Market

Hyperliquid (HYPE) Open Interest Surges to $44 Million

Hyperliquid’s native crypto token HYPE has recently experienced a significant 40% price decline. However, the altcoin is showing signs of recovery.

Traders have become increasingly bullish on HYPE, with many believing it can regain the losses sustained in the recent downturn. This renewed confidence, supported by positive market movements, has sparked hopes of a price rebound.

Hyperliquid Finds Strong Support

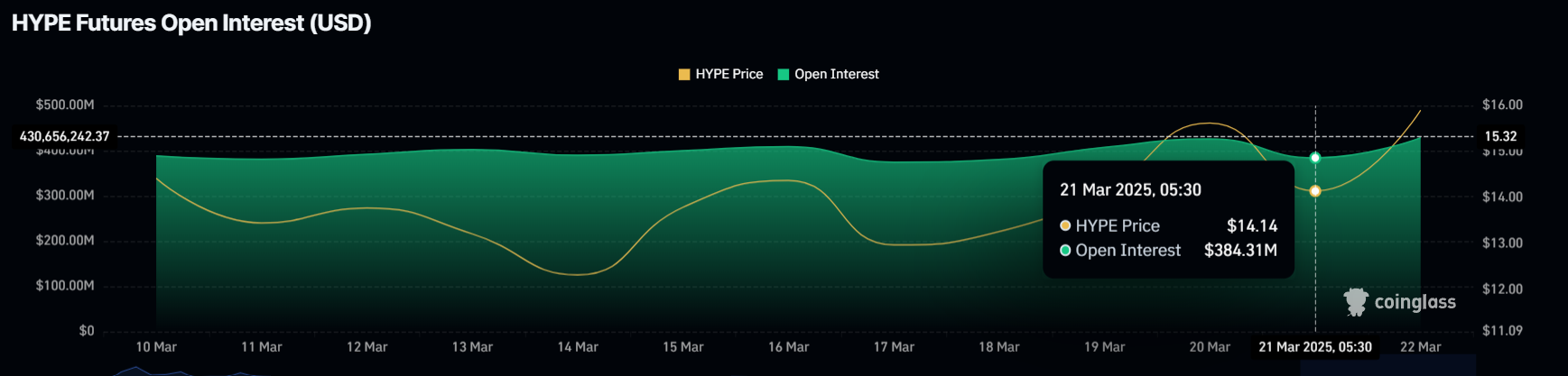

Over the past 24 hours, the Open Interest for Hyperliquid has risen by $44 million, bringing the total to $428 million. This increase follows a recent uptick in price, which added momentum to the ongoing recovery.

The growth in Open Interest suggests that traders are becoming more confident in HYPE’s potential for a price rise. This influx of interest has fueled optimism among investors and traders alike, with many viewing this as a sign of further upside.

As a result, there is a renewed sense of enthusiasm among HYPE enthusiasts, who believe the altcoin is well-positioned to reclaim lost value. This positive sentiment could contribute to continued price growth, particularly as market conditions remain favorable for a recovery.

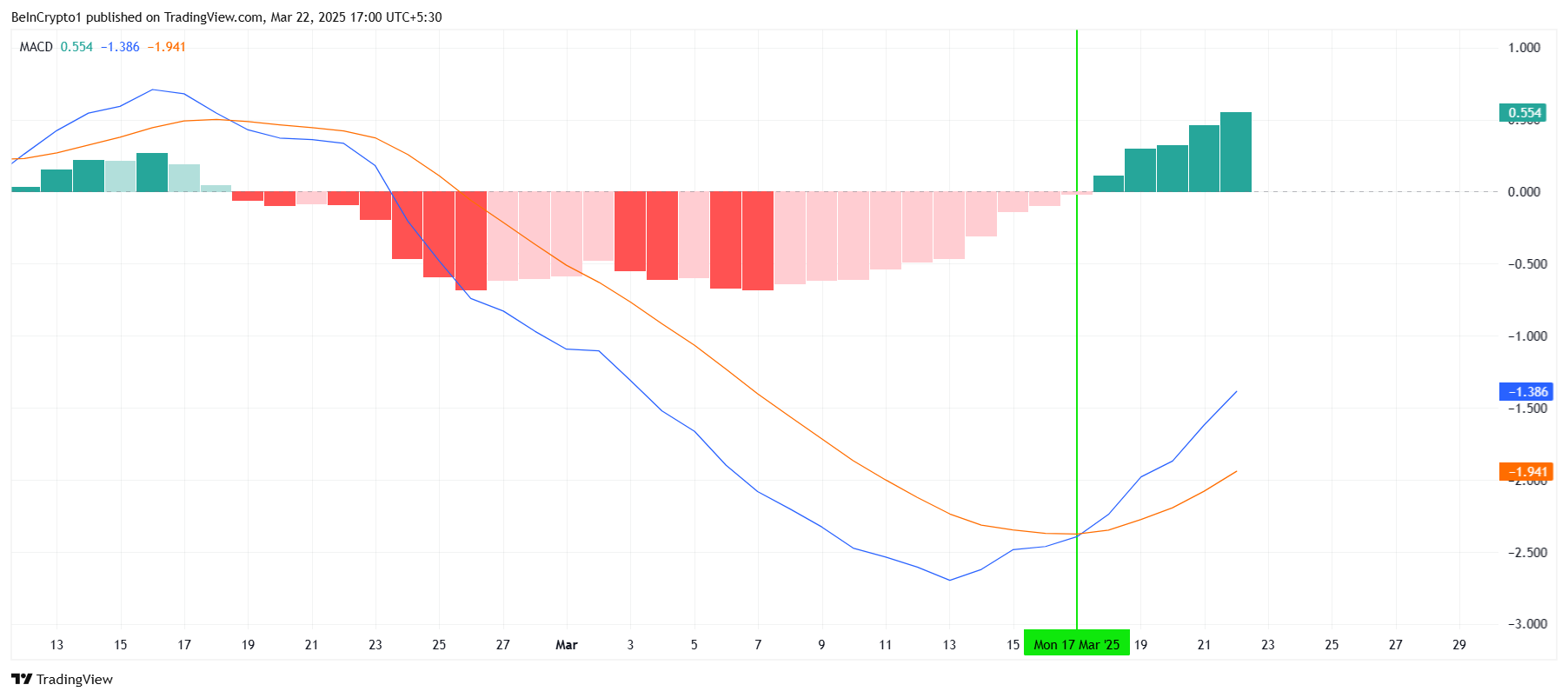

The overall macro momentum of Hyperliquid has shown significant improvement in recent days. Key technical indicators, such as the Moving Average Convergence Divergence (MACD), reflect a shift from a bearish to a bullish trend this week.

This change marks the end of a month-long bearish crossover and signals the potential for further upward momentum.

As the bullish momentum rises, it provides HYPE with the room needed to continue its recovery. The shift in the MACD reflects a positive shift in market sentiment, suggesting that the altcoin may be in a stronger position moving forward.

HYPE Price Faces Barrier

HYPE’s price is currently trading at $16.10, up by 14% over the last 24 hours. The altcoin is just under the $16.50 resistance level, having already recovered about half of its recent 40% decline. This price movement shows that Hyperliquid has significant upside potential.

Given the current momentum, there is a possibility that HYPE will breach the $16.50 barrier and continue its upward trajectory. If this occurs, the altcoin could move toward $19.16, potentially reaching $20.00 in the near future.

However, if the $16.50 resistance level proves too strong, HYPE may struggle to maintain its upward momentum. In this case, the price could fall back to $13.44, invalidating the bullish outlook and erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Holders Refuse To Liquidate, Support Price Rise to $0.85

Cardano (ADA) has faced a lack of bullish momentum recently, keeping the altcoin from staging a full recovery. However, despite this, it has maintained a micro uptrend, supported by a group of strong investors.

These holders are not liquidating their positions, and their support could help drive ADA’s price toward higher levels, possibly reaching $0.85.

Cardano Whales Move To Buy

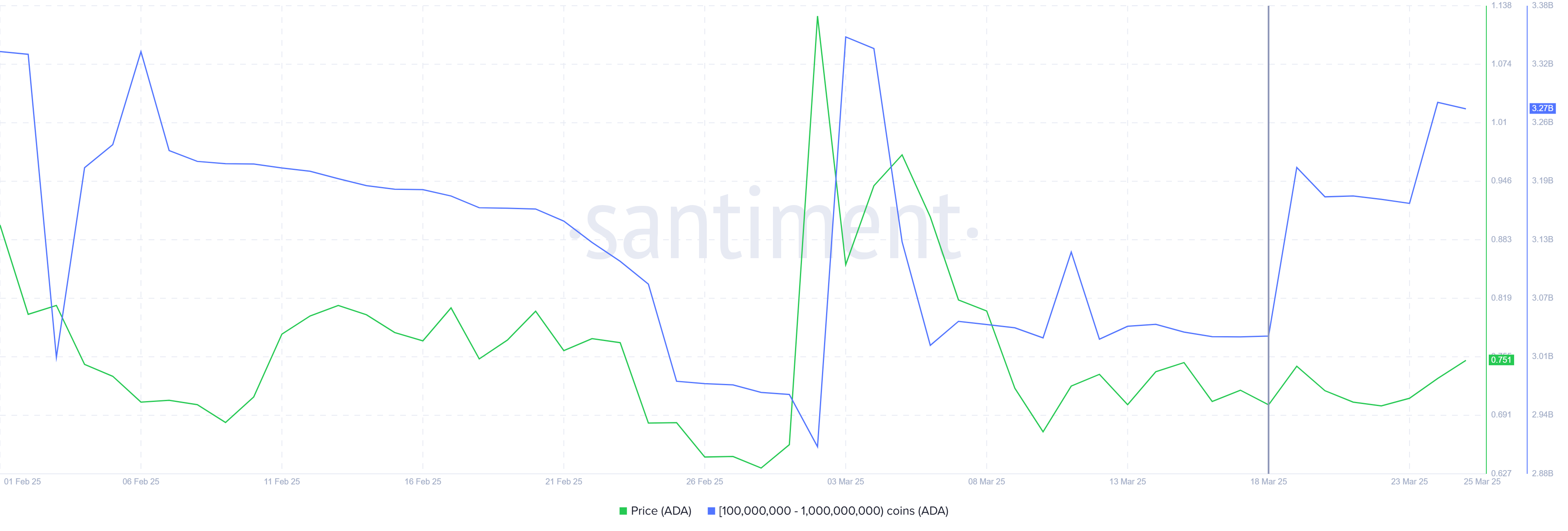

Whale addresses have been actively accumulating ADA at current low prices, which signals confidence in a potential recovery. Over the past week, addresses holding between 100 million and 1 billion ADA have added over 240 million ADA, worth more than $175 million. This significant accumulation by whales indicates their belief in Cardano’s long-term value and the likelihood of a price increase.

The accumulation of ADA by these large investors shows a strong conviction in the asset’s future performance. This behavior suggests that the whales are positioning themselves for a potential recovery, and their support could provide the necessary boost to help Cardano break through key resistance levels.

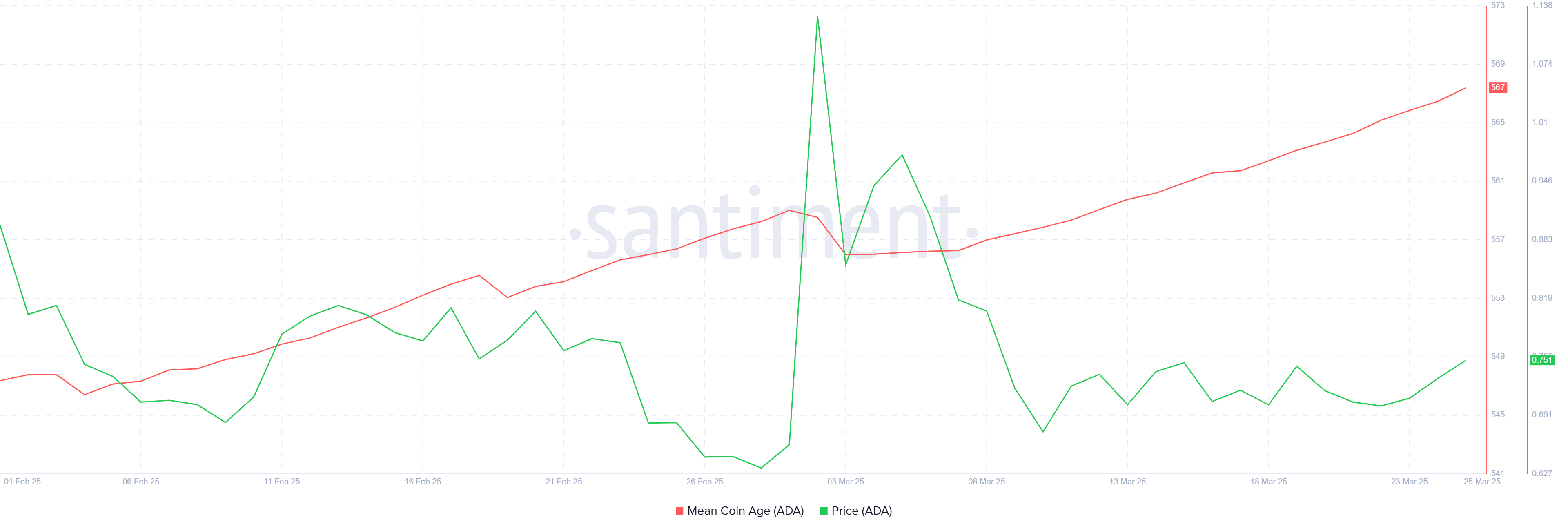

Cardano’s macro momentum is showing promising signs despite the overall bearish market conditions. The Mean Coin Age, a metric that tracks the average age of coins in circulation, has been steadily increasing. This uptick suggests that long-term holders (LTHs) are refusing to sell and are also holding on to their ADA tokens for extended periods. This reflects a sense of confidence among LTHs regarding the recovery of Cardano’s price.

The increase in Mean Coin Age implies that investors believe in Cardano’s long-term potential and are not inclined to liquidate their holdings during the current market downturn. This level of confidence from LTHs provides strong support for ADA and could help prevent any drastic price declines.

ADA Price Remains Subdued

Cardano is currently up by 6% in the last 24 hours, but this increase has not been sufficient to break the crucial $0.77 resistance level. Despite the recent uptick, ADA has been unable to breach this barrier, which is essential for confirming the altcoin’s recovery.

The factors discussed suggest that, with continued support from investors and whales, Cardano could break past the $0.77 resistance and rise to $0.85. This level is key in establishing a recovery rally for ADA, and if successfully breached, it could lead to sustained gains in the near future.

However, if Cardano fails to breach the $0.77 barrier, it will likely continue consolidating above the $0.70 support. In this case, ADA will remain vulnerable to a potential drop to $0.62, which could extend the consolidation phase and delay any significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PumpSwap’s Total Trading Volume Surpasses $1 Billion

PumpSwap, a newly launched decentralized exchange (DEX) on the Solana blockchain, has quickly reached significant milestones.

Developed by the Pump.fun team, this platform offers a seamless trading experience with low fees. It aims to reshape the DEX space on Solana.

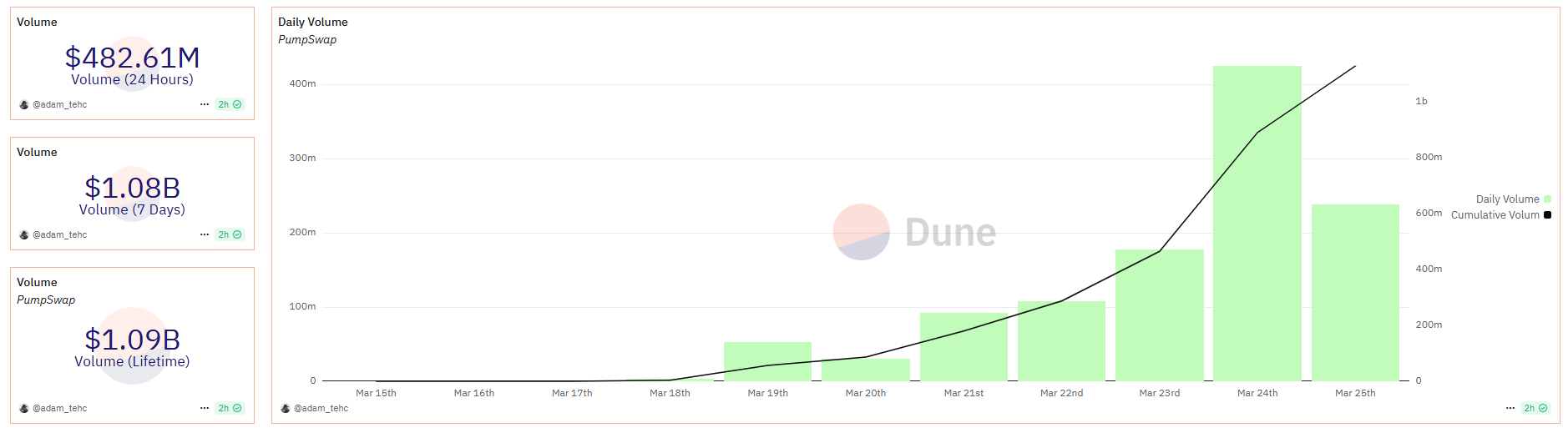

PumpSwap’s Cumulative Trading Volume Exceeds $1 Billion

Since its launch on March 20, 2025, PumpSwap has achieved impressive milestones, solidifying its position within the Solana ecosystem.

Data from Dune reveals that on March 24, PumpSwap recorded a 24-hour trading volume of $454 million. The platform attracted 243,000 users and generated $1.06 million in trading fees. PumpSwap accounted for 14% of Solana’s total DEX trading volume, a remarkable figure for a platform that has been live for less than a week.

PumpSwap’s total trading volume reached $1.04 billion in just seven days, showcasing rapid growth.

The launch of PumpSwap marks a crucial step in Pump.fun’s strategy. Pump.fun is a leading token launchpad on Solana. Previously, tokens completed the bonding curve on Pump.fun had to pay a 6 SOL fee to migrate to Raydium, which often took hours. PumpSwap was designed to eliminate this issue. It allows tokens to transition automatically without fees while providing higher liquidity and faster transactions.

The platform also plans to introduce a revenue-sharing model for token creators shortly. This initiative will incentivize new projects to join. PumpSwap’s emergence benefits users and intensifies competition with other DEXs like Raydium, which currently holds a 46.1% market share on Solana.

“Anyone still saying the team at Pump are greedy and don’t care about the community needs to get their facts straight. One of the reasons PumpSwap was created was so they have full control over the fee structure to benefit the users. Coin creators will soon be getting a percentage of the revenue earned. That alone is a game changer. Why would you launch a coin anywhere else?” a crypto expert commented.

Since the launch of PumpSwap, the number of new tokens created on Pump.fun has slightly increased. According to data from Dune, 34,000 meme tokens were created on March 24. This represents a 40% increase compared to the daily average of 24,000 tokens in March.

Additionally, the platform’s daily revenue reached $7.4 million, the highest level in the past month.

However, BeInCrypto has warned that the meme coin boom on DEXs like PumpSwap comes with high risks. Many of these tokens lack intrinsic value and may collapse after a period of rapid growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network’s Lack of Transparency Behind Listing Delay

A crypto analyst has proposed a theory explaining why Pi Network (PI) remains unlisted on major exchanges such as Binance and Coinbase.

Pi listing on these exchanges, especially Binance, has remained elusive despite significant community demand.

Analyst Alleges Transparency Gaps Behind Pi Network’s Binance Listing Delay

Dr. Altcoin, an analyst on X, ascribes the delayed listing of Pi coin to a lack of transparency from the Pi Core Team. Specifically, the opaque nature of Pi Network’s locking and burning mechanisms of billions of Pi coins may be the primary reason for the continued absence of a listing.

