Market

Solana (SOL) Risks Falling to $120 as Bearish Signals Grow

Solana (SOL) is under pressure after failing to sustain its recent rally and is now trading lower, following Bitcoin and Ethereum’s recent patterns. Despite briefly surging earlier this week, SOL has dropped over 3% in the past 24 hours.

Technical indicators are showing growing bearish signals, with sellers regaining control in the short term. Traders are watching key support and resistance levels as Solana struggles to regain its bullish momentum.

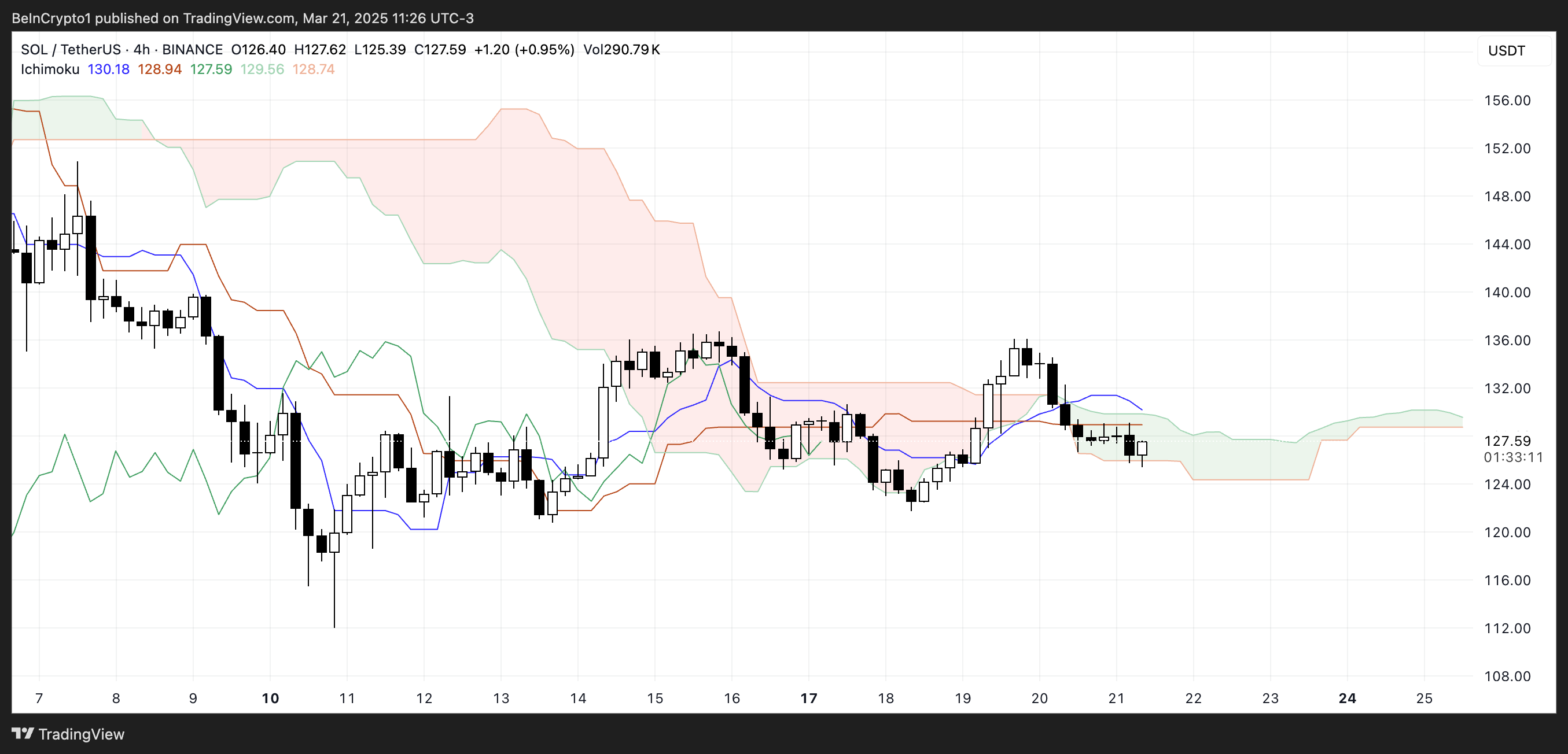

SOL Ichimoku Cloud Shows The Setup Is Turning Bearish

Solana is currently trading below the Ichimoku Cloud, indicating a bearish trend in the short term. The price has fallen under both the Tenkan-sen (blue line) and Kijun-sen (red line), suggesting downward momentum is still in play.

The cloud ahead is thin and flat, signaling weak trend strength and the potential for continued sideways or bearish price action unless buyers step in soon.

Additionally, the Lagging Span (green line) is positioned below both the price and the cloud, reinforcing the bearish sentiment. The price is hovering near the lower boundary of the cloud, which could act as immediate resistance if Solana attempts a rebound.

If sellers maintain control, SOL could face further downside pressure, while a breakback above the cloud would be needed to hint at a possible trend reversal.

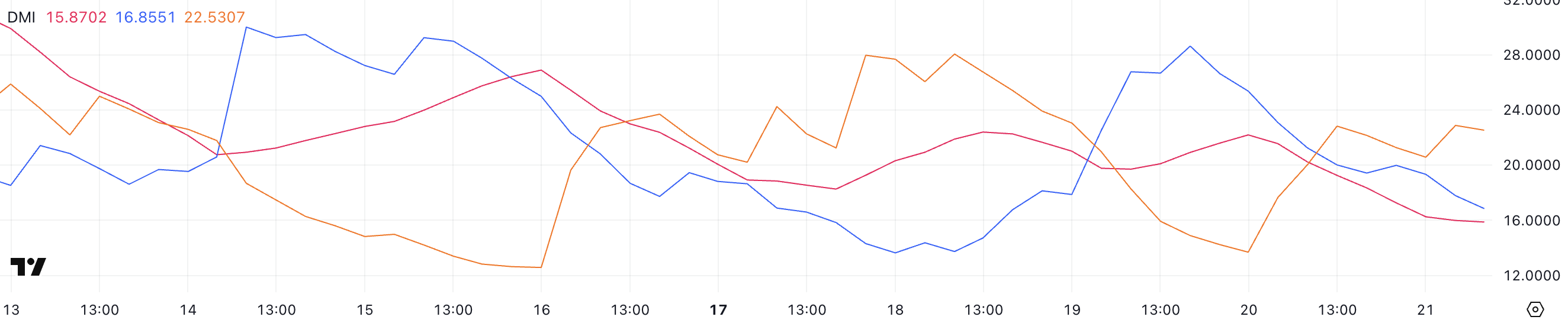

Solana DMI Shows Sellers Regain Control After The Brief Surge

Solana’s DMI chart shows that the ADX has dropped to 15.87 from 22.18 yesterday, indicating a weakening trend.

The Average Directional Index (ADX) measures the strength of a trend, with values above 25 suggesting a strong trend and values below 20 pointing to weak or consolidating price action.

At the same time, the +DI has fallen sharply to 16.85 from 28.62, showing a loss of bullish momentum. Meanwhile, the -DI has risen to 22.53 from 14.88, suggesting growing bearish pressure.

With the -DI now above the +DI and the ADX below 20, Solana could remain under selling pressure or enter a range-bound phase as bears take short-term control.

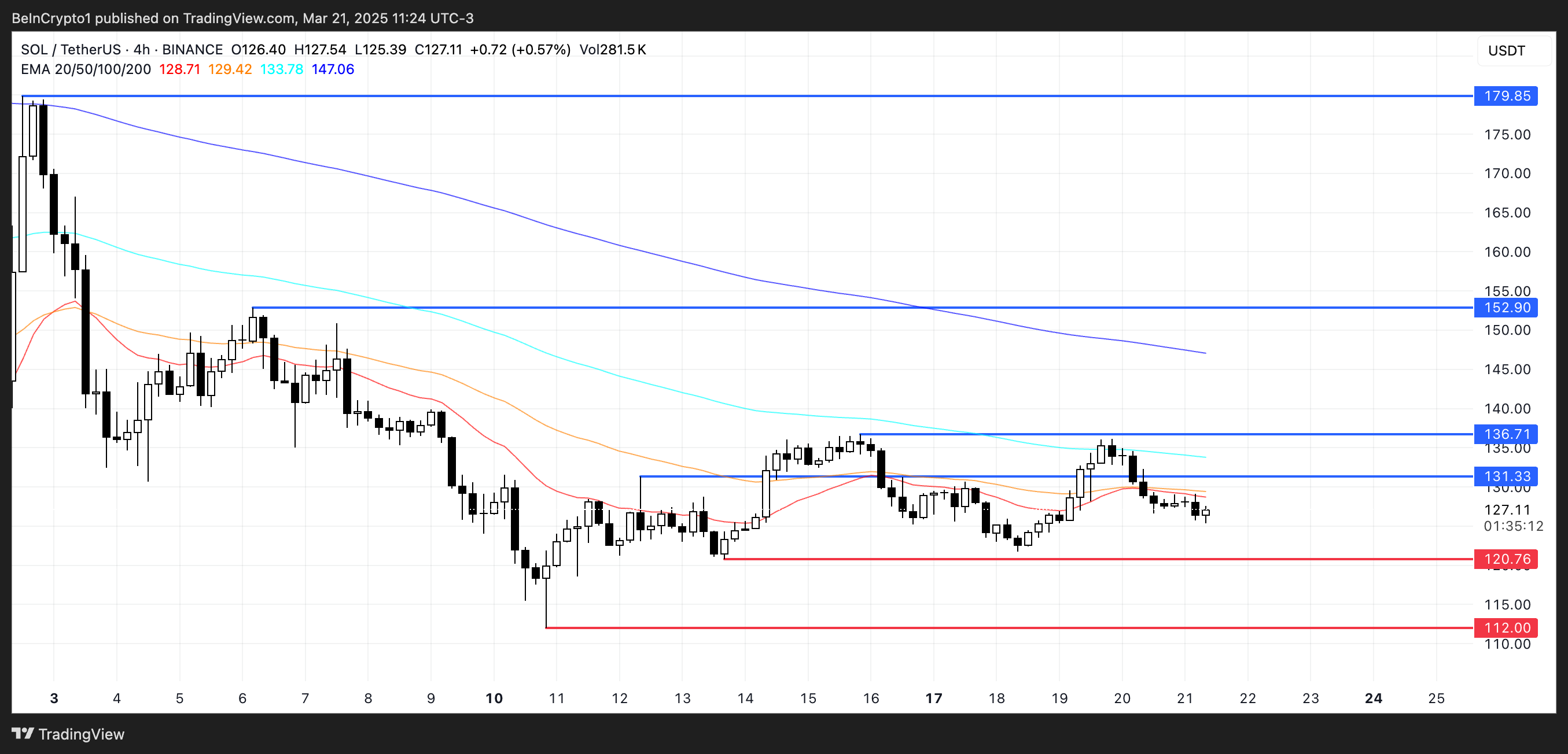

Solana Could Fall Until $112 If Bearish Momentum Intensifies

Solana followed a similar pattern to Bitcoin and Ethereum, briefly rallying between March 19 and 20 before reversing and dropping over 3% in the last 24 hours.

The price is now approaching key support around $120, and a break below this level could trigger a deeper decline toward $112 or even below $110.

Despite the recent corrections, according to Charles Wayn, founder of decentralized Web3 super-app Galxe, told BeInCrypto that Solana’s success shows blockchains need niches:

“As Solana celebrates the arrival of its first futures ETF, it has firmly disproved those who doubted its survival since its launch five years ago. While not becoming the “Ethereum killer” it was touted to be, it has – among other things – emerged as the blockchain for meme coin trading. With $3 billion in daily meme coin trading volume at the peak of the frenzy, Solana’s pump.fun is the largest and highest-grossing meme coin launchpad in the market. Solana has truly found its niche in the crypto market over the last five years – and now it’s time for other blockchains to find theirs.”

He also points out Solana’s success in the meme coins sector:

“Solana’s success in the meme coin sector demonstrates the need for multiple Layer1 blockchains in the crypto ecosystem. Indeed, many competitors have come into the space to challenge Solana as the retail chain, but its dominance in meme coins has kept it popular with new and mainstream users. There will always be faster, cheaper, more composable and more UX-friendly chains – however, specialized Layer1s that focus on a specific aspect of the industry are going to become more prevalent. Crucially, discovering a niche will allow chains to remain competitive and attract developers and users,” says Wayn.

If Solana price manages to regain bullish momentum, it could first target resistances at $131 and $136. It recently tried and failed twice to break that resistance.

A stronger recovery could lead to a rally toward $152.9 and potentially $179.85, which would mark its highest price since early March.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock Dominates RWA With BUIDL’s AUM Nearing $1.5 Billion

BlackRock’s tokenized US Treasury fund, BUIDL, has seen a sharp rise in adoption, with the fund’s assets under management (AUM) surging past the $1 billion milestone this month.

This growth highlights a strong shift toward real-world asset (RWA) tokenization, even as broader crypto markets face headwinds.

BlackRock’s BUIDL Leads the RWA Sector

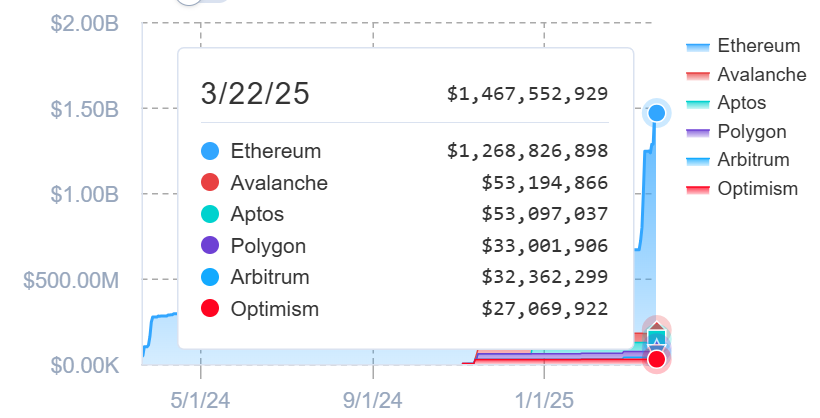

According to data from RWA. XYZ, BUIDL’s AUM, has increased by almost 129% over the last 30 days, bringing it to $1.4 billion.

This milestone means that it took only one year for the fund, which launched on the Securitize platform in March 2024, to cross the $1 billion mark.

While BUIDL has expanded to multiple blockchains, the majority of its supply—over $1 billion, or 86.46%—remains on Ethereum. This indicates strong minting activity on the network.

Other chains, such as Avalanche and Aptos, each hold about $56 million of the fund’s supply, or roughly 3.6%. Ethereum Layer-2 networks like Polygon, Arbitrum, and Optimism host the rest.

Meanwhile, investor participation has also grown. In the past month, the number of holders rose by 19%, bringing the total to 62.

Market observers pointed out that these numbers highlight the growing trust in blockchain-based financial products and the rising institutional interest in tokenizing bonds and credit.

Fidelity Joins the Tokenization Race

BUIDL’s milestone comes as asset management firm Fidelity also moves into the tokenization space.

Over the past week, the firm filed with the US Securities and Exchange Commission (SEC) to launch a blockchain-based version of its Treasury money market fund. The new share class, named “OnChain,” will operate using blockchain as a transfer agent and settlement layer.

“The OnChain class of the fund currently uses the Ethereum network as the public blockchain. In the future, the fund may use other public blockchain networks, subject to eligibility and other requirements that the fund may impose,” the filing added.

Fidelity’s move mirrors a broader trend. Financial institutions are turning to blockchain to tokenize bonds, funds, and credit instruments. This shift offers improved efficiency, round-the-clock settlement, and better transparency.

Meanwhile, the filing comes as institutional interest in RWAs continues to rise, despite a sluggish crypto market. While Bitcoin is down 11% year-to-date, RWA tokens have seen sustainable growth in 2025.

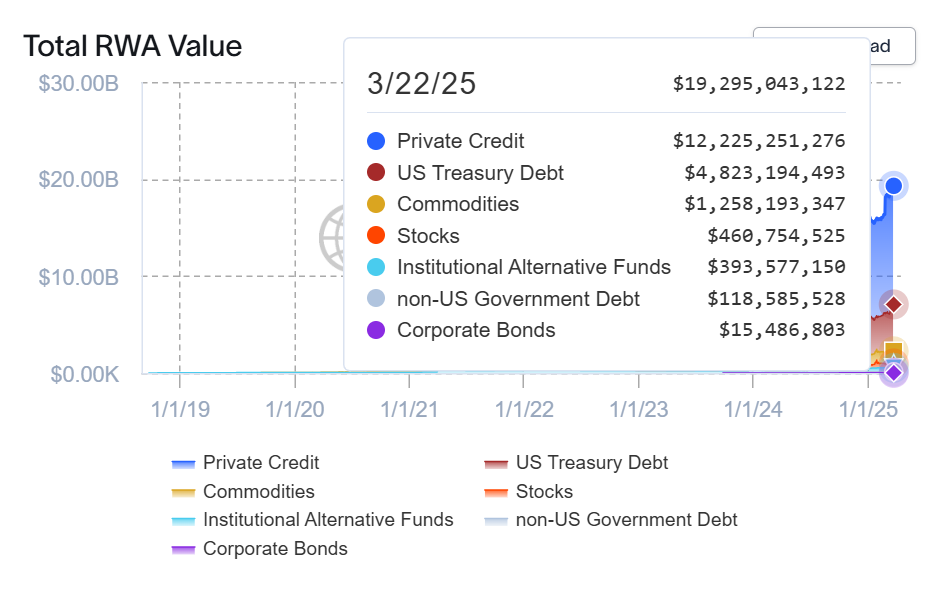

On-chain data shows the total RWA market has grown 18.29% in the past 30 days, reaching $19.23 billion. The number of RWA holders also increased by 5%, now nearing 91,000.

BlackRock’s BUIDL leads the RWA space by market cap. It’s followed by Hashnote’s USDY at $784 million and Tether Gold (XAUT) at $752 million.

Meanwhile, US Treasuries make up $4.76 billion of the total, while private credit dominates with $12.2 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Bulls Regain Control As Price Stays Above Moving Average

The meme-inspired cryptocurrency PEPE has once again captured the attention of traders as its price demonstrates remarkable resilience, holding firm above a key 100-day simple moving average (SMA) after a brief pullback. This technical strength has sparked speculation about whether PEPE is gearing up for a bullish continuation, potentially reigniting its upward momentum.

With traders closely monitoring price action, a breakout above nearby resistance could confirm a bullish continuation, setting the stage for further gains. However, failure to maintain support may shift momentum in favor of the bears as PEPE hovers at this critical juncture.

PEPE Recent Price Action: A Snapshot

PEPE has been displaying steady price movement, holding above a key support level and maintaining bullish momentum. After bouncing from recent lows, the meme coin has managed to stay above a crucial moving average. This stability suggests that buyers are still in control, preventing a deeper pullback and keeping the uptrend intact.

Technical indicators continue to support a bullish outlook for PEPE. The Relative Strength Index (RSI) remains in positive territory, reflecting sustained buying momentum. If the RSI holds its current course, it can strengthen the case for more upside, suggesting that the uptrend has room to extend.

Trading volume has remained consistent, indicating sustained interest from market participants. However, resistance levels ahead will play a crucial role in determining whether PEPE can extend its rally or face a temporary slowdown. If bullish momentum strengthens, the price could push toward the $0.00000766 resistance level.

A decisive breakout above this level serves as a strong bullish confirmation, paving the way for further upside. Should buying pressure intensify, PEPE may rally toward the next significant resistance, attracting more traders looking to capitalize on the upward trend.

Bearish Scenario: Key Support Levels If Momentum Shifts

While PEPE remains in bullish territory, a shift in momentum will open the door for a potential pullback. If selling pressure increases, the first key support to watch is the moving average level that has been acting as a price floor. A break below this level could weaken bullish confidence and trigger a deeper decline.

Further downside raises the risk of a decline toward secondary support zones such as $0.00000589 and $0.00000398, where buyers may attempt to regain control. Failure of the bulls to defend these levels will open the door for other support levels to be tested. Additionally, declining volume and a bearish crossover in momentum indicators such as the MACD or RSI could further confirm a shift in sentiment.

For now, the uptrend remains intact, but traders should remain cautious of any signs of weakness. Holding above these key support zones will be crucial in determining whether bulls can maintain control or if bears will take over.

Market

XRP Flashes Descending Trendline, Why A Surge To $4 Is Still In The Cards

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price is showing signs of a potential breakout, with a crypto analyst pointing to key technical indicators that suggest a potential surge to $4. Notably, the cryptocurrency has been trading within a descending trendline, but a decisive move above this resistance could ignite a long-awaited rally to a new all-time high.

XRP Price Eyes Breakout To $4

According to pseudonymous TradingView crypto analyst ONE1iMPACT, the XRP price has been making lower highs, forming a descending trendline on the 8-hour chart. The analyst’s chart analysis highlights key technical indicators based on price action that suggest that the XRP price may be gearing up for a possible rally to $4.

Related Reading

XRP’s projected surge to a $4 ATH is dependent on how it reacts to the descending trendline, which acts as a critical resistance area. With this in mind, a breakout and close above this trendline with higher-than-average volume signals bullish momentum for the XRP price.

Interestingly, the analyst disclosed that the market is currently hovering near or just below a key Moving Average (MA), indicated by the blue line in the chart. If XRP’s price can reclaim and hold above this MA, it would reinforce its bullish position and solidify the analyst’s optimistic price target. On the flip side, if it remains below this MA, the TradingView expert believes that it would put a barrier to its upside potential.

Moving forward, the analyst has shared key technical areas that could determine XRP’s next price movements. He revealed that if the cryptocurrency breaks above the descending trendline, the next major resistance area is the horizontal level around $3.40. Furthermore, a confirmed breakout could send its price toward $3.9 – $4.00, aligning with the target shown by the grey arrow in the chart.

The TradingView crypto expert warned investors and traders to pay attention to the volume and momentum of XRP as it aims for a descending trendline breakout. He explained that a low volume push above the trendline is a clear indication of a possible fakeout, where traders could be lured into entering long positions, only for the price to trace quickly. On the other hand, a high volume surge confirms the conviction of XRP’s bullish potential, leading to a sustained upward momentum and increasing prices.

The analyst also added that oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) could help traders gauge whether XRP’s momentum is building or fading as its price approaches the descending trendline resistance.

Possible Downside Target If Resistance Fails

In his analysis, ‘ONE1iMPACT’ also shared a bearish outlook for the XRP price if it fails to break and close above the descending trendline resistance. The TradingView analyst revealed that a rejection at this trendline could trigger further consolidation and decline for XRP.

Related Reading

He has shared several important support levels that could help prevent an even deeper correction in the XRP price. The $2.0 and $2.1 region, marked by the pink and gray box on the chart, acts as a strong support area for XRP, where buyers have stepped in before.

If the XRP price loses this zone, the analyst predicts a major breakdown toward $1.8 – $1.77. Another decline below this price low could result in a much larger correction.

Featured image from Adobe Stock, chart from Tradingview.com

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Rally Incoming? M2 Money Supply Rebound Signals Big Moves Ahead

-

Altcoin22 hours ago

Altcoin22 hours agoWill ETH ETF Net Outflow Exceed $20 Million?

-

Market22 hours ago

Market22 hours agoTornado Cash (TORN) Price is Set For Correction After 40% Rally

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Price Nears Major Resistance At $2,200, Why A 13% Crash Could Follow

-

Market19 hours ago

Market19 hours agoPancakeSwap Whales Buy 25 Million CAKE After 50% Price Rally

-

Altcoin18 hours ago

Altcoin18 hours agoWhat Could XRP Price Be In Trump’s Second term

-

Altcoin24 hours ago

Altcoin24 hours agoPancakeSwap Price Rallies As Trading Volume Tops $2.5B; What’s Happening?

-

Market23 hours ago

Market23 hours agoCardano (ADA) Faces Death Cross After Price Falls 37% In March