Altcoin

Analyst Reveals Why Cardano Price Rally To $10 Isn’t ‘Crazy’

Several theories are touting Cardano price to clinch $10 but critics are tagging the projections as outlandish. However, one cryptocurrency analyst has picked up the gauntlet to rationalize the claims of ADA reaching $10 during this cycle, citing a slew of factors.

Cardano Price To $10 Is In Play

Cryptocurrency analyst Dan Gambardello has reiterated claims that Cardano price is headed to $10 in this cycle. According to his analysis, Gambardello poked a hole through the barrage of criticisms leveled against ADA optimists backing the asset to reach $10.

Gambardello began his analysis with key ADA fundamentals, citing its speed, decentralization, scalability, and security standards. He points to incoming Bitcoin DeFi and the potential unlocking $2 trillion opportunity for Cardano. The recent Cardano Lace Wallet retrofitted with multichain functionality specifically for the Bitcoin blockchain underscores the point.

The analyst turns his gaze to the impending end of quantitative tightening and the start of quantitative easing by the Federal Reserve and its potential for cryptocurrencies. According to Gambardello, the move signals a major “bullish catalyst” for ADA given the uptick of liquidity flooding the market.

Gambardello bolsters his argument with ADA’s inclusion in the Digital Asset Stockpile as proof of Cardano’s price climbing to $10.

ADA Trading at $10 Is Not A Crazy Idea

At the moment, ADA is trading at $0,70, a far cry from the projected $10. However, Gambardello argues that the Cardano price can clinch reach $10 given its positives.

“A $10, $350 billion market cap sounds crazy to a lot of people, I understand,” said Gambardello. “But I will not ignore the possibility of it just because it sounds crazy.@

The analyst goes on to cite Cardano’s run to reach an all-time high, surging from $0.3 to $3.09 back in 2021. Gambardello says that at the time Cardano price climbed by nearly 1,000% without smart contracts or an inclusion into the Digital Asset Stockpile.

A move toward $10 represents a 1,300% jump for ADA which Gambardello says is within reach given Ethereum’s price action during the last bull run. While Gambardello did not give a clear timeline, he disclosed that multiple ADA retracements are a real possibility before the final march to $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Eyes 570% Surge As Price & RSI Break To The Upside

Crypto analyst Javon Marks has provided a bullish outlook for XRP, suggesting that the altcoin could witness another 570% surge as its price and RSI break to the upside. Meanwhile, crypto analyst Dark Defender predicted that the altcoin could rally to as high as $8 soon.

XRP Could Surge 570% Again As Price & RSI Break To The Upside

In an X post, Javon Marks revealed that XRP’s price and Relative Strength Index (RSI) have broken out to the upside. He revealed that the last breakout resulted in a price increase of about 570% and remarked that the altcoin can be ready for another substantial surge.

Based on history, the altcoin could record another 570% surge again, which would send its price to around $16 from its current level. In another X post, Marks indicated that the crypto was ready to witness a massive rally to the upside.

He stated that XRP’s next bullish wave looks to be nearing, and based on past performance, it can result in a push to the 1.618 Fib level at approximately $16.50. He added that a full similar performance to the last bull cycle could result in a rally to $100 or even higher.

Javon Marks’ prediction of $16 for the altcoin aligns with Egrag Crypto’s conservative target of $15 for XRP. Egrag Crypto also offered a more ambitious target, predicting that the altcoin could rally to as high as $44 in this cycle.

Crypto analyst Dark Defender also recently predicted that the altcoin could rally to as high as $23.20. He noted that the 3-month monthly close is approaching, and XRP boasts a clear bullish momentum on the higher timeframes. He added that there are ups and downs in smaller time frames, but the higher frames supersede smaller ones.

The crypto analyst also remarked that the 3rd wave is targeting between $5.85 and $8.076. Meanwhile, he claimed that the 5th wave is expected to finish the move between $18.22 and $23.20.

Final Countdown To A Breakout Is Here

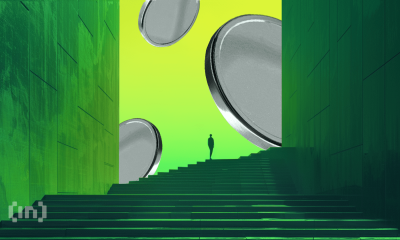

Crypto analyst CasiTrades stated that this is the final countdown to a breakout. She noted that XRP has been consolidating in a tightening structure ever since its breakout to $3.40 and that this pattern is quickly running out of time.

The crypto analyst asserted that what is even more exciting is that this price structure aligns perfectly with Fibonacci time analysis. She revealed that XRP is closing in on Time Zone 2 and the .618 Fibonacci time extension, both landing around March 30.

CasiTrades stated that it could take a week for this phase to resolve. Based on the current wave count and Fib confluence, she expects this to form a massive breakout near that time Fib towards the key price resistances at $2.70, $3.08, $3.80, and beyond.

The analyst also highlighted April 8, 25, and June 20 as key dates to watch. According to her, April 8 lines up with a major time pivot, which could lead to an attempt at $3.80, the current all-time high (ATH).

April 25 is the 1.0 Fib time extension and Time Zone 3, a strong indicator for a macro wave 3 top in this wave cycle. Meanwhile, June 20 is the Time Zone 5, which she claimed is likely the ultimate top in this market cycle for Wave 5 resistance.

CasiTrades stated that XRP is sitting right at the apex of this month-long consolidation. She added that the market is out of time, and it needs to make a decision.

With all the technicals aligning, the analyst believes the decision would be explosive. From a fundamentals standpoint, the altcoin’s outlook is also bullish, especially with Ripple dropping the cross-appeal against the US SEC and agreeing with the Commission to proceed with its XRP institutional sales, boosting the altcoin’s adoption.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Gets A $1.7 Billion Boost As BlackRock Expands Tokenized Funds

Financial management behemoth BlackRock has made another move in its approach to blockchain by starting a fund for big clients on the Solana network. Reports from Fortune say that this fund, called the USD Institutional Digital Fund (BUIDL), is now available on seven different blockchain platforms.

Solana & BlackRock: Pioneering Crypto Markets

BlackRock, which manages $11.6 trillion in assets, has been slowly entering the world of cryptocurrency and blockchain. Since its start in March 2024, BUIDL has already gathered $1.7 billion in assets. Experts believe the fund could reach $2 billion by April.

Expanding To A Strategic Network

Solana is attractive because it carries out transactions fast and charges low fees. This blockchain gives investors constant access to regular financial tools. Michael Sonnenshein, the COO of Securitize, says this way of doing things makes it easier and more convenient for funds like treasuries.

The institutions are here.

Today @Securitize launched the largest yield-bearing tokenized treasury fund ($1.7B), BUIDL, on Solana.

BUIDL is issued by BlackRock — the world’s largest asset manager. More from Fortune:https://t.co/pFRrr341Kv

— Solana (@solana) March 25, 2025

“We’re making them unboring,” Sonnenshein told Fortune. “We are advancing and leapfrogging some of the quote-unquote deficiencies that money markets may have in their traditional formats.”

BlackRock brought its Bitcoin ETP to Europe on Tuesday. It announced that it would start on Xetra and in Euronext Paris and Amsterdam.

SOL market cap currently at $73 billion. Chart: TradingView.com

Trends In Global Investment Taking Shape

Franklin Templeton also entered the blockchain scene by launching a money fund on Solana in February. This shows that more major financial groups are interested in using blockchain for investment products.

In addition to running funds on blockchain, BlackRock has set up Bitcoin and Ethereum exchange-traded funds (ETFs) in the US, Canada, and Europe. CEO Larry Fink believes blockchain will be important in future financial tools.

SOL price up following the news. Source: Coingecko

The company appears to have shifted its focus to asset tokenization after the breakthrough. Moving traditional investment vehicles to the blockchain is the next big thing, Fink said.

BUIDL is now a part of blockchain networks like Ethereum, Optimism, Aptos, Avalanche, Arbitrum, and Polygon. The fund, backed by cash and Treasury bills, offers big investors a new way to invest using regular financial methods.

BlackRock’s effort to merge blockchain with everyday financial products is clear with $1.7 billion already invested, showing strong interest from investors in these new financial tools.

Choosing Solana shows the growing confidence in this blockchain’s ability to manage many transactions fast and at a low cost. This makes it a suitable option for big financial firms seeking innovative investment methods.

Featured image from Gemini Imagen, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

How Hyperliquid Vault Risks Losing $230M Following This Solana Meme Coin’s Surge

Jelly-My-Jelly (JELLY JELLY) has spiked by over 100% over the last hour but the surge in value is triggering a wave of anxiety for Hyperliquid Vault. The automated market maker is in the middle of a short squeeze and could lose a fortune if the Solana memecoin continues to surge.

Solana Memecoin Threatens Hyperliquid Vault’s Holdings

According to a post by Wu Blockchain, Hyperliquid Vault is facing the possibility of a grim liquidation of its position. The decentralized exchange is in the middle of a short squeeze of JELLY JELLY after taking up the short position from a trader who voluntarily liquidated his position.

At the moment, Hyperliquid Vault is grappling with an unrealized loss of over $9 billion since betting against the Solana memecoin. Hyperliquid will lose over $230 million to the Solana memecoin short squeeze should prices spike to over 1 cent.

“If jellyjelly reaches $0.15374, Hyperliquid Vault will lose its entire $230 million in funds,” said Wu Blockchain.

JELLY JELLY has risen by over 200% at press time and currently trades at $0.04281. Meanwhile, transaction volume has surged by 412% in hours as the battle between the short sellers and long buyers continues to rage. For Hyperliquid, things are even grimmer given the frenetic pace of the Solana memecoin short-squeeze.

Report of the short

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin23 hours ago

Altcoin23 hours agoSolana Co-Founder Challenges Layer 2s—Are They Even Needed?

-

Market22 hours ago

Market22 hours agoTop 3 PumpFun Meme Coins to Watch Before March Ends

-

Market21 hours ago

Market21 hours agoSEC Will Return $75 Million to Ripple in the XRP Lawsuit

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Forms Complex iH&S Structure, Why $18,000 Is The Possible Target

-

Market23 hours ago

Market23 hours agoEthereum Price Stalls as Traders Await Clear Market Direction

-

Market18 hours ago

Market18 hours agoThis is Why Q2 2025 Could Be Bullish for Crypto Markets

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Price Set To Rally 10X Amid This Bullish Pattern

-

Altcoin22 hours ago

Altcoin22 hours agoHere’s Why The Dogecoin Price Surged Over 10%

✓ Share: