Altcoin

John Squire Says XRP Could Spark A Wave of Early Retirements

Renowned social media influencer John Squire has recently sent shockwaves across the broader crypto industry by saying, “XRP rise will trigger countless early retirements.” On Thursday, April 03, the influencer shared an X post conveying that Ripple investors could make enough earnings for early retirements, signaling that a bull run awaits. Crypto market traders and investors are left wondering if a price rally is really possible amid recent favorable advancements.

Particularly in the wake of a looming ETF approval and the U.S. SEC’s recent closed-door meeting that is set to offer clarity in the ongoing lawsuit, market watchers remain optimistic about Squire’s bold statements.

John Squire Bullish On XRP Price? Recent Comments Spark Speculations

John Squire’s X post reflected a highly bullish outlook about the crypto’s long-term prospects as it hinted that its investors could make enough earnings for early retirements. The statement could potentially be accurate due to a stockpile of factors impacting the coin’s market sentiment lately.

Ripple vs SEC Lawsuit: Clear Waters Ahead?

The U.S. regulator is set to conduct a closed-door meet today, with speculations mounting up around Ripple’s lawsuit’s conclusion. This meeting is expected to clear the waters around the ultimate resolution of the lawsuit after the SEC previously dropped cross-appeals.

While some believe that an imminent settlement between both the parties is ahead, others assume a final resolution could still take some time. Nevertheless, with the conclusion of today’s meeting, market watchers expect regulatory clarity about whether or not XRP is a security.

Pro-crypto endeavors across America, including Paul Atkins’ appointment as the new SEC chair, collectively signal that the lawsuit could end in favor of the American blockchain payments company. The native crypto could substantially leverage a bullish sentiment, given this happens.

ETF Odds Gain Weight

Simultaneously, the rising bets of a looming XRP ETF approval have added to bullish sentiments about the coin’s future aspects. CoinGape earlier reported that renowned market experts predicted a Ripple ETF approval would be shortly ahead.

On the other hand, Polymarket data shows that ETF approval odds in 2025 are at 75%. These broader developments collectively signal that ETF approval by U.S. regulators lies ahead.

XRP Price Overview

XRP’s price lost nearly 4% in value in the past 24 hours and closed in at $2.04. The coin hit a bottom and peak of $1.99 and $2.22, intraday. Today’s waning price action is in sync with a massive 1 billion token unlock from escrow.

Whale Alert’s data on X revealed that the American blockchain company unlocked 1 billion coins, worth nearly $2 billion, from escrow recently. This unlock comes as a part of the firm’s strategic monthly releases that raise the asset’s market supply. As a result, the price today takes a hit, abiding by the law of supply and demand. CoinGape previously reported that Ripple also moved another 1 billion coins in light of its escrow endeavors.

Nevertheless, despite waning action and the massive token unlock, market sentiments about future movements are brimming with optimism amid recent developments.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

21Shares Files For Spot Dogecoin ETF With US SEC

Asset manager 21Shares has filed with the US Securities and Exchange Commission (SEC) to offer a Dogecoin ETF. This development comes just as the Dogecoin price rebounds following a wave of sell-offs which saw it drop to as low as $0.14.

21Shares Files For Dogecoin ETF With US SEC

21Shares has filed the S-1 form for its Dogecoin ETF with the US SEC. The asset manager becomes the third to file for a DOGE ETF, joining Grayscale and Bitwise. The next step is for the asset manager, through an exchange, to file the 19b-4 form for this fund, which will officially kickstart the process towards a potential approval from the Commission.

Interestingly, this filing comes on the same day 21Shares launched its Dogecoin ETP on the SIX Swiss Exchange through its partnership with the House of Doge. These two will collaborate again if the SEC approves this ETF, as the asset manager revealed in the prospectus that the House of Doge, the corporate arm of the Dogecoin Foundation, will help in marketing the fund.

Meanwhile, the top crypto exchange, Coinbase, will be the Trust’s custodian. The ETF will hold Dogecoin and provide institutional investors an avenue to gain exposure to the top meme coin.

This undoubtedly provides a bullish outlook for the Dogecoin price, as this move could boost the meme coin’s adoption and further drive inflows into its ecosystem.

