Market

Is Binance Favoring BNB Chain in Token Listings and Delistings?

Binance has recently launched two mechanisms that empower the community to decide on token listings (Vote to List) and delistings (Vote to Delist).

However, behind these two initiatives, a critical question arises: Is there any bias in how Binance manages its token portfolio?

BNB Chain Projects Dominate “Vote to List”

On March 20, 2025, Binance kicked off the first batch of “Vote to List.” Following this announcement, multiple new BNB Chain tokens, including Broccoli, KOMA, and BANANAS31, secured their listings on the world’s largest exchange.

This is similar to how Binance had opened a vote for the community to decide whether to list Pi Network’s Pi Coin.

A day later, on March 21, 2025, Binance made headlines again by introducing “Vote to Delist“. The first 21 tokens selected for potential delisting were JASMY, ZEC, FTT, ELF, SNT, STPT, BAL, ARK, GPS, MBL, PROS, CTXC, HARD, BETA, CREAM, FIRO, VIDT, NULS, TROY, ALPACA, and UFT.

These events highlight Binance’s ambition to grant more decision-making power to the community. However, they also raise a critical question: Is there bias in how Binance manages its token portfolio? While BNB Chain dominates “Vote to List,” does “Vote to Delist” truly provide a fair playing field for projects from other blockchains?

“Vote to Delist”: Is Binance Favoring Its Ecosystem?

Interestingly, only ALPACA belongs to the BNB Chain among the 21 tokens targeted for delisting. The remaining represent Ethereum, Base, and other blockchain ecosystems. These tokens were flagged with a “Monitoring Tag” due to low liquidity, lack of team updates, or weak community engagement.

At this stage, the contrast between “Vote to List” and “Vote to Delist” reveals an interesting pattern. The process seems to lack balance in blockchain diversity, potentially favoring BNB Chain in listings while targeting external projects for delisting.

At the same time, while Binance’s listing criteria, like liquidity, project development, and community activity, apply to all tokens, non-BNB Chain projects often struggle to compete with the inherent advantages of tokens within the BNB Chain ecosystem.

Binance’s “Vote to List” and “Vote to Delist” mechanisms are significant steps toward community-driven governance. However, the disparity in blockchain representation raises concerns about fairness in token management.

Binance currently says this is a trial. It remains to be seen whether Binance will make adjustments to ensure a more level playing field or whether BNB Chain will continue to enjoy a privileged position on the exchange.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Is Preparing Audits to Meet US Stablecoin Regulation

Recent reports claim that Tether CEO Paolo Ardoino is in talks with the Big Four accounting firms to finally conduct a third-party audit. However, some members of the community are skeptical, citing a lack of firm commitments.

Such an audit would be mandated by upcoming stablecoin regulations, and an absolute requirement for future cooperation with the US government.

Is Tether Finally Getting An Audit?

Tether, the issuer of the world’s largest stablecoin, may soon seek closer integration with the US government. In a speech yesterday, President Trump alluded to his vision of stablecoins’ role in promoting dollar dominance.

To achieve this partnership, however, Tether will finally need to agree to a third-party audit.

According to a new report from Reuters, Tether is engaging with a Big Four accounting firm to make this audit happen. It didn’t specify which of these firms, PwC, EY, Deloitte, and KPMG, were in these talks or what progress had happened.

“It’s our top priority. Now we are living in a landscape where it’s actually feasible. If the President of the United States says this is top priority for the US, Big Four auditing firms will have to listen,” Ardoino claimed.

However, the news followed a lot of skepticism from the wider community. Despite regular internal reports, a new CFO, and years of promises, Tether has never once submitted to a third-party audit. This has created a certain jaded attitude in some parts of the community.

Some speculated that the firm may try to secure a reserve-only audit, but the Big Four will likely only agree to a full accounting. Ardoino’s comment about Trump’s “top priority” seems revealing from this angle.

Why would the Big Four need an incentive like that for a normal audit? Tether made $13 billion in profit last year; surely it can afford their services.

Stablecoin Regulation May Hold Up A Deal

A third-party audit is critical for Tether because of the upcoming potential US stablecoin regulations. According to the proposed GENIUS Act, stablecoin issuers will need to submit to independent audits and hold much of their reserves in assets like Treasury bonds.

So, stablecoin issuers will not be able to operate in the US market without an audit of their US Treasury-based reserve assets.

Yesterday, the firm revealed that it purchased $33 billion in Treasury bonds last year. However, Ardoino claimed that 99% of these are held by Cantor Fitzgerald, a firm with long-standing ties to Tether.

The company’s CEO was Howard Lutnick until this January when he stepped down to become the US Secretary of Commerce. These political ties have drawn some ire.

“Tether has a challenged reputation to say the least. It should be banned from buying US Treasuries until they pass a series of deep audits by US regulators — and that audit should go back to their inception. We’re taking a huge, unnecessary risk by letting this firm into our financial system,” Jason Calcanis claimed.

In other words, Tether skeptics are still not convinced that the stablecoin issuer will go through a large-scale public audit. Thanks to these political ties and substantial Treasury bonds, Tether is well-positioned to make a serious partnership with the US.

However, unless it passes an audit, as mandated by forthcoming regulations, Tether’s US presence might be at risk.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Faces Resistance at $85,000 As Whale Buying Levels Off

Bitcoin (BTC) sparked higher following the recent FOMC meeting but is now correcting, down nearly 3% in the last 24 hours. The price is struggling below key resistance as short-term momentum weakens.

Technical indicators, including the Ichimoku Cloud and EMA lines, are signaling potential challenges ahead for BTC. Meanwhile, whale activity has stabilized after a sharp accumulation phase, raising questions about whether BTC can reclaim higher levels this month.

