Market

SEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

Since US President Donald Trump assumed office, the Securities and Exchange Commission (SEC) has dropped, settled, or paused lawsuits against prominent crypto entities left and right. In stark contrast to the previous administration’s leadership under Chair Gary Gensler, the SEC seems to be parting from its previous crackdown on digital assets.

In an interview with BeInCrypto, Nick Puckrin, Founder of The Coin Bureau, and Hank Huang, Chief Executive Officer at Kronos Research, highlighted the substantial election influence the crypto industry had over Trump’s candidacy as a contributing factor to the SEC’s looser stance on crypto.

The SEC’s Approach Under Trump

The SEC has experienced a clear shift in its approach to crypto lawsuits under Trump’s presidency. Its move away from the aggressive enforcement tactics of its previous leadership has largely characterized this shift.

“When President Donald Trump won the US election, the crypto industry rejoiced. Finally, the ‘regulation by enforcement’ era, which the SEC under the leadership of Gary Gensler was so famous for, was about to come to an end. And the new administration didn’t disappoint. Within just a couple of weeks of Trump’s inauguration, the revamped SEC started dropping lawsuits against crypto firms left, right and center,” Puckrin said.

Two weeks ago, the SEC officially dropped its appeal and XRP lawsuit against Ripple Labs, ending a five-year legal battle. The Commission had originally accused Ripple of conducting an unregistered securities offering worth $1.3 billion through XRP sales.

“After more than four years in limbo, the SEC has officially decided that XRP is not a security (though what it is instead remains to be seen). This case has been weighing heavily on XRP – the fourth largest cryptocurrency with a market cap of roughly $130 billion– so its resolution is a major win,” Puckrin added.

The wider crypto community celebrated the outcome, with many arguing that it will set a precedent for how digital assets are classified in the US. This prediction is warranted, given that the SEC has been on a lawsuit-dropping spree.

Ripple and Coinbase Cases Mark Significant Wins

Shortly before ending the Ripple lawsuit, the SEC dropped its legal battle against Coinbase. The case also centered on whether Coinbase should be classified as a security.

“The SEC is clearly retreating from its once-aggressive stance on crypto, as seen in its 2025 dismissal of lawsuits against Ripple, Coinbase, and others. This shift, driven by the crypto-friendly and pro-business Trump administration, signals a future of more streamlined and transparent US crypto regulation,” Huang told BeInCrypto.

The SEC has also dropped several ongoing investigations against OpenSea, Robinhood, Uniswap Labs, Kraken, and Gemini. It has also asked a federal court to issue a 60-day pause over its litigation against Binance. Meanwhile, the Commission settled its investigation into ConsenSys over its Ethereum software products.

These lawsuits surfaced in parallel to a series of crypto-friendly measures meant to foster greater innovation and curb potential regulatory suffocation that had existed during the Biden era.

Will New Leadership Define Clear Crypto Regulations?

A day after Trump assumed office, SEC Acting Chairman Mark Uyeda announced the creation of a dedicated crypto task force led by Commissioner Hester Peirce. The task force was reportedly designed to resolve long-standing ambiguities in the regulatory treatment of digital assets.

In all SEC crypto lawsuits, Commissioner Uyeda has implemented a strategy prioritizing industry engagement to develop regulatory frameworks that balance innovation and investor protection.

Meanwhile, Trump strategically nominated Paul Atkins, a crypto-curious, regulation-light candidate, to replace Gensler as head of the SEC. Just this week, the Senate Banking Committee voted to advance Atkins’ nomination to the full Senate.

“Driven by Republican principles, the SEC under Trump could implement clearer crypto guidelines by 2025, reduce regulatory burdens, and roll back Biden-era policies that have stifled innovation by 2027. This could mark the beginning of treating most digital assets as commodities,” Huang said.

Now, only a stone’s throw away from becoming SEC Chair, Atkins is expected to loosen regulatory oversight on crypto.

“With the establishment of a new Task Force and key appointees like Paul Atkins fostering innovation, Trump’s strategic move to create a Bitcoin reserve within the government further underscores his commitment to supporting the industry. The future of crypto regulations will be focused on less oversight and the beginning of a delicate but promising thaw in the regulatory landscape,” Huang added.

