Market

Is Trump Tanking the Market on Purpose? Experts Weigh In

Trump’s economic policies have created much uncertainty in the past few months, stunting stock markets and rocking investor confidence. However, as the United States faces a significant debt maturity of $7 trillion and high yields, theorists wonder whether Trump’s tariffs can get the Federal Reserve to bring interest rates down.

BeInCrypto spoke with Erwin Voloder, Head of Policy of the European Blockchain Association, and Vincent Liu, Chief Investment Officer at Kronos Research, to understand why Trump might be using tariff threats to boost American consumers’ purchasing power. They warn, however, that the risks far outweigh the benefits.

The US Debt Dilemma

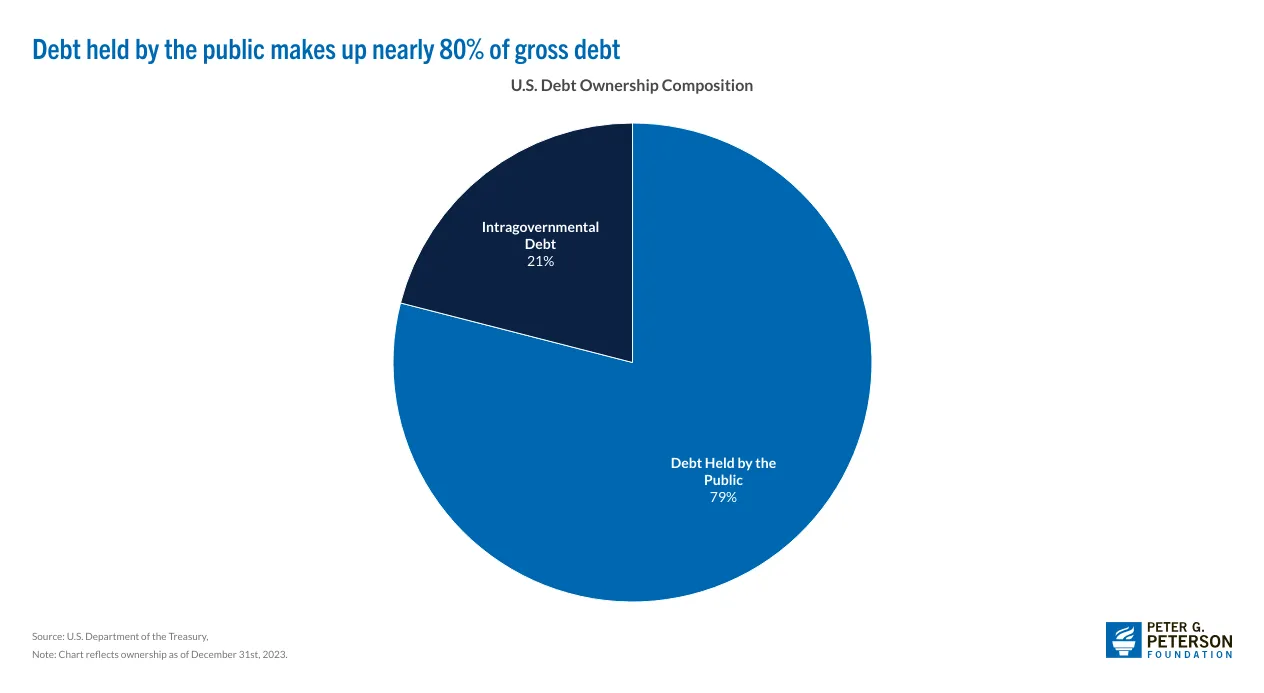

The United States currently has a national debt of $36.2 trillion, the highest of any country in the world. This figure reflects the total sum of funds the federal government has acquired through borrowing to finance past expenditures.

In other words, the US owes foreign and domestic investors a lot of money. It will also have to repay certain loans in the next few months.

When the government borrows money, it issues debt securities, like Treasury bills, notes, and bonds. These securities have a specific maturity date. Before this deadline, the government must pay back the original amount borrowed. In the next six months, the United States will have to pay back around $7 trillion in debt.

The government has two options: It can either use available funds to repay the maturity debt or refinance it. If the federal government opts for the latter, it must take out further loans to repay the current debt, increasing the already ballooning national debt.

Since the US has a history of opting for the refinancing option, direct repayment seems unlikely. However, steep interest rates currently complicate refinancing.

High Interest Rates: An Obstacle to Debt Refinancing

Refinancing allows the government to roll over the debt, meaning it doesn’t need to find the money from available funds to pay off the old debt immediately. Instead, it can issue new debt to cover the old one.

However, the Federal Reserve’s interest rate decisions significantly impact the federal government’s ability to refinance its debt.

This week, the Federal Reserve announced that it will keep interest rates between 4.25% and 4.50%. The Reserve has steadily increased percentages past the 4% benchmark since 2022 to control inflation.

While this is good news for investors who expect higher yield returns on their bonds, it’s a bad outlook for the federal government. If it issues new debt to cover the old one, it would have to pay more in interest, which will strain the federal budget.

“In practical terms, even a 1% higher interest rate on $7 trillion equates to $70 billion more in interest expense per year. A 2% difference would be $140 billion extra annually– real money that could otherwise fund programs or reduce deficits,” Voloder told BeInCrypto, adding that “the US already has a national debt exceeding $36 trillion. Higher refinancing rates compound the debt problem, as more tax revenue must go just to pay interest, creating a vicious cycle of larger deficits and debt.”

This scenario indicates that the United States needs to proceed cautiously with its monetary policies. With looming debt repayment deadlines and concerns over inflation, the government should embrace stability over uncertainty.

However, the Trump administration seems to be doing the opposite by threatening its neighbors with steep tariffs. The main question is: Why?

Trump’s Tariff Policies: A Strategy or a Gamble?

During Trump’s first and second terms in office, he has continuously toyed with a tariff policy targeting his neighbors Canada and Mexico and his longtime rival China.

In his most recent inaugural address, Trump reaffirmed his commitment to this trade policy, claiming it would bring money back into the United States.

“I will immediately begin the overhaul of our trade system to protect American workers and families. Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens. For this purpose, we are establishing the External Revenue Service to collect all tariffs, duties, and revenues. It will be massive amounts of money pouring into our Treasury, coming from foreign sources,” Trump said.

However, the ensuing uncertainty about trade relationships and consequent retaliatory actions from affected countries have inevitably created instability, causing investors to react sharply to the news.

Earlier this month, markets experienced a widespread selloff, driven by anxieties surrounding Trump’s tariff policies. These resulted in a sharp decline in US stocks, a drop in Bitcoin’s value, and a surge in Wall Street’s fear index to its highest point of the year.

A similar scenario also played out during Trump’s first presidency.

“Intentionally rising economic uncertainty via tariffs carries steep risks: markets could overreact, plunging and increasing percentages for a possible recession, as seen in 2018’s trade war drop,” Liu said.

Whenever traditional financial markets are affected, crypto also suffers by association.

“In the immediate term, Trump’s production-first, America-First economics means digital asset markets must grapple with higher volatility and less predictable policy inputs. Crypto is not isolated from macro trends and is trading increasingly in tandem with tech stocks and risk conditions,” Voloder said.

While some view Trump’s measures as careless and erratic, others see them as calculated. Some analysts have viewed these policies as a means to get the Federal Reserve to lower interest rates.

Is Trump Using Tariffs to Influence the Federal Reserve?

In a recent video, Anthony Pompliano, CEO of Professional Capital Management, argued that Trump was trying to lower Treasury yields by intentionally creating economic uncertainty.

Tariffs can disrupt trade relationships by acting as taxes on imported goods, consequently increasing the cost of goods for consumers and businesses. Given that these policies are often a great source of economic uncertainty, they can create a sense of instability in the economy.

As evidenced by the market’s strong reaction to Trump’s tariff announcements, investors were spooked out of fear of an economic slowdown or looming recession. Consequently, businesses might reduce risky investments while consumers limit spending to prepare for price spikes.

Investor habits may also change. With less confidence in a volatile stock market, investors may shift from stocks to bonds to seek safe-haven assets. US Treasury bonds are considered one of the safest investments in the world. In turn, this flight to safety increases their demand.

When demand for bonds increases, bond prices go up. This series of events indicates that investors are bracing themselves for prolonged economic uncertainty. In response, the Federal Reserve may be more inclined to lower interest rates.

Trump achieved this during his first presidency.

“The theory that tariffs could lift bond demand hinges on fear sparking market shifts. Tariff uncertainty might trigger equity sell-offs, boosting Treasuries and lowering yields to ease $7 trillion in US debt refinancing evidenced by 2018, when trade shocks cut yields from 3.2% to 2.7%. Yet, with inflation at 3-4% and yields at 4.8%, success is not guaranteed. This will require tariffs to be credible enough to adjust markets without stoking inflation,” Liu told BeInCrypto.

If the Reserve lowers interest rates, Trump can acquire new debt at a lower price to pay off the impending debt maturity.

The plan may also benefit the average American consumer– to an extent.

Potential Benefits

Treasury yields are a benchmark for many other interest rates in the economy. Therefore, if Trump’s trade policies get Treasury yields to fall, this could have a trickle effect. The Federal Reserve could lower interest rates on other loans, such as mortgages, car loans, and student loans.

In turn, borrowing rates would drop, and disposable income would increase. Thus, the average American citizen can contribute to overall economic growth with greater purchasing power.

“For an American family, a drop in mortgage rates can mean substantial savings on monthly payments for a new home or refinance. Businesses might find it easier to finance expansions or hire new workers if they can borrow at 3% instead of 6%. In theory, greater access to low-interest loans could stimulate economic activity on Main Street, aligning with Trump’s goal of revving growth,” Voloder explained.

However, the theory relies on investors reacting very specifically, which is not guaranteed.

“It’s a high-stakes bet with a narrow margin for error for success depending on many different economic factors,” Liu said.

In the end, the risks heavily outweigh the potential benefits. In fact, consequences can be grave.

Inflation and Market Instability

The theory of deliberately causing market uncertainty hinges on the fact that the Federal Reserve would bring down interest rates. However, the Reserve is intentionally keeping interest rates high to contain inflation. A tariff war threatens to spur inflation.

“Yields could hit 5% if inflation spikes, not drop, and [Jerome] Powell’s high odds of holding rates steadily undermine the plan,” Liu said.

To that point, Voloder added:

“If the plan backfires and yields don’t fall enough, the US might end up refinancing at high rates anyway and with a weaker economy, which would be the worst outcome.”

Meanwhile, since tariffs directly increase the cost of imported goods, this cost is often passed on to consumers. This scenario creates higher prices for a wide range of products and causes inflationary pressures, eroding purchasing power and destabilizing the economy.

“Inflation stemming from tariffs means each dollar earned buys less. This stealth tax hurts lower-income families the most, as they spend a higher fraction of their income on affected essentials,” Voloder said.

In this context, the Reserve would likely hike Treasury yields. The scenario could also gravely affect the health of the United States’ job market economy.

Impact on Jobs and Consumer Confidence

The economic uncertainty of tariffs can deter businesses from continuing to invest in the United States. In this context, companies may delay or cancel expansion plans, reduce hiring, and cut back on research and development projects.

“The impact on jobs is a major concern. Intentionally cooling the economy to force rate cuts is essentially flirting with higher unemployment. If markets drop and business confidence wanes, companies often respond by cutting back on hiring or even laying off workers,” Voloder said.

Rising prices and market volatility could also damage consumer confidence. This dynamic would reduce consumer spending, which is a major driver of overall economic growth.

“Americans face higher prices and eroded purchasing power as a direct result of tariffs and uncertainty. Tariffs on everyday goods –from groceries to electronics– act like a sales tax that consumers ultimately pay. These costs hit consumers at a time when wage growth may stall if the economy slows. So, any extra cash saved from lower interest payments could be offset by rising prices for consumer goods and possibly higher taxes down the road,” Voloder told BeInCrypto.

The consequences are not just limited to the United States, however. As with any trade dispute, countries will feel inclined to respond– and recent weeks have proven that they already have.

Trade Wars and Diplomatic Tensions

Both countries responded sharply when Trump imposed 25% tariffs on products entering the US from Canada and Mexico.

Canadian Prime Minister Justin Trudeau called the trade policy a “very dumb thing to do.” He then announced retaliatory tariffs on American exports and gave notice that a trade war would have consequences for both countries. Mexico’s President Claudia Sheinbaum did the same.