DOGE Forms Bullish Divergence

Amid 21Shares’ Dogecoin ETF filing, crypto analyst Kevin Capital has revealed that a daily bullish divergence on DOGE’s chart is starting to play out. He remarked that this development is obviously mostly due to the macro news, but nonetheless, the charts were already hinting at this possibility.

This macro news is Donald Trump’s decision to halt reciprocal tariffs for 90 days. Dogecoin and the broader crypto market rebounded on the back of this news.

However, it remains to be seen if this would be a bullish reversal or a bear trap. As CoinGape reported, crypto analyst Master Kebobi stated that the bottom is in for the top meme coin and predicts that the Dogecoin price would rally to the much-anticipated $1 level in the coming months.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Is Dogecoin Price Levels About To Bounce Back?

Dogecoin price has gained over 10% in the last 24 hours as investors scan the horizons for signals of a long-term rally. While short-term price movement is positive, Dogecoin languishes at 80% below its all-time high but one analyst thinks a rebound is in the offing

Dogecoin Price Can Set A New All-Time High

Dogecoin price has surged by 10.30% over the last day after a shoddy showing over the previous seven days. The sudden resurgence in prices comes amid a slew of macroeconomic uncertainties nevertheless, the surge is stoking enthusiasm that DOGE can set a new all-time high.

Cryptocurrency analyst Master Kenobi revealed on X that the bottom is in for DOGE and a rally is in the offing for the asset. He opines that Dogecoin price will surpass $0.73 in the coming months hinting at a push to $1. The predicted price movement will see DOGE surpass the previous ATH that it set in 2021.

“It’s only upward from here,” said Master Kenobi. “A new ATH for DOGE by early June.”

Despite trading at 80% less than its ATH, Dogecoin’s price has several positives going for it. For starters, a Dogecoin ETP by 21Shares and House of Doge is in the works and could send prices on a strong rally. Furthermore, Dogecoin has weathered reports of Elon Musk leaving DOGE to reach what analysts like Master Kenobi are calling the bottom.

A Bounce Back Will Face A Series Of Bumps

While there is consensus for a Dogecoin price rally, several factors are standing in the way of a bounce back. First, Dogecoin whales have dumped 1.3 billion DOGE sparking worries of concerted sell pressure from heavy hitters.

Furthermore, the DOGE transaction count has taken a major hit, dropping by 94% over the last month. The transaction count decline is stoking fears of a steep plunge in Dogecoin price as demand for the memecoin reaches an all-time low.

Bitcoin’s price crashes continue to have a negative impact on DOGE with top crypto dragging other altcoins underwater. The broader macroeconomic uncertainty is poised to affect cryptocurrency prices with China and the EU announcing retaliatory tariffs against the US. To post a new all-time high, DOGE will have to pick itself gingerly through a minefield of unsavory fundamentals and on-chain data.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

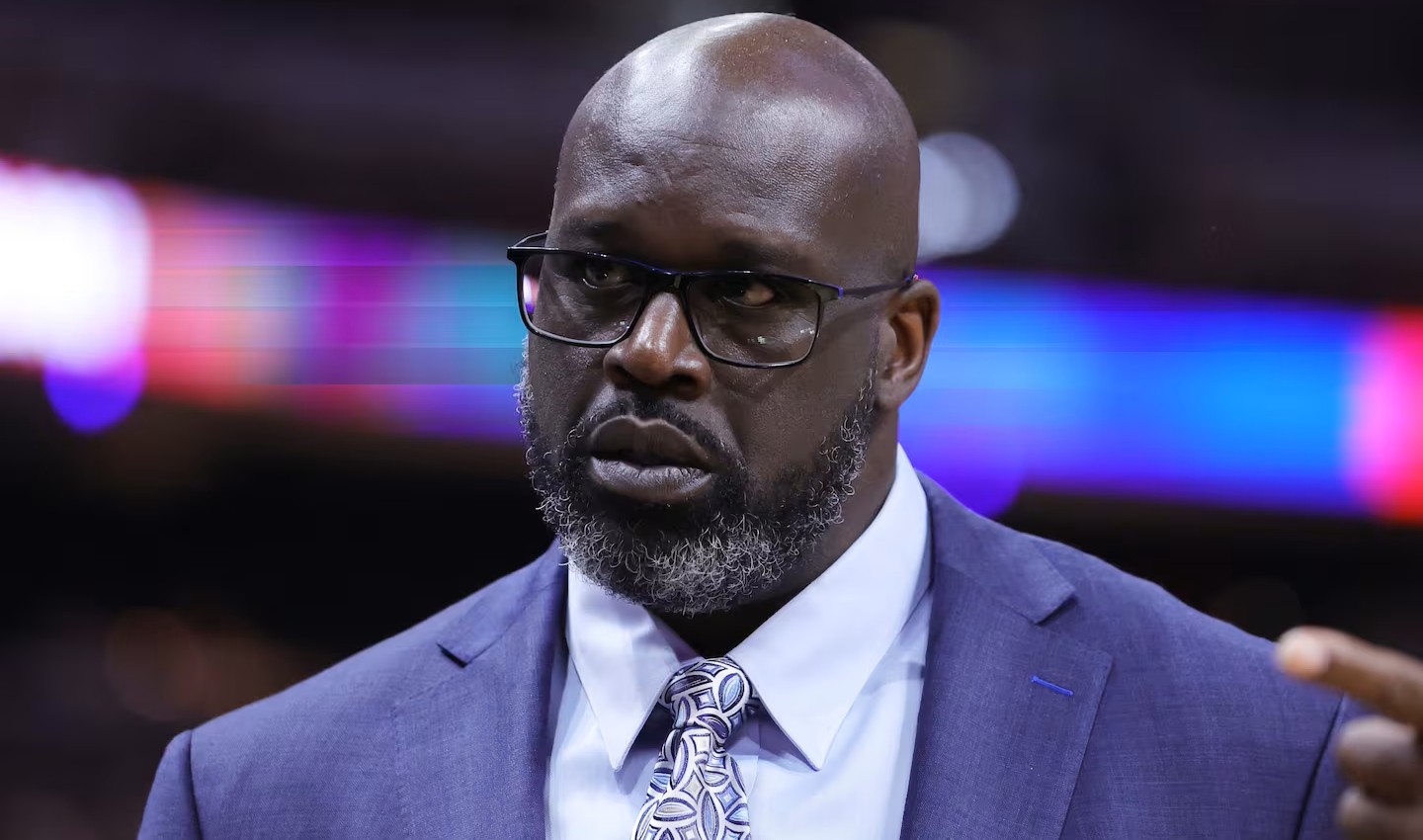

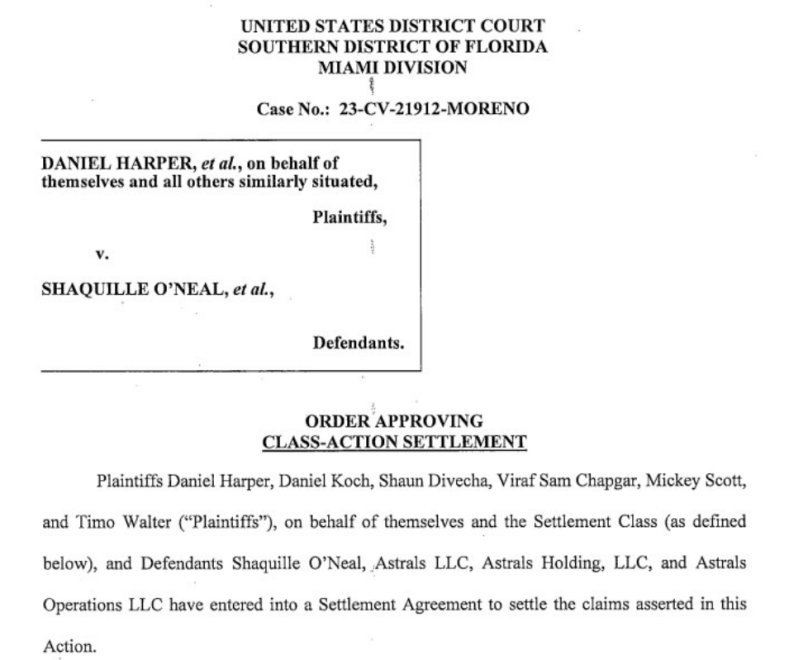

NFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

NBA legend Shaquille O’Neal has agreed to pay $11 million to settle a class-action lawsuit over his promotion of the failed Astrals NFT project. A Florida federal judge approved the settlement on April 1, with the order becoming public just this week on April 8, according to court documents.