Though some say Trump’s handling of crypto affairs has resulted in a never-before-seen triumph, others are weary that his increasing involvement in the industry has turned out to be a recipe for disaster.

The Impact of Crypto Donations on Regulations

Several industry leaders went to great lengths to ensure that Trump became America’s 47th president. Millions of dollars in donations from crypto firms throughout Trump’s campaign illustrated these efforts.

According to a Public Citizen report, over $119 million from crypto corporations went into influencing the 2024 federal elections, largely through Fairshake, a non-partisan super PAC backing pro-crypto candidates and opposing skeptics.

Coinbase and Ripple, among others who stand to profit, directly provided over half of Fairshake’s funding. The remaining funds mostly came from billionaire crypto executives and venture capitalists. Notable contributions included $44 million from the founders of Andreessen Horowitz, $5 million from the Winklevoss twins, and $1 million from Coinbase CEO Brian Armstrong.

So far, big crypto’s spending strategy is paying off with a more favorable environment.

“Political donations from the crypto industry during the 2024 election, particularly to pro-crypto candidates like Trump, played a significant role in shaping the SEC’s 2025 decision to drop lawsuits against crypto firms. These contributions helped align the administration with the industry’s interests and influenced Congress, driving about 50-60% of the shift,” Huang told BeInCrypto.

Without a clear framework to guide the crypto industry following these dropped lawsuits, this lax approach risks being short-lived. Ultimately, this could tarnish long-term crypto adoption.

Meme Coin Scams Highlight Deregulation Dangers

According to Puckrin, the success of the dropped lawsuits was obscured by the lack of regulations that have led to the proliferation of high-profile meme coin scams.

“Somehow, all these victories feel somewhat hollow after the reputation of the crypto industry has been tarnished by the billions of dollars in combined losses from meme coin scams. Meanwhile, Hayden Davis, the mastermind behind LIBRA, continues to launch fraudulent meme tokens, despite being on the Interpol wanted list,” he said.

A 2024 report by Web3 intelligence platform Merkle Science revealed that meme coin rug pulls cost investors over $500 million. The February LIBRA incident showed how this trend was carried over to 2025. Nansen data revealed that 86% of investors lost $251 million, while insiders pocketed $180 million in profits.

Though crypto scammers may be charged with related crimes like wire fraud or money laundering, rug pulling is legal. Better said, it’s unaccounted for. No regulation holds crypto insiders responsible for meme coin scams.

“As crypto becomes an ever more mainstream asset class, consumers need to be protected against those who choose to use it for nefarious purposes. One way to do this is through education, and that’s our job as an industry. But deterring scams and extractive behavior is the job of the regulators. And it’s time they stepped up to the task,” Puckrin told BeInCrypto.

If the SEC doesn’t take advantage of this opportunity to curb the consequences that meme coin scams can produce, it will result in an enormous setback for the industry.

Comprehensive Regulation Beyond Dropped Lawsuits

Puckrin illustrated the need for heightened regulatory clarity in crypto by drawing attention to the way the SEC penalizes insider trading in the context of traditional investing.

“In traditional investing, insider trading is a serious crime. In the US, it’s punishable by fines of up to $5 million for individuals and prison sentences up to 20 years. Similarly, federal penalties for engaging with illegal gambling activities include up to five years in prison. Perpetrators of memecoin scams must be punished with the same level of severity, because the result is the same: manipulating markets and cheating unsuspecting investors out of their savings,” he said.

Puckrin clarified, however, that the issue isn’t solely about penalizing fraudsters. Just as the SEC’s past overregulation hindered the industry, the current lack of meme coin rules creates an environment where new scams and exploitative schemes can easily flourish.

“Yes, the removal of lawsuits is great news for blockchain innovation, but something needs to replace it. Indeed, serious cryptocurrency firms have never advocated for an unregulated Wild West. What they want is clarity and rules that are fit for the nascent blockchain industry – not just a copy-and-paste of existing financial regulations that simply don’t work for crypto,” he said.

Although the Trump administration has only been in place for four months, the clock is ticking, and meaningful change takes time.

Unanswered Questions Loom

Puckrin expressed concern over the current administration’s prioritization of lawsuit dismissals instead of working faster to implement transcendental crypto regulation.

“My concern is that regulators will keep kicking the can down the road with crypto regulation, having gained the approval of the industry for dropping the many lawsuits that were stifling its growth. And this is incredibly dangerous,” he told BeInCrypto.