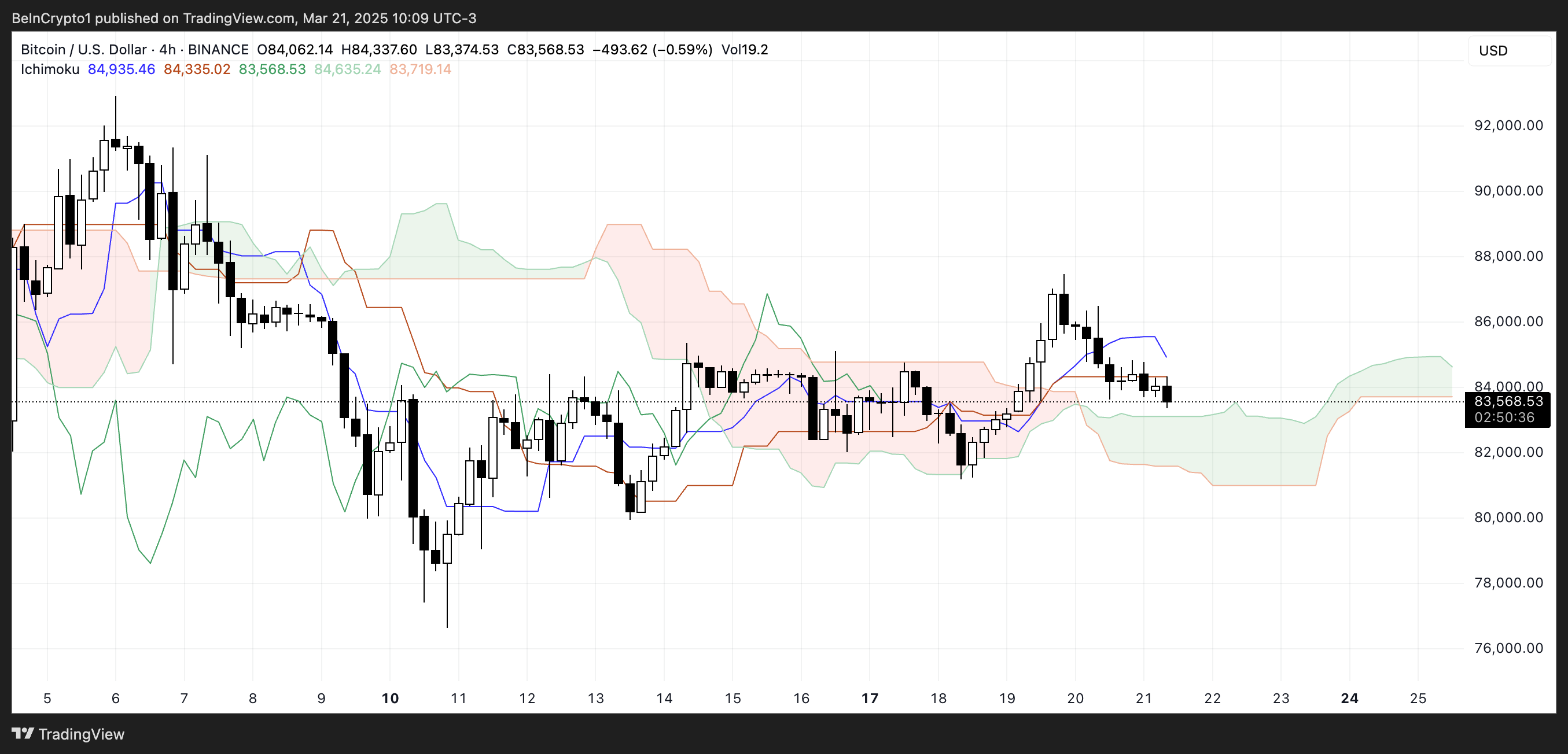

BTC Ichimoku Cloud Shows Challenges Are Coming

Bitcoin is currently trading below the Ichimoku Cloud, signaling a bearish trend in the short term. The price has fallen beneath both the Tenkan-sen (blue line) and Kijun-sen (red line), reinforcing the downside pressure.

The cloud ahead is thin and flat, suggesting weak momentum and the possibility of sideways movement or further bearish continuation unless the price reclaims higher levels.

The Lagging Span (green line) is also positioned below the price action and the cloud, confirming the prevailing bearish sentiment. However, the price is approaching the edge of the cloud’s lower boundary, which could act as immediate support.

If buyers fail to defend this zone, bearish momentum could extend further. On the other hand, any pushback above the Tenkan-sen and Kijun-sen could be an early signal of recovery, but the cloud resistance above remains a major hurdle.

Bitcoin Whales Are Now More Stable After A Recent Surge

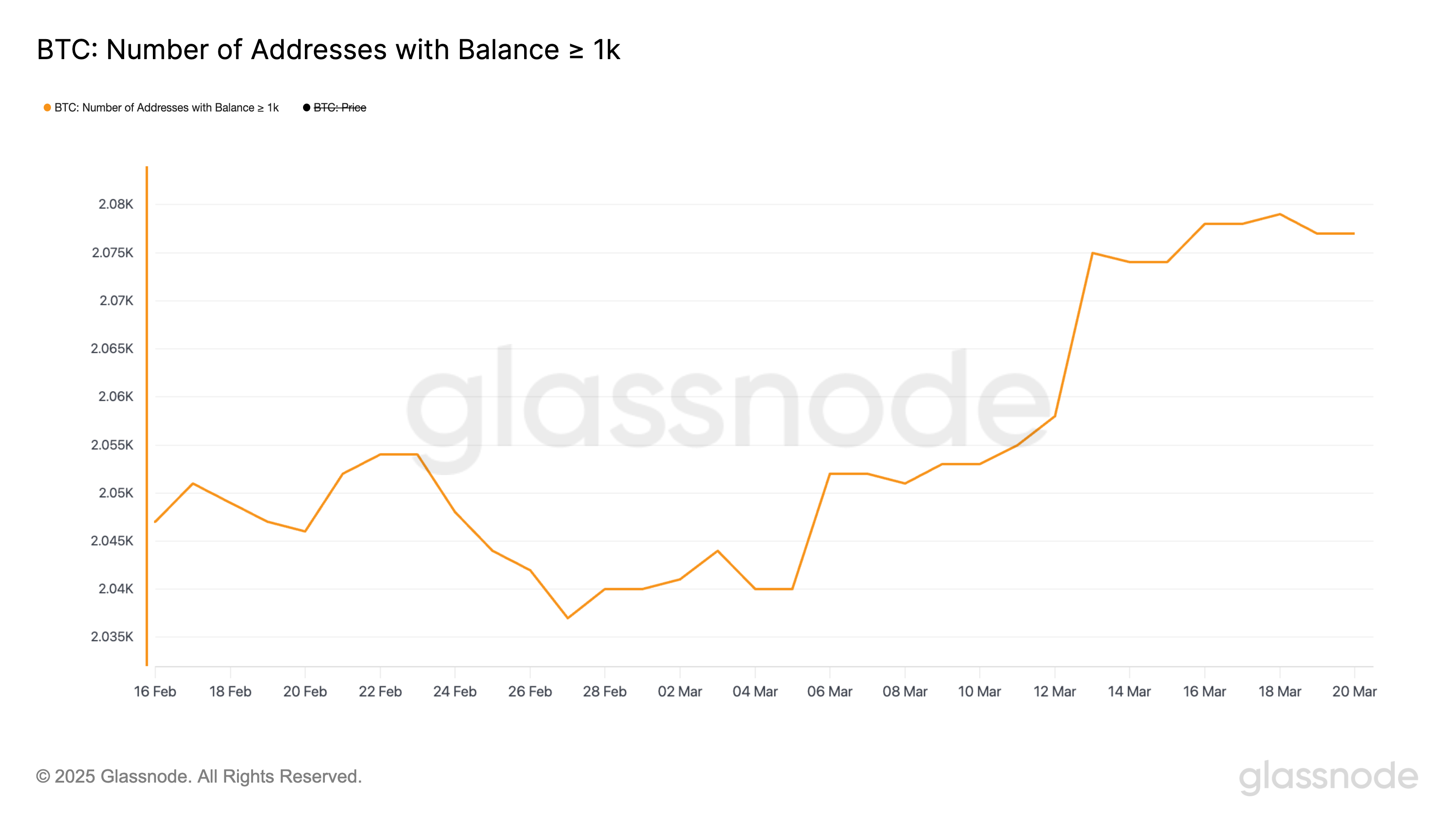

The number of Bitcoin whales has recently surged, with wallets holding at least 1,000 BTC rising from 2,040 on March 5 to 2,079 by March 18, marking the highest level since mid-December 2024.

While the sharp increase indicates strong accumulation during that period, the count has slightly stabilized at 2,077 over the past few days, suggesting the pace of accumulation has cooled for now.

Monitoring whale activity is crucial because, due to the size of their positions, these large holders can significantly influence Bitcoin’s price. A growing number of whales often signals rising confidence among major investors, which can lead to upward price pressure.

The recent surge in whale addresses may suggest institutional or high-net-worth investors are positioning for a potential price rally or at least seeking to accumulate during perceived dips or consolidation phases, as has been happening with BTC in the last few weeks.

Can Bitcoin Return Above $90,000 In March?

Bitcoin price is currently consolidating between resistance at $85,124 and support at $81,187, with its EMA lines showing a lack of clear direction as they move closely together. The recent price spike following the FOMC meeting appears to be losing steam, aligning with insights from Nic Puckrin, who suggests the rally may be short-lived based on current market conditions:

“The slight “Powell pump” we saw in crypto markets after (…) FOMC meeting has brought Bitcoin back above its 200-day moving average, which is certainly a bullish sign. Whether it can continue on this trajectory, however, is another question. If BTC does continue its current surge, a key resistance level to watch will be around $92,000-$93,000. If it manages to break out above this, we could see it extend the rally toward its previous all-time high. However, there is likely too much uncertainty in markets to provide the necessary support for such a move,” Puckrin told BeInCrypto.

If Bitcoin breaks above the $85,000 resistance zone, it could open the door for a push toward $92,920 or even $96,484 if bullish momentum strengthens.

However, failure to maintain support at $81,187 could trigger a move down to $79,955, with the risk of further downside to $76,642 if sellers gain more control.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Network’s DEX Trading Volume Is Less Than $50,000