Basketball Icon Caught In Crypto Controversy

The lawsuit, first filed in May 2023, claimed O’Neal promoted the sale of unregistered securities through the Solana-based Astrals NFT collection. Investors who bought Astrals NFTs or the project’s GLXY tokens between May 2022 and January 15, 2024, will now be eligible for compensation from the settlement fund.

Judge Federico Moreno previously acknowledged that plaintiffs had made a plausible case that the former NBA star acted as a seller under securities law. The settlement comes after months of legal back-and-forth, with O’Neal reaching an agreement with plaintiffs last November.

The next shot – Shaquille O’Neal and #Astrals NFTs + $GLXY tokens.

Shaq actively promoted the tokens, calling himself “Astrals Chief Astronaut.” But after the FTX collapse in November 2022, the project’s reputation took a hit, and token sales slowed significantly.$GLXY is down… pic.twitter.com/quHziiGCdA

— 11th.com (@11thestate) March 28, 2025

Lawyers Take Home $2.9 Million Slice

The court approved $2.9 million in attorney fees and related costs as part of the settlement package. Judge Moreno ruled these fees were “fair and reasonable,” and noted that none of the plaintiffs objected to the amount lawyers would receive.

The lawyers were able to convince the court that investors lost their money because of O’Neal’s marketing campaigns for the project.

Court papers indicate that O’Neal urged potential investors to “hop on the wave before it’s too late,” something that came to haunt him in court.

Screenshot of court document on Shaq's legal settlement. Source: Courtlistener

Failed Project Promised Virtual Meetings With Shaq

Astrals were released in April 2022, providing 10,000 one-of-a-kind 3D avatars designed by artist Damien Guimoneau. The venture presented itself as a fully immersive metaverse experience through which users would be able to interact with other users as well as with O’Neal himself.

Despite the star power behind it, the collection has shown zero signs of activity over the past two years based on data from NFT marketplace OpenSea.

O’Neal reportedly continued to support the project publicly even after the major cryptocurrency exchange FTX collapsed in November 2022.

The court did throw O’Neal one small victory, dismissing claims that he was a “control person” within the project—a designation that would have suggested he held actual power over its operations rather than just serving as its famous face.

Shaquille O’Neal to Face Legal Action Over Astrals NFT Project and FTX Involvement

TLDRShaquille O’Neal faces a class action lawsuit over his involvement in the Astrals NFT project

The court dismissed allegations that O’Neal was a “control person” but found he could be cons… pic.twitter.com/tslw52EwOw

— 🛑 BREAKING NEWS 🛑📢🔔⚠💥❗💬 (@NotAnotherTip) August 19, 2024

NFT Market Continues Downward Spiral

The settlement comes as the broader NFT market struggles to regain its former glory. Total NFT sales volume stood at just $27 million for the week ending April 7, 2025, a dramatic drop from the $2 billion-plus weekly volumes recorded during the market’s peak in 2021.

This downward trend has been ongoing, with trading volumes falling by more than 60% in February alone. The drop continues a slide that began in early 2024, suggesting the once-hot digital collectibles market remains in a prolonged slump.

Featured image from Megan Briggs/Getty, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin19 hours ago

Altcoin19 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Crashes Below $75,000 As Asian Stock Markets Bleed

-

Market23 hours ago

Market23 hours agoBerachain Drops 47% in a Month as Bearish Signals Grow

-

Bitcoin20 hours ago

Bitcoin20 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Market19 hours ago

Market19 hours agoFed Reverse Repo Facility Drains, Stealth Liquidity Injections Seen

-

Market18 hours ago

Market18 hours agoDogecoin (DOGE) at Risk of More Losses as Market Volatility Spikes

-

Market16 hours ago

Market16 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Altcoin16 hours ago

Altcoin16 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

✓ Share: