Market

SatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

Bitcoin has long been regarded as a store of value, often compared to digital gold. However, with the rapid advancements in decentralized finance (DeFi) and blockchain infrastructure, the demand for new ways to utilize Bitcoin beyond passive holding has surged.

SatLayer, a pioneering Bitcoin-based infrastructure provider, is at the forefront of this transformation. Through restaking and Bitcoin Validated Services (BVS), SatLayer aims to unlock new use cases for Bitcoin (BTC), ensuring its integration into the changing financial ecosystem. BeInCrypto spoke exclusively with SatLayer’s Co-Founder and CEO, Luke Xie, to explore how Bitcoin’s role expands and what the future holds for Bitcoin-based infrastructure.

Beyond a Store of Value: Bitcoin’s Next Evolution

According to Xie, Bitcoin has transitioned through multiple phases—from an experimental digital currency to a widely recognized store of value. Now, as the broader crypto ecosystem has evolved with smart contract capabilities, Bitcoin holders have sought new opportunities beyond simply holding their assets.

Xie highlights that Bitcoiners have observed Ethereum (ETH) and other chains, including Solana (SOL), offering staking and yield-generating opportunities. Meanwhile, Bitcoin itself has remained largely passive.

According to Xie, SatLayer’s mission is to change that by introducing restaking. In doing so, it enables Bitcoin holders to generate yield while securing decentralized applications (dApps).

“Naturally Bitcoiners, who’ve watched this innovation occur while they’ve been hodling hard, want a piece of that action: the yield, the use cases, the onchain opportunities. As we all know, the Bitcoin network was not built for that sort of stuff, but developers have painstakingly assembled the infrastructure for Bitcoin DeFi on Layer 2. The fees are low, the throughput is high, and the sort of primitives you’d hope to find – for trading, borrowing, and much more – are all in place,” Xie told BeInCrypto.

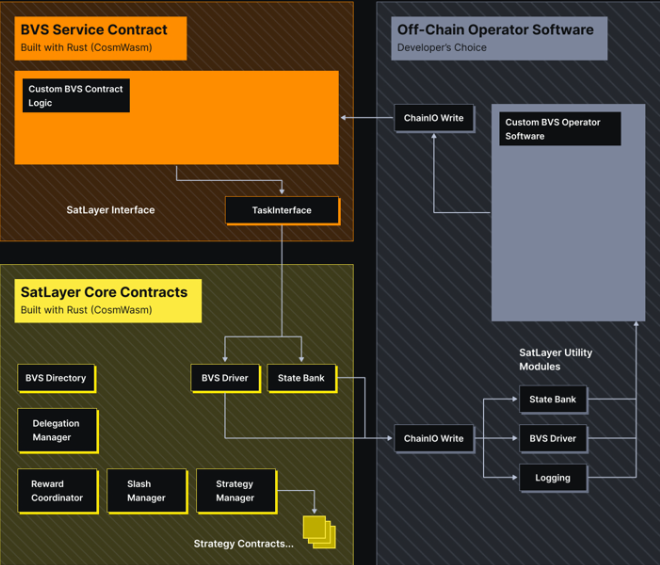

Bitcoin Validated Services (BVS): Enhancing Security and Utility

At the core of SatLayer’s vision is Bitcoin Validated Services (BVS). This concept allows dApps to be secured by restaked BTC. Unlike native tokens, which may lack liquidity and stability, Bitcoin’s unmatched value and liquidity make it the ideal asset for securing DeFi protocols.

BVS enables Bitcoin holders to collateralize their assets while simultaneously earning staking rewards. Xie explained how BVS enhances the security and utility of dApps.

“BVS describes any decentralized application or protocol that uses restaked BTC to secure its network. In real terms, this means that participants will use restaked BTC as collateral in return for having the right to validate network transactions. Because Bitcoin is valuable, this effectively eliminates the incentive for validators to act dishonestly,” Xie noted.

Any crypto asset, such as a native token, could serve as collateral for this purpose. However, it will be less liquid, valuable, and stable than BTC.