Meanwhile, critical questions that only the SEC can define remain unanswered.

“What are memecoins and who will ensure another LIBRA fiasco doesn’t happen? Are utility altcoins now commodities and if so, will the Commodities Futures Trading Commission (CFTC) regulate them? And, importantly, what do we do about compensating investors who have lost billions to crypto fraud?” Puckrin concluded.

The SEC’s current direction promises a regulated renaissance or a breeding ground for future crises.

With billions lost and critical questions unanswered, the future of crypto hinges on whether the regulatory body will translate its recent shift into a lasting framework that fosters innovation without sacrificing investor protection.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,550 zone. ETH is now correcting gains from $1,680 and finding bids near the $1,500 level.

- Ethereum started a decent increase above the $1,550 and $1,600 levels.

- The price is trading below $1,580 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,550 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,580 resistance zone.

Ethereum Price Trims Gains

Ethereum price formed a base above $1,400 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,480 and $1,550 resistance levels.

The bulls even pumped the price above the $1,600 zone. A high was formed at $1,687 and the price recently started a downside correction. There was a move below the $1,600 support zone. The price dipped below the 50% Fib retracement level of the upward move from the $1,385 swing low to the $1,687 high.

Ethereum price is now trading below $1,580 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,550 level. There is also a new connecting bearish trend line forming with resistance at $1,550 on the hourly chart of ETH/USD.

The next key resistance is near the $1,580 level. The first major resistance is near the $1,620 level. A clear move above the $1,620 resistance might send the price toward the $1,680 resistance. An upside break above the $1,680 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,580 resistance, it could start a downside correction. Initial support on the downside is near the $1,520 level. The first major support sits near the $1,500 zone and the 61.8% Fib retracement level of the upward move from the $1,385 swing low to the $1,687 high.

A clear move below the $1,500 support might push the price toward the $1,455 support. Any more losses might send the price toward the $1,420 support level in the near term. The next key support sits at $1,380.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,500

Major Resistance Level – $1,580

Market

Bitcoin Holds The Line—But Can It Bounce Back or Break Lower?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $80,000 zone. BTC is now correcting gains and might struggle to stay above the $79,500 support.

- Bitcoin started a fresh increase above the $80,000 zone.

- The price is trading above $79,500 and the 100 hourly Simple moving average.

- There is a new connecting bearish trend line forming with resistance at $80,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $80,500 zone.

Bitcoin Price Dips Again

Bitcoin price started a fresh increase above the $77,500 zone. BTC formed a base and gained pace for a move above the $79,500 and $80,000 resistance levels.

The bulls pumped the price above the $82,500 resistance. A high was formed at $83,548 and the price recently started a downside correction. There was a move below the $81,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

Bitcoin price is now trading above $79,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $80,500 level. There is also a new connecting bearish trend line forming with resistance at $80,500 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $81,500 level. The next key resistance could be $82,500. A close above the $82,500 resistance might send the price further higher. In the stated case, the price could rise and test the $83,500 resistance level. Any more gains might send the price toward the $85,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $80,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $79,500 level. The first major support is near the $79,000 level and the 50% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

The next support is now near the $78,000 zone. Any more losses might send the price toward the $76,500 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $79,500, followed by $79,000.

Major Resistance Levels – $80,500 and $81,500.

Market

How SEC Chair Paul Atkins Will Reset US Crypto Policy

On April 9, 2025, the US Senate confirmed Paul Atkins as the new Chair of the SEC with a majority 52–44 vote. This marked a new chapter for the crypto industry in the US.

The crypto community welcomed the news enthusiastically. Atkins is widely seen as someone who will bring transparency and support innovation—unlike the heavy-handed approach of his predecessor, Gary Gensler.

Paul Atkins Will Bring Clarity and New Direction to the US Crypto Industry

In Wednesday’s episode of the Crypto in America podcast, Republican Congressman Tom Emmer—House Majority Whip and Co-Chair of the Congressional Crypto Caucus—shared his optimistic expectations for Atkins’ role in reshaping crypto policy.

Emmer expressed strong confidence that Paul Atkins will steer the SEC back to its core mission: ensuring that all Americans have access to the world’s greatest financial markets, including digital assets.

