Ethereum

Ethereum Needs to Break This Key Level For A ‘Bullish Flip’, Analyst Predicts

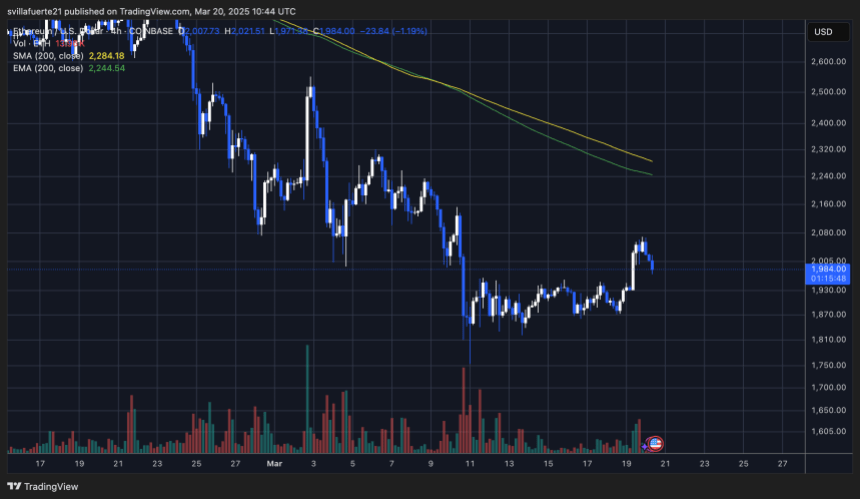

After Ethereum (ETH) surged past the psychologically significant $2,000 price level yesterday, its next major price hurdle stands at $2,400. Seasoned crypto analyst Ali Martinez emphasized that ETH must clear this level to regain bullish momentum.

Ethereum Needs To Clear $2,400 To Turn Bullish

Ethereum has climbed nearly 4.5% over the past week, rising from approximately $1,800 on March 13 to $1,992 at the time of writing. However, Martinez points out that despite the recent upward movement, ETH must conquer the $2,400 level to confirm a bullish shift.

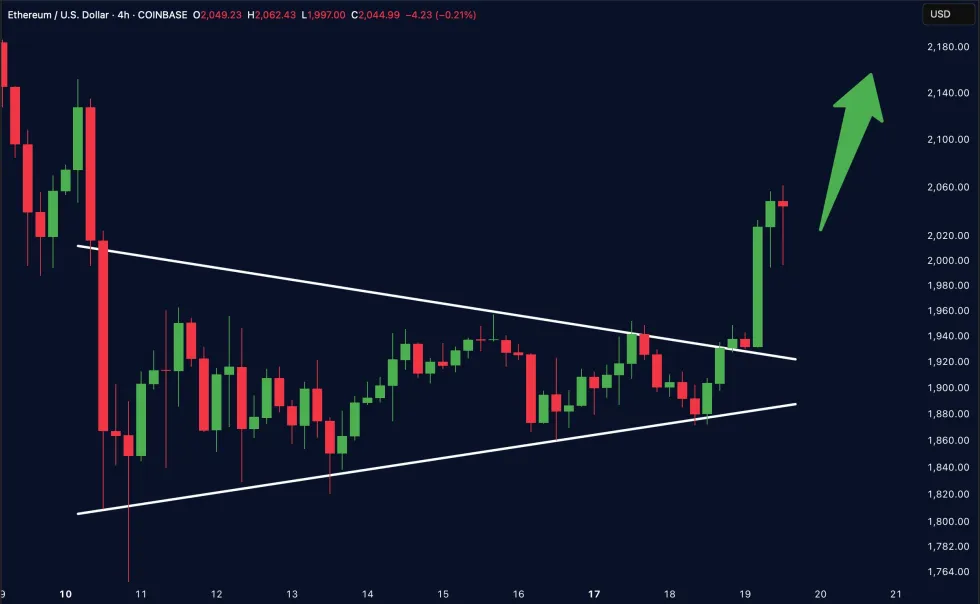

While $2,400 remains about 20% away from current price levels, multiple crypto analysts believe ETH could be on the verge of a bullish trend reversal. Crypto analyst Merlijn The Trader highlighted that ETH has broken out of a symmetrical triangle pattern on the 4-hour chart.