“I now better understand why Pi is not listed on major exchanges such as Binance and Coinbase. Likely, the Pi Core Team has not been transparent enough about the locking and burning mechanism involving the billions of Pi coins currently owned by the PCT,” Dr Altcoin opined.

The analyst previously noted that the circulating supply of Pi coins decreased by another 10 million to 6.77 billion. In their opinion, this suggested that the Pi Network core team could adjust the supply to stabilize prices.

“The last time a large number of Pi coins were unlocked, it sent the wrong signal and caused panic selling. However, the PCT [Pi Core Team] still needs to be transparent about the Pi burning mechanism and its plans for locking the majority of Pi coins owned by the PCT,” he added.

According to Dr. Altcoin, the absence of transparency makes it easy to misconstrue this as potential plans for market manipulation. He further suggested that Pi Network may eventually gain listings once the Pi Core team improves transparency and most community-held coins are traded for under $1.

This speculation aligns with recent concerns about Pi Network’s centralization issues, particularly concerning SuperNodes. BeInCrypt reported concerns about network control and governance transparency. These factors could further delay Pi’s acceptance by top-tier exchanges like Binance and Coinbase.

Pi Network’s Community Demand Faces Roadblock

Despite these concerns, Pi Network continues to enjoy significant community support. The project recently surpassed 4 million followers on social media, reflecting its strong user base. Moreover, a Binance survey revealed that 86% of participants wanted Pi listed on the exchange.

However, Binance has yet to take action, leading to controversy. Despite significant voter support in a community poll, Pi’s listing remains uncertain, fueling frustration among its supporters.

Of note, the vote to list Pi Network on Binance came amid the exchange’s resolve to involve the community in its listing and delisting actions.

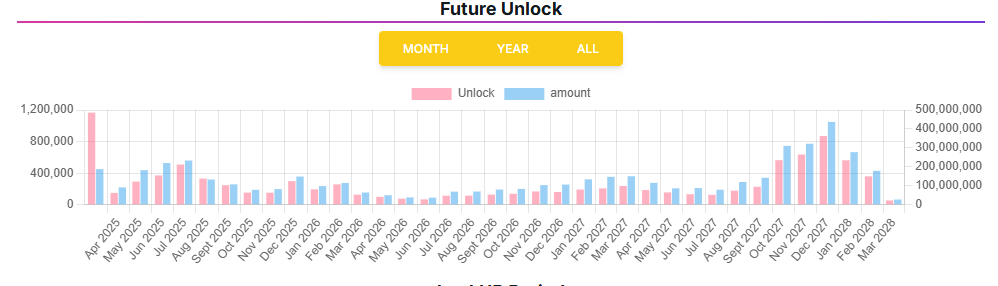

Adding to the uncertainty, Pi Network is preparing for another token unlock in April, following the release of 188 million tokens in March. These unlocks have raised fears of price manipulation, especially given the lack of clarity on how PCT handles locked and burned coins.

According to data on ExplorerPi, Pi Network will unlock over 91.9 million Pi tokens in April. Based on market rates as of this writing, $0.906 on CoinGecko, this volume of Pi coins is worth approximately $83 million.

Citing Keyrock research, BeInCrypto recently reported that 90% of token unlocks drive prices down. For Pi Network, therefore, a token unlock of this magnitude could impact the price of the Pi coin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoWorldcoin Jumps 13% As World Network Eyes VISA Partnership

-

Market24 hours ago

Market24 hours agoXRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit

-

Market23 hours ago

Market23 hours agoXRP Price Could Suffer April Flash Crash, Analyst Shows How Low It Could Go

-

Bitcoin22 hours ago

Bitcoin22 hours agoMicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

-

Market16 hours ago

Market16 hours agoDid World Liberty Financial Launch a Stablecoin on BNB Chain?

-

Regulation20 hours ago

Regulation20 hours agoChainlink Teams Up With Abu Dhabi’s ADGM To Promote Tokenization In The UAE

-

Market19 hours ago

Market19 hours agoSolana’s Anatoly Yakovenko Doubts the Need for Layer-2 Networks

-

Market13 hours ago

Market13 hours agoHedera (HBAR) Shows Bearish Signals Despite Recovering 5%