In response to Trump’s 20% tariff on Chinese imports, Beijing imposed retaliatory tariffs of up to 15% on various significant US agricultural products, including beef, chicken, pork, and soybeans.

Additionally, ten American companies now face restrictions in China after being placed on the country’s ‘reliable entity list.’ This list prevents them from engaging in import/export trade with China and limits their ability to make new investments there.

The Chinese Embassy in the United States also said that it wasn’t scared by intimidation.

Tariffs will also have consequences beyond harming international relations.

Global Supply Chain Disruptions

International trade wars could disrupt global supply chains and harm export-oriented businesses.

“From a macro perspective there is also the fear of trade war escalation globally which could have the boomerang effect of denting US exports and manufacturing, meaning US farmers losing export markets or factories facing costlier inputs. This global tit-for-tat could amplify the downturn and also strain diplomatic relations. Additionally, if international investors see US policy as chaotic, they might reduce investment in the US over the longer term,” Voloder told BeinCrypto.

Inflationary pressures and economic downturns could also push individuals to embrace digital assets.

“Additionally, if the US pursues mercantilist policies that alienate foreign creditors or weaken confidence in the dollar’s stability, some investors might increase allocations to alternative stores of value like gold or Bitcoin as a hedge against currency or debt crises,” Voloder explained.

Consumers might experience shortages of essential goods, while businesses would see increased production costs. Those that rely on imported materials and components would be particularly affected.

A High-Risk Strategy: Is it Worth it?

The theory that tariffs could lower yields by creating uncertainty is a highly risky and potentially damaging strategy. The negative effects of tariffs, such as inflation, trade wars, and economic uncertainty, far outweigh potential short-term benefits.

As products become more expensive and businesses reduce their workforce to equilibrate their balance sheets, the average American consumer will experience the brunt of the consequences.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SOL Circulation at 5-Month Low As Solana Price Stalls Below $135

Solana (SOL) has struggled to maintain upward momentum in recent weeks. Although the cryptocurrency showed signs of an uptrend, it is now facing challenges due to declining demand for SOL.

The market environment is also deteriorating, which is contributing to the struggles. At $129, Solana is stalled below the key $135 barrier. There is no clear indication of a breakout in sight.

Solana Struggles To Find Demand

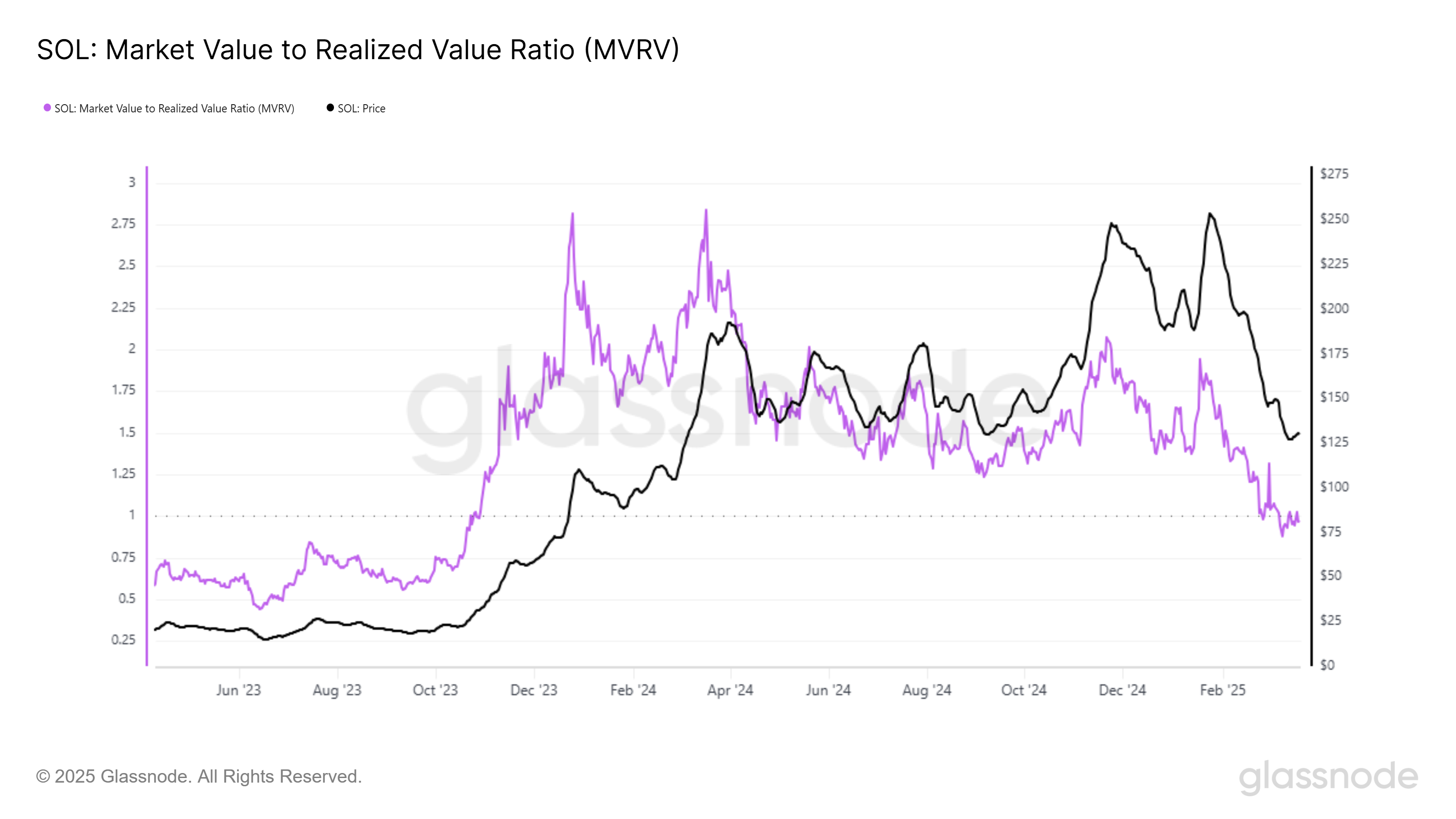

The Velocity of Solana has fallen to a 5-month low, signaling weakening demand. Velocity measures the rate at which an asset is circulated within the market. Solana’s current circulation levels are on par with those seen in October 2024, a clear indicator that the cryptocurrency is losing traction.

The drop in Velocity suggests that fewer investors are actively trading SOL, further adding to the bearish sentiment surrounding the token. This lack of demand makes a recovery increasingly difficult, as it implies that traders are hesitant to enter the market.

The ongoing low demand for SOL further confirms a bearish outlook. Many investors are likely waiting for a more favorable environment before committing to new positions, which could delay any potential recovery as the token struggles to attract fresh capital.

Analyzing the 2-week Market Value to Realized Value (MVRV) Ratio, a key metric that tracks the average profit or loss of recent buyers, reveals that the ratio is currently below the zero line. This suggests that investors who purchased SOL within the last two weeks are now facing losses.

This situation could lead to one of two scenarios: either investors hold their positions, hoping for a price recovery, or they sell to cut their losses.

If the latter occurs, increased selling pressure could push the price lower and potentially invalidate any attempts at recovery. In this scenario, the market would likely remain bearish until sentiment shifts.

SOL Price Is Struggling

Solana is currently trading at $130, struggling to break through the critical $135 resistance. While there has been a short-term uptrend, the likelihood of SOL breaching this level seems low. This suggests that the price could remain range-bound for the near future.

The combination of low demand and weak market sentiment points toward a potential decline. Solana may fall through its uptrend support line, with the next significant support levels lying at $125 and potentially $118.

This scenario would delay any recovery, pushing the token further into a bearish trend.

On the other hand, if Solana manages to break through the $135 resistance, the altcoin’s price push toward $148. A sustained move above this level could propel SOL to $150, invalidating the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hyperliquid (HYPE) Open Interest Surges to $44 Million

Hyperliquid’s native crypto token HYPE has recently experienced a significant 40% price decline. However, the altcoin is showing signs of recovery.

Traders have become increasingly bullish on HYPE, with many believing it can regain the losses sustained in the recent downturn. This renewed confidence, supported by positive market movements, has sparked hopes of a price rebound.

Hyperliquid Finds Strong Support

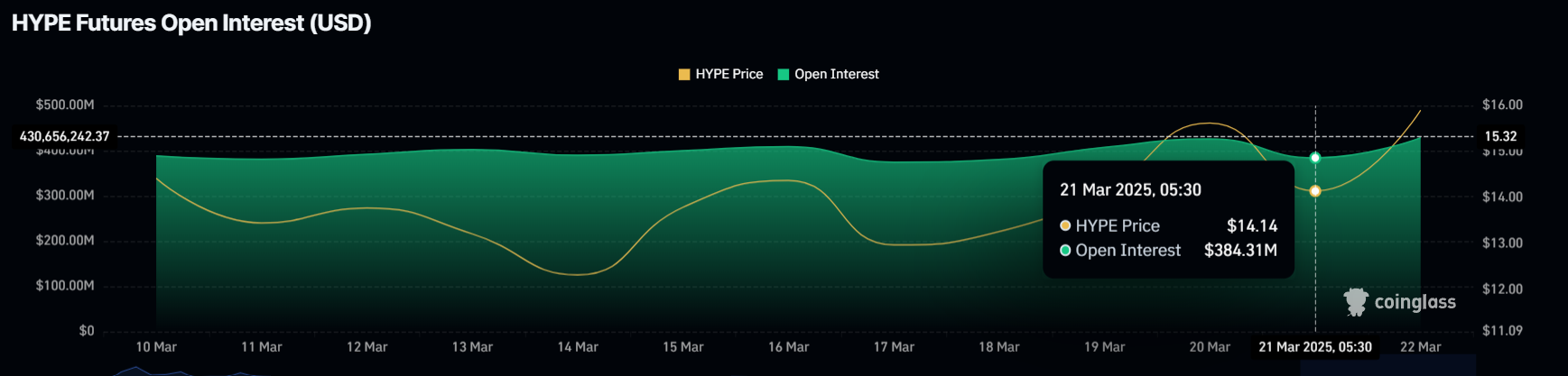

Over the past 24 hours, the Open Interest for Hyperliquid has risen by $44 million, bringing the total to $428 million. This increase follows a recent uptick in price, which added momentum to the ongoing recovery.

The growth in Open Interest suggests that traders are becoming more confident in HYPE’s potential for a price rise. This influx of interest has fueled optimism among investors and traders alike, with many viewing this as a sign of further upside.

As a result, there is a renewed sense of enthusiasm among HYPE enthusiasts, who believe the altcoin is well-positioned to reclaim lost value. This positive sentiment could contribute to continued price growth, particularly as market conditions remain favorable for a recovery.

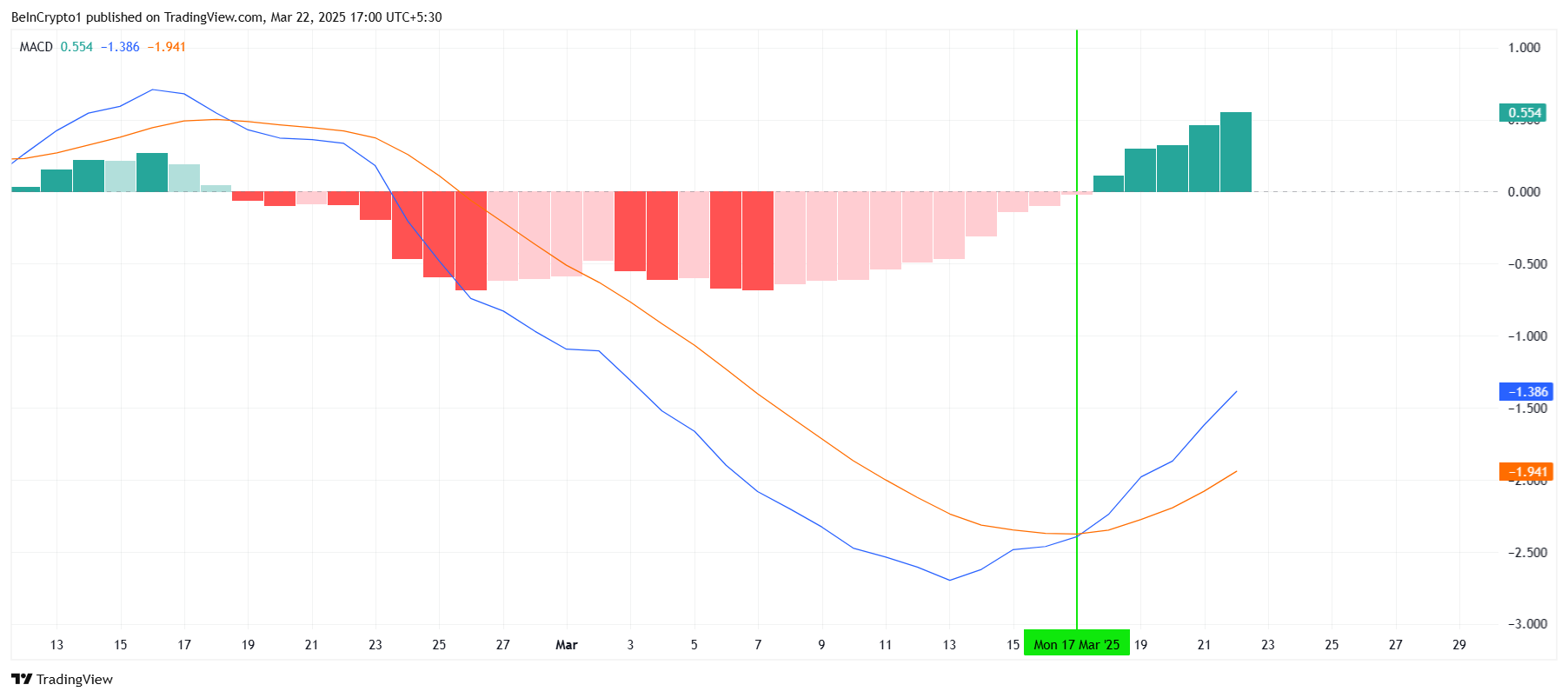

The overall macro momentum of Hyperliquid has shown significant improvement in recent days. Key technical indicators, such as the Moving Average Convergence Divergence (MACD), reflect a shift from a bearish to a bullish trend this week.

This change marks the end of a month-long bearish crossover and signals the potential for further upward momentum.

As the bullish momentum rises, it provides HYPE with the room needed to continue its recovery. The shift in the MACD reflects a positive shift in market sentiment, suggesting that the altcoin may be in a stronger position moving forward.

HYPE Price Faces Barrier

HYPE’s price is currently trading at $16.10, up by 14% over the last 24 hours. The altcoin is just under the $16.50 resistance level, having already recovered about half of its recent 40% decline. This price movement shows that Hyperliquid has significant upside potential.

Given the current momentum, there is a possibility that HYPE will breach the $16.50 barrier and continue its upward trajectory. If this occurs, the altcoin could move toward $19.16, potentially reaching $20.00 in the near future.

However, if the $16.50 resistance level proves too strong, HYPE may struggle to maintain its upward momentum. In this case, the price could fall back to $13.44, invalidating the bullish outlook and erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network To Launch PiDaoSwap Decentralized Exchange (DEX)

The Pi Network community is taking a significant step toward financial independence, developing its decentralized exchange (DEX), PiDaoSwap.

According to social media reports, the initiative will aim to curb alleged price manipulation by external exchanges.

PiDaoSwap to Launch on the Pi Network Ecosystem

Reportedly, PiDaoSwap is in the final stages of launching a multi-functional DEX on the Pi Network mainnet. The platform will ensure that the PI coin price reflects the actual market value of the token rather than being distorted by third-party platforms.

The announcement cited price manipulation by outside entities, a malpractice that impedes Pi Network’s growth and development.

“Once completed, the Pi price will be reflected at its true value and will no longer be manipulated by current external exchanges,” Pi Network VietNames claimed.

Pi Network VietNames is a community-driven profile that shares updates, opinions, and news about Pi Network.

Although in the final stages of development, PiDaoSwap specified that it was awaiting Know Your Business (KYB) approval from the Pi core team before launching.

For now, the prospective platform has secured Twitter’s organizational verification, signaling progress in its development.

Meanwhile, Pi Network’s imminent PiDaoSwap launch comes amid escalating frustrations within the PI community. Certain platforms reportedly use bots to alter Pi’s valuation artificially, affecting community sentiment.

Similarly, there are also allegations of fake price listings by external exchanges.

A recent BeInCrypto report echoes this sentiment amid allegations of bot activity on CoinMarketCap. This fueled skepticism about centralized price tracking mechanisms on the platform.

