Market

Here’s Why Shiba Inu Price’s 3-Month Downtrend Could Continue

Shiba Inu (SHIB), the popular meme coin, has been struggling to break out of a downtrend that has persisted for the past three months.

Despite recent efforts to regain momentum, SHIB’s price failed to sustain upward movement, indicating that the altcoin may not be able to recover just yet. As market conditions continue to fluctuate, Shiba Inu could face further challenges in its attempts at recovery.

Shiba Inu Sees LTHs Panicking

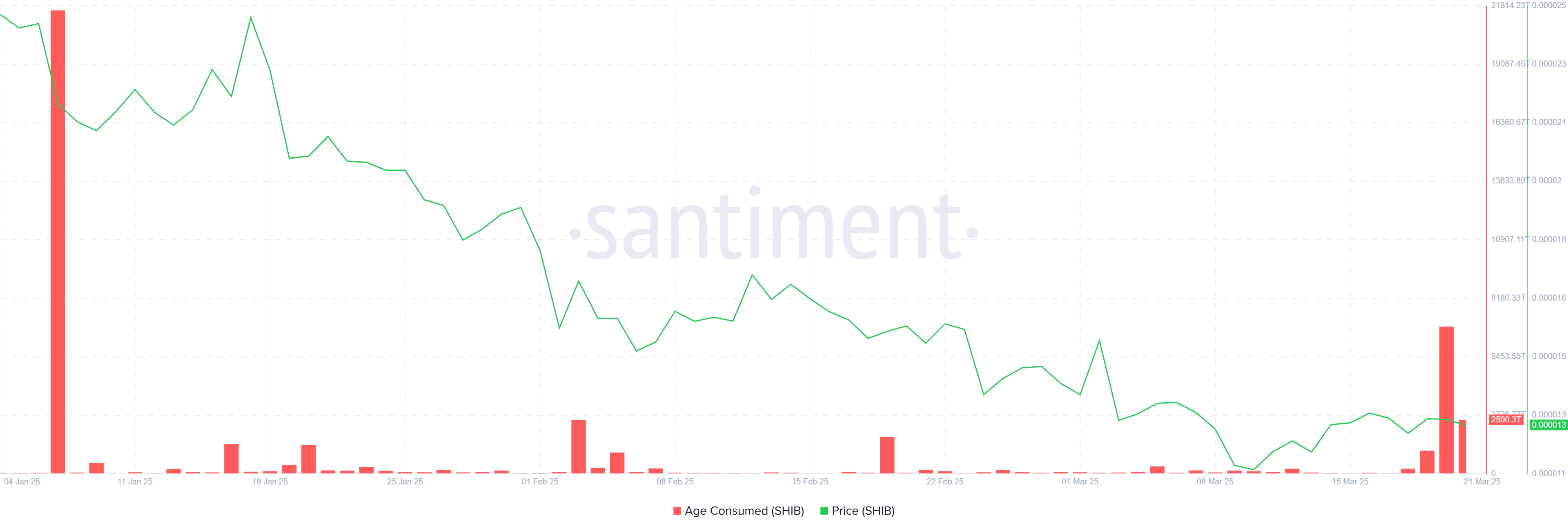

Investor sentiment has taken a bearish turn, as evidenced by the rising Age Consumed metric. This metric tracks the movement of coins that have been held for an extended period of time. During a price decline, a spike in Age Consumed often indicates that long-term holders (LTHs) are selling their positions to offset losses.

In the case of Shiba Inu, the increasing movement of HODLed coins suggests that investors are not confident in the short-term price recovery. As a result, the market’s outlook remains cautious, with LTHs likely contributing to the selling pressure. Additionally, the current shift in market sentiment reflects growing uncertainty among Shiba Inu holders.

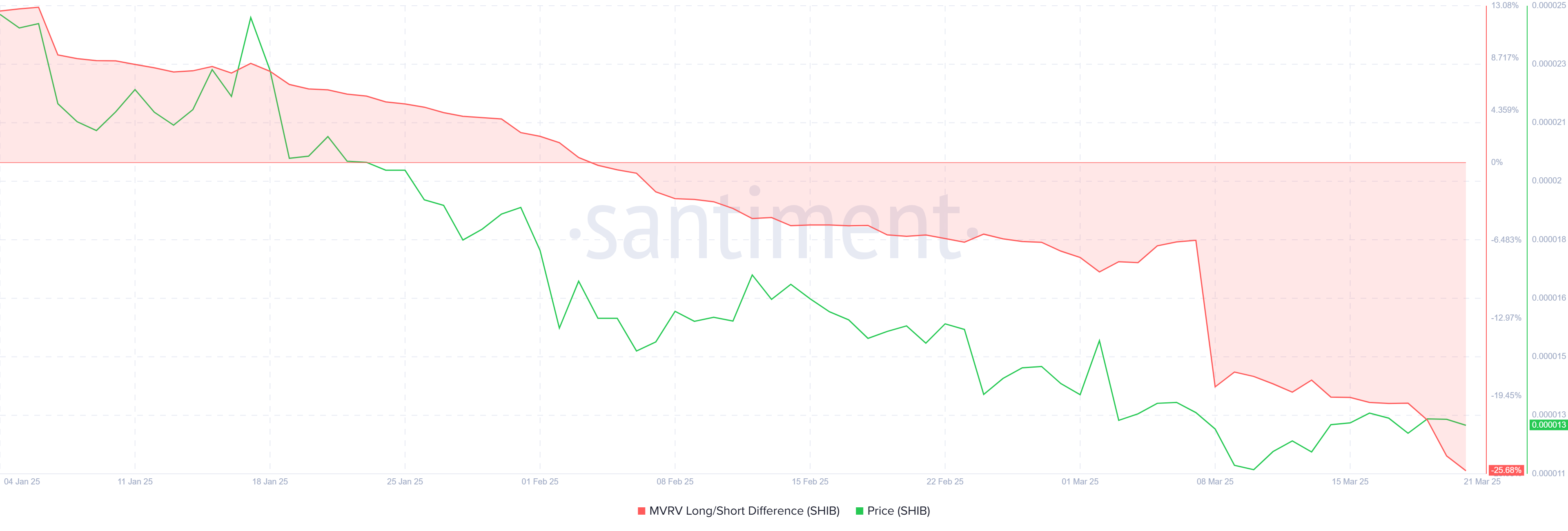

The macro momentum of Shiba Inu is also showing signs of weakness. The MVRV Long/Short Difference indicator, which measures the profit levels of short-term holders (STHs) versus long-term holders, suggests that STHs are dominating in terms of profits.

As STHs remain in control, the market could experience continued volatility, with investors hesitant to buy into the token without confirmation of sustained price growth. With short-term holders more likely to liquidate their assets quickly, Shiba Inu faces increased risks of further price declines.

SHIB Price Breakout Could Be Reversed

Shiba Inu’s price is currently hovering at $0.00001276, just above the support level of $0.00001275. After a brief breakout in the last 48 hours, SHIB failed to maintain upward momentum and is now facing resistance. The market sentiment suggests that further price drops could be on the horizon, and the coin could potentially slide back into the long-standing downtrend.

If the downtrend persists, SHIB could dip below $0.00001141, extending the current bear market. This would confirm the continuation of the negative price action and delay any potential recovery. Investors should remain cautious and prepare for more uncertainty in the short term.

However, should Shiba Inu manage to rebound from the support level of $0.00001275, it could potentially rise toward $0.00001462, clearing a significant resistance barrier. A break above this level would invalidate the bearish outlook and signal the start of a more substantial recovery for SHIB, allowing it to regain some of its lost value.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tornado Cash (TORN) Price is Set For Correction After 40% Rally

Tornado Cash (TORN) has recently experienced a sharp rally, rising by 40% over the last 24 hours. This surge was primarily driven by Tornado Cash’s removal from the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctions list.

While the price spike has been significant, the market may be preparing for a decline as it adjusts to the news.

Tornado Cash Skyrockets

Tornado Cash’s recent rally has pushed its Relative Strength Index (RSI) past the 70.0 threshold, indicating that the crypto is currently overbought.

This level is often seen as a sign of market saturation, where the altcoin’s bullish momentum has peaked. Historically, once the RSI crosses the 70.0 mark, a price reversal has typically followed, suggesting that a correction may be imminent.

The overbought condition of TORN suggests that the bullish sentiment driving the rally is losing steam. As the price continues to consolidate or pull back, the likelihood of a price drop increases, making the current price unsustainable in the short term.

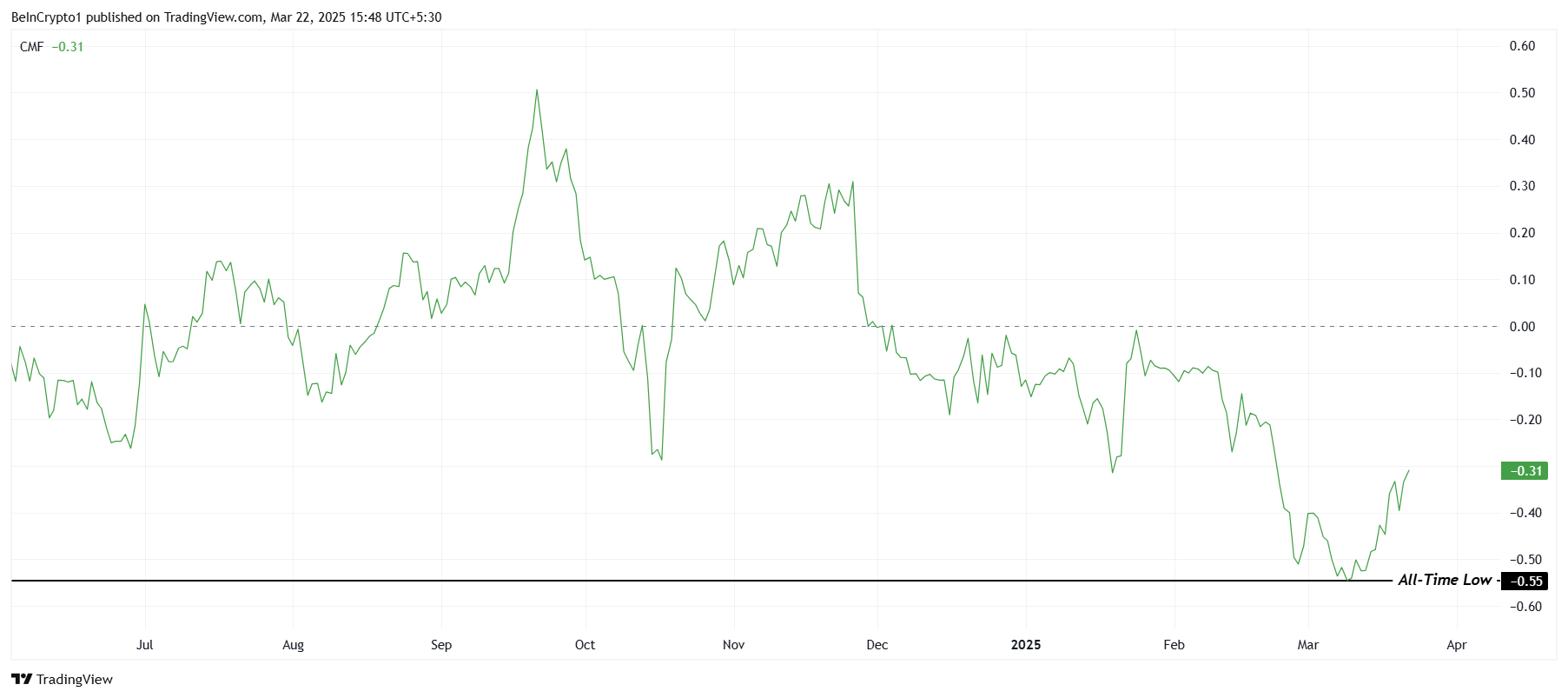

The macro momentum of Tornado Cash points to further challenges. The Chaikin Money Flow (CMF) indicator, which measures the volume-weighted average of accumulation and distribution, is currently stuck in the bearish zone.

It has remained far from the zero line for an extended period, signaling that selling pressure continues to outweigh buying pressure.

Additionally, Tornado Cash has seen its highest outflows since its inception, further dampening the outlook. These outflows suggest that investors are increasingly cashing out, which weakens the token’s long-term recovery potential.

Without significant inflows to counteract the outflows, TORN will have difficulty maintaining or extending its recent gains.

TORN Price Stirred Up A Tornado

Tornado Cash’s price is currently trading at $11.77, up 41% in the last 24 hours. The altcoin also noted an impressive intra-day high increase of 88%. Over the past 12 days, TORN has gained 135%, marking a strong short-term performance.

However, with the token sitting at these elevated levels, it faces substantial downside risk.

Given the overbought condition and bearish macro momentum, TORN is vulnerable to a fall through key support levels at $11.63 and $9.75. A breach of these levels could send the price down to $7.36, extending the correction and potentially erasing recent gains.

On the other hand, if Tornado Cash can sustain its bullish momentum and hold above $11.63, it may rebound. This could pave the way for the price to aim for $15.81.

A successful rally to this level would invalidate the bearish thesis. It would also solidify the recent price gains, signaling the potential for further upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Faces Death Cross After Price Falls 37% In March

Cardano (ADA) has been on a rocky path this month. After posting early gains, the altcoin has now retraced 37%, erasing most of its recent upside.

While broader market indicators hinted at a bullish outlook, technical patterns suggest that the momentum may not hold.

Cardano Losses Are Likely

Cardano appears to be nearing a Death Cross, a bearish technical signal. This occurs when the 50-day exponential moving average (EMA) slips below the 200-day EMA. Historically, this crossover has often preceded sharp price declines.

If this formation is confirmed, it would be ADA’s first Death Cross in 10 months. It would also officially end the ongoing five-month-long Golden Cross, a bullish pattern that previously supported the asset’s growth.

With momentum fading, investors may see this as a pivot toward further downside pressure.

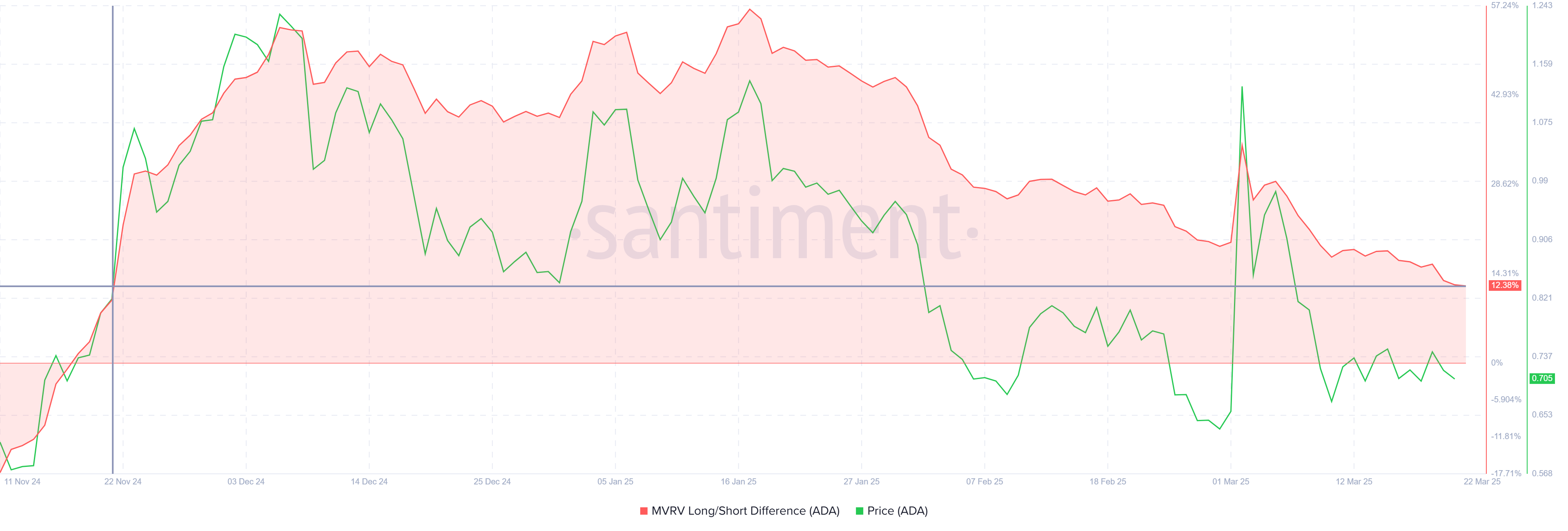

On-chain data further dampens investor confidence. The MVRV Long/Short Difference — a metric comparing the profitability of long-term holders (LTHs) to short-term holders (STHs) — has been declining steadily.

While still in positive territory, its fall suggests LTHs are seeing their profits shrink.

This metric is now sitting at a four-month low, increasing the risk of profit-taking by LTHs. If these investors begin to sell to preserve gains, it could introduce added selling pressure. The resulting drawdown may undercut any bullish momentum Cardano is attempting to hold onto.

ADA Price Is Consolidated

ADA is currently trading at $0.71, down 37% from its recent high. The decline has broken its macro uptrend, although the altcoin remains just above the $0.70 support level. This floor has acted as a key technical barrier.

However, the looming Death Cross, combined with fading long-term investor confidence, may push Cardano below this support. If $0.70 is breached, ADA could slip to $0.62. This would mark a further extension of the ongoing correction phase, reinforcing the bearish outlook.

On the other hand, if Cardano manages to invalidate the bearish thesis, it must rise above $0.77. This would end the current 11-day consolidation phase.

A successful breakout could propel ADA toward $0.85, reclaiming some of the lost ground and potentially restoring short-term investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Reveals the Dark Side of Crypto Airdrops

While crypto airdrops are always expected to fuel fortunes and adoption, Binance’s latest report exposes deep flaws. Reduced rewards, insider profit, and bot exploits are increasingly impacting community trust in airdrops.