The analyst added that ETH’s “most hated rally is about to ignite.” Merlijn’s assessment aligns with fellow analyst Ted, who noted that a short squeeze could rapidly propel ETH to $3,000.

Similarly, in an X post, crypto analyst Crypto Caesar suggested that ETH may be near this market cycle’s bottom and could soon experience a strong upward trend reversal. The analyst shared a chart showing ETH bouncing off a long-standing trendline multiple times since mid-2022.

Further supporting the bullish case, analyst Amr Taha explained in a CryptoQuant Quicktake post that over 150,000 ETH have exited derivatives exchanges in the past two days. Taha noted that such large outflows often signal accumulation by institutional investors – a traditionally bullish indicator.

ETH Threatens Slumping To $1,060

Despite the optimistic signals, some analysts warn that ETH may face more downside before any significant upside move. In an X post, crypto trader Mags suggested ETH could crash to a range low of $1,060 if no meaningful support level holds.

Additionally, other analysts caution that ETH could fall as low as $800 if it breaks down from an ascending triangle pattern. Data from crypto exchange-traded funds (ETF) tracker SoSoValue also indicates waning institutional confidence in ETH.

Notably, US-based spot ETH ETFs have seen continuous net outflows since March 5. As of now, total net assets held in spot ETH ETFs stand slightly above $7 billion, representing approximately 2.8% of ETH’s total supply.

That said, Ethereum’s MVRV Ratio dropping to 0.9 could signal a bullish setup for the digital asset, though such effects typically take time to play out. At press time, ETH trades at $1,992, down 1.7% in the past 24 hours.

Featured Image from Unsplash.com, Charts from X, CryptoQuant and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Ethereum

Ethereum Price Forms Megaphone Bottom Not Seen Since 2020, Here’s What Happened Last Time

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

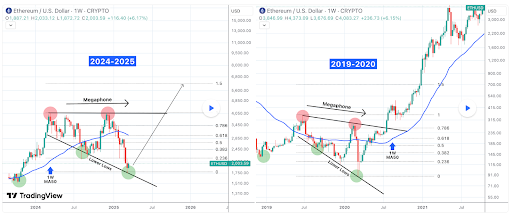

Crypto analyst TradingShot has revealed that the Ethereum price has formed a megaphone bottom which has not been seen since 2020. The analyst revealed what happened the last time ETH formed this bottom, which provides a bullish outlook for the altcoin.

Ethereum Price Forms Megaphone Bottom

In a TradingView post, TradingShot stated that the Ethereum price has formed a megaphone bottom like in March 2020. He noted that ETH is currently on the first week of a rebound after recording three consecutive red weeks when it could not break above the 1-week MA50. The analyst further remarked that ETH is taking on a lower lows trendline, which is technically the bottom of a 1-year megaphone since the March 11, 2024 high.

Related Reading

TradingShot claimed that the market is no stranger to long-term megaphone consolidation periods like that. He stated that the Ethereum price eventually broke upward the last time it formed this megaphone between June 2019 and March 2020, which happened after the brutal COVID crash bearish leg that touched bottom.

He noted that the March 2020 period is quite similar to the current bearish Ethereum price action since late December. The analyst then highlighted how perfectly aligned the Fibonacci retracement levels are. Based on this development, he predicted that the Ethereum price could at least test the 1.5 Fibonacci extension at $6,000 before this cycle tops at the end of the year.

Crypto analyst Crypto Patel also raised the possibility of the Ethereum price rallying to as high as $8,000. He suggested that this parabolic move could happen in phase E of ETH’s bull run. He indicated that ETH could face significant resistance at around $4,050 to this price level.

Bullish Fundamentals For ETH

Despite its underperformance, the Ethereum price has bullish fundamentals, which could spark a reversal to the upside and cause it to reach new highs. Crypto analyst Alternative Bull revealed that the exchange reserves of ETH are significantly declining. He remarked that this would lead to a limited supply which makes it only a matter of time before ETH goes parabolic. In line with this, the analyst affirmed that the altcoin is still in the early phases of its bull run.

