Market

Uptrend Resumes After A Healthy Pullback

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After a brief yet necessary cooldown, BNB is back in action, regaining bullish momentum and resuming its uptrend. The recent pullback provided a much-needed reset, allowing buyers to step in near the $605 support level and strengthen the foundation for a renewed climb.

Now, with increasing buying pressure, BNB is making another push toward key resistance levels, signaling that the rally may not be over just yet. However, breaking through overhead resistance will be a crucial test for bulls. If buying pressure continues to build, BNB could push toward new local highs. Meanwhile, if bears step in at key levels, another retracement could be on the horizon.

Technical Rebound: Charting The Recovery Momentum

After a strong rally, BNB experienced a brief pullback, allowing the market to cool off before resuming its upward trajectory. Rather than signaling a reversal, this dip served as a natural correction, shaking out weak hands while providing strong support for the next move.

Related Reading

During the pullback, BNB found support at a crucial level, preventing a deeper decline and reinforcing bullish confidence. The consolidation phase also helped ease overbought conditions, resetting momentum indicators like the Relative Strength Index (RSI) and allowing for a more sustainable climb.

Additionally, the price is currently holding above the 100-day Simple Moving Average (SMA). As long as the price remains above the 100-day SMA, the uptrend remains intact, suggesting the potential for further gains.

As BNB continues its recovery, key resistance levels will play a crucial role in determining the strength of its uptrend. The first major hurdle lies at $680, a psychological and technical barrier where previous rejections have occurred. A decisive break above this level could attract more buying pressure, paving the way for more growth.

Beyond $680, the next resistance to monitor is around $725, where sellers previously stepped in during the last rally. Clearing this zone would signal strong upward movement and open the door for a potential test of the $795 mark, a key milestone that might fuel further upside.

BNB Bearish Risks: What Could Halt The Uptrend?

Despite BNB’s renewed bullish momentum, several factors could stall its upward movement. One key risk is failure at critical resistance levels, particularly around $680. A rejection at these points combined with declining buying pressure, would trigger a pullback and encourage profit-taking.

Related Reading

Another concern is weak trading volume. If BNB’s rally lacks sufficient volume support, it may indicate waning investor confidence, making it easier for sellers to regain control. Additionally, if indicators like the RSI enter the overbought territory without strong price follow-through, a correction could be imminent.

Featured image from Unsplash, chart from Tradingview.com

Market

Binance Reshapes Listings with Binance Wallet’s TGEs Approach

Instead of directly listing tokens on the Binance exchange as before, Binance has recently implemented a new method through Binance Wallet.

Accordingly, the exchange has shifted from large-scale initial token offerings to a secondary listing model after hosting Token Generation Events (TGEs) through Binance Wallet.

The Secondary Listing Model

So far this year, five projects have been publicly launched on Binance Wallet. It facilitated the sales of projects, including Particle Network (PARTI), Bedrock (BR), and Bubblemaps (BMT).

It appears that Binance is reducing the direct listing of projects it deems to have potential. Instead, it is adopting a secondary listing model through other components within its ecosystem.

“Binance has pivoted away from doing huge initial launches with big Day-1 selling pressure, while doing more secondary listing shortly after running TGE campaign on Binance Wallet,” a user on X observed.

Binance does not list the tokens immediately after the TGE phase amid the selling pressure. Instead, it allows users to sell first on Binance Wallet, PancakeSwap, or other centralized exchanges (CEXs). This ensures that Binance users who did not participate in the TGE are not affected by price drops.

Finally, Binance can list the token when its valuation is lower, and selling pressure has decreased. Projects with strong capital may have already bought back their tokens at a low price, and at this point, the listing can create a new wave of price increases.

The impressive performance of these projects after TGE triggers a FOMO (Fear of Missing Out) effect, bringing numerous benefits to Binance’s ecosystem. This includes increasing the Total Value Locked (TVL) on the BNB Chain as new assets are issued, attracting new users to the Binance Wallet, and boosting demand for BNB purchases.