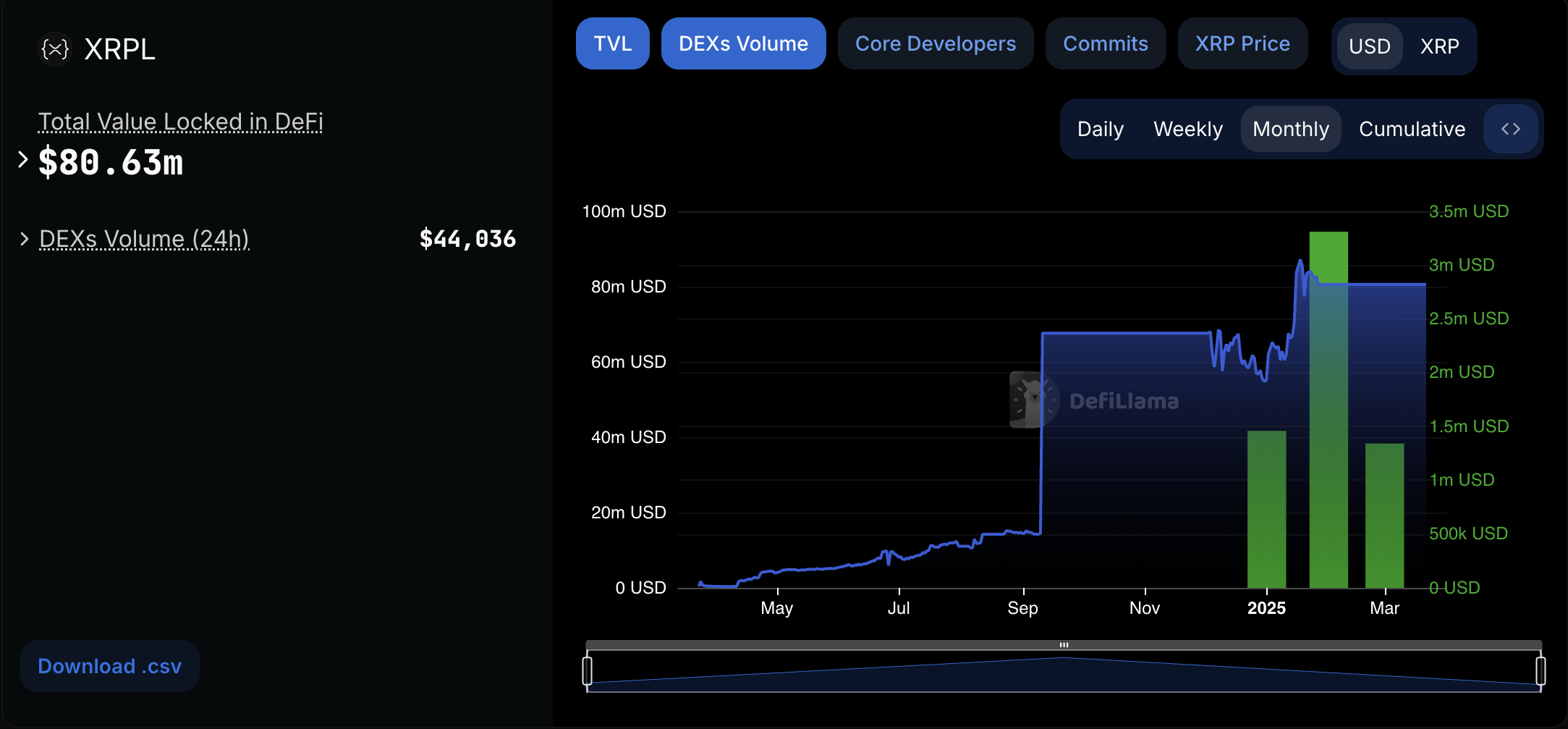

The XRP community is concerned about the network’s utility as its DEX trading volumes and TVL remain extremely low. Despite XRP’s impressive $137 billion market cap, the network recorded only $44,000 in daily DEX trading volume yesterday, raising questions about its overall utility and adoption.

When compared to leading blockchain networks, the XRP ledger suffers from a shortage of nodes, validators, and smart contract token holdings. This discrepancy highlights a clear misalignment between the altcoin’s market valuation and the practical usability of its blockchain network.

XRP Ledger Reflects Massive Issues

Since Donald Trump’s re-election in November 2024, XRP has become one of the most trending crypto assets in the market. Under the SEC’s pro-crypto regulatory shift, XRP has surged nearly 300% in the past four months, and become the 4th largest asset in the market.

Most notably, the SEC dropped its long-running lawsuit against Ripple, sparking hope that the token could reach an all-time high. Despite all of these positive developments, the XRP Ledger has shown little to no improvement in trading activity.

“I think XRP is the biggest financial scam the world has ever seen. There has never been something which has produced less value that has reached this market cap ($140 billion). The XRP ledger did $44,000 in volume in the last 24 hours, according to DefiLlama,” on-chain researcher Aylo claimed on X.

One look at DefiLlama’s data reveals the problem. So far, the network’s volume in March was a measly $1.5 million, and its TVL is $80 million. In other words, there’s practically zero utility for its size.