Restaking on Bitcoin: Unlocking Yield and Security

Further, Xie shared that SatLayer’s restaking mechanism is designed to be user-friendly and secure. By leveraging Wrapped Bitcoin (WBTC) or BTC Liquid Staking Tokens (LSTs), users can participate in restaking through the SatLayer platform, selecting protocols like Lombard, Lorenzo, or SolvBTC to restake with.

This process allows BTC holders to earn rewards while actively participating in securing emerging Bitcoin-based applications. The system mirrors the success of Ethereum-based restaking protocols like EigenLayer (EIGEN). It allows Bitcoin holders to contribute to network security without custodial risk.

Binance’s recent integration with Babylon, a major staking infrastructure provider, is a significant boost to this ecosystem. BeInCrypto reported that Binance has incorporated Babylon’s BTC staking solutions into its offerings. This marks a major step in legitimizing Bitcoin staking at scale.

This integration provides Bitcoin holders on Binance seamless access to staking and restaking services, further driving institutional and retail adoption. Likewise, with partnerships like Babylon, SatLayer enhances Bitcoin’s staking ecosystem.

“It’s a symbiotic relationship in which everyone benefits – Babylon, SatLayer, and most importantly Bitcoin holders,” he added.

By collaborating with Babylon, SatLayer strengthens Bitcoin’s DeFi presence. It creates a strong framework where BTC can be staked and restaked without compromising security. The synergy between these platforms accelerates Bitcoin’s growth from a passive store of value into an active financial instrument within the broader crypto economy.

Security and Future Innovations

Security remains a top priority for SatLayer. Xie emphasizes that rigorous audits and careful protocol design ensure that Bitcoin restaking maintains the security and decentralization that Bitcoin is known for.

Looking ahead, SatLayer plans to introduce AI-powered yield optimization. The firm also anticipates on-chain insurance backed by Bitcoin collateral and streamlined restaking services. Xie also sees Bitcoin infrastructure growing rapidly over the next five years.

“It’s still very early for restaking, so the obvious answer is a massive increase in TVL and the number of active users. It’s a self-fulfilling Simpsons nuclear power plant ‘days without incident’ narrative: the longer that Bitcoin restaking operates successfully, the greater the trust it will gain,” Xie concluded.

As Bitcoin grows, SatLayer’s innovations could be crucial in transforming the world’s most valuable cryptocurrency into a yield-generating asset. With Bitcoin’s infrastructure expanding, coupled with these developments, the pioneer crypto could go beyond its role as digital gold and transition into a fully integrated, yield-generating asset within the broader crypto economy.

Its dominance in the digital economy is poised to grow beyond being just a store of value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Price Stalls After Major $147 Million Token Unlock

SUI enters a critical phase today as a $147 million token unlock threatens to inject selling pressure into a market already testing key resistance levels. Despite a sharp rebound in momentum—evident in the RSI’s surge from oversold territory—SUI failed to break above the crucial 60 mark, signaling buyer hesitation.

The Ichimoku Cloud shows price action pressing against the cloud’s edge, but lacking the conviction needed for a clear breakout. With a possible golden cross forming on the EMA lines, bulls still have a chance—if they can overcome resistance at $2.50 and avoid being dragged down by post-unlock volatility.

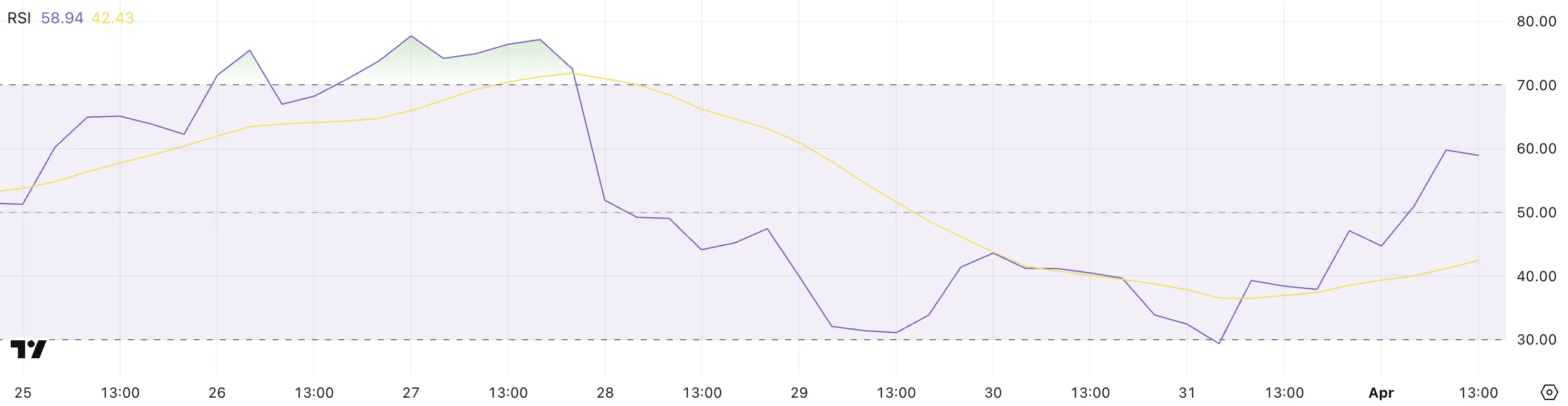

SUI RSI Surged Since Yesterday But Failed To Break Above 60

SUI’s Relative Strength Index (RSI) has jumped sharply to 58.94, up from 29.38 just a day ago, reflecting a strong shift in short-term momentum.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It typically ranges from 0 to 100. Readings below 30 suggest an asset may be oversold, while levels above 70 indicate it may be overbought.

The rapid rise in SUI’s RSI suggests buyers have stepped in aggressively after a period of heavy selling.

However, despite the impressive rebound, SUI’s RSI briefly approached but failed to break above the 60 threshold earlier today.

This level often acts as a short-term resistance during recovery phases, and the rejection may indicate lingering hesitation among buyers or profit-taking after the surge.

While the RSI nearing 60 is encouraging, a decisive move above it would be needed to confirm a breakout. For now, SUI appears to be in a recovery mode. However, the inability to push past 60 highlights that bulls are not fully in control just yet.

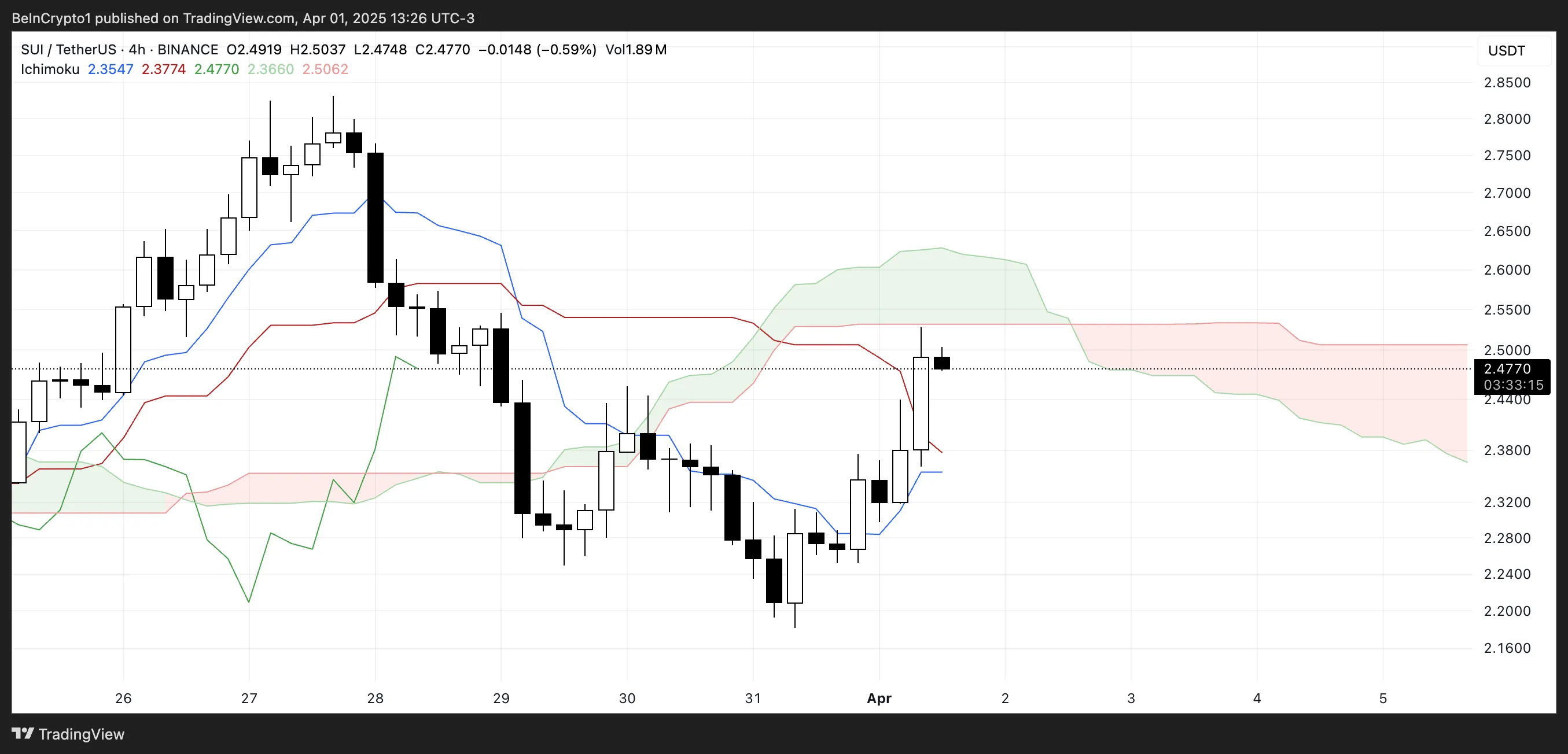

Ichimoku Cloud Shows Lack Of Strong Upward Momentum

SUI blockchain Ichimoku Cloud chart shows a potential breakout attempt, as the price has surged upward and is now hovering right at the edge of the Kumo (cloud).

This movement suggests bullish momentum is trying to build. However, the resistance provided by the thick, red cloud ahead could make it difficult for SUI to sustain the uptrend without stronger confirmation.

The Tenkan-sen (blue line) is starting to rise and has crossed above the Kijun-sen (red line), which is a bullish signal. However, the price still needs to clearly break and hold above the cloud to flip the overall trend from bearish to bullish.

For now, the cloud remains bearish and flat, indicating possible resistance and a lack of strong upward conviction.

The current position suggests that SUI is at a key decision point—either break through the cloud to initiate a trend reversal or get rejected and slip back into the previous downtrend range.

If buyers can sustain the pressure and push the price above the upper cloud boundary, it could trigger a stronger rally. But without increased volume and broader market support, the price risks getting stuck in consolidation or turning back downward.

Will SUI Rise Back To $2.80?

SUI’s EMA lines are tightening and showing signs of a potential golden cross. That happens when a short-term moving average crosses above a longer-term one—a classic bullish signal that often precedes upward momentum.

However, the price is currently grappling with a key resistance near the $2.50 level.

If bulls manage to break through this level, it could open the path for a move toward $2.83.

That said, downside risks remain, particularly with today’s $147 million token unlock, which could introduce significant selling pressure. If that selling materializes, SUI price could fall back to test the support at $2.23.

A breakdown below that level would likely shift momentum back in favor of bears. This would expose deeper supports at $2.11 and $1.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle Files for IPO

Leading stablecoin issuer Circle finally launched an IPO. It has been preparing for this launch for almost a year, and joins several other crypto firms that are interested in an IPO filing.

This gives Circle a number of opportunities, both to benefit financially and to better integrate with the financial infrastructure and regulatory apparatus.

