Market

Solana’s Anatoly Yakovenko Doubts the Need for Layer-2 Networks

Anatoly Yakovenko, co-founder of Solana, ignited a fresh debate on blockchain scalability by dismissing the necessity of Layer-2 (L2) solutions.

This adds to the greater discourse about L2 networks, with key industry leaders in the space taking notice.

Solana Founder Says There’s No Reason to Build L2

Yakovenko responded to Ethereum builder rip.eth’s claim that L2s are inherently faster, cheaper, and more secure than Layer-1 (L1) blockchains. They argued that L2s avoid the high costs and consensus risks of maintaining a full-fledged L1.

Citing the example of Eclipse, a Solana Virtual Machine (SVM)-based L2 leveraging Ethereum for security, rip.eth contended that L2s could deliver the best of both worlds: Solana’s speed combined with Ethereum’s decentralized security.

However, Yakovenko dismissed this, asserting that Solana’s L1 already provides sufficient scalability without needing an L2. The Solana executive countered, arguing that L1s can achieve those efficiencies without L2 complexity.

“There is no reason to build an L2. L1s can be faster, cheaper, and more secure,” Yakovenko stated.

He pointed out that L2s face trade-offs due to reliance on an L1’s data availability stack, fraud proofs, and upgrade multisigs. In his opinion, all these introduce additional security concerns.

The conversation quickly expanded beyond L1 vs. L2 efficiency. A user, Marty McFly, raised concerns about blockchain scalability, questioning what happens when the amount of data stored on-chain grows exponentially.

Yakovenko responded that Solana currently generates around 80 terabytes of data per year. He said this is relatively small in a business context but large for individual storage. Alan, an advocate for decentralization, questioned Solana’s approach to managing unused storage, given that its state rent mechanism is inactive.

“What is Solana’s plan to offload unused storage given the current state rent mechanism is not turned on,” posed Alan.

Yakovenko clarified that Solana’s ledger will be stored on decentralized solutions like Filecoin (FIL). He indicated that offloading historical blockchain data to external storage providers is part of Solana’s long-term plan.

Shifting Trends in Layer-2 Adoption

Yakovenko’s argument against L2s comes at a time when Ethereum is experiencing significant changes in its transaction fee model. BeInCrypto reported a decline in Ethereum transaction fees, suggesting that L2 adoption has helped reduce users’ costs. This trend challenges the notion that L1 blockchains alone can meet all scalability needs without L2 enhancements.

Additionally, Binance’s founder, Changpeng Zhao, recently sparked a debate on whether artificial intelligence (AI) projects should be built on L1 or L2 solutions. The discussion mirrored Yakovenko’s and rip.eth’s arguments, highlighting the ongoing industry divide over where future blockchain-based AI applications should reside.

Meanwhile, Ethereum co-founder Vitalik Buterin recently weighed in on L2 sustainability. Six months ago, he predicted that some L2 networks would fail, emphasizing that many projects are unsustainable due to economic and security constraints.

However, just two months ago, Buterin outlined a roadmap to scale Ethereum’s L1 and L2 protocols in 2025, acknowledging that both layers will contribute to its growth.

“We need to continue building up the technical and social properties, and the utility, of Ethereum,” Buterin wrote.

Yakovenko’s firm stance against L2s highlights the growing divergence in blockchain scaling strategies. While Solana aims to push L1 scalability to its limits, Ethereum continues to develop both L1 and L2 solutions to achieve a balanced approach.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

KiloEx TGE Debuts on Binance Wallet and PancakeSwap

Binance Wallet and PancakeSwap have joined forces to host the exclusive Token Generation Event (TGE) for KiloEx (KILO).

This development follows Binance’s shift to secondary listings, facilitating TGEs via Binance Wallet before secondary exchange listings.

Binance Wallet and PancakeSwap Host KiloEx TGE

Binance revealed that KILO TGE will occur on Thursday, March 27, between 10:00 a.m. and 12:00 p.m. UTC on the BNB Smart Chain. This carefully structured public sale will introduce the KILO token to the market.

“Binance Wallet is excited to host the exclusive Token Generation Event on BNB Smart Chain for KiloEx, the next generation user-friendly perpetual DEX, with PancakeSwap,” Binance wrote.

KiloEx, a next-generation decentralized exchange (DEX) specializing in perpetual contracts, aims to enhance accessibility and liquidity in the crypto space. Through this collaboration, Binance Wallet will facilitate the exclusive launch of KILO tokens. Meanwhile, PancakeSwap DEX will provide additional trading support immediately after the event.

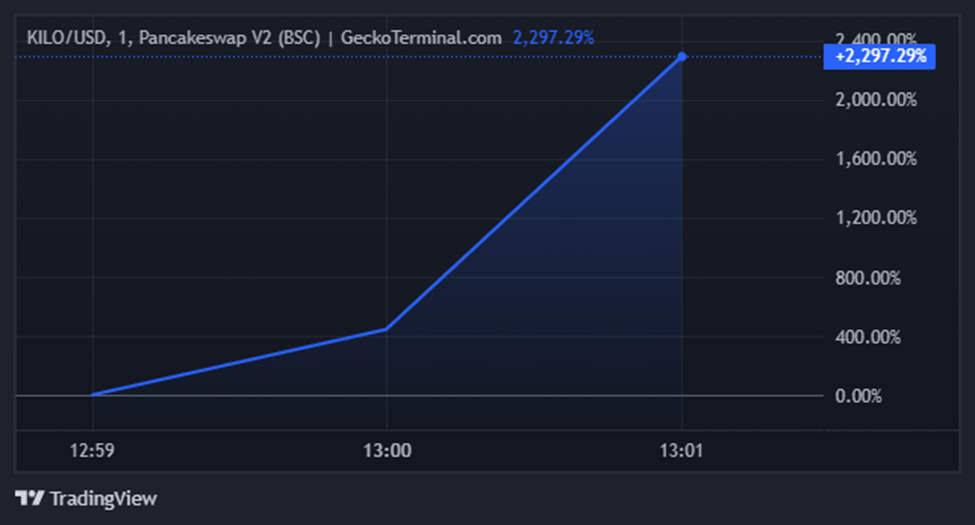

This partnership is designed to streamline token launches and offer a more user-friendly experience for investors looking to participate in early-stage projects. Data on GeckoTerminal shows that the KILO price is up by almost 2,300% on this news.

With a total raise of $750,000 in BNB and an initial allocation of 50 million tokens—representing 5% of the total supply—investors can participate in the event with a cap of 3 BNB per Binance Wallet user.

Unlike traditional fundraising models, this event will allocate tokens pro rata, ensuring fair distribution among participants. Additionally, there is no vesting period. This means users can immediately trade their KILO tokens on Binance Wallet DEX or PancakeSwap as soon as the event concludes.

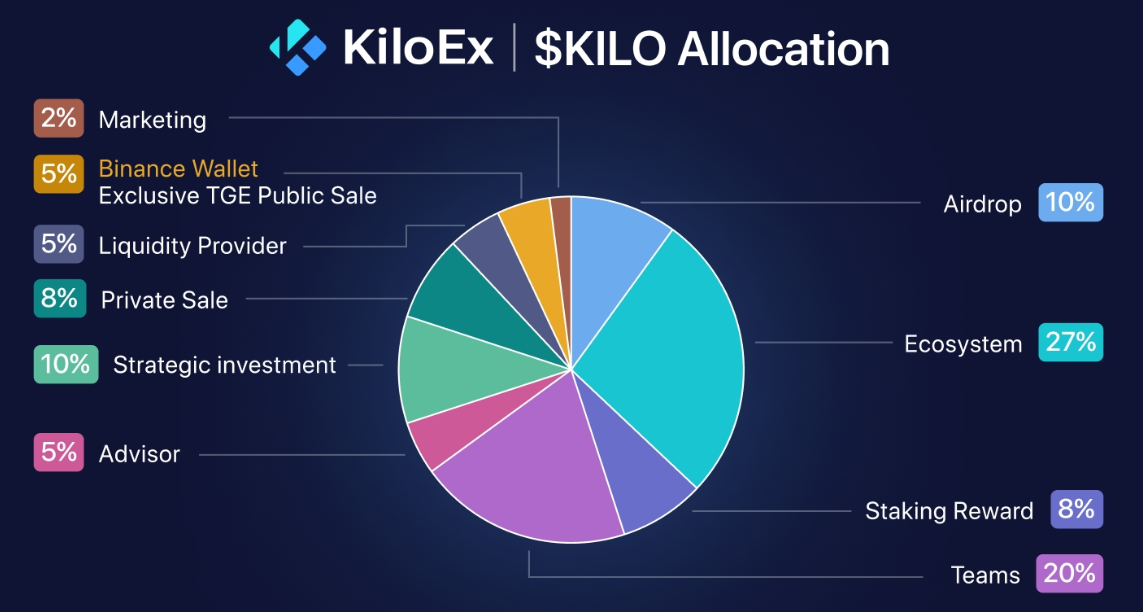

KiloEX Shares KILO Tokenomics

Beyond the TGE, KiloEx has unveiled a comprehensive tokenomics model for KILO. Shared on X (Twitter), the platform emphasized community engagement and long-term sustainability.

With a fixed supply of 1 billion tokens, 10% is earmarked for airdrops, while 27% will support the broader ecosystem. The exclusive public sale on Binance Wallet accounts for 5%. Additional allocations are also made for staking rewards, strategic investments, and liquidity provisions.

One of the key highlights is the ability to convert KILO into xKILO. This provision allows holders to stake their tokens and earn a share of 30% of the platform’s revenue. Additionally, KILO holders will play an active role in the protocol’s governance, ensuring a decentralized decision-making process.

“The key utilities of KILO include: Converting to xKILO for staking to earn 30% of the platform revenue. Future on-chain governance participation, enabling holders to help shape the project’s future,” KiloEx stated.

This initiative aligns with Binance’s broader strategy of shifting toward secondary listings, as seen in recent changes to its token launch approach. Instead of exclusively listing new tokens on its centralized exchange, Binance has been leveraging Binance Wallet to facilitate token launches on decentralized platforms.

“Binance has pivoted away from doing huge initial launches with big Day-1 selling pressure while doing more secondary listing shortly after running TGE campaign on Binance Wallet,” a user on X observed.

This move decentralizes the listing process and grants early adopters greater access. It also mitigates some of the challenges associated with centralized exchange listings. The collaboration with PancakeSwap reinforces this trend, positioning Binance Wallet as a pivotal player in the growth of decentralized token generation events.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Court Delays Upbit Business Restriction Imposed by FIU

Upbit and its parent company, Dunamu, secured a notable win after the Seoul Administrative Court temporarily suspended a three-month business restriction imposed by South Korea’s Financial Intelligence Unit (FIU).

New Upbit users can continue depositing and withdrawing crypto assets until at least 30 days after the main lawsuit’s final judgment.

Court Suspends Upbit Business Restriction

Local media reported that the decision came after Dunamu challenged the FIU’s disciplinary action. Specifically, Upbit’s parent company argued that the penalties were excessive.

Based on this, the 5th Administrative Division of the Seoul Administrative Court, led by Judge Soonyeol Kim, ruled in favor of Dunamu, granting an emergency suspension of the business restriction.

“…the effect will be suspended until 30 days from the date of the judgment of the main lawsuit. This is a measure to buy some time for Dunamu,” read the report.

The FIU’s initial penalty was based on allegations that Upbit violated South Korea’s Special Financial Transactions Act. The exchange reportedly allowed transactions with unregistered overseas exchanges without real-name verification.

Authorities discovered these infractions during an anti-money laundering (AML) audit from August to October last year.

“…We deeply sympathize with the purpose of the financial authorities’ recent sanctions, which are aimed at stably establishing the anti-money laundering system and strengthening the legal compliance system through strict discipline on virtual asset operators,” Upbit responded at the time.

Nevertheless, the FIU suspended Upbit’s ability to process deposits and withdrawals for new users for three months. Authorities reprimanded Upbit’s CEO, Lee Seok-woo, leading to the dismissal of the company’s compliance officer.

Dunamu quickly responded by filing a lawsuit to overturn the restriction and requesting a stay of execution. While the suspension was initially set to take effect on March 7, the court granted a temporary delay to review the case.

With the official suspension in place, Upbit can continue operations as usual until the final ruling.

This is not the first time Upbit has faced regulatory challenges. Just two months ago, South Korean authorities temporarily suspended the exchange over 700,000 Know-Your-Customer (KYC) violations.

Upbit was also under investigation for alleged antitrust violations six months earlier, with authorities scrutinizing its market practices.

While this ruling offers Upbit some breathing room, the legal battle is far from over. The final verdict in the main lawsuit will determine whether the FIU’s sanctions were justified or an overreach.

This ruling is pivotal for Upbit, South Korea’s largest crypto exchange. The South Korean government recently ordered Google to block 17 foreign cryptocurrency exchanges that failed to comply with local regulations. With these competitors effectively shut out, Upbit is in a prime position to strengthen its market presence and attract more users.

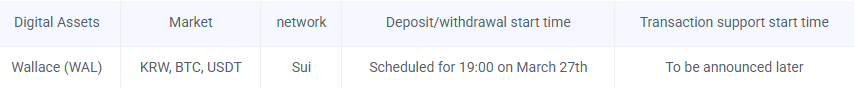

In a separate development, Upbit announced the launch of Wallace (WAL) trading pairs, citing the Korean won (KRW), Bitcoin (BTC), and USDT stablecoin.

WAL token ties to the Walrus protocol, which focuses on decentralized storage for blockchain data. Walrus, developed by the Sui (SUI) team at Mysten Labs, recently secured $140 million in funding, with its mainnet launch coinciding with Upbit’s announcement on March 27.

South Korea’s crypto market is influential, and Upbit’s listing could boost WAL’s visibility. However, past listings like ORCA and BONK show such gains often fade quickly.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Rejected at Resistance—Are Bears Taking Control?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin21 hours ago

Altcoin21 hours agoHow Hyperliquid Vault Risks Losing $230M Following This Solana Meme Coin’s Surge

-

Market20 hours ago

Market20 hours agoWhy Was Ben “BitBoy” Armstrong Arrested in Florida?

-

Market22 hours ago

Market22 hours ago3 Altcoins That Reached All-Time High Today

-

Market21 hours ago

Market21 hours ago5 Meme Coins to Watch in April 2025

-

Market19 hours ago

Market19 hours agoOnyxcoin Traders Bet on Recovery, Despite 70% Market Drop

-

Altcoin19 hours ago

Altcoin19 hours agoSolana Gets A $1.7 Billion Boost As BlackRock Expands Tokenized Funds

-

Market18 hours ago

Market18 hours agoPEPE vzrástol o 20 %. Pozornosť však púta AI Pepe meme coin

-

Altcoin24 hours ago

Altcoin24 hours agoRipple IPO Delayed Again? Here’s The Likely IPO Date