future gains.

This accumulation by LTHs could serve as a buffer against further price declines. Their confidence in Dogecoin’s recovery and long-term potential is helping to sustain the current price levels. If these holders continue to accumulate, it could prevent a drastic drop and even pave the way for a future price rebound.

DOGE Price Correction Unlikely

At the time of writing, Dogecoin is trading at $0.169, just above the critical support of $0.164. The altcoin has been unable to break the $0.176 resistance for several days, showing signs of stagnation.

The likely outcome is continued consolidation above $0.164 as investors await a potential catalyst for upward movement.

If Dogecoin manages to breach the $0.176 resistance, it could quickly rise to $0.198, marking a positive shift in sentiment. This would likely encourage more buying activity and help push the price higher.

However, without sufficient momentum, DOGE will remain trapped within its current range, potentially facing further consolidation.

If the price falls below $0.164, it could slip to $0.147 in the coming days, triggering more than $216 million in long liquidations. This scenario would signal a shift toward bearish momentum, invalidating Dogecoin’s bullish outlook.

The coming days will be crucial in determining whether DOGE can recover or continue its decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Privacy Coins Are Outperforming in 2025’s Crypto Chaos

In a year marked by market turbulence and mounting geopolitical tensions, privacy coins have emerged as the best-performing sector in the cryptocurrency space.

Analysts and privacy advocates argue this is no coincidence. In fact, some believe the outperformance signals the early stages of a larger shift in global financial dynamics.

Why Privacy Coins Are the Top Performers in a Fear-Driven Market

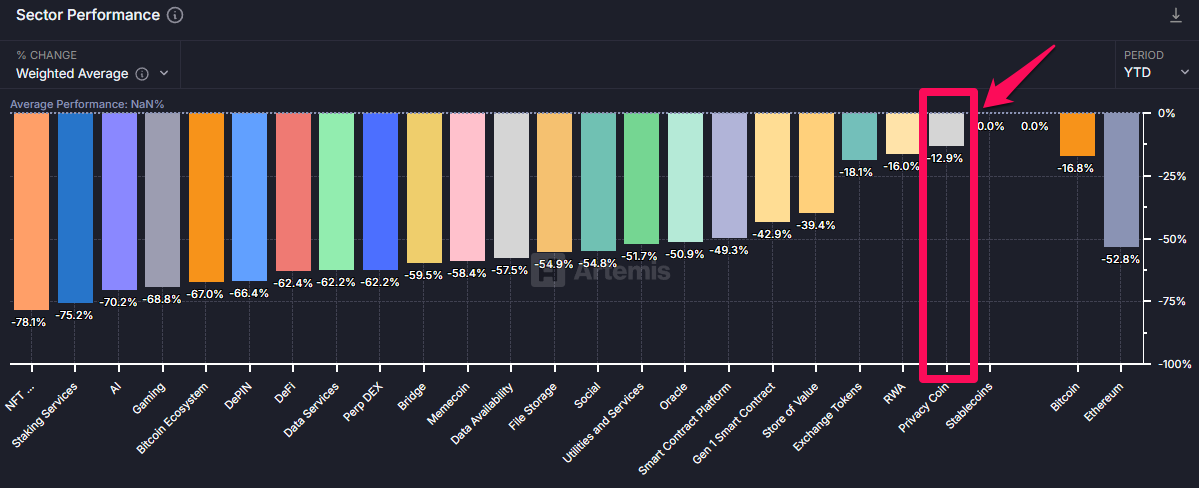

According to the latest data from Artemis, privacy-focused cryptocurrencies have dropped 12.9% since the start of the year, the smallest drop among all crypto sectors.

In comparison, Bitcoin (BTC) has seen a 16.8% decline. In addition, Ethereum (ETH) has also depreciated 52.8% year-to-date (YTD).

BeInCrypto data showed that over the past month, top privacy coins have fared well in comparison to BTC. Monero (XMR) has dipped 8.1%. Notably, Zcash (ZEC) has seen a modest rise of 9.1%. Nonetheless, with Bitcoin, the losses are slightly higher. Over the past month, the largest cryptocurrency has shed 9.8% of its gains.

In fact, privacy coins have also outperformed the broader cryptocurrency market in the past 24 hours. The privacy sector has seen a 7.0% decline, while the global crypto market has dropped 8.3%.

Patrick Scott, Head of Growth at DefiLlama, attributed this outperformance to broader macroeconomic shifts in a recent post on X (formerly Twitter).

“Privacy coins were the best-performing crypto sector during the crash. This isn’t about hype. It’s macro,” he wrote.

Scott pointed out that countries are becoming more economically isolated due to increasing tariffs and potential capital controls. He argued that privacy coins’ ability to resist censorship and operate privately would make them more important, shifting from being just a “narrative” to a practical necessity.

“The outperformance isn’t random. It’s an early reaction to a shifting global regime and the breakdown of the post-WW2 international order,” Scott remarked.

Meanwhile, many industry leaders echo a similar sentiment. Vikrant Sharma, Founder and CEO of Cake Investments, expressed strong support for privacy-focused solutions.

“I am a maxi.. a privacy maxi. That’s why I support privacy coins and tools like XMR, Zano, silent payments, and pay join for BTC, LTC-MWB, and yes, I think Zcash is fine too,” he posted.

Others, like Mike Adams, the founder of Brighteon, also stressed the importance of privacy in transactions.

“Use privacy crypto, folks. Monero, Zano, Firo… not BTC, which is completely transparency and has zero privacy,” stated Adams.

In addition to these factors, the demand for privacy coins is being fueled by their growing use in illegal activities. A recent report from BeInCrypto highlighted the dominance of privacy coins in illicit transactions, where they are preferred for their ability to conceal transaction details.

While Bitcoin and stablecoins are still used in such activities, privacy coins like Monero are gaining traction due to their superior anonymity features.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

Solana started a fresh decline below the $112 support zone. SOL price is now consolidating and might struggle to stay above the $100 support zone.

- SOL price started a fresh decline below $112 support zone against the US Dollar.

- The price is now trading below $105 and the 100-hourly simple moving average.

- There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could accelerate lower if there is a break below the $100 support zone.

Solana Price Dips Over 15%

Solana price started a fresh decline below the $122 and $115 levels, like Bitcoin and Ethereum. SOL even declined below the $112 support level to enter a bearish zone.

There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair. The price declined over 15% and traded close to the $102 level. A low was formed at $102 and the price recently started a consolidation phase.

The current price action is still very bearish below 23.6% Fib retracement level of the downward move from the $121 swing high to the $102 low. Solana is now trading below $105 and the 100-hourly simple moving average.

On the upside, the price is facing resistance near the $105 level. The next major resistance is near the $112 level or the 50% Fib retracement level of the downward move from the $121 swing high to the $102 low. The main resistance could be $116.

A successful close above the $116 resistance zone could set the pace for another steady increase. The next key resistance is $120. Any more gains might send the price toward the $125 level.

Another Decline in SOL?

If SOL fails to rise above the $105 resistance, it could start another decline. Initial support on the downside is near the $102 zone. The first major support is near the $100 level.

A break below the $100 level might send the price toward the $92 zone. If there is a close below the $92 support, the price could decline toward the $84 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $102 and $100.

Major Resistance Levels – $105 and $112.

Market

Bitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

Bitcoin fell below the $80,000 mark on Sunday as investor sentiment weakened across global markets. The move came alongside a spike in daily liquidations, which totaled $590 million.

Heightened anxiety over former President Donald Trump’s proposed tariffs and escalating geopolitical tensions weighed heavily on risk assets.

More Traders are Shorting Bitcoin After the Worst Q1 In a Decade

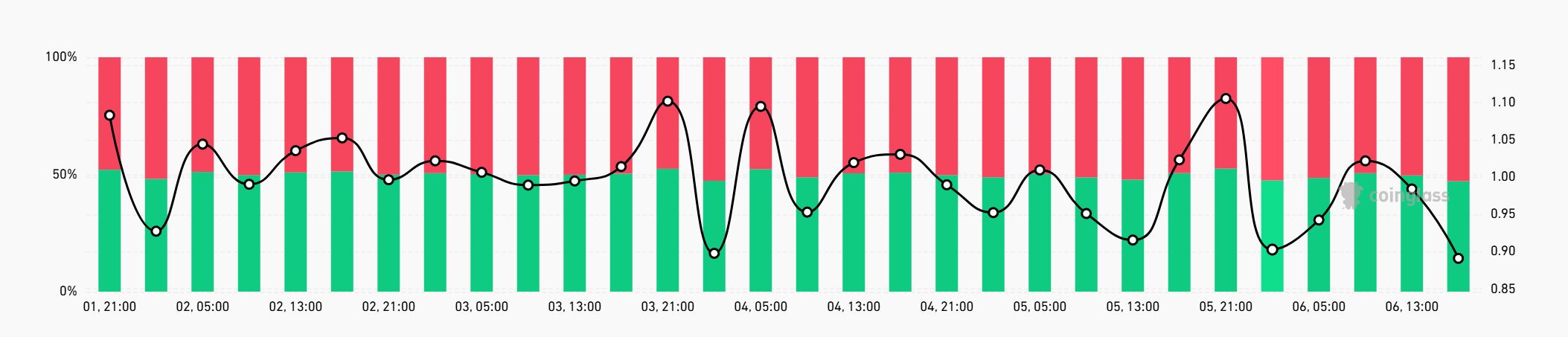

The long-short ratio for Bitcoin dropped to 0.89, with short positions now accounting for nearly 53% of activity. The shift reflects growing skepticism about Bitcoin’s short-term direction.

Traditional markets also suffered sharp losses. The Nasdaq 100, S&P 500, and Dow Jones all entered correction territory last week, posting their worst weekly performance since 2020.

Bitcoin closed the first quarter with a loss of 11.7%, making it the weakest Q1 since 2014.

The broader crypto market lost 2.45% on Sunday, reducing total market capitalization to $2.59 trillion. Bitcoin remains the dominant asset, holding 62% of the market share. Ethereum follows with 8%.

Sunday’s selloff triggered $252.79 million in crypto derivatives liquidations. Long positions made up the bulk of that figure at $207 million. Ethereum traders accounted for about $72 million in long liquidations alone.

Bitcoin’s price remains closely tied to shifts in global liquidity, often reflecting broader macro trends. With U.S. markets set to open Monday, this weekend’s activity signals continued volatility ahead.

Investors may face more pressure after Federal Reserve Chair Jerome Powell warned that Trump’s tariff plans could push inflation higher while slowing economic growth.

That combination raises the risk of stagflation, a situation where policy tools become less effective. Efforts to stimulate the economy can worsen inflation, while measures to control prices can limit growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoIs Ethereum Price Nearing A Bottom? This Bullish Divergence Suggests So

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Whale Activity Fades Since Late February – Details

-

Market20 hours ago

Market20 hours agoXRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

-

Market18 hours ago

Market18 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Altcoin22 hours ago

Altcoin22 hours agoHas The Dogecoin Price Bottomed Out? Analyst Points Out ‘Critical Decision Zone’

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Traders’ Realized Losses Reach FTX Crash Levels — What’s Happening?

-

Market19 hours ago

Market19 hours agoSEC Reconsiders Howey Test Use in Crypto Oversight

-

Bitcoin19 hours ago

Bitcoin19 hours agoAltseason Dead On Arrival? Data Shows Bitcoin Outperforming All Categories