Market

Cardano (ADA) Faces Death Cross After Price Falls 37% In March

Cardano (ADA) has been on a rocky path this month. After posting early gains, the altcoin has now retraced 37%, erasing most of its recent upside.

While broader market indicators hinted at a bullish outlook, technical patterns suggest that the momentum may not hold.

Cardano Losses Are Likely

Cardano appears to be nearing a Death Cross, a bearish technical signal. This occurs when the 50-day exponential moving average (EMA) slips below the 200-day EMA. Historically, this crossover has often preceded sharp price declines.

If this formation is confirmed, it would be ADA’s first Death Cross in 10 months. It would also officially end the ongoing five-month-long Golden Cross, a bullish pattern that previously supported the asset’s growth.

With momentum fading, investors may see this as a pivot toward further downside pressure.

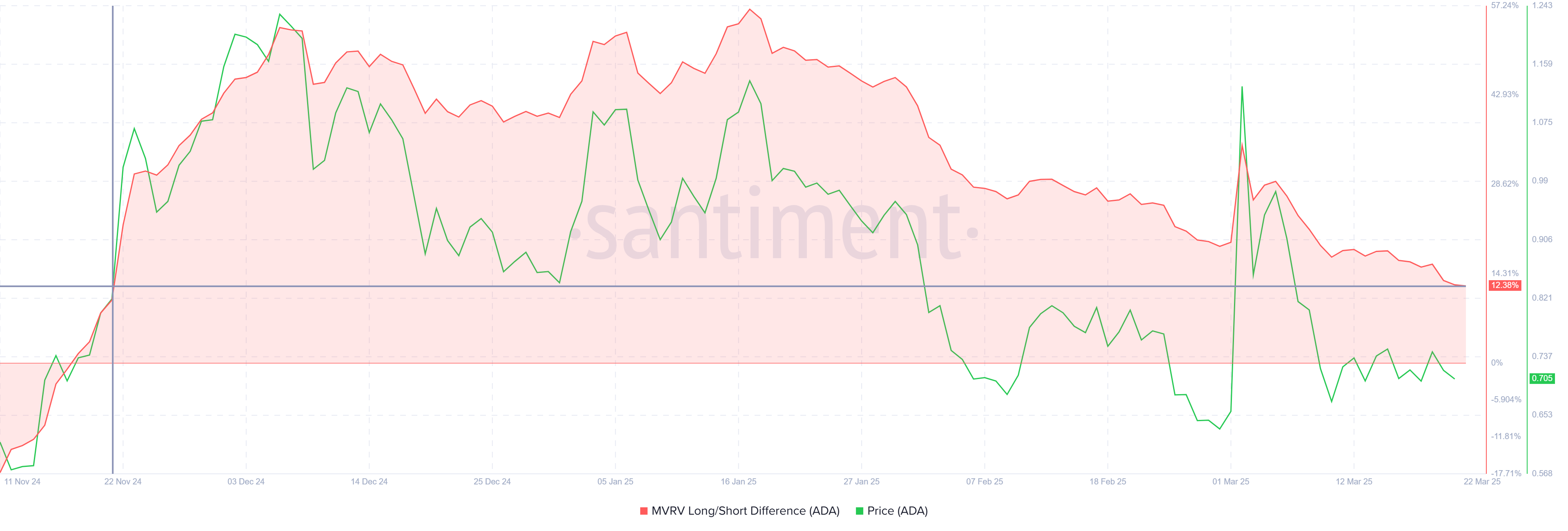

On-chain data further dampens investor confidence. The MVRV Long/Short Difference — a metric comparing the profitability of long-term holders (LTHs) to short-term holders (STHs) — has been declining steadily.

While still in positive territory, its fall suggests LTHs are seeing their profits shrink.

This metric is now sitting at a four-month low, increasing the risk of profit-taking by LTHs. If these investors begin to sell to preserve gains, it could introduce added selling pressure. The resulting drawdown may undercut any bullish momentum Cardano is attempting to hold onto.