Circle’s IPO Comes At Last

Circle, one of the world’s largest stablecoin issuers, just filed for an IPO. The firm has been planning this move for nearly a year, relocating to the United States to make the process easier. Since Trump won the most recent Presidential election, the firm’s chances of an IPO increased, and now it has finally pulled the trigger:

“For Circle, becoming a publicly traded corporation on the New York Stock Exchange is a continuation of our desire to operate with the greatest transparency and accountability possible. We are building what we believe to be critical infrastructure for the financial system, and we seek to work with leading companies and governments around the world in shaping and building this new internet financial system,” founder and CEO Jeremy Allaire claimed in the filing.

By launching this IPO, Circle has opened a few new doors for itself. Of course, it’s a substantial opportunity for revenue, but it’s also an important way to intensify the firm’s connections to the financial infrastructure. In this respect, it joins a number of other crypto firms that have sought their own IPO in the last month.

Circle’s IPO filing doesn’t list many concrete numbers, such as initial public offering price, number of available shares, proceeds to the selling stockholders, etc. However, this development is very recent. Further details will likely come to light as the sale progresses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Faces Resistance While ETH Sees DEX Volume Boost

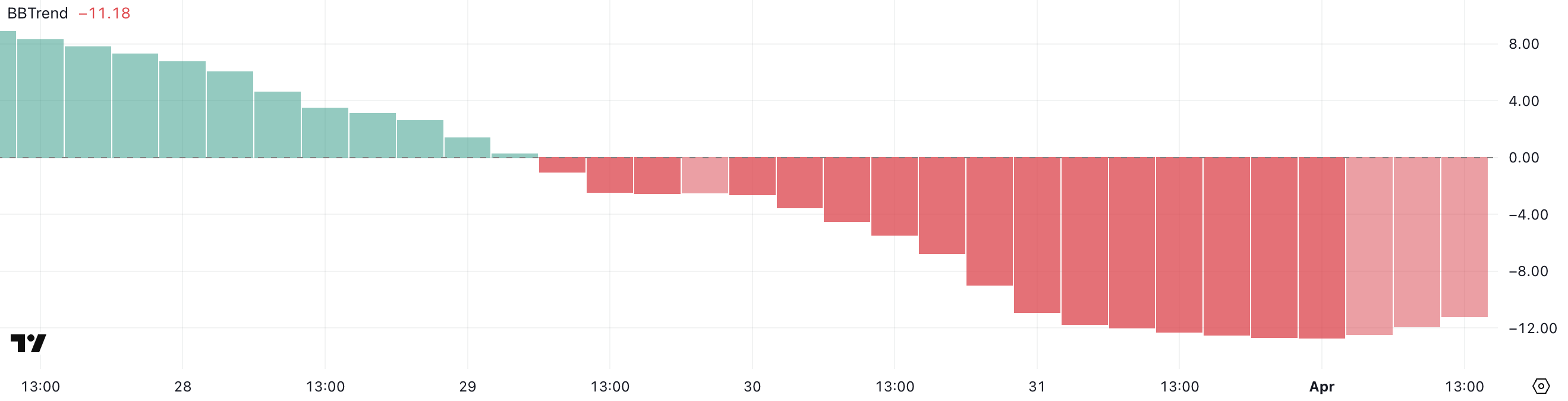

Solana (SOL) is attempting to recover from an almost 12% correction over the past seven days. The RSI has surged into overbought territory, suggesting strong bullish momentum. However, the BBTrend remains deeply negative—though it’s beginning to ease, hinting at potential stabilization.

Meanwhile, the EMA lines are setting up for a possible golden cross, signaling that a trend reversal could be forming if key resistance levels are broken. Still, with Ethereum overtaking Solana in DEX volume for the first time in six months and critical support levels not far below, SOL remains in a delicate position.