Related Reading

Crypto analyst Ali Martinez has also revealed that whales are actively accumulating ETH, which is bullish for the Ethereum price. In an X post, he stated that 360,000 ETH were withdrawn from crypto exchanges in the last 48 hours, a development that could spark a supply shock.

It is also worth mentioning that the Ethereum price could soon witness a supply shock through the ETH ETFs. Asset managers like Bitwise have filed with the US SEC to include staking in their funds. If approved, this could take more ETH out of circulation as some institutional investors opt to stake their ETH to receive yields.

At the time of writing, the Ethereum price is trading at around $1,969, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism in the market, but the momentum was short-lived, as ETH quickly pulled back below the level and was unable to confirm a solid hold. Analysts widely agree that a strong and sustained move above $2,000 is critical for Ethereum to initiate a broader recovery rally.

Related Reading

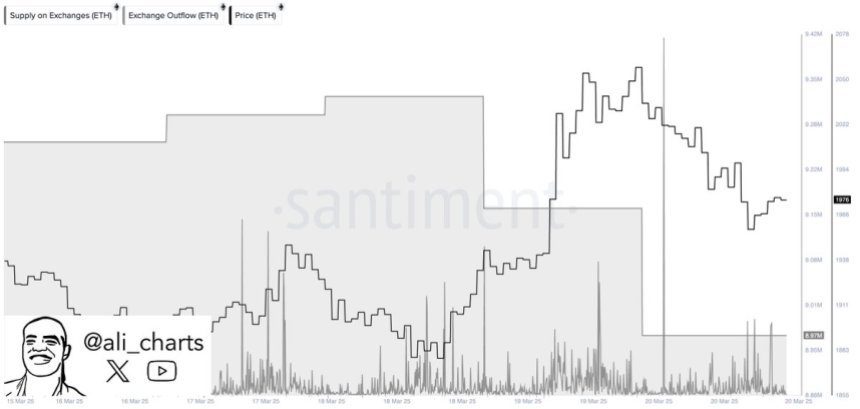

Despite the hesitation at resistance, on-chain data shows signs of growing investor confidence. According to Santiment, investors have withdrawn over 360,000 ETH from centralized exchanges in the last 48 hours. This shift is often interpreted as a bullish signal, suggesting that large holders are moving their assets to private wallets, possibly in anticipation of higher prices.

Meanwhile, the broader macroeconomic landscape continues to apply pressure. Trade war tensions and unpredictable policy decisions from the U.S. government have weighed heavily on both crypto and traditional markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest exchange outflows hint at a potential trend shift — one that could favor accumulation and set the stage for the next major move, provided bulls can reclaim and hold above the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has lost over 57% of its value since mid-December, falling from a high of around $4,100 to recent lows near $1,750. This sharp correction has created a challenging environment for bulls, who have repeatedly failed to reclaim and hold higher price levels.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the foundation for a recovery rally. However, a failure to do so would likely result in further downside and reinforce the bearish trend.

Related Reading

The current market landscape struggles with uncertainty. On one side, continued macroeconomic headwinds—rising trade tensions, inflation concerns, and policy shifts from the U.S. government—have weakened investor confidence and driven volatility across risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared data from Santiment, revealing that investors have withdrawn over 360,000 ETH from centralized exchanges in the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, as they suggest investors are moving assets into cold storage for long-term holding rather than preparing to sell.

This move could indicate growing confidence among large holders and signal the early stages of a new accumulation phase—provided Ethereum can hold above $2,000.

Price Holds Steady Below $2,000

Ethereum is currently trading at $1,960 after briefly attempting to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 remains a crucial barrier that bulls must overcome to shift market momentum in their favor. Despite a small bounce from recent lows, Ethereum has struggled to gain traction amid persistent market uncertainty.

Bulls need to push ETH above $2,000 and reclaim higher levels such as $2,150 and $2,300 to confirm the beginning of a recovery phase. A sustained move above these levels would not only signal a potential trend reversal but could also attract sidelined investors back into the market. Until that happens, Ethereum remains vulnerable to continued downside pressure.

