Market

Bitcoin Price Dips After Rally—Is This the Perfect Entry Point?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

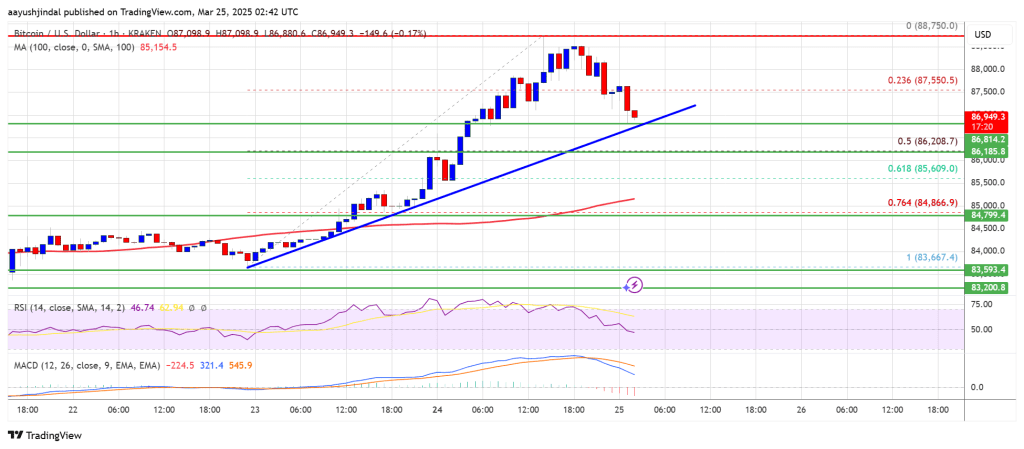

Bitcoin price started a steady increase above the $85,500 zone. BTC is now correcting gains from $88,750 and might find bids near $86,500.

- Bitcoin started a decent recovery wave above the $85,000 zone.

- The price is trading above $86,500 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $86,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $87,500 and $88,000 levels.

Bitcoin Price Regains Traction

Bitcoin price remained stable above the $83,200 level. BTC formed a base and recently started a recovery wave above the $85,500 resistance level.

The bulls pushed the price above the $88,000 resistance level. However, the bears were active near the $88,800 resistance zone. A high was formed at $88,750 and the price corrected some gains. There was a move below the $88,000 level.

The price dipped below the 23.6% Fib retracement level of the upward move from the $83,665 swing low to the $88,750 high. Bitcoin price is now trading above $86,200 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $86,800 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $87,200 level. The first key resistance is near the $87,500 level. The next key resistance could be $88,000.

A close above the $88,000 resistance might send the price further higher. In the stated case, the price could rise and test the $88,800 resistance level. Any more gains might send the price toward the $89,500 level or even $90,000.

More Losses In BTC?

If Bitcoin fails to rise above the $87,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $86,800 level and the trend line. The first major support is near the $86,200 level or the 50% Fib retracement level of the upward move from the $83,665 swing low to the $88,750 high.

The next support is now near the $85,500 zone. Any more losses might send the price toward the $85,000 support in the near term. The main support sits at $84,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,800, followed by $86,200.

Major Resistance Levels – $87,500 and $88,000.

Market

Will BlackRock & Fidelity Join?

The race for an XRP ETF (exchange-traded fund) in the US is heating up as top financial firms, including BlackRock and Fidelity, are predicted to join the competition.

Brazil beat the US with an XRP ETF already running after Hashdex secured approval a month ago, effectively pioneering the country’s financial instrument.

Nate Geraci Says XRP ETF Only A Matter of Time

Nate Geraci stated that XRP ETF approval is “simply a matter of time.” According to the president of the ETF Store, the XRP token is the third-largest non-stablecoin cryptocurrency by market capitalization, making it an attractive candidate for major ETF issuers.

He expects leading asset managers like BlackRock and Fidelity to enter the XRP ETF market. This would mean following the footsteps of other firms like Bitwise, Canary Capital, WisdomTree, and Grayscale, who have already submitted filings.

“Ripple lawsuit coming to end… Seems obvious that spot XRP ETF approval is simply a matter of time IMO. And yes, I expect BlackRock, Fidelity, etc. to all be involved. XRP is currently 3rd largest non-stablecoin crypto asset by market cap. Largest ETF issuers aren’t going to ignore this,” wrote Geraci.

While Fidelity’s position remains unclear, BlackRock recently said it would prioritize Bitcoin and Ethereum ETFs, citing their strong performance and market maturity. Specifically, regulatory uncertainty and low market share kept BlackRock from launching altcoin ETFs like Solana or XRP.