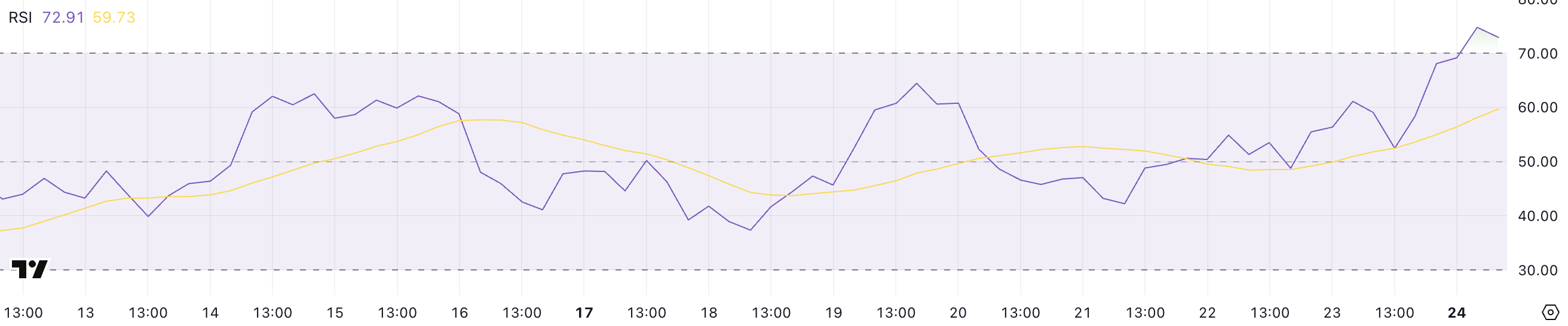

SOL RSI Is Now At Overbought Levels

Solana’s Relative Strength Index (RSI) has surged to 72.91, up sharply from 38.43 just a day ago—indicating a rapid shift in momentum from neutral to strongly bullish territory.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 typically suggest an asset is overbought and may be due for a pullback, while levels below 30 indicate oversold conditions and potential for a rebound.

With Solana’s RSI now above 70, the asset has officially entered overbought territory, reflecting intense buying pressure in the short term.

While this can sometimes precede a correction or consolidation, it can also signal the start of a breakout rally.

Traders should watch closely for signs of continuation or exhaustion. If momentum holds, Solana could push higher, but any stalling may trigger profit-taking and short-term volatility.

Solana BBTrend Is Decreasing, But Still Very Negative

Solana’s BBTrend indicator has climbed slightly to -11.18 after hitting a low of -12.68 earlier today. That suggests that the bearish momentum is starting to ease.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on how price interacts with the Bollinger Bands.

Values below -10 typically indicate strong bearish pressure, while values above +10 reflect strong bullish momentum. A rising BBTrend from deep negative territory can be an early sign of a potential reversal or at least a slowdown in the downtrend.

With SOL’s BBTrend still in bearish territory but improving, the market may be attempting to stabilize after a period of intense selling.

However, broader ecosystem developments complicate the technical picture. For example, Ethereum recently surpassed Solana in DEX volume for the first time in six months.

While the easing BBTrend hints at recovery potential, Solana still needs a stronger confirmation to shift the trend fully in its favor. Until then, cautious optimism may be warranted, but the bears haven’t fully let go.

Solana Still Has Challenges Ahead

Solana’s EMA lines are showing signs of an impending golden cross. A golden cross occurs when a short-term moving average crosses above a long-term one. That’s often seen as a bullish signal that can mark the start of a sustained uptrend.

If this pattern is confirmed and buying momentum continues, Solana price could push up to test the resistance at $131.

A successful breakout above that level may open the door to further gains toward $136, and potentially even $147.

However, downside risks remain if buyers fail to hold recent gains.

If SOL pulls back and loses the key support at $124, it could trigger further selling pressure, pushing the price down to $120.

Should the downtrend gain strength from there, SOL might revisit deeper support levels around $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Bitcoin14 hours ago

Bitcoin14 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market22 hours ago

Market22 hours agoTop 3 Made in USA Coins to Watch In April

-

Market20 hours ago

Market20 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Bitcoin12 hours ago

Bitcoin12 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market19 hours ago

Market19 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Ethereum19 hours ago

Ethereum19 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market18 hours ago

Market18 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz