Market

Binance Reveals the Dark Side of Crypto Airdrops

While crypto airdrops are always expected to fuel fortunes and adoption, Binance’s latest report exposes deep flaws. Reduced rewards, insider profit, and bot exploits are increasingly impacting community trust in airdrops.

Once a growth engine, crypto airdrops now risk becoming liabilities. Can the industry fix them before users lose faith?

Binance’s Analysis of Recent Crypto Airdrops

This report highlights the flawed system that is turning excitement into frustration. With this, Binance poses the rhetoric: Are airdrops crypto’s golden ticket or a ticking time bomb?

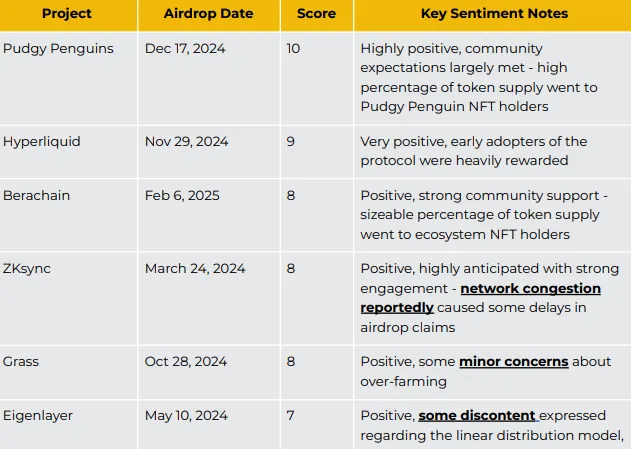

Binance exchange’s analysis gives Pudgy Penguins’ airdrop a near-universal 10/10 acclaim in community sentiment. Hyperliquid followed closely with a 9/10 rating after handsomely rewarding and setting new DeFi standards.

However, the fallout is swift and severe when airdrops fail to deliver. The Binance research cites Redstone (RED), which originally pledged 9.5% of its token supply to the community and slashed it to 5% at the last moment.

This triggered widespread backlash and a dismal 2/10 sentiment score, according to Binance’s Grok AI analysis.

It also cites Scroll’s October 2024 airdrop as another disaster, highlighting vague rules and an unclear eligibility snapshot leading to a disappointing 3/10 rating.

Similarly, in February 2025, Kaito distributed 43.3% of its supply to insiders while allocating a mere 10% to the community. The move saw influencers quickly dump their holdings, eroding trust.

Further, the report cites Sybil farming, where bots amass tokens in bulk. Technical failures such as Magic Eden’s botched claim process in December 2024 have further fueled user discontent.

Why Most Airdrops Fail to Deliver

Beyond exposing flaws, Binance’s report dissects the mechanics behind these failures—last-minute allocation changes, like Redstone’s, signal poor planning and damage credibility. Lack of transparency, as seen in Scroll’s unclear eligibility criteria, breeds suspicion of favoritism.

Insider-heavy token distributions, such as Kaito’s, alienate retail participants. Meanwhile, technical inefficiencies, including Magic Eden’s malfunctioning wallet claims, turn airdrops into frustrating user experiences.

With billions at stake, these issues are no longer minor hiccups but existential threats to the legitimacy of the crypto airdrop model.

“Tokens are a new asset class….Airdrops are their wild frontier,” wrote Binance macro researcher Joshua Wong.

Despite the turmoil, Binance outlines a potential path forward to restore confidence in crypto airdrops. First, it calls for transparency, urging retroactive airdrops to set clear eligibility criteria in advance.

Meanwhile, engagement-based models should commit to fixed point-to-token ratios.

Next, projects must prioritize genuine community engagement, treating tokens as more than just digital assets as tools for building loyal ecosystems.

Finally, technical solutions such as on-chain monitoring and proof-of-humanity tools, like those employed by LayerZero, could help combat Sybil farming and enhance fairness.

Taken together, Binance’s report is a wake-up call that while crypto airdrops present a unique opportunity to democratize wealth and strengthen blockchain communities, they also risk collapsing under the weight of mismanagement and exploitation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit

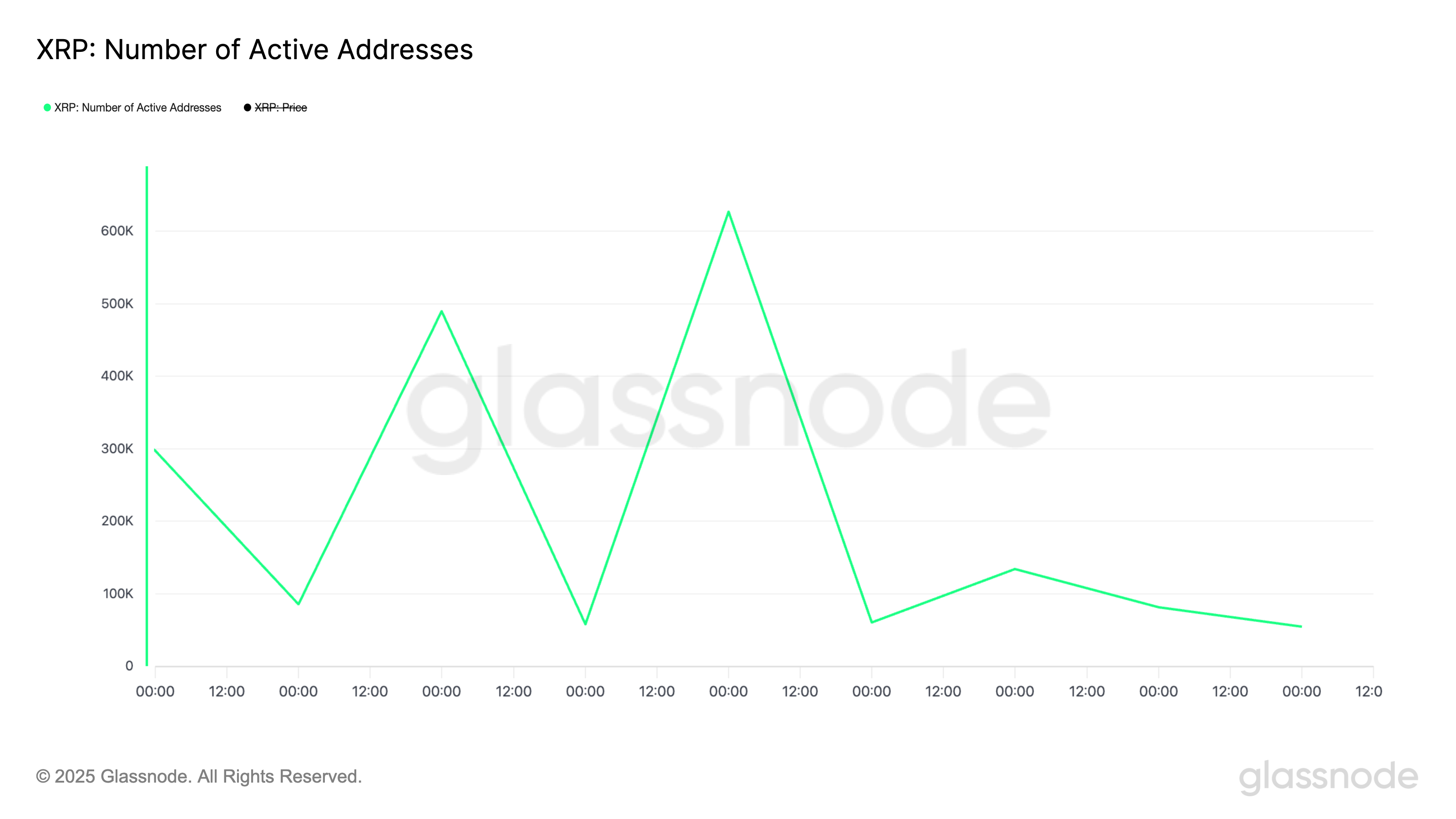

On March 19, the US SEC officially ended its four-year-long lawsuit against Ripple, sparking a surge in XRP network activity. On the same day, the number of active addresses that traded the token skyrocketed to a year-to-date (YTD) high, reflecting heightened investor interest.

However, this momentum has turned short-lived, as on-chain data reveals a steady decline in active wallet count since then.

XRP Demand Fades as Post-Lawsuit Hype Dies

On March 19, Ripple announced that the SEC had officially dropped its four-year-old lawsuit against the payment services company. This led to an immediate spike in the demand for the altcoin, reflected by its high active address count on that day.

According to Glassnode, this climbed to a year-to-date high of 626,854. However, as the post-lawsuit hype wanes, XRP demand has fallen. By March 23, its active address count had plummeted to a 30-day low of 54,704, highlighting the weakening buying pressure in the market.

A decline in an asset’s active address count suggests reduced transaction activity and waning buying interest. This is a bearish signal, as it signals declining liquidity, weak investor participation, and decreased utility for XRP.

In addition, on the price chart, XRP remains below its Super Trend Indicator, signaling continued bearish pressure in the market. As of this writing, this momentum indicator forms dynamic resistance above the altcoin’s price at $2.84.

The Super Trend indicator measures the direction and strength of an asset’s price trend. It appears as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

When an asset’s price is below this indicator, the market is in a bearish trend. Traders interpret this as a sell signal or a warning to exit long positions and take short ones.

XRP Bulls Eye Recovery—Breaking $2.61 Could Trigger a Run Toward $2.84

XRP trades at $2.46 at press time, holding above the long-term support formed at $2.13. If bearish pressure climbs, the token could attempt to test this support.

Should it fail to hold, XRP’s price could plunge to $2, where another strong support lies.

Conversely, if buying activity gains momentum, the altcoin could attempt a break above the resistance at $2.61. If the breach is successful, XRP could climb toward its Super Trend indicator at $2.84.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Tron Compete with Solana?

Justin Sun’s latest moves hint at an upcoming meme coin explosion on the Tron network.

Blockchain networks like Solana and, more recently, BNB Chain have witnessed strong performance thanks to meme coins. But is Tron’s entry at this stage too late, especially when the so-called “super cycle” of meme coins is predicted to have ended?

Tron and Justin Sun Enter the Meme Coin Race

With impressive price performances, meme coins have captured the attention of both investors and major blockchain ecosystems. Tron (TRX), under the leadership of Justin Sun, is making its move in this space.

The launch of the SunPump launchpad in August 2024 marks Tron’s official entry into the meme coin race. With Tron’s low transaction fees and high processing speeds, SunPump simplifies meme coin creation, strategically positioning itself as a competitor to platforms like Pump.fun on Solana (SOL).

Justin Sun now plans to join the meme coin space by buying tokens.

“The wallet is ready, and I’m starting to buy meme coins,” Sun revealed recently.

Sun made a strong statement in early March promoting meme coins on Tron as well.

“The first rule of creating memes on Tron: I will not take a single cent in profit from meme coins. Any losses will be fully covered by me, and all profits will be donated,” said Sun.

SunPump has already made waves with its six-month zero transaction fee policy, attracting numerous new projects. This initiative has fueled a surge in Tron’s meme coin market, with several projects gaining significant traction.

Justin Sun has also highlighted Tron’s advantages—low-cost transactions and high efficiency—through an X (formerly Twitter) post in August 2024, emphasizing that Tron provides the ideal environment for meme coin development.

It’s undeniable that meme coins have contributed to the success of major blockchain networks. For example, BNB Smart Chain (BSC) recently surpassed Solana in decentralized exchange (DEX) trading volume, largely due to the surge of meme coin projects on BSC.

Is Tron Too Late?

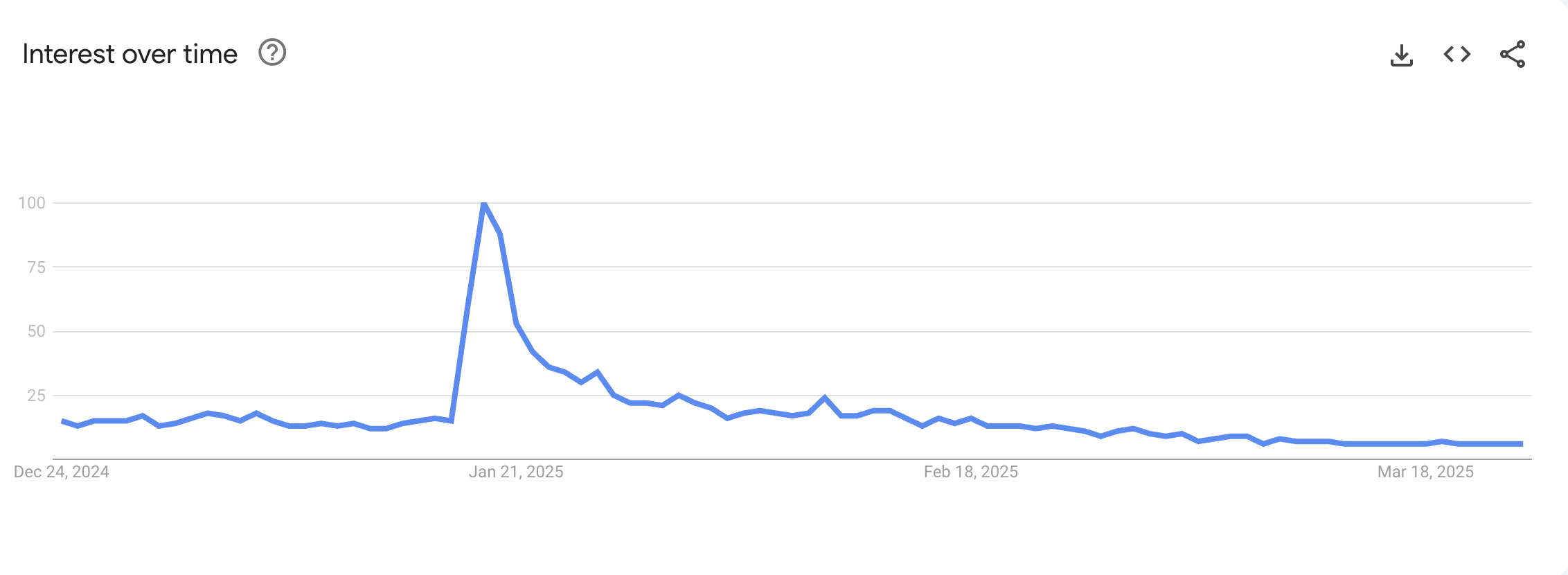

Despite Tron’s active involvement in meme coins, the market is declining. The meme coin market capitalization has dropped 56.8% from its peak of $125 billion in December 2024, signaling the possible end of the explosive “supercycle.”

Major meme coins like Dogecoin and Shiba Inu have experienced significant price drops, with trading volumes decreasing 26.2% in the past month. This decline reflects waning public interest, which is evident from Google Trends data and a decreasing number of new meme coin projects.

Even competitors like Pump.fun on Solana are facing difficulties. The platform’s daily fee revenue has plunged 95%, from 12,000 SOL in February to below 1,000 SOL in March 2025. This trend suggests a broad market downturn affected Tron and other major players.

Despite the cooling market, Tron still holds unique advantages. With SunPump and direct support from Justin Sun, Tron has the potential to establish itself as a key player in the meme coin ecosystem.

Tron must focus on community building and fostering innovative projects. The meme coin race is far from over, and Tron still has an opportunity to carve out a strong position if it effectively leverages its strengths.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why 2025 Will Redefine Crypto Acquisitions: Experts Weigh In

Industry experts have predicted that acquisition trends in the crypto market will intensify in 2025, signaling a new phase of market consolidation and growth.

This comes as the industry is experiencing a notable shift marked by a wave of high-profile acquisitions.

2025: A Game-Changer for Crypto Acquisitions

Recent deals illustrate this accelerating trend. For instance, Stripe closed its acquisition of stablecoin-focused Bridge last month for $1.1 billion. Meanwhile, Robinhood is on track to finalize its $200 million acquisition of Bitstamp, a globally-scaled crypto exchange.

In addition, BeInCrypto recently highlighted cryptocurrency exchange Kraken’s plans to acquire NinjaTrader, a futures trading platform, for $1.5 billion.

Shortly after, it was reported that Coinbase was in advanced talks to acquire Deribit. It is an options and futures exchange for Bitcoin (BTC) and Ethereum (ETH).

These are some of the many acquisitions that have dominated the space lately. In the latest X (formerly Twitter) post, Bridget Harris, an associate at Founders Fund, projected the trend would persist. She also pointed out the key factors that will fuel this ongoing momentum.

“More acquisitions incoming driven by 1) fomo + 2) US regulatory clarity,” Harris noted.

Her post sparked a flurry of reactions, with industry voices weighing in on the implications. Adam Lawrence, co-founder of RWA.xyz, suggested that the crypto industry is about to enter a new phase of competition. He referred to it as “The Great Distribution Wars.”

As regulatory clarity improves, Lawrence predicts that the biggest traditional finance (TradFi) firms will soon make their move into the crypto space, signaling a new wave of competition. In anticipation of this shift, companies within the sector are actively preparing for explosive growth and the challenges posed by these new, formidable entrants.

“It’s now a battle between tradfi and modern crypto fintechs,” Lawrence wrote.

Meanwhile, Jeremy Ng, CEO of OpenEden, added to the conversation by identifying projects that could receive increased attention amid this shift.

“Projects with strong base layer infrastructure, proven product and sticky customer base along with relevant licenses will be attractive targets,” he claimed.

This outlook comes as the industry observes a shift in the government’s stance towards the crypto space under President Donald Trump’s administration. Overall, the regulatory environment has become more favorable, with the administration taking steps to support the crypto industry’s growth and provide regulatory clarity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts Dogecoin Price Rally To $20, Here’s When

-

Market23 hours ago

Market23 hours agoShiba Inu (SHIB) Might Rally Likely If Bitcoin Breaches $90,000

-

Altcoin18 hours ago

Altcoin18 hours agoCrypto Tycoon Drops $1 Billion On Private Space Station

-

Altcoin23 hours ago

Altcoin23 hours agoFidelity Files For Tokenized US Dollar Money Market Fund On Ethereum

-

Market21 hours ago

Market21 hours agoNumber of New XRP Investors Drop to a 4-Month Low

-

Ethereum20 hours ago

Ethereum20 hours agoTime To Buy Ethereum (ETH)? Here’s What This Analyst Thinks

-

Altcoin17 hours ago

Altcoin17 hours agoCoinbase CLO Criticizes The US Treasury Over Tornado Cash SDN Delisting Procedure

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Exchange Reserve Hits New All-Time Low — Bullish For ETH Price?