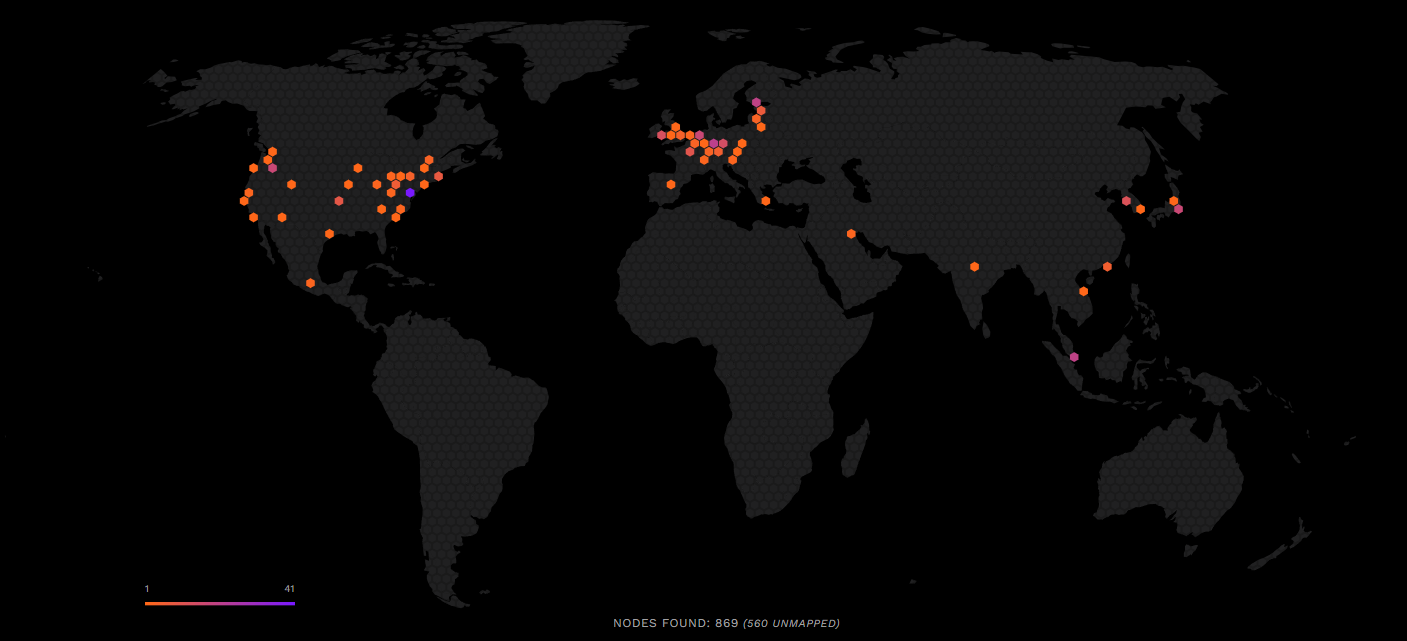

This trade volume and TVL data is an important window into the state of XRP, but there are other vital clues. For example, according to its own website, XRP currently has 386 nodes and 96 validators.

Compare this to other leading assets, Bitcoin has nearly 22,000 nodes, Ethereum has 11,000, and Solana has 4,700.

In other words, general crypto traders don’t seem to be interested in the network’s utility. It’s a concerning indication that the majority of the community considers XRP primarily as a speculative asset.

However, there is a counter perspective that the XRP community needs to consider. While XRPL DEX volume remains modest, Ripple continues to establish itself as a key infrastructure provider for global banking institutions.

Ripple’s technology streamlines cross-border payments by reducing settlement times and lowering costs, attracting leading banks and financial service providers worldwide. This strong institutional focus drives interest in XRP, as it supports efficient liquidity management.

In this context, XRP’s value proposition extends beyond conventional crypto trading. It plays a larger strategic role in modernizing global financial transactions and bridging traditional finance with emerging digital payment solutions.

So, XRPL’s low trading volume is concerning, but there is a good reason why it doesn’t align with the altcoin’s valuation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Needs to Break This Key Level For A ‘Bullish Flip’, Analyst Predicts

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Next for Dogecoin Price As Key Support Retests, Analysts Weigh In

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Trades At A Critical Level – Major Reclaim Or Steep Drop Ahead?

-

Market17 hours ago

Market17 hours agoTether Buys $33 Billion US Bonds Amid Forthcoming Regulation

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

-

Market22 hours ago

Market22 hours agoWho Is the 50X Hyperliquid Whale? ZachXBT Reveals Details

-

Market19 hours ago

Market19 hours agoAnalysts Predict Choppy Price Action

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Sellers Are Taking Control Below $0.20