Altcoin

What Could XRP Price Be In Trump’s Second term

XRP, the digital currency associated with Ripple Labs Inc., is considered one of the coins with big price prospects in this current Donald Trump administration. As the third largest asset by market capitalization, XRP was changing hands for $2.371, down marginally by 0.61% in 24 hours. Despite the mild bearish outlook, there is reason to stay optimistic about long-term growth.

Since President Trump’s election victory, XRP has seen an impressive growth trend. The Republican win paved the way for crypto innovation in the country, forming a major headwind for the coin. In the long term, less regulatory oversight can help the Ripple ecosystem thrive, with an upside for the coin.

XRP and the Strategic Reserve Advantage

The liberation of XRP over the past month is considered a start. However, with this administration’s pro-crypto tilt, analysts are divided on how high the coin could soar by 2028 when President Trump will be at the end of his current tenure.

In an earlier XRP price prediction, analysts issued a target of $150 for the coin. While this forecast is not conservative, the prospect of XRP’s inclusion in strategic crypto reserve in the US offers more optimistic projections. As reported earlier by CoinGape, market analyst Crypto Pal believes XRP could jump to a $10,000 to $35,000 range if added to the reserve.

Beyond the growing speculation of XRP’s inclusion in the reserve, a major challenge lies ahead. Most Bitcoin proponents believe altcoins in the stockpile might produce the opposite effect. However, if the coin bypasses this hurdle, the price has a huge prospect for a breakout.

XRP Utility Amid SWIFT and US Bank Integration

The Ripple Labs ecosystem is advancing rapidly, fueling the integration of some of its associated products in mainstream finance. As a blockchain payments firm, Ripple Labs always looks for top players to partner with. This has birthed speculations around a potential SWIFT partnership.

If this happens, the upside for the XRP price is enormous, with analysts suggesting a likely rally to $1,000. The coin and other Ripple products may come without much hurdle for SWIFT to integrate. The end of the Ripple and SEC lawsuit has cleared the path for the firm to grow its business in the United States.

Over the past few years, digital currency has been key in powering some global banks’ cross-border settlement systems. According to SBI CEO Yoshitaka Kitao, XRP is already on track to revamp Japanese banks’ remittance businesses.

The current regulatory outlook is expected to pave the way for US Banks to adopt XRP in the long term. Recall that the Office of the Comptroller of the Currency (OCC) has given the green light to banks to engage in crypto-related activities. This can help Ripple rebuild the payment partnerships it lost due to the SEC lawsuit.

Besides this outlook, President Trump’s trade policies, though worrisome at the moment, might indirectly favor American-first crypto innovations. With US Debt financing plans with crypto, the bull case for XRP is further solidified.

XRP Price Prediction for 2028

Different analysts forecast XRP using different models. However, CoinGape consulted DeepSeek AI on the coin’s price by 2028.

The AI model identified conservative, moderate, and bullish scenarios for the XRP price target. Under the conservative estimate, DeepSeek sees XRP trading around $10 to $20. This forecast hinges on the prospect of gradual adoption in the ecosystem.

The moderate estimate projects the coin to soar from $50 to $100 in the long term due to potential SWIFT and US partnerships. In the bull case scenario, the AI model sees the XRP price trading from $150 to $200 if it becomes integrated into crypto reserves.

Is XRP Price Breakout Ahead?

Many advocates believe XRP has faced suppression in the past four years owing to the Ripple lawsuit. However, President Trump’s renewed focus on encouraging crypto innovation has renewed the hope for cryptocurrency.

Macroeconomic trends, including potential rate cuts, create a headwind for the coin. This positive outlook shows Ripple may play a key role in redefining global finance by 2028, a trend that will profit XRP.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Can Chainlink (LINK) Price Hit $44 Amid This Crucial Partnership?

The Chainlink (LINK) price has seen a significant surge after partnering with Abu Dhabi’s ADGM. This sparks a bullish sentiment signaling a major rally ahead. Experts remain optimistic about LINK’s future trends and predict that Chainlink will soon ascend to new highs.

Let’s unveil Chainlink’s recent Abu Dhabi partnership and its potential implications on the LINK price.

Chainlink (LINK) Price Sees Major Rally: Is $44 the Next Target?

Driven by recent developments, the Chainlink (LINK) price has seen a significant uptrend. With its price increasing by more than 8% in a week, Chainlink is expected to continue its bullish path.

Recently, an analyst, known on X as CW, spotted a bull flag pattern on Chainlink’s one-day chart. While $12 serves as a crucial support level for the Chainlink price, the rally past the mark indicates the token’s potential upward trend. CW also pinpointed $18 as a resistance level, predicting that if Chainlink surpasses this point, it could soar to $44.