According to Pi Network VietNames, these manipulations have severely impacted the project’s credibility and adoption.

Meanwhile, Binance remains evasive when listing Pi coins. Despite community support, Pi Coin’s Binance listing decision remains unresolved, leading to frustration among fans.

Meanwhile, other concerns emerge regarding restrictions on using “Pi-related” branding. These are related to the intellectual property (IP) and trademark policies outlined by the Pi Network.

“As a community-driven ecosystem project under PIDao, with DAO as our core focus, would this still be prohibited? Or do we need to modify our project name and domain accordingly,” PiDaoSwap wrote.

Pi Network’s official documentation prohibits using “Pi-related” branding without approval. Therefore, this suggests modifications could be necessary before the prospected PiDaoSwap debuts.

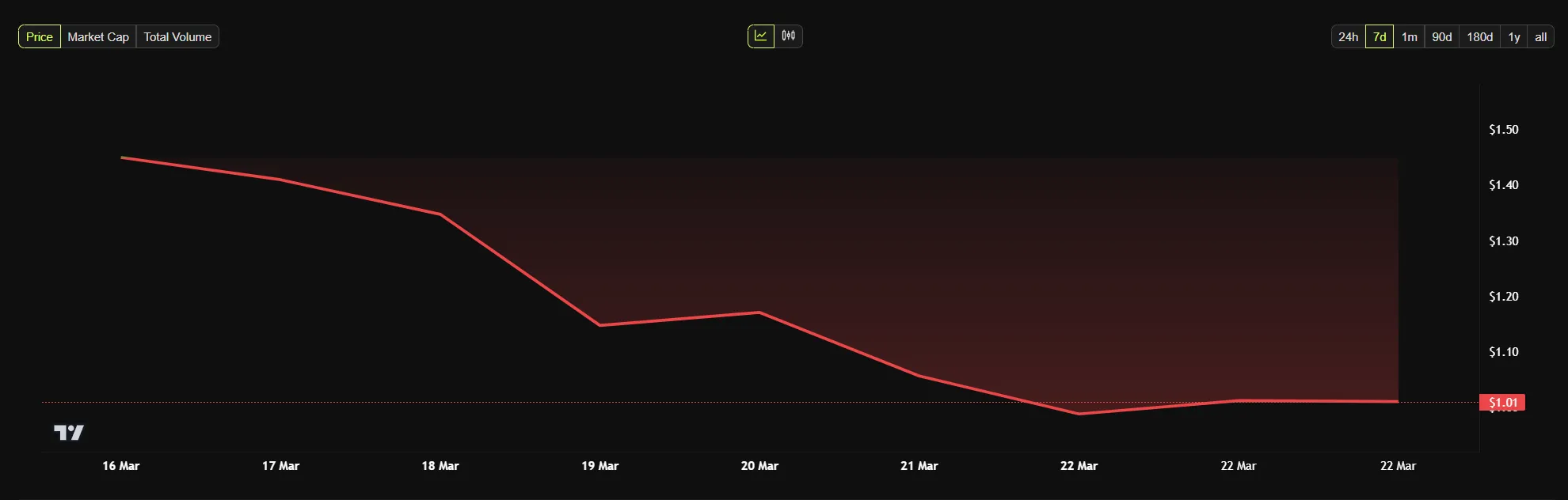

Meanwhile, PI fell below $1 on Saturday, down by over 30% in the past week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum Price Eyes Reversal as ETH/BTC Hits Key Support

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Coin (BNB) Price Update: What’s Happening Today

-

Market23 hours ago

Market23 hours agoBitcoin Faces Resistance at $85,000 As Whale Buying Levels Off

-

Market22 hours ago

Market22 hours agoTether Is Preparing Audits to Meet US Stablecoin Regulation

-

Market21 hours ago

Market21 hours agoEthereum (ETH) Can’t Breach $2,000 As Sellers Take Control

-

Market20 hours ago

Market20 hours agoPi Network Might Fall Below $1 As Bearish Sentiment Rise

-

Market19 hours ago

Market19 hours agoWhy Current ‘Boredom Phase’ Could Trigger Epic Rally

-

Altcoin19 hours ago

Altcoin19 hours agoDigital Euro Needed to Protect Europe’s Financial Sovereignty, Says ECB Expert