Market

German Regulators Reject Ethena’s USDe MiCA Application

German financial regulators have rejected Ethena Labs’ MiCA application. The regulator has ordered Ethena to halt EU operations, freeze its asset reserves, and prohibit any new services. Regulators claim that Ethena’s USDe will not be considered as unregistered securities.

Although USDe didn’t receive a MiCA approval previously, its application was submitted before the July 2024 deadline. Therefore, Ethena was allowed to offer USDe services until a decision was made.

Will EU Exchanges Delist Ethena’s USDe?

Ethena Labs, the issuer of the USDe stablecoin, is different from traditional stablecoins in a few key ways. It dubs this asset a “synthetic dollar,” correlating it with USD by financial derivatives and algorithmic mechanisms instead of a peg.

However, German financial authorities have taken issue with it and made a statement shutting down Ethena GmbH, its EU branch.

“The German financial supervisory authority BaFin has identified serious deficiencies in Ethena GmbH’s USDe token authorization process and ordered immediate action. Among other things, BaFin has prohibited Ethena GmbH from further offering its USDe token to the public and instructed the company to have the corresponding asset reserve frozen by the custodians,” it claimed.

Specifically, the German regulators have a few different issues with Ethena’s business practices. Many of them deal with MiCA, the EU’s new stablecoin regulations.

Ethena Labs does not have MiCA approval, but its GmbH spinoff submitted an application early enough to be grandfathered in. Today, regulators found “serious deficiencies” in the approval process.

German financial authorities claimed that Ethena GmbH is not in compliance with MiCA’s rules concerning stablecoin reserves or capital requirements. They also suspect that the firm is offering securities without the necessary prospectus.

To address this, they instructed Ethena GmbH to close business with new EU customers and not touch its asset reserve.

Ethena Labs quickly responded with its own statement. It claimed that Ethena GmbH, its main German office, is one of several “options and jurisdictions” it has been exploring for a global strategy.

Although it was disappointed by this ruling, it will continue exploring other options, particularly through offices other than Ethena GmbH.

“To be clear, the decision will in no way disrupt any current listings of USDe, or minting and redemption via Ethena (BVI) Limited (which services the vast majority of our mint users). Contrary to reports, no assets have been ‘frozen’ and all remain available for redemption. We will be revising our terms accordingly,” Ethena Labs stated.

Despite its impressive successes, Ethena Labs’ USDe token has plenty of serious opponents. Since its stablecoin doesn’t have a traditional peg, critics are concerned that a few flaws in its reserve metrics could cause the whole thing to collapse.

With this decision, EU exchanges will likely be compelled to delist Ethena’s USDe, much like what happened to Tether USDT.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Bullish AI Coins From This Week

RSS3, JAM, and ALI are the top-performing AI coins of the third week of March 2025. RSS3 and JAM have both surged 78% in the past seven days, while ALI is up 48%.

Combined, they stand out for their strong price action and growing market caps. Here’s a breakdown of why these AI coins are making headlines this week.

RSS3 has surged over 78% in the past week, pushing its market cap to $51 million.

The strong rally has made it one of the top performers among AI coins, despite the general correction in that sector.

RSS3 is a decentralized network that indexes and structures open information. Inspired by the original RSS, it supports the Open Information Initiative, aiming to power the Open Web and open artificial intelligence.

If momentum continues, RSS3 could retest resistance at $0.106, possibly reaching $0.11 for the first time since January 17. If momentum fades, support sits at $0.054, with further downside risk to $0.039.

JAM

JAM is one of the hottest AI coins on the Base network. It has soared 78% over the past week and reached a market cap of $18 million.

JAM powers JamAI, a platform where users can create AI agents with unique personalities. It combines elements of an AI agents platform and a crypto launchpad, with roots as a creator community on Farcaster.

JAM has been setting fresh all-time highs, and if momentum holds, it could break above $0.0050 and aim for $0.0075. If momentum fades, key support levels sit at $0.0039 and $0.0026.

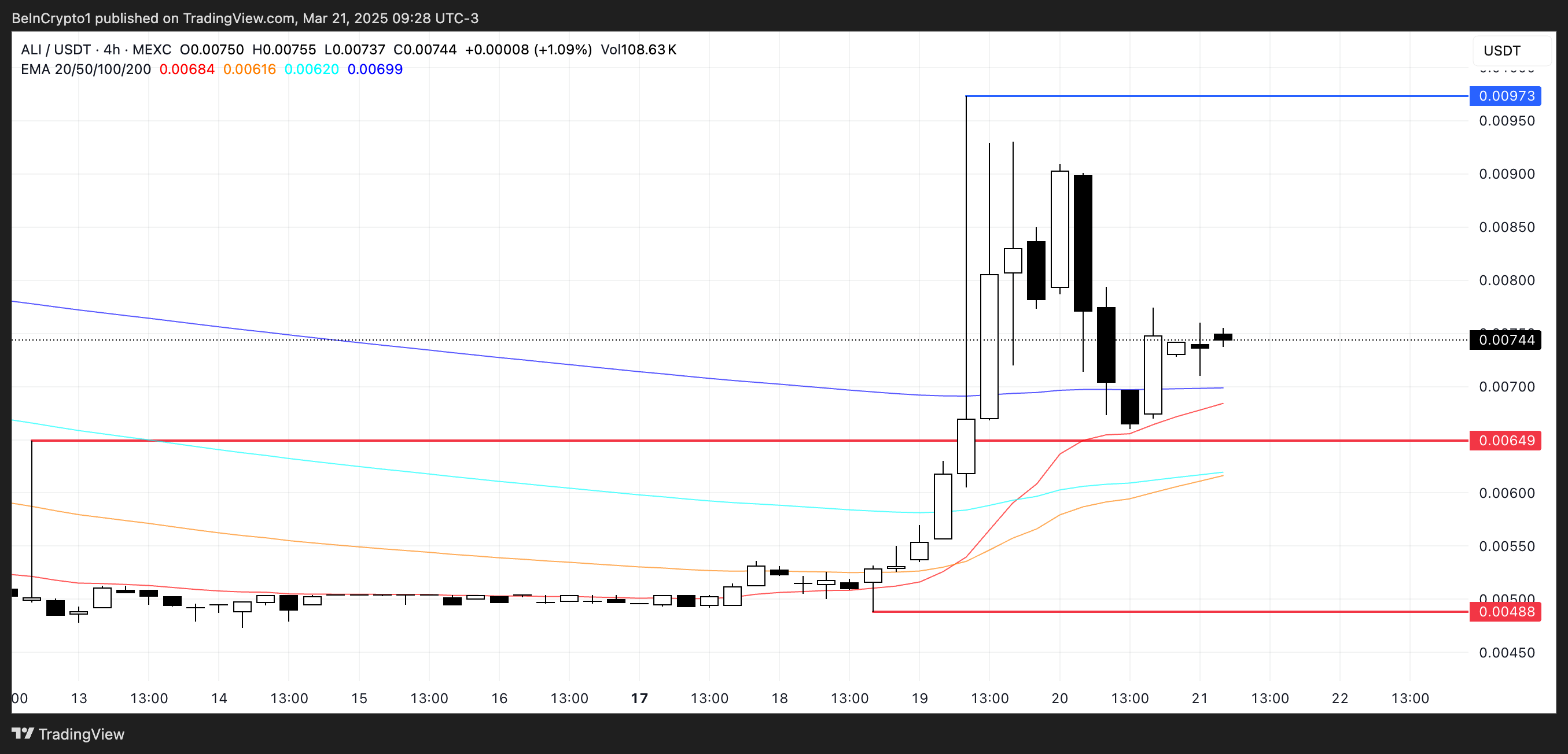

Artificial Liquid Intelligence (ALI)

Artificial Liquid Intelligence is driving several AI-focused crypto projects, including the AI Protocol, which builds a decentralized infrastructure for tokenized AI systems.

The company is also behind Alethea AI and its on-chain agentic AI characters, blending AI with blockchain to create interactive digital personas. Additionally, its ALI Agents Beta is set to launch soon, featuring staking, rewards, and upgraded AI functions.

ALI has gained over 48% in the past week, making it one of the best-performing crypto AI agents coins.

If momentum continues, ALI could push toward $0.0097, with a chance to break above $0.010. However, if a pullback occurs, support levels sit at $0.0064 and $0.0048.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A crypto analyst has predicted that the XRP price could hit $27 soon. He describes the cryptocurrency’s current price action as a “ Bermuda Triangle or boredom phase” — a period where the market moves slowly or sideways, fuelling doubt and uncertainty among traders and investors before a price rally.

XRP Price Boredom Phase To Trigger $27 Surge

Crypto analyst Egrag Crypto has warned that the XRP price is in a Bermuda Triangle, a boredom phase characterized by price stagnation and market uncertainty designed to shake out weak hands before a significant price move. According to his prediction, while traders and investors are growing impatient and questioning why XRP has not experienced any notable price increases, this phase is merely a set-up for a strong rally toward $27.

Related Reading

Following a predicted downturn in mid-March, XRP has struggled to recover its bullish momentum. The cryptocurrency was one of the top-performing altcoins in this bull cycle, jumping from a $0.5 low to over $3 for the first time in seven years.

Due to the current market decline, Egrag Crypto revealed that many traders are now wondering why “XRP hasn’t mooned.” The analyst explained that this price decline was intentional, forcing investors to second-guess themselves and make emotional trading decisions.

He also disclosed that the XRP market is now filled with ‘What ifs’, as Fear, Uncertainty, and Doubt (FUD) cloud traders’ minds. Moreover, concerns over potential dips to $1.60 or $1.30 could push investors to panic-sell or attempt risky trades.

The analyst also revealed that the XRP market is currently controlled by sharks and larger players, also called Whales. These large holders tend to influence price movements, triggering stop-losses and shaking out weak hands before a major rally.

Egrag Crypto warns that new investors and traders are especially vulnerable, as frustration and boredom can lead to making financial mistakes. He disclosed that the best strategy to implement during this current market phase is to do nothing. He suggested investors stay disciplined and patient, recognizing that boredom phases are normal in crypto market cycles.

The analyst also urged investors to remain vigilant and hold their positions while accumulating at ideal prices rather than react impulsively to rapid changes in the market.

XRP Breakout Point Hints At New ATH

In other analyses, market expert ‘Steph Is Crypto’ has announced that XRP is currently retesting breakout levels to trigger a surge to a fresh ATH. The analyst’s price chart shows a Falling Wedge pattern which has been broken above the resistance at the upper trend line.

Related Reading

After breaking out, XRP now retests this level to confirm a larger upward move. The large green arrow on the chart points to the cryptocurrency’s projected price target, suggesting a bullish continuation if the Falling Wedge breakout holds.

XRP’s upside potential is predicted to be $4 or higher if its bullish momentum is maintained. As of writing, the cryptocurrency is trading at $2.4, reflecting a 3.5% decline in the last 24 hours, according to CoinMarketCap. If its price rises to $4, it would represent a significant 66.7% increase from current levels.

Featured image from Unsplash, chart from Tradingview.com

Market

Pi Network Might Fall Below $1 As Bearish Sentiment Rise

Pi Network (PI) dropped by another 9% on Friday, adding to its recent bearish momentum. The decline comes after Justin Bons called the project a potential “scam,” fueling negative sentiment.

Technical indicators like BBTrend and RSI are also pointing to sustained downside pressure. As the price struggles below $1, traders are watching to see if PI can stabilize or if further losses are ahead.

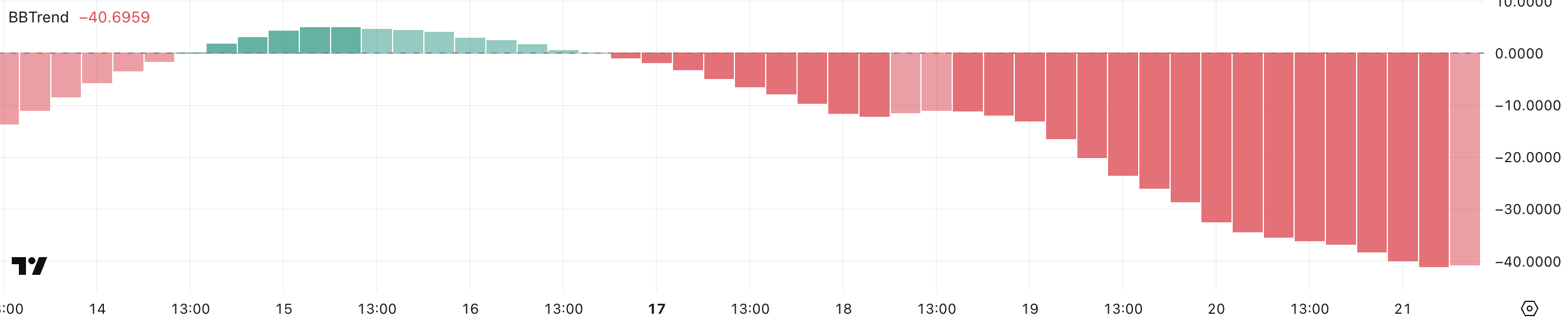

Pi Network BBTrend Reached Its Lowest Levels Ever

Pi Network’s BBTrend is currently at -40.69, marking its lowest reading on record and staying negative for the past five days. T

The BBTrend, or Bollinger Band Trend, is an indicator that measures trend direction and strength based on price movement relative to Bollinger Bands.