What Moves LINK Price Up?

In the latest development within the Chainlink ecosystem, the platform entered into a strategic partnership with the Abu Dhabi Global Market (ADGM) to promote tokenization in the UAE. As part of the collaboration, Chainlink and ADGM have signed an MoU to create a secure and legally sound environment for asset tokenization in financial markets.

Significantly, ADGM will provide regulatory guidance, frameworks for secure tokenization, and expertise in asset tokenization. At the same time, Chainlink will contribute its technical expertise, blockchain-based solutions, and tokenization infrastructure.

Acknowledging ADGM’s resilient infrastructure, Angie Walker, Senior Executive Officer at Chainlink Labs Abu Dhabi, stated,

Our alliance will elevate the blockchain ecosystem in the UAE, driving greater innovation and adoption. We are excited to see projects under the purview of ADGM Registration Authority adopt the Chainlink standard, enabling seamless compliance, enhanced connectivity across markets, and highly secure on-chain services.”

Chainlink Future Trends: Analyst Insights

LINK price today traded at $15.31, up 0.31% over the past day. The Chainlink price has experienced an 8.3% surge over the past week despite a monthly decline of 14%. The 24-hour trading volume, currently at $339.14 million, has seen a slight increase of 1.59%. As per a LINK price prediction, the crypto may not witness massive gains ahead based on the current trends.

Reflecting on this positive sentiment, analysts like CW foresee a major bullish upswing. Analyst Marzell provided a detailed analysis of Chainlink presenting a weekly chart. According to him, LINK is currently trading within a clear rising wedge structure, having just bounced off the 0.786 Fibonacci level at $13.55. This level is historically a strong retracement zone.

As this surge aligns with the lower trendline support, it hints at a potential continuation of the upward momentum. If this trend is sustained, the Chainlink price could hit $25.80, $32.66, and $40.70.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Why Is Pi Coin Price Down 5% Today?

Pi coin, the native cryptocurrency of Pi Network, is once again facing strong selling pressure following the rejection at $1. The Pi Coin price has tanked 5% in the last 24 hours, now trading at $0.923, with daily trading volumes crashing 30.56%, slipping under $200 million. The PI token unlocks and movement to centralized exchanges (CEXs) have led to the current selling pressure.

Pi Network Native Crypto Supply on Exchange Increases

Over the last seven days, the Pi Network native crypto Pi Coin has corrected 22% after it failed to breach past $.120 levels multiple times. This has also resulted in the cryptocurrency slipping from 11th position to now at 23rd position, while losing over $13 billion in market cap over the past month.

Pi Fails To Hold $1 Mark

Pi Coin price is failing to regain $1 as PI exchange deposits have shot up in recent days. This selling pressure comes with nearly 8 million PI tokens moving to centralized exchanges (CEXs). According to market analysts, the PiCore Team (PCT) must take urgent action to stabilize the token’s value. A proposed solution involves burning 60 to 100 million coins from the circulating supply in the coming days to prevent further price depreciation.

On the other hand, the total number of PiCoins held on CEXs has surged to over 338 million. This has further led to concerns about increased sell-offs and price volatility in Pi Network.

Where’s Pi Coin Heading Next?

A recent TradingView chart by Coinvo reveals a sophisticated trading pattern for the PI/USDT trading pair on Bitget, highlighting a potential “Triple ZigZag” formation that suggests a possible market trend reversal.

This 8-hour chart shows an Elliot wave analysis. This coupled with the “Triple ZigZag” chart specifically shows a series of corrective waves (labeled A, B, C) with the most recent waves suggesting a potential upward momentum.

Coinvo noted that as Pi Network’s Pi Coin price flirts around $0.9512, there’s a potential price appreciation happening in the coming weeks. Another market analyst TraderFy has shared a bold prediction for $PI eyeing a major breakout. “$PI is about to explode! A massive falling wedge breakout is inevitable,” he wrote sharing that the immediate price targets are $2.00529 and $2.38466.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ethereum Price To Hit $5K Before SOL Rally To $300, Arthur Hayes Says

BitMEX co-founder Arthur Hayes has once again stolen the spotlight with his recent comment on the social media platform. In a recent X post, Hayes said that Ethereum price will hit a new all-time high of $5,000 before Solana’s rally to $300. This bold prediction caught investors’ attention, especially after the Bitcoin price neared $89K in the last 24 hours.

Arthur Hayes Bets Big On Ethereum Price: Will ETH Outpace Solana?