Once a growth engine, crypto airdrops now risk becoming liabilities. Can the industry fix them before users lose faith?

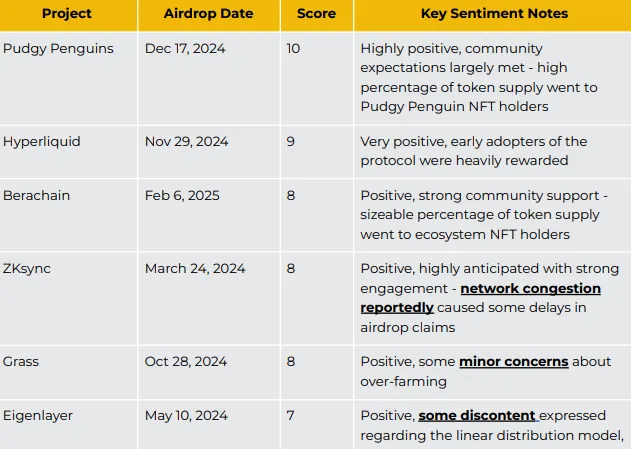

Binance’s Analysis of Recent Crypto Airdrops

This report highlights the flawed system that is turning excitement into frustration. With this, Binance poses the rhetoric: Are airdrops crypto’s golden ticket or a ticking time bomb?

Binance exchange’s analysis gives Pudgy Penguins’ airdrop a near-universal 10/10 acclaim in community sentiment. Hyperliquid followed closely with a 9/10 rating after handsomely rewarding and setting new DeFi standards.

However, the fallout is swift and severe when airdrops fail to deliver. The Binance research cites Redstone (RED), which originally pledged 9.5% of its token supply to the community and slashed it to 5% at the last moment.

This triggered widespread backlash and a dismal 2/10 sentiment score, according to Binance’s Grok AI analysis.

It also cites Scroll’s October 2024 airdrop as another disaster, highlighting vague rules and an unclear eligibility snapshot leading to a disappointing 3/10 rating.

Similarly, in February 2025, Kaito distributed 43.3% of its supply to insiders while allocating a mere 10% to the community. The move saw influencers quickly dump their holdings, eroding trust.

Further, the report cites Sybil farming, where bots amass tokens in bulk. Technical failures such as Magic Eden’s botched claim process in December 2024 have further fueled user discontent.

Why Most Airdrops Fail to Deliver

Beyond exposing flaws, Binance’s report dissects the mechanics behind these failures—last-minute allocation changes, like Redstone’s, signal poor planning and damage credibility. Lack of transparency, as seen in Scroll’s unclear eligibility criteria, breeds suspicion of favoritism.

Insider-heavy token distributions, such as Kaito’s, alienate retail participants. Meanwhile, technical inefficiencies, including Magic Eden’s malfunctioning wallet claims, turn airdrops into frustrating user experiences.

With billions at stake, these issues are no longer minor hiccups but existential threats to the legitimacy of the crypto airdrop model.

“Tokens are a new asset class….Airdrops are their wild frontier,” wrote Binance macro researcher Joshua Wong.

Despite the turmoil, Binance outlines a potential path forward to restore confidence in crypto airdrops. First, it calls for transparency, urging retroactive airdrops to set clear eligibility criteria in advance.

Meanwhile, engagement-based models should commit to fixed point-to-token ratios.

Next, projects must prioritize genuine community engagement, treating tokens as more than just digital assets as tools for building loyal ecosystems.

Finally, technical solutions such as on-chain monitoring and proof-of-humanity tools, like those employed by LayerZero, could help combat Sybil farming and enhance fairness.

Taken together, Binance’s report is a wake-up call that while crypto airdrops present a unique opportunity to democratize wealth and strengthen blockchain communities, they also risk collapsing under the weight of mismanagement and exploitation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoGerman Regulators Reject Ethena’s USDe MiCA Application

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Predicts XRP Price Could Hit New ATH As Ripple Lawsuit Ends

-

Altcoin19 hours ago

Altcoin19 hours agoRipple Provides Guidance To US SEC On Crypto Regulation

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Price Forms Megaphone Bottom Not Seen Since 2020, Here’s What Happened Last Time

-

Bitcoin16 hours ago

Bitcoin16 hours agoPi Network, XRP, Trump, Binance

-

Market16 hours ago

Market16 hours agoXRP Network’s DEX Trading Volume Is Less Than $50,000

-

Market15 hours ago

Market15 hours agoBitcoin Faces Resistance at $85,000 As Whale Buying Levels Off

-

Market14 hours ago

Market14 hours agoTether Is Preparing Audits to Meet US Stablecoin Regulation