X user Ahboyash commented that the token sale on Binance Wallet is part of a 4-stage strategy for new projects. The ultimate goal of this strategy is to list on Binance Futures and eventually aim for a Binance Spot listing.

The user also cited MyShell as an example. The project conducted its TGE Offering on Binance Wallet, then listed on Binance Alpha, and finally achieved a Binance Spot listing.

Impressive Performance of Binance Wallet TGE Projects

Thanks to this secondary listing model, projects conducting TGEs through Binance Wallet have shown strong performance. Data from icoanalytics indicates that all five projects launched via Binance Wallet in 2025 have achieved ROI ranging from 2.3x to 14.7x, outperforming projects on Binance Alpha.

This strategy has effectively reduced users’ risk and optimized the benefits for Binance ecosystem components, including BNB Chain and Wallet. As a result, Binance Wallet’s daily trading volume surged to $90.5 million on March 18. This represented a 24x increase from early March.

However, users on other CEXs may experience losses due to initial selling pressure. Additionally, if a project fails to develop successfully, both Binance and investors could face negative consequences.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will BlackRock & Fidelity Join?

The race for an XRP ETF (exchange-traded fund) in the US is heating up as top financial firms, including BlackRock and Fidelity, are predicted to join the competition.

Brazil beat the US with an XRP ETF already running after Hashdex secured approval a month ago, effectively pioneering the country’s financial instrument.

Nate Geraci Says XRP ETF Only A Matter of Time

Nate Geraci stated that XRP ETF approval is “simply a matter of time.” According to the president of the ETF Store, the XRP token is the third-largest non-stablecoin cryptocurrency by market capitalization, making it an attractive candidate for major ETF issuers.

He expects leading asset managers like BlackRock and Fidelity to enter the XRP ETF market. This would mean following the footsteps of other firms like Bitwise, Canary Capital, WisdomTree, and Grayscale, who have already submitted filings.

“Ripple lawsuit coming to end… Seems obvious that spot XRP ETF approval is simply a matter of time IMO. And yes, I expect BlackRock, Fidelity, etc. to all be involved. XRP is currently 3rd largest non-stablecoin crypto asset by market cap. Largest ETF issuers aren’t going to ignore this,” wrote Geraci.

While Fidelity’s position remains unclear, BlackRock recently said it would prioritize Bitcoin and Ethereum ETFs, citing their strong performance and market maturity. Specifically, regulatory uncertainty and low market share kept BlackRock from launching altcoin ETFs like Solana or XRP.

“We’re just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own IBIT and ETHA, so that’s what we’re focused on (vs. launching new altcoin ETFs),” Bloomberg’s Eric Balchunas stated, citing Jay Jacobs, the head of BlackRock’s ETF department.

Nevertheless, the growing confidence in an XRP ETF stems from recent positive developments in Ripple’s long-running legal battle with the US SEC (Securities and Exchange Commission). The securities regulator recently dropped its lawsuit against Ripple, marking a significant victory for the blockchain company.

As BeInCrypto reported, Ripple will retain $75 million from its settlement with the SEC as the case enters its final stages.

Ripple CEO Brad Garlinghouse has expressed renewed optimism about the company’s future in the US following this break. In his opinion, the legal victory paves the way for further institutional adoption.

Five months ago, Garlinghouse predicted that an XRP ETF was inevitable. Recent regulatory clarity has only strengthened this belief.