The current volatile scenario in the broader crypto market has left many investors wondering about the futures of the top altcoins. However, amid this, Arthur Hayes has caught the investors’ eyes with his latest bold prediction, which has sparked a Solana Vs Ethereum price debate.

Meanwhile, in a recent X post, the BitMEX co-founder said that Ethereum would reach the $5,000 mark before Solana’s likely rally to $300. Notably, this comment has further fueled speculations as it contradicts the current trend recorded in the market. Besides, it also comes after Hayes recently predicted that BTC will hit $110K soon.

Here’s A Quick Overview of Solana & Ethereum Prices

Arthur Hayes’s bold prediction on Ethereum price comes amid a slump in Ether price today. During writing, ETH price was down over 1% and exchanged hands at $2,052, while its one-day volume jumped 25% to $13 billion. Notably, the crypto has touched a 24-hour high and low of $2,101 and $2,038. Besides, a recent ETH price prediction indicates that the crypto might rest near the $2,100 level for this month.

On the other hand, SOL price today was up 0.5% and exchanged hands at $139.4. Notably, a flurry of factors has helped in the recent SOL price gains over the past few days. However, a SOL price prediction hints that the crypto might touch a max price of about $144 by this month’s end.

What’s Next For ETH & SOL?

Despite the volatile scenario recorded in the broader crypto market, experts and recent market trends hint at a potential rally ahead for both assets. For context, renowned expert Ali Martinez noted that Ethereum whale activity has surged recently and they have acquired 470,000 ETH through the prior week.