“We’re just at the tip of the iceberg with Bitcoin and especially Ethereum. Just a tiny fraction of our clients own IBIT and ETHA, so that’s what we’re focused on (vs. launching new altcoin ETFs),” Bloomberg’s Eric Balchunas stated, citing Jay Jacobs, the head of BlackRock’s ETF department.

Nevertheless, the growing confidence in an XRP ETF stems from recent positive developments in Ripple’s long-running legal battle with the US SEC (Securities and Exchange Commission). The securities regulator recently dropped its lawsuit against Ripple, marking a significant victory for the blockchain company.

As BeInCrypto reported, Ripple will retain $75 million from its settlement with the SEC as the case enters its final stages.

Ripple CEO Brad Garlinghouse has expressed renewed optimism about the company’s future in the US following this break. In his opinion, the legal victory paves the way for further institutional adoption.

Five months ago, Garlinghouse predicted that an XRP ETF was inevitable. Recent regulatory clarity has only strengthened this belief.

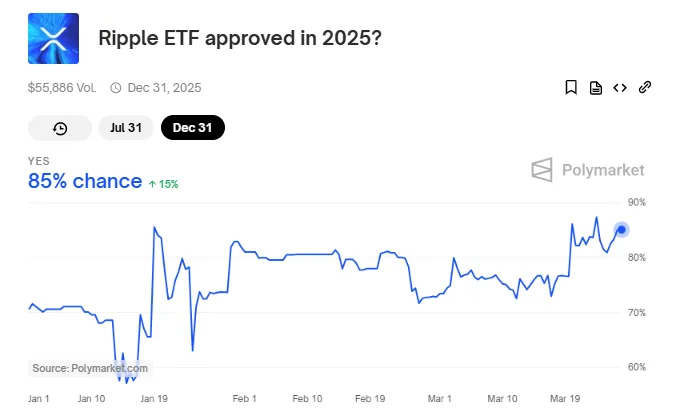

XRP ETF Approval Odds Soar to 82%

As of February, the SEC began a 240-day countdown to review XRP ETF applications, with approval odds increasing significantly. According to Polymarket data, the likelihood of an XRP ETF approval in 2025 has surged to 82%. At the same time, there is a 41% chance of approval by July 31, 2025.

This growing confidence reflects the SEC’s changing stance on crypto-based ETFs following the approval of spot Bitcoin ETFs earlier this year.

JPMorgan analysts predict that XRP ETFs could attract between $6 and $8 billion in 6 to 12 months. This projection reflects the strong demand for regulated crypto investment products. This is particularly pronounced among institutional investors seeking exposure to digital assets without direct custody risks.

However, while the optics look good for XRP ETFs, investor demand for additional products beyond Bitcoin and Ethereum ETFs remains uncertain.

Nic Puckrin, financial analyst and founder of The Coin Bureau, says the additional ETFs may be unnecessary in a soon-to-be oversaturated market.

“…Trump Media’s new “Made in America” ETFs – which are set to include US-made altcoins alongside stocks – will bring nothing new to the table. In all likelihood, their success will be short-lived and their long-term performance will be lackluster. Investors will continue choosing BTC ETFs over all this noise,” Puckrin told BeInCrypto.

BeInCrypto data shows XRP was trading for $2.47 as of this writing. This represents a modest surge of almost 2% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Price Under $0.20 Struggles To End 2-Month Downtrend

HBAR has struggled to break free from a two-month downtrend, with its price stuck under the $0.20 resistance level. Although the altcoin is attempting to bounce back, broader market conditions and a lack of investor confidence have hindered its efforts.

This ongoing struggle to regain upward momentum keeps HBAR in a difficult position, as it faces resistance both in price action and investor sentiment.

Hedera Investors Are Bearish

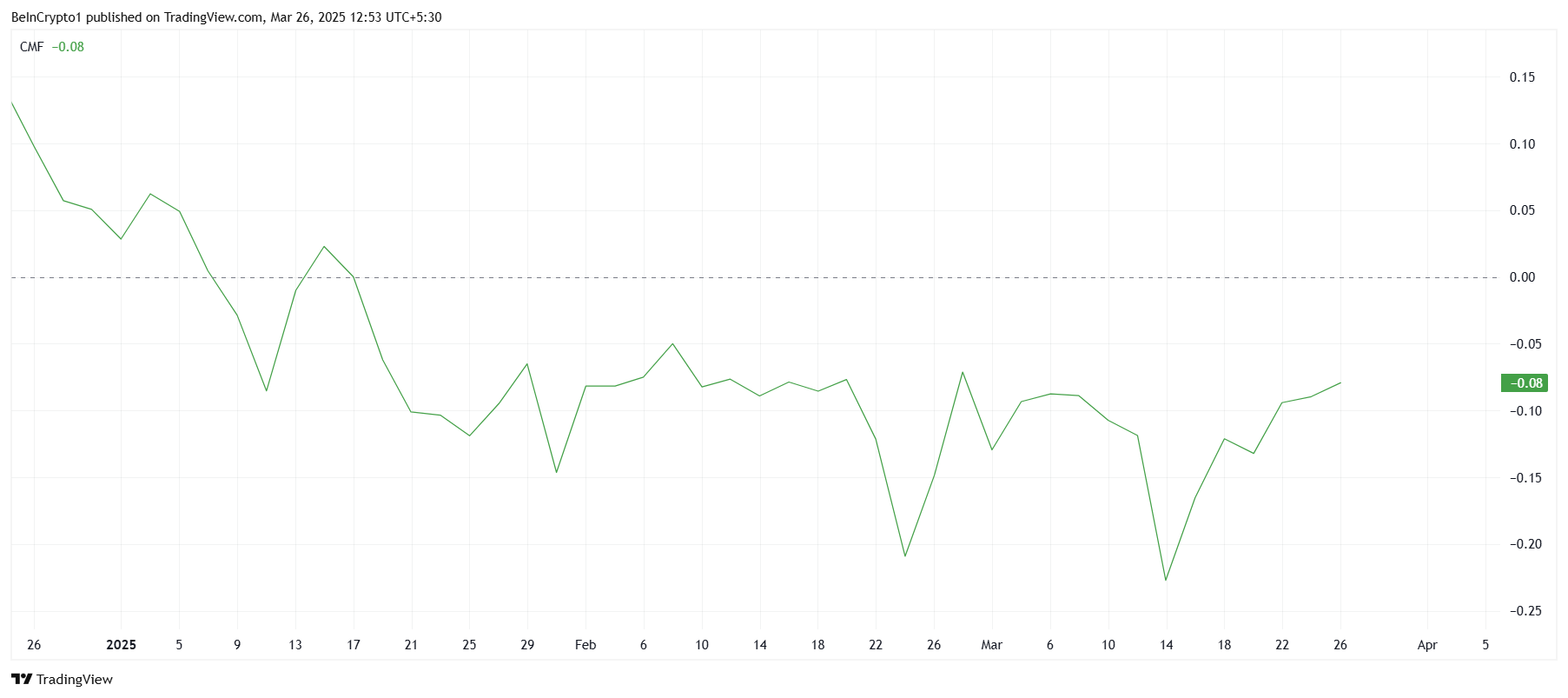

The Chaikin Money Flow (CMF) indicator has shown weak inflows since the beginning of the year. Over the past two months, HBAR’s inflows have been overtaken by outflows, a trend that has caused the CMF to remain below the zero line. This lack of strong buying interest reflects investor hesitancy, making it difficult for the altcoin to gain sustained bullish momentum.

With the CMF struggling to cross back above zero, HBAR’s market sentiment continues to be weak. This pattern indicates a lack of confidence from investors, as they are not actively driving up demand for HBAR.

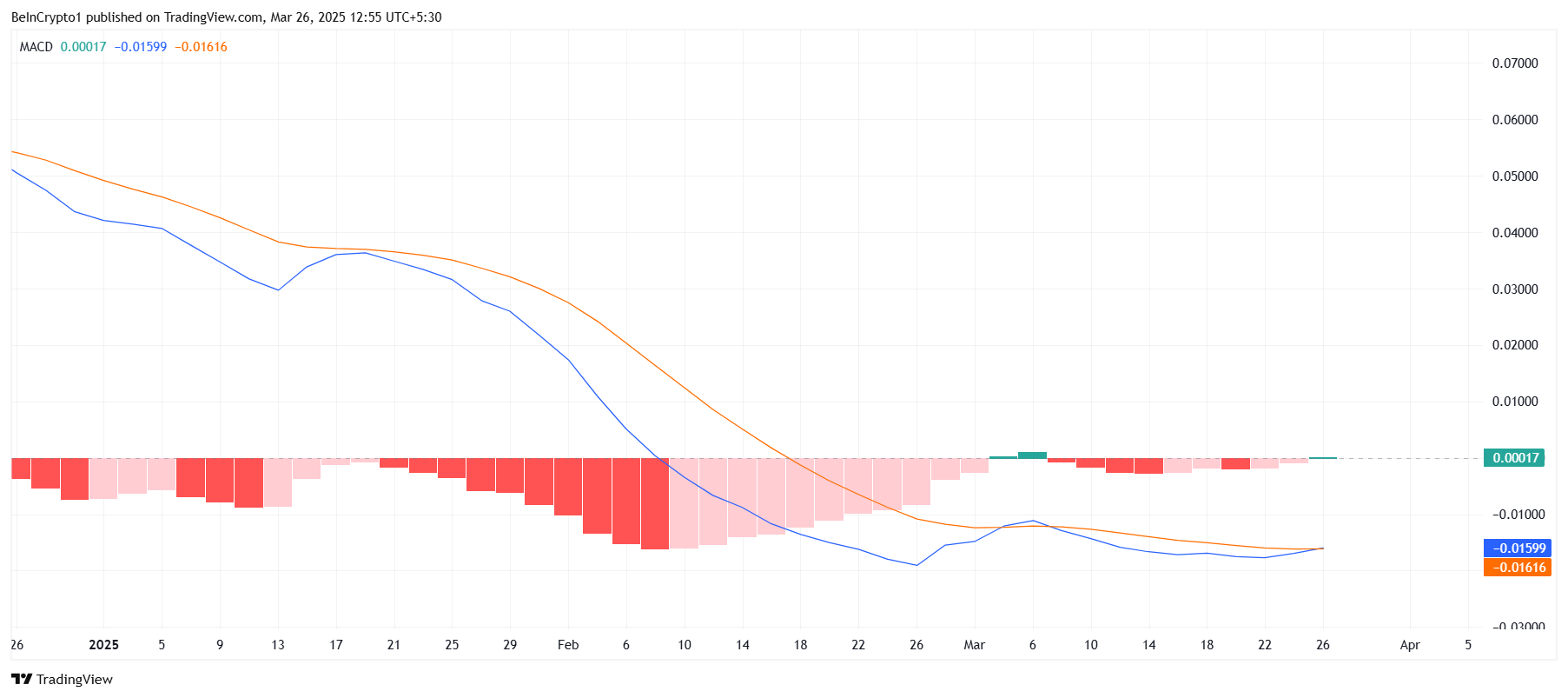

In terms of macro momentum, the Moving Average Convergence Divergence (MACD) has been showing mixed signals. Over the past three weeks, HBAR’s momentum has shifted from bullish to bearish, and now, it is back to bullish again. While this may seem like a positive sign, the lack of consistent momentum makes it unlikely that the uptrend will be sustainable.

The MACD’s fluctuations indicate that HBAR is struggling to maintain a steady trend, leaving its price vulnerable to sudden volatility. If the altcoin cannot establish a firm bullish trend, it may face further challenges in regaining investor confidence and stabilizing its price action.

HBAR Price Needs A Push

Currently trading at $0.197, HBAR is attempting to hold this level as support. However, it has been stuck under $0.200 for the past two weeks, unable to make significant gains. The price will need to consistently hold above $0.197 for a longer period to signal a potential recovery.

If the bearish momentum continues, HBAR may fail to breach $0.197 and instead fall to $0.177. A loss of this support level would open the door for a deeper decline, potentially bringing the price down to $0.154. This scenario would further extend the altcoin’s downtrend and delay any potential recovery.

On the other hand, if HBAR can break through the $0.197 resistance, it could pave the way for a rise to $0.222. Successfully securing this level would mark the end of the current downtrend and initiate a recovery, helping HBAR regain recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Next Move—Are Traders Eyeing a Big Push Higher?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin19 hours ago

Altcoin19 hours agoCBOE Files 19b-4 For Fidelity’s Solana ETF With US SEC

-

Altcoin24 hours ago

Altcoin24 hours agoCan Chainlink (LINK) Price Hit $44 Amid This Crucial Partnership?

-

Market23 hours ago

Market23 hours agoOnyxcoin Price Awaits Reversal To End 8-Week Long Downtrend

-

Market22 hours ago

Market22 hours agoPi Network’s Lack of Transparency Behind Listing Delay

-

Altcoin21 hours ago

Altcoin21 hours agoBlackRock’s BUIDL Launches On Solana Signaling Rising Institutional Adoption

-

Market20 hours ago

Market20 hours agoCardano Holders Refuse To Liquidate, Support Price Rise to $0.85

-

Market19 hours ago

Market19 hours agoUptrend Resumes After A Healthy Pullback

-

Market21 hours ago

Market21 hours agoPumpSwap’s Total Trading Volume Surpasses $1 Billion