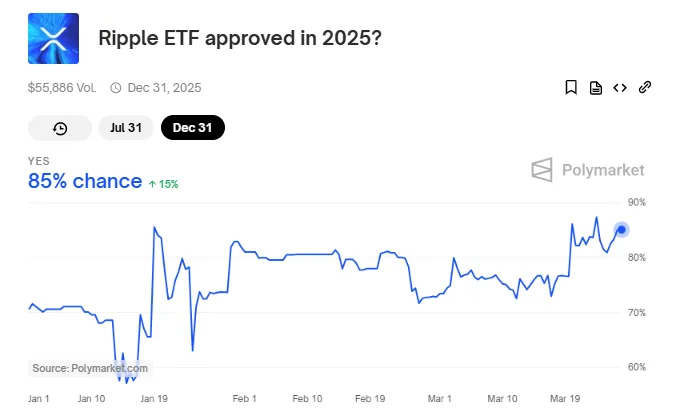

XRP ETF Approval Odds Soar to 82%

As of February, the SEC began a 240-day countdown to review XRP ETF applications, with approval odds increasing significantly. According to Polymarket data, the likelihood of an XRP ETF approval in 2025 has surged to 82%. At the same time, there is a 41% chance of approval by July 31, 2025.

This growing confidence reflects the SEC’s changing stance on crypto-based ETFs following the approval of spot Bitcoin ETFs earlier this year.

JPMorgan analysts predict that XRP ETFs could attract between $6 and $8 billion in 6 to 12 months. This projection reflects the strong demand for regulated crypto investment products. This is particularly pronounced among institutional investors seeking exposure to digital assets without direct custody risks.

However, while the optics look good for XRP ETFs, investor demand for additional products beyond Bitcoin and Ethereum ETFs remains uncertain.

Nic Puckrin, financial analyst and founder of The Coin Bureau, says the additional ETFs may be unnecessary in a soon-to-be oversaturated market.

“…Trump Media’s new “Made in America” ETFs – which are set to include US-made altcoins alongside stocks – will bring nothing new to the table. In all likelihood, their success will be short-lived and their long-term performance will be lackluster. Investors will continue choosing BTC ETFs over all this noise,” Puckrin told BeInCrypto.

BeInCrypto data shows XRP was trading for $2.47 as of this writing. This represents a modest surge of almost 2% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Price Under $0.20 Struggles To End 2-Month Downtrend

HBAR has struggled to break free from a two-month downtrend, with its price stuck under the $0.20 resistance level. Although the altcoin is attempting to bounce back, broader market conditions and a lack of investor confidence have hindered its efforts.

This ongoing struggle to regain upward momentum keeps HBAR in a difficult position, as it faces resistance both in price action and investor sentiment.

Hedera Investors Are Bearish

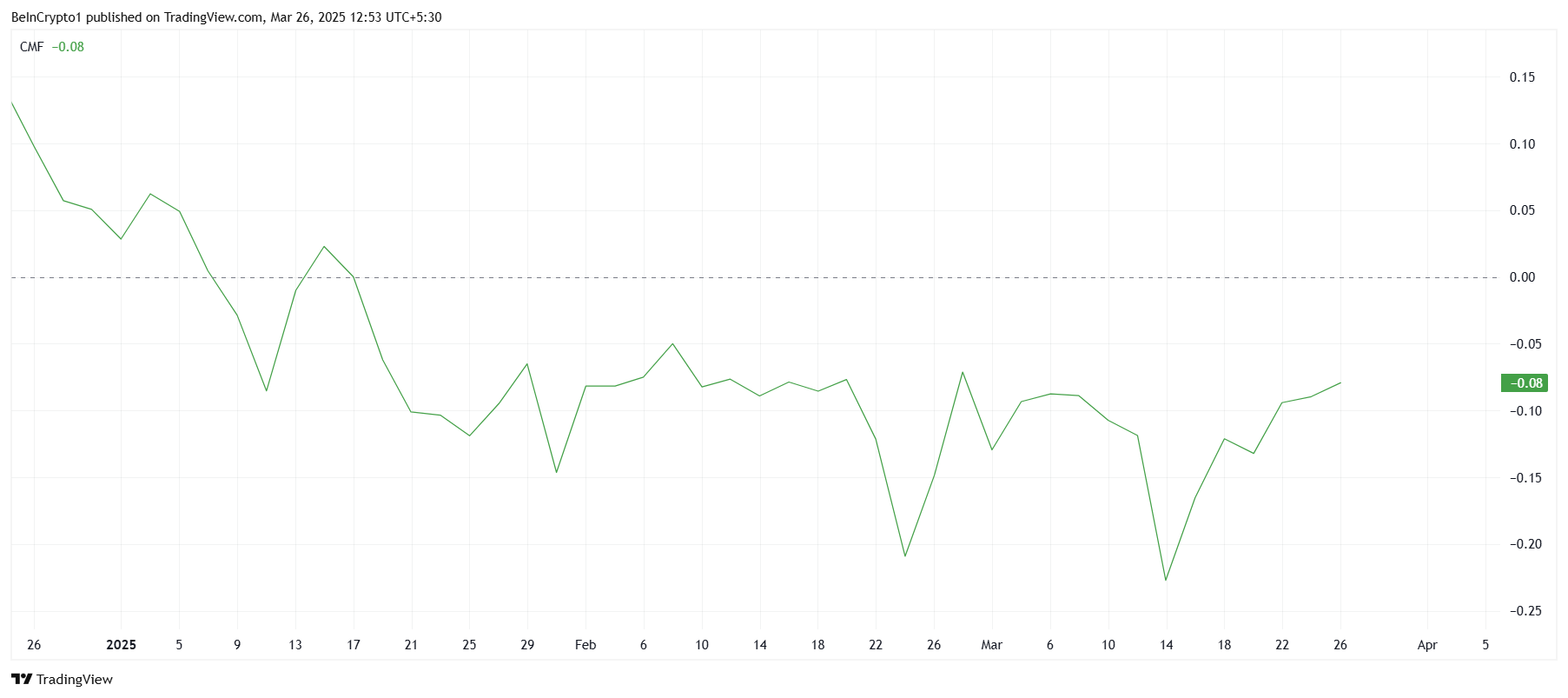

The Chaikin Money Flow (CMF) indicator has shown weak inflows since the beginning of the year. Over the past two months, HBAR’s inflows have been overtaken by outflows, a trend that has caused the CMF to remain below the zero line. This lack of strong buying interest reflects investor hesitancy, making it difficult for the altcoin to gain sustained bullish momentum.

With the CMF struggling to cross back above zero, HBAR’s market sentiment continues to be weak. This pattern indicates a lack of confidence from investors, as they are not actively driving up demand for HBAR.

