Market

SOL Circulation at 5-Month Low As Solana Price Stalls Below $135

Solana (SOL) has struggled to maintain upward momentum in recent weeks. Although the cryptocurrency showed signs of an uptrend, it is now facing challenges due to declining demand for SOL.

The market environment is also deteriorating, which is contributing to the struggles. At $129, Solana is stalled below the key $135 barrier. There is no clear indication of a breakout in sight.

Solana Struggles To Find Demand

The Velocity of Solana has fallen to a 5-month low, signaling weakening demand. Velocity measures the rate at which an asset is circulated within the market. Solana’s current circulation levels are on par with those seen in October 2024, a clear indicator that the cryptocurrency is losing traction.

The drop in Velocity suggests that fewer investors are actively trading SOL, further adding to the bearish sentiment surrounding the token. This lack of demand makes a recovery increasingly difficult, as it implies that traders are hesitant to enter the market.

The ongoing low demand for SOL further confirms a bearish outlook. Many investors are likely waiting for a more favorable environment before committing to new positions, which could delay any potential recovery as the token struggles to attract fresh capital.

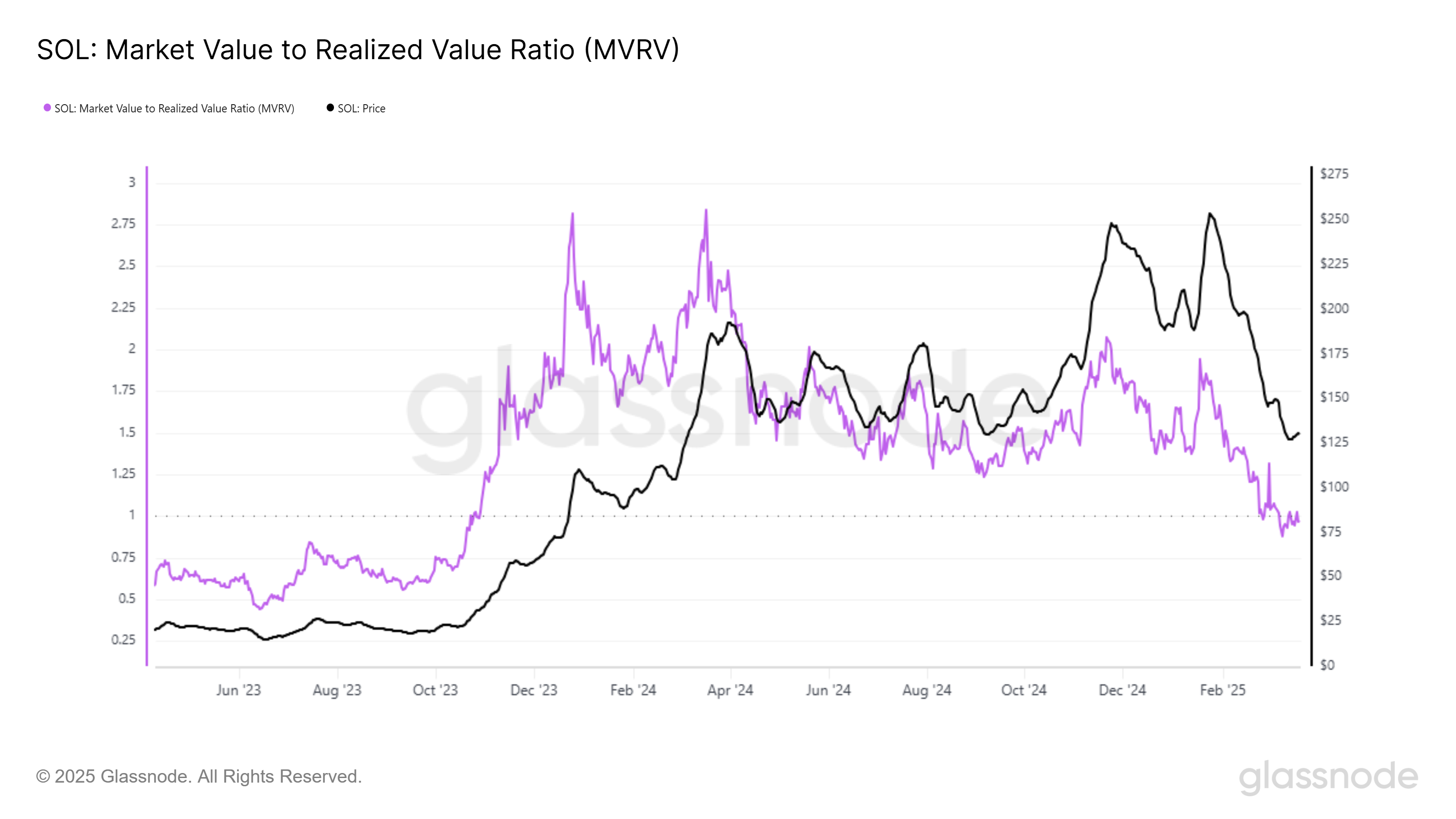

Analyzing the 2-week Market Value to Realized Value (MVRV) Ratio, a key metric that tracks the average profit or loss of recent buyers, reveals that the ratio is currently below the zero line. This suggests that investors who purchased SOL within the last two weeks are now facing losses.

This situation could lead to one of two scenarios: either investors hold their positions, hoping for a price recovery, or they sell to cut their losses.

If the latter occurs, increased selling pressure could push the price lower and potentially invalidate any attempts at recovery. In this scenario, the market would likely remain bearish until sentiment shifts.

SOL Price Is Struggling

Solana is currently trading at $130, struggling to break through the critical $135 resistance. While there has been a short-term uptrend, the likelihood of SOL breaching this level seems low. This suggests that the price could remain range-bound for the near future.

The combination of low demand and weak market sentiment points toward a potential decline. Solana may fall through its uptrend support line, with the next significant support levels lying at $125 and potentially $118.

This scenario would delay any recovery, pushing the token further into a bearish trend.

On the other hand, if Solana manages to break through the $135 resistance, the altcoin’s price push toward $148. A sustained move above this level could propel SOL to $150, invalidating the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Uptrend Resumes After A Healthy Pullback

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After a brief yet necessary cooldown, BNB is back in action, regaining bullish momentum and resuming its uptrend. The recent pullback provided a much-needed reset, allowing buyers to step in near the $605 support level and strengthen the foundation for a renewed climb.

Now, with increasing buying pressure, BNB is making another push toward key resistance levels, signaling that the rally may not be over just yet. However, breaking through overhead resistance will be a crucial test for bulls. If buying pressure continues to build, BNB could push toward new local highs. Meanwhile, if bears step in at key levels, another retracement could be on the horizon.

Technical Rebound: Charting The Recovery Momentum

After a strong rally, BNB experienced a brief pullback, allowing the market to cool off before resuming its upward trajectory. Rather than signaling a reversal, this dip served as a natural correction, shaking out weak hands while providing strong support for the next move.

Related Reading

During the pullback, BNB found support at a crucial level, preventing a deeper decline and reinforcing bullish confidence. The consolidation phase also helped ease overbought conditions, resetting momentum indicators like the Relative Strength Index (RSI) and allowing for a more sustainable climb.

Additionally, the price is currently holding above the 100-day Simple Moving Average (SMA). As long as the price remains above the 100-day SMA, the uptrend remains intact, suggesting the potential for further gains.

As BNB continues its recovery, key resistance levels will play a crucial role in determining the strength of its uptrend. The first major hurdle lies at $680, a psychological and technical barrier where previous rejections have occurred. A decisive break above this level could attract more buying pressure, paving the way for more growth.

Beyond $680, the next resistance to monitor is around $725, where sellers previously stepped in during the last rally. Clearing this zone would signal strong upward movement and open the door for a potential test of the $795 mark, a key milestone that might fuel further upside.

BNB Bearish Risks: What Could Halt The Uptrend?

Despite BNB’s renewed bullish momentum, several factors could stall its upward movement. One key risk is failure at critical resistance levels, particularly around $680. A rejection at these points combined with declining buying pressure, would trigger a pullback and encourage profit-taking.

Related Reading

Another concern is weak trading volume. If BNB’s rally lacks sufficient volume support, it may indicate waning investor confidence, making it easier for sellers to regain control. Additionally, if indicators like the RSI enter the overbought territory without strong price follow-through, a correction could be imminent.

Featured image from Unsplash, chart from Tradingview.com

Market

Cardano Holders Refuse To Liquidate, Support Price Rise to $0.85

Cardano (ADA) has faced a lack of bullish momentum recently, keeping the altcoin from staging a full recovery. However, despite this, it has maintained a micro uptrend, supported by a group of strong investors.

These holders are not liquidating their positions, and their support could help drive ADA’s price toward higher levels, possibly reaching $0.85.

Cardano Whales Move To Buy

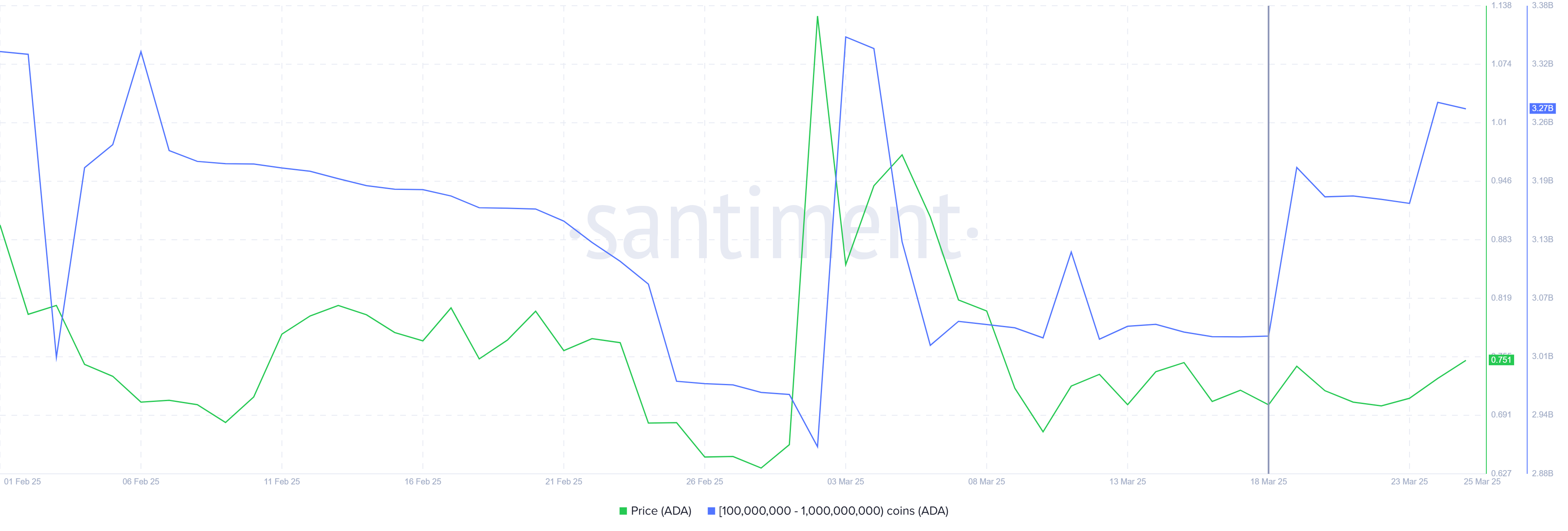

Whale addresses have been actively accumulating ADA at current low prices, which signals confidence in a potential recovery. Over the past week, addresses holding between 100 million and 1 billion ADA have added over 240 million ADA, worth more than $175 million. This significant accumulation by whales indicates their belief in Cardano’s long-term value and the likelihood of a price increase.

The accumulation of ADA by these large investors shows a strong conviction in the asset’s future performance. This behavior suggests that the whales are positioning themselves for a potential recovery, and their support could provide the necessary boost to help Cardano break through key resistance levels.

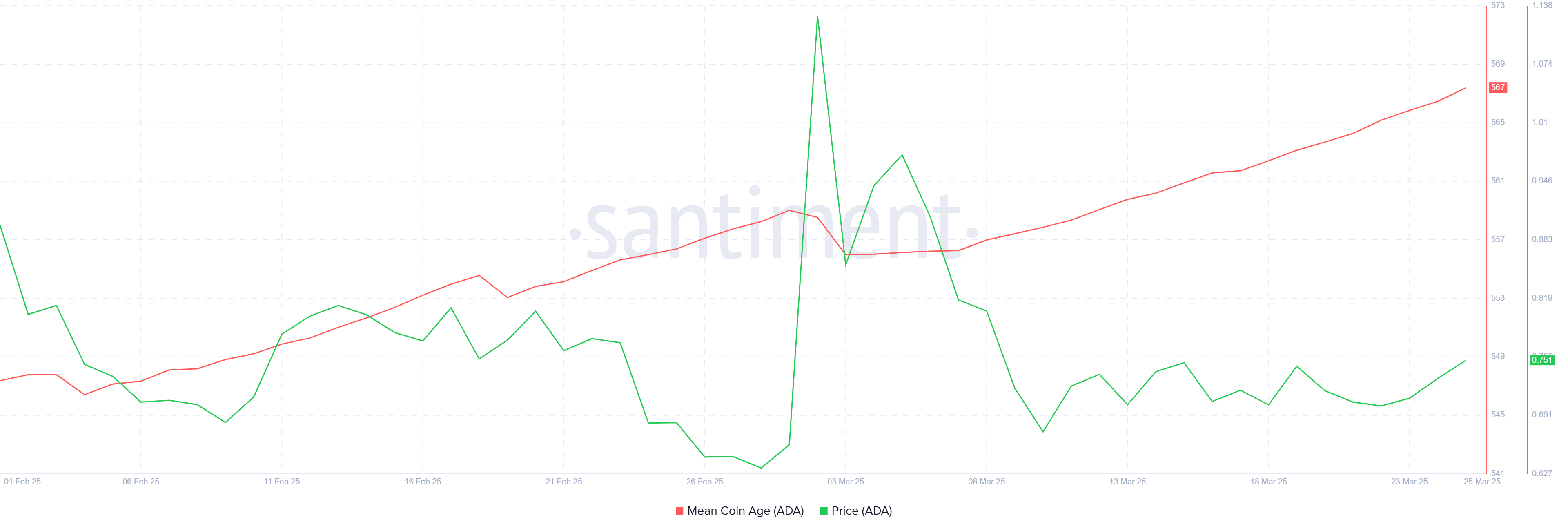

Cardano’s macro momentum is showing promising signs despite the overall bearish market conditions. The Mean Coin Age, a metric that tracks the average age of coins in circulation, has been steadily increasing. This uptick suggests that long-term holders (LTHs) are refusing to sell and are also holding on to their ADA tokens for extended periods. This reflects a sense of confidence among LTHs regarding the recovery of Cardano’s price.

The increase in Mean Coin Age implies that investors believe in Cardano’s long-term potential and are not inclined to liquidate their holdings during the current market downturn. This level of confidence from LTHs provides strong support for ADA and could help prevent any drastic price declines.

ADA Price Remains Subdued

Cardano is currently up by 6% in the last 24 hours, but this increase has not been sufficient to break the crucial $0.77 resistance level. Despite the recent uptick, ADA has been unable to breach this barrier, which is essential for confirming the altcoin’s recovery.

The factors discussed suggest that, with continued support from investors and whales, Cardano could break past the $0.77 resistance and rise to $0.85. This level is key in establishing a recovery rally for ADA, and if successfully breached, it could lead to sustained gains in the near future.

However, if Cardano fails to breach the $0.77 barrier, it will likely continue consolidating above the $0.70 support. In this case, ADA will remain vulnerable to a potential drop to $0.62, which could extend the consolidation phase and delay any significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PumpSwap’s Total Trading Volume Surpasses $1 Billion

PumpSwap, a newly launched decentralized exchange (DEX) on the Solana blockchain, has quickly reached significant milestones.

Developed by the Pump.fun team, this platform offers a seamless trading experience with low fees. It aims to reshape the DEX space on Solana.

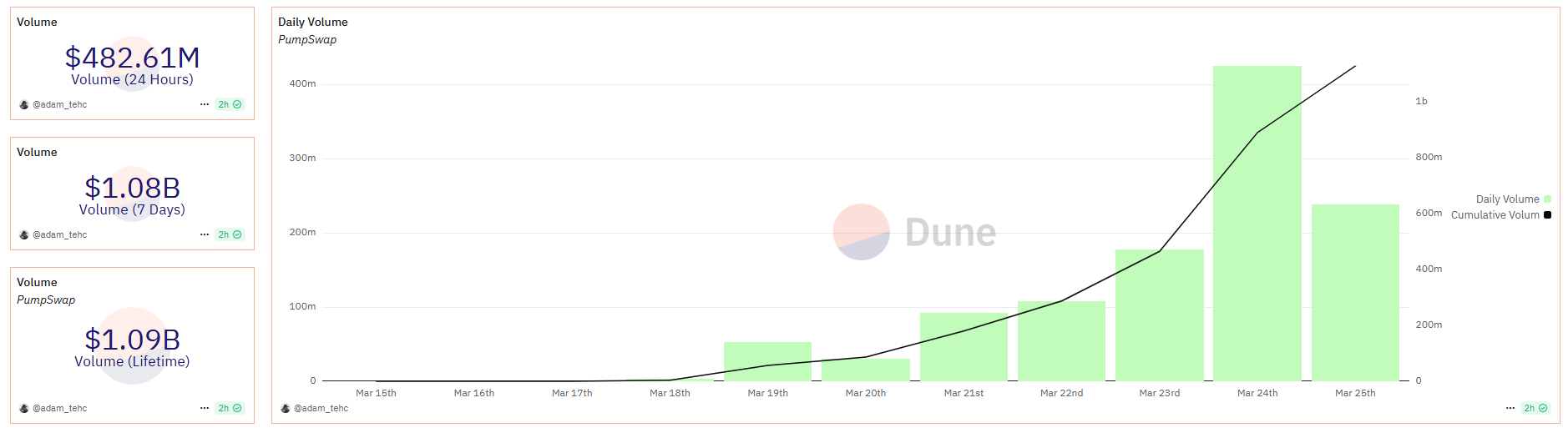

PumpSwap’s Cumulative Trading Volume Exceeds $1 Billion

Since its launch on March 20, 2025, PumpSwap has achieved impressive milestones, solidifying its position within the Solana ecosystem.

Data from Dune reveals that on March 24, PumpSwap recorded a 24-hour trading volume of $454 million. The platform attracted 243,000 users and generated $1.06 million in trading fees. PumpSwap accounted for 14% of Solana’s total DEX trading volume, a remarkable figure for a platform that has been live for less than a week.

PumpSwap’s total trading volume reached $1.04 billion in just seven days, showcasing rapid growth.

The launch of PumpSwap marks a crucial step in Pump.fun’s strategy. Pump.fun is a leading token launchpad on Solana. Previously, tokens completed the bonding curve on Pump.fun had to pay a 6 SOL fee to migrate to Raydium, which often took hours. PumpSwap was designed to eliminate this issue. It allows tokens to transition automatically without fees while providing higher liquidity and faster transactions.

The platform also plans to introduce a revenue-sharing model for token creators shortly. This initiative will incentivize new projects to join. PumpSwap’s emergence benefits users and intensifies competition with other DEXs like Raydium, which currently holds a 46.1% market share on Solana.

“Anyone still saying the team at Pump are greedy and don’t care about the community needs to get their facts straight. One of the reasons PumpSwap was created was so they have full control over the fee structure to benefit the users. Coin creators will soon be getting a percentage of the revenue earned. That alone is a game changer. Why would you launch a coin anywhere else?” a crypto expert commented.

Since the launch of PumpSwap, the number of new tokens created on Pump.fun has slightly increased. According to data from Dune, 34,000 meme tokens were created on March 24. This represents a 40% increase compared to the daily average of 24,000 tokens in March.

Additionally, the platform’s daily revenue reached $7.4 million, the highest level in the past month.

However, BeInCrypto has warned that the meme coin boom on DEXs like PumpSwap comes with high risks. Many of these tokens lack intrinsic value and may collapse after a period of rapid growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoWorldcoin Jumps 13% As World Network Eyes VISA Partnership

-

Market24 hours ago

Market24 hours agoXRP Price Could Suffer April Flash Crash, Analyst Shows How Low It Could Go

-

Bitcoin23 hours ago

Bitcoin23 hours agoMicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

-

Market17 hours ago

Market17 hours agoDid World Liberty Financial Launch a Stablecoin on BNB Chain?

-

Regulation21 hours ago

Regulation21 hours agoChainlink Teams Up With Abu Dhabi’s ADGM To Promote Tokenization In The UAE

-

Market20 hours ago

Market20 hours agoSolana’s Anatoly Yakovenko Doubts the Need for Layer-2 Networks

-

Altcoin14 hours ago

Altcoin14 hours agoAnalyst Predicts XRP Price Could Surge Above $1400 as Bull Flag Breaks

-

Regulation19 hours ago

Regulation19 hours agoUS SEC To Shift Attention From Crypto Enforcement To Traditional Cases: Details