“I think Paul Atkins will bring the clarity and certainty that we need. I’ve been saying for over nine years, we need to understand what is currency, what is security, and what is a commodity. I’m sick and tired of hearing about the case law and that, oh well, you know, the attorneys, the courts—why are we doing that? We’re Congress. Why don’t we act? And I think it’ll start with the new SEC Chair, but he will give us direction much like Trump is doing with executive orders.” Emmer said.

This statement reflects the long-standing demand from the crypto industry for a clear legal framework.

Paul Atkins is well-acquainted with the SEC and the financial sector. He served as an SEC Commissioner from 2002 to 2008 under President George W. Bush. During that time, Atkins gained recognition for his pro-free market stance and efforts to reduce regulatory burdens.

After his tenure at the SEC, Atkins founded Patomak Global Partners, a consulting firm that helps crypto companies navigate complex regulatory frameworks.

Notably, since 2017, he has served as Co-Chair of the Token Alliance, an initiative of the Digital Chamber of Commerce, where he has led efforts to develop best practices for the issuance and trading of digital assets.

Atkins’ career demonstrates a deep understanding of the intersection between technology and finance. Emmer expects him to adopt a “light-touch” approach—one that focuses on supporting innovation rather than stifling it.

“I think he’s gonna make sure that that’s the SEC that we believe it should be. Gary Gensler took it off mission. What it’s supposed to do is make sure that every single American has access to the greatest financial markets on the face of the planet. And what Gary Gensler was doing was saying, well, if you’re traditional finance, you can have access. But if you’re this new digital stuff, this is bad. We’re gonna make sure that we stop you from doing anything.” Emmer said.

Emmer added that this shift in leadership could pave the way for critical legislation like the FIT 21 Act, which passed the House in May 2024 to provide clear rules for digital assets.

With support from Atkins and the Trump administration—who had pledged to make America the “crypto capital of the world”—Emmer believes Congress can soon codify these reforms into law, creating a lasting impact on the market.

Criticism of Gary Gensler: A Legacy of Obstruction

In contrast to his optimism about Atkins, Emmer did not hesitate to criticize Gary Gensler, saying that he had set “a pretty low bar” for the SEC.

“We need to have clarity and certainty in the system so investors, entrepreneurs, can, you know, take risk and innovate. And what was Gary Gensler doing? He was stopping all of that. He was telling people, my door is open. Bring any idea you got, we’re happy to talk to you about it. Well, if you were naive enough to do that, he usually sued you, or he sent you a letter that you’re under investigation afterward.” Emmer criticized.

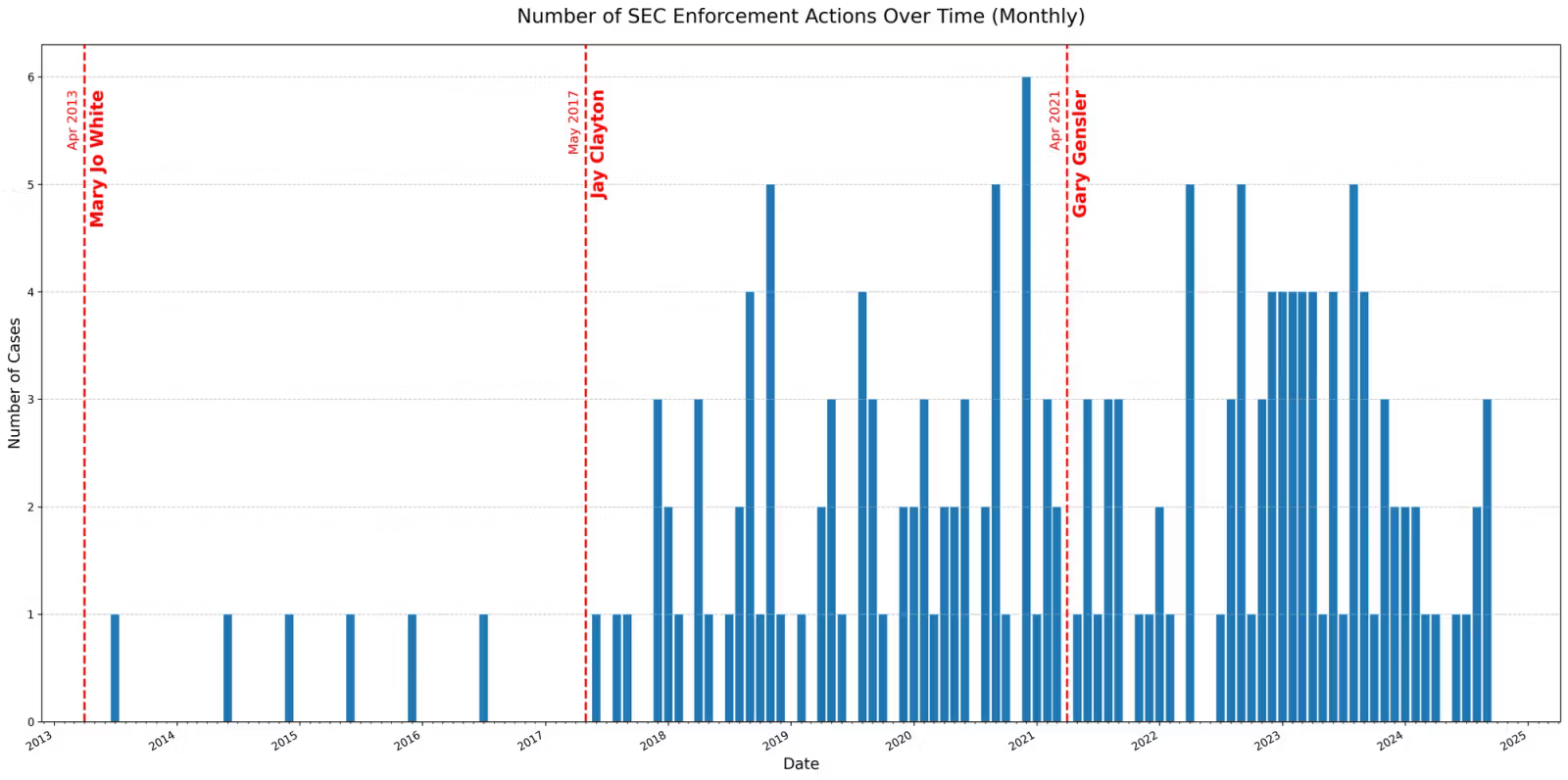

According to a report by Paradigm, since the SEC’s first crypto-related enforcement in 2015, the agency has taken action against 171 projects and individuals.

These actions spanned three presidential terms and three confirmed SEC chairs. Nearly half of them—88 cases—occurred under Gensler’s leadership.

Emmer also pointed out a striking contradiction in Gensler’s approach to meme coins, often criticized as vehicles for fraud.

“I heard a lot of complaints about meme coins yesterday during the hearing… But you realize Gary Gensler is the one that said, this is what we could use meme coins for. He’s the one that actually empowered the creation of meme coins the way we see it right now… If you don’t like it, stop complaining about it, and let’s figure out how we can put some guardrails on that.” Emmer revealed.

His remarks emphasized Gensler’s failure to provide guidance—instead choosing to criticize and punish. With Atkins, Emmer hopes to reverse that trend. He envisions an SEC that doesn’t just enforce but enables the crypto industry to grow within the United States.

A New Era for Crypto Policy

According to Tom Emmer, Paul Atkins’ appointment is more than a change in leadership. It’s an opportunity to reset crypto policy in America. Atkins could be the catalyst for Congress to turn reforms into reality—and, more importantly, to keep crypto businesses in the US rather than driving them overseas.

With a clear and supportive approach, Atkins could transform the SEC into an agency that champions the digital financial future rather than blocking it.

If successful, the crypto industry may be entering a new era of unprecedented growth under his leadership.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoTHORWallet CEO Explains Why DeFi is Here to Stay

-

Altcoin24 hours ago

Altcoin24 hours agoMost Altcoins Now In ‘Opportunity’ Zone, Santiment Reveals

-

Market23 hours ago

Market23 hours agoExperts Reveal What Could Drive Ethereum’s Price Recovery

-

Market21 hours ago

Market21 hours agoIs Trump’s Tariff Delay Masking a Crypto Dead Cat Bounce?

-

Altcoin19 hours ago

Altcoin19 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

-

Bitcoin17 hours ago

Bitcoin17 hours agoBullish Signal for Bitcoin in 2025?

-

Market17 hours ago

Market17 hours agoSolana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?