Bitcoin

Bitcoin ETFs Rebound With a $744 Million Weekly Inflow

After five weeks of consecutive outflows, US spot Bitcoin ETFs have rebounded with $744 million in net inflows this week. On Monday, March 17, ETFs saw a $274 million inflow, which was the highest daily figure in over a month.

This rebound suggests that institutional investors are coming back to the Bitcoin market as macroeconomic factors have priced in. However, BTC still remains below the $90,000 threshold.

Bitcoin ETFs Start Recovering from a $5 Billion Loss

US Bitcoin ETFs lost over $5.3 billion since the second week of February. The month was particularly brutal for ETFs, with a record-breaking $3.5 billion in outflows.

The sharp sell-off was attributed to institutional investors liquidating their holdings amid market volatility and shifting macroeconomic conditions. However, March has signaled a turnaround, with inflows steadily increasing over the past week.

With macroeconomic concerns easing, institutional investors appear to be regaining confidence in the market. The week began on a strong note, with Bitcoin ETFs recording $274 million in inflows on Monday.

The positive momentum persisted, culminating in six straight days of net inflows. On March 21 alone, the ETFs saw a total net inflow of $83.09 million.

BlackRock’s IBIT led the way, recording up to $150 million in positive flows on Friday. Meanwhile, all other issuers remained stagnant. The only outlier was Grayscale’s GBTC, which continued its trend of outflows, losing $21.9 million that day.

This shift suggests that institutional players may be positioning themselves for a potential market recovery. Crypto influencer and Open4Profit founder Zia ul Haque pointed to this resurgence, questioning whether institutional investors are acting on inside knowledge.

“Institutes started Accumulating Again: Do they know something?! Bitcoin ETF saw a positive inflow for the last consecutive 5 days! This is the major consecutive inflow this month. From the beginning of March, giants sold BTC heavily which created a massive panic and price dump in the market. But in the last few days, they are accumulating again. This could be a good sign for the market,” ul Haque wrote.

His observation aligns with the steady recovery in ETF inflows and Bitcoin’s price action, which continues to defend against further downside.

However, despite the positive ETF flows, not everyone shares the bullish outlook and optimism for Bitcoin’s price recovery. Some analysts think that Bitcoin ETF inflows do not clearly reflect resuming buyer interest.

Institutional trading strategies are potentially experiencing structural shifts. Hedge funds often leverage a low-risk arbitrage strategy involving Bitcoin spot ETFs and CME futures.

“The ETF ‘demand’ was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” popular analyst Kyle Chasse explained.

If this structural shift continues, it could influence market stability despite the recent return of ETF inflows.

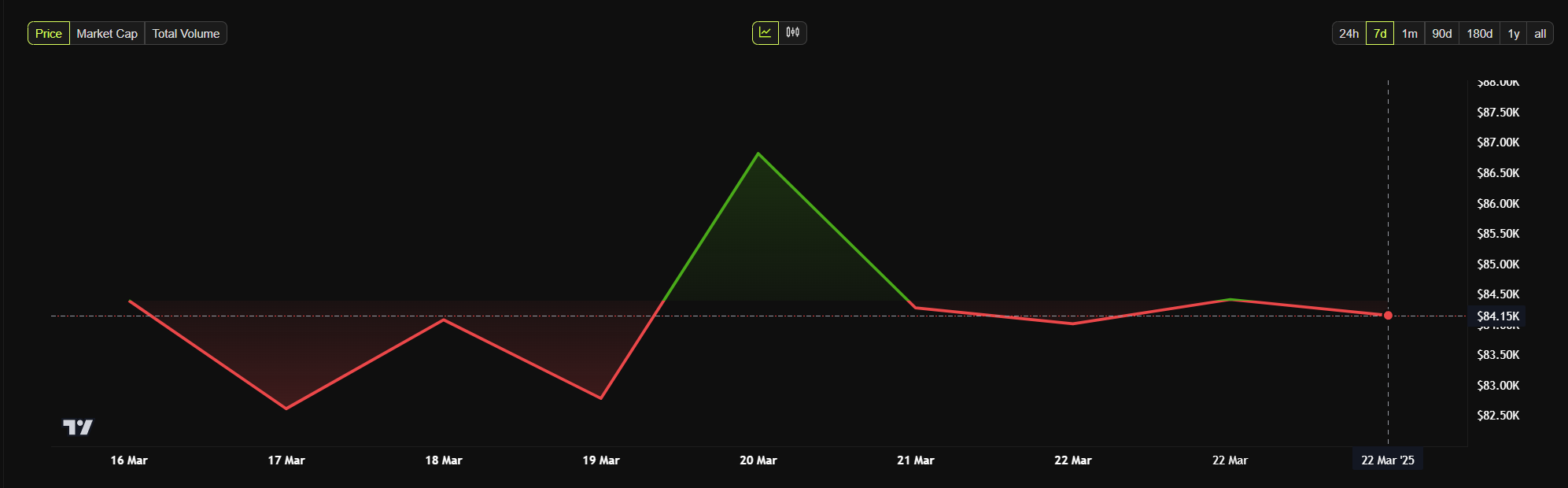

As of this writing, Bitcoin is trading at around $84,148. It is down by a modest 0.46% in the last 24 hours, failing to reflect optimism amid the recent uptick in Bitcoin ETF investments.

Meanwhile, Ethereum ETFs continue to post negative flows, with net inflows in 12 consecutive trading days (over two weeks).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Crypto Inflows Return with $644 Million Boost, Bitcoin Leads

The market is experiencing renewed optimism as crypto inflows reached $644 million last week.

It is a significant reversal after five consecutive weeks of outflows, suggesting a notable change in investor sentiment.

Crypto Inflows Reach $644 Million, Market Sentiment Recovers

The rebound follows a challenging period in which investor sentiment remained cautious, leading to substantial withdrawals from the market. With total assets under management (AUM) rising by 6.3% since March 10, the latest data suggests a decisive shift in market confidence.

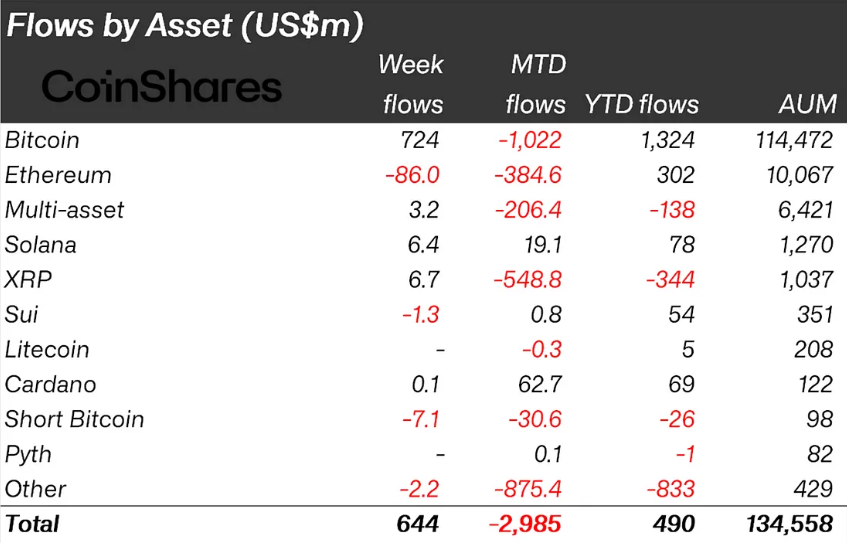

According to the latest CoinShares report, Bitcoin emerged as the primary driver of the market recovery. The pioneer crypto attracted $724 million in inflows, effectively ending a five-week outflow streak totaling $5.4 billion.

The surge in inflows reflects growing investor confidence in Bitcoin, which had previously seen sustained withdrawals amid broader market uncertainty. While Bitcoin saw a strong recovery, the altcoin market experienced a mixed performance.

Ethereum faced the heaviest outflows, with $86 million exiting the asset. On the other hand, Solana recorded $6.4 million in inflows.

The divergence in altcoin sentiment highlights that investors remain selective about where they allocate capital. Specifically, they focus on projects with perceived strong fundamentals. While the data points to continued investor caution regarding Ethereum (ETH), it also indicates investors see strong potential for Solana (SOL).

Meanwhile, most of last week’s infWeek’ssiginated from the US, which saw $632 million enter digital asset investment products.

March Reverses February’s Negative Trend

The return to inflows follows a difficult February and early March, during which crypto outflows surged. A week prior, crypto outflows totaled $1.7 billion, with Bitcoin withstanding the worst withdrawals.

Before that, outflows hit $876 million, led by US investors offloading digital assets amid a bearish trend. Therefore, the latest influx of capital suggests that sentiment may be turning, possibly driven by renewed institutional interest and a more stable macroeconomic outlook.

Further reinforcing the market’s rebound, Bitcoin ETFs (exchange-traded funds) also saw a strong influx of capital. After five consecutive weeks of outflows, Bitcoin ETFs recorded $744 million in inflows last week. This signals increased institutional participation.

The recovery aligns with Bitcoin’s broader market resurgence and suggests that investors are regaining confidence in crypto-based financial products.

“I bet BTC hits $110,000 before it retests $76,500. Why? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause transitory inflation,” wrote BitMex founder Arthur Hayes.

Meanwhile, BeInCrypto data shows BTC was trading for $87,720 as of this writing. This represents a surge of almost 4% in the last 24 hours, with the pioneer crypto steadily edging toward the $90,000 psychological level.

“Bitcoin rose above $87,000 on Monday, its highest since March 7, after dipping to $76,000 earlier this month. The rally comes as reports suggest upcoming Trump tariffs, set for April 2, will be more targeted and less disruptive than feared,” finance expert Walter Bloomberg observed.

The upcoming Trump tariffs, set for April 2 and dubbed “Liberation Day,” are expected to be less disruptive than anticipated. This could boost investor confidence in riskier assets like Bitcoin. The White House’s plan for reciprocal tariffs aims to equalize trade barriers, with Trump emphasizing no exceptions but offering unspecified “flexibility” for certain nations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Economic Data This Week: Key Events Shaping Bitcoin

This week in crypto, several US economic data releases will influence Bitcoin (BTC) and crypto market sentiment in general.

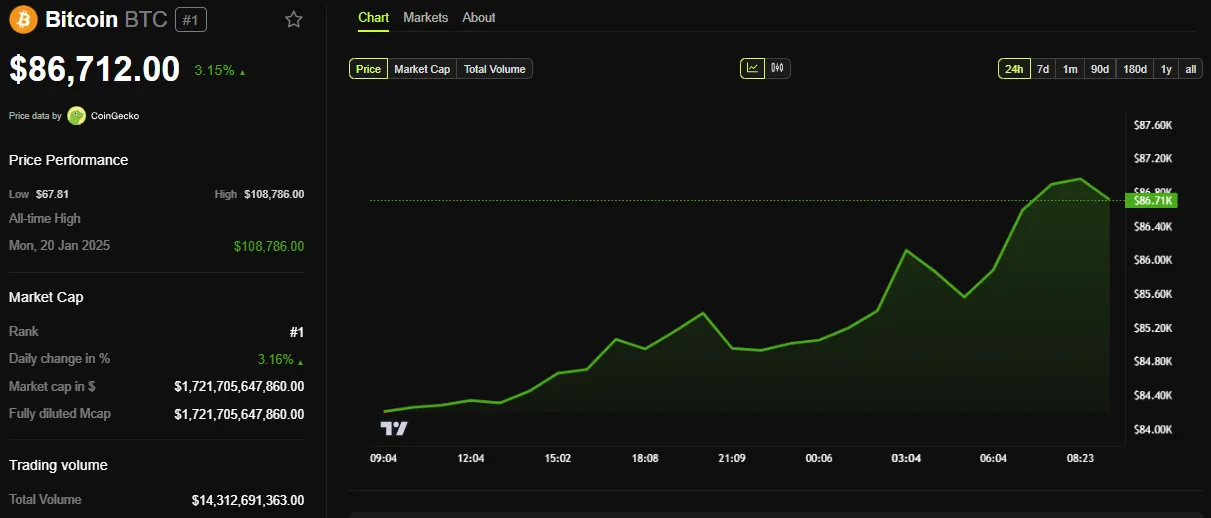

Meanwhile, Bitcoin’s price still hovers near the $87,000 threshold, defending against further downside despite being devoid of sufficient catalysts to activate its upside potential.

US Economic Data With Crypto Implication This Week

This week, five US economic data sets, including services and manufacturing PMI, consumer confidence, initial jobless claims, GDP, and PCE Index, interest crypto traders and investors. Here is how they could sway sentiment.

Services and Manufacturing PMI

The S&P Global US Services and Manufacturing PMI data, due on Monday, March 24, will gauge the health of these critical sectors. Recent trends show manufacturing holding strong at 52.7, while services follow at 51.0.

Strong manufacturing and services PMI readings could boost risk appetite, potentially lifting Bitcoin as investors seek high-yield assets. Conversely, readings below 50 would signal economic contraction, stoking recession fears and effectively driving safe-haven flows away from crypto.

With Trump’s pro-growth policies gaining traction, any upside surprise could amplify bullish sentiment, though persistent weakness may temper enthusiasm.

“A busy week as we come to the end of Q1 2025. How will the markets close out the first quarter of Trump’s new term?” analyst Mark Cullen of AlphaBTC posed.

Consumer Confidence

Tuesday’s Consumer Confidence Index from The Conference Board, expected around 10 AM ET, will reflect spending attitudes amid economic uncertainty. Despite solid job growth, February’s drop to 98.3—its steepest since 2021—hints at unease.

A rebound to the median forecast of 95.0 could signal waning retail optimism, a key driver for Bitcoin’s retail-heavy market, pushing prices higher.

However, if confidence sinks further, dovish Federal Reserve (Fed) expectations might grow, offering mixed outcomes. Liquidity hopes could buoy BTC price, but risk-off moves might dominate.

Initial Jobless Claims

Thursday’s Initial Jobless Claims report will track labor market strength, showing the number of US citizens filing for unemployment insurance.

The 223,000 reading for the week ending March 15, slightly below the expected 224,000, suggested a cooling economy, a focal point for Fed policy. It extended positive sentiment after the week ending March 8, where initial jobless claims in the US were 220,000, compared to an expected 225,000.

This time, however, the median forecast is a slight bump in initial jobless claims to 226,000 for the week ending March 22.

Higher claims could spark recession jitters, nudging investors toward Bitcoin as a hedge against instability. On the other hand, lower claims might bolster traditional markets, siphoning capital from crypto. With the Trump administration eyeing labor boosts, this data could pivot sentiment sharply.

GDP

The GDP second revision for Q4 2024, out Thursday, is forecasted at 2.3%. Stronger growth could dampen Bitcoin’s appeal as a risk asset if investors favor equities, especially with revised 2024 figures showing a 3% annual rise.

A weaker print might fuel rate-cut speculation, enhancing BTC’s allure as a store of value. Crypto traders are watching how this aligns with recent Bureau of Economic Analysis (BEA) updates signaling strong consumer spending.

Meanwhile, Bitcoin OG and economist George Selgin challenge claims that a Strategic Bitcoin Reserve would boost GDP. The finance expert argues that Bitcoin’s price growth does not directly or significantly influence a country’s economic output.

“…But that [Bitcoin] price has no definite and substantial bearing on GDP, so by stocking up on Bitcoin the gov’t does not grow the GDP,” he explained.

This standpoint stems from Trump’s March 2025 Executive Order creating a Strategic Bitcoin Reserve using forfeited assets. Selgin and others criticize this as a misuse of public funds.

PCE Index

Meanwhile, the Fed’s preferred inflation gauge, the PCE Index (Personal Consumption Expenditures), is due on Friday. The index for February will follow January’s 2.5% year-on-year (YoY) rise.

A hotter-than-expected core PCE (excluding food and energy) could delay rate cuts, pressuring Bitcoin downward as tighter policy looms. A softer reading might ignite a rally, reinforcing hopes of monetary easing. With inflation stickiness lingering, this release could dictate BTC’s near-term trajectory.

Crypto markets remain on edge, with these events poised to shape Bitcoin’s path amid changing US economic narratives.

BeInCrypto data shows BTC was trading for $86,712, up by over 3% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin’s Short-Term Holders Near Capitulation With $7B Losses, Yet Remain Within Bull Market Bounds

Bitcoin’s recent price action has put significant stress on a particular group of investors. Long-term holders are looking relatively okay with Bitcoin’s recent price action, short-term participants, on the other hand, are starting to feel the heat. Market data now suggests that this cohort may be nearing a point of capitulation, but the bigger picture reveals a more complex story where short-term holders can still hang on.

Short-Term Holders Face Losses But Stay Within Limits

On-chain data shows that Bitcoin’s short-term holders (STHs) have incurred realized losses of $7 billion over the past 30 days. Short-term holders are addresses who have held BTC for less than 155 days. This trend is noted through data from on-chain analytics platform Glassnode, which pointed out that the run of losses marks the most prolonged loss event of the current market cycle.

In addition to realized losses, unrealized losses have intensified, pushing many STH-held coins underwater. Glassnode’s analysis indicates that these losses are nearing the +2σ threshold, which is a level that has historically pointed to an increased risk of capitulation.

Image From X: Glassnode

Despite the mounting capitulation risk, history shows that short-term Bitcoin holders are not in the worst position they could be in. The current figures remain well below the $19.8 billion and $20.7 billion loss spikes witnessed during the 2021–2022 crash.

Image From X: Glassnode

Although the losses are significant, they are still aligned with patterns seen in the middle of previous corrections during bull markets. This relates to a technical outlook from crypto analyst PlanB that Bitcoin is still in the middle of its bullish run.

Bitcoin Bull Score Plunges, ETF Outflows Pressure Sentiment

Although Bitcoin might still be mid-cycle, sentiment indicators paint a pressured picture, with the price down by 23% from its recent all-time high in January. Data from CryptoQuant reveals that Bitcoin’s Bull Score has dropped to 20, its lowest point in two years. Major price recoveries have only taken place when the Bull Score climbs above 60. This current low reading is a sign that the crypto market is still trapped in uncertainty, where sellers are currently outpacing buyers and momentum.

Image From X: CryptoQuant

A contributing factor has been the sustained capital outflow from Bitcoin exchange-traded funds. Since February, more than $4.4 billion has flowed out of spot Bitcoin ETFs. These outflows have added weight to an already fragile price structure after Bitcoin started correcting from its all-time high in January.

As such, short-term holders who entered close to this high and were banking on a continued upside have been exposed to most of the losses.

Image From X: Ali_Charts

Despite the heavy outflows that defined the past few weeks, there are early signs that this trend may be turning. Data from SosoValue shows that Spot ETF behavior shifted last week, with consecutive days of net inflows into spot Bitcoin ETFs.

Image From SoSoValue

Particularly, Spot Bitcoin ETFs ended the week on a $744.35 million net inflow, bringing an end to five consecutive weeks of outflows. This return of institutional interest could be the first sign of stabilizing positive Bitcoin sentiment.

At the time of writing, Bitcoin was trading at $84,815.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market22 hours ago

Market22 hours agoNumber of New XRP Investors Drop to a 4-Month Low

-

Ethereum21 hours ago

Ethereum21 hours agoTime To Buy Ethereum (ETH)? Here’s What This Analyst Thinks

-

Altcoin19 hours ago

Altcoin19 hours agoCrypto Tycoon Drops $1 Billion On Private Space Station

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Exchange Reserve Hits New All-Time Low — Bullish For ETH Price?

-

Altcoin18 hours ago

Altcoin18 hours agoCoinbase CLO Criticizes The US Treasury Over Tornado Cash SDN Delisting Procedure

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Holds Critical Support At $83,444 As Bulls Target Key Resisitance

-

Altcoin15 hours ago

Altcoin15 hours agoStablecoin Market Cap Hits $220 Billion

-

Bitcoin8 hours ago

Bitcoin8 hours agoUS Economic Data This Week: Key Events Shaping Bitcoin