Market

Filipinos Can Now Use USDC Stablecoin Through GCash

GCash, the Philippines’ leading digital money app, announced support for Circle’s USD Coin (USDC). Users in the country can now hold and transact with the stablecoin.

This marks a major step in integrating stablecoins with everyday transactions in the country.

Circle’s USDC Ventures Into the Philippines Market

Local media revealed the integration, noting that GCash users in the Philippines can buy, hold, and send USDC through GCrypto, the app’s cryptocurrency platform. GCash’s Group Head of Wealth Management, Arjun Varma, says this integration presents a game-changer for financial inclusion in the Philippines.

“By offering easy access to digital dollars, we empower our users with a stable and globally recognized financial asset,” local media reported, citing Varma.

Unlike volatile cryptos like Bitcoin (BTC) and Ethereum (ETH), USDC is a stablecoin pegged to the US dollar. This makes it a more reliable digital asset for payments and savings.

The move is expected to help millions of Filipinos bypass traditional banking infrastructure, which is reportedly slow, expensive, and inaccessible to many.

“Philippines payments are absolutely horrible. Some of the worst rails and ramps in the world,” one user remarked.

With USDC reserves held at regulated financial institutions, they undergo regular third-party attestations to ensure transparency. Circle CEO Jeremy Allaire highlighted the scale of this expansion, citing an opportunity for growth in the firm’s stablecoin network.

“The largest and most widely used digital money app in the Philippines, GCash, just announced support for USDC in their mobile wallet. Another ~100m users being brought into Circle’s stablecoin network,” he expressed.

Meanwhile, this move signals Circle’s outward expansion as competition in the stablecoin market intensifies. Major traditional finance institutions, including the Bank of America (BoA), are now eyeing stablecoin adoption.

This poses competition for stablecoin issuers like Tether and Circle as established banks look to enter the space with their stablecoin offerings. As financial giants move in, fintech companies like GCash offer themselves as potential avenues for expansion to stablecoin issuers.

“GCash’s USDC move puts a global digital dollar in 100 million Filipino hands. Stablecoins might just leapfrog banks in places like this,” another user added.

Despite the optimism, transparency remains a significant concern for stablecoin adoption. While the blockchain’s openness is great for security and trust, it is not always ideal for everyday payments.

“Crypto payments failed for one small reason that needs fixing: When sending USDC, let the recipient see the transaction but not your address. Nobody wants to reveal their wallet for a 10 USDC beer payment,” DeFi researcher Ignas said recently.

While GCash’s USDC integration offers convenience, calls for stablecoin transparency, like revealing wallet addresses for USDC transactions, may deter adoption even for Philippine users.

Still, GCash’s move reflects a broader trend of digital wallets embracing blockchain-based finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Dips After Rally—Is This the Perfect Entry Point?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

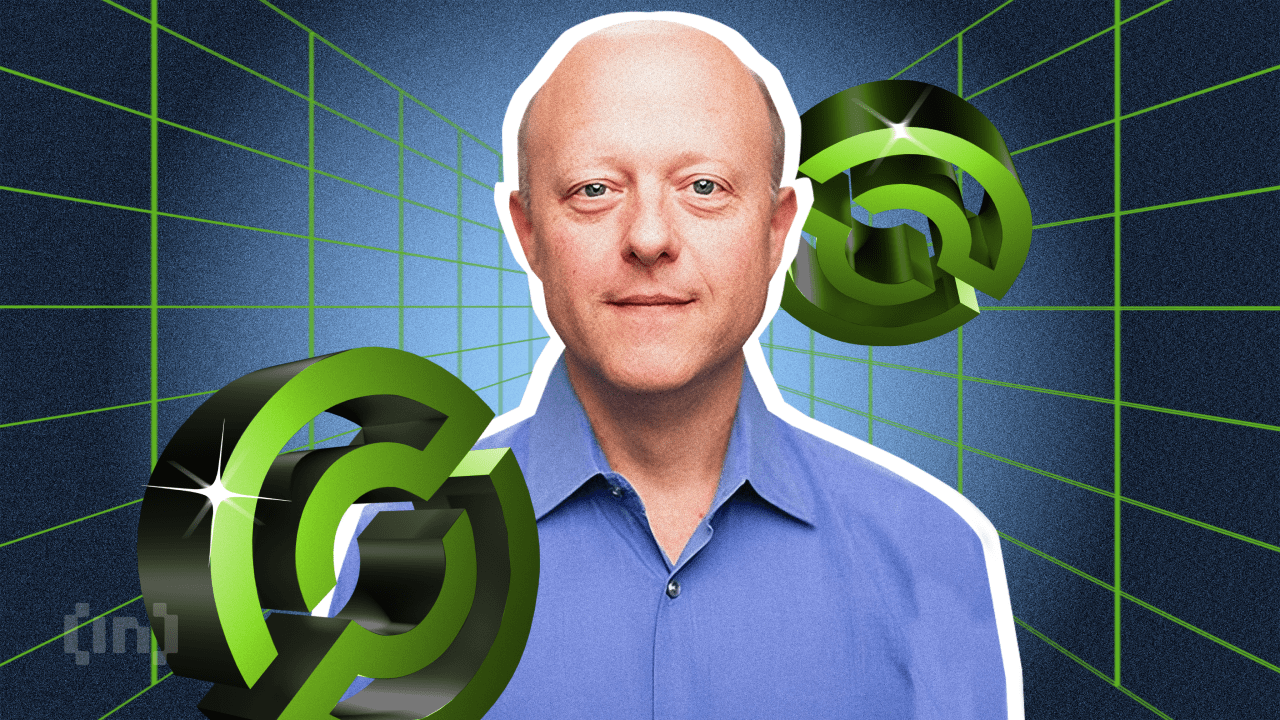

Bitcoin price started a steady increase above the $85,500 zone. BTC is now correcting gains from $88,750 and might find bids near $86,500.

- Bitcoin started a decent recovery wave above the $85,000 zone.

- The price is trading above $86,500 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $86,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $87,500 and $88,000 levels.

Bitcoin Price Regains Traction

Bitcoin price remained stable above the $83,200 level. BTC formed a base and recently started a recovery wave above the $85,500 resistance level.

The bulls pushed the price above the $88,000 resistance level. However, the bears were active near the $88,800 resistance zone. A high was formed at $88,750 and the price corrected some gains. There was a move below the $88,000 level.

The price dipped below the 23.6% Fib retracement level of the upward move from the $83,665 swing low to the $88,750 high. Bitcoin price is now trading above $86,200 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $86,800 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $87,200 level. The first key resistance is near the $87,500 level. The next key resistance could be $88,000.

A close above the $88,000 resistance might send the price further higher. In the stated case, the price could rise and test the $88,800 resistance level. Any more gains might send the price toward the $89,500 level or even $90,000.

More Losses In BTC?

If Bitcoin fails to rise above the $87,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $86,800 level and the trend line. The first major support is near the $86,200 level or the 50% Fib retracement level of the upward move from the $83,665 swing low to the $88,750 high.

The next support is now near the $85,500 zone. Any more losses might send the price toward the $85,000 support in the near term. The main support sits at $84,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,800, followed by $86,200.

Major Resistance Levels – $87,500 and $88,000.

Market

BlackRock Expands Bitcoin ETPs to Europe After US ETF Success

BlackRock, the world’s largest asset manager, is launching its first Bitcoin ETP (exchange-traded product) in Europe, expanding its presence in the crypto investment space.

This move follows the success of its US-listed spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), which has accumulated $50.6 billion in assets under management (AUM).

BlackRock to List Bitcoin ETP in Europe

The new iShares Bitcoin ETP will be available for trading on Xetra and Euronext Paris under the ticker IB1T and on Euronext Amsterdam as BTCN.

The expansion into Europe marks BlackRock’s first crypto-backed ETP offering outside North America. This suggests growing institutional interest in digital assets.

To encourage early adoption, BlackRock is offering a temporary fee waiver, reducing the expense ratio of the ETP to 0.15% until the end of the year. This makes the product one of the most cost-effective Bitcoin ETPs in the European market. It could attract both retail and institutional investors looking for exposure to digital assets at a competitive price.

Europe has been a pioneer in crypto ETPs, with over 160 digital asset-tracking products available. However, its overall market size remains relatively small compared to the US.

Bloomberg ETF analyst Eric Balchunas pointed out that US spot Bitcoin ETFs dominate the global market. Specifically, the US holds approximately 91% of total assets despite being introduced only a year ago.

“Europe barely on leaderboard of spot bitcoin ETFs by size. US spot ETFs only year old and have 91% share of world,” Balchunas said in a February post.

Balchunas also noted that Europe has struggled to compete with the US in terms of liquidity and cost efficiency. He speculated that BlackRock’s entry into the European market could provide a significant boost. Specifically, the asset manager could replicate the cost-effectiveness and trading volume seen in the US.

“If BlackRock brings even some of the US Terrordome over there, it should see success, although Europeans are generally less into ‘hot sauce’ than US and certain Asian investors,” he added.

Notwithstanding, BlackRock’s Bitcoin ETP in Europe is a game-changer for institutional adoption. As access broadens, it could increase BTC demand.

Despite the news, however, the impact on Bitcoin’s price remains muted. BTC was down by 0.55% in the last 24 hours. As of this writing, Bitcoin was trading for $86,601.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Consolidates—Breakout Incoming or More Choppy Moves?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin21 hours ago

Bitcoin21 hours agoCrypto Inflows Return with $644 Million Boost, Bitcoin Leads

-

Altcoin24 hours ago

Altcoin24 hours agoWhy Trump’s World Liberty Financial Stacked 6 Million MNT?

-

Altcoin23 hours ago

Altcoin23 hours agoRipple Coin and Bitcoin Dominate the $644M Weekly Inflow

-

Market21 hours ago

Market21 hours agoCan Tron Compete with Solana?

-

Market20 hours ago

Market20 hours agoXRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit

-

Market19 hours ago

Market19 hours agoXRP Price Could Suffer April Flash Crash, Analyst Shows How Low It Could Go

-

Bitcoin18 hours ago

Bitcoin18 hours agoMicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

-

Market12 hours ago

Market12 hours agoDid World Liberty Financial Launch a Stablecoin on BNB Chain?