ADA Price Is Consolidated

ADA is currently trading at $0.71, down 37% from its recent high. The decline has broken its macro uptrend, although the altcoin remains just above the $0.70 support level. This floor has acted as a key technical barrier.

However, the looming Death Cross, combined with fading long-term investor confidence, may push Cardano below this support. If $0.70 is breached, ADA could slip to $0.62. This would mark a further extension of the ongoing correction phase, reinforcing the bearish outlook.

On the other hand, if Cardano manages to invalidate the bearish thesis, it must rise above $0.77. This would end the current 11-day consolidation phase.

A successful breakout could propel ADA toward $0.85, reclaiming some of the lost ground and potentially restoring short-term investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana’s Anatoly Yakovenko Doubts the Need for Layer-2 Networks

Anatoly Yakovenko, co-founder of Solana, ignited a fresh debate on blockchain scalability by dismissing the necessity of Layer-2 (L2) solutions.

This adds to the greater discourse about L2 networks, with key industry leaders in the space taking notice.

Solana Founder Says There’s No Reason to Build L2

Yakovenko responded to Ethereum builder rip.eth’s claim that L2s are inherently faster, cheaper, and more secure than Layer-1 (L1) blockchains. They argued that L2s avoid the high costs and consensus risks of maintaining a full-fledged L1.

Citing the example of Eclipse, a Solana Virtual Machine (SVM)-based L2 leveraging Ethereum for security, rip.eth contended that L2s could deliver the best of both worlds: Solana’s speed combined with Ethereum’s decentralized security.

However, Yakovenko dismissed this, asserting that Solana’s L1 already provides sufficient scalability without needing an L2. The Solana executive countered, arguing that L1s can achieve those efficiencies without L2 complexity.

“There is no reason to build an L2. L1s can be faster, cheaper, and more secure,” Yakovenko stated.

He pointed out that L2s face trade-offs due to reliance on an L1’s data availability stack, fraud proofs, and upgrade multisigs. In his opinion, all these introduce additional security concerns.

The conversation quickly expanded beyond L1 vs. L2 efficiency. A user, Marty McFly, raised concerns about blockchain scalability, questioning what happens when the amount of data stored on-chain grows exponentially.

Yakovenko responded that Solana currently generates around 80 terabytes of data per year. He said this is relatively small in a business context but large for individual storage. Alan, an advocate for decentralization, questioned Solana’s approach to managing unused storage, given that its state rent mechanism is inactive.

“What is Solana’s plan to offload unused storage given the current state rent mechanism is not turned on,” posed Alan.

Yakovenko clarified that Solana’s ledger will be stored on decentralized solutions like Filecoin (FIL). He indicated that offloading historical blockchain data to external storage providers is part of Solana’s long-term plan.

Shifting Trends in Layer-2 Adoption

Yakovenko’s argument against L2s comes at a time when Ethereum is experiencing significant changes in its transaction fee model. BeInCrypto reported a decline in Ethereum transaction fees, suggesting that L2 adoption has helped reduce users’ costs. This trend challenges the notion that L1 blockchains alone can meet all scalability needs without L2 enhancements.

Additionally, Binance’s founder, Changpeng Zhao, recently sparked a debate on whether artificial intelligence (AI) projects should be built on L1 or L2 solutions. The discussion mirrored Yakovenko’s and rip.eth’s arguments, highlighting the ongoing industry divide over where future blockchain-based AI applications should reside.

Meanwhile, Ethereum co-founder Vitalik Buterin recently weighed in on L2 sustainability. Six months ago, he predicted that some L2 networks would fail, emphasizing that many projects are unsustainable due to economic and security constraints.

However, just two months ago, Buterin outlined a roadmap to scale Ethereum’s L1 and L2 protocols in 2025, acknowledging that both layers will contribute to its growth.

“We need to continue building up the technical and social properties, and the utility, of Ethereum,” Buterin wrote.