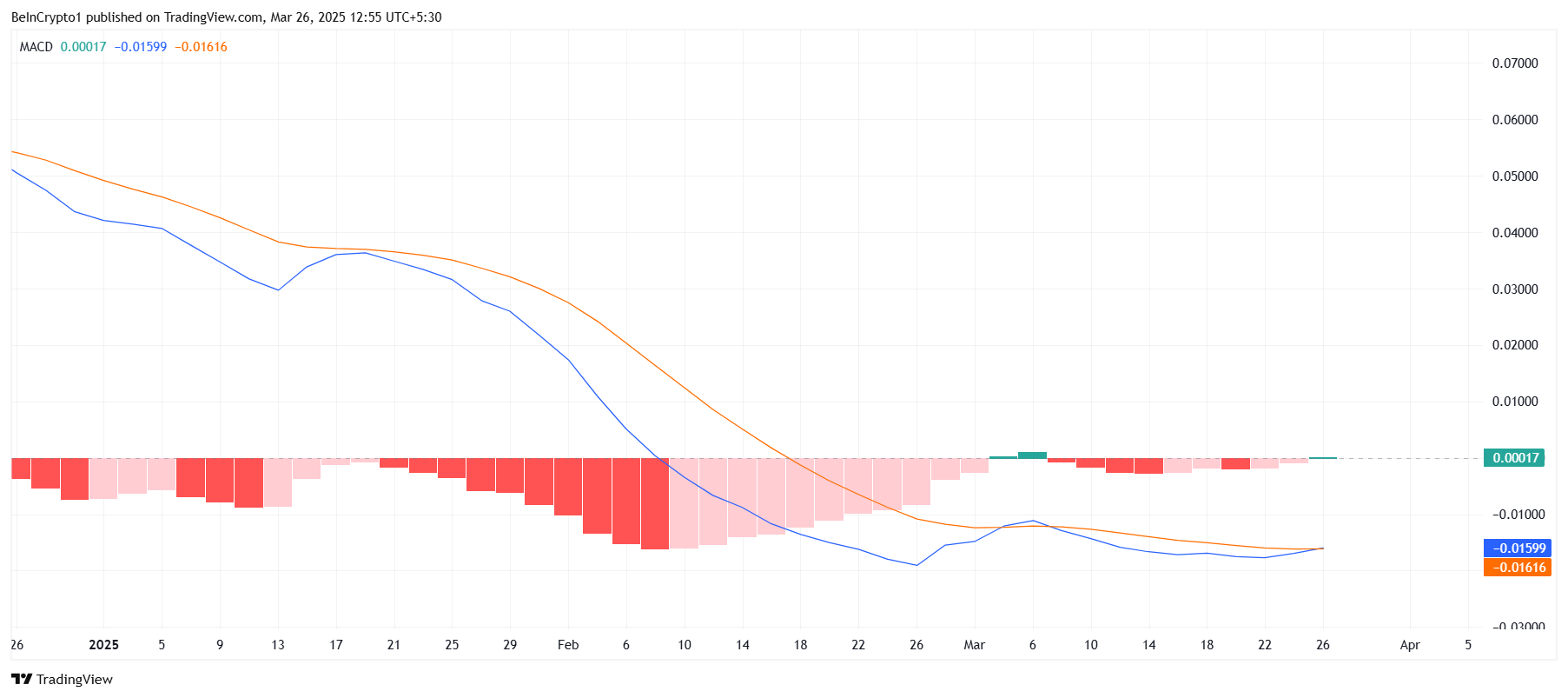

In terms of macro momentum, the Moving Average Convergence Divergence (MACD) has been showing mixed signals. Over the past three weeks, HBAR’s momentum has shifted from bullish to bearish, and now, it is back to bullish again. While this may seem like a positive sign, the lack of consistent momentum makes it unlikely that the uptrend will be sustainable.

The MACD’s fluctuations indicate that HBAR is struggling to maintain a steady trend, leaving its price vulnerable to sudden volatility. If the altcoin cannot establish a firm bullish trend, it may face further challenges in regaining investor confidence and stabilizing its price action.

HBAR Price Needs A Push

Currently trading at $0.197, HBAR is attempting to hold this level as support. However, it has been stuck under $0.200 for the past two weeks, unable to make significant gains. The price will need to consistently hold above $0.197 for a longer period to signal a potential recovery.

If the bearish momentum continues, HBAR may fail to breach $0.197 and instead fall to $0.177. A loss of this support level would open the door for a deeper decline, potentially bringing the price down to $0.154. This scenario would further extend the altcoin’s downtrend and delay any potential recovery.

On the other hand, if HBAR can break through the $0.197 resistance, it could pave the way for a rise to $0.222. Successfully securing this level would mark the end of the current downtrend and initiate a recovery, helping HBAR regain recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoCBOE Files 19b-4 For Fidelity’s Solana ETF With US SEC

-

Market23 hours ago

Market23 hours agoPi Network’s Lack of Transparency Behind Listing Delay

-

Market22 hours ago

Market22 hours agoPumpSwap’s Total Trading Volume Surpasses $1 Billion

-

Altcoin22 hours ago

Altcoin22 hours agoBlackRock’s BUIDL Launches On Solana Signaling Rising Institutional Adoption

-

Market15 hours ago

Market15 hours agoTop 3 PumpFun Meme Coins to Watch Before March Ends

-

Market21 hours ago

Market21 hours agoCardano Holders Refuse To Liquidate, Support Price Rise to $0.85

-

Altcoin16 hours ago

Altcoin16 hours agoSolana Co-Founder Challenges Layer 2s—Are They Even Needed?

-

Altcoin15 hours ago

Altcoin15 hours agoHere’s Why The Dogecoin Price Surged Over 10%