Positive values typically indicate bullish momentum, while negative values suggest bearish momentum, with extreme values often signaling strong trends.

With Pi Network’s BBTrend sitting deeply in negative territory, it points to sustained bearish momentum.

This could suggest that sellers are firmly in control, and the asset may continue to face downward pressure unless a sharp reversal occurs.

A prolonged negative BBTrend like this often signals that the market is in a strong downtrend, and traders may remain cautious until signs of stabilization or a positive shift appear.

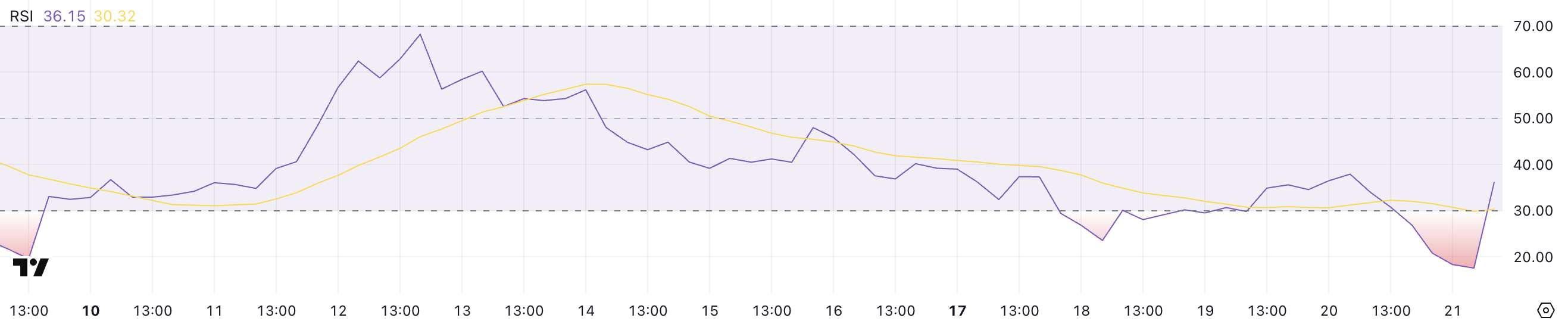

Pi Network RSI Is Recovering After Touching Oversold Levels

Pi Network’s RSI has rebounded to 36.15 after dropping as low as 17.5 just a few hours ago, showing a slight recovery in momentum.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. Values above 70 indicate overbought conditions, and values below 30 suggest an asset is oversold.

Pi Network’s RSI is now just above 36, moving out of the oversold zone but remaining in bearish territory.

This could imply that while some buying pressure has returned, the overall trend is still weak. Further upside will depend on whether the RSI continues to climb.

If the RSI fails to move higher, Pi Network may remain vulnerable to additional corrections.

Will PI Fall Below $0.90?

Pi Network has recently dropped below the $1 level for the first time since February 22 as bearish momentum builds. This decline comes as Justin Bons recently exposed Pi Network’s flaws, raising concerns and calling the project a potential “scam.”

If the correction deepens, PI price could test key support zones around $0.81 and possibly $0.62.

However, if Pi Network manages to regain strength despite the criticism, it could push toward resistance at $1.23.

A strong rebound could open the door for a move toward $1.79, but sentiment remains fragile following Bons’ claims and the recent price breakdown.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Needs to Break This Key Level For A ‘Bullish Flip’, Analyst Predicts

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

-

Market22 hours ago

Market22 hours agoTether Buys $33 Billion US Bonds Amid Forthcoming Regulation

-

Market23 hours ago

Market23 hours agoCyberCapital’s Justin Bons Slams Pi Network as a Scam

-

Altcoin23 hours ago

Altcoin23 hours agoWhy Is Pi Coin Price Down 20% Today?

-

Altcoin16 hours ago

Altcoin16 hours agoCan Shiba Inu Price Hit $0.01 As SHIB Burn Rate Rockets 500%?

-

Altcoin17 hours ago

Altcoin17 hours agoWhy Is Solana DEX ORCA Price Skyrocketing 170% Today?

-

Market24 hours ago

Market24 hours agoAnalysts Predict Choppy Price Action