Yakovenko’s firm stance against L2s highlights the growing divergence in blockchain scaling strategies. While Solana aims to push L1 scalability to its limits, Ethereum continues to develop both L1 and L2 solutions to achieve a balanced approach.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Signals Breakout Above $90,000 As Bullish Cycle Builds

Bitcoin (BTC) has increased more than 4% in the last 24 hours and over 5% in the past seven days as it attempts to recover the $90,000 level. The recent price rebound comes amid improving technical indicators that suggest growing bullish momentum.

Traders are closely watching whether Bitcoin can reclaim $90,000 and build a stronger foundation for further upside. Several trend indicators, including the DMI, Ichimoku Cloud, and EMA lines, are signaling that a potential breakout could be forming.

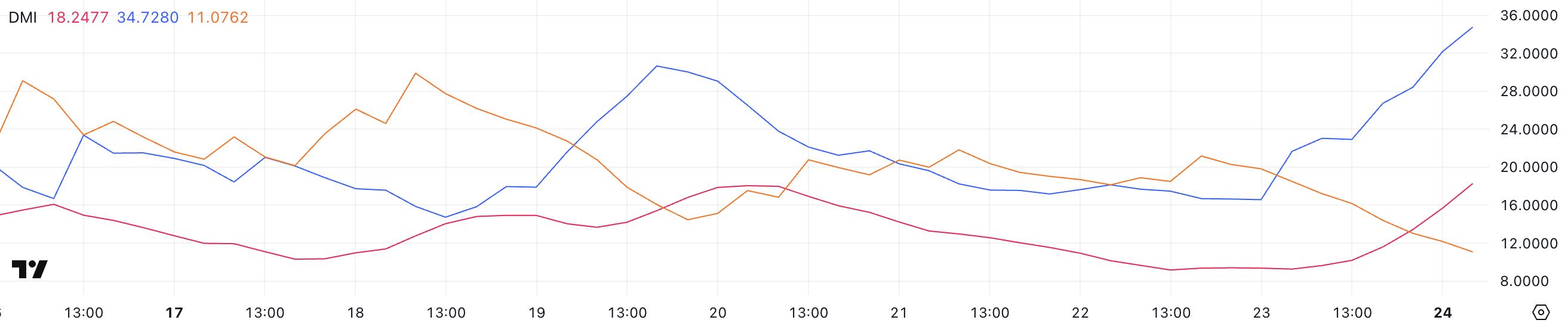

BTC DMI Shows Buyers Are Now In Full Control

Bitcoin’s DMI chart is showing a significant uptick in momentum. The ADX (Average Directional Index) has climbed to 18.24 today, a notable increase from 9.2 just yesterday, signaling that the strength of the current trend is building.

An ADX reading below 20 typically suggests that the market is trending weakly or is range-bound, so this rise could be an early sign of a developing trend.

While the ADX itself does not indicate the direction of the trend, it measures the overall strength, and today’s reading suggests momentum is beginning to pick up.

The ADX is a widely used technical indicator that helps traders gauge the strength of a market trend. Generally, an ADX value below 20 signals a lack of a clear trend, while readings above 25 suggest a strong trend is present.

Alongside the ADX, the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator) provide insight into trend direction. Currently, the +DI has surged to 34.7 from 16.57 yesterday, while the -DI has declined to 11 from 21.17.

This widening gap between +DI and -DI indicates that bullish momentum is gaining dominance, as buyers appear to be overwhelming sellers. If this trend continues, it could point to a further rise in BTC’s price in the near term, as the market shifts towards a more decisive bullish trend and Bitcoin ETFs show signs of recovery.

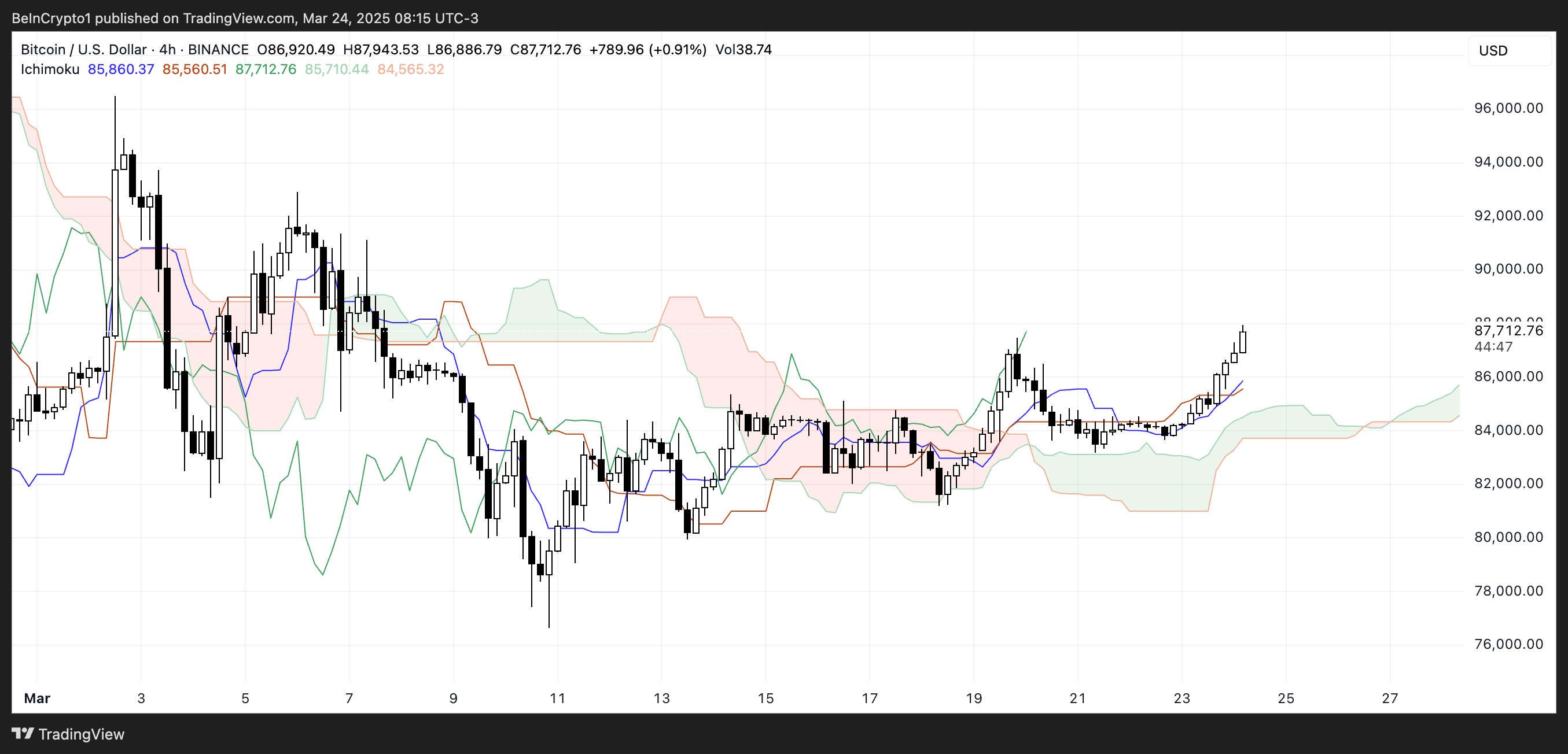

Bitcoin Ichimoku Cloud Shows A Bullish Setup Is Forming

The Ichimoku Cloud chart for Bitcoin shows the Tenkan-sen (blue line) and Kijun-sen (red line) crossing in a bullish pattern. The faster Tenkan-sen moves above the slower Kijun-sen, signaling a momentum shift.

These lines have converged after a period of separation, indicating strengthening trend conditions.

The cloud formation (Kumo) has changed from red to green in the right portion of the chart, marking a shift from bearish to bullish sentiment. Price action has broken above the cloud after testing it as support multiple times throughout mid-March.

This emergence above the cloud signals that previous resistance has potentially become support. The cloud’s varying thickness throughout the period reflects changing market volatility and conviction in the trend direction.

Can Bitcoin Reclaim $100,000 Before April?

Bitcoin’s EMA lines are currently showing mixed signals. While the broader trend remains bearish, short-term exponential moving averages have started to turn upward, and a recent golden cross suggests that bullish momentum is building.

If this momentum continues and additional golden crosses occur, Bitcoin price could target key resistance levels. The first major resistance lies at $92,920, and a successful breakout could see BTC pushing towards $96,484.

If the uptrend strengthens further, Bitcoin may test $99,472. It has the potential to break above $100,000 for the first time since February 3. This could be driven by 5 US economic events that can influence Bitcoin sentiment this week.

However, the bullish scenario hinges on sustained buying pressure. If the upward momentum fades and the broader bearish trend resumes, Bitcoin could first retest the support level at $85,124.

A break below this level might open the door for a decline towards $81,187, with further downside potentially leading BTC back below the $80,000 mark.

In a stronger bearish scenario, Bitcoin could revisit $76,642, reinforcing the bearish bias.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Worldcoin Jumps 13% As World Network Eyes VISA Partnership

According to reports, World Network is in talks with Visa to launch a new stablecoin wallet. This would integrate crypto-native features into Visa’s massive customer base.

Worldcoin’s price jumped 13% since this news first broke. However, there is no firm indication of how likely these parties are to reach an actual deal.

Will Visa Partner with Worldcoin?

World Network (formerly Worldcoin), a blockchain-based biometric identification system, may be entering a partnership with Visa soon.

According to recent reports, World’s parent company, Tools for Humanity, initiated this dialogue. It wishes to team up with Visa to create a new stablecoin wallet integrated with a massive customer base:

“OpenAI CEO Sam Altman is reportedly working with Visa to develop a crypto stablecoin wallet tied to the Worldcoin ecosystem. The wallet would integrate on-chain card features and allow stablecoin payments across Visa’s global network. Sources say the goal is to make the World Wallet a ‘mini bank account’ with FX, fiat ramps, and more,” Mario Nawfal stated on X.

Over the past few months, Worldcoin’s value has gone down dramatically. Although it briefly rallied towards the end of 2024, investor sell-offs and regulatory setbacks have consistently frustrated its fans.

However, since the talks between Visa and World network were first publicized, Worldcoin managed a rally of 13%.

Visa, for its part, has collaborated with several crypto companies in the past. It entered the RWA market in 2024 and also partnered with Coinbase to allow Visa debit cards for instant fund transfers.

However, the firm also explored stablecoin market trends last year, with discouraging results. Stablecoins may even threaten Visa’s core business model.

In other words, World Network wants stablecoins at the center of a future deal with Visa, but that might be a sticking point. So far, the talks are apparently in the early stages, and there is no indication whatsoever of how likely a deal is. Nonetheless, active discussions are happening, and this has helped Worldcoin’s value rebound.

It’s important to remember that stablecoins may be a much bigger component of world finance soon. In a recent speech, Donald Trump claimed that stableoins will have an important role in promoting dollar dominance worldwide.

This may possibly incentivize Visa to partner with World Network, but it’s too soon to say.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoCrypto Tycoon Drops $1 Billion On Private Space Station

-

Ethereum24 hours ago

Ethereum24 hours agoTime To Buy Ethereum (ETH)? Here’s What This Analyst Thinks

-

Altcoin21 hours ago

Altcoin21 hours agoCoinbase CLO Criticizes The US Treasury Over Tornado Cash SDN Delisting Procedure

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Holds Critical Support At $83,444 As Bulls Target Key Resisitance

-

Altcoin18 hours ago

Altcoin18 hours agoStablecoin Market Cap Hits $220 Billion

-

Bitcoin11 hours ago

Bitcoin11 hours agoUS Economic Data This Week: Key Events Shaping Bitcoin

-

Market11 hours ago

Market11 hours agoEthereum Price Teases a Breakout—Can This Spark a Momentum Shift

-

Altcoin11 hours ago

Altcoin11 hours agoBinance Reveals Key Update On UNI, ALGO, CRV, & These 3 Crypto, Here’s All