Related Reading

If bulls fail to break above the $2,000 resistance in the coming sessions, Ethereum could lose support at current levels and revisit lower demand zones around $1,850 or even $1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak sentiment, the coming days are likely to be pivotal for ETH’s short-term direction. A decisive move either above or below this key range will likely set the tone for the next major price action.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Trades At A Critical Level – Major Reclaim Or Steep Drop Ahead?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a crucial surge above the $2,000 mark, a key level that bulls have struggled to reclaim since March 10. This breakout brings renewed optimism, as analysts believe a stronghold above this level could trigger a rally toward higher prices. However, if ETH fails to maintain support above $2,000, a significant drop could follow, leading to further market instability.

Related Reading

Macroeconomic uncertainty and trade war fears have continued to shake the crypto market, with Ethereum being one of the most affected assets. The recent price action reflects investor caution, as global financial conditions remain unpredictable.

Top analyst Jelle shared a technical analysis on X, revealing that ETH is trading at a critical level that will determine its long-term direction in the coming weeks. Bulls must sustain momentum to solidify a bullish structure, while bears are watching for signs of weakness to drive prices lower. With ETH at a pivotal juncture, the next few trading sessions could be decisive for its trajectory.

Ethereum at a Crossroads: Breakout or Breakdown?

Ethereum has lost over 57% of its value since mid-December, with bulls struggling to reclaim higher prices as selling pressure dominates the market. Despite occasional relief rallies, ETH has remained under key resistance levels, leaving investors uncertain about its next move. Speculation about a potential recovery and a continuation of the downtrend are colliding, as price action shows no clear direction.

The $2,000 level has become the ultimate test for Ethereum. Bulls must defend this price with conviction to sustain any meaningful recovery. Losing this support could lead to a sharp decline, pushing ETH into deeper bearish territory.

Jelle stated in his analysis that either ETH is about to put in a massive reclaim or it’s about to jump off a cliff. The $2,000 level is the key limit that will determine Ethereum’s next move. If bulls can maintain strength above this mark, a push toward $2,300 and beyond could follow. However, failure to hold $2,000 would signal further downside, with the next major support sitting around $1,750.

Ethereum’s fate hangs in the balance, and the coming days will be crucial in deciding whether it regains bullish momentum or continues its descent.

Related Reading

Ethereum Battles to Hold $2,000: Key Levels to Watch

Ethereum is currently trading at $1,980 after days of struggling below the crucial $2,000 mark. Bulls managed to briefly push the price above this level, but sustaining it is now the real challenge. Holding above $2,000 is critical for Ethereum’s recovery, as it would signal strength and open the door for a rally toward the $2,200 mark.

The $2,200 level is the most important resistance for ETH to reclaim in order to confirm a bullish reversal. A successful break and consolidation above this point would indicate that bulls are regaining control, potentially leading to a move toward higher targets.

However, if Ethereum fails to hold above $2,000, selling pressure could increase, leading to a deeper correction. A drop below this level could trigger a sharp decline, pushing ETH toward the $1,800 support zone. If this support fails, the next major liquidity level would be around $1,750, where buyers might step in to prevent further downside.

Related Reading

Ethereum is at a critical turning point, and the coming sessions will determine whether bulls can establish a strong foothold above $2,000 or if another wave of selling pressure will drive prices lower.

Featured image from Dall-E, chart from TradingView

-

Regulation24 hours ago

Regulation24 hours agoPaul Atkins To Face Nomination Hearing for US SEC Chair Role

-

Altcoin22 hours ago

Altcoin22 hours agoWhat’s Next for Dogecoin Price As Key Support Retests, Analysts Weigh In

-

Market21 hours ago

Market21 hours agoWho Is the 50X Hyperliquid Whale? ZachXBT Reveals Details

-

Market23 hours ago

Market23 hours agoBerachain (BERA) Struggles at $6 Despite Weaker Bearish Signals

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Trades At A Critical Level – Major Reclaim Or Steep Drop Ahead?

-

Altcoin16 hours ago

Altcoin16 hours agoEthereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

-

Market22 hours ago

Market22 hours agoHedera (HBAR) Sellers Are Taking Control Below $0.20

-

Market18 hours ago

Market18 hours agoAnalysts Predict Choppy Price Action