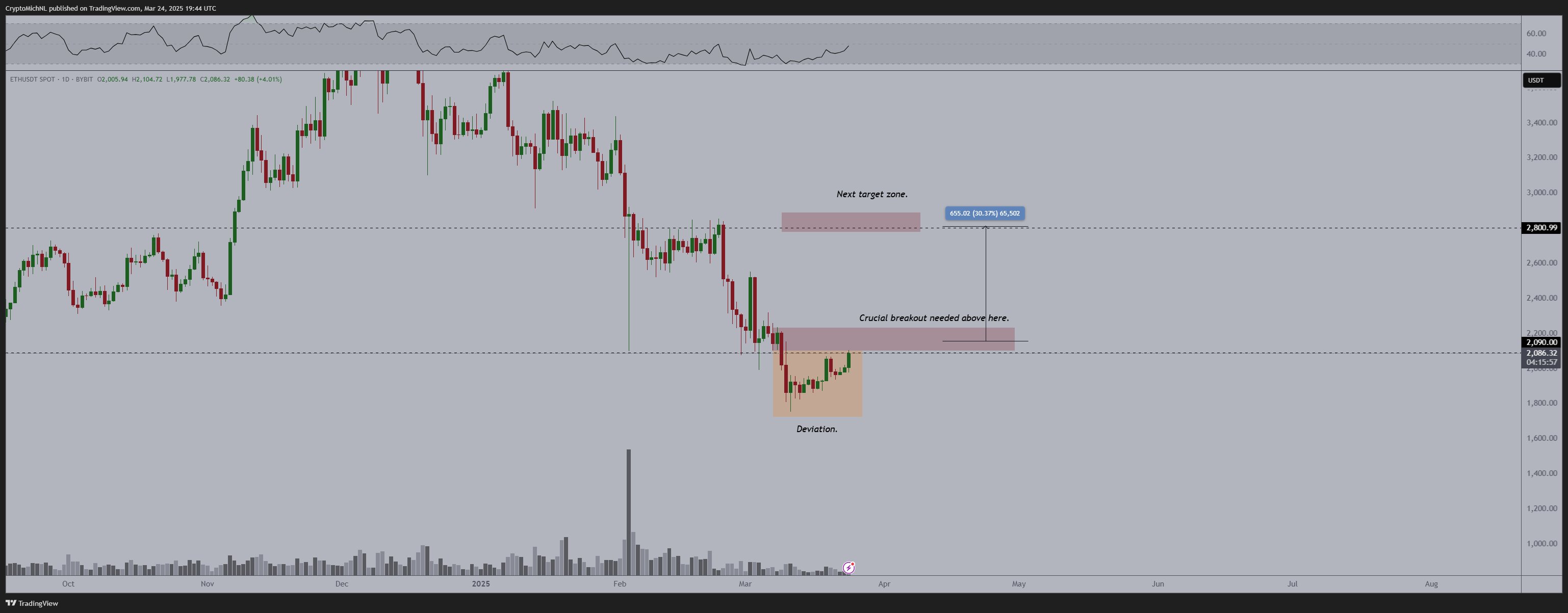

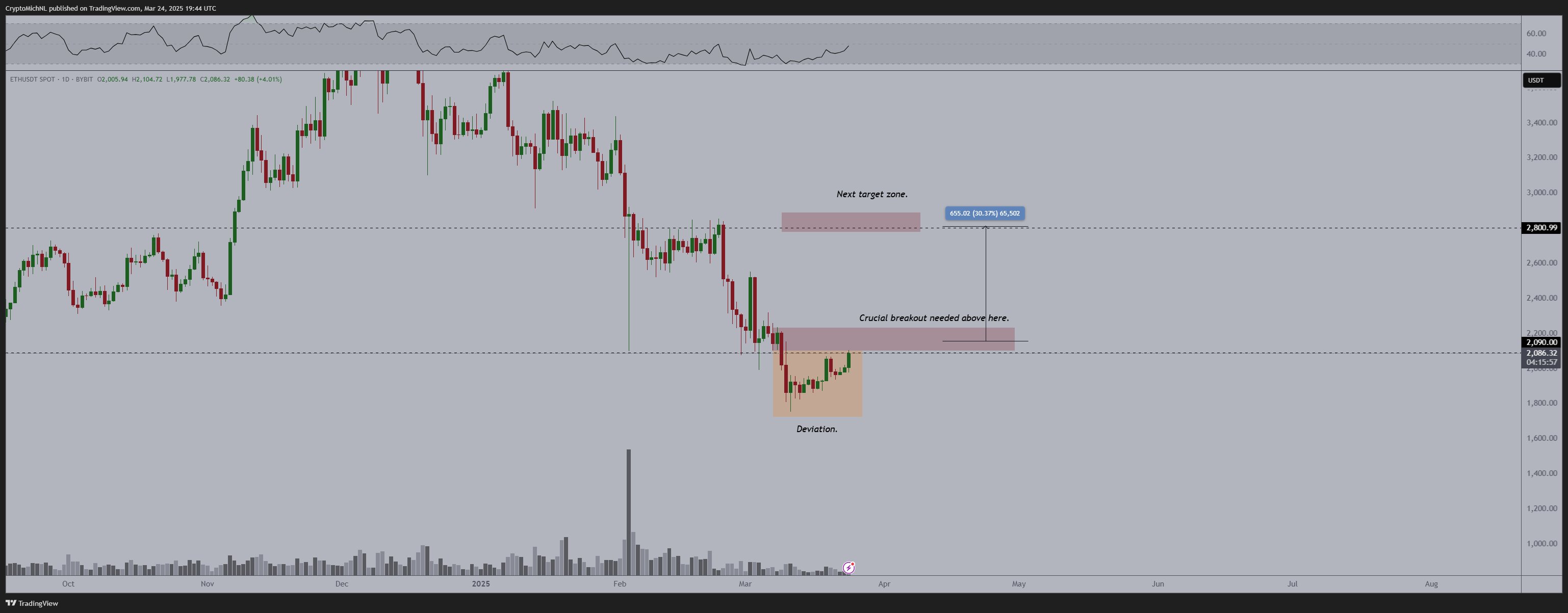

Besides, another expert Michael van de Poppe also shared crucial insights on the future trajectory of Ethereum price. In a recent X post, the expert noted that if ETH breaks through the $2100-$2150 level, it could target $2,800 in the near term. Besides, he also predicted a likely “good Q2” for the asset.

Simultaneously, for SOL price, analyst CryptoCurb said that the crypto is on the verge of a breakout ahead. Echoing a similar sentiment, analyst Satoshi Flipper said that the short-term performance hints at a likely rally for SOL price.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market20 hours ago

Market20 hours agoWorldcoin Jumps 13% As World Network Eyes VISA Partnership

-

Bitcoin24 hours ago

Bitcoin24 hours agoCrypto Inflows Return with $644 Million Boost, Bitcoin Leads

-

Market21 hours ago

Market21 hours agoXRP Price Could Suffer April Flash Crash, Analyst Shows How Low It Could Go

-

Bitcoin21 hours ago

Bitcoin21 hours agoMicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

-

Market15 hours ago

Market15 hours agoDid World Liberty Financial Launch a Stablecoin on BNB Chain?

-

Regulation19 hours ago

Regulation19 hours agoChainlink Teams Up With Abu Dhabi’s ADGM To Promote Tokenization In The UAE

-

Market23 hours ago

Market23 hours agoCan Tron Compete with Solana?

-

Market22 hours ago

Market22 hours agoXRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit

✓ Share: